Sometime, within the next twelve to eighteen months, the average circulation of the weekday edition of the New York Times will drop below one million. This event marks the continuing decline in the fortunes of what had been the U.S. newspaper of record as the New York Times' average circulation has been well above this level for decades.

We base this prediction upon data recently provided by the New York Times Company in its annual report, which it released earlier this year. Combined with circulation data provided by the Grey Lady's parent company in its previous Securites and Exchange Commission financial data filings, we've updated our charts showing the trend in the New York Times' weekday circulation since it peaked in 1993:

The table below provides the circulation numbers that we used to create the chart above, both nationally and within the newspaper's home region. Clicking the "Year" links provides the relevant NYT's SEC filing for the indicated year, from which we obtained the newspaper's circulation data, which is reported in the section of the annual report in which the company's management discusses its business:

| New York Times Average Weekday Circulation, 1993 through 2007 | |||||

|---|---|---|---|---|---|

| Year | Weekday Circulation (Mon-Fri) | Weekday Percentage of Total Circulation in NYC | Weekday Circulation Within NYC Market | Weekday Circulation Outside NYC Market | Percentage Decline of Total Weekday Circulation |

| 1993 | 1,183,100 | 64 | 757,184 | 425,916 | 0.0 |

| 1994 | 1,148,800 | 64 | 735,232 | 413,568 | -2.9 |

| 1995 | 1,124,300 | 62 | 697,066 | 427,234 | -5.0 |

| 1996 | 1,111,800 | 62 | 689,316 | 422,484 | -6.0 |

| 1997 | 1,090,900 | 62 | 676,358 | 414,542 | -7.8 |

| 1998 | 1,088,100 | 61 | 663,741 | 424,359 | -8.0 |

| 1999 | 1,109,700 | 60 | 665,820 | 443,880 | -6.2 |

| 2000 | 1,122,400 | 59 | 662,216 | 460,184 | -5.1 |

| 2001 | 1,143,700 | 58 | 663,346 | 480,354 | -3.3 |

| 2002 | 1,131,400 | 55 | 622,270 | 509,130 | -4.4 |

| 2003 | 1,132,000 | 53 | 599,960 | 532,040 | -4.3 |

| 2004 | 1,124,700 | 50 | 562,350 | 562,350 | -4.9 |

| 2005 | 1,135,800 | 49 | 556,542 | 579,258 | -4.0 |

| 2006 | 1,103,600 | 48 | 529,728 | 573,872 | -6.7 |

| 2007 | 1,066,600 | 47 | 501,302 | 565,298 | -9.8 |

The New York Times had staved off a greater circulation decline through its strategy of moving to become a national newspaper in the late 1990s. However, this national strategy has not been successful in holding off the newspaper's decline in total circulation since 2001. More importantly, between 2006 and 2007, the New York Times' circulation decline has accelerated, which is evident in the steeper downward slope in the chart.

In fact, the NYT management's strategy may well have also accelerated the newspaper's circulation decline in its home market, which is evident in the steeper decline seen in the chart above, as the publishers and editors (the newspaper's management) have effectively chosen to ignore crafting a more successful product for its home market in favor of chasing higher circulation in the national market.

These problems are compounded by the New York Times' management's longstanding leftist tilt in the newspaper's news and editorial coverage, which effectively sabotages the newspaper's ability to successfully reach a wider, more politically diverse, audience by limiting the newspaper's attractiveness to consumers in that bigger market.

The New York Times' circulation decline is not limited to its weekday editions. The same trend of decline is evident even in the newspaper's larger Sunday circulation data. The chart below shows the trend in the New York Times' circulation since 1993:

And for good measure, here's our table showing the data underlying the trends shown in the New York Times Sunday circulation chart:

| New York Times Average Sunday Circulation, 1993 through 2007 | |||||

|---|---|---|---|---|---|

| Year | Sunday Circulation | Sunday Percentage of Total Circulation in NYC | Sunday Circulation Within NYC Market | Sunday Circulation Outside NYC Market | Percentage Decline of Total Sunday Circulation |

| 1993 | 1,783,900 | 63 | 1,123,857 | 660,043 | 0.0 |

| 1994 | 1,742,200 | 63 | 1,097,586 | 644,614 | -2.3 |

| 1995 | 1,720,300 | 60 | 1,032,180 | 688,120 | -3.6 |

| 1996 | 1,701,800 | 60 | 1,021,080 | 680,720 | -4.6 |

| 1997 | 1,651,400 | 59 | 974,326 | 677,074 | -7.4 |

| 1998 | 1,638,900 | 58 | 950,562 | 688,338 | -8.1 |

| 1999 | 1,671,200 | 56 | 935,872 | 735,328 | -6.3 |

| 2000 | 1,686,700 | 55 | 927,685 | 759,015 | -5.4 |

| 2001 | 1,659,900 | 53 | 879,747 | 780,153 | -7.0 |

| 2002 | 1,682,100 | 51 | 857,871 | 824,229 | -5.7 |

| 2003 | 1,682,100 | 49 | 824,229 | 857,871 | -5.7 |

| 2004 | 1,669,700 | 47 | 784,759 | 884,941 | -6.4 |

| 2005 | 1,684,700 | 44 | 741,268 | 943,432 | -5.6 |

| 2006 | 1,637,700 | 44 | 720,588 | 917,112 | -8.2 |

| 2007 | 1,529,700 | 42 | 642,474 | 887,226 | -14.2 |

The declines documented above reflect a worsening business situation for the New York Times, as lower circulation figures point to lower revenues realized through advertising and subscriptions. While the New York Times is now moving to grow its online presence and corresponding advertising revenues, online ads generate far less revenue than do traditional advertisements, which strains the company's financial performance.

This distress is evident in the newspaper's stock price, which we've shown from January 1998 through March 2008 (to date), in the chart below (via Yahoo! Finance):

The price of the New York Times' Company stock grew as the newspaper transitioned to become a national newspaper up until 2001, reflecting the peak of the newspaper's success with this strategy in holding off greater declines. However, since then, the company's stock price has dropped with its declining fortunes.

Labels: business

Welcome to the Friday, March 28, 2008 of On the Moneyed Midways, the only place on the world wide web where you'll find the week's best money and business-related blog posts contributed to the best of the week's bes money and business-related blog carnivals!

Welcome to the Friday, March 28, 2008 of On the Moneyed Midways, the only place on the world wide web where you'll find the week's best money and business-related blog posts contributed to the best of the week's bes money and business-related blog carnivals!

We have a very strong contender for the title of being The Best Post of the Year, Anywhere! this week. If your time is short this weekend, add Paul Graham's essay You Weren't Meant to Have a Boss to your essential reading list!

If you have more time for essential reading than what what you would need just to read one post, the other eight posts we've selected from the hundreds we reviewed in the past week deserve your attention - like squawkfox, we "just say 'NO' to crap!"

Scroll down for the best posts of the week that was!

| On the Moneyed Midways for March 28, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | 5 Questions To Ask Your Creditors When Making Debt Reduction Payments | No Credit Needed | NCN lists the five most important questions to ask the outfits to whom you owe money if you're thinking about paying your debt off early and explains why you need to know the answers. |

| Carnival of Personal Finance | Just Say "NO" to Crap! | squawkfox | squawkfox launches an anti-crap campaign, identifies three major sources of crap, and provides five reasons to kick back at crap in Absolutely essential reading! |

| Carnival of Personal Finance | Your Problem Isn’t Starbucks | Beyond Paycheck to Paycheck | Michael takes on those so-called financial experts who seem to believe that if you only give up your coffee habit, all will be well in your financial world. Absolutely essential reading! |

| Carnival of Personal Finance | An Engineer’s View of Retirement | Canadian Dream - Free at 45 | Tim presents an absolutely great and humorous post that highlights the kind of problem solving that us engineers do when we approach the kinds of real-world problems that flummox others outside the engineering disciplines. Absolutely essential reading! - and a post that in any other week might have been The Best Post of the Week, Anywhere! |

| Carnival of Real Estate | Does the National Association of Realtors Really Need an Economist? | San Diego Real Estate | Bob Schwartz looks at the track record of the economists hired to shill for the National Association of Realtors and argues that the NAR would be better off just presenting the facts instead of trying to spin them. |

| Cavalcade of Risk | Counterfeit Heparin and Baxter Liability | New York Personal Injury Law Blog | Eric Turkewitz previews the legal argumenets that will be made both for and against pharmaceutical maker Baxter related to the counterfeit component its China-based producer incorporated into anti-clotting drug Heparin. |

| Festival of Frugality | Beware Of The Laundry Detergent Cap | No Credit Needed | Do those marks inside the cap for dispensing liquid laundry detergent have any relationship to the recommended amounts for a load? NCN busts the laundry cap controversy wide open! |

| Festival of Stocks | What About LOR-Lazard World Dividend & Income Fund? | Living Off Dividends | ND responds to a reader's e-mail regarding whether Lazard World Dividend Fund (LOR), and its current 25% dividend yield, is investment-worthy. |

| Odysseus Medal | You Weren't Meant to Have a Boss | Paul Graham | The Best Post of the Week, Anywhere! Paul Graham couldn't put his finger on what was wrong with a group of programmers out on a team-building scavenger hunt, which ultimately leads to his fascinating proposal for a very different way for companies to organize themselves to do business. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The economic books on 2007 closed today, with the U.S. Bureau of Economic Analysis' final release of GDP data for the fourth quarter of 2007. There was very little change from the advance and preliminary estimates, as all came right around 0.6% for an annualized rate growth over a one-quarter period and 2.7% for an annualized rate of growth over a two-quarter period, so we'll go straight to our GDP bullet charts:

The economic books on 2007 closed today, with the U.S. Bureau of Economic Analysis' final release of GDP data for the fourth quarter of 2007. There was very little change from the advance and preliminary estimates, as all came right around 0.6% for an annualized rate growth over a one-quarter period and 2.7% for an annualized rate of growth over a two-quarter period, so we'll go straight to our GDP bullet charts:

The top GDP bullet chart above shows the annualized growth rates that you'll see in most mainstream media reports, which only considers the rate of economic growth over a one-quarter period, for which the chart depicts the results for the three most recent periods. The bottom GDP bullet chart goes a step further, showing the rates of GDP growth over a two-quarter period of time for the three most recently ended quarters, and therefore, effectively covers the entire past year.

On both charts, these individual data points are illustrated against the backdrop of what's been typical of economic growth in the U.S. since 1980, in the form of the temperature color scale. We can see that on the one-quarter bullet chart, that the fourth quarter of 2007 dipped into the cold end of the chart, while the two-quarter rate of growth falls between the cool (blue) and moderate (green) growth range.

The two-quarter data is especially important as it provides the means by which we can project where GDP will be in the future. The next chart shows our projections using both the Climbing Limo method developed by the Skeptical Optimist, which looks three quarters ahead in time, and our tweaked Modified Limo technique, which only looks ahead toward the next quarter:

With Real GDP coming in at $11,675.7 billion in Year 2000 dollars for the fourth quarter of 2007, we would anticipate that Real GDP for the first quarter of 2008 would come in at the following levels for each of our various forecasting methods:

| Projected Values for Real GDP, 2008-Q1 | |||

|---|---|---|---|

| Forecasting Method | Projected Real GDP [billions 2000 USD] |

One-Quarter Annualized Growth Rate from 2007-Q4 |

Real GDP Data Used to Make Projection |

| One-Quarter Projection (BEA) | 11,672.5 | 0.58% | 2007-Q3 and 2007-Q4 |

| Climbing Limo Projection | 11,709.6 | 1.17% | 2006-Q4 and 2007-Q2 |

| Modified Limo Projection | 11,754.8 | 2.74% | 2007-Q4 and 2008-Q3 (Climbing Limo Projection) |

The data used to create the 2008-Q3 Climbing Limo projection for the Modified Limo technique are the Real GDP figures for 2007-Q2 and 2007-Q4.

Going back to our GDP forecast chart, we note that we see a sharp decline in what the Climbing Limo method would project from 2008-Q2 to 2008-Q3. This effect is driven by a sharp change in recorded GDP levels from previous quarters, which in turn tells us that the one-quarter projection, which we obtain simply by extending the performance of the most recent quarter-over-quarter period one quarter ahead, is likely to be the closest to what the actual figure will be that we should also expect that it will come in below this value.

Given that low value of 0.6%, we would therefore anticipate that Real GDP will be between 0.0 and 0.6%.

It might not be a recession, but there's no denying that economic growth in the U.S. is dragging.

Labels: gdp forecast

Now that the major league baseball season is finally underway, we were wondering which franchises in either the National or American leagues are the most valuable out of all of Major League Baseball (MLB). Has the Red Sox Nation really overwhelmed those damned New York Yankees? How badly has Baltimore Orioles owner Peter Angelos damaged the value of that team?

Now that the major league baseball season is finally underway, we were wondering which franchises in either the National or American leagues are the most valuable out of all of Major League Baseball (MLB). Has the Red Sox Nation really overwhelmed those damned New York Yankees? How badly has Baltimore Orioles owner Peter Angelos damaged the value of that team?

Sure, we could look at the payrolls of each team, take their minor league farm systems into account, or go by the value of their broadcasting rights, but those measures wouldn't necessarily reflect the value of each brand in baseball. Television and radio broadcast income is shared between teams according to a formula set by MLB. An older major league franchise is much more likely to have an extensive farm system compared to a much newer one, which would skew the data in favor of older teams. Relative payrolls between teams are affected by salary cap and luxury tax considerations. So, how could we find the relative value of each team?

We finally hit on the idea of using the ultimate expression of fan loyalty: the authentic home jersey. Here, if we consider those jerseys that have not been customized in any way, to remove vanity and star player effects upon their value, we might reasonably get a measure of each team's value with respect to one another, simply by comparing the price of each. The cool part of this approach is that the price of a non-customized authentic home jersey would provide a fairly solid representation of the value of a team's brand - their value would purely be determined by the value that those teams biggest fans place upon their teams!

From here, all it took was a shopping trip to MLB.com to find the prices of each MLB team's authentic home jersey. Our results are tabulated in the dynamic table below - you can sort the data in the table by clicking the various column headings. We've also included each team's 2007 winning percentage to see to what extent how well they performed last season might affect their relative values.

| Major League Baseball Authentic Home Jersey Prices |

|---|

| City or State | Team | League | 2007 Winning Percentage | Authentic Home Jersey Price | Comment |

|---|---|---|---|---|---|

| Arizona | Diamondbacks | National | 0.556 | 189.99 | 2007 NL West Division Champion |

| Atlanta | Braves | National | 0.519 | 169.99 | None |

| Baltimore | Orioles | American | 0.426 | 129.99 | None |

| Boston | Red Sox | American | 0.593 | 174.99 | 2007 World Series Patch, World Series Champions |

| Chicago | White Sox | American | 0.444 | 129.99 | None |

| Chicago | Cubs | National | 0.525 | 139.99 | 2007 NL Central Division Champion |

| Cincinnati | Reds | National | 0.444 | 149.99 | None |

| Cleveland | Indians | American | 0.593 | 189.99 | 2007 AL Central Division Champion |

| Colorado | Rockies | National | 0.552 | 189.99 | 2007 World Series Patch, 2007 NL Wild Card |

| Detroit | Tigers | American | 0.543 | 139.99 | None |

| Florida | Marlins | National | 0.438 | 199.99 | World Series 10th Anniversary Patch |

| Houston | Astros | National | 0.451 | 189.99 | None |

| Kansas City | Royals | American | 0.426 | 159.99 | None |

| Los Angeles | Dodgers | National | 0.506 | 149.99 | None |

| Los Angeles | Angels | American | 0.58 | 189.99 | 2007 AL West Champion |

| Milwaukee | Brewers | National | 0.512 | 189.99 | None |

| Minnesota | Twins | American | 0.488 | 159.99 | None |

| New York | Yankees | American | 0.58 | 149.99 | 2008 All Star and Yankee Stadium Commemorative Patches, 2007 AL Wild Card |

| New York | Mets | National | 0.543 | 169.99 | 2008 Shea Stadium Commemorative Patch |

| Oakland | Athletics | American | 0.469 | 139.99 | None |

| Philadelphia | Phillies | National | 0.549 | 149.99 | 2007 NL East Division Champion |

| Pittsburgh | Pirates | National | 0.42 | 159.99 | None |

| San Diego | Padres | National | 0.546 | 159.99 | None |

| San Francisco | Giants | National | 0.438 | 174.99 | 2007 All-Star Patch |

| Seattle | Mariners | American | 0.543 | 179.99 | 30th Anniversary Patch |

| St. Louis | Cardinals | National | 0.481 | 199.99 | 2006 World Series Champions Patch |

| Tampa Bay | Rays | American | 0.407 | 219.99 | New Jersey for 2008 |

| Texas | Rangers | American | 0.463 | 179.99 | None |

| Toronto | Blue Jays | American | 0.512 | 139.99 | None |

| Washington (DC) | Nationals | National | 0.451 | 189.99 | None |

There are a lot of surprises in this data! And, as it turns out, some problems as well. Let's discuss the surprises first, and get our first reactions to the data recorded for posterity.

The Tampa Bay Devil Rays are the most valuable team in baseball?!!!! That's can't be right! How come the damned Yankees are in the middle of the pack? And the Boston Red Sox, too!? But then the Chicago White Sox and the Baltimore Orioles are in the basement. Where they belong. So how far off can we be?

Pretty far off as it turns out. Just looking at authentic home jersey prices is like looking only at the price of a stock. To get a much better sense of a value of a brand, we need to find out what each team's effective market capitalization value might be, just like we would in considering the relative values of companies. A company's market cap is determined by multiplying its price per share of stock by the number of shares in the market. Likewise, for our approach to really work, we would need to find out how many of each kind of MLB authentic home jersey has been produced.

And that's where we hit a dead end with this particular project. MLB's exclusive producer of authentic home jerseys, Majestic, declined our request for the data, so we're investigating other means of obtaining it for a future post.

Meanwhile, we do have some anecdotal evidence that supports our idea of using team jersey market cap values as an effective measure of each team's brand. Visiting a local major big box sports apparel retailer revealed that a higher volume of Yankee jerseys must be being produced (as we're far away from the home New York market), as are Boston Red Sox jerseys. The most common jersey in evidence however was the one for our local major league franchise, which is what we would expect.

And we also discovered that Tampa Bay recently redesigned their uniforms for 2008, which suggests that the price may be deceptively high as a measure of team value, as it may be more reflective of the new jersey being in comparatively short supply. We'll give Tampa Bay some credit - it's a really nice looking jersey. Now all they need is a good team to wear them!...

Speaking of which, winning percentage doesn't seem to have much correlation with home jersey prices - maybe that will change if we can ever get the quantity data we're now seeking, but it might explain why Baltimore Orioles owner Peter Angelos' consistently underinvests in his team. He could very well be the Bill Bidwell of baseball!

Labels: business, marketing, sports

Because we're tied up doing other projects at the moment, we thought it might be fun to take a moment to consider just what the heck the Federal Reserve is doing lately.

Because we're tied up doing other projects at the moment, we thought it might be fun to take a moment to consider just what the heck the Federal Reserve is doing lately.

When we last peered into the Fed's inner sanctums, where the members of the Fed's Open Market Committee meet to discuss monetary policy and perform ritual sacrifices (latest victim: Bear Stearns), we noted that the Fed was starting to really crank up the supply of money in the U.S. economy by setting the target federal funds rate well below where recent data would suggest it should be.

We know this, in part, because of the genius of N. Gregory Mankiw, who developed an alternative Taylor-rule type method for anticipating where the federal funds rate target might be set back in the 1990s, which we realized could provide an independent framework against which we could assess the most recent actions of the Fed.

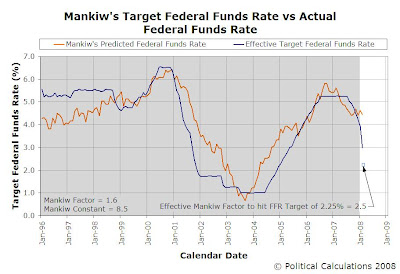

Here's an example of what we mean - here's our newly created, most recent predicted vs. actual Federal Funds Rate Chart which provides data through February 2008:

In the chart above, the orange line indicates roughly where the Fed would set the Federal Funds Rate target based upon the general policies they've followed since January 1999 using Mankiw's approach, while the dark blue line indicates where the Fed actually did set the Federal Funds Rate target.

What makes the chart interesting are those times when the dark blue line of the actual plunges well below where the purely backward-looking data driven Mankiw method would place it. This change would seem to coincide with the situation in which the Fed is racing to keep ahead of an economic plunge by sharply increasing the supply of money in the U.S. economy. We last saw this in early 2001, and we see it again today.

Measured against the framework developed by Mankiw, we can account for this change by altering what we call "the Mankiw factor," which can be thought of as the Fed's dial setting for controlling the flow of money into the U.S. economy. From January 1999 through December 2007, the Mankiw factor had an average value of 1.6. Generally speaking, the Fed is increasing the money supply when the dark blue line is below the predicted value illustrated by the orange line, and is decreasing the money supply when the blue line is above the orange line. When the lines overlap one another, it indicates that the Fed's policy is fairly neutral (if we take a Mankiw factor value of 1.6 as representing the Fed's desired balance.)

Then, beginning in January 2008, the Fed's repeated slashing of the federal funds rate confirms that it isn't business as usual any more. Taking into account the third rate cut this year that lowered the FFR to 2.25%, we now find the Mankiw Factor would have to increase to 2.47 to be justified by the rates of inflation and unemployment through February 2008, which tells us that the Fed has seriously turned the knob well past the monetary policy equivalent of eleven.

And that's where we are today. Otherwise, to get to a Federal Funds Rate of 2.25% under the typical conditions that have existed since 1999 (represented by a Mankiw factor of 1.6), either the rate of inflation, less food and energy, would need to decrease to 0.9% from February's 2.27% (holding the rate of unemployment steady) or the rate of unemployment would need to increase to 6.2% from February's 4.8% (holding inflation steady.) Or some combination of lower inflation and higher unemployment would justify that level as well.

It's finding the right balance between the two that makes the Fed's job so tough!

Labels: forecasting

Welcome to the Friday, March 21, 2008 edition of On the Moneyed Midways, your one stop in the blogosphere to find the best posts contributed to the best of the week's past business and money-related blog carnivals!

Welcome to the Friday, March 21, 2008 edition of On the Moneyed Midways, your one stop in the blogosphere to find the best posts contributed to the best of the week's past business and money-related blog carnivals!

We have a very short edition this week, as we're falling between weeks for the money and business-related blog carnivals that have biweekly editions, and it's still too soon for those that go online with once-a-month editions. And because we're looking forward to a long weekend ourselves, we'll keep the commentary just as short so we can get right to it - keep scrolling down for the best posts of the week that was:

| On the Moneyed Midways for March 21, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Is Your Bank Book Your Financial Statement? | InvestorBlogger | The InvestorBlogger finds that far too many people just look at their bank account balance when assessing their financial health, and argues that figuring out your net worth every so often is really a better way to go. |

| Carnival of HR | I'm Not Lazy, I Just Don't Care | 8 Hours & A Lunch | HR professional Deb Owen reveals that those once-a-year performance reviews really don't matter all that much, and quotes Office Space to make her point! |

| Carnival of HR | Can Anyone Learn to Be a Great Leader? | Three Star Leadership | Wally Bock not only hosted this week's Carnival of HR, but also contributed this gem in which he answers "No, but..." Absolutely essential reading! |

| Carnival of Personal Finance | Who's Your Star Wars Money Hero? | Monevator.com | It's pure silliness, but did you ever wonder if you might have Darth Vader's or Yoda's characteristics when it comes to money? |

| Carnival of Real Estate | San Diego Housing Market March 2008: Heating Back Up | Searchlight Crusade | It's only anecdotal evidence so far, but Dan Melson reports that the housing market may be beginning to recover in San Diego and discusses how he expects things will develop. The Best Post of the Week, Anywhere! |

| Festival of Frugality | Cash to Burn: Why a Credit-Only Lifestyle Works for Me | But Why Doesn't It Grow on Trees? | Turning conventional wisdom on its head, Suchong explains the dynamics of why credit cards help her keep better control over her spending than following a cash-only spending plan. |

| Festival of Stocks | Investing in AeroGrow's Gourmet Herb Gardens | Living Off Dividends | The Passive Income Investor wonders if AeroGrow (AERO), a company that makes "kitchen crop appliances" featuring technology developed by NASA, is investment-worthy. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

They're using Google to get the answer, but at least they're trying to answer the question!...:

Labels: none really, recession forecast

One of the ways in which a real estate agent can separate themselves from the pack is to develop and promote a hyper-local market focus. By zeroing in on a particular market niche or geographic area, an agent with strong marketing savvy can really set themselves apart from other agents in the area and become a leading choice to become the listing agent for homesellers within that market.

One of the ways in which a real estate agent can separate themselves from the pack is to develop and promote a hyper-local market focus. By zeroing in on a particular market niche or geographic area, an agent with strong marketing savvy can really set themselves apart from other agents in the area and become a leading choice to become the listing agent for homesellers within that market.

We've previously remarked on how one agent has gone about establishing both transparency and building goodwill with prospective future clients in our own community. Way back in the stone age for Political Calculations, in fact, we cited one of the things that set them apart: a regular newsletter that provides information about the current state of the real estate market for the realtor's target region, in which the Realtor:

Lists all recent sale prices of homes sold for the Realtor's targeted market neighborhoods. The information is organized by neighborhood, address, house features (number of bedrooms, bathrooms, garages, square footage) and is listed by price from highest to lowest.

That was back in July 2005, in the early days of the building of the housing bubble. We recently received the Realtor's latest newsletter, and were surprised to see how they've modified the information they provide about recent home sales to adjust to the post-bubble market. The Realtor still organizes the data related to recent sales much the same way, but has dropped the garage data in favor of a much more useful metric: the number of days the homes that have recently sold were listed on the market!

This is extremely useful information - in fact, so useful that we've created the following chart showing the recent successful sales in our area, which reveals where the latest level of equilibrium has been established for the housing prices in our area:

A quick note before continuing. For the Realtor's targeted neighborhoods, in which lot sizes are pretty similar from property to property, we've determined that the strongest driver that affects the selling price of a home is the house's square footage, followed next by the neighborhood in which the home is located, which affects the selling price to a much lesser extent. Other features, such as number of bedrooms, bathrooms, garages, etc. would seem to have a much lesser impact (or rather, are reflected in the square footage data.)

Now back to the chart. What we find is that the Realtor is rather subtly communicating where potential homesellers should be setting their asking prices. By including the days on market data, in which the lowest number of days listed until sold is 7 and the highest is 626 for the period covered by these recent home sales, we can have some pretty good confidence that the mean selling price per square foot of $144.37 is very close to the true equilibrium for housing prices today, as the number of days on market would seem to be largely independent of the price at which the home finally sold.

From this basic figure, the only other adjustment that a homeseller might need to be make is to adjust the asking price to take the home's neighborhood into account.

Armed with this data, the prospective homeseller can now have a reasonable expectation that their home will sell within a desirable period of time. We'd have to go through the entire MLS history for the homes that were on the markets the longest, but we strongly suspect that each of these homes started out being listed at much higher prices - only selling when they reached the relative level of equilibrium prices with homes listed for much shorter periods of time.

The chart also suggests that there is some stability entering into this particular housing market. To be sure, we'd have to go searching through the Realtor's back newsletters and preferably, MLS data, but as we don't have access to the MLS, we'll leave that exercise to either an enterprising Realtor or perhaps an economics student looking for a good thesis project.

Labels: marketing

What are the odds of dying in a given year as a result of being bitten by a poisonous snake in the U.S.? How about exposure to radiation? What are the odds that you'll die as a result of medical or surgical complications in your lifetime?

What are the odds of dying in a given year as a result of being bitten by a poisonous snake in the U.S.? How about exposure to radiation? What are the odds that you'll die as a result of medical or surgical complications in your lifetime?

These are exactly the kinds of questions that the statisticians of the U.S. National Safety Council have considered, and for which they have posted the odds that someone in the U.S. will die of either in a single year, or during their lifetime, based upon the number of recorded occurrences of each non-natural cause of death in 2004.

We've taken a handful of that data and presented it in a dynamic table below, which you can sort according to the various column headings. We'll have some interesting observations below the table....

| National Safety Council Odds of Dying in the U.S. |

|---|

| Type of Accident or Manner of Injury | Deaths in 2004 | Odds of Death in Any Given Year | Odds of Death in Lifetime |

|---|---|---|---|

| All - All External Causes of Mortality | 167,184 | 00,001,756 to 1 | 000,023 to 1 |

| Assault - All | 017,357 | 00,016,919 to 1 | 000,217 to 1 |

| Assault - Firearm | 011,624 | 00,025,263 to 1 | 000,324 to 1 |

| Intentional Self Harm | 032,439 | 00,009,053 to 1 | 000,116 to 1 |

| Legal Intervention - All | 000,372 | 00,789,400 to 1 | 010,134 to 1 |

| Legal Intervention - Execution | 000,052 | 05,647,247 to 1 | 072,494 to 1 |

| Legal Intervention - Involving Firearm Discharge | 000,311 | 00,944,324 to 1 | 012,121 to 1 |

| Medical and Surgical Care Complications | 002,883 | 00,101,858 to 1 | 001,308 to 1 |

| Operations of War - All | 000,028 | 10,487,744 to 1 | 134,631 to 1 |

| Transport Accidents - All | 047,385 | 00,006,197 to 1 | 000,080 to 1 |

| Transport Accidents - Motor Vehicle | 044,933 | 00,006,535 to 1 | 000,084 to 1 |

| Unintentional - Alcohol Poisoning | 000,358 | 00,820,271 to 1 | 010,530 to 1 |

| Unintentional - All | 063,959 | 00,004,591 to 1 | 000,059 to 1 |

| Unintentional - Bitten or Struck by a Dog | 000,027 | 10,876,179 to 1 | 139,617 to 1 |

| Unintentional - Bitten or Struck by Other Mammals | 000,077 | 03,813,725 to 1 | 048,957 to 1 |

| Unintentional - Cataclysmic Storm | 000,063 | 04,661,220 to 1 | 059,836 to 1 |

| Unintentional - Contact with Hornets, Wasps and Bees | 000,052 | 05,647,247 to 1 | 072,494 to 1 |

| Unintentional - Contact with Venomous Snakes and Lizards | 000,006 | 48,942,807 to 1 | 628,277 to 1 |

| Unintentional - Exposure - All Forces of Nature | 001,102 | 00,266,476 to 1 | 003,421 to 1 |

| Unintentional - Exposure - Earthquake | 000,030 | 09,788,561 to 1 | 125,655 to 1 |

| Unintentional - Exposure - Excessive Natural Cold | 000,676 | 00,434,404 to 1 | 005,576 to 1 |

| Unintentional - Exposure - Excessive Natural Heat | 000,226 | 01,299,367 to 1 | 016,680 to 1 |

| Unintentional - Exposure to Electric Transmission Lines | 000,094 | 03,124,009 to 1 | 040,103 to 1 |

| Unintentional - Exposure to Radiation | 0 | N/A | N/A |

| Unintentional - Firearms Discharge | 000,649 | 00,452,476 to 1 | 005,808 to 1 |

| Unintentional - Flood | 000,022 | 13,348,038 to 1 | 171,348 to 1 |

We found it pretty interesting that Americans are more likely to die in an earthquake than they are in operations of war, or for that matter, just about any force of nature, which suggests that a lot of Gaia-worshipping, anti-war protesters really might need to rethink their worldview. We'll also note that global warming may not be a such a bad thing, seeing as three times as many people die from exposure to excessive natural cold than die from exposure to excessive natural heat. At least, it's not a bad thing if you really care about people.

Now, what we won't do is compute your odds of dying if some of these events are combined into some sort of event that might earn the unlucky individual a Darwin Award, such as simultaneously handling venomous snakes during a cataclysmic storm while being suspended from electric transmission lines near a beehive while being attacked by a dog in the course of a legal intervention.

But only because we think that's less likely than being exposed to radiation.

Labels: none really

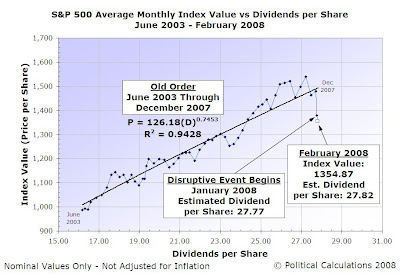

Previously, we uncovered the fundamental relationship between stock prices and dividends per share that describes how the stock market behaves when the market is characterized by relative stability. Today, we're going to use that relationship as a tool to recognize when order in the stock market has broken down.

First, here's the latest update of a chart we've previously featured, showing where the stock market was as of the end of February 2008:

Reviewing this chart, a good question to answer at this point is: "How did you recognize that order in the stock market broke down in January 2008?"

The short answer to that question is that we look to see if the data in our chart has shifted sharply away from an established trend line, which is defined by our fundamental stock market equation, moving along something close to a vertical line or trajectory.

The longer answer is that in periods of relative stability, we assume that we can treat the stock market price and dividends per share data as if they are normally distributed about a central tendency, which is defined by our fundamental relationship. While this is a really bad assumption over medium to long terms, in the short periods that characterize when order has emerged in the stock market, it seems to work pretty well. Or rather, we can't determine that a normal distribution does not exist, so we're running with it!

For those short periods of relative stability, as a loose rule at this point, we simply look for a shift, either positive or negative, that exceeds three times the standard deviation of that for the data that corresponds to the existing period of order. Much like how a control chart on a production line might be used to determine if a particular manufacturing process is sufficiently stable and in control.

For the sake of avoiding putting lots of math in this post, let's use our data visualization skills to see how well this method works with recent stock market history. The following chart shows the average monthly index value for the S&P 500 and the index' dividends per share from March 1991 through February 2008:

We selected this period since our first data point of March 1991 coincides with the end of a period of recession in the U.S.. The trend line defined by the subsequent data for what we've identified as the pre-Bubble order, and shown by the dashed line extending over the purple data line, is characterized by the following equation:

Index Value = 0.1454(Dividends per Share)3.1645; R2 = 0.9659

As you can see by the orange line that represents the Dot-Com Bubble in the stock market, a disruptive event began in April 1997 and subsequently ended in May 2003. We have a significant vertical shift upward beginning at that point, which ultimately peaks, pops and drops well below the extended trend line we've shown, before recovering to a higher level and establishing a new period of relative order in the market beginning in June 2003 (the equation describing that order is presented in our first chart.)

That latter period of order lasted through December 2007, as January 2008 marks the period in which a new disruptive event began. And that's where we find ourselves today!

Really, this stuff isn't rocket science. And we'd know!

Labels: data visualization, dividends, SP 500, stock market

At the risk of alienating the pseudo-Irish population of the world, whose idea of celebrating the day devoted to the patron saint of both Ireland and engineers is to take their fizzy light yellow beer and add green food dye to it so they can drink fizzy light green beer instead, we thought we'd step in to discuss how those of you turned Irish (or an engineer) for a day might improve your celebratory experience.

At the risk of alienating the pseudo-Irish population of the world, whose idea of celebrating the day devoted to the patron saint of both Ireland and engineers is to take their fizzy light yellow beer and add green food dye to it so they can drink fizzy light green beer instead, we thought we'd step in to discuss how those of you turned Irish (or an engineer) for a day might improve your celebratory experience.

First, pour out that green food dye contaminated fizzy light yellow beer. You're not fooling anyone and you're only asking for trouble. And although it might taste like it, it does not work well as a degreasing agent for automotive parts, so there's no point in trying to save it.

Having said that, when we mention beer in the rest of this post, we'll be referring to Guinness draught, the most commonly known Irish stout, although a knowledgable fan of such stouts may substitute Beamish, Murphy's or any number of other not-fizzy green-dyed light yellow beers of their choice.

Second, you need to find a proper Irish pub, or at least a close copy of one. Here's what you need to look for to find a qualified server:

- Clean glasses.

- 20 oz. pints.

- Clean beer lines.

- Correct gas mixture, 75 percent nitrogen, 25 percent CO2.

- Correct serving temperature: 40 degrees Fahrenheit (4.4 degrees Celsius).

From here, let's follow Alan Clinton's Guide for the Un-Initiated to Buying Guinnes in an Irish Pub:

1 Choose your pub carefully. A pint of Guinness does not appreciate loud music, loud people or bright flashing lights.

2 Ask politely for a pint of Guinness. Depending on the pub, it is possible to catch the barman's eye and mouth the word "pint", he will translate this accurately.

3 The barman will fill the glass between 70% and 80% capacity. It will then be put to the side for a few moments to allow it "to settle". Once the brownish liquid has almost turned to a solid black the barman will then fill the rest of the glass. NB: do not under any circumstances take the glass before it is filled. Some virgins seem to think that the settling stage is the final stage and walk away with an unfinished pint. At this point we Irish DO understand the predicament, but I assure you it causes endless mirth as well.

4 Once you have received your pint, find a comfortable stool or seat, gaze with awe into the deep blackness, raise the pint to your mouth and take a large mouthful. Be firm.

5 A good pint can distinguished by a number of methods. A smooth, slightly off- white head is one, another is the residue left on the inside of the glass. These, surpise surprise, are known as rings. As long as they are there you know your're okay. A science of rings is developing - the instance that comes to mind is determining a persons nationality by the number of rings (a ring is dependent on a swig of Guinness each swig leaving it's own ring). An Irishman will have in the region of 5-6 rings (we pace ourselves), an Englishman will have 8-10 rings, an American will have 17-20 (they sip) and an Australian won't have any at all as they tend to knock it back in one go!

6 As you near the end of your pint, it is the custom to order another one. It is a well known fact that a bird does not fly on one wing.

Now for our contribution: how to tip your bartender. For any true Irish pub, the traditional tip is to buy the barman a pint. You may tip the equivalent value in cash should the barman choose to have one a bit later.

And that's how you might more properly celebrate St. Patrick's Day!

Labels: none really

Welcome to this Friday, March 14, 2008 edition of On the Moneyed Midways! Each week, we can the best of the past week's money and business related blog carnivals, seeking the best posts from each one, just so we can assemble them together in one place for your weekend reading pleasure!

Welcome to this Friday, March 14, 2008 edition of On the Moneyed Midways! Each week, we can the best of the past week's money and business related blog carnivals, seeking the best posts from each one, just so we can assemble them together in one place for your weekend reading pleasure!

This week, two of the top posts of the week come at the same principle at very different angles. The Best Post of the Week, Anywhere! proposes a free market solution for making the Internet into an effective self-policing system, while the post we found to be Absolutely essential reading! looks at how one company in the Internet has the potential to do the same service for the real estate industry.

Somewhere or another, a lot of venture capital is going to flow toward making self-policing markets on the Internet a reality, and for the real estate industry, it already is - we think it's just phenomenal that we're catching the wave from two different directions in the same week!

Those posts, along with the best posts of all the other business and money related blog carnivals of the past week, await you below!...

| On the Moneyed Midways for March 14, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Prosper Rocks! | Debt Reduction Formula | Can you really auction off your debt? Ryan Healy shows how he used microlender Prosper.com to consolidate his high interest debt at a much lower rate! |

| Carnival of Personal Finance | Reverse Strategy: Decreasing Contribution Percent | My Dollar Plan | The conventional wisdom is that you should increase the amount to contribute to a retirement plan every year. Madison turns that conventional wisdom on its head and shows how and when it makes sense to do the opposite! |

| Carnival of Real Estate | Ruthless Walk Aways - A False Start | Salt Lake City Real Estate | Nigel Swaby looks at the new phenomenon of people with good jobs walking away from the homes they bought in recent years just because their value has decreased, and considers where the finger of blame should be pointed. |

| Carnival of Taxes | Are Credit Card Rewards and Cash Rebates Considered Taxable Income? | Money Blue Book | Do you have one of those credit cards that are tied to a rewards program? Will the IRS come looking for you for more taxes if you do? Raymond explores the gray areas the IRS has established. |

| Blawg Review | The "Notary Internet" | The Legal Satyricon | Mark Randazza describes Jon Garfunkel's imaginative free market idea for dealing with the problem of false statements made about individuals on the Internet. The Best Post of the Week, Anywhere! |

| Cavalcade of Risk | Why Hairdressers Have a Low Flood Risk | waterworlds | Nicky Clarke explains why hairdressers can expect to be unusually resilient by being back in business fast following being flooded out. Who knew?! |

| Festival of Frugality | Why You Should Never Buy Another Textbook | Broke Grad Student | The Broke Grad Student looks back to experience to provide six tips current college students should consider before going anywhere near the university bookstore. |

| Festival of Stocks | Great Businesses According to Buffett | Fat Pitch Financials | George reveals what he learned about Warren Buffett's investing philosohy from reading his latest letter to Berkshire Hathaway investors. Interesting tidbit: "restrict your investments to companies with durable competitive advantages" since this "'eliminates the business[es] whose success depends on having a great manager.'" |

| Carnival of Money Stories | Tip Your Pizza Delivery Person! | DebtFree-Revolution | Ana, herself a pizza delivery driver, reveals why tipping drivers is so important! |

| Odysseus Medal | Zillow Creates the End of the World as We Know It, and I Feel Fine | BloodhoundBlog | Teri Lussier considers "a world where real estate agents will have to prove themselves where it really matters- with clients and consumers." Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

CareerBuilder.com just released the results its most recent online survey of hiring managers and HR professionals, in which the following list of the 10 "wackiest" things recent interviewees did during the course of their interviews was revealed. Our snarky comments added in italics....:

- Candidate answered cell phone and asked the interviewer to leave her own office because it was a "private" conversation.

It's, like, even more important than you and this job opportunity, you see!...

- Candidate told the interviewer he wouldn’t be able to stay with the job long because he thought he might get an inheritance if his uncle died - and his uncle wasn’t "looking too good."

He could go at any moment - oh wait, my cell phone is ringing!

- Candidate asked the interviewer for a ride home after the interview.

Oh, and could we stop at the grocery store on the way? I want to pick up some beer for my uncle's funeral....

- Candidate smelled his armpits on the way to the interview room.

Like Mighty Mouse and the scent of flowers, the hiring candidate drew the strength to prevail in the interview from breathing long and deep!

- Candidate said she could not provide a writing sample because all of her writing had been for the CIA and it was "classified."

Strangely, she said the same thing about submitting a urine sample for drug-screening.

- Candidate told the interviewer he was fired for beating up his last boss.

It was a family business and I worked for my uncle. Why are you looking at me like that?

- When applicant was offered food before the interview, he declined saying he didn’t want to line his stomach with grease before going out drinking.

But, that's a key job requirement for this sales position!...

- A candidate for an accounting position said she was a "people person" not a "numbers person."

My uncle never understood that....

- Candidate flushed the toilet while talking to interviewer during phone interview.

And so, we find the perfect metaphor to describe the candidate's chances of being hired!

- Candidate took out a hair brush and brushed her hair.

Because looking good in a job interview is the most important thing!

Labels: business, jobs, none really

What is the total percentage change between an old figure and a new one? And for that matter, what is the average rate of change over the time between when the old and new values were recorded?

These are questions that we answer all the time, so we were somewhat gobsmacked to realize that we had never gotten around to posting a tool that anyone can use to answer the same questions for themselves. So, we're getting around to it today!

The data you'll need to enter in the tool below is really straightforward: you just need to enter an older (or starting) value, a newer (or ending) value, and enter the amount of time that elapsed between when these figures were noted. Our tool will find the total percentage change between the older and newer values and will also find the compound annual growth rate (CAGR) that corresponds with the time interval and values that you enter.

That's it! Here's the tool:

In the calculations for the tool above, the total elapsed time is found by adding each of the entries for elapsed years, months and days. We figure that feature makes this particular tool slightly easier to use with time periods you're much more likely to know than what some similar tools that you might find elsewhere on the web require.

Looking at what we do, we find we do this kind of math all the time for all kinds of things, such as finding out how big an increase in a budget line item, taxes, GDP, investment value or other personal finance stuff is compared a previous level or to find out what the annualized rate of change in a value between two points in time might be.

Like we said at the beginning - we were surprised to find we hadn't done it already!

Labels: tool

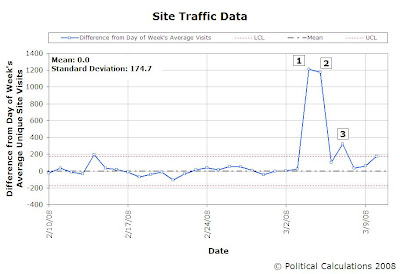

Last week, we noticed an unusual spike in our daily site traffic in mid-week, which corresponded to having been linked first by TheStreet.com and later by The Consumerist. Being who we are, we immediately pitted the two sites against each other in a contest to see who could drive more visitors our way!

At the time, we declared The Consumerist to be the winner of that contest for one big reason: TheStreet.com had linked to two separate posts at Political Calculations, while The Consumerist had only linked to one, even as the number of unique visitors was nearly identical on both days.

Then it got interesting. Just two days later, TheStreet.com turned around and linked once to the same post that The Consumerist had, which means that we can now directly compare the ability of both sites to direct traffic our way and provide the kind of independent assessment of commercial web sites that online advertisers crave!

First, let's look at some of our site traffic statistics. The following chart goes back to Sunday, 10 February 2008 and shows our daily unique site visits through Monday, 10 March 2008 against our average daily site visits for the past month preceding Tuesday, 4 March 2008, along with upper and lower control limits, between which some 98% of our number of daily site visits would be expected to fall in normal circumstances:

The boxed numbers on the chart indicate the unique events that launched our natural test. Box #1 is the day that TheStreet.com first linked to two of our posts. Box #2 is the day that The Consumerist linked to one of our posts. Box #3 is the day that TheStreet.com linked to the same post The Consumerist did.

You can see that the data coinciding with Boxes #1 and #2 are well outside what can be expected to be a normal, if high, level of traffic at Political Calculations in the month preceding when these posts were linked. Box #3 would, at first glance, seem to fall within our typical levels of traffic over the preceding month.

But does it? The chart also reveals that our site traffic has a cyclic pattern. Basically, our traffic builds from Sundays through Wednesdays, falls off on both Thursdays and more so on Fridays, before hitting the bottom of the trough on Saturdays. This corresponds with our level of posting activity - we generally only post on Mondays through Fridays, with no posts at all on Saturdays and Sundays.

So the question is how much above our usual traffic on each of the days which these larger sites linked to us? To find out, we calculated the average number of posts we could expect for each day of the week in the month preceding when these spikes in unique visitors occurred. We then calculated the difference between the number of unique site visits we had against the averages we found for each day of the week. The following chart shows our results:

The chart above confirms that each day that either TheStreet.com or The Consumerist linked to us was a banner day. The number of posts we saw from each source of site visitors was well above our typical level of traffic that might be considered normal in the preceding month.

We now see that The Consumerist is the clear winner of our "How Much Traffic Can You Send to Political Calculations" contest! By a nearly a 3 to 1 margin, The Consumerist was able to send substantially more of its readers to the Political Calculations blog than was TheStreet.com.

Now, before we get too excited, let's consider some factors that may have influenced these results:

- Daily traffic variation. Like Political Calculations, both sites may also see variations in the amount of daily traffic during the course of the week that affects the number of potential people each have on any given day to see or click an original link.

- Different audience interests. One site's readers may not be as interested in finding out more about a particular topic as the other site's readers.

- Relative audience size. We don't know which site might have a larger pool of readers, but a site with a much higher volume of traffic could reasonably be expected to deliver a higher number of clicks-through to our site.

- Posting approach. The Consumerist built an article around the data we featured in our original post, while TheStreet.com provided an Instapundit-style one-line link. As we've often argued about what makes a good blog carnival, readers need a compelling reason to click a link.

We could go on, but you get the general idea. And for what it's worth, we're just happy to have the additional traffic. More, please!

Update: Added the text ", even as the number of unique visitors was nearly identical on both days" to the end of the second paragraph to clarify why we had previously declared The Consumerist to be the victor!

Labels: none really

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.