As promised, here's our operational definition of an economic bubble:

An economic bubble exists whenever the price of an asset that may be freely exchanged in a well-established market first soars then plummets over a sustained period of time at rates that are decoupled from the rate of growth of the income that might be realized from owning or holding the asset.

Here are a couple of examples of our definition at work:

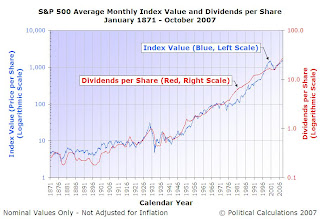

- For a stock market, a bubble can be said to exist when the price of stocks changes at a rate that is not coupled with the growth rate of dividends, the payments investors might receive from holding stocks. An example of a bubble occurred in the U.S. stock market from April 1997 and lasted until June 2003. Prices in the U.S. stock market were well-coupled during the periods preceding the bubble and afterward.

Regular readers of Political Calculations will recognize the following chart illustrating the Dot-Com stock market bubble:

- For a housing market, a bubble can be said to exist when the price of houses grows at a rate that is not coupled with the growth rate of rent, the payments owners might receive from owning housing properties. Our example of a bubble in the U.S. housing market is incomplete, as the plummeting phase of the recent housing bubble is still underway. Here however is the best evidence that a housing bubble is underway, the chart on the left is taken from Robert Shiller's 2007 Jackson Hole paper Understanding Recent Trends in House Prices and Home Ownership, the chart on the right is one we've presented previously, showing the S&P 500's index value and dividends per share in a similar format to what Shiller shows:

To recognize that a bubble exists in housing, we should observe the similarity between the relative rise of housing prices with respect to rent to that of the value of the S&P 500 index with respect to the index' dividends per share for the period that we've identified for the Dot-Com bubble (in particular, where we've pointed to the Index Value in the chart!)

Side Note: We've found that the best way to visualize the magnitude of an economic bubble is to plot the price of the asset against the corresponding dividend or rent income taken at different times, but unfortunately, we don't have access to Shiller's housing data to better illustrate the point, so this comparison will have to do for now.

Applying this definition gets trickier where non-renewable commodities like oil are concerned. After all, oil is something that is consumed - there is really no way that you can rent oil to use for just a little while then give the asset back to the owner! Still, there has to be some kind of stream of payments related to the production of oil whose value should be expected to increase in near lockstep with the price of oil when the price is driven by fundamental supply and demand impulses, and would not if the growth rate in the price of oil is decoupled from them. The best we could figure would be oil royalties, so here's how we would put it in terms of our operational definition of an economic bubble:

- For the oil commodity market, a bubble can be said to exist when the price of oil grows at a rate that is not coupled with the growth rate of oil royalties, the payments the owner of a recoverable oil-producing asset might receive from oil extractors.

What we don't have to check this latter example is data related to the value of oil royalty payments over time. If there's anyone out there who does have that kind of data, plot it against the price of a barrel of oil over time and see if anything emerges!

Speaking of things emerging, we can also now more formally define when order exists in economic markets:

Order exists in a market whenever the change in the price of assets in the market are closely coupled with the change in the income that might be realized from owning or holding the assets, within a band of approximately normal variation about a central tendency.

And now market disorder:

Disorder exists in a market whenever the change in the price of assets in the market is not coupled with the change in the income that might be realized from owning or holding the assets within a band of approximately normal variation about a central tendency that would describe the relationship between the two when order exists in the market.

Finally, let's recognize that bubbles are not the only kind of disorder that can occur in a market:

A disruptive event may be said to be taking place whenever a significant change in the price of assets in the market is not coupled with the change in the income that might be realized from owning or holding the assets over a limited period of time.

An economic bubble is an example of a disruptive event, as are shifts in the equilibrium that exists between prices and ownership-derived realizable income, such as market crashes or stable bull markets.

Labels: dividends, economics, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.