The S&P 500 (Index: SPX) closed at 3,961.63 on Friday, 22 July 2022, rising over 2.5% from the previous week.

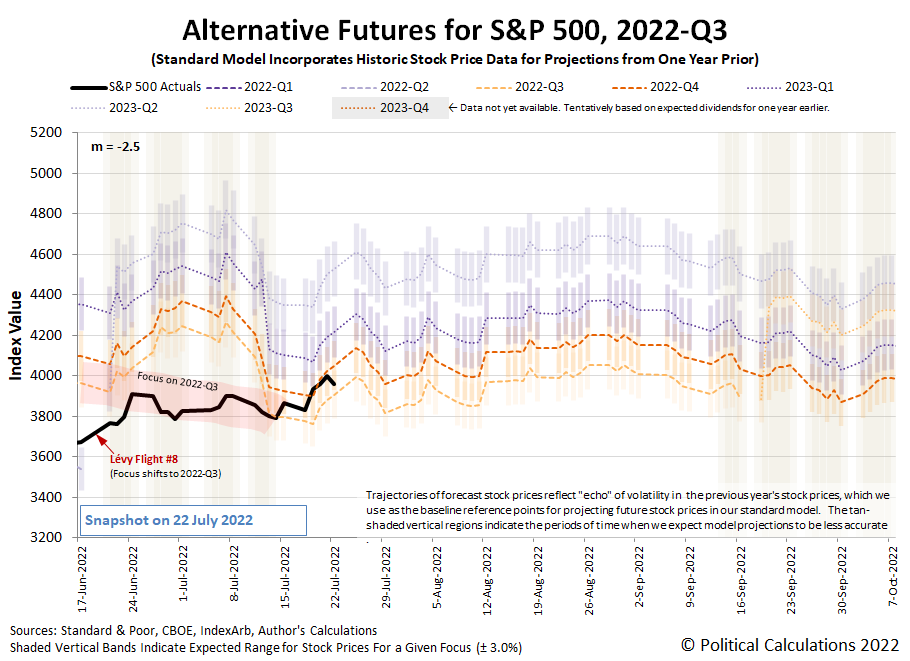

It could have risen higher. For much of the week, the trajectory of the S&P 500 tracked with the dividend futures-based model's projection of where the index would go if investors focused their forward-looking attention on 2022-Q4. But on Friday, they shifted their attention back toward 2022-Q3 and the index stayed below the 4,000 threshold we identified in last week's edition. Here's the latest update to the spaghetti forecast chart showing that action.

Looking forward, having the index bounce around that 4,000ish threshold would still indicate investors are paying close attention to how the Fed will set short term interest rates during the current quarter of 2022-Q3. Should stock prices rise significantly above that level would indicate investors have shifted their investment horizon to a more distant future quarter.

With so much attention on the actions the Fed will take following its upcoming meetings, what change in expectations could prompt investors to re-focus their attention so much further out in time? We'll get to that shortly, but first, here are the market moving headlines of the week we've identified to help provide the needed context:

- Monday, 18 July 2022

- Signs and portents for the U.S. economy:

- Big U.S. banks see loan growth slowing as outlook for demand, economy darkens

- Oil gains $5 on weaker dollar, tight supplies

- U.S. home builder sentiment plunges, services activity in New York region stalls

- ECB minions getting excited about hiking rates after thinking about it for so long!

- Wall Street closes down on slide in Apple shares, bank stocks

- Tuesday, 19 July 2022

- Signs and portents for the U.S. economy:

- U.S. housing starts drop to lowest in nine months in June

- Oil settles up 1% at 2-week high on worries about tight supply

- For auto retailers, pandemic-era profit boost in rear-view mirror

- Bigger trouble developing in Japan:

- Expectation grow ECB minions will deliver bigger interest rate hike:

- Euro rallies after report that bigger ECB rate hike is on the cards

- Half of euro zone June inflation came from energy - Eurostat

- Wall Street closes sharply higher on strong corporate earnings

- Wednesday, 20 July 2022

- Signs and portents for the U.S. economy:

- GDP may fall again in Q2. Does it mean recession?

- Consumers shun candles, barbecue kits as budgets tighten

- Oil falls on lackluster U.S. summer gasoline demand

- U.S. existing home sales slide again; prices hit fresh record high

- Fed minions expected to deliver another three-quarter point rate hike:

- Bigger trouble developing in Eurozone, China, Canada:

- EU asks countries to cut gas demand by 15% until spring

- Chinese banks’ half-truths hinder mortgage fix

- Canada's inflation rate hit 8.1% in June as gasoline prices bite

- BOE minions gearing up for big rate hike:

- Wall Street closes higher boosted by tech stocks gains on upbeat earnings

- Thursday, 21 July 2022

- Signs and portents for the U.S. economy:

- U.S. GDP may fall again in Q2. Does it mean recession?

- U.S. jobless benefits rolls grow; key factory output gauge slumps

- Oil slumps $3/bbl on gasoline stockpiles, rate hikes and resuming supply

- Bigger stimulus developing in China, S. Korea:

- China approves projects worth $50 billion after easing environment rules

- S.Korea to cut taxes for companies, workers and retail investors

- Despite higher inflation, BOJ minions won't stop, can't stop never-ending stimulus:

- ECB minions finally acts to combat Eurozone inflation:

- ECB goes big with 50 basis-point hike, ending negative rates era

- ECB raises rates for first time in decade with safety net for debtors

- Analysis: Debt-laden Italy looks no less vulnerable as rates shoot higher

- Analysis-ECB's new tool fails to impress as Italy confronts political paralysis

- Analysis-R.I.P. forward guidance: Inflation forces central banks to ditch messaging tool

- Wall Street closes higher boosted by strong Tesla earnings

- Friday, 22 July 2022

- Signs and portents for the U.S. economy:

- U.S. crude ends below $95/bbl as EU tweaks Russian oil sanctions

- U.S. business activity contracts in July for first time in 2 years, survey shows

- Bigger trouble developing in Japan, S. Korea, Eurozone:

- Japan's July factory activity growth slows to 10-month low - flash PMI

- Japan's inflation stays above BOJ's target for 3rd straight month

- South Korea's economy likely lost some steam in Q2 - Reuters poll

- Euro zone business activity contracted in July as price rises bite - PMI

- ECB minions pledge to keep up rate hikes until inflation (or Eurozone economy) breaks:

- Bigger stimulus developing in China:

- Wall Street ends lower as ad tech, social media stocks drop

Now, here's where we'll get to why investors would have a strong reason to shift their attention to the more distant future: how investors expect the Fed will change interest rates at different points of time in the future. The CME Group's FedWatch Tool still projects a three-quarter point rate hike for July (2022-Q3), followed by half point rate hikes in September (2022-Q3) and November (2022-Q4), with the Federal Funds Rate topping out between 3.25 and 3.50%. In 2023, the tool anticipates the Fed will be forced to begin cutting rates in May 2023 as the U.S. central bank responds to more fully developed recessionary conditions.

Speaking of which, turning our attention back to the recent past, the Atlanta Fed's GDPNow tool's latest projection for real GDP suggests the U.S. economy will have shrunk by 1.6% in the recently ended second quarter of 2022. That's down from last week's projection of -1.5% growth, which we had incorrectly identified as the GDPNow tool's final estimate for 2022-Q2 in the previous edition of our S&P 500 chaos series. Looking forward, the BEA will provide its first official estimate of 2022-Q2's GDP later this week, after which, the Atlanta Fed's GDPNow tool will start giving its estimates of real GDP for the current quarter of 2022-Q3.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.