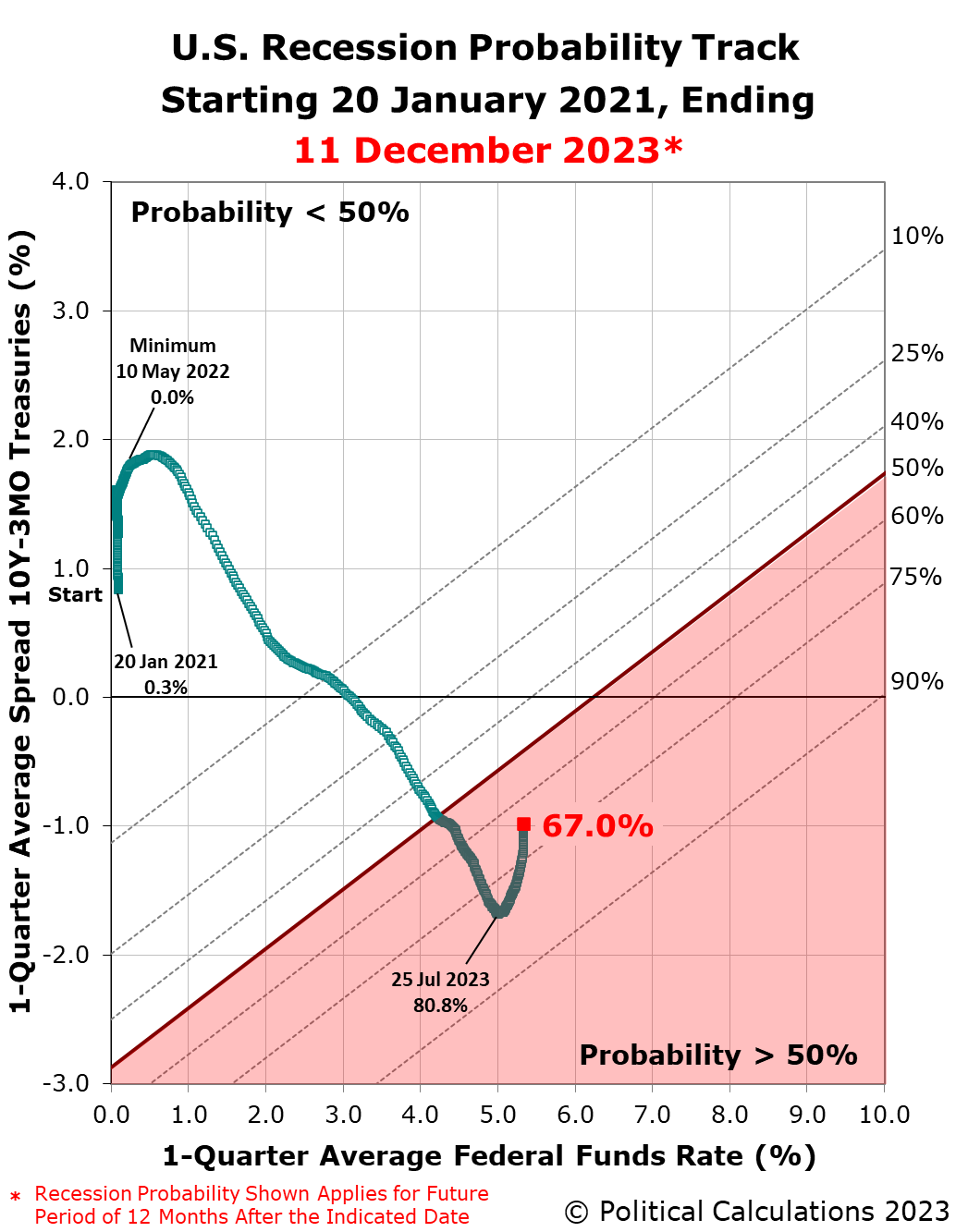

The probability the U.S. economy will experience an official period of recession sometime in the next twelve months continued to recede during the past six weeks. That probability now stands at 67%, which applies to the period from 11 December 2023 through 11 December 2024, which is to say there's about a two out of three chance of an official recession starting during that span of time.

The probability peaked at 80.8% on 25 July 2023, just before the U.S. Federal Reserve announced it would hike the Federal Funds Rate by another quarter point, bringing its target range up to 5.25-5.50%. The Fed has since held rates steady at that level and is expected to announce it will continue doing so after its Federal Open Market Committee concludes its two-day meeting on 13 December 2023.

Since July, the probability of a recession starting sometime in the next 12 months has declined. That change coincides with the average spread between the constant maturity 10-year and 3-month U.S. Treasuries over a one-quarter long period becoming less inverted in the weeks since the recession probability peaked. Since our previous update however, the U.S. Treasury yield curve has become more inverted. We may be looking at a reversal for the recession probability track at our next update in six weeks.

For now, here's the latest update to the Recession Probability Track illustrating how things stand going into the FOMC's two-day meeting:

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 11 December 2023 and 11 December 2024.

The probability of recession peaked at nearly 81% on 25 July 2023, which makes the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

We will continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- U.S. Recession Odds Recede to Two Out of Three Chance in 2024

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Psychic vision signage photo by Wyron A on Unsplash.

Labels: recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.