The probability the U.S. economy will see a recession begin sometime in the next twelve months has started to fall again during the past six weeks. after having hit a double-top.

Since our previous update, the probability has dropped from over 76% to just under 71%, confirming the double-top after having previously peaked at 81% in July 2023.

These probabilities are determined using a recession forecasting method developed for the Federal Reserve Board in 2006. They represent a portion of the economic data and forecasts Federal Reserve officials will consider as they meet from 30 April to 1 May 2024 to review how they will set the level of short term interest rates in the United States in the months ahead. The expected timing of rate cuts by the Fed has been slipping later and later during the past six weeks.

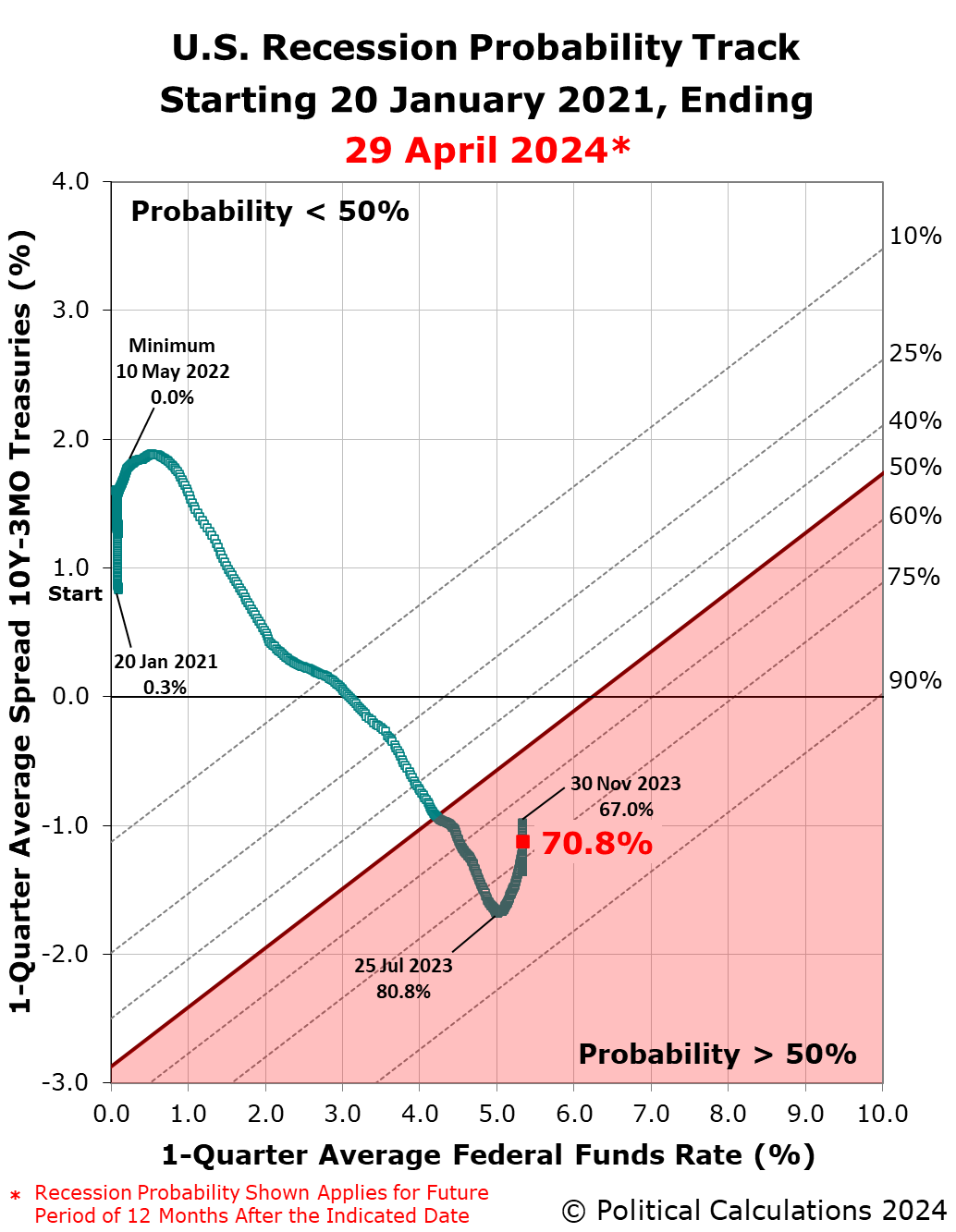

The following chart presents the latest update of the Recession Probability Track. It reveals how that probability appears as the Federal Reserve's Open Market Committee (FOMC) goes into its April 2024 meetings to review and potentially change the Federal Funds Rate (FFR). The FOMC is expected to continue holding the FFR steady at this meeting, but is expected to start lowering this core interest rate at later meetings in 2024. Markets anticipate the Fed may cut this interest rate at its September 2024 meeting.

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 29 April 2024 and 29 April 2025.

The double-top pattern we've described at the beginning of this article can be better seen by simply tracking the recession probability over time. The next chart shows that forecast probability using the data available from 30 April 1983 through 29 April 2024, with the probabilities shown shifted 12 months into the future to coincide with the end of the period in which they apply.

The probability of recession peaked at nearly 81% on 25 July 2023, making the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction. The prolonged elevation of the Federal Funds Rate combined the deepened inversion of the U.S. Treasury yield curve in recent weeks has made the period between 18 March 2024 and 18 March 2025 the second most-likely period that will include the peak of a business cycle that marks when a recession began.

Another way to interpret the double-top pattern is to consider that it extends the period in which the highest probability of recession is elevated. Under that interpretation, the period in which the probability of an official recession starting would be greater than 70% is running from 25 July 2023 through at least 29 April 2025.

Only time will tell if that's an appropriate way to interpret the data. Looking at the underlying data that's used to determine the recession probability, we anticipate it will continue falling in the near term, making a "triple-top" event unlikely.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have provided a tool to make it easy to do.

We will continue following the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold. We're curious to see how this forecasting method performs.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- Recession Probability Falls After Hitting Double-Top

- U.S. Recession Probability Nears a Double-Top

- Probability of U.S. Recession Resurges to Nearly 75%

- U.S. Recession Odds Recede to Two Out of Three Chance in 2024

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image Credit: Microsoft Copilot Designer. Prompt: "A signpost with the words 'Recession Ahead?'"

Labels: recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.