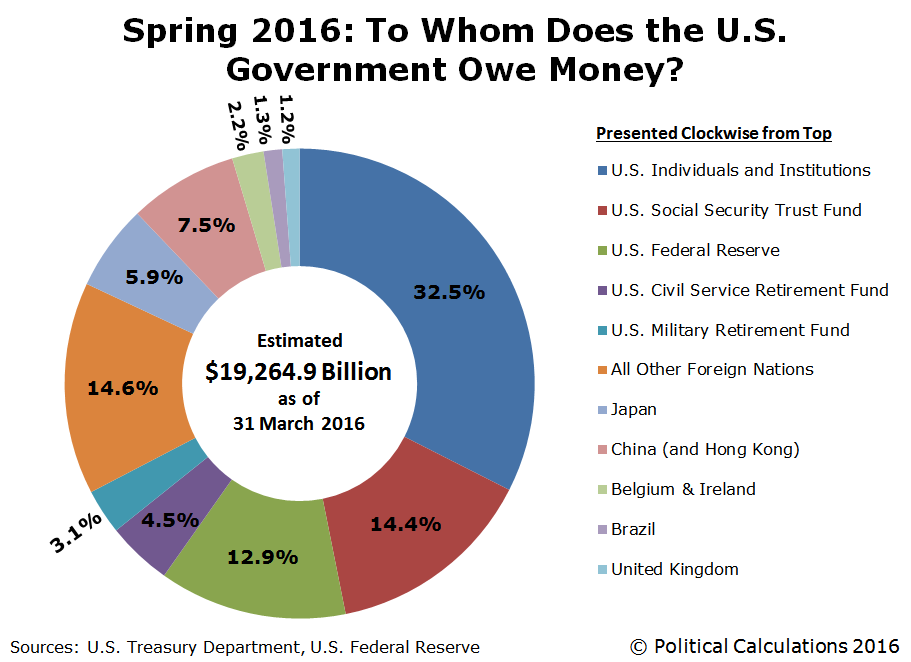

On Monday, 16 May 2016, the U.S. Treasury updated its accounting of the national origins of the major foreign holders of debt issued by the U.S. government through the end of March 2016, the halfway point of the federal government's fiscal year. With that new information, we can update our visualization of all the money that the U.S. federal government has borrowed and currently owes through the end of March 2016.

In the chart above, we've grouped Belgium and Ireland together, next to the pairing of Mainland China and Hong Kong, because major banks in these nations have been increasingly acting as intermediaries for China's total holdings of U.S. government-issued debt securities. Along with a number of banks in the United Kingdom, which have served a similar role in recent years, we believe that a good portion of China's ownership of U.S. Treasuries is being incorrectly attributed to these nations.

Meanwhile, Brazil's holdings have fallen over the past year, as falling oil prices and falling exports to China have taken a toll on the South American nation's economy. Back in 2011, we had noted the rise of Brazil's holdings of U.S. Treasuries were an indication that it was a rising world power. Those holdings peaked in 2014 and since then, Brazil's status has faded along with its economic and now political challenges.

But perhaps the biggest news in the U.S. Treasury's updated data is that discontinued its previous grouping of "oil exporters" as a single category, instead presenting the U.S. Treasury holdings of Saudi Arabia, United Arab Emirates, Kuwait, and others individually for the first time since it began reporting the data in 1974. Of these nations, Saudi Arabia had the largest holdings at $117 billion, accounting for 0.6% of the total public debt outstanding for the U.S. government.

Much of those holdings were accumulated in the time from when oil prices began surging in 2004 until global oil prices began falling dramatically in mid-2014.

Like China however, many of Saudi Arabia's actual holdings of U.S. government-issued debt securities are likely being attributed to other nations. Since Saudi Arabia recently threatened to sell off $750 billion worth of U.S. Treasuries and other assets, which suggests the nation maintains most of these assets in non-direct accounts based in other nations.

Data Sources

Federal Reserve Statistical Release. H.4.1. Factors Affecting Reserve Balances. Release Date: 2 April 2015. [Online Document]. Accessed 15 May 2015.

U.S. Treasury. Major Foreign Holders of Treasury Securities. Accessed 15 May 2015.

U.S. Treasury. Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2015 Through March 30, 2015. [PDF Document].

Labels: national debt

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.