In November 2007, after adjusting the for seasonal variances, the number of employed individuals in the United States peaked at a level of 146,647,000. Through September 2008, the number of individuals counted as being employed has declined by 1,392,000.

We thought we'd take a closer look at how the employment level has changed by age group. In the following chart, we've broken the monthly data for each month since November 2007 to examine how teenagers (Age 16-19) and young adults (Age 20-24) are being affected in the employment downturn:

As of September 2008, some 20.1% of the total reduction in the number of employed individuals are made up of those Age 16 to 19. An additional 23.6% of the total reduction in the number of employed individuals are Age 20 to 24.

That's pretty remarkable when you consider that those Age 16-19 make up 3.82% of the employed U.S. workforce, while those Age 20-24 represent just 9.4% of the entire number of people counted as being employed in September 2008.

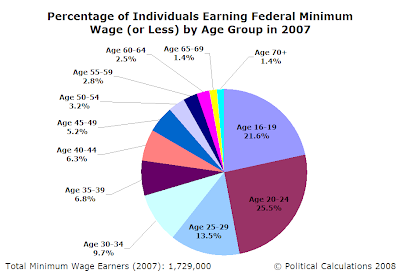

If it helps understand why those falling in these age ranges are those most impacted by the reduction of jobs in the U.S. economy, consider the following chart, which shows each age group's percentage of federal minimum wage earners in 2007:

Here, we see that of the 1,729,000 people counted as minimum wage earners in 2007, 373,464 (21.6%) are between the ages of 16 and 19, while 440,895 (25.5%) are between the ages of 20 and 24. For reference, those earning minimum wage account for 6.4% of the entire number of employed individuals Age 16-19 and 3.2% of the entire number of employed individuals Age 20-24.

Given the bizarrely age-biased outcome of the reduction in employment levels, you might think that the recent hikes in the federal minimum wage might be negatively affecting employment levels. If that's you, you're not alone. 2008 Democratic Party presidential nominee Senator Barack Obama (D-IL) thinks so too, but won't come out and say so, since admitting that raising the minimum wage was a mistake would exact a heavy political price.

Instead, Senator Obama has recently proposed giving a $3,000 annual tax credit to businesses that increase their payrolls over current levels for a two year period to encourage higher employment levels (HT: Marginal Revolution). Here's some quick back-of-the-envelope analysis that we provided in MR's comments (where we've corrected June 2006 in our MR comments to be June 2007):

Barack Obama may be admitting with this proposal that raising the minimum wage over the past two years was a mistake. At $5.15 per hour, the federal minimum wage through June 2007, a full-time employee earning that would see an annual income of $10,712 (assuming 2080 hours worked per year, aka "full time".)

At today's federal minimum wage of $6.55 per hour, and the same full time level of hours per year, an individual earning minimum wage for the entire year would see an annual income of $13,624.

The difference? $13,624 - $10,712 = $2,912.

He's not giving much of a credit for the costs that a business owner has in employing people above and beyond what an employee sees on their paycheck.

But unless he wants to repeat the last two years of declining minimum wage employment levels, look for that business income-tax credit to become permanent and to rise if he gets into office. Talk about deadweight loss!

We're not sure why Senator Obama believes that increasing the cost of minimum wage earners for businesses, the direct result of arbitrarily increasing the federal minimum wage, while also subsidizing the same businesses to increase their full-time employment head counts by an amount very similar to what the minimum wage increases would cost them for just two years is a good idea. And when two years has passed, why would a small business bother keeping those people on the payroll unless the face-saving subsidy continues? And if he doesn't increase it, how would Obama deal with further reductions in the employment level when the next minimum wage hike hits in July 2009?

It certainly reeks of inefficiency and waste.

Labels: business, economics, minimum wage, politics

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.