Having closed the door for assessing the performance of the January 2020 'Phase 1' trade deal between the U.S. and China, we've refocused our ongoing trade analysis to focus on the trade recovery from 2020's coronavirus pandemic.

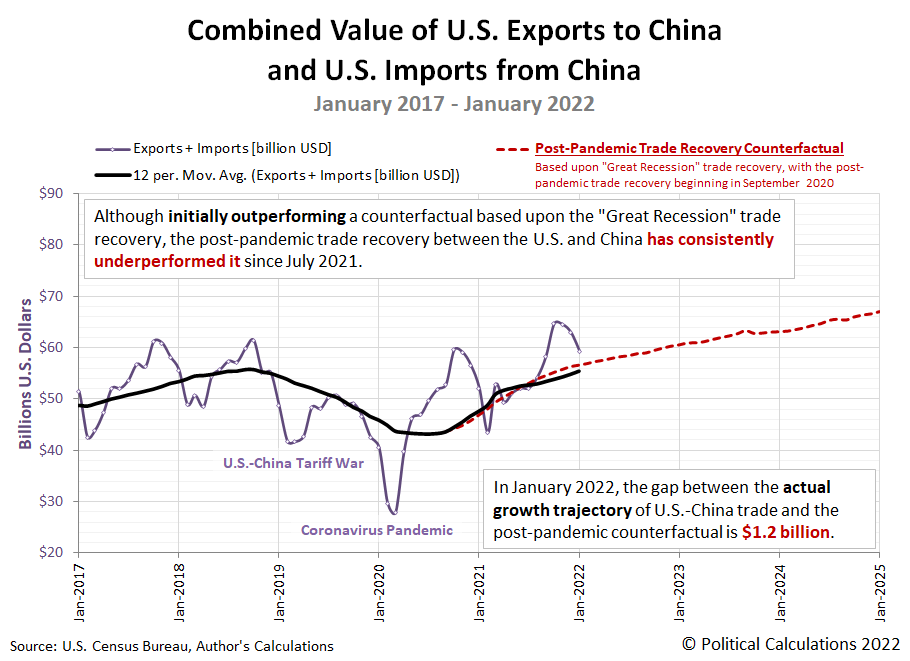

To do that, we need to compare the actual trajectory of the trade between the U.S. and China with a counterfactual - a projection of what the future for trade could reasonably look like following a recession. For our purposes, we opted to model a counterfactual after the recovery in trade between the U.S. and China that followed the so-called "Great Recession". The following chart shows the trailing twelve month average of the combined value of that trade as the heavy black line, where the counterfactual is shown by the dashed red line. We're using the trailing twelve month average to account, in part, for the seasonality in the actual monthly data, which we've shown as the thinner purple line.

Going by the trailing twelve month average of the combined value of goods exchanged between the U.S. and China, the recovery in trade between the two countries began after this measure bottomed in September 2020. In the first ten months since, up to July 2021, the rate of growth of trade outperformed what was observed in the recovery following the "Great Recession". But since July 2021, the level of trade has consistently underperformed the Great Recession trade recovery. In January 2022, it would take an additional $1.2 billion of goods traded between the two countries to match that earlier recovery.

In truth, that underperformance took hold several months earlier, following March 2021, after a spike in the value of goods traded between the two countries was recorded. This period roughly coincides with a growing backlog of container ships at the U.S.' west coast ports, and specifically at the ports of Los Angeles and Long Beach in southern California. These two ports typically account for 40% of all imported goods processed into the U.S. economy, where congestion at these two ports built up and was allowed to fester for months without any action to correct the worsening situation by the Biden administration.

The good news is that after months of neglect, the Biden administration was finally forced to take steps to address the problem. There are indications the worst of the trade congestion at these two ports is in the rear view mirror.

That's a positive development, which we see in the small narrowing of the gap between the counterfactual and the actual trajectory of the U.S.-China trade level in January 2022. We'll see how well that progress might continue in the months ahead.

Labels: coronavirus, recession, trade

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.