We had a lot of fun watching the S&P 500 (Index: SPX) during the first week of May 2022. In case you missed it, the index swung through relatively rare 3%+ changes in its daily value.

And all of it was well telegraphed! Or rather, it was consistent with how the dividend futures-based model says the index would act given the new information investors have had to absorb in recent weeks. Here's a quick recap of our relevant coverage:

- The "Mystifying" Moves of the S&P 500

- The S&P 500 on the Edge

- The S&P 500 Falls Off the Edge

- Increasing Day-to-Day Volatility for the S&P 500

- Third Lévy Flight of 2022 Sends S&P 500 Much Lower

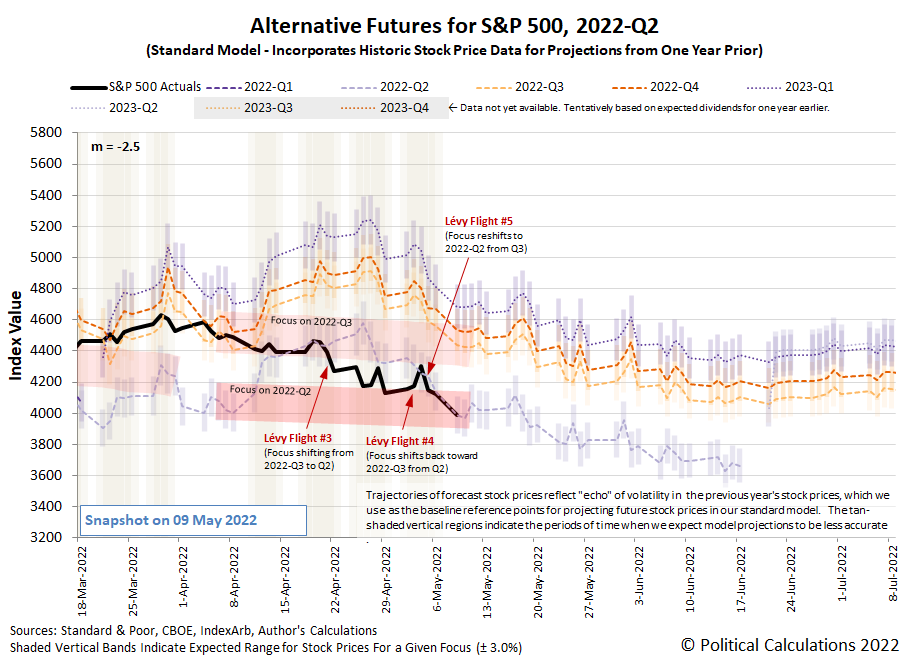

That last post contains updates addressing the specific causes of last week's wild market action, which added two more Lévy flight events to 2022's tally! Here's how they look on the latest update to the alternative futures spaghetti forecast chart:

Through Friday, 6 May 2022, we find investors are mainly focusing on the current quarter of 2022-Q2 in setting current day stock prices. Investors are betting the Fed will be compelled to hike interest rates by a bigger amount before the end of the quarter than they've been willing to publicly commit, completely reversing the expectation the Fed set on Wednesday, 4 May 2022 that 2022-Q2 would not see such a larger hike.

If you've been following the S&P 500 chaos series, you already know the importance of following the random onset of new, market-moving information. Although we've discussed the specific triggers for last week's market volatility via updates to last Monday's regular entry to the series, here's a more comprehensive picture of what was new and noteworthy during the week that was.

- Monday, 2 May 2022

- Signs and portents for the U.S. economy:

- Fed minions want U.S. housing market to "cool it":

- Bigger trouble developing in the Eurozone, Japan, China, Mexico:

- Euro zone factory output growth stalled in April - PMI

- German retail sales unexpectedly fall in March

- Supply disruption, weaker demand cloud outlook for German manufacturers - PMI

- Japan's April factory activity expands at slower rate -PMI

- China April factory activity contracts at steeper pace as lockdowns bite

- Mexico's factories contract for 26th straight month, inflation near four-year high

- Wall Street ends higher amid topsy-turvy trade before Fed meeting

- Tuesday, 3 May 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in China:

- Hong Kong Q1 GDP shrinks more than expected on COVID curbs

- Snarled-up ports point to worsening global supply chain woes - report

- Bigger inflation developing in South Korea:

- Central bankers getting serious about hiking rates to combat inflation:

- Australia's central bank hikes interest rates, flags more to come

- Czech central bank seen raising main rate to 5.50%, highest since 1999: Reuters poll

- ECB may hike rates in July to combat extreme inflation -Schnabel

- Wall Street ends higher after choppy session ahead of Fed

- Wednesday, 4 May 2022

- Signs and portents for the U.S. economy:

- Record high U.S. job openings, resignations likely to fuel wage inflation

- From coffee to ketchup, retailers seek price 'shields' as inflation runs riot

- U.S. service sector slows; input prices measure at record high - ISM survey

- Robust imports push U.S. trade deficit to record high in March

- Fed hikes rates by half percentage point, starts balance sheet reduction June 1

- Rrrrrrb: Quantitative Tightening Begins June 1, Capped Initially At $47.5BN And Growing To $95BN

- Fed's Powell: 75 basis point rate hike not being 'actively considered'

- Instant View: Fed hikes 50 bp, Powell tamps down speculation of 75 bp hike

- Growth signs in Eurozone:

- Central bank minions hiking rates to combat inflation:

- Wall Street rallies to end higher after Fed's interest rate hike

- Thursday, 5 May 2022

- Signs and portents for the U.S. economy:

- U.S. weekly jobless claims rise; productivity plunges at fastest pace in 74 years

- Oil steadies near $110/bbl as strong dollar offsets Russian oil ban

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- Central bank minions hiking rates to combat inflation:

- Czech central bank surprises with big rate hike, says more may come

- Bank of England raises rates to 1% despite looming recession risk

- Cash handouts to Danes could worsen inflation, central banker warns

- Norway keeps rates on hold, remains on track for June hike

- Economists expect higher rate hikes after RBI's hike to tame inflation

- ECB minions standing by to take action to combat inflation:

- ECB sees sequence of moves to lift rates into positive territory: Lane

- ECB should not raise rates in July before Q2 GDP data: Panetta

- Wall Street slumps as investors fear bigger Fed rate hikes

- Friday, 6 May 2022

- Signs and portents for the U.S. economy:

- Fed minion try to shape expectations for lesser rate hikes, former Fed minions call for bigger rate hikes:

- Fed's Kashkari Op-Ed: Policy Has Tightened a Lot. Is It Enough?

- Former Fed policymakers call for sharp U.S. rate hikes, warn of recession

- Bigger trouble developing in the Eurozone, China:

- German industrial output falls more than expected in March

- China's trade seen faltering in April as COVID curbs hit output: Reuters poll

- Bigger stimulus developing in China:

- ECB minions still thinking about doing something to combat inflation:

- ECB must quickly raise key rates, says head of Germany's Ifo institute

- ECB must keep inflation expectations at bay - Elderson

- ECB rate should be back in positive territory by year end: Villeroy

- Wall St falls as rate hike fears overshadow strong jobs data

The CME Group's FedWatch Tool projects the Fed will hike rates by three-quarters of a point in June (2022-Q2) and by another half point in July (2022-Q3), followed by a quarter point hike in September (2022-Q3). The prospects for a larger-than-half-point rate hike in June is why investors are now mainly focusing their attention on 2022-Q2 in setting current day stock prices.

The Atlanta Fed's GDPNow tool's is forecasting 2022-Q2 will rebound with a positive 2.3% real growth rate following 2022-Q1's negative growth.

Update 9 May 2022

Another exciting day for the S&P 500, which dropped more than three percent again! But as you'll see, that drop moved the level of the index right toward the middle of the redzone forecast range associated with investors focusing on the current quarter of 2022-Q2:

Big movement, but not a new Lévy flight because it is really a continuation of 2022's fifth event.

At this level, provided investors maintain their forward-looking focus on 2022-Q2, much of the wild swings should become relatively tempered. As you can see from the projected alternative future trajectory corresponding to this time horizon, there could still be significant declines ahead of up to 200-300 points, but that would come without the big upward movements associated with a new Lévy flight event.

Now, here's the catch. There's only a finite amount of time investors can maintain their focus on 2022-Q2. As the current quarter, the clock is already ticking down on it, which means investors will be forced to shift their attention to a different point of time in the future at some point on or before the third Friday of June 2022. That potentially forced shift of focus will trigger a new Lévy flight event. It's just a question of when, with its magnitude determined according to which other quarter investors might shift their attention and what the associated expectations for dividend growth are for that future quarter at the time when it happens.

Looking forward, the big market-moving news event for this week will likely come on Wednesday, 11 May 2022 when the next official report on inflation comes out. That will be early in the day, so we shouldn't have long to wait to find out what kind of impact it will have, especially if the actual figure reported for April 2022 is significantly different from what is expected going into the trading day.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.