Previously, we found that the average price of a gallon of gasoline in the U.S. can be used to forecast what the U.S. unemployment rate will be about two years ahead in time.

Since then, gasoline prices have been rising pretty significantly across the U.S. and are predicted to rise even further, so today, we're presenting a tool based upon our analysis that you can use to anticipate what the jobs situation will be like two years from now.

To find out, enter the latest average price of a gallon of gas in the U.S. into the tool as well as the most recently available value for the Consumer Price Index for All Urban Consumers, which lets us take inflation into account, and we'll project what the U.S. unemployment rate will likely be two years from now.

Now for a quick word of caution. The correlation between gas prices and the unemployment rate is positive, but is only of low-to-medium strength, which you can see in the spread of the data points about the trend line in our chart showing the correlation.

What that means is that while higher gasoline prices do generally translate into a higher unemployment rate two years into the future and lower gasoline prices translate into lower unemployment rates, the actual unemployment rate two years from now can be significantly different from what the tool forecasts.

As such, our tool is best used to anticipate the general trend in the unemployment rate rather than the specific unemployment rate.

For example, using the default data for our tool, which takes the average retail price of motor gasoline in the United States from 21 February 2011 and pairs it with the Consumer Price Index for All Urban Consumers (CPI-U) from January 2011, our tool projects that the unemployment rate will be about 8.3%, which is lower that the 9.0% unemployment rate reported in January 2011, suggesting a mild improvement from now until then.

However, if average gasoline prices rise quickly to exceed $3.50 per gallon across the nation, as they already have in California, our tool would project that no significant improvement in the U.S. unemployment rate will take place over the next two years.

Previously on Political Calculations

- Correlating the Price of Gas and the Unemployment Rate

- Why Are Americans Driving Less?

- How Much Does Your Commute Cost You?

- Should You Move Closer to Work to Save Commuting Costs?

- How to Save Money on Gas, Without Driving Less

- How Much Are Higher Gas Prices Really Hurting You?

- Should You Trade in Your Gas Guzzler?

- Is It Worth the Drive?

- Do Hybrids Really Save Money?

- How Much Do You Pay in Gas Taxes?

Labels: gas consumption, tool, unemployment

With massive popular uprisings sweeping many of the most politically-repressed nations of the world, Americans are looking toward the upcoming weekend with a mixture of both fear and dread because it's time, once again, for the annual Academy of Motion Picture Arts and Sciences Awards ceremony to be televised.

The primary reason for that is because the Academy Awards ceremony has increasingly become an unbearably abysmal viewing experience over the past decades, as Hollywood feels compelled to produce a spectacle that, well, is doomed to flop, even by our much lower critical standards for award shows.

But another reason why is because of the anti-American political bias of many of the movie stars, producers and directors whose achievements in 2010 will be celebrated this Sunday evening, 27 February 2011, beginning live at 5:00 PM Eastern Time on the ABC television network with hosts James Franco and Anne Hathaway. Because nothing makes for more a more dreadful viewing experience than some highly talented movie stars seeking to exploit the worldwide platform they've been given to show off how much they care about the ongoing tragedy of "fill-in-the-blank," which could be fixed if only Americans cared as much as the movie stars did and demonstrate by their willingness to go far over the allotted time they've been given for accepting their award. Assuming they get through thanking the laundry list of people who worked on their movie that pretty much only they know....

But then we wondered whether Hollywood has a financial motive for being so apparently anti-American? We've previously found that anti-U.S. movies tend to flop badly at the U.S. box office, but what about overseas film markets? How do those anti-U.S. movies do in those foreign box offices?

We decided to find out! We went back and identified the most anti-U.S. movies that Hollywood has produced in recent years to see how they did in both their domestic U.S. market and in foreign theaters. We then narrowed our selection to consider only movies set in contemporary times, the issues related to which foreign audiences would most closely recognize and to which they would presumably be most receptive to sitting through a 90 minute long anti-U.S. screed.

The obvious candidates then turned out to be the anti-"War on Terror" movies that have been produced since 2006. The chart below shows how these movies performed and the domestic U.S. and foreign box office, which we then compared with each movie's estimated production costs.

What we find is that in all but one case, the 2009 Best Picture-winning Hurt Locker, none of the films presented in our chart above earned back their production costs from their U.S. box office receipts. Meanwhile, only two films earned more in the U.S. than they did overseas: Stop Loss, a critically-praised but audience-hated movie that was only released in a dozen countries, limiting its foreign earning potential and The Kingdom, the most politically-neutral of all the films we identified, which perhaps explains its success at the U.S. box office.

Overall, the combined box office take from domestic and foreign box offices was enough for four of the nine films to make back their production costs and for another two films to nearly do so.

| Anti-U.S. Film Domestic U.S. and Foreign Box Office Take | |||||

|---|---|---|---|---|---|

| Movie | Release Date | Total Box Office | U.S. Box Office Percentage | Foreign Box Office Percentage | Comments |

| Stop Loss | 28 March 2008 | $11,207,130 | 97.4% | 2.6% | Released in over 12 nations. Largest foreign box office in Australia ($135,000). |

| In the Valley of Elah | 14 September 2007 | $29,541,790 | 22.9% | 77.1% | Released in over 47 countries. Largest box office take in Spain ($3.046 million) but near tie in France and French-speaking Northern African nations ($3.014 million). Combined total accounts for one fifth of total box office. |

| Redacted | 16 November 2007 | $782,102 | 8.4% | 91.6% | Released in over 13 countries. Most popular in France and French-speaking Northern African nations ($363,766, or 47% of total box office.) |

| The Kingdom* | 28 September 2007 | $86,658,558 | 54.9% | 45.1% | Politically neutral. Released in over 60 nations. Largest box office in United Kingdom ($5.8 million). |

| Rendition | 19 October 2007 | $27,038,732 | 36.0% | 64.0% | Released in over 50 countries, largest box office in United Kingdom ($5.3 million, or nearly one-fifth of total box office.) |

| Lions for Lambs | 9 November 2007 | $63,215,872 | 23.7% | 76.3% | Released in over 92 countries. Largest box office take in Italy ($8,321,849, or over one-eighth of total box office). |

| Home of the Brave | 15 December 2006 | $499,620 | 10.3% | 89.7% | Released in 4 countries. Largest box office in Spain ($203,079, or over 40% of total box office). |

| Green Zone | 12 March 2010 | $94,875,650 | 36.9% | 63.1% | Released in over 53 countries, largest foreign box office in United Kingdom ($8.2 million). |

| Hurt Locker | 26 June 2009 | $49,230,726 | 34.6% | 65.4% | Best Picture Winner for 82nd Academy Awards. Released in over 48 countries, biggest foreign box office in Japan ($7.8 million). |

| Total | N/A | $276,391,622 | 34.2% | 65.8% | * Total Omits The Kingdom's Box Office Results |

Omitting The Kingdom as a control sample, given its political neutrality, we find that the remaining eight anti-U.S. films earned a combined U.S. and foreign total of $276,391,622, with $94,620,951 (34.2%) coming from the U.S. box office and the remaining $181,770,671 (65.8%) from outside the U.S. In simple terms, Hollywood earns roughly two dollars overseas for every one it makes in the U.S. for these anti-U.S. movies.

The combined total of the estimated production costs for these eight films is $243,292,000. With the total box office take of these movies being $276,391,622, we find that Hollywood did indeed make a profit on these films, earning $33,099,622, or just shy of a 12% profit margin when compared to their estimated production costs.

It seems that Hollywood does indeed has a pretty large financial incentive for being so anti-American. Who knew that good old-fashioned greed could help explain Hollywood's political posturing?

Labels: academy awards

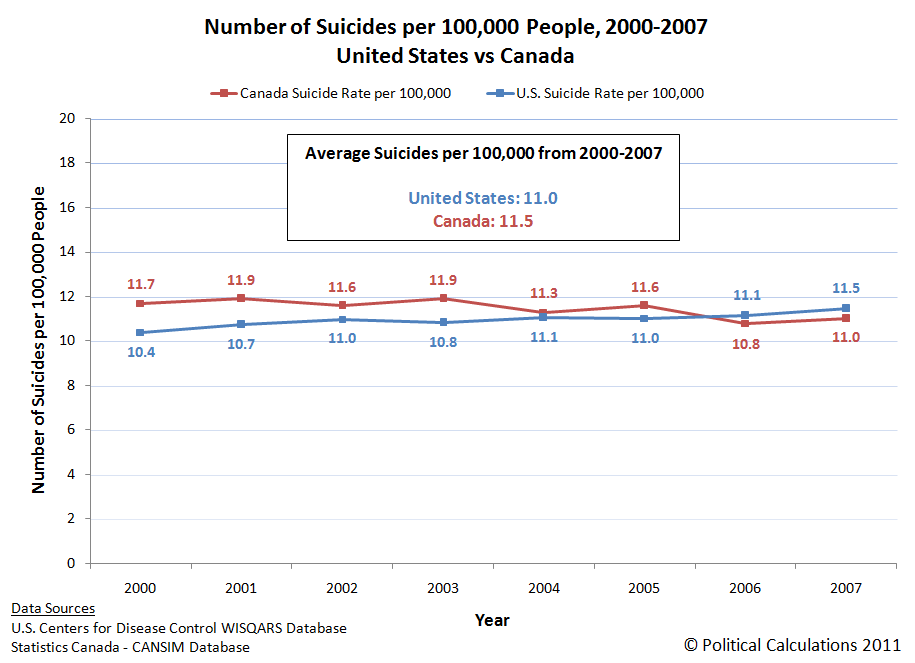

How does the United States and Canada compare with one another where each nation's number of suicides each year is concerned? Sure, the nations share a 3,145 mile-long border (that's 5,061 kilometres for our Canadian readers), but as either Americans or Canadians can tell you, what happens on one side of the border can be very different from what happens on the other.

We'll first consider the total number of cases each year for each nation where the cause of death was determined to be the result of self-inflicted injuries.

In looking at this first chart, we see that since 2000, the U.S. appears to have a rising number of suicides, while the trend in Canada appears to be relatively flat in comparison.

That comparison doesn't take the differences in the size of the population of either country into account, much less how the population for each might be changing over time, so we'll next consider the so-called "suicide rate" for each country - the number of suicides per each 100,000 individuals of population, which will directly address this issue.

Here, we find that on whole, both trends we observed in the earlier chart appear to hold. We also observe that both the United States and Canada sees a similar rate of suicides each year, with Canada averaging 11.5 suicides per 100,000 people and the U.S. averaging just a bit lower at 11.0 suicides per 100,000 people in the years from 2000 through 2007.

So on the whole then, the U.S. and Canada would appear to be very similar to one another where deaths caused by self-inflicted injuries are concerned. If Canada's population were identical to the United States, it would likely see the same number of suicides each year, or actually a bit more than that, given its slightly higher suicide rate.

Things change dramatically however when we consider the methods by which people in the U.S. and Canada have committed suicide in the years from 2000 through 2007.

Here we find that Canada's much more restrictive gun laws significantly changes the preferred methods by which Canadians commit suicide compared to the U.S., where firearm-related self-inflicted injuries represent the majority of suicides. We observe that compared to Americans, Canadians appear to substitute the methods of hanging and suffocation, poisoning and other types of self-inflicted fatal injuries for the use of firearms.

But note that they only exchange the method of suicide - the suicide rate data between the two nations clearly demonstrates that Canada's more restrictive gun laws do little or nothing to affect the number of Canadians who successfully act to end their lives in any given year.

Consequently, we find that the restrictions that a nation might place on gun ownership by its citizens very likely do little or nothing to affect the number of suicides that take place within the nation.

On a final note, we also find that the use of firearm-related death figures that includes firearm-related suicides by gun control advocates is highly misleading. As we can see in the analysis above, the number of suicides a nation will experience in any given year is effectively independent of the use of firearms and any restrictions it has for firearms.

With that being the case, we find that gun control advocates using such figures may be considered to be deeply dishonest. And that's the best case interpretation of this situation. In the worst case interpretation, they could quite legitimately be considered to be monsters, as they would appear to be very much in favor of seeing thousands more people hang or poison themselves when committing suicide, which would be the nearly inevitable outcome of the restrictions they seek to impose upon others.

If perhaps they had chosen to stick with using homicide data, which we'll look at soon, they would have more credibility. But then, they've apparently made other choices.

Actually caring about people just doesn't seem to be among those choices.

Data Sources

Centre for Preventing Suicide. Suicide in Canada: Numbers, Rates, and Methods. 2000-2003. Accessed 20 February 2011.

Statistics Canada. Suicides and Suicide Rate, by sex and by age group. CANSIM Results. Table 102-0551. Deaths and mortality rate, by selected grouped causes, age group and sex, Canada, annual, 2000-2007. Accessed 20 February 2011.

U.S. Centers for Disease Control. WISQARS Database. 2000 to 2007. All Races. All Hispanic Origin. All Sexes. Accessed 20 February 2011.

Labels: demographics, quality

According to standards adopted by the California State Board of Education in December 1997 and reposted again in June 2009, secondary school students in the state's public education institutions are expected to take and pass Algebra sometime between the 8th and 12th grades. In achieving that standard, graduates from the state's high schools should be very well prepared to enter college ready to do well because of the role of Algebra as a "gateway" class - one that establishes a solid foundation of basic learning that is a prerequisite for supporting the kind of higher level learning that is highly valued by employers.

So how well are California's public high schools doing at achieving that standard, which the state adopted over twelve years ago and reaffirmed less than two years ago?

One way we can find out is to see how much remedial learning of Algebra is taking place at the state's community colleges. Here, students who attend the state's community colleges are much more likely to have also graduated from the state's public high schools, unlike students who might attend the state's top-tier public universities, which draw top students from California and around the world. As such, California's community college students would represent how well the state's public high school's are doing in satisfying the state's minimum standards needed for students to be prepared to enter college.

Dayna Straehley of the Press Enterprise, a newspaper serving the southern Californian counties of Riverside and San Bernandino (aka "the Inland Empire"), reports:

High schools think they're preparing students for college, but when many graduates get there, they have to take remedial classes, Inland educators say.

Statewide, about 90 percent of California's community college students need remedial math and 75 percent need remedial English.

Almost 96 percent of first-time freshmen must take remedial math, and 82 percent must take remedial English.

It's not just precalculus or even algebra that students haven't mastered. Some high school graduates need remedial arithmetic, according to the community colleges.

At Crafton Hills College in Yucaipa, 97 percent of new students need at least one pre-collegiate class, said Cheryl Marshall, vice president for instruction.

As with any government-operated system, the bureaucrats who run it are quick to find excuses:

Students need remedial math for various reasons, Riverside City College math instructor Pamela Whelchel said. Some learned algebra and geometry or even calculus in high school, but didn't study or review for the placement test. Some students forgot the math they once knew.

RCC student Fadi Dib, 19, said he took Algebra 2 in high school but needed a refresher in the subject. He was working elementary algebra problems in Whelchel's math lab recently.

"Math, if you don't keep practicing on it, you'll forget it," Dib said.

Whelchel said the class is comparable to high school Algebra 1, which California expects students to master by the ninth grade.

Chris Contreras, 21, one of her students, remembered the Algebra 1 he took in high school as way easier than the work he was doing recently in RCC's math lab.

Student Chris Contreras may have a point, in that compared to high school classes, which are taught over an entire school year, an Algebra 1 class at the college level would be completed in 16 weeks or less. However, since he would have had previous exposure to the material in high school, that faster pace should not have presented a significant burden. Unless he hadn't been adequately exposed to the kind of math that would be included as part of a college-level Algebra 1 class in the first place.

Which brings up another good question: Is the kind of Algebra being taught in high school different from what's taught in college? As Straehley finds, perhaps it is:

States tell high schools what to teach, so students can pass standardized tests required by No Child Left Behind, which set federal requirements for school testing. But those requirements have been academic minimums, not what students need to succeed in college.

Daniel Martinez, Riverside Community College District's associate dean of institutional research, said California's high school standards just don't line up with college expectations.

The "No Child Left Behind Act of 2001" was former President George W. Bush's "signature" achievement in education. Unfortunately for Californians, that federal law had no impact upon the setting of the standards for math to which public secondary schools in the state of California are required to comply. As we've already revealed, those standards were set in 1997, nearly four years before "No Child Left Behind" even became federal law. We also see that they were not altered as a result of the federal law, which we confirm in the standards being reposted, without change, in 2009.

Could it then be a problem of miscommunication between state-run bureaucracies? Perhaps the state's public secondary education schools are unaware of what they really need to be teaching the students attending their institutions so they don't require remedial education if and when they reach a college campus.

Or perhaps not:

The University of California puts out documents of what it expects of college freshmen, but she said high schools have paid little attention. Schools have been forced to focus on state requirements and No Child Left Behind.

So we find that the real standard for math that California's public high school students need to achieve by the time they reach college isn't some mysterious secret known only to an elite sect who dresses in funny hats and robes. Somehow though, despite knowing what the real standards should be, the state's public secondary schools are so busy doing other things that they can't be bothered to adapt to their customers (aka "students") real needs. Somehow, they would appear to be claiming, doing that would render it impossible for them to satisfy the state Board of Education's low requirements for math education as well as the No Child Left Behind federal law which, we've already seen, never affected the state's standards for math education in the first place.

We're not exactly sure how acting to ensure that their students can perform the kind of math at the higher standard actually required at the college level would make it impossible for the school to comply with a lower standard for math education, but perhaps that's something California's educators learn in the graduate education schools they attend as they seek to become fully credentialed.

Now, how does their ability to apply quantitative reasoning skills, like the ones that are supposed to be taught in high school Algebra classes, compare to nearly every other post-graduate major in non-education-related fields again?...

References

California State Board of Education. Mathematics Content Standards for California Public Schools, Kindergarten Through Grade Twelve. Adopted December 1997, Reposted 9 June 2009.

Are engineers really smarter than business students? How do people studying the social sciences stack up against those studying physical sciences? And where exactly do the people who presumably plan to teach children for a living fit into the relative smarts picture?

Sure, it would be nice to use good old-fashioned IQ-type tests to resolve these questions once and for all, but maybe the next best thing is to compare the performance of students who are required to take the GRE (the Graduate Record Examination) as a prerequisite for entering into a graduate school to pursue a Masters degree.

Here, we can measure school smarts by considering how the students taking the GRE's various component exams, which are designed to assess the prospective graduate student's Analytical Writing, Verbal Reasoning and Quantitative Reasoning skills performed on each GRE component. We can then compare the relative performance of students in different majors according to the average results recorded for each graduate major program that the GRE-takers declared they intended to enter.

The dynamic table below reveals the GRE results by major recorded for 2007-2008. Just click the table's column headings to sort the data in the table from either high to low, or again to sort the data low to high, according to the selected column heading category. (Note: The dynamic sorting feature will only work if you've enabled JavaScript on your web browser, and then only if you access the dynamic table directly on Political Calculations - like our tools, it won't work on sites who simply republish just our RSS feed!)

| Average GRE Scores by Intended Graduate Major, 2007-2008 |

|---|

| Category | Intended Graduate Major | Analytical Writing |

Verbal Reasoning |

Quantititative Reasoning |

|---|---|---|---|---|

| Arts & Humanities | Arts - History/Theory/Criticism | 4.7 | 537 | 565 |

| Arts & Humanities | Arts - Performance/Studio | 4.3 | 489 | 551 |

| Arts & Humanities | English Language/Literature | 4.8 | 561 | 550 |

| Arts & Humanities | Foreign Languages/Literatures | 4.6 | 532 | 571 |

| Arts & Humanities | History | 4.7 | 542 | 554 |

| Arts & Humanities | Other Arts & Humanities Major | 4.8 | 567 | 599 |

| Arts & Humanities | Philosophy | 5.0 | 590 | 635 |

| Business | Accounting | 4.1 | 440 | 591 |

| Business | Banking and Finance | 4.2 | 461 | 715 |

| Business | Business Administration/Management | 4.1 | 438 | 559 |

| Business | Other Business Major | 4.0 | 436 | 588 |

| Education | Administration | 4.2 | 426 | 520 |

| Education | Curriculum/Instruction | 4.3 | 459 | 543 |

| Education | Early Childhood | 4.1 | 420 | 498 |

| Education | Elementary | 4.2 | 440 | 522 |

| Education | Evaluation/Research | 4.3 | 451 | 531 |

| Education | Higher | 4.5 | 464 | 547 |

| Education | Other Education | 4.2 | 439 | 528 |

| Education | Secondary | 4.5 | 484 | 576 |

| Education | Special | 4.1 | 430 | 502 |

| Education | Student Counseling/Personnel Services | 4.2 | 426 | 498 |

| Engineering | Chemical | 4.1 | 470 | 718 |

| Engineering | Civil | 4.1 | 458 | 698 |

| Engineering | Electrical/Electronics | 4.1 | 459 | 725 |

| Engineering | Industrial | 4.0 | 440 | 705 |

| Engineering | Materials | 4.3 | 493 | 726 |

| Engineering | Mechanical | 4.2 | 472 | 724 |

| Engineering | Other Engineering | 4.4 | 495 | 714 |

| Life Sciences | Agriculture | 4.1 | 455 | 583 |

| Life Sciences | Biological Sciences | 4.4 | 489 | 629 |

| Life Sciences | Health and Medical Sciences | 4.2 | 446 | 551 |

| Other | Architecture/Environmental Design | 4.3 | 474 | 606 |

| Other | Communications | 4.4 | 471 | 530 |

| Other | Home Economics | 4.2 | 434 | 499 |

| Other | Library/Archival Sciences | 4.5 | 537 | 541 |

| Other | Public Administration | 4.3 | 454 | 515 |

| Other | Religion and Theory | 4.8 | 542 | 587 |

| Other | Social Work | 4.1 | 429 | 465 |

| Physical Sciences | Chemistry | 4.3 | 486 | 678 |

| Physical Sciences | Computer and Information Sciences | 4.0 | 462 | 696 |

| Physical Sciences | Earth, Atmospheric and Marine Sciences | 4.4 | 495 | 634 |

| Physical Sciences | Mathematical Sciences | 4.4 | 501 | 732 |

| Physical Sciences | Natural Sciences | 4.0 | 470 | 596 |

| Physical Sciences | Physics and Astronomy | 4.5 | 531 | 735 |

| Social Sciences | Anthropology/Archeology | 4.6 | 534 | 565 |

| Social Sciences | Economics | 4.5 | 504 | 708 |

| Social Sciences | Other Social Science Major | 4.3 | 464 | 526 |

| Social Sciences | Political Science | 4.7 | 525 | 585 |

| Social Sciences | Psychology | 4.4 | 471 | 544 |

| Social Sciences | Sociology | 4.5 | 489 | 545 |

Overall, we find that engineers are indeed much smarter than business majors where quantitative reasoning skills are involved, but only have a small advantage where verbal reasoning skills come into play and are on a nearly even keel for analytical writing ability. Meanwhile, we find that students of the physical sciences outclass their social science peers in quantitative reasoning, but that the social scientists beat them in verbal reasoning and analytical writing ability.

But perhaps most distressingly, the students pursuing graduate degrees in education-related fields, who presumably either teach or plan to teach children for a living, dominate the lowest performing half of the table for both verbal and quantitative reasoning skills.

That probably says quite a lot about the state of education in America today. Especially if we're relying upon people who are among the least capable of applying verbal and quantitative reasoning skills to teach those same skills to America's children.

Previously and Next on Political Calculations

We originally considered this topic in our post Ranking School Smarts by Major, our first look at the relative performance of students from different majors on standardized graduate school admission tests, which summarized 20 years worth of data spanning the years from 1962 through 1982. Comparing those older results with the results that we're presenting today reveals that not much has changed where the relative abilities of individuals entering education-related graduate programs in the nearly three decades since are concerned.

That's especially distressing given that public school systems and education schools have emphasized satisfying stronger credential requirements for teachers, especially to teach subjects like math and science.

If you follow the links in the paragraph above, you'll find that they all consider the state of education credentialing in California, which has had a very active program to increase the percentage of "fully credentialed" public school teachers in that state for well over a decade. Tomorrow, we'll look specifically at the state of mathematics education in California's secondary schools, as it relates to how well the state's increasingly "well credentialed" teachers are doing in preparing their students for the academic challenges they would face in attending college.

We've got good news and some potentially bad news regarding the current state of the stock market. First, the good news: stock prices are rising thanks to what seems to be an improving outlook in the market's underlying fundamentals.

We can see this improvement in the expected future level of dividends anticipated by the market, where we can see changes in the fundamental outlook for the stock market by observing how the spread between the amount of cash dividends expected to be paid out in future quarters is changing over time.

Here, we see that since mid-January, the spreads between the amount of dividends expected to have be paid out in future quarters is widening, which suggests that the business situation of the publicly-traded companies that make up the S&P 500 index is improving.

That improving outlook then would lead us to anticipate that the average of stock prices for the S&P 500 in the month of February 2011 will likely fall in a range between 1294 and 1332, at least, if you go by the math behind how stock prices work. This marks an improvement from the 1289-1321 range that we had previously forecast for the S&P 500 at the beginning of the month.

Though 17 February 2011, just a bit past the mid-point for the month, the average of daily closing stock prices for the S&P 500 is 1321.71, with a closing price of 1340.43 on 17 February 2011.

Which brings us to the potentially bad news. With average stock prices now moving significantly above the midpoint of our updated forecast range (1313), not to mention trading above the top end of our updated forecast range for the month (1332), we would describe the current state of the market as being a bit overheated.

That, in turn, suggests a correction is in the offing.

Now, that's no surprise given that we've had another indicator pointing to February 2011 as being a very likely month by which a correction would begin, but we can't predict which day that will happen.

There's another angle to consider as well. If the U.S. Federal Reserve is indeed using stock prices to assess how well their Quantitative Easing 2.0 program is going in setting future inflation expectations, stock prices running hot as they are today would be a signal to them that they need to take their foot of the QE pedal.

That may also have a negative effect on stock prices in the current economic situation, especially if future inflation expectations fall as they did in the interval between the Fed's QE 1.0 program and the current QE 2.0 program to near deflationary levels.

Unless, that is, they've finally been successful in convincing everyone that inflation is here to stay.

Labels: forecasting, inflation, SP 500

Doug McClune had a neat idea - visualize the level of crime in a geographic area by giving it an elevation on an otherwise two-dimensional map. The image below provides several different angles of where prostitution arrests are most likely to be made in San Francisco, which cast a surprisingly large shadow upon the rest of the city....

McClune notes:

... the prostitution arrests are peaking on Shotwell St. at the intersections of 19th and 17th. I’m sure the number of colorful euphemisms you can come up with that include the words “shot” and “well” are endless.

I love the way the mountain range casts a shadow over much of the city. There’s also a second peak in the Tenderloin (which I’m dubbing Mt. Loin).

McClune also provides topographical crime maps based on the locations of San Franscisco Police Department's arrests for larceny, narcotics, assault, vandalism, vehicle theft, robbery and warrants served!

Labels: data visualization

In the 1980s and 1990s, General Electric (NYSE: GE) was led by one of the most influential corporate chiefs in American history: Jack Welch.

Throughout his tenure, Welch maintained a tight focus on improving the profitability of each of GE's business divisions. His goal was that GE would either be the most profitable or the second-most profitable company among all competitors in each of its business segments. To that end, he earned the nickname "Neutron Jack" for how he dealt with the poorest performing divisions and managers within the conglomerate, as he stopped money-losing operations by exiting non-profitable businesses either by closing divisions or selling them and by firing the lowest performing 10% of the company's managers each year.

By the time he retired from GE's CEO position two decades later, GE had been transformed from a bloated conglomerate into one of the most successful and profitable companies in the world. Its manufacturing and technology-oriented businesses had grown to become industry leaders and the company's expansion into the financial industry had also been enormously successful, for which Welch was enormously well compensated.

And that's when GE's fortunes permanently changed for the worse, although it would be years before anyone would realize it. Because Jack Welch's successor, Jeffrey Immelt, couldn't compete his way out of a wet paper bag to real success by comparison.

To understand why, we'll need to consider the findings of new academic research into CEO compensation.

Here, Partha Mohanram and Sudhakar Balachandran had asked the question "Are CEOs Compensated for Value Destroying Growth in Earnings?" To answer the question, they tapped the Execucomp database, which tracks the compensation of business executives at some 1500 publicly-traded companies.

What they found is that corporate boards too often reward CEOs too generously for generating the wrong kind of growth from the perspective of creating real shareholder value. Here, many CEOs are effectively being overcompensated by focusing on generating "easy" profits through investment-related growth at the expense of improving the real profitability of their business operations.

Over time, the incentives for higher compensation leads executives to favor investment-related activities too strongly over working to achieve the more organically-generated growth that results from improving their business' real profitability. That leads to substantial losses of shareholder value when the investment climate turns stormy.

In a nutshell, that's what has happened to GE under Jeffrey Immelt's tenure. The financial arm of the company, GE Capital, grew to dominate all its other business segments, as this single division grew to represent 39.5% of GE's total revenues and 42.1% of its total segment profits by 2007.

That worked all the way up until the bubble for easy profits to be made through investment activity in the U.S. popped in 2008 and the investment climate turned nasty. Through 2009, GE Capital's share of GE's total revenues had dropped to 32.6%, while the division's share of total segment profits plunged to 12.1%.

Soon after the bubble popped, mounting losses from GE Capital's lending activity caused GE's earnings to plunge, with share prices following as the market adapted to the loss of value resulting from the consequences of Immelt's too-long misplaced focus on generating "easy" profits through investment activity. Ultimately, even Jeffrey Immelt's compensation followed suit as the company's declining situation forced him to decline bonuses and as the value of his stock awards has fallen. (Note: Immelt's has continued to receive his annual base salary of $3.3 million.)

But that's not all. GE's fiscal situation deteriorated so much in 2008 that it required massive bailouts from the federal government to stay afloat. Beyond that, GE has moved to scavenge itself to raise cash, seeking to sell off several highly-valued business divisions to competitors, sometimes at significant losses.

Even the kinds of business that GE now pursues are perhaps best characterized by their likelihood to receive either special protection from competitors or subsidies from the federal government, relying on close connections to politicians rather than real competitive ability to win new business. For example, in December 2010, GE announced that it would invest in developing high-speed rail technologies. On 8 February 2011, Vice-President Joseph Biden announced that the U.S. government would spend over $53 billion over six years to build high speed rail systems and infrastructure in the U.S.

That $53 billion should really be considered yet another bailout for GE, as the company's high-profile entry into the field combined with the newly announced government subsidy program would seem to be designed to guarantee the company a portion of the revenue to be provided from the federally-funded boondoggle at the expense of competitors, not to mention more economic, efficient and effective methods of transportation for people between cities (aka "every other form of transportation").

Real companies that aren't basket cases don't pursue business strategies whose success hinges on government mandates, protections and subsidies, much less that rely upon fulfilling the outdated visions of dimwitted politicians and bureaucrats. Instead, they focus on improving the profitability of what they do so that both their shareholders and their customers are happy, which is what creates real value for everybody involved.

That kind of focus just happens to be what GE has been missing from its top leader now for more than a decade. Which perhaps may be what Immelt was really trying to confess to the company's shareholders in describing recent times at GE as "The Decade from Hell".

Disclosure: Ironman, as your ecomagination might already tell you, holds no position in GE.

Labels: business, management

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.