Here at Political Calculations, we're all about, well, political calculations. But more than that, we're also about the tools that you can use to do them! And with 2008 being a political year, and politicians being a calculating sort, we're wading into the now almost never-ending U.S. presidential election race to do one of the things that we do best: find out whose tools rule!

Here at Political Calculations, we're all about, well, political calculations. But more than that, we're also about the tools that you can use to do them! And with 2008 being a political year, and politicians being a calculating sort, we're wading into the now almost never-ending U.S. presidential election race to do one of the things that we do best: find out whose tools rule!

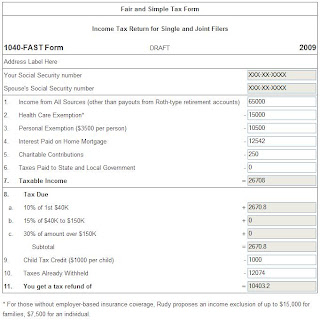

The first tool we're reviewing in this election year is all about making taxes easier to do, and revolves around Republican presidential candidate Rudy Giuliani's proposal for simplifying and streamlining income taxes for the middle class, what his campaign calls the 1040-FAST form!

Now, before we go any further, we're here to review the tool and not necessarily the reform, although we'll be discussing it in the process as it will be relevant to our evaluation of the tool. That's where our expertise is, so that's where our focus will be.

Who It's Intended For

What's interesting about Rudy Giuliani's tax reform proposal for individual income tax payers is that it keeps the current tax code fairly intact, but adds a simpler and streamlined option for filing income taxes. That means taxpayers would have a choice of which form they might use when filing their income taxes each year.

It appears that Rudy Giuliani's proposed tax reform for individual income tax filers is aimed squarely at the middle class, or more appropriately, those taxpayers who have earned income in excess of the threshold needed to qualify for the Earned Income Tax Credit (EITC). Those who are eligible for the EITC should use the existing 1040-EZ form, which at 12 individual line items is certainly comparable to the proposed 1040-FAST form.

Meanwhile, those taxpayers who earn very large incomes would likely benefit more from using the standard IRS Form 1040, as the opportunity to pay fewer taxes by exploiting the established complexity of the current tax code would be more beneficial.

A Simpler and More Streamlined System

Compared to a standard IRS Form 1040 and its 77 line items spanning two pages, Rudy Giuliani's proposed 1040-FAST option would just be one page long and contain just 11 line items. It also reduces the number of marginal tax brackets from six down to three, the number of allowances and tax credits from several dozen to the "Big 6" while introducing seemingly lower tax rates.

We say "seemingly lower" as Rudy Giuliani's proposed 1040-FAST tax form represents a trade-off for middle class taxpayers. Here, a taxpayer can basically choose how much work they want to do to in filing their taxes for the amount of benefit they might receive. Taxpayers could either do a lot of record-keeping throughout the year and gain an edge through the detailed exemptions and tax credits available through the standard Form 1040, with its higher marginal tax rates, or they could save the time, trouble and cost by opting for the simpler proposed form and its lower marginal tax rates to achieve pretty much the same or better outcome.

That same or better outcome comes about as many middle class taxpayers may not be eligible for many of the tax reducing exemptions available on the standard form and would, as a result, pay a higher tax bill.

We should also note that for those who have others prepare their taxes, the proposed 1040-FAST form could save several hundred dollars worth of the fees their tax preparers might otherwise charge.

The marginal tax rates that apply to the proposed 1040-FAST form are 10% of the first $40,000 of taxable income earned, 15% of the next $110,000 of taxable income earned (up to a threshold of $150,000), and for taxpayers with over $150,000 of taxable income, a top rate of 30% applies.

The Big 6 Income Tax Allowances and Tax Credits

For individual income tax filers, Rudy Giuliani's proposal includes the following tax allowances (which reduce your taxable income) and tax credit (which reduces the amount of taxes you pay.) These include:

- A health-care exemption of $7,500 for an individual or $15,000 per family that applies if your employer doesn't provide health insurance.

- A personal exemption of $3,500 per person.

- The total interest you paid on your home mortgage.

- The amount of your contributions to charity.

- The taxes you paid to state and local government.

- A tax credit of $1000 per child.

Reviewing the 1040-FAST Tool

Now that we've covered the basics of what Rudy Giuliani has proposed for individual taxpayers, it's time to take a closer look at the tool. Here's a screen capture (click for a larger image):

Design

We suspect that since the 1040-FAST is intended to compete against paper forms that it was inevitable that the tool would so closely resemble one, with some key exceptions. For example, there are grayed out areas that represent areas you might fill out on paper, but which are unnecessary for the online tool. The grayed out areas are those in which the user cannot enter or alter data, such as where you might enter your Social Security number at the top of the tool (completely redundant for this tool), or the values calculated by the tool (a much more practical application.)

The layout is a classic two-column design, with the requested data for input listed on the left and a text input field on the right. In our experience, we've found that this format works well for clearly communicating what information is required for web-based tools and keeps the user interface very simple.

The tool's designers have broken the data entry for the tool into two parts: one for collecting income data and the other for tax data. It's very simple and very effective.

In Use

For any taxpayer whose filed any version of IRS Form 1040 more complex than the 1040-EZ, the proposed 1040-FAST form is a model of clarity and simplicity. The tool clearly communicates what each of the items are that will affect what your taxable income and taxes will be. More-over, it clearly communicates how the taxes the 1040-FAST filer would be broken down between the proposed marginal tax rates.

That's important because it would have been very easy to just put the subtotal for the amount of tax due without any consideration for the proposed rates of taxation that are key to Rudy Giuliani's proposal. As a result, the form scores clear communication points with the user.

For user-friendliness, the tool is good, but not excellent. While most of the individual line items involve entering straightforward data, two require the user to calculate the appropriate values offline: the amount for the Personal Exemption and the Child Tax Credit.

Here, the "paper form" layout of the tool interferes with usability. It would be easy to add a couple of dropdown boxes for the user to select the number of persons affected by the Personal Exemption and number of children for the Child Tax Credit and have the tool calculate the appropriate numbers.

Conclusion

It's early in the election season, but Rudy Giuliani's team has done a very good job with their tool for his proposed 1040-FAST form for middle class taxpayers. Even with minor user-interface flaws stemming from its paper form inspiration, the tool is effective at communicating the candidate's proposal for individual taxpayers and at doing the math it's designed to do. It's not enough to earn Political Calculations' top honor Gold Standard, it is however, enough to earn our newly-minted "Silver Standard" award for online web tools.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.