Should you, as an investor, let a groundhog decide when to buy stocks in the U.S. stock market?

To many rational investors, that sounds completely crazy. But if you believe investors are irrational, and you happened to have seen a recent paper presented in Finance Research Letters, you might just consider it. Here's the conclusion from the paper by Savva Shanaev, Arina Shuraeva, and Svetlana Federova:

This study has discovered a new calendar anomaly on the United States stock market associated with the prognostications of Punxsutawney Phil on the Groundhog Day. Across 1928–2021, the S&P 500 substantially appreciated subsequent to Phil’s “prediction” of an early spring, while the returns were moderately negative after he “predicted” a long winter. The difference in buy-and-hold abnormal returns two weeks after the Groundhog Day is a statistically and economically significant 1.85%, establishing the importance of the Groundhog Day superstition to investor sentiment and market performance. There is a seemingly puzzling positive anticipation effect to an early spring prognostication equalling 1.14% over the two weeks prior to the announcement that implies either informed trading or, more likely, rational investors exploiting their awareness of the superstition and weather forecasts. The results are robust in subsamples, when controlled for a wide range of other calendar anomalies, as well as to time-varying risk premia and conditional heteroskedasticity.

The findings have implications for academics and stock market participants. For individual and institutional investors, this study has identified an exotic yet moderately profitable trading strategy. For empirical finance researchers, it has highlighted the nuanced idiosyncratic nature and persistence of calendar anomalies, showing that country-specific superstitions can have notable market specific effects. While some anomalies can have no explanations consistent with the efficient market hypothesis – like Friday the 13th effect or, indeed, the Groundhog Day effect established in this paper – they seem to exist, hence the market truly is that irrational.

In the study, the authors reviewed daily U.S. stock market data extended back to 1928, which includes 18 years in which Punxatawney Phil did not see his shadow, signaling both an early end to winter and an opportune time to invest in the U.S. stock market. That opportune time is defined as the period covering the 11 trading days preceding Groundhog Day (2 February) each year, through the 10 trading days following it.

We wanted to confirm their results for ourselves, so we tapped Yahoo! Finance's historical data for the S&P 500 (Index: SPX). This database contains daily trading data for the index beginning in January 1950, where the period since contains 17 of the 18 Groundhog Days where Punxatawney Phil did not see his shadow to predict an early spring. The following chart suggests Shanaev, Shuraeva, and Federova may be onto something....

For all years since 1950 where Punxatawny Phil saw his shadow, forecasting a long winter, the average value of the S&P 500 ten trading days after Groundhog Day was barely changed from its value eleven trading days before it. But in the 17 years where Punxatawny Phil did not see his shadow, predicting an early end to winter, the value of the S&P 500 rose an average 3.0% above its pre-Groundhog Day anomaly value.

So are you ready to start taking investing advice from the world's most famous groundhog? Before you do, you may want to consider the following video:

As with any scientific hypothesis, it takes only one bit of contrary evidence to debunk it. In this case, all we need to do is show that instead of being irrationally influenced by the weather prognostications of a burrowing rodent, investors in any one of the years in which Punxatawney Phil saw no shadow were instead motivated by rational considerations to bid up stock prices.

We chose 2020. The year the coronavirus pandemic would negatively impact the world's economy. The year that saw billions of people deal with the irrational fear of a deadly spreading virus amplified by responses of public officials that were often even more irrational. A year in which irrationality would seem to have abounded like no other in recent history!

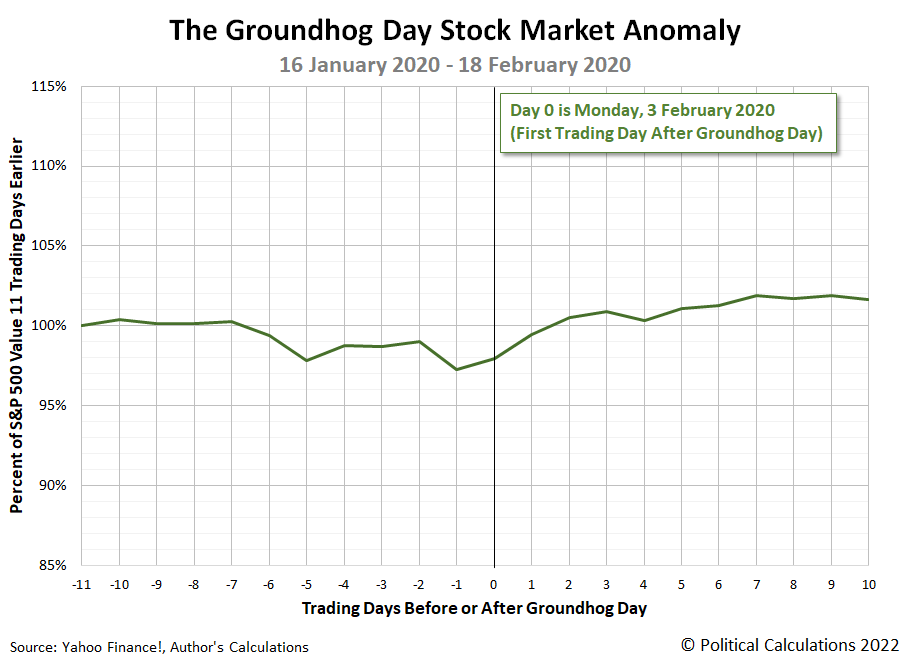

The next chart shows how the S&P 500 evolved during 2020's Groundhog Day anomaly window, which covers the trading days from 16 January 2020 through 18 February 2020:

So far, it seems to check the boxes for irrational behavior the Groundhog Day anomaly. We see Groundhog Day fell on a Sunday, so we set our Day 0 as Monday, 3 February 2020. We visually confirm that the preceding trading day of Friday, 1 February 2020 saw the S&P 500 bottom at 97.2% of its pre-anomaly window value. It began rising on 3 February 2020, proceeding to end the anomaly window period at 101.6% of its pre-anomaly period value after peaking at 101.9% on the seventh day after Groundhog Day.

But that doesn't consider what other information investors were considering during this period, much less what parts of that information were driving the stock market. For that, we tapped our own archives, where the clues to indicate investors were actually behaving very rationally were built into the headlines of our weekly recaps of the S&P 500's activity:

- S&P 500 in First Lévy Flight Event of 2020

- S&P 500 Completes First Lévy Flight Event of 2020

- Coronavirus Fears Weigh S&P 500 Down

- S&P 500 U-Turns to Reach Record Highs on China Liquidity Injections

- Fed Love-Hate Relationship With Liquidity Injections Pushes S&P 500 To New Record High on Valentine's Day

What we describe as a Lévy flight event corresponds to the decline of the index' value during the early part of the Groundhog Day anomaly window, which then combined with the realization that China's response to the epidemic would negatively affect the outlook for U.S. businesses. On 3 February 2020, U.S. stock prices rebounded slightly from that low based on strong U.S. manufacturing data with a small boost from tech stocks.

But what really caused stock prices to surge came on Tuesday, 4 February 2020, when China's central bank signaled they would initiate major stimulus programs to offset the negative economic impact of the spreading pandemic. The U.S. Federal Reserve also acted to boost liquidity in U.S. money markets at this time, but that was a much smaller act than the stimulus rolling out in China. U.S. stock prices remained elevated through the end of this period as Fed officials sought to boost confidence in the U.S. economy.

Most of that positive response would dissipate as the seriousness of the coronavirus pandemic became more apparent by the end of February 2020, but if you follow the links above to see the contemporary news headlines, there was nothing pointing to the prospects of an early spring that would affect the trajectory of the S&P 500 during the Groundhog Day anomaly window. Unless, of course, the Bank of China's officials took their policy direction from Punxatawney Phil. Whose 2020 weather prediction for an early spring also turned out to be wrong, as indicated by this late April 2020 photo....

The following video clip provides better advice for those irrational enough to follow the life advice of groundhogs:

Update: According to Punxatawny Phil, there will be no Groundhog Day-related stock market rally in 2022!

References

Savva Shanaev, Arina Shuraeva, Svetlana Federova. The Groundhog Day stock market anomaly. Finance Research Letters. DOI: 10.1016/j.frl/2021.102641. 22 December 2021.

Yahoo! Finance. S&P 500 Historial Prices. [Online Database]. Accessed 1 February 2022.

Image credit: Photo by Ralph Katieb on Unsplash

Labels: forecasting, geek logik, ideas, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.