We think we're getting a better understanding of what went through the minds of sailors when they reached the edge of their charts while crossing the seas.

Truth be told, our method of projecting where the future value of stocks will be shares much in common with the sailing practice known as "dead reckoning." If we know where we are, and we know the direction and changing velocity of the stock market's dividends per share, we can do a pretty good job of anticipating where stock prices will go, which is similar to how sailors use what they know of where they are and the direction and speed of the winds to determine where their ships will go.

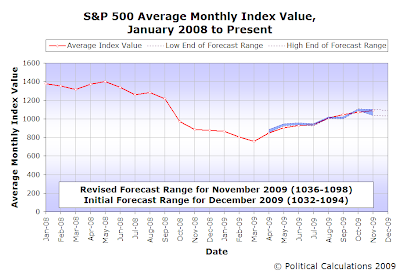

Right now, using the latest dividend futures data available to us, which at this writing only extends to the fourth quarter of 2010, we would forecast that the average the daily closing values for the S&P 500 in December 2009 would be nearly identical to what we had forecast for November 2009. Using our typical range of amplification factors, with 6.5 at the low end, 9.0 in the middle and 11.0 at the high end, and using the dividend futures data available for the fourth quarter of 2010 as our point of investor focus, we would project that stock prices will fall between 954 at the low end and 1094 at the high end, with a midpoint of 1032. Following our usual practice of narrowing our forecast to either just the upper or lower end of our full forecast range, we would anticipate stock prices in December 2009 to average somewhere between 1032 and 1094.

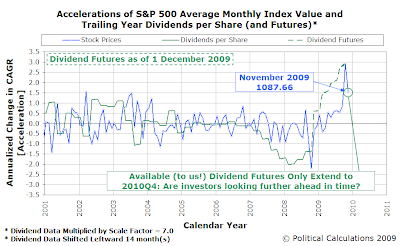

But we have a problem, and that problem is that we strongly suspect we've run over the edge of our chart. Here's exactly what we're looking at on 1 December 2009 as we consider our forecast:

There are two potential explanations for what we observe. The first is that investors have perhaps focused their attention upon the second quarter of 2010 instead of the fourth quarter, as we see that the level of the amplified change in the growth rate of dividends per share would seem to correlate reasonably well with the change in the rate of growth of stock prices we observed for November 2009.

That would make sense if there were some news affecting the expected future level of dividends per share to be paid in that quarter. However, we're unaware of any such news and in its absence, we think that to be unlikely.

The other potential explanation for what we see happening is that investors are looking past where they expect the S&P 500's dividends per share will be in 2010Q4 to the first quarter of 2011 instead, as determined by the dividend futures contract that applies for each quarter. That would make sense since the 2011Q1 contract would correspond to the period of time that includes the end of 2010, as the 2010Q4 futures contract only extends to 17 December 2010. That focus would also agree with much of what we observed during this year, with investors primarily focused from May through October upon the dividend futures contract for 2010Q1.

But we won't know for sure until later this month, when our data source for the dividend futures data might be updated to include the data for the contracts extending into 2011. In other words, we've reached the edge of the map!

When that happens, we will likely revise our forecast for December 2009. Stay tuned!...

Labels: forecasting, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.