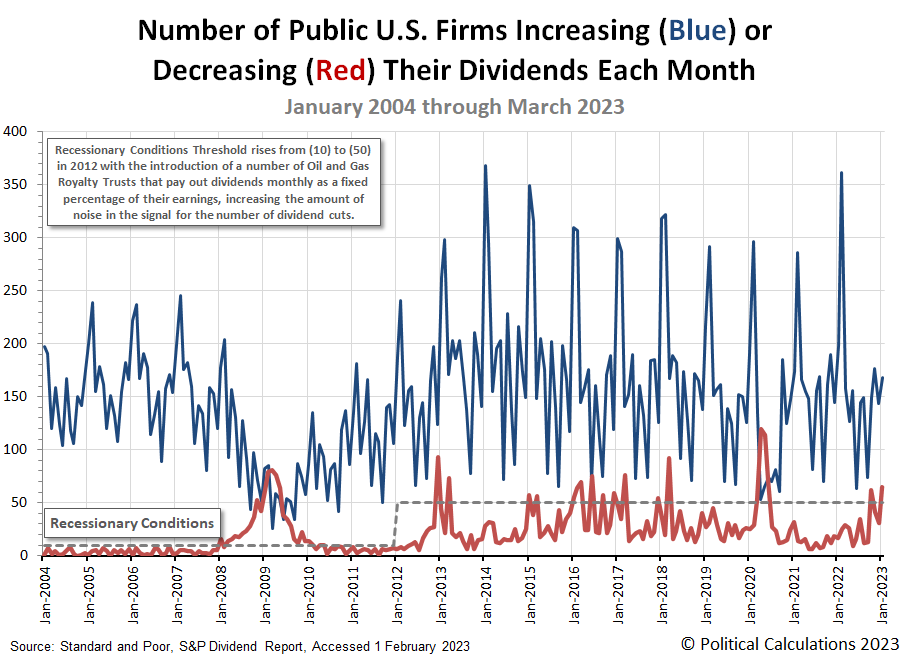

2023 got off to a rocky start for dividend paying stocks in the U.S. stock market. The number of firms announcing dividend reductions jumped back above the threshold indicating recessionary conditions are present in the U.S. economy. Meanwhile, the number of dividend increases announced during January 2023 presents a more mixed picture, up month over month, but down year over year.

These changes are visualized in the following chart.

With the new year, we're revamping how we present the U.S. stock market's monthly dividend metadata. The following table presents the data for the just completed month of January 2023, the preceding month of December 2022, and the year ago month of January 2022. We've also presented the Month-over-Month (MoM) and Year-over-Year (YoY) changes for January 2023's dividend metadata:

| Dividend Changes in January 2023 | |||||

|---|---|---|---|---|---|

| Latest | Previous Month | Previous Year | |||

| Jan-2023 | Dec-2022 | MoM | Jan-2022 | YoY | |

| Total Declarations | 3,127 | 5,528 | 2,401 ↓ | 2,224 | 903 ↑ |

| Favorable | 221 | 281 | 60 ↓ | 264 | 43 ↓ |

| - Increases | 168 | 144 | 24 ↑ | 198 | 30 ↓ |

| - Special/Extra | 48 | 135 | 87 ↓ | 59 | 11 ↓ |

| - Resumed | 5 | 2 | 3 ↑ | 7 | 2 ↓ |

| Unfavorable | 65 | 31 | 34 ↑ | 17 | 48 ↑ |

| - Decreases | 65 | 31 | 34 ↑ | 17 | 48 ↑ |

| - Omitted/Passed | 0 | 0 | 0 ↔ | 0 | 0 ↔ |

Our sampling of dividend decreases only captured 13 of the 65 reported dividend reductions. They are predominantly concentrated in the U.S. oil and gas sector among firms that pay variable dividends to their shareholding owners. These firms have made frequent appearances in recent months, coinciding with the ~35% decline in the price of crude oil from early June through December 2022. Dividend reductions most often represent a mildly lagging indicator for declining business conditions, so their appearance in January 2023 is not unexpected.

Here's the list for our sampling, where we also find industrial representation from the real estate and financial services sectors of the economy.

- MV Oil Trust (NYSE: MVO)

- Sabine Royalty Trust (NYSE: SBR)

- BP Prudhoe Bay Royalty Trust (NYSE: BPT)

- Gladstone Commercial (REIT-Diversified) (NASDAQ: GOOD)

- KNOT Offshore Partners (NYSE: KNOP)

- Permianville Royalty Trust (NYSE: PVL)

- Vornado Realty Trust (REIT-Office) (NYSE: VNO)

- Dorchester Minerals (NASDAQ: DMLP)

- Permian Basin Royalty Trust (NYSE: PBT)

- Hugoton Royalty Trust (OTC: HGTXU)

- VOC Energy Trust (NYSE: VOC)

- Mesa Royalty Trust (NYSE: MTR)

- Artisan Partners Asset Management (NYSE: APAM)

Going back to the dividend metadata, we're surprised we're not seeing more firms being recorded as omitting (or suspending) their dividend payments to shareholders. We suspect Standard and Poor is including them with the number of dividend decreases they report. That makes sense since both dividend cuts and omissions count as unfavorable changes, which we're now tracking in our monthly dividend metadata summary.

Reference

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 February 2023.

Labels: dividends, recession, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.