In January 2023, there were only two components of the S&P 500 (Index: SPX) whose market capitalization exceeded one trillion dollars.

As of the close of trading on Friday, 2 June 2023, there are now four. The membership of the S&P 500's trillion dollar market cap club has doubled!

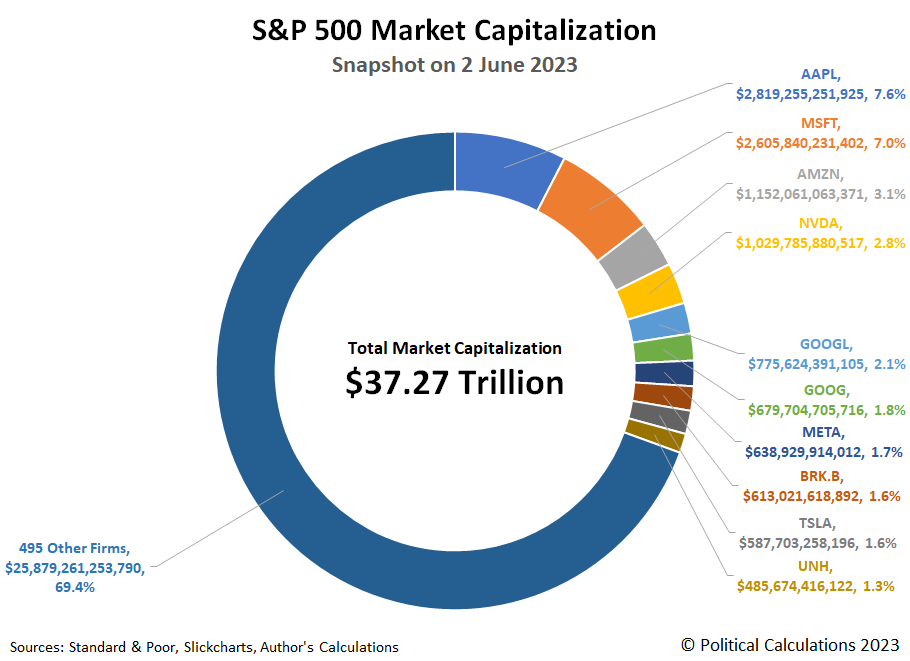

Together, those four companies account for 20.4% of the entire index' market capitalization of $37.27 trillion. The next six largest components of the index account for another 10.1% of that market cap. The following chart shows Top 10 firms' market cap as a share of the whole S&P 500:

The other 495 firms in the S&P 500 have a collective market capitalization of $25.88 trillion, or 69.4% of the index' total valuation.

Here is the list of the top 10 components of the S&P 500 index as of 2 June 2023:

- Apple (NASDAQ: AAPL)

- Microsoft (NASDAQ: MSFT)

- Amazon (NASDAQ: AMZN)

- Nvidia (NASDAQ: NVDA)

- Alphabet (A) (NASDAQ: GOOGL)

- Alphabet (C) (NASDAQ: GOOG)

- Meta Platforms (A) (NASDAQ: META)

- Berkshire Hathaway (B) (NYSE: BRK.B)

- Tesla (NASDAQ: TSLA)

- UnitedHealth Group (NYSE: UNH)

The Top 10 firms of the S&P 500 have increased their overall share of the index' total market capitalization, rising from 29.5% in our snapshot a little over 13 months ago to 30.6% on 2 June 2023.

Since that snapshot, the rankings of several firms within the Top 10 have changed. The most notable changes are Nvidia's recent surge to join the trillion-dollar valuation club, while Tesla's market cap has dropped from fourth to ninth place. Although it didn't change its ranking, Amazon has seen its market cap rise above the $1 trillion threshold. Meanwhile, Meta Platforms (formerly known as Facebook) has risen while Berkshire Hathaway has dipped.

But maybe the bigger story is that the 495 firms at the bottom of the market cap ratings within the S&P 500 have seen their collective market cap's decline, falling from $28.15 trillion in April 2022 to $25.88 trillion in June 2023. The growth of the index over the past 13 months has been highly concentrated within its largest market-cap weighted members.

That might explain MarketWatch's Brett Arends' latest opinion piece, in which he calls the concentration of the index' valuation "ridiculous":

The S&P 500 has become ridiculous. It has become so top-heavy that it is effectively just a bet on a handful of stocks. If you want to bet your retirement on the fortunes of a small number of companies, that’s your choice. But you should at least know you’re doing it. I suspect most people have no idea.

Apple alone now accounts for nearly 8% of the S&P 500 by market value. That is more than the bottom 200 companies in the index.

Put another way, if you invest in a typical U.S. (large cap) mutual fund, you are betting more of your money on Apple alone than you are on such household names as Walgreens Boots Alliance Darden Restaurants (Olive Garden, Ruth’s Chris, LongHorn Steakhouse), Royal Caribbean Cruises and Carnival cruise operators, kitchen table staples Kellogg Campbell Soup and JM Smucker casino giants MGM International Las Vegas Sands Caesar’s Entertainment and Wynn Resorts booze companies Molson Coors and Brown-Forman (Jack Daniel’s) toys giant Hasbro (G.I. Joe, Monopoly, Peppa the Pig) airlines United American and Southwest plus around180 other U.S. companies…put together.

Apple may be a wonderful company. But for $2.8 trillion, if I had to choose, would I rather own one company or these 200?

That's a good question. If you value diversification, what should you do? In his article, Arends suggests an equally-weighted index of S&P 500 component stocks might be more desirable.

That's good timing, because a little over a week earlier, Cullen Roche weighed the two types of indexing and compared how they have performed with respect to each other over the time that equal-weighted funds have existed as an available investing option.

We now have 20 years of real-time market data from live market cap and equal weight ETFs (SPY vs RSP). The performance is interesting because the equal weight index has outperformed by almost 1% per year. But it’s also come with added risk along the way where the standard deviation has been 2% higher and the maximum drawdown was 5% deeper. On the whole they’ve looked very similar though, but to earn that slight premium you needed a little stronger stomach.

Roche continues with an informative discussion of the nature of how the risks of investing in an equal-weighted index differs from a market cap-weighted index. But for our purposes, he does get to the bottom line:

The bottom line is, in the long-run these are very similar indices on a risk adjusted basis and there’s nothing wrong with owning the equal weight index as long as you know you’re using a factor tilt that takes a little more risk. At the same time, it’s useful to understand that while this is true in the long-run it’s not always true in the short-term. And now is one of those times where the market cap weighted S&P 500 is generating that 8.5% return by taking a much more concentrated risk relative to other broad markets.

Does the long or the short investment horizon matter more to you today?

References

Standard and Poor. S&P 500 Index Earnings and Estimates. [Excel Spreadsheet]. Accessed 2 June 2023.

Standard and Poor. S&P Market Attributes. [Excel Spreadsheet]. Accessed 2 June 2023.

Slickcharts. S&P 500 Companies by Weight. [Online Database]. Accessed 2 June 2023.

Ycharts. S&P 500 Market Cap. [Online Database]. Accessed 2 June 2023.

Labels: ideas, index, investing, market cap, personal finance, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.