Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, expectations for the S&P 500's has improved. The change reverses the negative pattern where earnings expectations have worsened at each of our snapshots since May 2022.

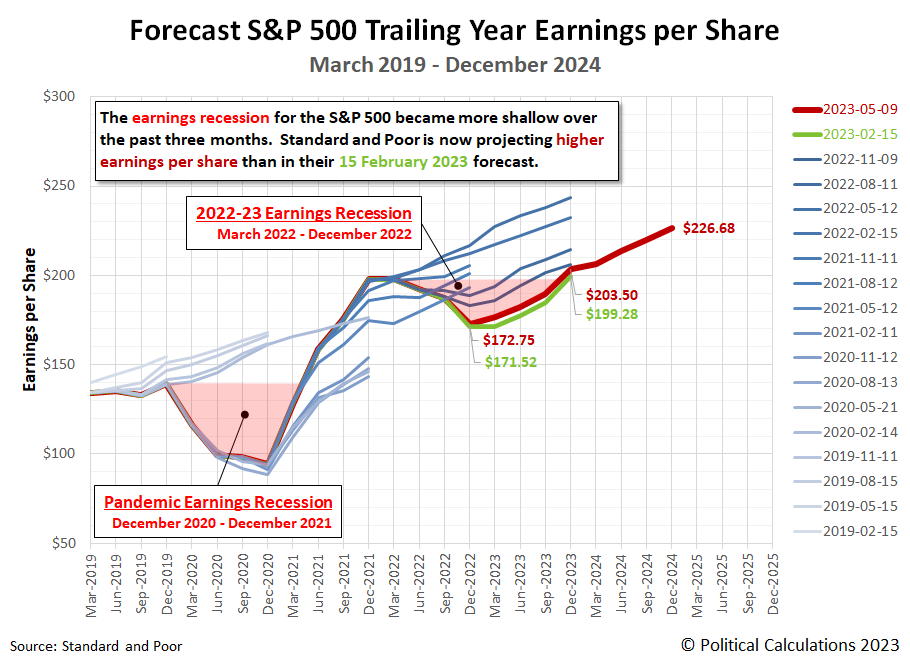

That negative pattern coincides with the onset of an earnings recession for the S&P 500, which became slightly shallower than previously projected over the previous three months. The bottom for that earnings recession is still December 2022, which rose to $172.75 per share from an estimated $171.52 in our Winter 2022 snapshot.

Looking forward to the end of 2023, expectations for the index' future earnings per share has increased from $199.28 to $203.50. Earnings at that level would correspond to a full recovery to the level of earnings recorded in March 2022, which marks the beginning of the S&P 500's earnings recession.

The following chart illustrates how the latest earnings outlook has changed with respect to previous snapshots:

Standard and Poor's projections also provide a first look at the level of earnings anticipated at the end of 2024. They show the S&P 500's earnings per share increasing to $226.88.

About Earnings Recessions

Depending on who you talk to, an earnings recession has one of two definitions. An earnings recession exists if either earnings decline over at least two consecutive quarters or if there is a year-over-year decline over at least two quarters. The chart identifies the periods in which the quarter-on-quarter decline in earnings definition for an earnings recession is confirmed for both the Pandemic Earnings Recession (December 2020-December 2021) and the new earnings recession (March 2022-December 2022) according to the first definition. The regions of the graph shaded in light-red correspond to the full period in which the S&P 500's earnings per share remained below (or are projected to remain below) its pre-earnings recession levels.

Our next snapshot of the index' expected future earnings will be in three months.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 9 May 2023. Accessed 9 May 2023.

Image credit: Photo by Sushobhan Badhai on Unsplash.

Labels: earnings, forecasting, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.