Quite a lot has happened since we last commented on the S&P 500 and the news events that influenced it during the first part of the third week of May 2016. In short, the following major events happened:

- More officials at the U.S. Federal Reserve indicated that they were likely to hike interest rates at their upcoming June 2016 meeting.

- The minutes of the Fed's April meeting released during the week confirmed that the Fed is actively considering that move.

- The Fed appears to have quietly launched a new round of quantitative easing (QE).

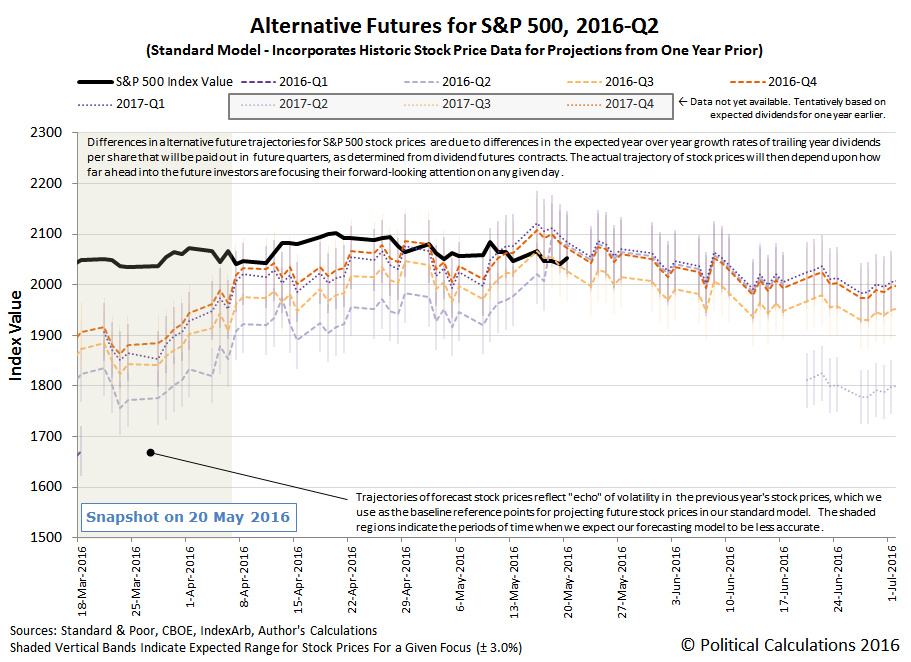

Following what happened over the preceding several days, U.S. investors appear to have focused on 2016-Q3 in setting the level of the S&P 500. Our alternative futures chart shows how the rest of Week 3 of May 2016 played out for the S&P 500.

Here are the more significant headlines from the rest of Week 3 of May 2016 that caught our attention:

- Wednesday, 18 May 2016

-

- Oil advances on U.S. refined fuel drawdown; Brent near $50 per barrel

- U.S. dollar up on hawkish Fed; bank stocks rally

- Fed signals interst rate hike firmly on the table for June

- Wall Street turns negative as Fed signlas June rate hike possible

- Dollar jumps after Fed minutes signal possible June hike

- Hawkish Fed sends U.S. dollar soaring; bank stocks rally

- Thursday, 19 May 2016

-

- Wall Street opens lower as Fed rate hike looms, oil falls

- Dudley joins chorus of Fed officials seeing rate hikes soon

- Wall St. falls on Fed rate hike worry

- U.S. Fed buys $7.5 billion of mortgage bonds, sells none - In the absence of an offsetting move, this is nothing less than the return of QE (let's call it QE 4.0), which is similar to how QE 3.0 was first implemented, although on a smaller scale. More remarkably, the Fed may actually be following part of our policy advice from August 2015, when if was first considering hiking interest rates after years of adhering to its previous Zero Interest Rate Policy (ZIRP).

- Friday, 12 May 2016

The Fed's net increase in its holdings of Mortgage Backed Securities (MBS) is reminiscent of the actions it took in 2012, when it became clear that the U.S. economy was beginning to slide toward recession during the summer of 2012, where the Fed's first action in QE 3.0 was to begin making large MBS purchases to further stimulate the nation's real estate market.

The Fed's intervention at that time succeeded in preventing the U.S. economy from falling into recession before the November 2012 elections, but following the elections, the Fed was forced to expand its QE efforts to offset the negative impact from the U.S. government's fiscal policies, where large tax increases desired by President Obama on all working Americans were set to take effect on 1 January 2013.

As we saw in 2012, the Fed's new MBS purchases should have little effect, if any, on U.S. stock prices. They are really a way to partially offset the full impact of its next planned interest rate hike, which they will now likely announce on 15 June 2016, but which will be implemented in 2016-Q3, which is why investors are focusing on this future quarter.

On a final note, we think that there is a pricing anomaly in the CBOE's implied forward dividends contract for S&P 500 in the second quarter of 2016 (CBOE: DVJN), which suddenly jumped in value from 113.00 to 116.40 on Wednesday, 18 May 2016, which has been sustained over the last several trading days. (You can estimate the amount of ordinary dividends that will be paid out for the S&P 500 during 2016-Q2 by dividing the value of these contracts by 10).

Since that large increase hasn't also shown up in the implied forward dividends for 2016-Q3 (CBOE: DVST), 2016-Q4 (CBOE: DVDE) and 2017-Q1 (CBOE: DVMR), which would confirm that the change is the result of a sustained improvement in the expectations for future dividend payments, it instead suggests that something unusual is going with the DVJN contract.

That is something that is possible because these contracts are periodically very thinly traded, which allows such pricing anomalies to occasionally develop. It will be interesting to see how long that situation might persist.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.