We're opening our month-ahead look at where stock prices will go with Herbert Stein's famous observation, which also goes by the name of "Herbert Stein's Law." Except we're going to add a corollary to it for our purposes today:

"Until it stops, it will continue."

Or as Sir Isaac Newton might put it to a child or high school physics student:

"Objects in motion tend to stay in motion. Objects at rest tend to stay at rest."

This idea of inertia lies behind what we see driving stock prices today. Although we still cannot yet determine how much of the market's recent decline is the result of signal, which we identify as changes in the expected growth rate of the market's dividends per share, or noise, in which we lump all other causes of changes in stock prices, what we are observing is a strongly negative acceleration in stock prices.

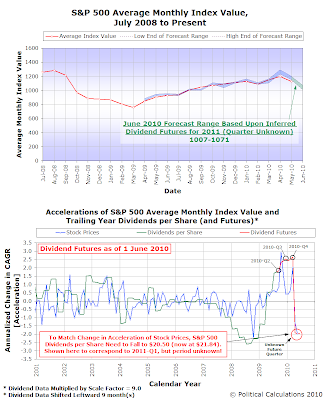

From that observation, we can use the math we've developed to describe the relationship between dividends per share and stock prices in reverse to infer the effective level of the market's trailing year dividends per share. Here, given the typical amplification level we have observed in the market since January 2001, we find that dividends per share would have to fall to coincide with the negative acceleration we see in stock prices. Doing that math offline, we find that trailing year dividends per share for the S&P 500 would have to drop to a level of $20.50 to match the observed change in the growth rate of stock prices that we observe through the end of May 2010.

That kind of change would represent a major shift in the future outlook for the market's dividends per share. In June 2010, we anticipate that trailing year dividends per share will be $21.84, so a level of $20.50 would correspond to a drop of $1.34 per share.

But that would assume that all of the change in the growth rate of stock prices that we're observing today is the result of a change in the expected future rate of growth of dividends per share. It's very likely that there's quite a bit of noise driving also stock prices today as well.

That's supported by what we've observed in the available dividends future data to which we do have access, which indicates that dividends per share is expected to rise, at the very least, through the end of 2010.

These observations then suggest that there's an enormous amount of noise affecting stock prices. And that's where our corollary to Herbert Stein's Law comes into play, because we're going to assume that until the noise stops, it will continue.

If we use the $20.50 figure that we determined from May 2010's data in our math, we would anticipate the average of stock prices for the month would fall to a range between 946 and 1037. We've presented the "less noisy" range in our prediction track record chart above, as we are assuming that May 2010 was "more noisy," which we justify by observing that the so-called "flash crash" occurred during this month, which can only be described as a major noise event.

Speaking of which, while stock prices in May 2010 fell outside the range we originally predicted at the beginning of the month (we revised our forecast later in the month), we do find that the month-to-month change in the average closing price of the S&P 500 paralleled the trajectory we anticipated they would take.

That outcome suggests that our inverse method for anticipating stock prices works, but is subject to greater error than our regular method, where we can better quantify the level of noise in the market. Which is exactly the kind of outcome that we should expect given the forecasting circumstances.

Labels: forecasting, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.