Extraordinary things are afoot for the S&P 500 (Index: SPX). After recovering from the Eurozone geopolitics noise event last week, the index plunged on 13 September 2022 as investors reacted to the news that inflation in the U.S. is running much hotter than expected. By the end of the trading week, the S&P 500 retreated to 3,873.33, some 19.2% below its 3 January 2022 all-time record high and just 0.8% away from the 20% decline threshold that defines a bear market.

Investors reacted that way because the high inflation means the Federal Reserve will keep hiking rates until a hard landing in the form of a recession is inevitable. The CME Group's FedWatch Tool projects a three-quarter point rate hike next week (2022-Q3), which investors are now betting will be followed by another three-quarter point hike in November (2022-Q4). The tool then projects the pace of rate hikes may slow a bit, with a quarter-point rate hike in December (2022-Q4) to close out 2022 in the target range of 4.00-4.25%. In 2023, the FedWatch tool anticipates quarter-point rate hikes in both February and March (2023-Q1) to reach a target range of 4.50-4.75% before potentially reversing in either May or June (2023-Q2) in response to building recessionary conditions.

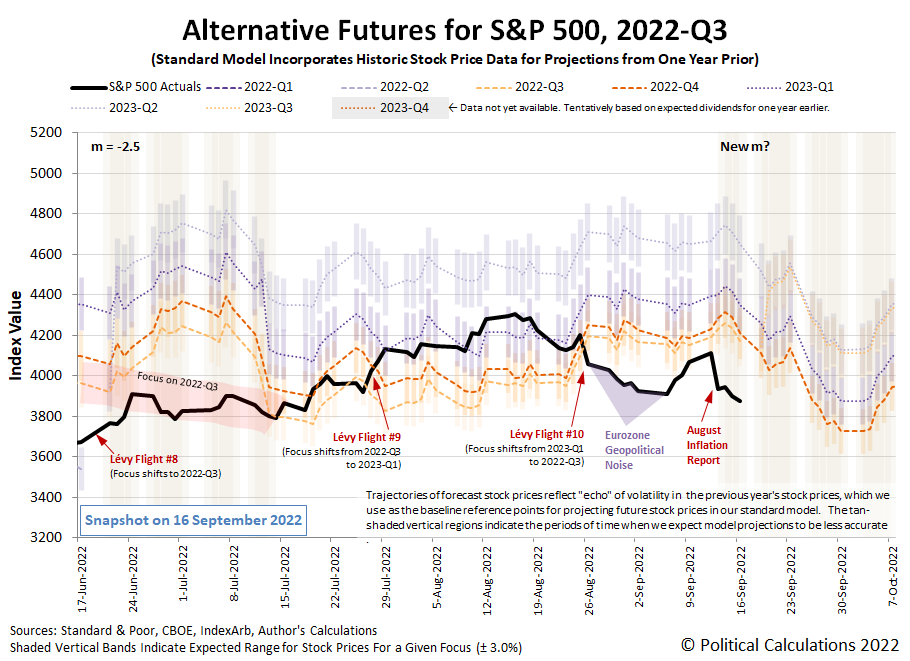

The latest update to the alternative futures chart captures the plunge in stock prices, which have fallen below the levels associated with the dividend futures-based model's projected trajectories associated with how far investors are looking into the future and their expectations for dividend growth at those times.

As this is being written, it's still too early to make a firm determination, but here are the possibilities for what that development means:

- The market is experiencing a new noise event. If so, the deviation from the model's projections will be temporary, as it was for the Eurozone Geopolitical Noise event that ended the previous week, and we'll see stock prices rebound up to the levels projected by the model after the noise dissipates.

- The market is experiencing a regime change. For the dividend futures-based model, that means investors are resetting how they value changes in the growth rate of dividends with respect to how they relate to changes in the growth rate of stock prices. In the model, that relationship is often stable and can be nearly constant for prolonged periods of time. But it does change and when it does, it shows up as a change in the value of the model's basic multiplier (m).

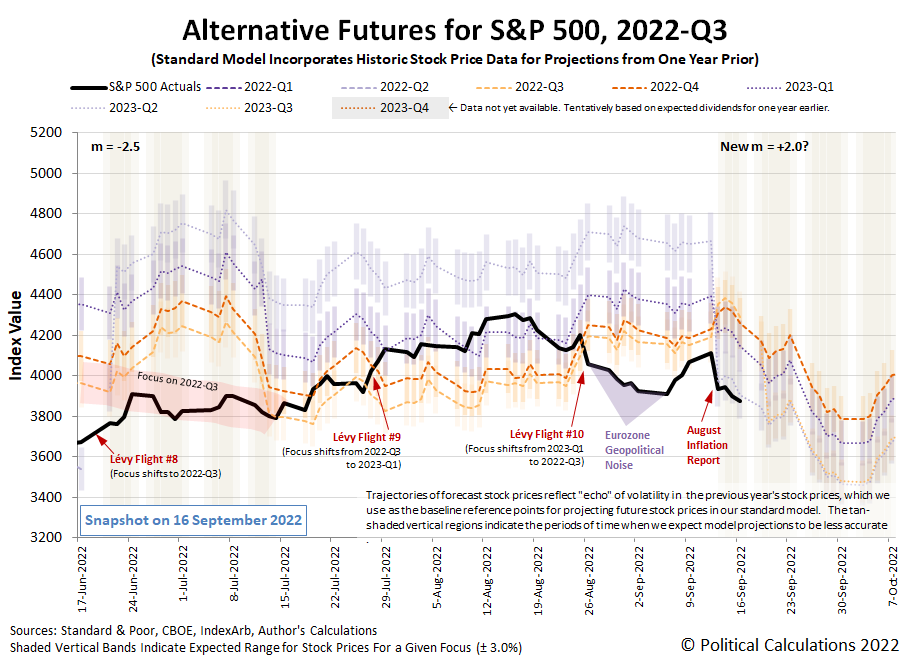

The early evidence is supporting the second option, if we also assume investors shifted their forward-looking focus toward 2023-Q2 in setting current day stock prices, which is to say the inflation report prompted another Lévy flight event this year. If so, the value of m changed from the -2.5 it has been since 16 June 2021 to instead be around +2.0 as of 13 September 2022. The next chart shows how the model's projections would change under that scenario:

The week's market-moving headlines and the FedWatch tool's projections provide evidence in support of such a new Lévy flight event, in which investors would be looking out to 2023-Q2 as the likely timing in which the Fed's current series of rate hikes reach their terminal peak before the Fed is forced to reverse and begin cutting rates because of building recessionary pressures. It may however be some weeks before we have a clear answer as to which scenario we've described applies or if something else altogether is at work. Unofficially, we're hoping the scenario we described is wrong and the first scenario is the right one.

But that's all part of what makes tracking the S&P 500 such chaotic fun! Here's the past week's market moving headlines:

- Monday, 12 September 2022

- Signs and portents for the U.S. economy:

- Oil prices settle higher amid supply concerns heading into winter

- U.S. holiday sales growth likely to slow as inflation hits shoppers - report

- Fed set for another 75-basis-point rate hike; early pivot unlikely: Reuters poll

- Bigger trouble developing in the Eurozone:

- Bigger stimulus developing in China:

- Central banks signaling growing recession risks will cap rate hike plans:

- BOJ minions still happy with never-ending stimulus shrinking value of yen:

- Wall Street closes higher ahead of CPI report

- Tuesday, 13 September 2022

- Signs and portents for the U.S. economy:

- Biden celebrates 'Inflation Reduction Act' as food, rent prices climb

- Hot US Aug CPI seen cementing aggressive FOMC

- Fed seen getting more aggressive as inflation roars

- Stubbornly high rents, food prices boost U.S. inflation in August

- Oil dips nearly 1%, reversing gains after bearish U.S. economic data

- U.S. banks feeling strangely confident before inflation report:

- Global economy may avoid recession as inflation risks ease - J.P. Morgan

- U.S. banks' key performance metric set to turn around in second half

- Fed minions expected to deliver bigger rate hikes after inflation report:

- Bigger trouble developing in Japan, Eurozone:

- Japan's Aug wholesale inflation hits 9% as price rises broaden

- German economy could contract in H2 - economy ministry report

- Bigger bailouts developing in Eurozone, Canada:

- Germany to step up state bank credit for struggling energy firms

- Canada's Trudeau announces C$4.5 billion inflation relief package for low earners

- Central banks gearing up for more rate hikes:

- Wall St tumbles to biggest loss in two years following CPI data

- Wednesday, 14 September 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage interest rates top 6% for first time since 2008

- Oil rises 1% on supply concerns, expectations for fuel switching

- Bigger trouble developing in Japan, Eurozone:

- Japan Sept factory mood tanks on cost pressure - Reuters Tankan

- Euro zone industrial production much weaker than expected in July

- BOJ minions say they won't let never-ending stimulus crash the yen:

- Japan's Kanda: Will 'respond appropriately' to yen moves

- BOJ conducted rate check in apparent preparation for currency intervention -Nikkei

- Japan will act 'swiftly' if it intervenes in FX market - Finance Minister

- Japan signals chance of yen intervention; market unconvinced

- Yen rallies vs dollar after BOJ rate check, hints on intervention, U.S. PPI data

- ECB minions thinking about how high they're going to hike interest rates:

- Top of ECB rates cycle an open question, ECB's Herodotou says

- ECB could reach neutral rate by year end - Villeroy

- Wall St staggers to higher close as Fed rate hike looms

- Thursday, 15 September 2022

- Signs and portents for the U.S. economy:

- U.S. Northeast faces potential energy shortages as rails start to shut

- Oil slumps over 3% on U.S. rail agreement, demand concerns

- U.S. manufacturing output ekes out small gain in August

- U.S. retail sales unexpectedly rise, but inflation hampering spending

- Bigger trouble developing in China:

- Big Chinese state-owned banks to cut personal deposit rates - Securities Times

- China central bank pauses monetary easing, partially rolls policy loan, keeps rate unchanged

- Chinese economy's export pillar shows cracks from global slowdown

- BOJ minions get first reality check:

- ECB minions "determined" to root out inflation:

- ECB must take determined steps to root out high inflation, de Guindos says

- 'Small' or 'determined'? ECB policymakers spar on rate hikes

- Wall St tumbles amid Fed tightening jitters, economic rumblings

- Friday, 16 September 2022

- Signs and portents for the U.S. economy:

- Oil prices up after Basra spill, but log weekly decline

- Forecast for Fed terminal rate hits new high, shaking stocks and bonds

- Mixed economic signs in China:

- China's economy perks up but dogged by property crisis

- China's property woes deepen in Aug as prices, sales and investment drop

- BOJ, Japanese government minions getting ready to keep yen from crashing as prices surge:

- Japan signals readiness to act in FX market if sharp yen volatility persists

- Japan August core inflation seen hitting near 8-year high - Reuters poll

- ECB minions say they need bigger recession to slow inflation, suggest they may go for it:

- Euro zone slowdown not enough to control inflation, ECB's de Guindos says

- Euro zone inflation confirmed at 9.1% as energy, food prices surge

- ECB's Lagarde says price stability priority before growth

- Explainer-Can the ECB really stop at the 'neutral' rate?

- Wall St drops to two-month lows as recession fears mount

The Atlanta Fed's GDPNow tool's forecast for real GDP growth in 2022-Q3 plunged for the second consecutive week, from 1.3% to 0.5%. The Bureau of Economic Analysis will provide its first official estimate of real GDP growth for the U.S. economy in 2022-Q3 on 27 October 2022.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.