After breaking through it's previous record high last week, the S&P 500 (Index: SPX) continued rising slowly to record a series of new highs for another four days before dipping 3.19 points to close out the trading week ending on Friday, 26 January 2024 at 4,890.97. Overall, the index was up a little under 1.1% for the week.

While the index rose during the past week as expected, the amount of the increase is not consistent with investors having shifted their forward-looking focus from the current quarter of 2024-Q1 to the more distant quarter of 2024-Q2. Even though expectations of the timing in which the Fed will start cutting interest rates slipped from 2024-Q1 to 2024-Q2 last week, stock market investors are so far remaining focused on the current quarter of 2024-Q1.

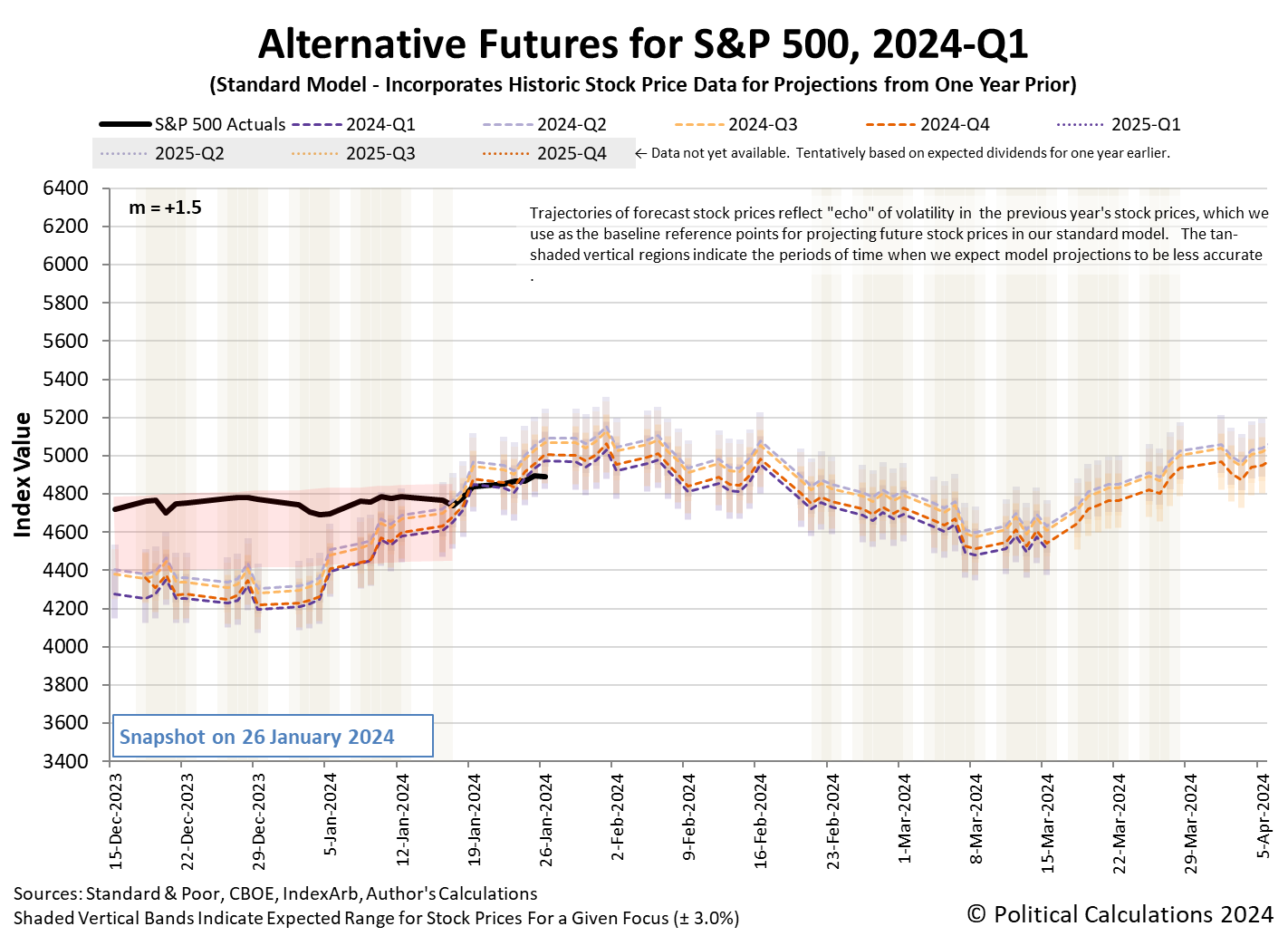

That's the conclusion we're drawing from the latest update to the dividend futures-based model's alternative futures chart. In it, we find the trajectory of the S&P 500 is much more consistent with investors focusing their attention upon 2024-Q1 in setting current day stock prices.

Had investors definitively shifted their attention toward 2024-Q2, we could have very optimistically seen stock prices increase by as much as another four percent.

It is possible however that other factors contributed to investors keeping their attention on the current quarter of 2024-Q1. Earnings season is now underway for the U.S. stock market, where several large components of the S&P 500 index reported lackluster results that made the week's market-moving headlines. Here are those headlines for the week that was:

- Monday, 22 January 2024

-

- Signs and portents for the U.S. economy:

- Oil rises 2% on supply disruptions in Russia, U.S.

- January set to break record as busiest for new US corporate bonds

- Fed minions say China's growing troubles "not having strong effect" on U.S.

- China's 'lackluster recovery' not having strong effect on US economy -Brainard

- Fed's inflation puzzle still missing a piece or two

- Bigger trouble, stimulus developing in China:

- BOJ minions expected to keep never-ending stimulus alive a little longer:

- Nasdaq, S&P, Dow ended in the green and scaled to new all-time highs

- Tuesday, 23 January 2024

-

- Signs and portents for the U.S. economy:

- Unemployment rises in nearly a third of US states in December

- Oil prices settle down slightly on more supply in US and abroad

- Expected timing of Fed minions' first 2024 rate cut slips to 2024-Q2:

- Bigger stimulus, trouble developing in China:

- China weighs stock market rescue package backed by $278 bln - Bloomberg News

- Exclusive: China moves to support yuan as stock markets tumble

- Mixed economic signs in Japan, BOJ minions to keep never-ending stimulus alive, but thinking about their exit plan:

- Japan Jan factory activity languishes, but service sector picks up - PMI

- BOJ signals conviction on hitting inflation goal in hawkish tilt, stands pat for now

- When and how would BOJ exit ultra-loose monetary policy?

- S&P 500 notches third straight record high close

- Wednesday, 24 January 2024

-

- Signs and portents for the U.S. economy:

- Oil steadies near $80 as China announces stimulus

- Rate cut hopes fuel bets real estate crisis is easing

- Bigger stimulus, trouble developing in China:

- China cuts bank reserves to defend markets, spur growth

- China's attempts to lift confidence in economy fall flat

- Exclusive: China regulators ask funds to curb short selling of stock index futures

- Recovery sign seen in Japan:

- ECB minions start worrying about possibility of bank runs:

- Nasdaq, S&P, Dow end mixed as Netflix-inspired gains fizzle out; Tesla results in focus

- Thursday, 25 January 2024

-

- Signs and portents for the U.S. economy:

- Oil jumps, settles up 3% on strong US economy, Red Sea tensions

- US new home sales rebound in December as mortgage rate retreat

- Fed minions see no need to continue bank bailouts:

- ECB minions claim they'll keep rates higher for longer as Eurozone economy slows, markets think they'll be forced to do rate cuts sooner:

- ECB sticks to inflation fighting even as rate cuts loom

- Traders step up ECB rate cut bets, sensing shift on inflation front

- ECB open to March pivot, possible June cut if data allow -sources

- S&P 500 extends streak of record highs; Tesla tumbles

- Friday, 26 January 2024

-

- Signs and portents for the U.S. economy:

- Oil settles at highest in nearly 8 weeks on strong economic growth

- US prices rise moderately in December; inflation trending lower

- U.S. home sales rise by most in over 3 years

- Markets gearing up early for Fed minions' expected interest rate cuts:

- BOJ minions discussing ending never-ending stimulus:

- Nasdaq, S&P, Dow end mixed, but Wall Street posts third straight weekly gain ahead of Fed

Overall, we can't complain too much because the market did rise and the stock market bull is looking out from a newer, higher vantage point than it did a week ago.

The CME Group's FedWatch Tool continued to signal investors expect the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 1 May 2024 (2024-Q2). This date marks the anticipated beginning of a series of quarter point rate cuts that are expected to take place at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's first "nowcast" estimate of real GDP growth for the first quarter of 2024 (2024-Q1) is a bold +3.0%. This forecast compares to an initial "Blue Chip Consensus" real GDP growth forecast centered on +1.0% for 2024-Q1 (the range of forecasts in the consensus range from a low of 0% to a high of +2.0% growth for the quarter).

Image credit: Microsoft Bing Image Creator. Prompt: "A bull standing on a mountain looking out over distant mountains. Nature photography. Highly detailed. Photo realistic. 4k."

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.