What month will the National Bureau of Economic Research someday get around to saying marked the beginning of the next recession in the U.S.?

The NBER is notoriously slow in identifying when the business cycle in the U.S. either peaks before going into recession or troughs when coming out of one, often lagging behind these events by many months. That's because they take a number of data series into consideration and will wait until many go through revisions before determining if the national U.S. economy has truly changed direction from growth to contraction or vice versa according to their model of the economy.

Because they're so slow, analysts have built models to try to predict the timing of when the country's business cycle has changed when evidence is building that it has, long before the NBER makes its "official" determination. Some of these models are oriented toward recession forecasting. They have been built to use currently available data to try to anticipate the most likely timing of when the NBER will be likely to say the business cycle changed from boom to bust.

In a sense, they're using models to predict when the NBER's business cycle model will someday find the U.S. economy went into recession! That brings us to a recession forecasting model whose results we've been featuring since October 2022, when a leading recession indicator first flashed a red warning light.

That model was introduced by Jonathan Wright in a 2006 paper while he worked at the Federal Reserve Board. This model uses just three data series to generate the probability the NBER will identify a month sometime between a date of interest and one year into the future. One of those datapoints is the rolling one-quarter average of the Federal Funds Rate. The other two are the rolling one-quarter averages of the yields of two constant maturity U.S. Treasurys, one for the 10-Year UST note, the other for the 3-Month T-bill.

For this data, the red warning light starts flashing when the yield of the 10-Year Treasury drops below the yield of the 3-Month Treasury. This is a clear signal the U.S. Treasury yield curve has inverted, with short term yields paying higher yields than long-term yields. Historically, yield curve inversions have occurred before the U.S. economy entered into recession. Wright's innovation was to also take the level of the Federal Funds Rate into account, recognizing that how the Federal Reserve sets it in accordance with its monetary policies affects the likelihood of recession.

As of the close of trading on 27 April 2023, Wright's recession forecasting model anticipates a 67.0% probability the period between now and the end of April 2024 will contain the month the NBER will someday say marked the beginning of a national recession in the U.S.

The latest update to the Recession Probability Track shows how that probability has evolved since our previous update one month ago.

The chart shows the current probability of a recession being officially determined to have begun between 27 April 2023 and 27 April 2024 is 67.0%. Assuming the Fed follows through on hiking the Federal Funds Rate by another 0.25% next week, the probability of an "official" recession will continue rising. Doing some back-of-the-envelope math using our recession odds reckoning tool, with the 10-Year and 3-Month Treasuries as inverted as they are today, the odds of recession will breach the 70% threshold in about two weeks. Even if the Federal Reserve stops hiking the Federal Funds Rate after its Federal Open Market Committee meets to set its rate next week, the odds of recession will breach the 80% threshold in early July 2023.

Analyst's Notes

Two members of the NBER's Business Cycle Dating committee have a new working paper in which they indicate Americans should expect a recession in 2023 and 2024. The role Federal Reserve officials in changing from expansionary to contractionary monetary policies looms large in their assessment.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Photo by Annie Spratt on Unsplash.

Labels: recession, recession forecast

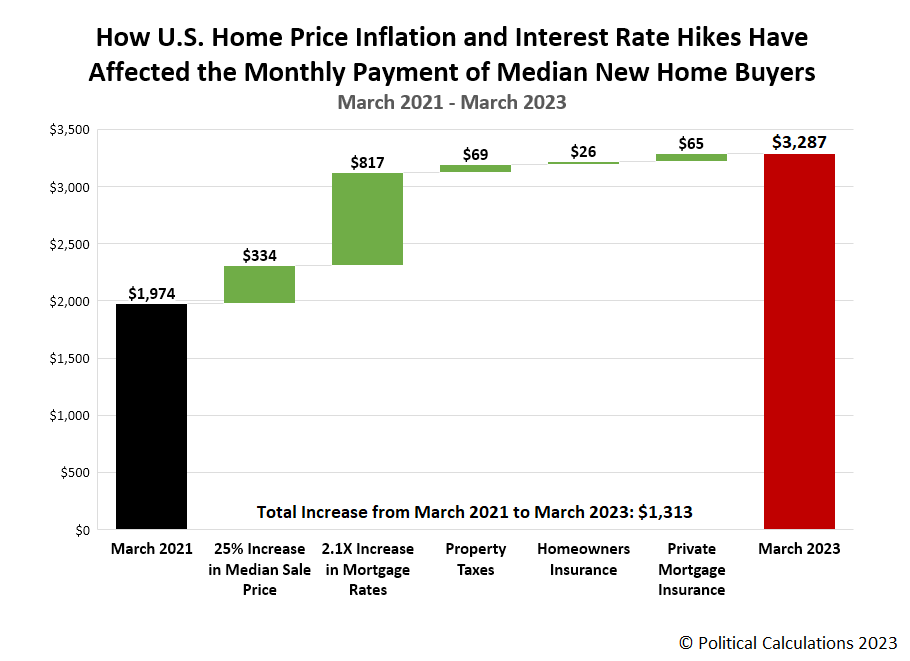

Imagine you were out to buy a typical new home home back in March 2021. The median price of a new home sold in the U.S. that month was $359,600. The average 30-year conventional mortgage rate back then was 3.083%.

Flash forward two years later, to March 2023, and a new home buyer in the U.S. would pay a median price of $449,800 for a new home according to initial estimates. And the interest rate on their 30-year conventional mortgage would be about 6.544%. How different would the monthly mortgage payment be for someone buying the median new home sold in March 2023 compared to what someone would have paid for the median new home sold two years earlier?

There's a little more to it than that, because we also need to take things like property taxes and homeowners insurance into account. We would also need to factor in how big the median down payment for a home is these days, and if that's less than 20% of the sale price of the new home, how much private mortgage insurance would add to its monthly payment.

So we did all that and created the following chart to show how different the monthly payment is for a median new home sold in March 2023 is from that for the median new home sold back in March 2021.

Overall, we find that between the increase in the median price of new homes sold in the U.S. and interest rate hikes, the monthly payment for the buyers of median new homes has increased by $1,313, rising 66.5% from $1,974 in March 2021 to $3,287 in March 2023.

Of that monthly increase, $334 is because of the inflation of new home sale prices, which is how much higher a basic mortgage payment would be if interest rates had not also risen. Of course, a higher home value would also boost the amount of property taxes owed by $69 per month and the amount of homeowners insurance by $26 per month.

That doesn't include the stand-alone increase in the size of a down payment, which for 2022's median of 13% of the sale price of a home, would have risen by $11,276, increasing from $46,748 to $58,474.

Because the median down payment for a home in 2022 was 13%, the cost of private mortgage insurance would also be tacked onto the monthly payment. While that can range anywhere from 0.19% and 1.86% of the balance owed on a mortgage, we set it at 1.0% for our brand new homeowner to put it in the middle of that range.

Briefly going back to property taxes, the estimates we used in our calculations is based on the median statewide property tax rate of 0.92%, which just happens to be the rate that applies in the state of Georgia. We did not factor in any county, municipal, or local property taxes.

The remaining $817 of the monthly payment increase is entirely due to the rise of average mortgage interest rates between March 2021 and March 2023. With the 30-year mortgage rate more than doubling during this period, this factor represents the biggest contributor to the increase in the monthly cost of owning a new home. It's all the more remarkable because nearly all of the increase in mortgage rates took place after December 2021.

Finally, we were inspired to create this waterfall chart by u/CheeryOaf's original version at r/dataisbeautiful. It's a neat way to capture how the various components of the monthly cost of homeownership have changed.

Image credit: Photo by Tierra Mallorca on Unsplash.

Labels: data visualization, personal finance, real estate

As expected, the market capitalization of new homes sold in the U.S. continued rising in March 2023. Increases in the number of new homes sold and their sale prices are responsible for the development, building on the momentum from February 2023's first increase of the nation's new home market cap after 11 months of steep decline.

That decline coincides with the Federal Reserve's series of rate hikes that began in March 2022 when the Fed finally responded to inflationary pressures that began building a year earlier. The rate hikes have contributed to pushing up mortgage rates, which peaked around 7.0% in November 2022 and have come down since. A 30-year conventional fixed rate mortgage reached an average post-peak low of 6.3% in February, before bouncing up to an average of 6.5% during March 2023.

While mortgage rates averaged slightly higher in March, it wasn't enough to overcome the positive momentum for new home sales, as Reuters reports "the worst of the housing market rout is likely over". But they note there's a cloud to go with that silver lining - more on that later....

Here is the latest update to our chart tracking the trends for the market cap of new homes, which illustrates how U.S. new home builders and this sector of the U.S. economy are faring:

The chart shows the time-shifted rolling twelve month average of the U.S. new home market capitalization for March 2023 is $26.95 billion. This figure is an initial estimate, which will be subject to revision during each of the next three months.

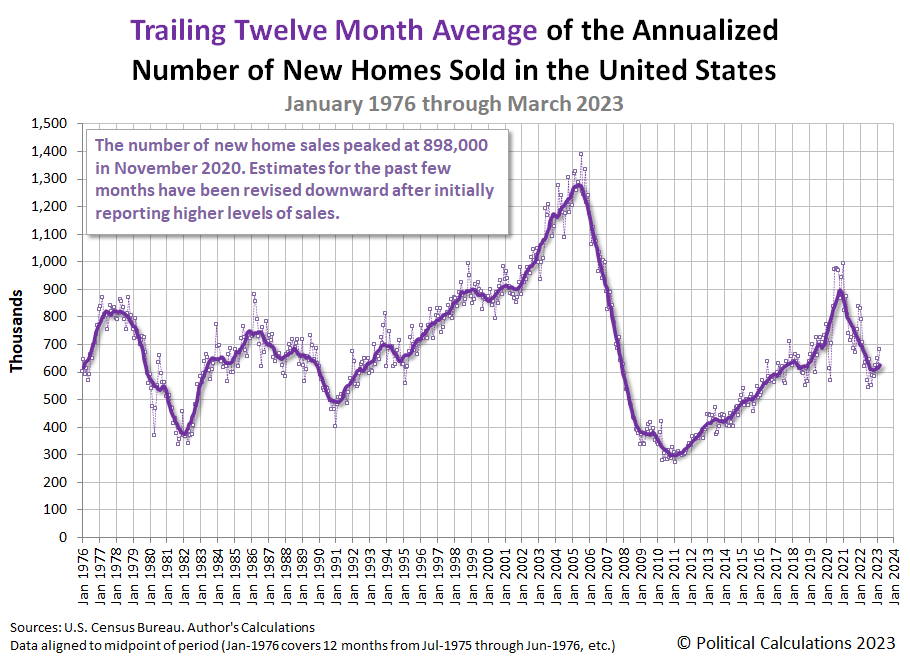

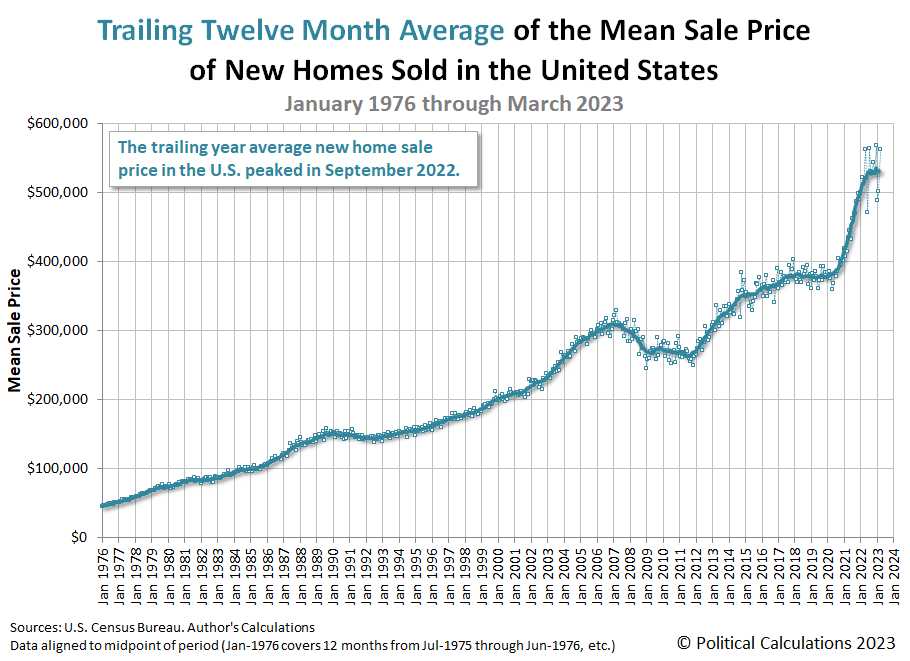

The next two charts show the latest changes in the trends for new home sales and prices:

As we mentioned, there is a cloud in the silver lining for U.S. new home builders. Reuters finds the potential for gloom after pointing to the glittery lining:

Home builder sentiment continues to creep up, though it is still depressed. Single-family housing starts have risen for two consecutive months in March and permits for future construction increased to a five-month high.

Still, challenges remain. Banks have tightened lending standards, which could make it harder for homebuilders to access funding for new projects and for prospective home buyers to secure loans to purchase houses.

The median new house price in March was $449,800, a 3.2% rise from a year ago. There were 432,000 new homes on the market at the end of last month, down from 434,000 in February. At March's sales pace it would take 7.6 months to clear the supply of houses on the market, down from 8.4 months in February.

The question for new home builders continues to be whether the positive momentum can overcome the negative conditions that are developing in the U.S. economy. Now that we're past the first quarter of 2023 and soon reaching what's expected to be the end of the Fed's series of rate hikes, the answer to that question will hinge on other developing economic factors.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 April 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 April 2023.

Image credit: WikiMedia Commons: Home Under Construction. Creative Commons Attribution-Share Alike 3.0 Unported License.

Labels: real estate

If you had to pick a sales tax rate that would be "typical" for what consumers pay when they buy things in your state, what rate would you pick?

That's a tough question to answer because in addition to state sales taxes, you may also have county, city, and municipal sales taxes added onto your receipts whenever you buy something. Plus, it's quite unlikely you only do all your shopping within your home town or county. What you pay in combined state and local sales taxes will differ depending on where your transactions take place.

The Tax Foundation has a neat solution for determining the average combined state and local sales tax rate for an entire state. They start with the most local sales tax rate data they can get, roughly all the way down to the zip code level. They take these super-local sales tax rates and add them to the state's sales tax rate, then weight them according to the percentage of the state's population that lives within the super-local regions these combined sales tax rates apply. The final result is a population-weighted average combined state and local sales tax rate.

In the following interactive map, we've presented their results for each state.

Here's a little more background for what this data shows:

Retail sales taxes are one of the more transparent ways to collect tax revenue. While graduated income tax rates and brackets are complex and confusing to many taxpayers, sales taxes are easier to understand; consumers can see their tax burden printed directly on their receipts.

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states. This report provides a population-weighted average of local sales taxes as of January 1, 2023, to give a sense of the average local rate for each state.

As of this writing, the data reflects the nation's population distribution as of 2010. It may be interesting to see how the population-weighted combined state and local sales taxes change after the 2020 Census data becomes available, even if the state and local taxes themselves didn't change.

But wait, there's more!

Although they didn't map it, the Tax Foundation also included the basic statewide sales tax rates with their analysis. That data is presented in our next interactive map!

If you go back and forth between the two maps, you can get a sense of how much local sales taxes add to the shopping bills of consumers in your state of interest. Assuming, of course, they do most of their shopping where most the population of the state lives!

Labels: data visualization, taxes

Rising fears of recession did little to alter the trajectory of the S&P 500 (Index: SPX) during the third week of April 2023. The index ended the week at 4133.52, down just 0.1% from where it closed the previous week.

It didn't start off that way. Earlier in the week, signs that China's efforts to stimulate its economy were finally gaining traction buoyed the U.S. stock market. But by week's end, investors returned their focus to the domestic situation in the U.S. economy, with the net effect of leaving the S&P 500 index just slightly lower.

That action, or lack thereof, can be seen in the latest update to the alternative futures chart. We find the level of the S&P 500 is just a bit below the midpoint of the redzone forecast range we added for last week's update.

Our reading of why stock prices behaved as they did in the week that was is drawn directly from the week's market-moving headlines. Here's our summary of the new information investors had to absorb during the past week:

- Monday, 17 April 2023

-

- Signs and portents for the U.S. economy:

- Oil drops 2% on higher dollar, interest rate concerns

- Tighter lending seen bringing mild recession later this year-Vanguard

- Bigger stimulus still developing in China:

- Eurozone government minions, ECB minions claim they're worried about inflation:

- Inflation is a tough beast says German finance minister

- ECB can review inflation goal once it's achieved, Lagarde says

- Wall St ends higher; investors await earnings, Fed cues

- Tuesday, 18 April 2023

-

- Signs and portents for the U.S. economy:

- Some Fed minions looking for bigger rate hikes:

- More signs of economic recovery developing in China:

- BOJ minions pledge they'll keep never-ending stimulus alive:

- ECB minions willing to leave size of rate hike to chance:

- S&P 500 ekes out gain as tech supports, J&J, Goldman disappoint

- Wednesday, 19 April 2023

-

- Signs and portents for the U.S. economy:

- More US consumers are falling behind on payments

- Oil falls 2% as dollar gains on potential Fed rate hike

- Fed minions see economy plodding along:

- Bigger trouble developing in Japan:

- Bigger stimulus developing in China:

- China says drafting plans to boost recovery, expansion of consumption

- China may hold lending benchmarks steady as recovery remains on track -analysts

- Analysis: China's 'atypical' deflation cycle gives central bank a headache

- ECB minions worried about inflation have more inflation, credit squeeze to deal with:

- Core euro zone inflation edges up in March, keeping ECB on alert

- Euro zone services booming but sentiment recovery may have stalled -ECB's Lane

- Credit squeeze 'biggest threat' to economic outlook, Fidelity says

- Dow dips, S&P 500 stable after medtech gains, Netflix drag

- Thursday, 20 April 2023

-

- Signs and portents for the U.S. economy:

- US existing home sales resume downward trend in March

- US labor market cooling; leading indicator flashes recession

- Oil falls 2% on recession fears, swelling US fuel stocks

- Fed minions looking for one more rate hike:

- China central bank minions claim they're not worried about deflation:

- BOJ minions think all is economically well in 7 of 9 regions of Japan, thinking about changing up never-ending stimulus sometime later:

- BOJ keeps upbeat economic view on seven of Japan's nine regions

- https://www.reuters.com/article/japan-economy-boj-ycc/boj-open-to-tweaking-ycc-this-year-if-wage-momentum-holds-sources-idUSKBN2WH0AR

- ECB minions want more rate hikes before stopping, don't trust inflation is over in Eurozone:

- ECB's Lagarde: "still a bit of a way to go" on monetary policy

- Some ECB governors doubted 'immaculate disinflation' in March

- Wall St slides after gloomy earnings led by Tesla

- Friday, 21 April 2023

-

- Signs and portents for the U.S. economy:

- U.S., Euro zone business activity accelerates to 11-month highs in April

- US bank deposits, loans ticked down in latest week -Fed data

- Fed minions looking forward to one more rate hike, blame loophole for their missing signs of Silicon Valley Bank failure, not so sure of their next steps:

- Fed tilts toward rate hike, with a possible pause in view as lending slows

- U.S. Fed works on loophole that masked losses on SVB's securities -WSJ

- Fed's Cook sees a less certain outlook for future of monetary policy

- Bigger stimulus developing in China:

- BOJ minions see less economic shrinkage, broadening inflation, not going to change never-ending stimulus, say all's good with financial system:

- Japan's factory activity shrinks at slowest pace in six months - PMI

- Japan's broadening inflationary pressures test BOJ's dovish stance

- BOJ likely to maintain ultra-low rates, dovish guidance next week -sources

- BOJ sees 'sound and resilient' financial system despite some jitters

- ECB minions thinking about keeping rate hikes going:

- Wall St posts slim gain ahead of big earnings week

- Monday, 24 April 2023

-

- Late breaking bonus headline!

- Analysis-China rebound buoys hopes for stronger-than-expected US, Europe earnings

- This analysis follows up the factors we observed boosting U.S. stock prices in the earlier part of the preceding week. Given its focus, we thought it made sense to add it to this week's roundup of market-moving headlines as a late breaking bonus headline.

The CME Group's FedWatch Tool anticipates the Fed will hike the Federal Funds Rate by a quarter point to a target range of 5.00-5.25% at its upcoming meeting on 3 May (2023-Q2). After that, the FedWatch tool anticipates a series of quarter point rate cuts starting from 1 November (2023-Q4) and continuing at six-to-twelve-week intervals through the CME FedWatch tool's available forecast period, which extends through 25 September 2024 (2024-Q3).

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 held steady at +2.5% over the past week. The so-called Blue-Chip consensus predicts it will be +1.5% (or rather, that's the average of 10 forecasts that anticipate real growth anywhere from +0.3% to +2.5% for 2023-Q1). The GDPNow tool is now fully looking backward instead of forward and will continue to do so until the U.S. Bureau of Economic Analysis releases its advance estimate of real GDP on 27 April 2023.

Image credit: Photo by Aditya Vyas on Unsplash.

If you suddenly lost your source of income, how long could you afford to pay your bills and live your life as if nothing had happened?

With so many layoffs hitting tech companies in recent months, many who thought their jobs were secure are finding out otherwise. Once you lose your job, it could be many months before you find another that pays as well. Until then, there's unemployment, but chances are that won't cover all your bills until you land your next job. In the worst case, that source of temporary income could run out after you've exhausted your benefits and before you take your next job.

If you think your job could be at risk, it will be to your advantage to prepare yourself for these scenarios. One place to start is to calculate your basic liquidity ratio. In finance, analysts will calculate this ratio for companies to assess how capable they are of paying their short-term debt obligations. In personal finance, the basic liquidity ratio can be used to determine how long an individual or family could continue to meet their household expenses using their cash assets after losing their job. The higher the ratio, the longer they can sustain themselves without additional income. It’s a useful tool for planning and managing finances during uncertain times.

Cash assets refers to all the money you have in your checking, savings, or perhaps your retirement savings accounts. It can also include any things or assets you own that you can easily sell as quickly as you might need to keep paying your bills.

We've generated a new tool that will calculate your basic liquidity ratio (more on that later...), where you can enter the value of your total monetary assets and your total monthly expenses. It will determine your liquidity ratio, which in this context, will directly correspond to how many months you can keep paying your bills and living your life as if you hadn't lost your source of income. If you're accessing this article on a site that republishes our RSS news feed, you may need to click through to our site to access a working version.

| Total Monetary Assets: | |

| Monthly Expenses: | |

| Liquidity Ratio: |

For the default scenario, with $6,000 in total monetary assets matched against monthly expenses of $4,800, the basic liquidity ratio works out to be 1.25. A household with these assets and expenses would last 1.25 months (or about 5 weeks) before running out of money. For this context, the higher the ratio, the more time you have to find your next job.

If you want to find out how unemployment benefits might affect the results, you have two alternatives to simulate them. You can either estimate your monthly unemployment benefits and subtract it from your Monthly Expenses or you can calculate the maximum benefit you may receive before it runs out and add it to your Total Monetary Assets. Unfortunately, and for obvious reasons, you cannot do both!...

About the Code

We had Microsoft Bing's AI-powered chat generate the code used in the tool featured in this post. It took about 30 seconds, here's the prompt and the code it created for us.

Generate the javascript code, including html tables, for a calculator that solves for the basic liquidity ratio given both total monetary assets and monthly expenses.

Sure! Here’s a simple JavaScript code that you can use to create an HTML table for a calculator that solves for the basic liquidity ratio given both total monetary assets and monthly expenses:

function calculateLiquidityRatio() {

var totalMonetaryAssets = document.getElementById("totalMonetaryAssets").value;

var monthlyExpenses = document.getElementById("monthlyExpenses").value;

var liquidityRatio = totalMonetaryAssets / monthlyExpenses;

document.getElementById("liquidityRatio").innerHTML = liquidityRatio;

}<table>

<tr>

<td>Total Monetary Assets:</td>

<td><input type="number" id="totalMonetaryAssets"></td>

</tr>

<tr>

<td>Monthly Expenses:</td>

<td><input type="number" id="monthlyExpenses"</td>

</tr>

<tr>

<td>Liquidity Ratio:</td>

<td id="liquidityRatio"></td>

</tr>

</table>

<button onclick="calculateLiquidityRatio()">Calculate</button>This code creates an HTML table with input fields for total monetary assets and monthly expenses, and a button to calculate the liquidity ratio. When the button is clicked, the calculateLiquidityRatio function is called, which calculates the liquidity ratio and displays it in the table.

Is this what you were looking for?

It was 95% of what we needed. Most impressively, we didn't even have to provide the mathematical formula for the ratio; it found it on its own. We did have to add some additional coding so you can run it, but we view that as comparatively trivial.

Image credit: Stable Diffusion DreamStudio Beta: "U.S. $100 dollar bills flowing out of a faucet, digital concept art".

Labels: ideas, personal finance, tool

It has been said that President Biden's economy is now "stuck between a rock and a hard place". But to understand why it is being described that way, we need to understand how we got here. How we got here is a story of failure.

The story of that failure begins, as many of these stories do, with the people responsible for it attempting to justify the actions they took that contributed to it. In Washington, D.C., that means the story begins with an anonymous official within the Biden administration who is trying to put the best possible face on the situation by claiming they only had the best of intentions.

Biden set out to use the COVID-19 aid dollars to get people back to work quickly and prevent the typical "scarring" in recessions that can leave people earning less for the rest of their careers and, in some cases, permanently jobless. He succeeded at that mission as the economy has about 4 million more jobs than the Congressional Budget Office forecasted it would at this stage.

A White House official said the policies were designed with the specific goal of bringing jobs back faster than in past recoveries. After the Great Recession began at the end of 2007 and the economy crashed, it took more than six years for the total number of U.S. jobs to return to pre-downturn levels. In the pandemic recovery, the jobs total rebounded to its prior level in a little over two years. The official, who spoke on condition of anonymity to discuss private conversations, said Biden's goal was to spur a burst of hiring that would cause strong growth in the long term. If the jobs recovery had dragged on, some people would give up hope and drop out of the labor force, reducing the ability of the economy to grow for decades to come.

What could possibly go wrong with such noble intentions?

Alas, in seeking to boost the jobs numbers by so much so quickly, the Biden administration's plan to overshoot the economy's output gap to obtain that outcome unleashed inflation with all its negative and cascading consequences. That persistent inflation wasn't supposed to happen according to the extremist activists who most fervently pushed the "Go Big" stimulus plan the Biden administration ultimately adopted. They claimed conventional measures of the output gap were flawed and they assumed the economy's potential GDP and its output gap were much larger than those mainstream estimates indicated. Arguing that was the case, they asserted little to no inflation would result from their plan for a super-sized stimulus.

That proved to be a bad assumption.

That assessment is confirmed by Paul Krugman, perhaps the most respectable backer of the "Go Big" plan, and so far, the only backer who has since acknowledged that assumption was badly wrong. The following excerpts from his July 2022 mea culpa describe what he was thinking at the time and the lesson he's learned from the failure:

In early 2021 there was an intense debate among economists about the likely consequences of the American Rescue Plan, the $1.9 trillion package enacted by a new Democratic president and a (barely) Democratic Congress. Some warned that the package would be dangerously inflationary; others were fairly relaxed. I was Team Relaxed. As it turned out, of course, that was a very bad call....

Those of us on Team Relaxed argued, however, that the structure of the plan would lead to a much smaller surge in G.D.P. than the headline number would suggest. A big piece of the plan was one-time checks to taxpayers, which we argued would be largely saved rather than spent; another big piece was aid to state and local governments, which we thought would be spent only gradually, over several years.

We also argued that if there were a temporary overshoot on G.D.P. and employment it wouldn’t sharply increase inflation, because historical experience suggested that the relationship between employment and inflation was fairly flat — that is, that it would take a lot of overheating to produce a big inflation surge....

Even so, historical experience wouldn’t have led us to expect this much inflation from overheating. So something was wrong with my model of inflation — again, a model shared by many others, including those who were right to worry in early 2021....

In any case, the whole experience has been a lesson in humility. Nobody will believe this, but in the aftermath of the 2008 crisis standard economic models performed pretty well, and I felt comfortable applying those models in 2021. But in retrospect I should have realized that, in the face of the new world created by Covid-19, that kind of extrapolation wasn’t a safe bet.

Krugman's mea culpa is a model to follow for all professionals who takes economics as a science seriously. Unlike the ideologically-motivated activists who refuse to acknowledge the role they and Biden's COVID stimulus had in contributing to the inflation that followed its implentation, Krugman can do what they are unwilling to admit. He can honestly acknowledge the Biden administration's choice to overshoot the output gap and run the economy "hot" helped make the inflation that followed and learn from that failure:

Much, although not all, of the inflation surge seems to reflect disruptions associated with the pandemic. Fear of infection and changes in the way we live caused big shifts in the mix of spending: People spent less money on services and more on goods, leading to shortages of shipping containers, overstressed port capacity, and so on. These disruptions help explain why inflation rose in many countries, not just in the United States.

But while inflation was confined mainly to a relatively narrow part of the economy at first, consistent with the disruption story, it has gotten broader. And many indicators, like the number of unfilled job openings, seem to show an economy running hotter than numbers like G.D.P. or the unemployment rate suggest. Some combination of factors — early retirements, reduced immigration, lack of child care — seems to have reduced the economy’s productive capacity compared with the previous trend.

These factors were either ignored or given short shrift by the partisans who dismissed the conventional measures that indicated the output gap would be greatly exceeded by the "Go Big" stimulus measure. Since Krugman's acknowledgment, more evidence has accumulated these factors may have been decisive in shaping how the economy responded to the American Recovery Plan Act's massive stimulus spending.

Earlier this month, the nonpartisan Brooking Institution's Lauren Bauer, Wendy Edelberg, Sara Estep, and Brad Hershbeln released a study backed by data that points to many of the same factors Krugman identified as contributing to inflationary pressures. In a separate analysis, the U.S. Chamber of Commerce's Stephanie Ferguson identified many of the same inflationary factors at work.

Meanwhile, another study released days earlier by the Brooking Institution's Katharine Abraham and Lea Rendell provides a demographic explanation for why the pandemic recovery for the labor force has played out the way it has and why improvements in the labor force participation rate are now mostly over:

Almost all of the remaining shortfall in U.S. labor force participation is the result of demographic and other trends that predate the COVID-19 pandemic, according to new research that suggests little chance that growth in the number of workers will help ease a tight American job market.

After accounting for factors such as population aging and changes in education that influence people's willingness to work, the study showed that U.S. labor force participation was only about 0.3 percentage points short of where it would have been without the pandemic - equivalent to around 700,000 "missing" workers.

"Much of the decline in labor force participation over the past three years should have been anticipated even absent the pandemic," Katharine Abraham, a University of Maryland economics professor and former U.S. Bureau of Labor Statistics commissioner, and Lea Rendell, a University of Maryland doctoral candidate, wrote in a study released late on Wednesday in conjunction with a conference at the Brookings Institution think tank.

These demographic factors make it unlikely the unemployment rate can get much lower than 3.5%. That constraint matters because Biden's "Go Big" stimulus plan has made the economy "inefficiently tight", which aligns with Krugman's mid-2022 observation the economy is "running hotter than numbers like G.D.P. or the unemployment rate suggest":

A new independent economic analysis helps to show why the low unemployment rate has yet to resonate with people: There aren’t enough workers to fill the open jobs, causing the economy to operate with speed bumps and frictions that make things seem worse than they are in the data. The analysis suggests that the economy would arguably function far more smoothly with unemployment higher at 4.6%, even though that could translate into nearly 2 million fewer people holding jobs.

The job market is what economists call “inefficiently tight,” a problem the United States also faced during the Vietnam War, the Korean War and World War II. The current tightness is as severe as it was at the end of World War II. This mismatch causes companies and consumers alike to feel as though the economy is in a rut, said Pascal Michaillat, an economist at Brown University.

Not in a rut, so much as failing to deliver on its promise by making everything both more costly and more scarce than the economy can either afford or sustain. In the now immortal words of Larry Summers, President Biden's "excessive stimulus driven by political considerations was a consequential policy error". Then again, Larry Summers is in the enviable position of being able to say "I told you so!"

But the activists who pushed the "Go Big" stimulus thought they knew better. Looking in the rear view mirror, it's amazing to learn how much they didn't know but should have. It's also rather amazing to consider what they knew but chose to disregard in dismissing the warnings of mainstream economists. Their legacy will make for quite a cautionary tale.

References

Katharine Abraham and Lea Rendell. Where are the missing workers? Brookings Institution. [PDF Document]. 30 March 2023.

Lauren Bauer, Wendy Edelberg, Sara Estep, and Brad Hershbeln. Who's missing from the post-pandemic labor force? Brookings Institution. [Online Article]. 4 April 2023.

Stephanie Ferguson. Understanding America's Labor Shortage. U.S. Chamber of Commerce. [Online Article]. 7 April 2023.

Paul Krugman. I Was Wrong About Inflation. New York Times. [Online Article]. 21 July 2022.

Pascal Michaillat. US Labor Market Continues to Cool in March But Remains Inefficiently Tight. Pascal's Newsletter. [Online Article]. 7 April 2023.

Political Calculations. How Bidenflation Was Made. [Online Article]. 30 March 2023.

Image credit: Photo by Brett Jordan on Unsplash.

Labels: economics

In a world that is both swimming in big data and becoming more dependent upon it, sometimes you come across data that isn't all it's cracked up to be. Data that doesn't tell you what you think it does. Data that isn't particularly useful, but for whatever reason, continues to be compiled and reported. Month by month. Year after year.

We started wondering about this problem after running into the opposite problem. There is data that is useful, that can give you a much better understanding of how the world really works or how history really happened, but for whatever reason, portions of which have become either unavailable or even potentially lost over time. We may never find that missing information and that is a loss.

While we might call it big data, it isn't, by any means, all data. Nor could it be, because there are constraints on how much data we can store. Nor should it be, because not all data is useful.

If you were in charge of building a global database project that would store and provide useful information instantly on demand, how would you ensure it contains useful information while avoiding populating it with data that's less than useful?

One place to begin might be to identify the data objective analysts find doesn't help them make better sense of the world that is. Back in 2010, Time's Justin Fox asked a number of analysts what their "least favorite economic indicator" was. Here's the list he compiled of what he termed the "most overrated economic indicators":

- FHFA house price index

- Weekly chain store sales

- Challenger layoff announcements

- Producer price index

- Index of leading economic indicators

- Consumer confidence index

- ADP employment index

- Gross domestic product

- Consumer price index

In 2023, we can confirm all these metrics have survived to the present. They are all still regularly compiled and reported. Is that because these examples are really more useful than they were made out to be in 2010? Or are these zombie datasets that somehow keep plodding along because of the inertia they've built up over time?

The potential answers to those questions are intriguing enough we thought it might make for an interesting series to explore these indicators. And since there are only nine indicators and the law of internet lists require ten items, we're open to suggestions for a tenth item to include in the list of less than useful economic indicators.

Image credit: Big Data by LearnTek via Flickr. Creative Commons CC0 1.0 Universal (CC0 1.0).

Labels: ideas

U.S. Income Tax Day arrives on April 18 in 2023. And what better way could there be to celebrate the most dreaded day on the American calendar than by filling out another income tax form?

Before you start pounding the "back" button, there's nothing for you to worry about! You won't have to pay any more income taxes than what you already have reported on whichever version of IRS Form 1040 you're filing this year. Instead, we've built the following tool to transport you in time back to 1913, where our tool will estimate how much your federal income taxes would be if that year's income tax rules still applied.

Why 1913? That's the year the Internal Revenue Service first issued its infamous Form 1040. We've modeled our tool after the first page of the original Form 1040, which back then, consisted of just four pages:

- The summary sheet modeled below (Page 1),

- the Gross Income calculation sheet (Page 2),

- the General Deductions sheet (Page 3), and finally,

- one page of Instructions (Page 4).

Yes, you read that right. Paying U.S. income taxes used to only require one page of instructions!

We'll make it even easier. All you need to do is to enter the indicated data (shown in boldface type, in the rows with a white background), using your figures from this year that should still be very fresh in your memory, and we'll take care of the math! The tool will display its calculated results in the rows with a gray background, where you won't have to worry about entering any values.

If you are accessing this article on a site that republishes our RSS news feed, please click here to access a working version of the tool on our site. Now, if you're ready, let's get to it!...

Here are several excerpts from the instructions for filling out the original IRS Form 1040, which explain some of the math our tool is doing.

Excerpts from the Instructions

3. The normal tax of 1 per cent shall be assessed on the total net income less the specific exemption of $3,000 or $4,000 as the case may be. (For the year 1913, the specific exemption allowable is $2,500, or $3,333.33, as the case may be.) If, however, the normal tax has been deducted and withheld on any part of the income at the source, or if any part of the income is received as dividends upon the stock or from the net earnings of any corporation, etc., which is taxable upon its net income, such income shall be deducted from the individual's total net income for the purpose of calculating the amount of income on which the individual is liable for the normal tax of 1 per cent by virtue of this return.

19. An unmarried individual or a married individual not living with wife or husband shall be allowed an exemption of $3,000. When husband and wife live together they shall be allowed jointly a total exemption of only $4,000 on their aggregate income. They may make a joint return, both subscribing thereto, or if they have separate incomes, they may make separate returns; but in no case shall they jointly claim more than $4,000 exemption on their aggregate income.

Previously on Political Calculations

Haven't had enough taxes yet? Here's a couple of other tools that might be of interest to you!

Image credit: Stable Diffusion DreamStudio Beta: "A greedy Uncle Sam wants to make Americans pay taxes".

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.