Suppressors are devices that deaden the noise that would otherwise be loudly heard when a bullet is fired from a gun. First patented in 1909 by Hiram Percy Maxim, they work by trapping the explosive gases that propel the bullet from the barrel of a gun after it is fired and the sonic boom that accompanies it.

SmarterEveryDay's Destin Sandlin worked with modern day suppressor manufacturer Soteria to visualize what happens inside a suppressor to better understand how they work by using a see-through acrylic sleeve on the supressor and firing several while filming with a high speed camera. You can learn a lot of engineering (and about engineering) in a short period of time from the footage of the bullet moving through the modified suppressors (HT: Core77):

The son of inventor Hiram Stevens Maxim, who had invented the first fully automatic machine gun some three decades earlier, Hiram Percy Maxim was an early automobile industry pioneer who would also apply the principles of his firearm silencer to that industry through his invention of the muffler for gasoline-powered engines in 1913.

Labels: technology

Following our analysis that indicates that the market for new homes in the U.S. is showing signs of topping out, we can also report that the median cost of a new home with respect to the median household income of a U.S. household is at or near an all time record.

The following chart shows the ratio of the trailing twelve month averages of median new home sale prices to our estimates of monthly median household income peaked in July 2017.

The trailing year average median price of new homes sold in the U.S. has risen to be 5.45 times the trailing year average of our estimate of median household income through July 2017. Preliminary data for August 2017 suggests the ratio has slightly declined with the median sale price of a new home having significantly declined from the previous month, but that figure will be subject to several revisions during the next several months, where we've found that later revisions for this data are most frequently revised upward before being finalized.

Data Sources

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [PDF Document]. Accessed 27 September 2017.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 1 September 2017. Accessed: 1 September 2017.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 1 September 2017. Accessed: 1 September 2017.

Sentier Research. Household Income Trends: January 2000 through May 2017. [Excel Spreadsheet with Nominal Median Household Incomes for January 2000 through January 2013 courtesy of Doug Short]. [PDF Document]. Accessed 22 June 2017. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars.]

Labels: data visualization, median household income, real estate

The just released new home sales data for August 2017 is preliminary, and the data for June and July 2017 is still subject to revision, but it looks like the market capitalization of the new home sales market in the United States may have topped out.

You can see what we mean in the following animated chart that shows the trailing twelve month averages of both the nominal market cap and the inflation-adjusted market cap for new home sales in the U.S. from December 1975 through August 2017.

Market capitalization is the product of the annualized number of new homes sold each month and their average sales price. In the following chart, we've isolated the trailing twelve month average of the annualized number of new homes sold each month from December 1975 through August 2017.

Using the trailing twelve month average of the annualized number of new home sales lets us compensate for the annual seasonality in the monthly data, which in this case, lets us see that the number of new home sales may have peaked in June 2017. We won't know for sure for several months if that month will prove to be a top in the new home sales market, as the preliminary data we have now is revised and the data for new months is reported.

Digging into the raw data for the annualized number of new home sales each month, we find that the number of new homes sales actually peaked in March 2017, where the monthly sales data has already been finalized, where declines in new home sales since have been registered in all census regions of the U.S.

This information confirms that the declines are not concentrated in the "South" census region, which might be expected in the aftermath of both Hurricane Harvey in Texas and Hurricane Irma in Florida, which both fall within the South census region. If anything, the "West" region has been the most negatively impacted in the period from March 2017 through August 2017.

What that suggests is that the topping of the market capitalization of new home sales in the U.S. is perhaps more directly attributable to a slightly delayed reaction by U.S. new home consumers to the series of interest rate hikes undertaken by the Federal Reserve since December 2016.

Data Sources

U.S. Census Bureau. Monthly New Residential Sales. Release Number: CB17-161. [PDF Document]. 26 September 2017. Accessed 26 September 2017.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. [Online Application]. Accessed 26 September 2017.

Labels: data visualization, real estate

The Fed did nothing with short term interest rates in the U.S. at its September 2017 meeting last week, yet the probability of a recession in the U.S. getting started at sometime in the next year ticked ever so slightly upward since the last Federal Open Market Committee meeting.

With the Federal Funds Rate still effectively set at 1.16% (the midpoint of the FOMC's current target range between 1.00% and 1.25%) and the slightly declining spread in the yields between the 10-year and 3-month constant maturity U.S. Treasuries declining slightly, the probability of a recession occurring within the next 12 months ticked up just a fraction of a percentage point to 0.38%. Or to put it more simply, there is currently very little chance that the National Bureau of Economic Research will someday declare that a national recession began in the U.S. between now and 22 September 2018 as based upon Jonathan Wright's recession forecasting method.

Perhaps the most interesting thing about what the Fed has done with short term interest rates in recent months is that it has set its Federal Funds Rate to be higher than the yields of the 1-Month, 3-Month and sometimes the 6-Month constant maturity U.S. Treasury securities. According to the textbook version of monetary policy, when the interest rate on Treasury bills is lower than the federal funds rate, banks will reduce the quantity of low-yielding Treasuries they hold and will instead increase loans to other banks, with the result that both the price of a Treasury bill rises and interest rates rise, which is exactly what we're seeing.

Previously on Political Calculations

Labels: recession forecast

The S&P 500 closed the third week of September 2017 exactly 1.99 points higher than it closed the previous week of the month. In percentage terms, that's a gain of almost 0.08%!

For a week in which the U.S. Federal Reserve met and officially decided the future fate of both its balance sheet and short term interest rates in the U.S., that outcome basically meant that the Fed did just about exactly what investors expected the U.S. central bank to do.

The solidification of that view during Week 3 of September 2017 can be seen in the change in the probabilities that investors are currently attaching to the size and timing for the Fed's next announced change in the Federal Funds Rate, as measured by the CME Group's FedWatch Tool.

| Probabilities for Target Federal Funds Rate at Selected Upcoming Fed Meeting Dates (CME FedWatch on 22 September 2017) | ||||||

|---|---|---|---|---|---|---|

| FOMC Meeting Date | 75-100 bps | 100-125 bps (Current) | 125-150 bps | 150-175 bps | 175-200 bps | 200-225 bps |

| 13-Dec-2017 (2017-Q4) | 0.0% | 27.1% | 71.4% | 1.4% | 0.0% | 0.0% |

| 21-Mar-2018 (2018-Q1) | 0.0% | 19.6% | 59.0% | 20.5% | 1.0% | 0.0% |

| 13-Jun-2018 (2018-Q2) | 0.0% | 13.0% | 45.5% | 33.3% | 7.8% | 0.5% |

Compared to the previous week, the probability that the Fed's next move for its Federal Funds Rate will be to increase it from the 100-125 basis point target range it is today to the 125-150 basis point target range in December 2017, increased significantly. However, we also see that investors are not anticipating another increase above that level at this time, and if we go by our dividend futures-based model, it appears that investors are splitting the difference between 2017-Q4 and 2018-Q2 as the most likely timing for the next rate hike increase.

In the chart above, the red-shaded zone indicates the range where we would expect the S&P 500 to be after adjusting for the effect of past volatility of the historic stock prices that we use in our model as the base reference points from which we project future stock prices, which in this case, assumes that investors are focused on 2018-Q2, and the expectations associated with that quarter, in setting today's stock prices. As you can see, the actual trajectory of the S&P 500 is currently near the top end of that predicted range.

That suggests that investors are still focusing more of their forward-looking attention on that distant future quarter than they are on 2017-Q4, which would also suggest that stock market investors are betting that the Fed won't hike interest rates again until 2018-Q2.

This is the first time that we've seen that kind of disagreement between the CME Group's future probabilities for the Federal Funds Rate and our dividend futures-based model. We think that eventually, one or both views of the future will change so that their outlooks converge, but for now, we're in new analytical territory, where we'll have to turn to other means to see which outlook might prevail.

Speaking of which, the headlines for the week didn't offer much insight into which outlook should be given greater weighting.

- Monday, 18 September 2017

- Tuesday, 19 September 2017

- Wednesday, 20 September 2017

- Thursday, 21 September 2017

- Friday, 22 September 2017

What else happened during Week 3 of September 2017? Barry Ritholtz lists the positives and negatives bullet points for the U.S. economy and markets for the week that was.

Any chemical can be toxic and cause death when ingested in large enough quantity. The thing that keeps things made from chemicals from killing everyone and everything they touch (and remember, everyone and everything is made from chemicals to begin with), is their dose, which determines whether the chemical in question will be effectively harmless or will turn out to be a fatal poison.

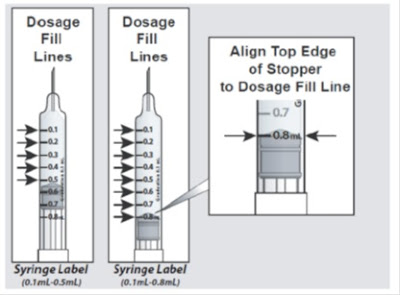

That's why it is important to pay attention to the instructions and labels included with many medications that specify their maximum allowable daily dosage (such as this example for many commonly prescribed or over-the-counter medications). But how far does that maximum "allowable" dose fall below what would be considered to be a fatal dose?

The reason why we're asking that question today is because we were surprised to learn from Josh Bloom of the American Council on Science and Health that acetaminophen, a very common and popular pain relieving and fever reducing medication, is considered by some to be the "most dangerous drug ever made".

The reason why it is considered such is because the margin of safety between a fatal dose of acetaminophen and the maximum allowable daily dose indicated on the over-the-counter medication's label is comparatively low when compared to other drugs that are popularly perceived as being more toxic.

In medicine, the approximate safety margin of an estimated fatal dose of a given substance with respect to the amount of a dose recommended to achieve its desired benefit in 50% of the population is given by a quantity called its Therapeutic Index (TI). For acetaminophen, an estimated lethal dose would be considered to be 10 grams (10,000 mg), while the maximum allowable daily dose for the drug has been set at 3,000 mg since 2011.

Those values let us calculate the therapeutic index for acetaminophen, which we've built the following tool to do the math. If you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version of the tool on our site.

Prior to 2011, the maximum allowable daily dose for acetaminophen was 4,000 mg, which would give it a Therapeutic Index of 2.5. With its maximum allowable dose having dropped to 3,000 mg per day, the TI for acetaminophen is 3.3, which is still very narrow when compared with other pain relieving medications that are perceived by the public as being more dangerous, such as hydrocodone (estimated TI = 8 to 16), which must be prescribed by a medical professional.

That narrow margin for its TI value, along with its wide availability, may be why acetaminophen overdoses are surprisingly common. Neurologist Dr. Aric Hausknecht recently described the scope of the issue:

Each year a substantial number of Americans experience intentional and unintentional Tylenol (acetaminophen) associated overdoses that can result in serious morbidity and mortality. Analysis of national databases show that acetaminophen-associated overdoses account for about 50,000 emergency room visits and 25,000 hospitalizations yearly. Acetaminophen is the nation's leading cause of acute liver failure, according to data from an ongoing study funded by the National Institutes for Health. Analysis of national mortality files shows about 450 deaths occur each year from acetaminophen-associated overdoses; 100 of these are unintentional.

Doing the math, that's 350 intentional deaths that occur each year that can be directly attributed to overdoses of acetominophen. If all of these deaths are suicides, overdoses of acetaminophen would account for about 5% of all suicides by poisoning in the U.S.

For all the other cases, the bottom line is that the maximum allowable daily dose indicated on a medication's label should not ever be exceeded without direct monitoring and care provided by trained medical professionals.

How much do you need to save for retirement to maintain your pre-retirement lifestyle?

It's an easier question to ask than to answer because there are a multitude of factors that can affect what the right answer to the question will be for you. And that assumes that whatever answer you come up with turns out to be the right answer!

Still that doesn't stop people from asking and firms offering their retirement planning services from attempting to answer in the simplest ways they can.

The latest firm to do so is Fidelity, where they've developed the concept of using age-based savings factors to help you determine if you've saved enough at various points of your life. For the simplest estimate, all you need to get started is find the appropriate savings factor that applies for your age, multiply it by your annual income, then see how the balance of your retirement savings account compares to it. The following chart is one that they have provided for that simple math.

Seems pretty simple, right? And to be fair, the math involved is pretty simple. In the following chart, we've started with the median income earned by a typical American between the ages of 25 and 29 in 2016, then showed the inflation-adjusted savings that such an individual would have to accumulated at different points throughout their life to meet Fidelity's savings targets. The income trajectory shown for the individual is also one that Fidelity assumes, which we've listed along with a number of additional assumptions Fidelity is making....

Will all those assumptions apply to you? Maybe yes, maybe no. Just for fun, we decided to play with just one of those assumptions, where instead of Fidelity's assumed 1.5% annual inflation-adjusted raise, we wondered how differently the chart would look if the individual to whom it applied was simply earning 2016's median income for the indicated age. After all, since it is the median, 50% of Americans have annual incomes above that level and 50% of Americans have annual incomes below it, so that particular income trajectory might be considered to be more representative of what a typical lifetime income trajectory for an American randomly plucked from the population at large might have, so here that chart is.

It's quite a lot different from Fidelity's assumed lifetime of annual faster-than-the-rate-of-inflation raises. So the real question is which chart better represents the kind of pre-retirement lifestyle that an American looking to retire would want or be able to maintain?

We'll leave other questions that might come up about Fidelity's assumptions, such as "can someone with this income really afford to set aside 15% of their annual income for their retirement at Age 67?", as an exercise for our readers!

Labels: investing, personal finance, risk

What are the differences between the Congressional Budget Office's estimates of income inequality among U.S. households and the annual estimates produced by the U.S. Census Bureau?

We've taken a stab at answering that question in a visual format through the following infographic! Please click the image to access a larger, more readable version of the chart to get the quick run-down on what makes each of the indicated estimates different from one another, while also checking out over 50 years worth of U.S. household income inequality data as measured by the estimable Gini ratio.

As for Item 4, we'll have more information soon, but as a quick indication of what we can do with the Census data that cannot be done with the CBO's data, check out our tool What Is Your Income Percentile Ranking?

Data Sources

Congressional Budget Office. The Distribution of Household Income and Federal Taxes, 2013. [PDF Document]. Supplemental Data [Excel Spreadsheet]. June 2016.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic Supplements. Historical Income Tables: Households Table H-4. Gini Ratios for Households, by Race and Hispanic Origin of Householder. All Races. [Excel Spreadsheet]. 10 August 2017.

Labels: data visualization, income distribution, income inequality

The pace of dividend cuts in 2017-Q3 has decelerated from what we were observing a month ago, where suddenly, 2017-Q3 is perhaps shaping up to be the best quarter to date in 2017. The following chart compares where the cumulative number of dividend cuts announced in 2017-Q3 stack up against similar points of time in the two preceding quarters of 2017-Q1 and 2017-Q2.

Despite having the potential to be the best quarter in 2017, the pace of dividend cuts for the third quarter is at a level that is consistent with recessionary conditions being present in the U.S. economy. Based on our near-real time sampling of dividend cut declarations, those conditions are largely concentrated in the oil and gas industry, which has accounted for 23 of the 37 dividend cuts announced since 1 July 2017. The financial and real estate industries rank second, accounting for 10 of dividend cuts that have been announced so far during 2017-Q3.

Compared to a year ago however, we see that 2017-Q3 is faring slightly worse than 2016-Q3.

We'll wrap up the stories for dividend cuts in September 2017 and for 2017-Q3 on 3 October 2017.

Data Sources

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database]. Accessed 18 September 2017.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 18 September 2017.

Labels: dividends

U.S. stock prices during the second week of September 2017 were largely driven by two news events:

- Actual damage from Hurricane Irma in Florida proved to be considerably less than had been projected.

- Inflation data put rate hikes back onto the Federal Reserve's table in the near future.

By "near future", the likelihood that the Fed would next hike short term U.S. interest rates went from last week's zero percent chance of happening anytime soon to a greater than 50% probability that they will act to make it happen in December 2017, where the CME Group's FedWatch Tool indicates that the market expects no change in rates to be announced at the Fed's meeting this week.

| Probabilities for Target Federal Funds Rate at Selected Upcoming Fed Meeting Dates (CME FedWatch on 15 September 2017) | ||||||

|---|---|---|---|---|---|---|

| FOMC Meeting Date | 75-100 bps | 100-125 bps | 125-150 bps | 150-175 bps | 175-200 bps | 200-225 bps |

| 20-Sep-2017 (2017-Q3) | 1.4% | 98.6% | 0.0% | 0.0% | 0.0% | 0.0% |

| 13-Dec-2017 (2017-Q4) | 0.6% | 41.6% | 55.6% | 2.2% | 0.0% | 0.0% |

| 21-Mar-2018 (2018-Q1) | 0.4% | 31.7% | 52.0% | 15.0% | 0.8% | 0.0% |

| 13-Jun-2018 (2018-Q2) | 0.3% | 22.6% | 45.9% | 25.6% | 5.1% | 0.3% |

The effect of this new information on stock prices can be seen in our alternative futures "spaghetti" chart.

With investors shifting their forward-looking focus from 2018-Q2 to 2017-Q4, the S&P 500 rose to reach a record high during Week 2 of September 2017, although right now, the data suggests that investors are splitting their attention between 2017-Q4 and 2018-Q2, where stock prices are reaching toward the very top of the echo effect-adjusted range we indicated for 2018-Q2 just last week.

The thing to pay attention to this week that might more fully cement investor focus onto 2017-Q4 is the statement that will be issued by the Federal Reserve's Federal Open Market Comittee at the conclusion of its upcoming meeting on Wednesday, 20 September 2017, as well as the statements of individual Fed officials in the following days.

Looking backwards, here are the more signficant market moving headlines that caught our attention during Week 2 of September 2017.

- Monday, 11 September 2017

- Tuesday, 12 September 2017

- Wednesday, 13 September 2017

- Thursday, 14 September 2017

- Friday, 15 September 2017

Meanwhile, Barry Ritholtz succinctly summarized the positives and negatives for Week 2 of September 2017.

A 1977 classic short on the relative scale of everything in the universe.

HT: Quanta's Robbert Dijkgraaf, who linked the Charles and Ray Eames' film while discussing reductionism and emergence as the tools for solving the biggest mystery in physics today.

Labels: data visualization, math

The United States and China are the two largest national sources of carbon dioxide emissions on Earth. We thought it might be interesting to compare their annual CO2 outputs, from 1958 through 2015, which we've visualized in the following animated chart.

As an interesting aside, from 1988 through 2015, both nations have emitted approximately equal amounts of carbon dioxide. Looking at the first and last years of that period, the U.S.' carbon dioxide emissions totaled 4,889 [million] tonnes in 1988 and 5,093 [million] tonnes in 2015, peaking at 5,790 [million] tonnes in 2005.

Meanwhile, China emitted 2,368 [million] tonnes in 1998 and 10,216 [million] tonnes in 2015, with a peak value of 10,294 [million] tonnes in 2014, almost doubling the U.S.' carbon dioxide emissions in that year.

Update 19 September 2017, 9:23 PM: Corrections added in brackets [Thanks Jim!]

References

Boden, T.A., G. Marland, and R.J. Andres. 2016. Global, Regional, and National Fossil-Fuel CO2 Emissions. Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy, Oak Ridge, Tenn., U.S.A. doi 10.3334/CDIAC/00001_V2016: National Emissions v1.0 [Excel Spreadsheet]. November 2016. Accessed 13 September 2017.

Labels: data visualization, environment

The U.S. Census Bureau has published its annual report on Income and Poverty in the United States, which we've used to visualize the cumulative distribution of income for U.S. individuals, families and households in the following animated chart!

The cumulative income data applies for the 2016 calendar year, which the Census Bureau collected through its March 2017 survey sample, which they processed and published on 12 September 2017. Income data for the 2017 calendar year will not be collected until March 2018 and not published until September 2018.

If you would like to see static versions of the cumulative income distribution charts in the animation above for individuals, families and households, we can accommodate you! If you would like to estimate where you fall on the the income distribution spectrum in the U.S. using these charts, all you need to do is find your income on the horizontal axis, trace a vertical line up to where it intercepts the curve on the graph, then trace a horizontal line to the left side of the chart where you can roughly approximate your income percentile ranking on the vertical scale.

If you would like a more precise estimate, we have updated our "What Is Your Income Percentile Ranking?" tool with the 2016 income distribution data. Our tool can also estimate what your income percentile would have been in any calendar year from 2010 through 2015.

Labels: data visualization, income, income distribution, median household income

Although it only lasted from 17 August 2017 through 2 September 2017, Hurricane Harvey will have an impact on trade between the U.S. and China.

The reason why has everything to do with its impact on Texas' ports, like Corpus Christi, where crude oil is loaded onto large container ships whose destination is China.

The meteoric growth of U.S. oil exports to China is perhaps one of the most underreported economic stories of 2017, which many mainstream media sources have only begun to catch onto in recent months. The growth of these exports directly increases the U.S.' national GDP and reduces the nation's trade deficit with China.

That growth however will be disrupted by the impact of Hurricane Harvey as it closed Texas' ports until the storm passed and the ports could reopen after clearing or repairing damaged equipment and vessels. Corpus Christi, which is on track to becoming the United States' "main energy export hub", was closed from 25 August 2017 through 31 August 2017, at which time no vessels bound for China were loaded with oil.

That weeklong shut down at Texas' ports will likely show up in the U.S. Census Bureau's U.S-China trade data for either August or September 2017, where the data for August will be released on 5 October 2017.

But the closure of Texas' ports will not be the only contributor to reduced U.S. energy exports. Port Arthur, Texas' VPS-5 refinery, the largest oil refinery in the U.S., just reopened on 11 September 2017 after having been closed for two weeks due to Hurricane Harvey, so we can also expect to see the impact of its closure show up in the energy export data for September 2017, which won't be released until November 2017.

So that makes the following chart showing the growth rates of total value of goods and services exported between the U.S. and China the "Before" picture for the impact that Hurricane Harvey will have on the U.S.' energy exports in the third quarter of 2017.

The chart indicates relatively healthy conditions in both the U.S. and China, as the year-over-year rate of growth of both nations' exports to each other in July 2017 are both near 10% annual growth.

If the Census Bureau's August data captures the last week of that month however, we would expect to see the growth rate of U.S. exports to China drop relative to China's exports to the U.S. when that data is released in October, and again for September 2017's data when it is released in November.

Data Sources

Board of Governors of the Federal Reserve System. China / U.S. Foreign Exchange Rate. G.5 Foreign Exchange Rates. Accessed 11 September 2017.

U.S. Census Bureau. Trade in Goods with China. Accessed 11 September 2017.

Labels: trade

After the last two weeks of seeing so many spaghetti models that forecast the potential trajectory of hurricanes in the news, we can't help but note that the forecasting charts that we show each week really represent a similar concept being applied to the future path of the S&P 500.

Only for us, the difference between the alternative trajectories that the S&P 500 might follow comes down to how far into the future investors are collectively looking at any given point in time, where the base reference points that we're projecting from are 13 months, 12 months and 1 month in the past.

That would seem to be a pretty straightforward proposition, but not always. Sometimes, the historic stock prices that we use as those base reference points reflect have been affected by an abnormal amount of volatility in the stock market, where the echo of past volatility skews our dividend futures-based model forecasts.

Last week, we entered one of those periods, which will affect the accuracy of our raw forecasts through 8 November 2017.

That's why we've adjusted our alternative futures chart for the S&P 500 by overwriting the overall trajectory in which we expect the S&P 500 to fall during the next several weeks, where we've assumed that 2018-Q2 will continue to be the point in time to which investors will focused their attention, just as they have over the last several weeks.

Our basis for making that assumption may prove to be very short-lived however. The CME Group's Fedwatch Tool no longer anticipates any change in the level of the Federal Funds Rate in the U.S. through the indefinite future (or rather, at least 1 August 2018), where other factors may soon affect how far into the future investors look.

Consequently, we may see greater volatility in the S&P 500 as a result, where breaking news may cause investors to suddenly shift their attention to other points of time in the future.

As that might happen, we'll redraw the chart to show the echo-adjusted trajectory they might settle upon. Right now however, we'll observe that will have a positive effect on the level of the S&P 500 if they focus upon 2017-Q4 or 2018-Q3, but a negative one if they have reason to focus upon 2018-Q1. Update 10:15 AM EDT: Early trading on 11 September 2017 suggests either 2017-Q4 or 2018-Q3!

And since that other kind of news may have a more significant impact on stock prices now that investors expect the Fed to sit on the sidelines, here are examples of the kinds of headlines that can drive stock prices from the last week.

- Monday, 11 September 2017

- Tuesday, 12 September 2017

- Mixed message for oil and gasoline:

- Fed policymakers signal caution on inflation, rate hikes

- Federal Reserve should be patient on rate hikes, says Kaplan

- Brainard's warning signals Fed cautious on inflation

- Fed's rate hikes may be doing real harm to U.S. economy: Kashkari

- Fed's Kaplan sticks to view that balance sheet should shrink

- Fresh North Korea tensions hit Wall Street

- Wednesday, 13 September 2017

- Thursday, 14 September 2017

- Oil mixed, Brent rises as Irma casts shadow over Harvey recovery

- Dudley stands by Fed rate hikes, still sees U.S. inflation rebound

- Wishful thinking? Weak U.S. inflation puzzle should clarify in six months: Fed's Dudley

- Fed's Mester says wants to 'set it and forget it' on balance sheet

- A preview for Hurricane Irma in Puerto Rico and Florida: Hurricane Harvey boosts U.S. jobless claims to more than two-year high

- Wall St. ends flat as media stocks slump, healthcare gains

- Friday, 15 September 2017

- Oil slides as Irma heads for Florida, threatening demand

- Throwing in the towel for a September 2017 rate hike: Too soon to predict timing of next Fed rate hike: Dudley

- S&P 500 slips as Hurricane Irma nears Florida; tech falls

For a bigger picture of the week's major economic and market news, Barry Ritholtz succinctly summarizes the positives and negatives for Week 1 of September 2017.

If you believe Tim Harford, and you should, the elevator is one of the 50 things that made the modern economy.

But the elevator as we have known it since 1852 has had some major practical limitations. Specifically, elevators can generally only go up or down, and despite such theoretical concepts as the Wonkavator, elevators that can be found to do more than just move up and down a single shaft are few and far in between.

One of those few and far in between places is ThyssenKrupp's prototype elevator test facility in Rottheim, Germany, where the company's MULTI elevators can go up, down, and sideways. (HT: Core77).

If it proves feasible, this is the kind of development that could significantly reshape the architecture of major cities, much as the invention of the safety elevator itself enabled the practical construction of skyscrapers that helped create the modern city skyline.

"Where a full cabin is stopping at every floor and people are smiling at each other outside and inside the elevator and nobody is getting out or in, this will change," said Andreas Schierenbeck, CEO of ThyssenKrupp Elevator.

"Instead you fill a cabin with six to eight people and they're going to the exact location where you want without any stops—it's like a metro system where you stop at the station where you want."...

"With the horizontal movement of the MULTI, you can connect buildings. You can connect train stations with your buildings, you could even have your own cabin waiting for you at your hotel room—all these things which have been a little bit science fiction maybe three, four, five years ago are now possible,” added Schierenbeck.

The potential applications go beyond buildings. Laid out horizontally, the same technologies that ThyssenKrupp is pioneering in its elevator application could reshape modern manufacturing by better facilitating the flow of production from one work station to another, or to even reconfigure the layout of modular work stations themselves on the fly as needed to meet changing production requirements.

Labels: technology

In January 2017, Philadelphia imposed a 1.5-cent-per-ounce tax upon all naturally and artificially sweetened regular and diet beverages distributed for retail sale within the city. Through June 2017, the city has failed to hit any of its monthly revenue collection targets for the tax, which has fallen anywhere from 7% to 18% below its desired revenue levels in each month of the year to date. The following chart illustrates just how far short those revenue collections have been through the first six months of 2017, where the biggest shortfalls have occurred in months that should be seeing the greatest revenues.

In the chart above, the upper blue line represents an estimate of the amount of revenue that Philadelphia would need to collect each month to achieve its annual revenue target of $92.4 million. The lower red line represents the city's actual tax collections from its controversial beverage tax in each of the first six months it has been in effect.

Last month, Courtney Shupert and Scott Drenkard of the nonpartisan Tax Foundation made some pretty startling claims in discussing the failures of Philadelphia's controversial soda tax, where they suggested that because the city's soda tax was so high, it might actually be encouraging Philadelphians to drink more alcoholic beverages. Here are some key excerpts from their analysis, aptly titled "Soda Tax Experiment Failing in Philadelphia Amid Consumer Angst and Revenue Shortfalls":

On June 16, 2016, the Philadelphia City Council adopted legislation implementing a city-wide excise tax on nonalcoholic sugar-sweetened and diet beverages.1 Levied on distributors, the 1.5 cent-perounce beverage tax went into effect on January 1, 2017.

The tax, which is 24 times the state excise tax rate on beer, has received mixed reviews among constituents. Some Philadelphians support the tax for the programs it funds. Meanwhile, local business owners and workers have filed lawsuits against the tax....

Purchases of beer are also now less expensive than nonalcoholic beverages subject to the tax in the city.15 Empirical evidence from a 2012 journal article suggests that soda taxes can push consumers to alcohol, meaning it is likely the case that consumers are switching to alcoholic beverages as a result of the tax. The paper, aptly titled From Coke to Coors, further shows that switching from soda to beer increases total caloric intake, even as soda taxes are generally aimed at caloric reduction.16

That brings up an interesting question: Are Philadelphia's "angst"-filled consumers increasing their alcohol consumption now that it has become relatively more affordable than it was before Philadelphia's tax on sweetened soft drinks went into effect?

In what might be the first confirmation that particular kind of substitution is indeed taking place, we found evidence to suggest that is the case in Philadelphia's liquor tax collection data, which is used to provide funds for the city's school district. The following chart shows what we found when we tallied the trailing 12 month total for Philadelphia's 10% tax on the sale price of all alcohol beverage sold within the city.

In this chart, we see that the trailing year total of Philadelphia's liquor tax collections followed a very steady upward trajectory from April 2015 through December 2016, a period that included the implementation of reforms in Pennsylvania's liquor sale laws, which enabled more alcohol beverages like wine to be purchased at retailers that already were selling beer outside of state-owned liquor stores, which took effect in August 2016. Despite that change however, Pennsylvania's government-owned liquor stores still dominate the market for alcohol sales, setting fairly uniform retail prices for alcohol-based beverages throughout the state.

That began to change in January 2017 however, when the city's liquor tax collections began to significantly increase above that established trend, a change that directly coincides with the implementation of the city's tax on sweetened beverages. The city went on to end its 2017 fiscal year in June 2017 having collected at least $3 million more from its alcohol beverage sales tax than would have been expected from the pre-soda trend established for its liquor tax collections.

That in itself isn't enough to confirm that the effect of Philadelphia's sweetened beverage tax in raising the relative price of soft drinks in the city to be more directly competitive with alcoholic beverages, so we went the extra mile and looked at a similar alcoholic beverage sale tax that applies on the opposite end of the state, in Allegheny County, which falls within Pittsburgh's metropolitan area. The following chart reveals what we found for the same period of time.

Here, we find that the trailing 12 month totals for Allegheny County's alcohol sales tax collections are not seeing the same kind of rising trend that Philadelphia's alcohol beverage sales tax collections have seen since the latter city's soda tax went into effect. Instead, we see that it dropped below that region's established trend in December 2016, but has paralleled the trend in the months since.

There are other confounding factors to consider, such as the relative economic growth in each regiun, where Philadelphia has increased its trailing 12 month average employment by just 5,000 since the end of 2016 as its employment growth has slowed in 2017, while Pittsburgh's employment level has been flat-to-lower over the same period of time.

In Philadelphia's case however, that relative employment growth is not sufficient to explain the sharp growth of the city's alcohol tax collections that have been realized since its soda tax went into effect. We think that the most likely explanation for that change is that the city's consumers are increasingly substituting alcohol beverage purchases for soft drinks now that their prices have become more relatively competitive with them.

It will take more work to untangle the various confounding factors, but the data we have available today strongly suggests that Philadelphia's soda tax is succeeding in driving consumers in the city to drink more alcohol than they were willing to drink before the soda tax made so many non-alcohol soft drinks much more expensive than they had been.

It's just a good thing that apparent increase in alcohol consumption in Philadelphia is not so far leading to more drunken driving incidents thanks to ridesharing apps!

References

City of Philadelphia Department of Revenue. School District Monthly Revenue Collections, Fiscal Years 2015, 2016 and 2017. [PDF Documents]. Accessed 19 August 2017.

Shupert, Courtney and Drenkard, Scott. Soda Tax Experiment Failing in Philadelphia Amid Consumer Angst and Revenue Shortfalls. Tax Foundation Fiscal Fact No. 555 Aug. 2017. [PDF Document]. 3 August 2017.

U.S. Bureau of Labor Statistics.

Economy at a Glance: Philadelphia, PA (Labor Force Data: Employment). July 2014 through June 2017. [Online Database]. Accessed 6 September 2017.

Wagner, Chelsa. Allegheny County Controller Financial Reports. [Online Database]. Accessed 19 August 2017.

Wansink, Brian and Hanks, Andrew S. and Just, David R., From Coke to Coors: A Field Study of a Fat Tax and Its Unintended Consequences (May 26, 2012). Available at SSRN: https://ssrn.com/abstract=2079840 or http://dx.doi.org/10.2139/ssrn.2079840. [Online Article].

Previously on Political Calculations

Presented in chronological order....

- Examples of Junk Science: Taxing Treats

- Philadelphia Soda Tax Crushes Soft Drink Sales

- Philadelphia's Soda Tax Collections Are Falling Short

- Philly's Soda Tax Collections Continue to Fall Short of Goals

- Jobs Gained and Lost from Philadelphia's Soda Tax

- Philadelphia Soda Sales Volume Down 34% Since Tax

- Philadelphia's Soda Tax to Shrink City's Economy by $20 million (updates an earlier analysis in the series based on new information)

- Big Miss for Philadelphia's Beverage Tax

- Odds and Ends for Philadelphia's Soda Tax - a short legal update, a family baker goes under, and bootlegging booms!

- Legal Jeopardy for Philadelphia's Soda Tax

Labels: economics, food, taxes

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.