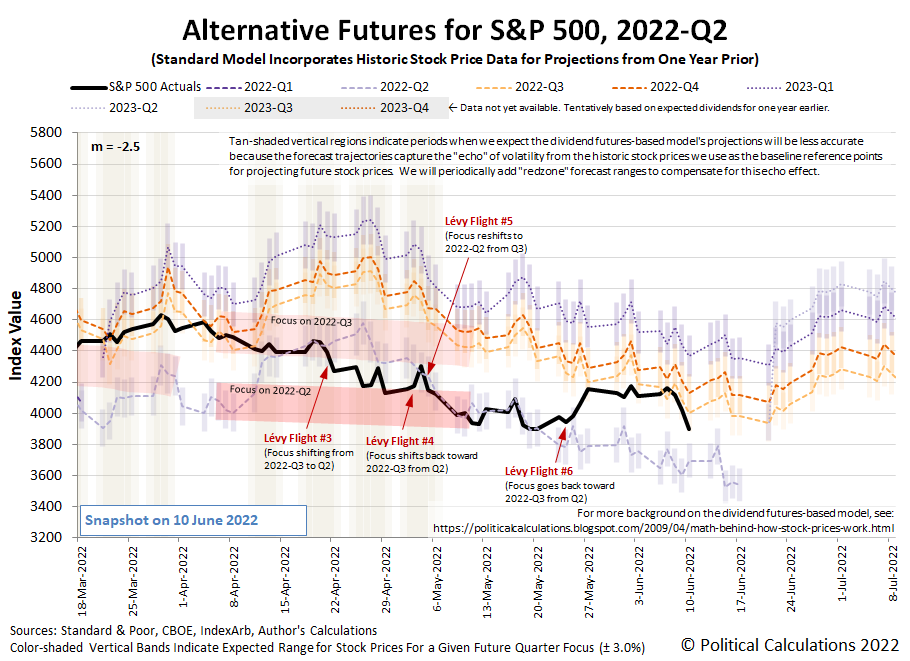

The daily action of the S&P 500 (Index: SPX) nearly crossed the threshold of becoming very interesting last week. For us, we define "very interesting" as being a three percent change from its previous day's closing value. But ultimately, the index came up short, ending the trading week at 3,900.86 after dropping 2.91% on Friday, 10 June 2022.

That nearly very interesting decline happened because the Consumer Price Inflation report came in much hotter than expected, confirming President Biden's inflation still hasn't been slowed. Because that's the case, the report shifted a portion of the forward-looking attention of investors back toward the current quarter of 2022-Q2. The new information about U.S. inflation puts more attention on what the Federal Reserve may do about it when they meet next week, accounting for the partial shift.

But not a full shift, for the practical reason of the coming expiration of dividend futures contracts for 2022-Q2. With those contracts expiring on Friday, 17 June 2022, investors kept a majority of their focus on 2022-Q3 as their primary time horizon.

At least, that's what we can divine from the latest update to the dividend futures-based model alternative futures chart.

It's possible this change will become large enough to fully qualify as a new Lévy flight event. On that count, we'll find out for sure soon enough, and no later than at the end of the Fed's two day meeting on Wednesday, 15 June 2022.

Until then, here's our recap of the market moving headlines of the trading week ending 10 June 2022, where you can see investors began absorbing the news U.S. inflation would come in higher than previously anticipated on Thursday, 9 June 2022. Before that point in time, we would describe the day-to-day volatility of the index as being consistent with garden-variety noise.

- Monday, 6 June 2022

- Signs and portents for the U.S. economy:

- Former top Fed minion to face music for wrong inflation call:

- Bigger trouble developing in China:

- BOJ minions determined to keep never-ending stimulus plan going:

- ECB minions expected to do something about Eurozone inflation:

- Investment banks ramp up ECB rate hike forecasts

- Confronting the inflation beast: Five questions for the ECB

- Wall Street ends up with growth stocks, but inflation fears linger

- Tuesday, 7 June 2022

- Signs and portents for the U.S. economy:

- Record exports help shrink U.S. trade deficit

- Yellen says inflation to stay high, Biden likely to up forecast

- Bigger trouble developing in Japan, Eurozone, World:

- Japan's household spending falls as rising costs squeeze consumers

- German industrial orders fall more than expected in April

- Italy statistics bureau cuts growth forecasts, warns of "strong downside risks"

- Mixed economic signs in China:

- China's May exports, imports seen recovering as supply chains restart - Reuters poll

- Analysis-China's consumers keep their wallets in lockdown as COVID curbs ease

- Central bank minions outside Japan take combatting inflation seriously:

- Australia's central bank raises rates by 50 bps in hawkish surprise

- All of Poland's MPC members backed 75 bps hike in March- voting records

- BOJ's Kuroda apologises for saying people are beginning to accept price rises

- Wall Street jumps with tech, energy; Target news weighs on retailers

- Wednesday, 8 June 2022

- Signs and portents for the U.S. economy:

- U.S. unveils new Latin America economic plan at reboot summit dogged by dissent

- U.S. plans new trade pact with 'like-minded partners,' says senior official

- Exclusive: Under Biden, China has widened trade lead in much of Latin America

- IMF's Gopinath sees risk of de-anchoring U.S. inflation expectations

- Yellen says some China tariff cuts may be warranted, not inflation 'panacea'

- Bigger trouble developing in Japan, China:

- BOJ to consider issuing bleaker view on output after China lockdowns - sources

- Downward pressure on China's economy still striking - cabinet

- Better than expected signs in the Eurozone:

- Central bank minions dealing with inflation, ECB minions to be late to rate hiking party:

- Instant View: India cenbank hikes rates for second straight month; drops 'accommodative' from stance

- Traders price in 75 bps of ECB rate hikes by September

- Wall Street falls as Amazon, chipmakers weigh

- Thursday, 9 June 2022

- Signs and portents for the U.S. economy:

- U.S. weekly jobless near five-month high; labor market still very tight

- Yellen says U.S. recession unlikely, but no drop in gasoline prices soon

- U.S. official sees moderation in goods and services inflation in months ahead

- Bigger trouble developing in Mexico:

- Bigger stimulus developing in China:

- China takes steps to ease up on regulatory crackdown as economy slows

- China's May new yuan loans seen rebounding on central bank support -Reuters poll

- ECB minions signal they're done thinking and will wait until July to start rate hikes:

- ECB signals rates lift-off, eyes bigger move in September

- Stocks, euro slip as ECB set to join rate hike club

- Wall St drops as investor jitters climb before CPI data Friday

- Friday, 10 June 2022

- Signs and portents for the U.S. economy:

- U.S. annual inflation posts largest gain in nearly 41 years as food, gasoline prices soar

- Oil dives as U.S. inflation data surges; China imposes lockdowns

- Expectations grow of more, bigger rate hikes by Fed minions:

- No respite from Fed rate hikes this year, chances rising of four 50 bps in a row - Reuters poll

- Fed seen sharpening rate hikes to smother searing inflation

- Bigger trouble developing in China, Japan:

- Parts of Shanghai return to Covid lockdown as Beijing district shuts entertainment venues

- Defying global surge, China's factory inflation hits 14-month low

- China's May vehicle sales fall 12.6%, industry body says

- Japan edges closer to intervention in yen after rare gov't, cbank joint statement

- Bigger stimulus developing in China:

- Bigger central bank rate hikes getting on the table to combat inflation:

- Czech inflation hits 16%, raising bets of big June rate hike

- Rates must rise but ECB will fight fragmentation: policymakers

- Canada jobless rate hits record low, bolstering case for 75-bps rate hike

- Wall Street ends down sharply as hot inflation data intensifies investor fears

Combining Thursday and Friday's investor reactions to news of higher than expected inflation in the U.S., the S&P 500 lost 5.3% of its value in response. The index was down 5.1% for the week, where that smaller change indicates the index was rising before the higher inflation news arrived.

A lot changed for expectations of the Federal Reserve's plan to hike rates in the latter part of the trading week ending on 10 June 2022. The CME Group's FedWatch Tool is projecting a half point rate hike to be announced after the Fed meets next week (2022-Q2), with a greater than 20% probability they'll boost it to a three-quarter point hike. Beyond that, the FedWatch tool now also expects a three-quarter point rate hike just six weeks later (2022-Q3), followed by another half point rate hike in September 2022 (also 2022-Q3), which has become the future quarter of interest for investors to focus their forward-looking attention.

The Atlanta Fed's GDPNow tool turned even more pessimistic in the past week. Its forecast of real GDP growth of 0.9% for the U.S. in 2022-Q2 is down from last week's projection of 1.3% annualized growth. If that downward trend continues, it suggests the U.S. economy is potentially in the midst of experiencing two consecutive quarters of real GDP shrinkage, which many associate with the economy being in recession.

Update 13 June 2022, 11:00 PM EDT: A New Lévy Flight Event

It's official. This is the seventh Lévy Flight event of 2022. Investors have fully shifted their attention back to the current quarter of 2022-Q2, waiting to see what the Fed will do next. There are surging expectations that the Fed will hike rates on Wednesday by at least 75 basis points (three-quarters of a percent), rather than the 50 basis point rate hike the Fed's minions had been signaling for weeks.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.