You might think having a stock market index clock in with new highs might get boring, but it hasn't yet. The S&P 500 (Index: SPX) rose almost 1.4% over its previous week's close to set another new record high close of 4,958.61 on Friday, 2 February 2024.

Part of what made the week not boring is how stock prices reacted to the news on Wednesday that the U.S. Federal Reserve had all but taken of starting a series of rate cuts in March 2024 off the table. Investors reacted that day by sending stock prices down 1.6% below the previous day's close, or 0.9% below where it closed in the previous week.

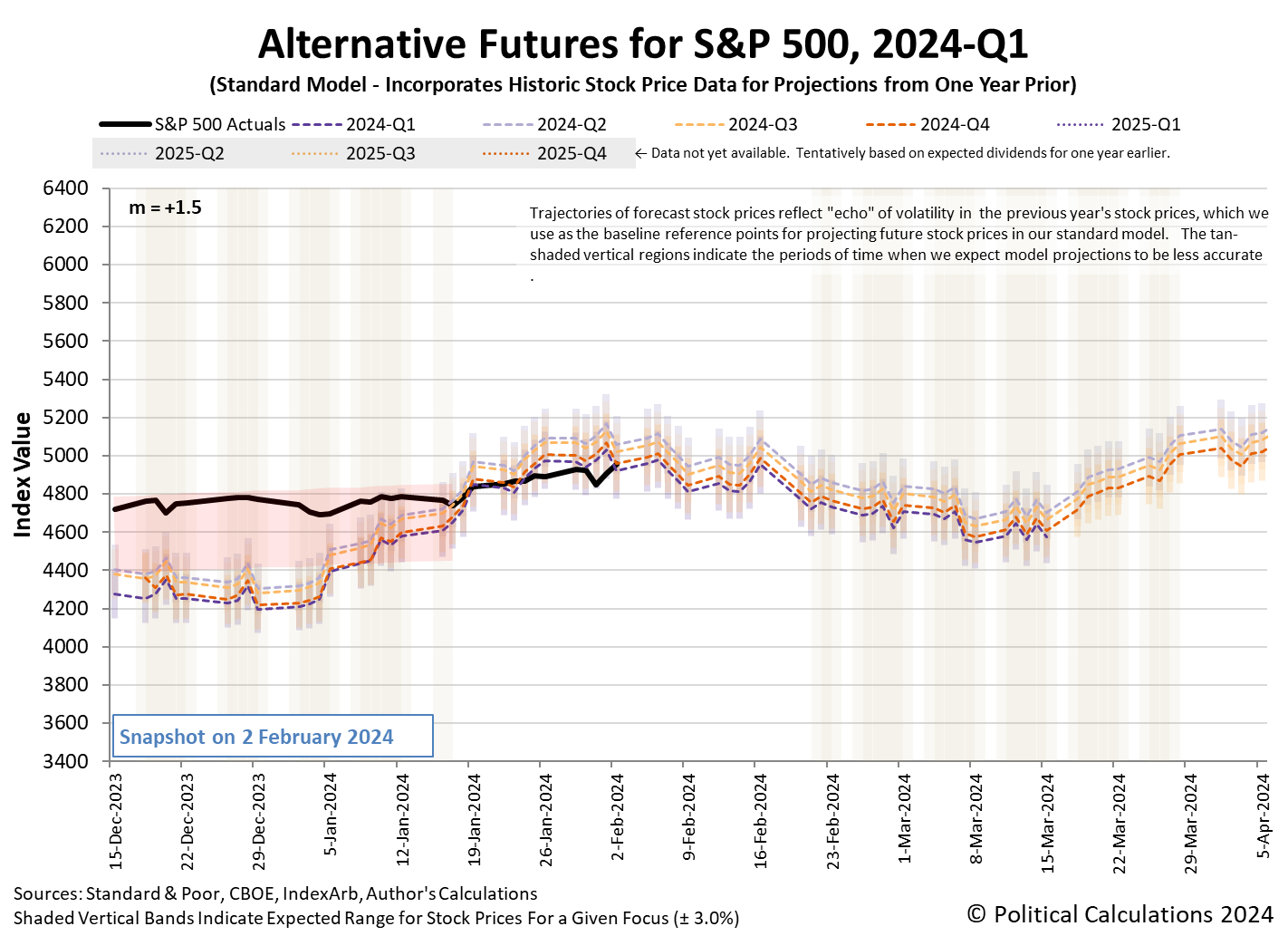

But then stock prices recovered and went on to increase into record high levels. Remarkably however, the latest update for the dividend futures-based model's alternative futures chart suggests investors are still closely focused on the current quarter of 2024-Q1 in setting the trajectory for the S&P 500.

With the prospect of rate cuts starting in March now all-but-dead, the bigger question is why are investors still apparently focusing their attention on the current quarter of 2024-Q1?

The best hypothesis we have at the moment for why investors are holding their attention on the current quarter is that it is still earnings season, with companies reporting their financial results for the fourth quarter of 2024 and providing their outlooks for 2024. The market-moving news headlines of the past week hint at that new information being absorbed by investors, but not so definitively for us to say "that's it!" In any case, here are the headlines that moved markets during the week that was:

- Monday, 29 January 2024

-

- Signs and portents for the U.S. economy:

- US economic expansion likely hinges on a nimble Fed this time

- WTO says its trade growth estimates appear 'overly optimistic'

- Oil drops as China demand concerns counter supply jitters

- Fed minions thinking about next steps in pivot to easier monetary policy:

- Bigger trouble, stimulus developing in China:

- China's vice premier urges more support for listed firms amid market rout

- China Evergrande ordered to liquidate in landmark moment for crisis-hit sector

- China's growth model pushes Beijing into more trade conflicts

- Japanese politician calls for BOJ minions to end never-ending stimulus policy:

- ECB minions say no rate cuts until Eurozone wage raises stop being so generous:

- S&P ends at new record closing high, Nasdaq and Dow also advance to kick off busy week

- Tuesday, 30 January 2024

-

- Signs and portents for the U.S. economy:

- Fed minions thinking about next steps in pivot to easier monetary policy:

- Bigger trouble, stimulus developing in China:

- China's factory activity shrinks again, weak demand hobbles economy

- China's major state banks defend yuan as stock markets slide - sources

- State-backed 'national team' of investors piles in to support China stocks

- Chinese major cities ease home purchase limits to boost sales

- Bigger trouble developing in Eurozone, ECB minions ready plans for rate cuts:

- Euro zone economy stagnates as Germany struggles

- ECB likely to cut rates in small increments with pauses - Vujcic

- Nasdaq, S&P, Dow end mixed a day ahead of first Fed monetary policy decision of 2024

- Wednesday, 31 January 2024

-

- Signs and portents for the U.S. economy:

- Fed minions worrying about their "narrative":

- Fed's faith in 'immaculate disinflation' narrative put to the test

- Fed Chair Powell faces tough communications task on rate cuts ahead

- Fed minions kill narrative suggesting rate cuts in March 2024:

- Inflation-focused Fed shoots down Wall Street’s hopes of March cut

- Fed plans 'in-depth' talks on balance sheet run-off in March: Powell

- Bigger trouble, stimulus developing in China:

- China unveils new property support measures amid concerns about Evergrande fallout

- Exclusive: Chinese automakers hit by production issues with Huawei computing unit

- Nasdaq, S&P, Dow end in the red as Fed chair Powell says March rate cut unlikely

- Thursday, 1 February 2024

-

- Signs and portents for the U.S. economy:

- US job cuts more than double in January -report

- Oil prices drop 2% on unsubstantiated ceasefire reports, refinery shutdown

- Rising US oil production frustrates OPEC+ cuts

- Bigger trouble, stimulus developing in China:

- Decline in China's property sector may be slowing, no recovery yet

- China pledges to stick with fiscal expansion to spur economy

- China's factory activity expands on export order boost - Caixin PMI

- Nasdaq, S&P, Dow rebound from Fed-inspired sell-off; Apple, Amazon, Meta results in focus

- Friday, 2 February 2024

-

- Signs and portents for the U.S. economy:

- US labor market sizzles; delivers large job and wage gains

- Oil falls as US jobs data dents hope for near-term rate cuts

- US regional bank sell-off a cautionary sign of more pain to come

- Fed minions expected to keep rates higher for longer after unexpectedly strong jobs report:

- Wall St climbs, S&P 500 powers to record high on solid earnings, robust data

The CME Group's FedWatch Tool continues to signal investors expect the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 1 May 2024 (2024-Q2). This date marks the anticipated beginning of a series of quarter point rate cuts that are expected to take place at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's updated estimate of real GDP growth for the first quarter of 2024 (2024-Q1) jumped to +4.2% up from last week's initial +3.0% growth estimate.

The S&P 500 is now just 49.31 points, or 0.83%, away from breaking through the 5,000 level for the index. Which is a big deal, seeing as it first broke through the 1,000 level in February 1998 during the inflation phase of the Dot-Com Bubble and hasn't been below it since July 2009. It's hard to believe the index has grown nearly five-fold over the last 14-15 years.

Image credit: Microsoft Bing Image Creator. Prompt: "A Wall Street bull celebrating after the stock market hits a new high."

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.