The S&P 500 (Index: SPX) continued to be pulled lower during the trading week ending on Friday, 17 March 2023.

The index closed out the week at 3916.64, some 18.3% below its all-time record high from 3 January 2022. It is now within close range of the 20% below-peak level that commonly defines the boundary of bear territory for the U.S. stock market.

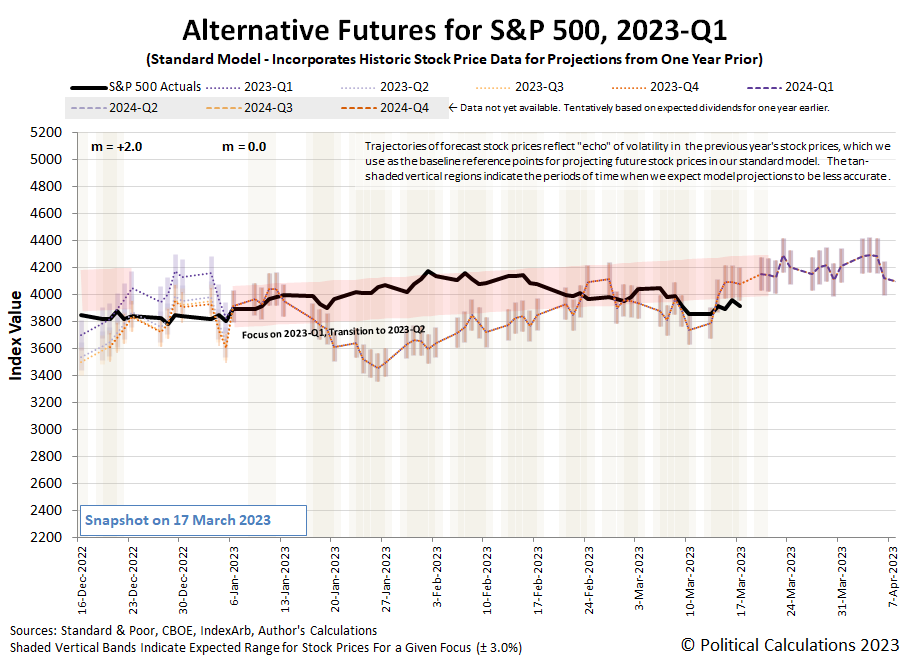

A series of news events related to bank failures, bailout actions, and potential impending failures prompted the fall in stock prices. Investors are on edge waiting for the proverbial next shoes to drop. The latest update alternative futures chart shows the level of stock prices running below the redzone forecast range, but not greatly below it at this point.

The developments suggest the dividend futures-based model's multiplier may have shifted in response to the change in outlook. If so, it will take time to sort out how much it may have shifted, because expectations for future dividends have also been negatively impacted by the past week's events. We'll take a closer look at how dividend futures have changed later this week.

With the Federal Reserve meeting later this week to discuss hiking rates once again, despite the developing banking crisis, the Fed's minions have been mostly silent, making the bank failures and potential contagion fear the main market-moving news headlines for the week that was.

- Monday, 13 March 2023

-

- Signs and portents for the U.S. economy:

- Bank failures may force Fed minions to give up on rate hike plan they wanted:

- SVB collapse may prompt Fed to go slow on rate hikes

- Goldman analysts no longer expect Fed rate hike in March after SVB failure

- Sliding bank shares drag Wall Street down in choppy trade

- Tuesday, 14 March 2023

- Signs and portents for the U.S. economy:

- Some U.S. banks facing stock rout may need to seek partners

- U.S. consumer prices increase solidly in February

- Fed minions expected to deliver quarter point rate hike in March:

- Bigger trouble developed in New Zealand:

- Bigger stimulus developing in China:

- BOJ minions claim they're not worried about U.S. bank failures:

- Wall Street ends green as inflation cools, bank jitters ebb

- Wednesday, 15 March 2023

-

- Signs and portents for the U.S. economy:

- Oil slumps nearly 5% to lowest in more than a year as banking fears mount

- Large U.S. banks view Credit Suisse exposure as manageable -sources

- BlackRock CEO Fink warns of financial risks, persistent inflation

- U.S. producer prices unexpectedly fall in February

- U.S. business inventories fall for first time in nearly two years

- Fed minions devise bailout plan for banks facing ruin from rate hikes so they can keep hiking rates:

- U.S. bank loan plan provides Fed rate hike path amid SVB fallout

- Fed's new banking backstop could slow balance sheet drawdown

- Bigger trouble developing in the Eurozone:

- German economy expected to contract slightly in 2023 -Ifo

- Denmark's central bank sees 4% inflation this year, risk of wage-price spiral

- French inflation revised upwards in February to 7.3% - final figures

- More post-COVID lockdown recovery signs in China:

- China coal output up 5.8% in Jan-Feb as new capacity comes online

- China Jan-Feb aluminium output up 7.5% as demand hopes rise

- China's economy shows gradual recovery after COVID reopening

- BOJ minion thinks their never-ending stimulus plan was "half successful", other minions having second thoughts:

- BOJ's Kuroda defends his bazooka stimulus as 'half successful'

- BOJ debated feasibility of tweaking yield control in Jan-minutes

- ECB minions want to keep big rate hikes going, but are rethinking their plans:

- ECB likely to stick to big rate hike despite banking turmoil

- ECB rate hike plans clouded by financial turmoil

- Barclays: ECB more likely to hike rates by 25 bps rather than 50 bps or no hike

- Wall Street down as Credit Suisse sparks fresh bank selloff

- Thursday, 16 March 2023

-

- Signs and portents for the U.S. economy:

- Large US banks lead First Republic rescue, Credit Suisse takes up $54 billion lifeline

- US regulators say deposits into First Republic Bank show system's resilience

- Exclusive-California bank PacWest Corp in talks to get liquidity boost -sources

- Goldman Sachs, JPM expect hit to US economic growth from SVB crisis

- U.S. bank deposits have started moving to money market funds - Goldman Sachs

- U.S. single-family housing starts, building permits rebound in February

- US import prices fall in February, post first annual drop since 2020

- Oil snaps declining streak as Saudi, Russia meeting calms markets

- Fed minions expected to hike rates just a quarter point at next meeting:

- Fed seen delivering quarter-point rate hike next week

- Fed likely to raise rates by 25 bps, with eyes on banks -PIMCO's CIO

- More post-COVID lockdown recovery signs in China:

- Bigger trouble developing in South America:

- Argentina hikes interest rate 300 basis points after inflation breaks 100% barrier

- Argentina February inflation data "very bad": government spokesperson

- ECB minions keeps big rate hikes alive despite new bank failures:

- ECB pushes through 50 bps rate hike despite market turmoil

- ECB sets the template for rate hikes in a time of instability

- ECB cuts through bank turmoil to keep rate hike pledge

- Wall Street closes higher as First Republic helps lift banks

- Friday, 17 March 2023

-

- Signs and portents for the U.S. economy:

- US consumer sentiment deteriorates in March, inflation expectations retreat

- US manufacturing output ekes out gains in February

- Expectations set for Fed minions:

- Bigger stimulus developing in China:

- ECB minions thinking they should ignore problems in bank sector to fight Eurozone inflation:

- Two ECB hawks call for more rate hikes despite banking turmoil

- Euro zone labour costs jump 5.7% y/y in Q4

- Wall Street ends sharply lower on bank contagion fears

The CME Group's FedWatch Tool completely changed direction this week. While a quarter point rate hike appears to still be set for the Fed's 22 March (2023-Q1) meeting, investors now expect that will be followed by a series of rate cuts starting as early as 14 June (2023-Q2) and continuing every 6-to-12 weeks through June 2024, when the Federal Funds rate will have fallen to a target range of 3.25-3.50%. That kind of forecast action only occurs during recessions.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 rose to +3.2% from its previous +2.6% estimate. Since the first quarter is nearly over, that indicator is transitioning to look backward instead of forward.

Image credit: Photo by Maxim Hopman on Unsplash.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.