The U.S. government measures the number of layoffs in the U.S. economy by counting the number of Initial Unemployment Insurance Claims made each week. We thought it would make for a neat project to go back through the last four years of that data to see if we could successfully apply our statistical dating analysis technique, which would make it possible to isolate what events may have triggered major shifts in layoff activity in the United States throughout that time.

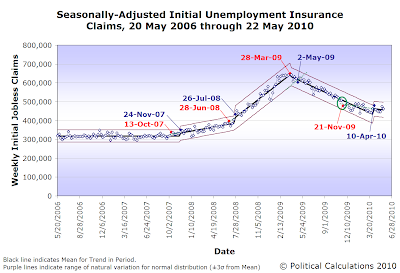

We recognize a break in an established trend whenever a data point falls outside that range of expected natural variation. The chart above shows four such breaks, which are indicated by the solid blue diamonds labeled with the indicated dates in blue: 24 November 2007, 26 July 2008, 2 May 2009 and 10 April 2010.

Missouri Unemployment Line Having found these break points, we use the new trend that is established afterward to track backwards to a point in time where we can identify that the new trend appears to have taken effect. We marked these points in time on the chart with solid red diamonds, which we recognize as being the end of the reporting period where the new trends established themselves.

Missouri Unemployment Line Having found these break points, we use the new trend that is established afterward to track backwards to a point in time where we can identify that the new trend appears to have taken effect. We marked these points in time on the chart with solid red diamonds, which we recognize as being the end of the reporting period where the new trends established themselves.

From here, it's just a matter of some detective work to determine what events led to the change in the rate at which businesses have laid off employees during the past four years. We do make two assumptions: First, businesses considering laying off employees require 2 to 3 weeks to act on their plans following a change in the outlook for their business. This time lag coincides with the typical weekly, biweekly, bimonthly and monthly pay periods for employees in the U.S., where we consider that businesses will follow through on executing their existing plans through their current pay period before implementing any changes driven by the change in their business outlook to coincide with their next pay cycle.

Second, we only consider events that would apply to the United States' job market. For example, the beginning of the Greek sovereign debt crisis would coincide with the new trend we observe beginning between 14 November 2009 and 21 November 2009, however since that crisis began with the announcement of a much larger-than-expected annual deficit, which would do little to affect the employee retention decisions of U.S. businesses, who were largely unaware of the news, we can exclude it as not relevant to their decision making.

We've presented our findings of the likely triggers for shifts in U.S. layoff activity in the table below:

| Timing and Events of Major Shifts in Layoffs of U.S. Employees | ||

|---|---|---|

| Date of Confirmed Break from Previous Trend | Period in Which New Trend Takes Effect | Likely Event Triggering New Employment Trend (Occurs 2 to 3 Weeks Prior to New Trend Taking Effect) |

| 24 Nov 2007 | 6 Oct 2007 - 13 Oct 2007 | Federal Reserve acts to slash interest rates for the first time in 4 1/2 years as it begins to respond to the growing housing and credit crisis, which coincides with a spike in the TED spread. Negative change in future outlook for economy leads U.S. businesses to begin increasing the rate of layoffs on a small scale. |

| 26 Jul 2008 | 21 Jun 2008 - 28 Jun 2008 | Oil prices spike toward inflation-adjusted all-time highs (over $140 per barrel in 2008 U.S. dollars.) Negative change in future outlook for economy leads businesses to sharply accelerate the rate of employee layoffs. |

| 2 May 2009 | 21 Mar 2009 - 28 Mar 2009 | Stock market bottoms as future outlook for U.S. economy improves, as rate at which the U.S. economic situation is worsening stops increasing and begins to decelerate instead. U.S. businesses react to the positive change in their outlook by significantly slowing the pace of their layoffs. |

| 10 Apr 2010 | 14 Nov 2009 - 21 Nov 2009 | Introduction of HR 3962 (Affordable Health Care for America Act) derails improving picture for employees of U.S. businesses, as the measure (and corresponding legislation introduced in the U.S. Senate) is likely to increase the costs to businesses of retaining employees in the future. Employers react to the negative change in their business outlook by slowing the rate of improvement in layoff activity. |

Coincidentally, we should note that President Barack Obama signed massive health care reform legislation into law just 2-3 weeks before the statistical confirmation of the break in the previous trend in U.S. layoffs occurred, so at least there's some sense of ironic symmetry there....

We note that Geoff at Innocent Bystanders has arrived at a similar conclusion regarding the beginning of a new trend in layoffs beginning in November 2009, but hasn't attributed a specific cause to account for the marked shift in layoff activity. Elsewhere, looking more closely at the most recent trend from its origin in mid-November 2009, he finds that it actually is somewhere between being flat to somewhat of an uptick in layoff activity.

If it does indeed turn out to be flat, it would represent the stabilization of layoff activity far above the seasonally adjusted average number of weekly new unemployment claims of 317,911 established in the last stable period that ended between 6 October 2007 and 13 October 2007. Which would be the last time the U.S. economy was anywhere near full employment levels.

Which if our finding holds, says a lot about President Barack Obama's signature achievement.

Labels: economics, jobs, quality

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.