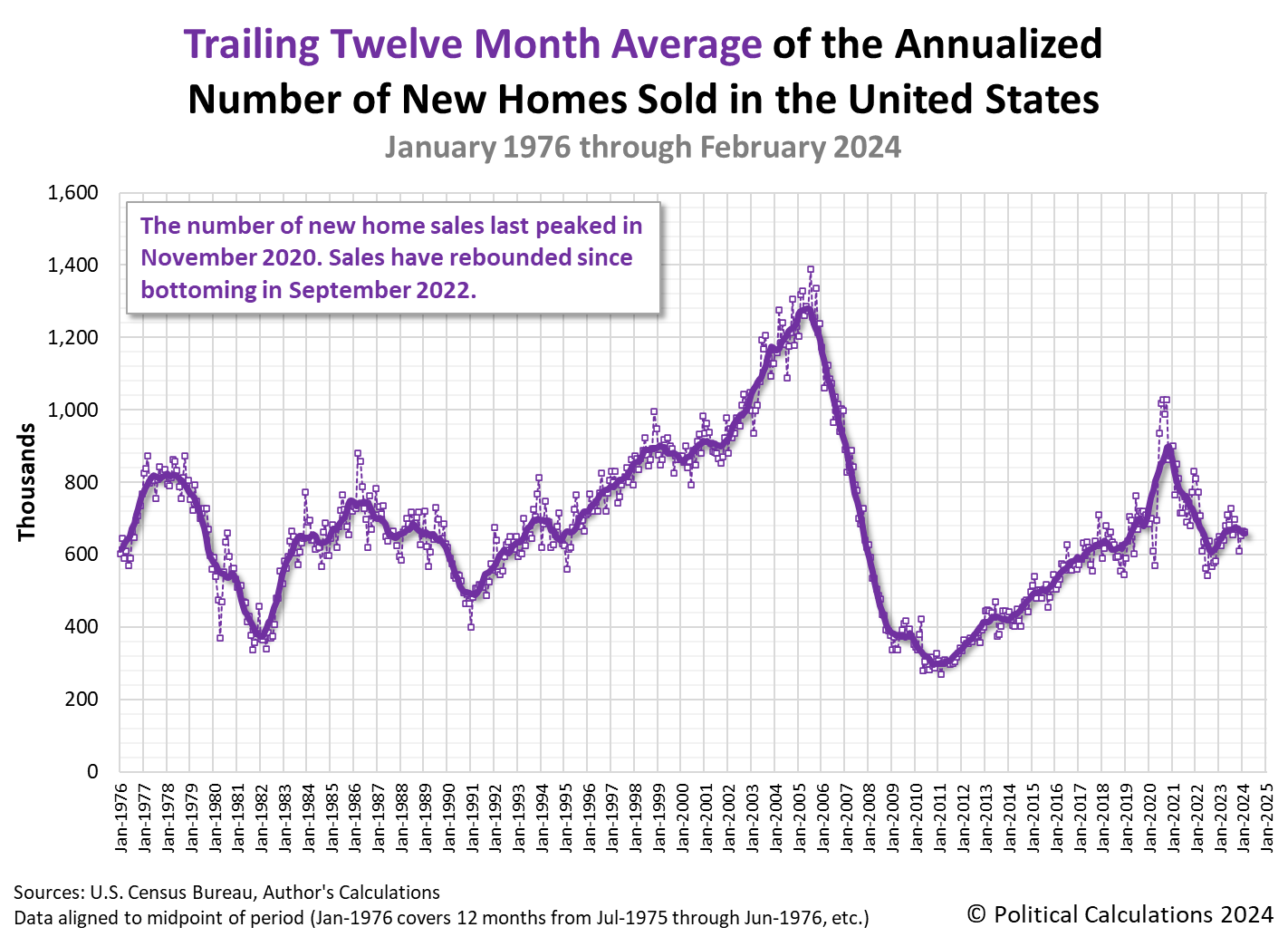

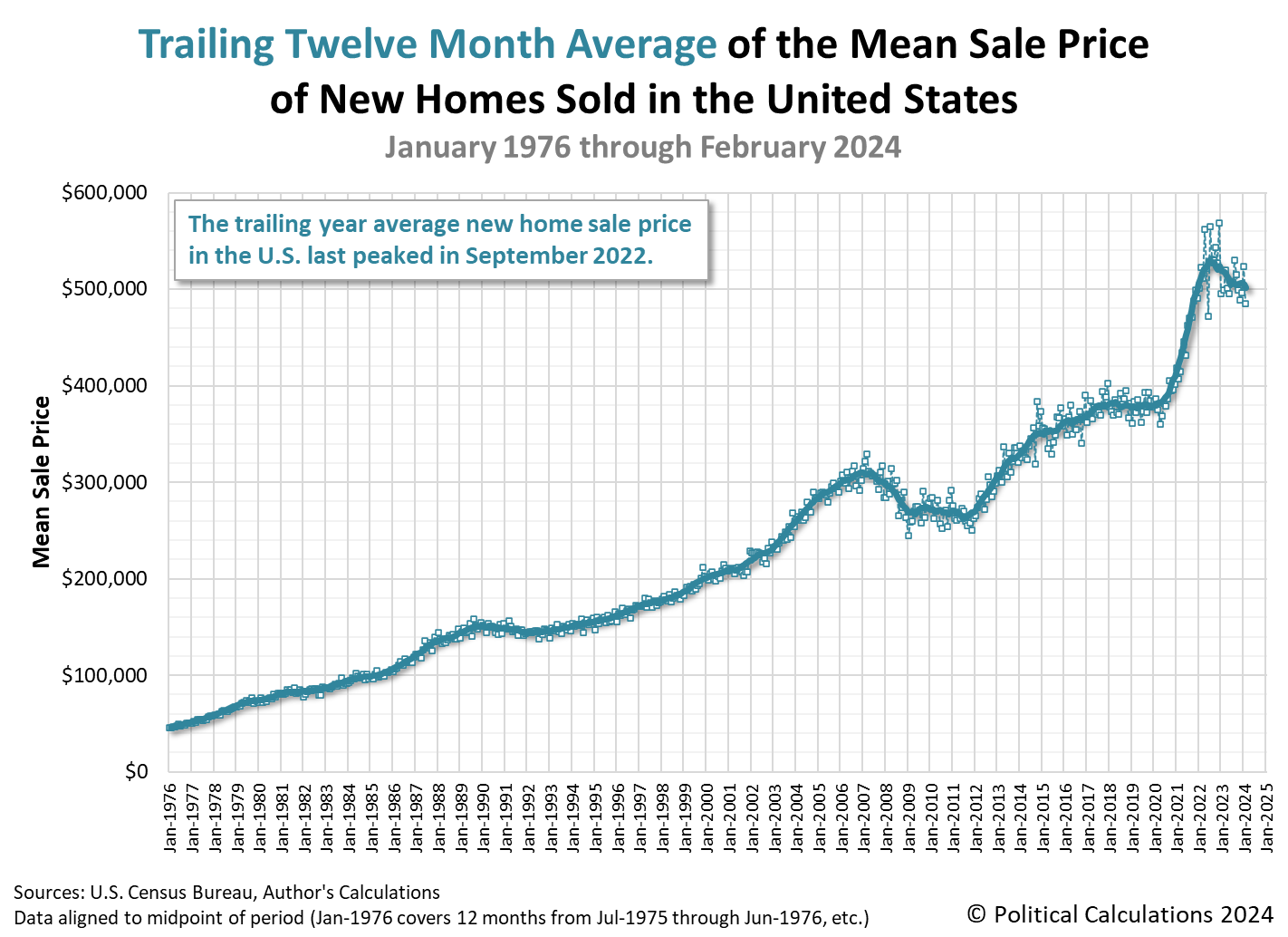

It happened again in February 2024. The size of the U.S. new home market as measured by its market capitalization shrank for the fifth month in a row.

Political Calculations' initial estimate of the size of the new home market cap in February 2024 is $26.38 billion. This estimate is nearly 7% below September 2023's now finalized estimate of $28.34 billion. It is also 12.5% below the December 2020 post-housing bubble peak of $30.12 billion.

The average price of a new home sold in February 2024 declined month-over-month. The U.S. Census Bureau's initial estimate of the average price for a new home sold in February 2024 is $485,000. This average price came in well below January 2024's revised estimate of $523,400, which itself was reduced from a first estimate of $534,300.

Meanwhile, the estimated number of new homes sold saw a small increase from January to February 2024. The first estimate of the seasonally-adjusted annualized number of new homes sold in February 2024 is 662,000, just 2,000 less than the preceding month's upwardly revised total of 664,000.

That small decrease in sales combined with the much larger decline in sale prices to cause the new home market cap to fall for the fifth consecutive month. The following charts show the evolution of the U.S. new home market capitalization, the number of new home sales, and also new home sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through February 2024.

Some market observers strained to find a silver lining in these gloomy numbers.

Sales of new U.S. single-family homes unexpectedly fell in February after mortgage rates increased during the month, but the underlying trend remained strong amid a chronic shortage of previously owned houses on the market.

The report from the Commerce Department on Monday also showed the median new house price last month was the lowest in more than 2-1/2 years, while supply was the highest since November 2022. Builders are ramping up construction, while offering price cuts and other incentives as well as reducing floor size to make housing more affordable.

"Housing activity is stabilizing as homebuilders appear to be building cheaper, and therefore, likely smaller homes," said Conrad DeQuadros, senior economic advisor at Brean Capital. "Sales have been relatively stable at December's level over the last two months and prices have been falling at mid-single-digit rates on a year-over-year basis."...

The overall housing market has likely turned the corner, with home resales surging to a one-year high in February. Nonetheless, supply remains inadequate, keeping house prices elevated and homeownership out of the reach of many.

We'll take a separate look at the relative affordability of new homes sold in February 2024 in the near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 March 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 March 2024.

Image credit: New Home Construction photo by Paul Brennan on PublicDomainPictures. Creative Commons CC0 1.0 Deed.

Labels: market cap, real estate

Life happens. And when it happens, it will often come with an unexpected price tag. Is that extra bill something you can afford to pay? Even on top of all your other bills?

Wouldn't it be nice if you already had the cash to pay that unexpected bill? Without having to borrow any money from family, friends, professional lenders, or your neighborhood loan shark? Or set up a GoFundMe fundraiser? Or count on winning the next lottery drawing?

If it's not obvious already, having cash saved and ready to use in case of emergency is a real solution to the money problems posed by potentially unexpected life events.

But there's a catch. In order to have a supply of cash available when an unexpected event happens, you have to have saved it first. According to Bankrate, just 44% of Americans have the savings to pay an unexpected bill of $1,000. If saving was as easy as banks make it sound, wouldn't that percentage be much higher? Right off the bat, 56% of Americans would seem to agree that saving is harder than it sounds.

To Bankrate's credit, they do suggest two basic steps for establishing up an emergency savings fund, including:

- Setting up an account for your emergency savings in a savings account at a bank that earns a high rate of interest. They also say if you can get a cash incentive from the bank to set up a new account, more power to you.

- Regularly funding the account a little at a time using direct deposit from your paycheck.

If you don't like banks and are willing to give up earning interest on your savings, you could cut the bank out of the picture and save cash in a piggy bank or in a safe at home. Both of which have their own risks, such as your kids helping themselves to what's in your piggy bank or you forgetting the combination to the safe! But there are some new options for setting up an emergency savings fund you might want to consider that may be available to you through your job.

If your employer offers a 401(k) program that is managed by Fidelity, you may have access to Fidelity's new Goal Booster program. This is a new program that automatically combines payroll deduction with savings accounts that are directly linked to your specific savings goals but are separate from your retirement savings. That means you can take out money from them when you need to without paying any early withdrawal hardship penalties. Other employers are starting to provide access to similar programs managed by firms like SecureSave and Sunny Day Fund.

What we haven't yet discussed is how much to save for an emergency. That's a different topic for a different day, which we'll get around to covering in Part 2!

Image credit: Piggy bank on a pink background image by Quince Media on Pixabay. Creative Commons CCO 1.0 Universal Public Domain Dedication.

Labels: personal finance

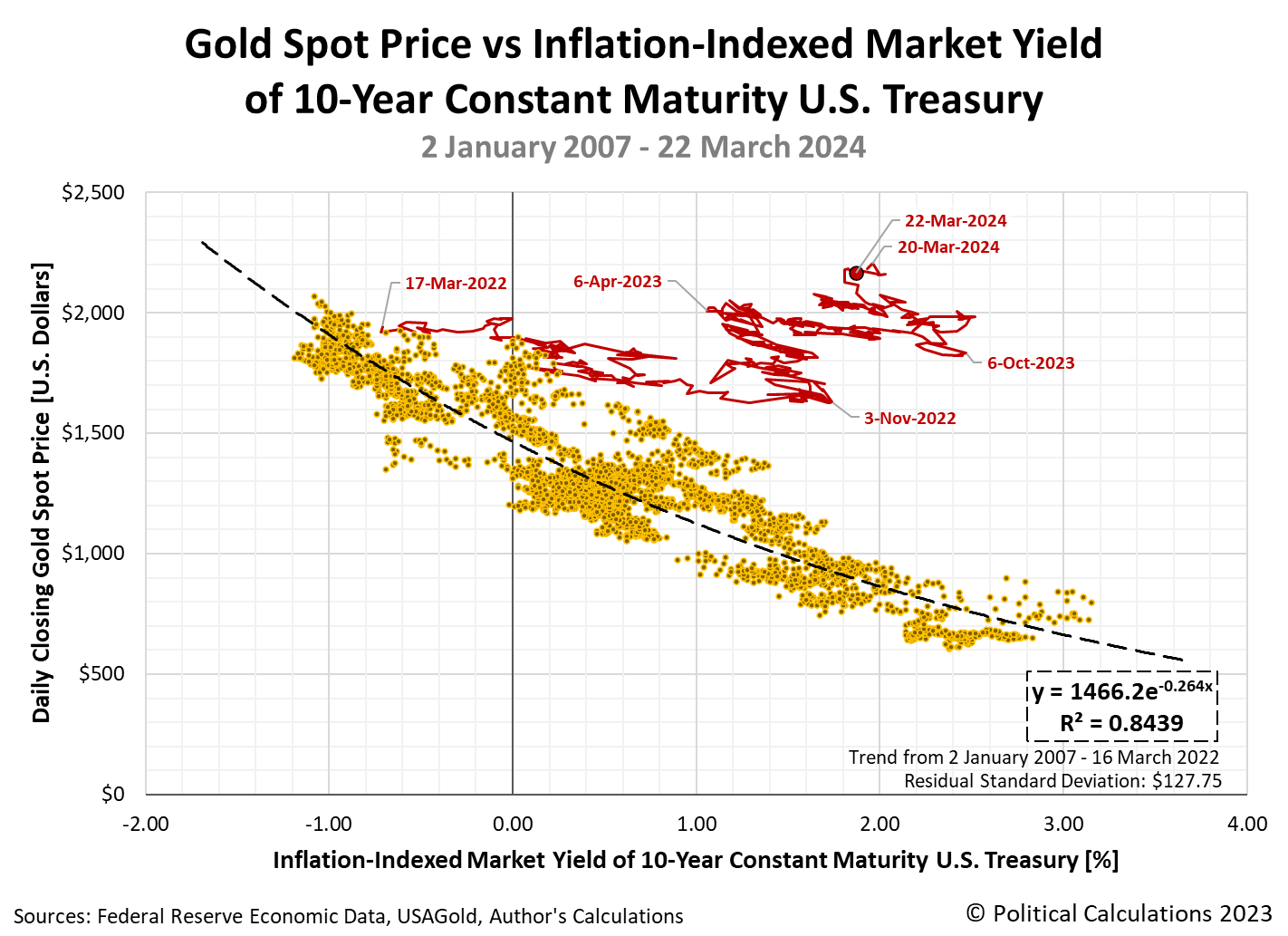

What drives the price of gold?

That's a fascinating question, which is the subject of an article asking that exact question at Investopedia. We're going to cut straight to their bottom line answer:

Today, the demand for gold, the amount of gold in the central bank reserves, the value of the U.S. dollar, and the desire to hold gold as a hedge against inflation and currency devaluation all help drive the price of the precious metal.

We have a unique perspective on this topic because of the fortunate timing of a snapshot we took mapping the recent historic relationship between the spot price of gold and real 10-Year U.S. Treasury yields some two years ago. That snapshot covered the period from 2 January 2007 to 17 March 2022, which is significant because a new paradigm for gold prices took hold starting on that latter date.

Two years later, this new paradigm can be seen in the following update to our chart, in which how the price of gold has changed with respect to the inflation-adjusted yield of the 10-Year Treasury is shown by the red line.

The big thing that stands out in the chart is that the price of gold has been rising even though the inflation-indexed market yield of a 10-Year U.S. Treasury has also risen during this period as the rate of inflation has fallen. This pattern contradicts the previous paradigm, in which gold prices rise as high inflation makes real yields fall or even turn negative in value, while low inflation rate has the opposite effect. In the old paradigm, there is an inverse relationship between the two.

The other thing that stands out are the periodic changes in direction of gold prices with respect to real 10-Year Treasury yields. We've marked the dates of the most significant turning points in the new paradigm on the chart.

We next mined through the market-moving headlines we've been capturing for years as part of our ongoing S&P 500 chaos series. While we seek to record headlines that have the potential to affect stock prices, it turns out we've also captured the events that proved to be major turning points for gold prices in the new paradigm. Here are the notable headlines occurring within a trading day of the indicated date on the chart marking the turning points:

- 16 March 2022: Fed hikes interest rates, signals aggressive battle against inflation

- 2 November 2022: Fed delivers fourth 75 bp hike, signals scale-back coming and Fed's Powell: "Ultimate level of interest rates will be higher than previously expected"

- 6 April 2023: 'Powell's curve' plunges to new lows, flashing US recession warning

- 9 October 2023: Top Fed officials nod to higher bond yields as cause for caution on rates and Marketmind: Fed pivot begins to crystallize

- 20 March 2024: Fed sees three rate cuts in 2024 but a more shallow easing path

For that last headline, gold prices broke through the $2,200 per ounce level to record an all-time high in terms of U.S. dollars. As of the final data point for the snapshot, we find gold prices hovering just a little below that level.

What all these headlines have in common is they herald actions by the U.S. Federal Reserve to alter the course of monetary policy in the United States. In the new paradigm, when the Fed alters its direction, investors alter the trajectory of gold prices.

References

Federal Reserve Economic Data. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Inflation-Indexed. [Online Database (Text File)]. Accessed 24 March 2024.

USAGold. Daily Gold Price History. [Online Database]. Accessed 23 March 2024.

Image credit: American Eagle One-Ounce Gold Coin photo by U.S. Mint. U.S. Government works public domain image.

Labels: data visualization, economics

For S&P 500 (Index: SPX) investors there was one, and only one, market moving headline during the week that was. The Federal Reserve confirmed on Wednesday, 20 March 2024 that interest rate cuts are coming in 2024.

That confirmation was like lighting off a rocket on Wall Street. The index rose nearly 0.9% after the Fed's "dot-plot" projection of future interest rates was released on Wednesday afternoon, closing at an all-time record high. The index would proceed to reach its current new record high of 5,241.53 on the following day, but dipped slightly on Friday, 22 March 2024 to close out the week at 5,234.18. That value represents a 2.3% gain over its previous week's close, making the third week of March 2024 the best of the year to date for the S&P 500.

The CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), unchanged from last week. The expectation that the Fed will begin a series of quarter point rate cuts starting on that date and continuing at mostly twelve-week intervals is also unchanged from the previous week.

With the Fed's first rate cut expected in June 2024, investors have locked their forward looking focus on the current quarter of 2024-Q2 in setting current day stock prices. The latest update shows that even though the trajectory of the index is just off its record high, it falls almost right in the middle of the redzone forecast range we added to the chart several weeks ago, which is based on the assumption investors would be focused on 2024-Q2 at this time.

Other things happened during the third week of March 2024. Here's a summary of all the other market-moving news headlines that investors absorbed during the week, along with the week's most influential headline.

- Monday, 18 March 2024

-

- Signs and portents for the U.S. economy:

- Morning Bid: Rates, oil lifted by China's green shoots

- Oil prices inch higher amid attacks on Russian energy facilities

- US aims to return emergency oil reserve to prior levels by year-end

- US factory production rebounds from weather-induced slump

- Fed minions expected to signal slower pace of anticipated interest rate cuts:

- Some trouble continues, but "green shoots" developing in China:

- China's upbeat industrial output, retail sales tempered by frail property

- China's CNOOC discovers 100 million ton oilfield in Bohai Sea

- China's property investment declines slow but sector still shaky

- Who are these BOJ minions setting the stage to end never-ending stimulus?

- BOJ to call time on negative interest rates and end yield curve control - Nikkei

- Japanese bank trains staff for a novel scenario: positive interest rates

- Bigger trouble developing in the Eurozone:

- Nasdaq, S&P, and Dow rallied higher as focus shifts to the FOMC meeting

- Tuesday, 19 March 2024

-

- Signs and portents for the U.S. economy:

- Crude oil hits new five-month highs but Citi sees possible drop to $55 by late 2025

- US single-family housing starts soar in February

- BOJ minions finally end never-ending stimulus:

- Bank of Japan scraps radical policy, makes first rate hike in 17 years

- BOJ cuts maximum limit of JGB purchase amount after major policy shift

- Nasdaq, Dow gain after BoJ's historic pivot, S&P notches new record close; all eyes on Fed

- Wednesday, 20 March 2024

-

- Signs and portents for the U.S. economy:

- Oil slips as investors weigh Fed rate decision

- US retail sales to rise at a slower pace in 2024, says NRF

- Fed minions confirm interest rate cuts, looser monetary policy lie ahead:

- Fed sees three rate cuts in 2024 but a more shallow easing path

- Instant view: Fed stands pat on rates and view on 2024 cuts, in face of elevated inflation

- Fed policymakers stick to three-rate-cut view in '24, but barely

- Amid forecast shift, Fed's Powell flags uncertainty over longer-run outlook

- Fed's Powell says balance sheet drawdown taper coming soon

- China central bank doesn't change rates, does change staff:

- BOJ minions' plan to exit never-ending stimulus not going as well as hoped:

- ECB minions going to cut rates, uncertain about what they do next:

- S&P, Dow close at new record highs, Nasdaq rises +1% after Fed's optimism on rate cuts

- Thursday, 21 March 2024

-

- Signs and portents for the U.S. economy:

- Oil settles lower on weaker US gasoline demand, Gaza ceasefire hopes

- US Treasury key yield curve inversion becomes the longest on record

- US existing home sales rise to one-year high in February

- US new vehicles sales set to rise in March, report shows

- Fed minions expected to start delivering rate cuts in June 2024:

- Bigger stimulus developing in China:

- BOJ minions see positive growth signs in Japan, plan end to bond buying next:

- Japan's factory activity declines slow, service sector picks up

- BOJ's Ueda eyes future drop in bond buying in sign of steady exit

- Central banks start pivoting to interest rate cutting mode after Fed greenlights cuts in 2024:

- The great central bank policy reversal kicks off

- Swiss central bank cuts rates in surprise move, getting ahead of global peers

- Bank of England sees economy 'moving in right direction' for rate cuts

- Norway keeps interest rate on hold, eyes September cut

- Wall Street hits record closing highs on rate-cut optimism; chip sector rallies

- Friday, 22 March 2024

-

- Signs and portents for the U.S. economy:

- Fed minions start trying to dial back rate cut expectations they unleashed:

- Fed's Bostic scales back to single rate cut on the year, versus two previously

- Fed gets an earful about 'stranglehold' from high rates

- Bigger bailout developing in China:

- S&P 500 ends near flat but index posts biggest weekly gain of year

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) decreased to +2.1% after last week's +2.3% growth projection.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a Federal Reserve official lighting a rocket with 'RATE CUTS' written on it and the Wall Street bull in the background."

If you're a firefighter, one of the biggest hassles you have involves directing the water from a firehose to where a fire is burning.

That's not an easy job because of the high pressure of the water flowing through the firehose. For traditional firehoses, once the water is turned on, firefighters are limited in how they can direct it. They can angle the end of the hose within a small range and they can move the hose laterally along the ground to some extent, but doing so takes a lot of manual effort as you can see in firehose handling training videos.

But what if you could fly or steer the hose exactly where you need it to be to put out a fire? Better still, what if the hose could be either automatically or remotely-controlled so the risks to firefighters' lives from their inherent occupational hazards could be reduced?

That thinking lies behind the "Dragon Firefighter" flying robotic firehose being developed as an open source project by Japanese researchers at the Akita Prefectural University. As you'll see in the following video, "Dragon Firefighter" isn't just a cute project name. It's a useful description that accurately conveys what their innovation is and how it is intended to work.

If it's not already clear from the video, here's a written description of how the Dragon Firefighter works (HT: Core77):

The Dragon Firefighter’s firehose is propelled upward (flying at two meters above the ground) by eight controllable jets of water spouting from its center and head. The firehose can change shape and be oriented towards flames, steered by a control unit in a wheeled cart behind. The cart is connected through a supply tube to a fire truck with a water reservoir of 14,000 liters.

The nozzles spout water at a rate of 6.6 liters per second with a pressure of up to one megapascal. The hose’s tip contains a conventional and thermal imaging camera, which help to find the location of the fire.

The researchers anticipate they their flying robotic firehose concept is about ten years of development away from finding its way into the everyday arsenal of modern fire departments, where one of their bigger challenges is extending its length and range.

Labels: technology

Ernest Hemingway wrote one of the great lines about how change happens in The Sun Also Rises. Here is the set-up and delivery:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

The phrase "gradually and then suddenly" captures the nature of how real world change happens in ways that go far beyond the context of bankruptcy discussed by the characters in Hemingway's 1926 novel.

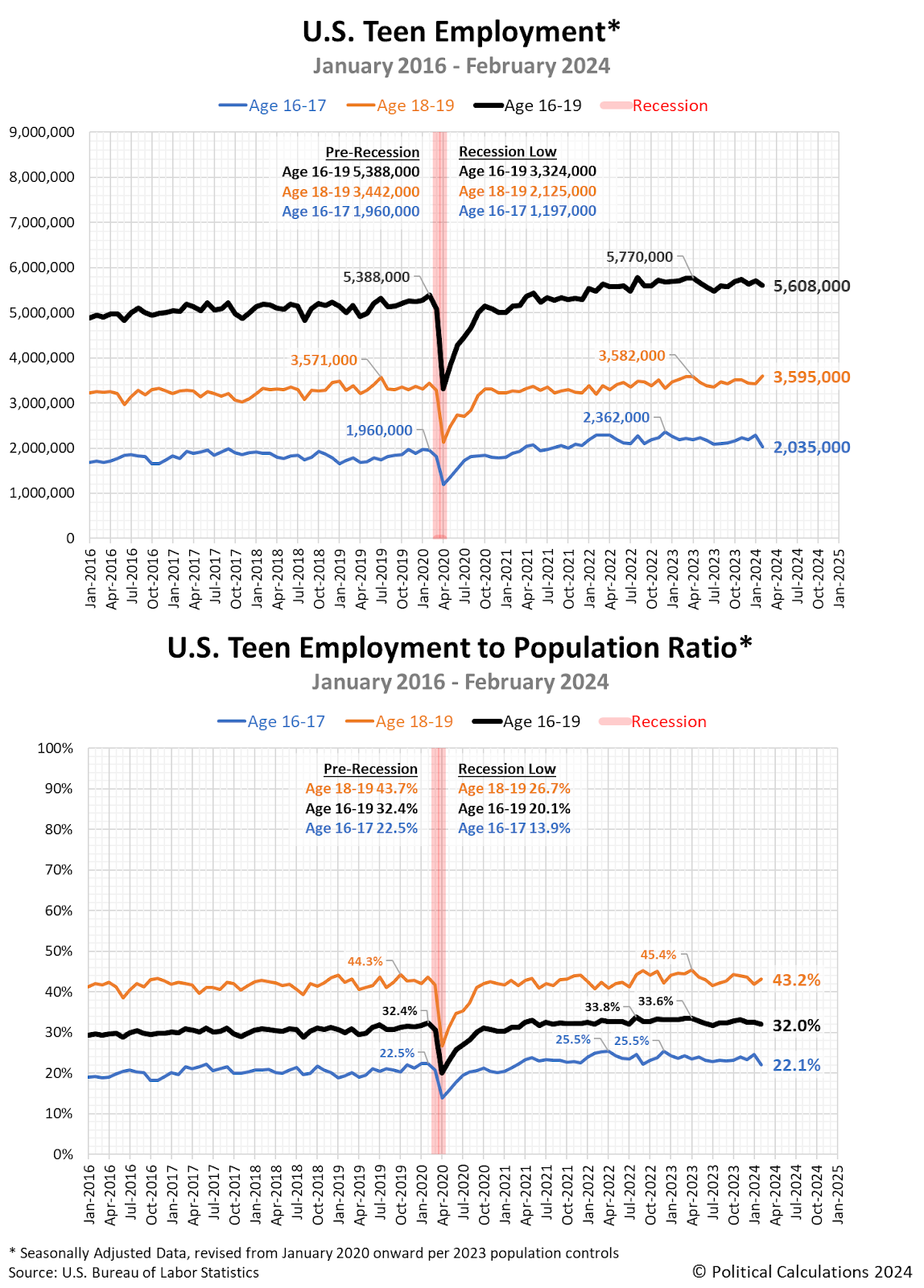

Applied to the employment situation of U.S. teens, that phrase is relevant because we're seeing some small changes in the trends being reported in the employment data for this demographic group. That matters because teens represent the most marginal members of the U.S. work force, having the least education, least training, and least work experience of all workers in the U.S. economy. And as a general rule, the younger the teen, the more marginal they are as a member of the U.S. work force because they lack the education, training, and work experience acquired by all older workers.

The following charts visualize the seasonally-adjusted numbers for the number of working teens in the U.S., showing the employment figures and employment-to-population percentages for younger teens (Age 16-17) and older teens (Age 18-19) as well as the combined population of working Age 16-19 year olds.

Since each of these data series receives its own seasonal adjustment, the numbers of working Age 16-17 year olds and Age 18-19 year olds won't necessarily add up to the totals shown for the combined Age 16-19 population. If you're looking for employment figures that do add up, you'll want to review non-seasonally adjusted data.

Looking at the most current trends, we find some small changes developing for the teen employment situation in the U.S.

- As a percentage of the available teen population, overall teen employment peaked at 60.4% in July-August 2023 and has slowly decreased in the months since, declining to 60.1% through February 2024.

- Older teens (Age 18-19) have seen their seasonally adjusted numbers generally rise over this period, with their employment data showing a flat-to-slightly rising trend and their employment-to-population ratio showing a slightly falling trend.

- But younger teens are seeing erosion in their employment numbers, with both the number of employed Age 16-17 year olds and their employment-to-population ratio falling. In February 2024, the number and percentage of employed Age 16-17 year olds has dropped to their lowest level since October 2021. Both peaked in December 2022.

Even though the number of younger working teens is much smaller than the number of older working teens, the changes being experienced within this demographic group are large enough to affect the overall trend for the entire population of working teens. The falling employment and employment-to-population ratio for younger teens since December 2022 indicates U.S. economic growth isn't as strong as it was before December 2022. The fading employment prospects for the most marginal portion of the U.S. work force is one reason the Federal Reserve clearly signaled it will cut interest rates this year.

Keep in mind the Fed would have no reason to cut rates if they thought U.S. economic growth and employment would continue to be either positive or stable without that action. They're responding to gradually developing negative trends in signaling a slow pace of rate cuts this year. How do you suppose they'll respond if those negative changes start happening more suddenly?

References

U.S. Bureau of Labor Statistics. Labor Force Statistics (Current Population Survey - CPS). [Online Database]. Accessed: 20 March 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "A 16 year old applying for a job."

Labels: jobs

If you want to explain why the S&P 500 has been rising, you don't have to look far beyond how the expectations investors have for the index' dividends have been changing over the last several months.

We last presented our regularly scheduled winter snapshot of the expected future for the quarterly dividend payouts for the S&P 500 (Index: SPX) just under six weeks ago. Within those six weeks, the outlook for the index' dividends has continued to improve. With that fundamental underlying support, it's no wonder the index has been recording a series of new record highs.

The developing trend is such that if it continues, we'll have to modify the vertical scale of our chart when we take our regularly scheduled Spring 2024 snapshot of the S&P 500's dividend outlook about six weeks from now.

In the following animated chart, we show how much the expectations for the S&P 500's dividends have changed for each future quarter of 2024. The chart presents both historic (darker blue) and projected (lighter blue) dividend futures data for the S&P 500 from CME Group for the period from 2021-Q4 through 2024-Q4 at various snapshots we've taken between 14 November 2023 and 19 March 2024.

In this animated bar chart, while the data for 2023-Q4 changes from a projected value (lighter blue) to a historic value (darker blue), most of the real action happens in the projections for each quarter of 2024.

In particular, if you look at the bar for the second quarter of 2024, you'll see this quarter (marked as 2024-Q2) has risen so much that it starting to "break through" the top of the chart. This increase is why we will soon have to reset the vertical scale for the chart.

You'll also see the outlook for each future quarter's dividends has improved in the period from mid-November 2023 to mid-March 2024. That improved outlook provides the underlying support for the S&P 500's recent series of record highs.

Looking beyond 2024-Q2, you'll see something unusual. There's projected drop-off in quarterly dividends between 2024-Q2 and 2024-Q3. It's unusual because we would ordinarily expect to see the third quarter's anticipated dividends fall in between the projected values for the second and fourth quarters. And since the outlook for the index' dividends in all quarters has been improving, we would have at least expected to see it close the gap between the second and fourth quarter's values.

But it hasn't. If anything, the projected drop-off in the dividends expected to be paid from 2024-Q2 to 2024-Q3 has been remarkably persistent in all the months we have been observing it and has increased in size. That persistence suggests investors have potentially built in expectations of turbulence ahead for dividend paying stocks.

That market turbulence would most likely take place during the upcoming quarter of 2024-Q2, which would subsequently show up in the dividends paid in the following quarter of 2024-Q3. Since quarterly dividends are projected to rise in 2024-Q4, that suggests investors expect this turbulence will be relatively short-lived.

At least, that's the implied expectation at this juncture. The most important thing to remember about the future is that it's subject to change with little notice.

Image Credit: Microsoft Copilot Designer.. Prompt: "A fortune teller looking into a crystal ball to make a prediction about the S&P 500".

Labels: dividends, forecasting, SP 500

The odds the U.S. economy will see a recession start at sometime in the next twelve months continued to rise during the past six weeks. Since our previous update, that probability has risen a couple of notches to just over 76%. This resurgence began after the recession probability bottomed at 67% at the end of November 2023 after having previously peaked at 81% in July 2023. The rebound in the odds of recession is nearing what might be described as a double-top.

These probabilities are based on a recession forecasting method developed for the Federal Reserve Board in 2006. As such, they reflect the kind of real data that Federal Reserve officials will be weighing as they meet from 19-20 March 2024 to discuss how they will be setting short term interest rates in the United States.

The prospect for recession has ticked up since bottoming largely because the inversion of the U.S. Treasury curve deepened since December 2023, with longer term interest rates falling further below the level of short term rates. That change has coincided with reports of higher-than-expected inflation prompting Fed officials to delay the beginning of expected interest rate cuts by at least three months.

The following chart presents the latest update of the Recession Probability Track, capturing how that probability appears going into the Federal Reserve's second two-day meeting of 2024. The Fed's Federal Open Market Committee is expected to continue holding the Federal Funds Rate steady at this meeting. The Fed is expected to start lowering this core interest rate at later meetings in 2024, with markets currently anticipating the Fed will act to cut rates at its June 2024 meeting.

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 18 March 2024 and 18 March 2025.

The probability of recession peaked at nearly 81% on 25 July 2023, making the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction. The prolonged elevation of the Federal Funds Rate combined the deepened inversion of the U.S. Treasury yield curve in recent weeks has made the period between 18 March 2024 and 18 March 2025 the second most-likely period that will include the peak of a business cycle that marks when a recession began.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have provided a tool to make it easy to do.

We will continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- U.S. Recession Probability Nears a Double-Top

- Probability of U.S. Recession Resurges to Nearly 75%

- U.S. Recession Odds Recede to Two Out of Three Chance in 2024

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "An editorial cartoon of a Federal Reserve official spinning a carnival wheel to set interest rates."

Labels: recession forecast

As trading weeks go, the second week of March 2024 resembled a disappointing roller coaster ride for investors. The S&P 500 (Index: SPX) climbed to a new record high of 5,175.27 on Tuesday, 12 March 2024, but then went on to lose 1.1% of that new high value by the end of the week on the downhill part of its ride. The index closed at 5,117.09, a small 0.13% decline from the previous week's close.

What made the week disappointing for investors is a shift in expectations for how frequent interest rate cuts will be during 2024. Higher than expected inflation reports drove the change. While the CME Group's FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2) when it is expected to begin a series of quarter point rate cuts starting on that date, the FedWatch Tool's outlook changed to indicate investors are now anticipating these rate cuts will proceed at twelve week intervals, occurring less often than was projected just last week.

The downward leg of the S&P 500's roller coaster ride during the past week puts the index' trajectory closer to the middle of the redzone forecast range, as indicated in the latest update in the alternative futures chart.

Speaking about the future for interest rates, there were two other big economic news headlines involving them during the week that was. First, the European Central Bank (ECB) signaled it will almost certainly begin cutting Eurozone interest rates by the end of the this month. But in Japan, the Bank of Japan will take the opposite action as inflation ramps up in that country, marking the end of its long-running negative interest rate policy.

Those headlines, and more, are included in the following summary of the week's market-moving headlines:

- Monday, 11 March 2024

-

- Signs and portents for the U.S. economy:

- Oil prices steady as Middle Eastern supply concerns ease

- US labor market cooling; unemployment rate rises to two-year high of 3.9%

- Fed minions close bailout fund for regional banks, expected to start rate cuts in June:

- Emergency Fed bank effort ends lending, as eyes turn to discount window

- Fed to start rate cuts in June; risk fewer delivered this year: Reuters poll

- Bigger bailout, trouble developing in China:

- Exclusive: Chinese regulators ask large banks to step up support for Vanke

- China warns overall pressure on employment yet to ease

- China's consumer prices swing up on seasonal Lunar New Year gains

- BOJ minions happy with near-zero growth in Japan:

- ECB minions say "wait for it…" on upcoming rate cuts:

- Nasdaq, S&P, and Dow ended mixed as attention now shifts to the upcoming CPI report

- Tuesday, 12 March 2024

-

- Signs and portents for the U.S. economy:

- Oil prices settle slightly down after US boosts crude output forecast

- US natgas output to decline in 2024 while demand rises to record high, EIA says

- Fed minions expected to hold rates steady until starting cuts in June 2024:

- BOJ minions gearing up to end never-ending stimulus:

- BOJ to offer guidance on bond buying pace upon ending YCC - sources

- BOJ chief Ueda slightly tones down optimism on economy

- ECB minions thinking about ending Eurozone bank bailout:

- Nasdaq, S&P, and Dow move up in the wake of the latest retail inflation report

- Wednesday, 13 March 2024

-

- Signs and portents for the U.S. economy:

- Oil prices up 3% to 4-month high on US crude stock drop, Russian refinery attacks

- Bigger stimulus developing in China:

- BOJ minions to end never-ending stimulus if Japan wage gains are too high:

- ECB minions thinking about ending Eurozone bank bailout and cutting Eurozone interest rates in spring:

- ECB to wean banks off free cash at gentlest pace

- ECB's Villeroy: spring interest rate cut remains probable

- ECB should 'make a bet' on rates before long, says Wunsch

- Nasdaq, S&P, Dow end mixed as Wall Street's bull run takes a breather

- Thursday, 14 March 2024

-

- Signs and portents for the U.S. economy:

- Gasoline, food boost US producer prices in February

- Oil prices climb as revised IEA outlook signals tighter market

- Bigger trouble, stimulus developing in China:

- China's efforts to prop up its ailing stock market

- China c.bank leaves key policy rate unchanged, as expected

- China's plan to cut downpayments for cars likely to fall flat, analysts say

- BOJ minions signal they're finally going to end never-ending stimulus:

- BOJ preparing to end negative interest rate policy at March meeting, Jiji reports

- BOJ to go slow in hiking rates after ending negative rates, says ex-c.bank executive

- ECB minions thinking about cutting Eurozone interest rates:

- ECB policymakers offer contrasting timeline for rate cuts

- ECB could cut rates at least three times from June, Knot says

- Nasdaq, S&P, Dow end in the red, yields surge after hot PPI, weak retail sales

- Friday, 15 March 2024

-

- Signs and portents for the U.S. economy:

- US consumers still reeling from earlier price rises even as inflation slows

- Peak rates boost U.S. demand for riskier form of corporate debt

- Fed minions reading their tea leaves:

- Bigger trouble developing in China:

- BOJ minions edging closer to ending never-ending stimulus:

- Japan on cusp of ending negative interest rates, chance of March BOJ exit heightens

- Japan's Feb inflation likely quickened as BOJ weighs ditching negative rates: Reuters poll

- ECB minions getting serious about thinking about cutting Eurozone interest rates:

- Nasdaq, S&P, Dow slip on triple witching day; all eyes now on Fed meeting next week

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) fell to +2.3% after last week's +2.5% growth projection.

Image credit: Microsoft Copilot Designer. Prompt: "A bull and a bear riding a roller coaster together, not smiling."

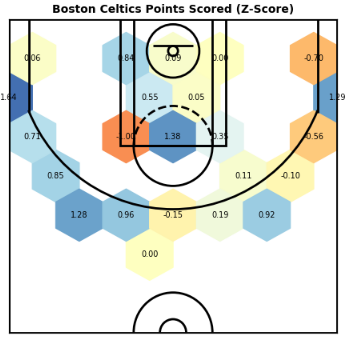

What separates the top teams in the National Basketball Association from the bottom teams in the league?

If you answered "their scores", you're right. But you might be surprised by how seemingly little difference there is between teams.

The offensive performance of NBA teams can be summarized in a figure known as the offensive rating. This statistic combines several different scoring statistics into a single measure that can be used to rank teams. According to the available data at StatMuse, at this point of the NBA's 2023-2024 season, the Boston Celtics have the highest offensive rating of 122.5, while the Detroit Pistons have the lowest at 111.6. If you've been paying attention to the NBA season, that these teams are in their respective positions should sound about right. The Celtics are recognized as a dominant team while the Pistons would be at high risk of being sent down to a lower league if European-style relegation existed for U.S. sports leagues.

But as we're about to show, the two teams have some very similar statistics. The data below shows their offensive output on several different categories of scoring for the 2023-2024 season through Sunday, March 9, 2024.

Boston Celtics:

- Points per game (PPG): 120.8 points per game, most in the NBA.

- Field Goals Made (FGM): 43.8 field goals per game, fifth overall and 48.5% of their attempts.

- Three-Pointers Made (3PM): 16.2 three-pointers per game, 38.5% of their attempts and best in the NBA.

- Free Throws Made (FTM): 17.0 free-throws per game, 80.8% of their attempts, ranking 17th in the NBA.

Detroit Pistons:

- Points per game (PPG): 112.4 points per game, tied for fifth-lowest in the NBA.

- Field Goals Made (FGM): 41.9 field goals per game, 47.1% of their attempts and ninth-lowest in the league.

- Three-Pointers Made (3PM): 11.3 three-pointers per game, 35.6% of their attempts and second-lowest in the NBA.

- Free Throws Made (FTM): 17.3 free-throws per game, 78.4% of free-throws attempted, tenth-lowest among NBA teams.

Only 8.4 points per game separates the two teams' overall averages. They are within two baskets per game of each other when considering field goals and free-throws, where they even have very similar shooting percentages. Where they differ most is three-point shots. On average, the Boston Celtics successfully make five more three-point shots per game than the Detroit Pistons do.

That single statistic goes a long way to explaining why the Celtics have the highest offensive rating in the NBA and why the Pistons have the lowest, despite the two teams scoring on 38.5% and 35.6% of their respective three-point attempts. With such a similar percentage of successful attempts, that means the Celtics higher number of successful three-point shots per game is based on their ability to attempt more of these shots than the Pistons are able to. That ability is the key to the Celtics offensive dominance during the 2023-2024 season.

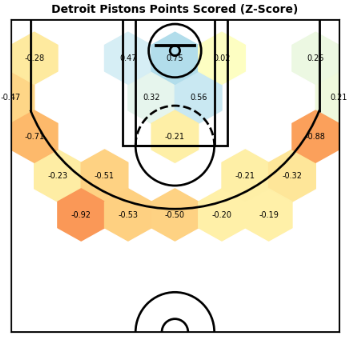

If only there were a great way to visualize that respective dominance. Over at Reddit's r/dataisbeautiful, Solid_Example7519 has put together a fantastic heat map graphic to illustrate how every team in the NBA compares to each other in their ability to score from different parts of the court at about the time of the NBA's All Star Game. We've excerpted the following charts for the Boston Celtics and the Detroit Pistons to show them next to each other:

Here's how Solid_Example7519 describes what the data visualization shows:

Blue is good, red is bad....

I calculated how many points every team got in each position on the court and then normalised it using a Z-score (0 means they got an average number of points, a score of 1 is one standard deviation above meaning top 16%, 2 is two standard deviations and means they are in the top 2.5%)....

I filtered it to be only the coordinates where a team scored at least 5 points, and so if there are no points within a hexagon with more than 5 points then it is blank. This was to make it easier to read and draw meaning from i.e. because these empty spots had teams scoring very few points in them, it meant they got a really really low score, while teams only had to score relatively few points to be seen as disproportionately good there....

It is relative to other teams, so a high z-score on the three-pointer line means that they score more points there relative to other teams.

The individual team charts also emphasize the extent to which the three-point shot affects how professional basketall is played in 2024. The mostly empty hexagonal grids that fall between the key and the three-point line confirm that nearly all teams have bought into the strategy of either going in close to score field goals or shooting from a distance to collect higher points, even though they score less often per attempt.

Comparing Boston to Detroit again, we see the Celtics are highly at the three point line from the left hand side of the court. The Detroit Pistons, on the other hand, are best around the basket itself, but are very weak along the entire arc of the three-point line.

We'll close by pointing again to Solid_Example7519's entire chart, but please do click through to the r/dataisbeautiful post to find out more about how it was generated.

Previously on Political Calculations

Image credits: Brown and Black Basketball photo photo by Kylie Osullivan on Unsplash. NBA 2023-2024 Heat Map by u/Solid_Example7519 on r/dataisbeautiful. Used with permission.

Labels: data visualization, sports

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.