How many U.S. companies have been publicly listed on the AMEX, NASDAQ and NYSE stock market exchanges over each of the past 40 years?

The answer is graphically presented in the following chart! [Update: A newer version of the chart is available here!]

In the chart, we've also indicated the National Bureau of Economic Research's official periods of recession in the U.S. economy, and also the period of time from April 1997 to June 2003 during which the Dot Com Bubble first inflated (up to August 2000) and then deflated.

Data Sources

Doidge, Craig, Karolyi, G. Andrew and Stulz, Rene M. The U.S. Listing Gap. Charles A. Dice Center for Research in Financial Economics. Dice Center WP 2015-07. Table 5. Listing counts, new lists, and delists. U.S. common stocks and firms listed on AMEX, NASDAQ, or NYSE, excluding investment funds and trusts. [PDF Document]. May 2015.

Wilshire Associates. Wilshire Broad Market Indexes, Wilshire 5000 Total Market Index Fundamental Characteristics. [2013, 2014, 2015 (For month ending 03/31/2015)]. Accessed 18 May 2015.

Labels: business, data visualization, stock market

Given its established trend, we anticipate that Social Security's Disability Insurance Trust Fund will be fully depleted in or shortly after October 2016. When that happens, Social Security's Trustees have indicated that the payments to individuals receiving its Disability Insurance benefits will be reduced by nearly one-fifth.

As recently as 2008, Social Security's Trustees believed that its Disability Insurance (DI) Trust Fund would have enough money to last until 2025. Even in 2009, on the eve of the official end of the so-called "Great Recession", the Trustees indicated that the DI Trust Fund would last into 2020.

So what happened? Why is Social Security's disability trust fund running out of money so much more quickly than Social Security's actuaries ever expected?

The primary reason why Social Security's DI Trust Fund is now on track to be fully depleted so many years earlier than had been expected has a lot to do with the surge of Americans who lost their jobs during the Great Recession, who then went on to fully exhaust the unemployment insurance benefits that had been made available to them as the U.S. economy failed to meaningfully recover under President Obama's economic policies. Without the prospect of finding jobs as their unemployment benefits ran out, many applied for welfare disability benefits to replace the money they had been getting through unemployment.

And because being classified as disabled would remove such individuals from being counted as both unemployed and part of the U.S. civilian labor force, the Obama administration had a strong incentive to get the program's administrators to look the other way at the disability insurance applications for benefits that were being made as jobless benefits were expiring, as the resulting math would considerably reduce the official unemployment rates reported by the U.S. Bureau of Labor Statistics.

To show how that played out, we've tapped Social Security's data on the number of Disability Insurance beneficiaries by age at the end of each year from 2005 through 2014, which would allow us to do some accounting for the age demographics of the U.S. population, where we'll focus on the members of the Baby Boom Generation - Americans born in the years from 1946 through 1964. Our first chart shows the number of Social Security's Disability Insurance beneficiaries by age for each of these years.

In our next chart, we calculated the net change from one year to the next for each of the birth year cohorts covered by the data, where we would take the number of 31-year old disability benefit recipients in 2009 and subtract the number of 30-year old disability benefit recipients in 2008 from it.

The key bit of information to take away from this chart is that regardless of year, individuals seeking Social Security disability insurance benefits Age 50 and over are predominantly the ones who are awarded it. This is directly due to how the program is managed, where the Social Security Administration is much more aggressive in challenging the disability claims of individuals under Age 50 than it is for individuals who are Age 50 or older.

We next set 2006 as our baseline reference year for measuring differences over time, as that year would provide a good representation of the rate at which disability insurance beneficiaries would typically be added during a relatively healthy economic period of time, as the nation's economy grew at a real rate of 2.7% as over 3.2 million jobs were added over the previous year.

Having set our baseline, we next calculated the "surplus" of disability beneficiaries by age with respect to the net change that was recorded in 2006. The results of our math are presented in our third chart, which because that's a lot of data to digest, we've opted to animate:

Let's go year by year, beginning with 2007:

- 2007: Very little change from 2006, except for Ages 60 and 61, which is mainly notable because these are the ages at which Americans born at the leading edge of the Baby Boom, 1946 and 1947, would turn those ages. Other than that observation however, there is no real difference from the data recorded in 2006, which should be expected because the economy grew throughout the year, peaking in December 2007.

- 2008: The first year of the "Great Recession", which took hold after December 2007, saw a net increase in the number of individuals across the board, regardless of age, with the largest increases occurring above Age 43. Coincidentally, the youngest Baby Boomers would be at least Age 44 in 2008.

- 2009: This year saw the largest job losses during the Great Recession, which continued after the U.S. economy officially began "growing" again in June 2009. Note that the net change in the number of individuals now receiving disability benefits grew uniformly for those between the ages of 21 and 43, which is something that could only happen if the welfare program's administrators were purposefully looking the other way, as there were no Baby Boomers younger than Age 45 in 2009.

- 2010: The number of "surplus" individuals receiving disability benefits continued to grow in 2010, once again, across the entire spectrum of ages. 2010 coincides with the beginning of when those who lost their jobs in 2008 would begin having their extended emergency unemployment insurance run out after 99 weeks. Once again, the near uniformity of the surplus disability insurance beneficiaries for the younger age ranges suggest that the program's administrators had an allowance for adding people to the nation's disability rolls.

- 2011: The first declines in the number of "surplus" individuals receiving disability benefits begin for those under Age 55, while continuing to rise for those over Age 55. This year would coincide with the expiration of 99 weeks of unemployment benefits for workers laid off as part of the implosion of the U.S. automotive industry in late 2008, early 2009.

- 2012: For individuals Age 47 and under, the number of "surplus" disability benefit recipients fall back to the level they had been in 2006. Meanwhile, the number of "surplus" disability recipients also begins to fall for individuals Age 48 and older, which corresponds, once again, to the age of the youngest Baby Boomers. The numbers remain highly elevated, which indicates that the period of economic distress following the "Great Recession" was continuing.

- 2013: The number of "surplus" individuals joining the ranks of those collecting Social Security disability insurance benefits continued to fall as the U.S. economy improved - so much so that we actually see the number of "surplus" new individuals between Age 34 and 49 falls below the numbers than had been recorded in 2006. The end of 2013 also saw the end of the federal government's "emergency" extended unemployment benefits.

- 2014: The number of "surplus" disability beneficiaries continues to fall across the board as the pace of new job creation picked up considerably in 2014, but now, the numbers are such that there are considerably fewer individuals being added to the ranks of the disabled in the age range from 21 through 54 than were in 2006. That's remarkable in that the youngest baby boomers turned Age 50 in 2014 - if the number of people going onto disability was demographically driven, given the program's guidelines, we shouldn't see any of the number of new beneficiaries Age 50 or older drop below their 2006 levels.

What these numbers tell us is that the state of the economy is the determining factor behind the pace at which individuals have been added to the ranks of those collecting DI benefits, rather than say, the incidence of disabilities in the U.S. population. Also, we see that while the age demographic data explains why we observe higher numbers of people above a given age threshold being added to the disability rolls, that they're being added is primarily driven by the nation's employment situation.

What that observation confirms is that Social Security's disability insurance program was operated as somthing of a dumping ground for the nation's long term unemployed after they exhausted their very generous extended unemployment benefits following the end of the Great Recession. Particularly if they were above the key Age 50 threshold that determines the level of challenge their disability claims would face, but surprisingly for a very large percentage of younger Americans.

In fact, if we total up the number of all the "surplus" number of Social Security disability insurance beneficiaries from 2007 through 2013 for those Age 21 through 64, we find that 913,207 more Americans were put onto the nation's disability rolls above and beyond what would have been considered to be typical numbers in 2006, which would account for why the Social Security trust fund has been depleted so much faster than expected. It is only in 2014 that we find fewer Americans being added on net than what we would have been typical in 2006, but that would also coincide with the best year for jobs recorded since the Great Recession began, proving our point that the nation's employment situation is the main determinant of the rate at which Social Security awards disability benefits.

Before we conclude, we have one last observation. If we go back to our first chart and look at the overall changes in the number of Social Security disability benefit recipients over time, we confirm that except for the oldest Baby Boomers who were collecting disability benefits, who have since aged out of the program and are now receiving Social Security pension benefits instead, the vast majority of those who were added to Social Security's disability rolls during the period from 2008 through 2013 are still on them.

In 2012, the Obama administration indicated that this situation is unlikely to ever change under current rules. In March 2014, Social Security proposed tightening some of their rules for awarding disability benefits, in apparent response to a 2011 Wall Street Journal article, but doesn't appear to have implemented the proposed changes that year.

Notes

[1] Our projections are consistent with the Social Security Trustees' Intermediate Assumptions, where they anticipate the Disability Insurance (DI) Trust Fund becoming depleted in the fourth quarter of 2016. In their 2014 Annual Report, they project that the program only has enough revenue to support benefits at 81% of their current level without any additional funds being available to be tapped from the DI trust fund, which is documented in Table IV.B3 of the report. In the absence of Congressional action, all recipients of Social Security's Disability Insurance benefits would therefore have their monthly payments slashed by 19% after the DI Trust fund is depleted.

Data Sources

U.S. Social Security Administration. Benefits Paid by Type of Beneficiary. Disabled Worker. Monthly. All Years. [Online Database]. Accessed 20 May 2015.

U.S. Social Security Administration. Disabled worker beneficiaries in current payment status at the end of December, distributed by age and sex. [Online Database: 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014]. Accessed 20 May 2015.

Labels: data visualization, politics

Via The Telegraph: a world map showing the national debt burden by country around the globe:

Some excerpts from the related article, which quotes Andrew Wilson, the head of Goldman Sachs' Europe, Middle East and Africa Asset Management division:

"There is too much debt and this represents a risk to economies. Consequently, there is a clear need to generate growth to work that debt off but, as demographics change, new ways of thinking at a policy level are required to do this," he said....

"The demographics in most major economies – including the US, in Europe and Japan - are a major issue – and present us with the question of how we are going to pay down the huge debt burden. With life expectancy increasing rapidly, we no longer have the young, working populations required to sustain a debt-driven economic model in the same way as we've managed to do in the past."

Wilson went on to offer his solution:

Mr Wilson said there was hope for countries with high debt burdens. "The demographic shift means that we need to look to more creative policy, including immigration and workforce expansion in order to find ways to pay down debt.

It has often been suggested that many of U.S. President Obama's policies are actually authored in the offices of Goldman Sachs, which has been described as a "political organization masquerading as an investment bank". Which if you think about it, explains an awful lot - especially when you see a Venn diagram showing the overlap of Obama administration members and upper echelon Goldman Sachs' employees.

But then, since Goldman Sachs is a prime broker of U.S. government-issued debt securities, such unique subservience might be best understood as a show of respect for those upon whom you are dependent. Especially where the nation's debt is concerned.

Labels: national debt

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 at approximately the midpoint of the current quarter. Today, we'll confirm that the expected earnings per share for the S&P 500 throughout 2015 has continued to fall from the levels that Standard and Poor had projected they would be back in February 2015.

The table below quantifies the carnage for what can now be described as a deepening earnings recession, which Standard & Poor continues to forecast will run through the third quarter of 2015:

| Expected Future Earnings per Share for the S&P 500 | |||||

|---|---|---|---|---|---|

| Future Quarter | 2014-Q4 | 2015-Q1 | 2015-Q2 | 2015-Q3 | 2015-Q4 |

| On 13 November 2014 | $109.96 | $118.23 | $124.48 | $131.07 | $134.89 |

| On 15 February 2015 | $102.89 | $103.34 | $103.77 | $105.00 | $112.03 |

| On 21 May 2015 | $102.31 | $99.25 | $98.79 | $99.49 | $106.61 |

| Change in Expectations Since 13 November 2014 (mid 2014-Q4) | $7.65 | $18.98 | $25.69 | $31.58 | $28.28 |

Much of the decline in earnings expectations is tied to the decline in global oil prices, which primarily affects the oil industry, and also affects the business outlook for financial institutions and capital equipment manufacturers.

What we find especially curious however is that S&P would currently appear to expect an exceptionally robust recovery in the S&P 500's earnings per share beginning in the fourth quarter of 2015, largely driven by the energy-related sector of the S&P 500 index. Based on what we see in the expected future for crude oil prices through the end of 2015, we don't think that earnings recovery based on improving revenues is well supported, unless a significant amount of cost reduction occurs within the industry. Since that reduction in economic activity would ripple outward from the energy sector and negatively affect other sectors of the economy, we think that the overall earnings for the S&P 500 would be likely to perform much less well than S&P currently expects.

Data Source

Silverblatt, Howard. S&P Indices Market Attribute Series. S&P 500 Monthly Performance Data. S&P 500 Earnings and Estimate Report. [Excel Spreadsheet]. Last Updated 21 May 2015. Accessed 22 May 2015.

Labels: earnings, forecasting, recession forecast, SP 500

Did you ever wonder what gift you could possibly get for the guy who has everything?

The Victorinox Swiss Army SwissChamp XAVT is available on Amazon, where as of this writing on 22 May 2015, may be obtained at a discount of $100.01 off its regular price of $480.

And though it features 80 tools, including a ball point pen, barometer, altimeter, pharmaceutical spatula and corkscrew in addition to both a large and small blade, it's not quite as impressive as the Wenger 16999 Swiss Army Knife Giant, which features 7 more, but alas, is not available as of this writing.

And that's why this is the Ultimate Swiss Army Knife You Can Buy Today!

Labels: technology

We're breaking news today as it appears that the Apollo Group (NASDAQ: APOL), the parent company of the for-profit University of Phoenix, the largest private educational institution in the United States, has had a major setback in its technology-based strategy to retain students and improve graduation rates in its Associate's degree programs, which have seen a dramatic decline in enrollment since peaking in 2010.

The setback is tied to the Apollo Education Group's August 2011 $75 million acquisition of Carnegie Learning, a developer of computer-based math instruction. The New York Times described the motivation for the Apollo Group's purchase.

Hoping to keep more of its students from dropping out, the Apollo Group, which operates the profit-making University of Phoenix, said Tuesday that it would pay $75 million to buy Carnegie Learning, which offers computer-based math instruction.

Carnegie Learning, based in Pittsburgh, was founded in 1998 by scientists from Carnegie Mellon University who developed an approach to teaching math that combines classroom work with computer instruction. Its Cognitive Tutor software analyzes students' weaknesses as they work through problems and offers new problems until they are ready to move on.

"Math is a subject where we see a lot of students having difficulty" at the college level, said Gregory W. Cappelli, Apollo's co-chief executive. "We think by adding the Carnegie Learning solution into our platform, we'll really help our students to have better outcomes in math."

The acquisition was an integral part of the Apollo Group's billion dollar bet on its development of an adaptive learning platform, part of its internally developed "Learning Genome Project", in which it would seek to personalize the learning experience of the students enrolled in its classes.

The Apollo Group implemented Carnegie Learning's Adaptive Math Practice system in its University of Phoenix' Associate's degree program math classes in the period from October 2013 (PDF document) through December 2013 (PDF document), replacing the My Math Lab system developed by Pearson Higher Learning (NYSE: PSO) that it had previously used.

On 27 February 2015, University of Phoenix faculty members were notified (PDF document) that Carnegie Learning's Adaptive Math Practice system would be phased out of use in its Associate's degree program math classes with a transition back to Pearson's My Math Lab system beginning on 1 April 2015, which would be completed by 1 June 2015.

The notification indicates that the change was based upon negative feedback provided by students and faculty members, and that a pilot effort to transition math classes in the University of Phoenix' Bachelors degree program from the Carnegie Learning system back to Pearson's My Math Lab system earlier in 2015 had been successful in drastically reducing technical support tickets.

That technical situation must have been extraordinarily bad for the Apollo Group to return the system that it had previously attributed to be a cause of its declining enrollment. According to Pearson, access to a MyMathLab course costs $85.50 per student. With our estimate of the University of Phoenix' Associate's degree program enrollment of 66,000, the Apollo Group may be required to pay Pearson as much as $5.6 million over the course of a full year to abandon its Adaptive Math Practice system, which perhaps gives a sense of how costly those technical support tickets were.

The setback is particularly significant in that it was such a clear part of the business strategy behind the Apollo Group's effort to develop a Learning Management System (LMS) that could be sold to other educational institutions.

Facing new regulations and slowing enrollment for their degree programs, companies like the Apollo Group, parent of the University of Phoenix, are quietly developing or expanding other educational services that they could sell to nonprofit colleges and corporations, moves that could signal the future direction of the for-profit college industry.

Among other things, that means it might not be long before the Apollo Group seeks out other colleges as customers for the electronic learning platform it has spent years and millions of dollars developing. A company spokesman said licensing that platform to other colleges is one of the many options its new Apollo Educational Services division is exploring. Although the entire Phoenix student body won't be fully on the new platform until spring, Apollo has been inviting higher-education leaders to its San Francisco development center to show off the new system for the past several months.

"We'd love to partner with existing educational institutions. We'd love to partner with global companies," says Mark Brenner, Apollo's senior vice president for external affairs.

With the apparent failure of Carnegie Learning's Adaptive Math Practice system in its own classes, that option would no longer appear to be as viable in the near term for the Apollo Group as it had previously appeared.

Labels: business, education, technology

In April 2008, the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds projected that Social Security's Disability Insurance (SSDI) trust fund would likely peak in 2008 and then would be slowly drawn down until it ran out of money in 2025.

They were half right. Our chart below shows both how history really played out and how it would apparently appear to be on track to play out.

Going by the apparently steady burn rate for the depletion of Social Security's Disability Insurance Trust Fund established since June 2011, the SSDI trust fund would appear to be on track to completely run out of money as early as October 2016.

Curiously, the 2009 Board of Trustees Report from May 2009, issued just one month before what would ultimately be the month that the National Bureau of Economic Research would identify as marking the end of the "Great Recession", indicates that they believed that the Disability Trust Fund would actually peak in 2009 and would last through 2020.

But then, Social Security's Board of Trustees in both years were perhaps not taking into the account the extent to which Social Security's Disability Insurance program would become a dumping ground for Americans whose jobs were displaced during the recession after their extended unemployment benefits ran out.

Nor perhaps were they appreciating the politically-driven expansions of the interpretation of what constitutes a disability that unscrupulous politicians and bureaucrats would adopt for the sake of reducing official unemployment rate figures by getting people who would otherwise be able to work onto Social Security's disability insurance benefits, where they would no longer be considered to be part of the U.S. civilian labor force and would therefore not be counted as being unemployed.

References

Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. The 2008 Annual Report of the Board of

Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. Table II.D1. -- Projected Maximum Trust Fund Ratios Attained and Trust Fund Exhaustion Dates Under the Intermediate Assumptions. [PDF Document]. 10 April 2008.

Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. The 2009 Annual Report of the Board of

Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. Table II.D1. -- Projected Maximum Trust Fund Ratios Attained and Trust Fund Exhaustion Dates Under the Intermediate Assumptions. [PDF Document]. 12 May 2009.

U.S. Treasury Department. Bureau of the Fiscal Services. Monthly Treasury Statement (MTS) Archive. [Previous Issues]. Accessed 16 May 2015.

Labels: politics

On Friday, 15 May 2015, the U.S. Treasury identified the national origins of the major foreign holders of debt issued by the U.S. government through the end of March 2015, the halfway point of the federal government's fiscal year. With that information, we can now update our chart showing just who has loaned the U.S. government money in the Spring of 2015:

Update 24 May 2016: We have updated our visualization through March 2016!

The big news is that debt held by "Mainland China" has once again edged out the total U.S. government-issued debt holdings of Japan to reclaim its undisputed spot as the biggest foreign owner of the U.S. national debt. That China is the largest foreign holder of that debt however was never really in dispute, because the figure for Mainland China omits the amount of U.S. debt held by Hong Kong, which has been under Chinese rule since 1997.

Collectively, foreign entities hold about 47% of all the U.S. government's "Debt Held by the Public", which totaled $13.099 trillion on 30 March 2015.

Domestically, the big story about the U.S. national debt is that it has been essentially frozen at $18.152 trillion since 13 March 2015, which is when the total public debt outstanding of the U.S. government hit its statutory debt ceiling. Since that time, the U.S. Treasury has been playing something of a shell game to hold the U.S. national debt at that level, replacing the holdings of debt held by entities it controls with I.O.U.s as it continues issuing new debt to other holders.

In our chart above, that shell game shows up as a decrease in the amount of debt that appears to be held by the U.S. Civil Service Retirement and Disability Fund, which appears to have fallen from the $857.2 billion it was reported as holding at the end of the U.S. government's 2014 fiscal year to $818.2 billion just six months later. What that change means is that in just the first 14 days after the U.S. national debt hit its statutory ceiling, the U.S. Treasury has exchanged at least $39 billion of short-term debt that came due in the holdings within the U.S. Civil Service Retirement Trust Fund with I.O.U.s so it could continue issuing new public debt to other parties.

That situation will change suddenly and dramatically when the U.S. Congress acts to increase the nation's statutory debt ceiling, which will likely happen as it progresses toward passing a budget for the first time since 2009. When that happens, the U.S. Treasury will rush to exchange the I.O.U.s that it has issued into the accounts it controls with newly-issued U.S. government debt securities. When that happens, it will be as if the U.S. national debt had never been frozen at 18.2 trillion dollars.

Data Sources

Federal Reserve Statistical Release. H.4.1. Factors Affecting Reserve Balances. Release Date: 2 April 2015. [Online Document]. Accessed 15 May 2015.

U.S. Treasury. Major Foreign Holders of Treasury Securities. Accessed 15 May 2015.

U.S. Treasury. Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2015 Through March 30, 2015. [PDF Document].

Labels: national debt

You wouldn't necessarily think of it from the news reports, but according to the number of U.S. companies announcing that they would be cutting their dividends, the last week was the best week of 2015!

Although the total level of U.S. companies cutting their dividends in 2015-Q2 remains ahead of the pace established in 2015-Q1, a quarter that "some economists" have finally caught up to us in predicting that the U.S. economy shrank during, the past week has been surprisingly quiet.

For U.S. stock prices, investors would still appear to be focused on the expectations associated with the current quarter of 2015-Q2 in setting today's stock prices, as the Federal Reserve has not yet clearly defined its intentions with respect to the timing of future short term interest rate hikes.

We'll therefore repeat our observations from 27 April 2015, striking out the bits that would no longer apply and emphasizing the bits that came true:

At present, given the current expectations for future dividends, U.S. investors would appear to be focused on 2015-Q2 in setting current day stock prices. As long as their focus continues to fall on this current quarter, as they await greater clarity from the U.S. Federal Reserve

this weekwith respect to its plans to hike short term interest rates in the U.S., stock prices may continue following their largely sideways to slightly upward trajectory while that uncertainty continues, assuming no major changes in the expectations for future dividends.However, if they shift their focus to a different point of time in the future, there is a high potential for stock prices to fall, the degree to which will depend upon which future point of time they might choose to focus their forward looking expectations upon and the timing of when such a shift in focus would occur.

Noting that the upward spike in our alternative future trajectories for the S&P 500 for the week beginning 11 May 2015 is really an artifact of our using historical stock prices in our forecasting model, making that bump something of an echo of a past event, investors would still appear to be focused closely on 2015-Q2 as they would appear to be awaiting more effective guidance from the Fed regarding its intentions.

Meanwhile, investors are running out of 2015-Q2 to focus their forward-looking attention upon, which means that a shift in that focus to another point of time in the future is becoming imminent. For the quarters for which we have data indicating future expectations, the most positive outcome would be for investors to shift their focus to 2015-Q4, which would mean that "mostly sideways" would be the outcome of the best case scenario for stock prices through the end of the current quarter, absent significant changes in future expectations.

When the first trailer for Star Wars: Episode VII came out, a new star was born that stood out from everyone else in it. You know who we mean:

It was the droid BB-8, who also stole the show when rolling out onto the stage at Star Wars Celebration Anaheim:

But wait! Did you know you could hack your own BB-8 style droid together from a Sphero and some magnets?

Industrial designer Christian Poulsen provides step-by-step directions. But if that's beyond your personal level of technical competence, you could just wait for Sphero to come out with an officially licensed version at some time in the future....

Labels: academy awards, technology

Has the bubble in higher education begun to burst?

To answer that question, we need to look at the performance of marginal higher education institutions that offer a wide range of degrees in a number of academic fields. Here, we mean "marginal" in the economic sense - institutions whose student population is drawn from the ranks of the general population where the economic return of completing a degree program may not be positive. The requirement of providing a wide range of degrees in a number of academic fields is to avoid supply and demand issues for a given profession may affect the demand for a particular field in which a college might specialize, such as law schools.

Here, the for-profit institution of the Apollo Group, the parent company behind the for-profit University of Phoenix and a number of other institutions, would seem to fit the bill. We went through the financial statements that the Apollo Group has filed with the U.S. Securities and Exchange Commission to extract the data they have reported about their enrollment levels since the first quarter of 2004. We selected 2004-Q1 as our starting point because that precedes the Apollo Group's addition of its two-year Associate's degree program later that year.

Our first chart shows the Apollo Group's total reported student enrollment across all its Associate's, Bachelor's, Master's and Doctorate programs:

Here, we observe that student enrollment at the Apollo Group's family of for-profit universities started out at 215,900 in the first quarter of 2004, rose steadily upward on something of an exponential trajectory until the third quarter of 2009, then rose slowly to peak at 476,500 a year later, before entering a period of steady decline since. Through the first quarter of 2015, the Apollo Group's level of student enrollment has fallen to 213,800, which is below the level it reported in the first quarter of 2004, before it added its Associate's degree programs.

We next went through the detailed enrollment data that the Apollo Group has reported in its financial statements on enrollment by degree type to extract the impact that the addition of its Associate's program in 2004 had upon its overall enrollment levels. Our next chart shows what we found:

In this chart, we see that the vast majority of the exponential growth that the Apollo Group/Univerity of Phoenix family of for-profit schools had in the period from 2004 to the third quarter of 2009 took place in its Associates degree program, rising from 3,700 to over 200,000. That growth effectively stalled out after the third quarter of 2009, managing to reach a maximum level of 212,900 a year later, but has since fallen considerably since.

The Apollo Group's Bachelor's Master's and Doctoral degree program enrollment has been more steady by contrast, ranging between 212,500 and 234,000 in the period preceding the official period of the so-called Great Recession, then rising during that period of economic distress before peaking in the fourth quarter of 2010, before falling steadily since.

The Apollo Group's financial statements make for some interesting reading with respect to its reported level of enrollment, as they went from accurately detailing out its enrollment levels by degree type in its financial statements up until its declines in enrollment began. After those declines began, the Apollo Group adopted the strategy of averaging enrollment levels over the four preceding quarters in its annual reports, which is a technique that would, in effect, hide the degree of its declining enrollment.

Beginning with the first quarter of 2013, the Apollo Group no longer details its enrollment levels by degree program, only reporting a total enrollment level. We've projected the enrollment level of its Associate's program and its other degree programs since the fourth quarter of 2012 based on the share of Assoicate's enrollment reported in the Apollo Group's 2012-Q4 10-K filing, where Associate's degree programs accounted for 31.5% of its total enrollment.

In reality, as the Apollo Group's enrollment has plunged, the percentage share of students enrolled in its Associate's degree programs has also been falling. As a result, the Apollo Group's Associate's degree enrollment since 2012-Q4 is very likely lower than what we've indicated in the chart above, while the enrollment of other degree programs is higher than what we've indicated.

Regardless, the Apollo Group's enrollment data indicates that the institution is in considerably worse shape in 2015 than it was before it added its Associate's degree programs in 2004, since a much larger share of its student enrollment today is made up of the academically marginal students who typically enroll in such programs.

The problem for the Apollo Group is that their tuition costs are such that such students are unlikely to obtain a satisfactory return, which would drive their decision to not enroll at the Apollo Group's University of Phoenix and other related institutions, which is what we're really seeing in the enrollment data.

Because of what may be a glitch in in our RSS news feed, our latest post, Developing the National Dividend Into a Monthly Economic Indicator, may be accessed directly at our site.

Enjoy feedly readers!

Labels: update

One of the challenges we've taken on this year is developing more real-time indicators of the health of the U.S. economy. One of the other challenges we've taken on is the determination of a consumption-based National Dividend - a concept for measuring the well-being of the people of a nation that was first proposed by Irving Fisher in 1906, but which couldn't be developed because it was too difficult to amass the consumption data needed to calculate it. At least, until we finally got our hands on the problem earlier this year!

The problem with making our national dividend calculation into a near-real time indicator of the economic health of the American people is once again the data. The Consumer Expenditure Survey that provides the data we need to calculate the national dividend is presented semi-annually. If we want to make it a near-real time indicator, we need that kind of data a lot more frequently.

That's where we realized that our observation that there is an almost perfect 1-to-1 correlation between a consumer unit's average annual consumption expenditures and the median household income would be an important discovery - we can use the monthly median household income data collected and published by Sentier Research as a reasonable substitute for monthly consumer expenditure data!

With that in mind, here's the nominal and inflation-adjusted median household income that has been reported by Sentier Research in each month since January 2000 through the most recent data available for March 2015:

To reasonably estimate both the nominal and real national dividend then, we would just need to multiply the monthly values for these figures by the number of consumer units in the U.S. Only here, we took the data for July of each year that overlaps the annual Consumer Expenditure Survey reports so we could determine the correlation between the two. Given the once-a-decade data revisions in the Census Bureau's monthly household estimates however, it was more complicated that it sounds. The chart below reveals the correlation we found for each year, which we will apply to the appropriate monthly data to get a monthly estimate of the number of consumer units in the U.S.

Here's how that math translates the U.S. Census Bureau's monthly estimates of the number of U.S. households translates into the number of U.S. "consumer units" with the correlations we identified in the previous chart after we graft them together, which fits together a lot better than you might have expected from the correlations we identified:

That was more work than it really needed to be, but now that we've done it, let's get to our results. The chart below shows our estimate of the nominal and real national dividend on a monthly basis since January 2000:

Here's what we observe in the data:

- The negative impact of the 2001 recession would appear to have been concentrated outside of U.S. households, as the national dividend rose during the months spanning the recession.

- The recovery from that recession would appear to have been especially slow, as the national dividend remained largely flat for about 18 months afterward. This observation is consistent with the general perception that this period represented a jobless recovery.

- The national dividend then began to grow steadily up until the start of the so-called "Great Recession".

- In real, inflation-adjusted terms, the Great Recession was really more of a double-dip affair, with a false recovery that reversed into a deeper decline in the last quarter of 2008, first with the financial system crisis triggered by the collapse of Lehman Brothers, then by the implosion of the U.S. automotive industry.

- In real terms again, the Great Recession went on far longer than the official NBER recession dates indicate. It didn't really bottom until the second quarter of 2011 - two years after the second quarter of 2009 that the National Bureau of Economic Research marked as the end of the Great Recession.

- We see that the phenomenon of a first quarter dip has been a recurring feature in the U.S. economy during the past decade. The suggestion that seasonal adjustments in the U.S. construction industry are off is not supported by our consumption-based national dividend calculation.

Looking at the most recent months, since December 2014, we see that our nominal and inflation-adjusted consumption-based measure of the economic well being of the ultimate end consumers in the U.S. has turned downward, which would so far appear to coincide with a period of greatly decelerated GDP growth, if not outright contraction. We'll get the official word on that for the first quarter of 2015 near the end of June, but our estimate of the national dividend certainly supports that outcome.

One thing that will be interesting to consider is if the impact of the Federal Reserve's various quantitative easing programs has had any effect upon the national dividend, which will be something that we'll explore in an upcoming post.

We'll conclude by repeating our previous observation that the national dividend has primarily risen since January 2000 because of the population of the U.S. increasing over time, or more accurately, because of the increase in the number of "consumer units" or households in the U.S., rather than real increases in the incomes earned by U.S. households.

Previously on Political Calculations

Once upon a time, less than two months ago, we solved a problem that had stymied economists since 1906. And we made it look easy!

Also, a rough draft of this post appeared briefly on the morning of 12 May 2015 giving a sneak peak at what we've been working on developing, under the working title "The National Dividend Monthly", which sounded way too much like the name of some obscure magazine!

Data Sources

Sentier Research. Household Income Trends: February 2015. [PDF Document]. 23 April 2015.

U.S. Census Bureau. Housing Vacancies and Homeownership (CPS/HVS). Historical Tables. Table 13. Monthly Household Estimates: 1955 to Present. [Excel Spreadsheet]. Accessed 3 May 2015.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. Accessed 3 May 2015.

We had planned to retire our chart tracking the change in the number of employeed by age group since November 2007, when the total employment level in the U.S. peaked ahead of the beginning of the so-called "Great Recession", but data in the April 2015 Employment Situation report is giving us cause to resuscitate it.

Only this time, we're also going to identify periods where oil and fuel prices in the U.S. were either rising, falling or holding stable as a backdrop against which the changes in employment for U.S. teens (Age 16-19), young adults (Age 20-24) and adults (Age 25 and older) have been taking place.

Looking at the changes in the employment levels of U.S. young adults, we see that in general terms, employment in this age group would appear correlated with the trend for oil and fuel prices in the U.S., where when these prices are stable or falling, the number of working young adults tends to grow, and when these prices are rising, the number of employed 20-24 year olds tends to fall.

That pattern matters today in that falling oil and gas prices in the U.S. began to slow and reverse in February and March 2015, and since the beginning of April 2015, have begun to rise. At the same time, we observe that the number of young adults employed in the U.S. civilian labor force has begun to decline, falling back below the level that was recorded back in November 2007.

Or rather, it would appear that the Great Recession is not quite over for young adults in the U.S.

And if you go back to the earliest months of the Great Recession, job losses were concentrated among Americans in this age group, which bore the largest brunt of all job losses recorded in the first six months of the Great Recession in 2008, while at the same time, a number of individual states were hiking their minimum wages.

That combination would not be a good one for the employment situation for young adults. Here, Americans Age 20 to 24 make up nearly a quarter of all individuals who earn the minimum wage or less in the U.S. At the same time, many of the businesses that employ workers at the minimum wage tend to be in industries such as food and accommodation, which are very sensitive to changes in oil and food prices and the effects they have on the disposable income of Americans.

These kinds of businesses are negatively affected when rising oil and fuel prices reduce the amount of money that American consumers have available for other kinds of consumption, such as dining out at fast food restaurants and similar establishments, while the reverse situation applies when oil and fuel prices are falling, the latter of which is really the story of the economic recovery from July 2014 through March 2015.

It would seem then that in the seven years since the Great Recession began, U.S. policy makers have clearly not learned the lessons they need to avoid this negative outcome for young adults.

Data Sources

U.S. Bureau of Labor Statistics. April 2015 Employment Situation Report. 8 May 2015.

U.S. Energy Information Administration. Cushing, OK WTI Spot Price FOB. [Online Database]. Accessed 11 May 2015.

Labels: jobs

With the spot price of West Texas Intermediate crude oil having broken above $50 in the second week of April 2015, it now appears that the rebound in oil prices has now put new jobless claims in the eight high cost oil production states we've been tracking on the verge of breaking what had been their statistical uptrend for layoffs.

The various lines we show on this chart actually represent key thresholds in a statistical hypothesis test. While the data points fall within the outermost red lines, the null hypothesis for that test holds, which in this case, means that the upward trend for layoffs still holds and that all the variation from week to week is the simply result of random variation or "noise". But once the data points start falling outside of that range, it is a clear indication that our null hypothesis no longer holds and that the previous trend has broken down - something other than random factors has caused the data to fall consistently outside the range where we would expect it to be if the variation were just the result of randomness.

In this case, there's an obvious explanation for why the previous rising trend for layoffs would break down: a reversal in the trend for oil prices for the eight states where high cost oil production represents a significant part of their local economies and job markets. With oil prices now rising, firms engaged in that economic activity are able to avoid having to lay additional workers off in order to remain solvent.

Meanwhile, in the other 42 states, the trend of new jobless claims remains on its long established downward trend, which has been the case since oil prices began to fall beginning in early July 2014.

Nationally, where we have an addtional week's worth of data, we believe that the continued rise in oil prices will result in breaking what had been an upward trend in layoffs in the oil patch states with the data through 2 May 2015 that will be reported for individual U.S. states later this week.

The downside of rising oil prices however is that should that trend continue, we would see the rate at which layoffs have been decreasing across the nation each week since oil prices started to decline will flatten out and possibly reverse depending upon how far oil prices rise. If we had to guess, we would say that will happen if oil prices rise back into or above the $65-$75 per barrel range, so there is some margin for continued improvement before rising oil prices might once again choke off improvements in the U.S. job market.

In the meantime, we should see a general but slowly falling number of layoffs each week until such an equilibrium level is reached in the national data.

Labels: jobs

The busiest airport in the world is the Hartsfield-Jackson Atlanta International Airport (ATL), which saw 96,631,755 passengers pass through in transit in the 12 months ending January 2015, nearly 10.6 million more than the world's second busiest airport, Beijing Capital International Airport (PEK). Or as they say in the American south, "whether you go to heaven or hell, you must change planes in Atlanta first."

Earlier this year, Dubai's International Airport (DXB) overtook London's Heathrow Airport (LHR) as the world's busiest international hub as measured by the number of people from other countries who fly through it. And although all airports everywhere are always under construction, the airport that will very likely quickly become the world's biggest airport after it opens is Beijing Daxing International Airport.

But perhaps the most impressive airport ever built is also one of the smallest. Literally. Knuffingen International Airport is the largest miniature model airport in the world, which is located in the Miniatur Wunderland in Hamburg, Germany. At 1:87 scale, it is modeled after Hamburg International Airport (HAM), occupies 150 square meters (1,615 square feet) of space, and was built for just $4.8 million. And yes, it has daily flight operations!

It's a wonderful airport. We just wish the line to check in for our flight was faster....

Labels: none really, technology

Supporters of the Patient Protection and Affordable Care Act, which is popularly known as "Obamacare" and is often abbreviated as "ACA", have claimed that the law is responsible for bending the cost curve of expected future health care spending down from its previous trajectory.

Is that really true?

Many would say that this is a difficult question to answer because of all the things that can affect health care spending. Things like the changing age distribution of a population over time, advances in health care technology and treatments, and even how a nation's economic health evolves over time can impact how much a nation's health care spending changes over time.

As it happens, things like the changing age distribution of a nation's population would be a known factor - that knowledge would influence the expectations for future health care expenditures, so we can exclude that possibility from consideration.

Meanwhile, advances in health care technology and treatments is well understood as a long and difficult process, one that would not produce a sudden deviation in the trajectory of health care spending over time, but one that would instead produce incremental changes as time goes by.

By contrast, if changes in economic growth rates are a major factor in how health care spending per capita evolves over time, we should see that impact as a sudden change in trajectory. Likewise, we would see a similar shift in trajectory for an event-driven change, which if Obamacare did indeed bend the cost curve for the U.S., is how we should expect to see its impact.

To find out which scenario might apply, we tapped the OECD's online database that reports the amount of health expenditures per capita for the nation's that belong to the organization and provide this data to it. To account for differences in the nation's various exchange rates and the relative purchasing power of their currencies, we accessed each member nation's health care spending per capita in terms of U.S. dollars after adjusting those expenditures for each nation's relative purchasing power parity (PPP).

We next calculated the percentage change for each OECD nation in its PPP-adjusted health care spending since 2000, and then filtered those results to focus upon those nations whose economies experienced significant economic recessions in the period from 2007 onward.

The reason why we've taken this approach is to determine the extent to which a nation that experienced a significant period of economic contraction might alter the trajectory of its health care spending per capita, which would allow us to isolate a change in economic growth rate as a significant factor in influencing the trajectory of a nation's health care expenditures per capita.

Our results are graphically presented in the following chart:

Examining the data visually presented in the chart above, we find that each of the indicated nations that experienced major recessions in the period from 2007 onward has also experienced a significant deviation in the trajectory of their PPP-adjusted health care spending per capita, the degree of deviation coinciding with the duration and severity of their respective periods of recession.

Meanwhile, the general absence of small, incremental changes among all these nations would indicate that advancements in health care technologies and treatments that might reduce the cost of health care have not been a significant factor shaping the trajectory of health care spending per capita.

Focusing at just the U.S., we observe that the trajectory for U.S. health care spending per capita bends slightly downward after 2007, coinciding with the recession in the U.S., and not in or after 2010, which is when the Affordable Care Act became law, as the shift in trajectory was established well before that time.

Meanwhile, in comparing the other OECD nations experiencing recessions during this period, we see that each has seen a significant changes in the trajectory of their PPP-adjusted health care spending per capita. Changes that are far more significant for most nations than those that occurred in the United States, as the U.S. recession was much milder in comparison.

What that outcome reveals is that economic growth is a much more significant factor in determining the trajectory of the cost curve for a nation's health care spending per capita - one that far exceeds and dwarfs any contribution that the Affordable Care Act has had after it became law in 2010.

It would then be much more accurate to say that the trajectory of health care spending in the U.S. after 2007 has much more to do with the recession and the atypically slow economic recovery the nation has experienced in the years than any aspect of the passage of the Affordable Care Act or its implementation since 2010.

We therefore reject the claim that the bending of the cost curve for health care expenditures per capita in the United States may be attributed to the passage and implementation of the Patient Protection and Affordable Care Act in any meaningful way. Given what we observe in other nations, where Obamacare was not implemented, it is clear that recession and enduring anemic economic growth are a much more convincing explanation that explains the downward bending of the cost curve for health care spending that we actually observe over time.

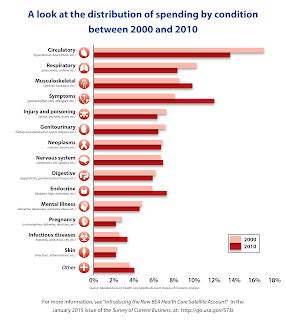

On a final note, we've excerpted some infographics on health care spending from the Bureau of Economic Analysis, which identify the trends in health care spending for a variety of conditions before the passage of the Affordable Care Act in 2010 could have had any meaningful effect, which not only demonstrate our point, but are cool to look at!

Data Source

Organisation for Economic Co-operation and Development. OECD.StatExtracts. OECD Health Statistics 2014. Health Expenditures Since 2000. [Online Database]. Accessed 22 April 2015.

Labels: health care

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

![Selected OECD Nations Health Care Expenditures per Capita as Percentage of Year 2000 Expenditures, 2000-2013 [U.S. Dollars Adjusted for Purchasing Power Parity]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiNQBOP5UDMjJX3x7FLn2L28fJLJAWFexKgwpRfKx_QiFnGEXdhJFjAB4QQuZFvUZWK1ergrLmsw7sFCl_O5Yi47F0QL5ukkiJy6XkpOCvgd8b56AD0AyUVAqsLxwy8L9buY7VJBw/s1600/selected-oecd-nations-health-care-expenditures-per-capita-adjusted-for-ppp-as-percent-of-year-2000-expenditures-2000-2013.png)