Welcome to the Friday, September 28, 2007 edition of On the Moneyed Midways, the blogosphere's only collection of the top posts from this week's best business, economics, investing, personal finance, real estate and otherwise-somehow-related-to-money blog carnivals!

Welcome to the Friday, September 28, 2007 edition of On the Moneyed Midways, the blogosphere's only collection of the top posts from this week's best business, economics, investing, personal finance, real estate and otherwise-somehow-related-to-money blog carnivals!

We're tipping our hats to The Super Saver of My Wealth Builder this week. Not only did The Super Saver do a great job in hosting the Festival of Stocks, which focused purely on whether investors should buy, sell or hold stock in Apple this past week, The Super Saver also contributed the best money-saving tip of the week in, of all places, the Cavalcade of Risk!

And while both of these are good posts, they're not the best from the week that was! For those, keep scrolling down....

| On the Moneyed Midways for September 28, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Money Stories | My Ongoing Battle with the Cash in My Pocket | The Simple Dollar | Economists have argued over what the "optimal" amount of cash is for individuals to carry around, but somehow, they never really consider the factors that Trent contends with that say the "optimal" amount is zero. Absolutely essential reading! |

| Carnival of Personal Finance | Understanding Indexed Annuities | Art Dinkin's Moment on Money | What are indexed annuities and do they make sense for your investing portfolio? Art Dinkin provides an excellent tutorial into these stock market linked investment vehicles. |

| Carnival of Real Estate | How to Sell a House in Over 6 Months | Live.Awake | It takes work on the part of a homeowner to draw the selling process out over more than half a year - Ben Cotton offers up a humorous take on the things you can do to really drag it out without simply setting the price too high! |

| Carnival of the Capitalists | The Cancer of Short-Term Thinking | Trusted Advisor | Charles H. Green once again provides Absolutely essential reading! with a post that spotlights the problems with pursuing corporate goals in the short term at the expense of destroying trust and business performance in the long term. |

| Cavalcade of Risk | Insurance Update Saves Money | My Wealth Builder | If you're reducing the amount of miles you're driving, as the Super Saver is doing, you might be able to also reduce your insurance premiums. |

| Consumer Focused Real Estate | How Buyers can Walk in the Shoes of Sellers and Listing Agents | Silicon Valley Real Estate Blog | Steve Leung delivers The Best Post of the Week, Anywhere! discussing what a prospective buyer working with an agent can do in setting their offer price. While focused on real estate, the lessons of negotiation carry well beyond the buying and selling of houses. |

| Festival of Frugality | When Frugality Becomes a Dirty Stinkin' Excuse | A Penny Closer | Is there a difference between being frugal and being lazy? Melissa finds her quality of life declines as a result of using frugality as an excuse to put essential tasks off to "save" money. |

| Festival of Stocks | Festival of Stocks #55 - Apple, Inc. Edition: Buy, Sell or Hold? | My Wealth Builder | The Super Saver hosts a special themed-edition of the Festival of Stocks gathering the financial blogosphere's best arguments for buying, selling or holding stock in Apple Computer (AAPL). |

| Odysseus Medal (Real Estate) | Believe It or Not, the 'Optimal' Mortgage is an Option ARM | Hot Property | BusinessWeek's Peter Coy reports on a study into the world of fully rational and self-interested borrowers, which finds that an adjustable rate mortgage that allows negative amortization and that has high prepayment penalties is the optimal choice. |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The BEA just released the final revision to the U.S.' Gross Domestic Product and that means it's time again for us to update our GDP growth bullet charts!

The first chart below shows the annualized percentage change in Real (inflation-adjusted) GDP for the just finalized revision for the second quarter of 2007 (3.8%), along with the percentage changes in the two preceding quarters (0.6% for one quarter ago and 2.1% for two quarters ago.)

These changes are presented against a temperature scale that illustrates the historic rates of GDP growth (or at least, since 1980) that correspond with slow growth, shown in purple at the "cold" end of the scale, and faster rates of economic growth, shown in the "temperature" transitions from purple to blue to green to yellow and finally to red at the "hot" end of the scale!

The second chart does the same, but finds the rate of economic growth over a two-quarter long period of time: 2.2% for the two quarters ending in 2007Q2, 1.3% for the two quarters ending in 2007Q1 and 1.6% for the two quarters ending in 2006Q4. Spanning these periods allows a full year's worth of specific GDP growth data to be directly represented in the bullet chart:

The two-quarter GDP bullet chart demonstrates that economic growth in the U.S. has been substantially less volatile than the one-quarter bullet chart would suggest, which we confirm in looking at the spread viewed in both charts. The one-quarter GDP bullet chart shows a 2.2% difference between high and low growth rate data, while the two-quarter GDP bullet chart indicates a 0.9% difference.

The lower volatility displayed in the rates of growth measured by the two-quarter chart underlies the forecasting ability of our GDP forecasting tool, for which we'll provide an updated forecast next week.

Labels: data visualization, gdp

Europe marks the fourth stop in our continuing series comparing the relative economic performance of the nations of the world with their nearest neighbors!

Europe marks the fourth stop in our continuing series comparing the relative economic performance of the nations of the world with their nearest neighbors!

We've built a dynamic ranking table to show each of the nations' Gross Domestic Product (GDP) adjusted for Purchasing Power Parity (PPP), 2006 population and their corresponding 2006 GDP-PPP per Capita. We've also determined each country's rate of growth since 2004 by finding the annualized rate of change in their GDP-PPP per Capita!

Once again, we find that the fastest growing nations in our survey all share a unique characteristic, which would seem to be a major factor helping spark their economic growth. We'll identify the Ten New Lions of Europe in our commentary below the table.

As with all our dynamic tables, you may sort the data by clicking on any of the column headings. Doing so will almost instantaneously sort the data in the table from low to high value or from high to low (by clicking a column heading a second time.) To restore the original order, you'll need to refresh the page in your web browser.

| 2006 GDP-PPP for Europe |

|---|

| Country | July 2006 Est. Population | 2006 Est. GDP-PPP | 2006 GDP-PPP per Capita | % Change GDP-PPP per Capita, Since 2004 |

|---|---|---|---|---|

| Albania | 3,581,655 | 20,460,000,000 | 5,712.44 | 8.0% |

| Austria* | 8,192,880 | 283,800,000,000 | 34,639.83 | 5.2% |

| Belarus | 10,293,011 | 82,940,000,000 | 8,057.89 | 8.9% |

| Belgium* | 10,379,067 | 342,800,000,000 | 33,028.02 | 4.0% |

| Bosnia and Herzegovina | 4,498,976 | 25,280,000,000 | 5,619.06 | -7.3% |

| Bulgaria* | 7,385,367 | 78,680,000,000 | 10,653.50 | 14.0% |

| Croatia | 4,494,749 | 60,260,000,000 | 13,406.76 | 9.4% |

| Cyprus* | 784,301 | 22,580,000,000 | 28,789.97 | 5.0% |

| Czech Republic* | 10,235,455 | 224,000,000,000 | 21,884.71 | 14.1% |

| Denmark* | 5,450,661 | 201,500,000,000 | 36,967.99 | 7.1% |

| Estonia* | 1,324,333 | 26,850,000,000 | 20,274.36 | 18.9% |

| Finland* | 5,231,372 | 176,400,000,000 | 33,719.64 | 7.8% |

| France* | 60,876,136 | 1,891,000,000,000 | 31,063.08 | 4.0% |

| Georgia | 4,661,473 | 17,880,000,000 | 3,835.70 | 11.6% |

| Germany* | 82,422,299 | 2,630,000,000,000 | 31,908.84 | 5.5% |

| Greece* | 10,688,058 | 256,300,000,000 | 23,980.03 | 6.2% |

| Hungary* | 9,981,334 | 175,200,000,000 | 17,552.76 | 8.6% |

| Iceland | 299,388 | 11,380,000,000 | 38,010.88 | 9.2% |

| Ireland* | 4,062,235 | 180,700,000,000 | 44,482.90 | 18.2% |

| Italy* | 58,133,509 | 1,756,000,000,000 | 30,206.33 | 4.4% |

| Latvia* | 2,274,735 | 36,490,000,000 | 16,041.43 | 18.1% |

| Lithuania* | 3,585,906 | 54,900,000,000 | 15,309.94 | 10.5% |

| Luxembourg* | 474,413 | 33,870,000,000 | 71,393.49 | 10.1% |

| Macedonia | 2,050,554 | 16,940,000,000 | 8,261.18 | 7.9% |

| Malta* | 400,214 | 8,411,000,000 | 21,016.26 | 7.5% |

| Moldova | 4,466,706 | 9,070,000,000 | 2,030.58 | 3.4% |

| Netherlands* | 16,491,461 | 529,100,000,000 | 32,083.27 | 4.3% |

| Norway | 4,610,820 | 213,600,000,000 | 46,325.82 | 7.6% |

| Poland* | 38,536,869 | 552,400,000,000 | 14,334.32 | 9.4% |

| Portugal* | 10,605,870 | 210,100,000,000 | 19,809.78 | 5.1% |

| Romania* | 22,303,552 | 202,200,000,000 | 9,065.82 | 8.5% |

| Slovakia* | 5,439,448 | 99,190,000,000 | 18,235.31 | 12.0% |

| Slovenia* | 2,010,347 | 47,010,000,000 | 23,384.02 | 9.2% |

| Spain* | 40,397,842 | 1,109,000,000,000 | 27,451.96 | 8.6% |

| Sweden* | 9,016,596 | 290,600,000,000 | 32,229.46 | 6.5% |

| Switzerland | 7,523,934 | 255,500,000,000 | 33,958.30 | 0.2% |

| Ukraine | 46,710,816 | 364,300,000,000 | 7,799.05 | 11.3% |

| United Kingdom* | 60,609,153 | 1,930,000,000,000 | 31,843.38 | 3.8% |

| European Union* | 456,953,258 | 13,060,000,000,000 | 28,580.60 | 5.8% |

| Europe (All) | 580,485,495 | 14,426,691,000,000 | 24,852.80 | 6.0% |

* - Member of the European Union.

The Ten New Lions of Europe

Assuming you've sorted the table above to make it easy, you've found that the European nations with double-digit rates of growth over the years from 2004 to 2006 are Bulgaria, Czech Republic, Estonia, Georgia, Ireland, Latvia, Lithuania, Luxembourg, Slovakia, and Ukraine. What makes these nations stand out in comparison to their neighbors, or rather, nine of them, is their tax systems and increasing levels of international trade.

Low, or Flat, Taxes

Six of the fastest growing European nations have established flat tax rates for individuals (Estonia, Georgia, Latvia, Lithuania, Slovakia and Ukraine). On the corporate side, Ireland has established the lowest corporate tax rate in all of Europe, drawing substantial international investment.

Meanwhile, Luxembourg is considered to be a tax haven and benefits greatly from its much lower taxes compared to those of its neighboring countries.

Trade

Bulgaria and the Czech Republic round out the top ten nations of Europe, and both have benefited greatly by greater ties to international markets since their days under the control of the Soviet empire. Both have increased their economic ties with the European Union, with Bulgaria becoming part of the EU in January 2007.

Sources and Acknowledgements:

- 2006 GDP-PPP Data: The World Factbook, 2007

- July, 2006 Population Estimate: The World Factbook, 2006 via Bartleby.

- Table Sorting Function: The Daily Kryogenix.

Previously on Political Calculations

2006 Economic and Population Data

2004 Economic and Population Data

- Pacific Rim: 2004 GDP Rankings

- GDP Rankings in Muslim Nations

- 2004 GDP Rankings for Asia

- European Union 2004 GDP Rankings

- GDP in Africa: 2004

- GDP Rankings of the Americas: 2004 Edition

- EU vs US: Two Years of Economic Data Later....

2002 Economic and Population Data

- EU vs USA

- Cool Tools and GSP

- GDP of the Americas

- GDP in the Muslim World

- GDP in Europe

- GDP: Africa

- GDP Along the Pacific Rim

- GDP in Asia

- GDP: And the rest...

I lie every second of the day. My whole life is a sham.

While George Costanza's whole life may be a sham, odds are, your life is isn't. George Costanza is a fictional character and you, for what it's worth, are a real person. Or so we're led to believe....

No matter what though, the subject of lying brings up an interesting question: Is it ever okay to lie?

The topic came up a while back in a discussion forum at Bressler.org, from which we've excerpted the following interchange, misspellings and all, below:

Dave: "Lying...it''s a no no, but sometimes it seems better to fib then to reveal the truth and hurt people's feelings.

We lie to our kids from the time they are born (Santa Claus).

"I know I have to bend the truth from time to time in my occupation, I don't like to but I don't always have a choice....for example, I had a voice mail first thing this morning from a client who told me his wife would be calling with questions about their tax return. She is going to ask about things that he doesn't want her to know about...I hate being put in this position.

"I don't like to lie, it doesn't make me feel very good about myself.

"What situations is it okay to extend the truth, is there any situation where it is okay??"

shotglass: "You're putting yourself at risk if you lie in a professional situation. I would let Mr. know that if she asks, you are going to tell her the truth. You might lose the business, but you keep yourself out of a much more expensive lawsuit further down the line."

Dave: "In this case, I am exepcted to avoid the issues he doesn't want her to know about, not really lie but play dumb.....if she directly asks...then I don't know what I will say because I feel like you do Shotty."

shotglass: "However, when you get home at 4 am, drunk as a skunk, some woman's lipstick and fingernail scratches all over you, somehow spent $200 or so, and can't remeber where you left your car...you'd not only better lie about where you've been, but it had better be a damned good one, too.

"You're still gonna get the skillet upside the head, but you sure as hell can't admit where you've been. Especially if you can't remember all the details..."

To paraphrase that last comment: "It's okay to lie when you can't remember the truth!"

The discussion brings up several other good questions. If it's not okay to lie in a professional situation, what circumstances make it okay to lie in a personal situation? How guilty will you feel if you lie? What are the consequences of lying? What are the consequences of telling the truth?

Surely, there's a better way to decide whether or not you should lie! And if you've read down this far, you know that:

- Yes, there's a tool you can use to help you answer this question, and

- Geek Logik's Garth Sundem worked out the math to help you answer it.

We've taken Garth's math and magnitude measurement scales and built the tool below to help you answer this question - just enter the indicated data that applies to your situation below and we'll see where that gets you....

In the tool above, the numerical threshold at which the tool will tip toward either lying or telling the truth is 1, with values greater than this suggesting that lying might be an option you consider. As always, we point this out so that you can play with shading the truth in the tool before you attempt to do it in real life. (And if you're going to lie, or tell your girlfriend what you really think about some aspect of her appearance, please take this opportunity to familiarize yourself with our tool that's designed to help you answer the question that will soon become very relevant in your life: Should You Apologize?)

More seriously, back in 2001, Jamie Walters focused on the "innocent, everyday lies" that people tell to avoid conflict or hurting someone's feelings and offered advice for how to approach the situations that might otherwise result in lies being told, arguing that avoiding the impulse to lie is key to building a stronger character. Walters' approach relies on the individual having a solid self-awareness that takes a lot of time and effort to develop. He recommends first answering the following questions to dig into why you might consider lying:

- What triggers your decision-making process to discern that a lie is the best route?

- What fear is behind this choice? For instance, your fear of being wrong, or that you'll be perceived as being unlikeable or cruel if you speak truthfully, or a fear that you lack the skill to speak the truth in a kinder, more respectful way that may be better received by someone else.

- In any particular situation, why do you believe that the lie will have the better outcome, and for whom?

Answering these questions may help you better recognize the situations in which you might go straight into "lie mode", rather than carefully considering your actions. If nothing else, doing so will help you avoid those unintended consequences from following your instinct to lie that could otherwise derail your life.

Assuming, that is, that you're a real person. We still have our doubts....

Labels: geek logik, tool

How hot is the real estate market in your area? Is it heating up or cooling down? If you're thinking about selling, what price should you set for your house when listing it for sale?

How hot is the real estate market in your area? Is it heating up or cooling down? If you're thinking about selling, what price should you set for your house when listing it for sale?

These are classic questions for any homeowner at any time, but answering these questions offers special challenges when the housing market cools off dramatically after booming for an extended period of time. Writing in the New York Times, Austan Goolsbee describes the findings of a study that tells what happened when Boston condominium owners faced this situation when that housing market crashed in the early 1990s:

From 1989 to 1992, prices in Boston fell sharply, with condominium prices dropping as much as 40 percent. For a great many of those who bought condominiums during that period, selling could be done only at a significant loss. And, basically, many people refused to sell....

Properties listed above the market price just sat there. In the Boston market over all, sellers listed their properties for an average of 35 percent above the expected sale price, and less than 30 percent of the properties sold in fewer than 180 days. In other words, much of the market went into a deep freeze as many people held out for market prices that no one would reasonably pay.

Goolsbee notes that the aversion to loss that drove the Boston real estate market in the early 1990s may be an influential factor today:

Move ahead to September 2007. Many regions may be starting down a path like that of Boston’s market freeze of the 1990s. Wherever prices decline, look for lots of sellers holding out for unrealistic prices in a vain attempt to recoup their losses. It’s a hang-up that people have, and it can cause big problems. A number of houses with high prices just sit on the market while everyone waits.

Phoenix area realtor Jonathan Dalton offers a solution for this problem, which the homeowner's listing agent might use to both clearly communicate the state of the local housing market to the homeowner while also breaking the deep freeze that might be taking hold of the real estate market:

Take your home’s value back in November 2004 before the run began. Compute what your home’s value would be based on 5% annual appreciation. Then take the last sales price (or prices for currently active homes) and find the midpoint between that price and your adjusted home value.

For example: your home was worth $200,000 in 2004. Assuming 5% annual appreciation, your home would be worth roughly $231,000 now. If currently active homes are selling at $270,000, split the difference - $250,000.

Congratulations. You now have your list price.

Dalton indicates that pricing a home this way can seriously cut through the noise of an overpriced market and lead to a rapid sale (the title of his post is, after all, "Sell Your Phoenix Real Estate in Two Weeks"). BloodhoundBlog's Greg Swann likes this approach for cutting through the pricing hang-ups the homeseller might have (this is where the fish slapping comes into play!):

It’s possible that the price you arrive at by this method will be too low for current market conditions. But, at a minimum, you will have slapped your sellers upside the head with a cold wet fish, which just might get them thinking more rationally about pricing to the market.

For our part, here's a tool you can use to determine the listing price of your home using this method:

What's nice about this approach is that a long-term homeowner still gets a good portion of the benefits of the run-up in home prices during the bubble period, while the homeowner who bought at the peak can limit their losses and avoid being locked into their overpriced homes indefinitely, hoping the market might recover enough someday to recoup their investment and thereby eliminating that element of uncertainty. Another plus is that if the home is indeed priced too low for current market conditions, as Greg Swann might fear, that would increase the likelihood of drawing multiple bids and increasing the negotiated sale price, which would greatly benefit the homeseller.

Austan Goolsbee would seem to support this kind of reality fish slapping. Here, he draws advice from Christopher Mayer, one of the economists behind the study of the Boston condominium market, in the final paragraphs of his article:

What is to be done? Well, if you are holding out for an above-market price to recoup your losses, perhaps you would do well to hear the advice that Professor Mayer gives his own family members.

"If you want to sell your house then you list it at the market price and you sell it," he said. "If you don't really want to sell then don't put it on the market. But don't say you want to sell and then set the price so high that you spend the year cleaning up every morning, having people walk through your living room and look in your medicine cabinets and reject you. That's just painful — and expensive."

His research offers a simple lesson for everyone out there waiting for a high price to push them back into the black: Get real.

Indeed.

Correction: We corrected the spelling of Austan Goolsbee's name in both the title and the post!

Labels: real estate, tool

Welcome to the Friday, September 21, 2007 edition of On the Moneyed Midways, the only collection of the top posts from this week's best business, economics, investing and somehow money-related blog carnivals!

Welcome to the Friday, September 21, 2007 edition of On the Moneyed Midways, the only collection of the top posts from this week's best business, economics, investing and somehow money-related blog carnivals!

We found lots of great stuff from this past week's money, business and economic-related blog carnivals for this week's edition of OMM. We found everything from an exploration of the "Freegan" lifestyle, to what you can learn from the Roman army, to how to take all the control you can of your job hunt and to what you should consider when investing in a barbeque grill!

And it's all below - just scroll down for the best of the week that was!...

| On the Moneyed Midways for September 21, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Bootstrapping Entrepreneurs | How You Know It's Time to Grow | Small Business Buzz | Are you facing new challenges? Do you feel like your losing control of your business? Is your management not cutting it anymore? Is your revenue stagnant? Michelle Cramer says how you answer these questions provide a clear cut sign if it's time to grow your business. |

| Carnival of HR | Controlling Your Job Hunt | Fortify Your Oasis | Rowan Manahan asks "Who here actually enjoys job-hunting?" finding that most people really dislike the lack of control they have over the process. Better yet, he charts out exactly what areas of the process over which job hunters have the most control! |

| Carnival of Money Stories | A Tale of 3 Grills | Brip Blap | What's wrong with buying cheap? Brip Blap answers the question with the story of wasted time and money in Absolutely essential reading! |

| Carnival of Personal Finance | Climbing the Consumption Ladder Together | Advanced Personal Finance | Who do you compare yourself to when it comes to your own conspicuous consumption? KMC argues that TV isn't so influential as that one person near you who's just ahead of you on the consumption scale. |

| Carnival of Real Estate | Apples, Oranges, and the Cost of Different Heating Fuels | Asheville Mountain Real Estate Blog | Having trouble choosing between homes heated by #2 fuel oil, electricity, natural gas, propane or kerosene? Black Bear Realty runs the numbers to show which option is best in Asheville, North Carolina. |

| Carnival of the Capitalists | Put Your Trust in Systems, Not in Genious | Three Star Leadership | Wally Bock draws on the Roman Empire, Toyota, Jack Welch, Frederick Winslow Taylor and W. Edwards Deming in producing The Best Post of the Week, Anywhere! |

| Ethics, Values, and Personal Finance | Dumpsters Get Popular: Freegans and Junk Yard Tours | Green LA Girl | siel explores both the Freegan alternative-lifestyle and an entrepreneurial business that's found opportunity in providing tours of junkyards in search of disposed electronic items! |

| Festival of Stocks | To Time or Not to Time | Money and Such | Shadox lays out what's wrong with trying to time the market. The quick summary: it's financially unhealthy, you're not that smart and even if beat the odds against you, the government will wipe out a good portion of your gains. |

| Odysseus Medal (Real Estate) | Should Lenders Be Permitted to Sell Real Estate? | Searchlight Crusade | Dan Melson offers Absolutely essential reading in contending that the National Association of Realtors don't have the best interests of buyers or the real estate industry at heart in pushing for laws prohibiting lenders from being able to directly sell the real estate they own. |

| Stock Market Carnival | Are Recessions a Good Thing? | Adventures in Money Making | WBL believes that the U.S. may already be in a recession and provides a quote from a newsletter that argues that "Corrections, like revolutions, confessions and forest fires, are unpleasant. But they are often necessary. They clear away the dead wood." |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Now that health care has once again become a primary political topic in the United States, and since the largest survey ever in examining how the nations of Europe fare with respect to cancer survival rates has been released, we thought we might compare the U.S. with Europe!

We adapted a graphic from the BBC showing how the United Kingdom compared with the other nations included in the Eurocare 4 study to include the U.S. below. The chart illustrates the percentage of those diagnosed with cancers of all types who survive at least five years after their initial diagnosis:

The Times confirms the difference between U.S. and European cancer survival rates:

Europe’s survival rates are lower than in the US, where 66.3 per cent of men and 62.9 per cent of women survive for five years, compared with 47.3 per cent of European men and 55.8 per cent of women.

The Times indicates that the difference in 5-year cancer survival rates may be a result of earlier diagnosis in the U.S. compared to European nations. An opinion by the Center for Science in the Public Interest's Merrill Goozner on his blog suggests that the earlier diagnosis rate may be the result of additional tests ordered by U.S. doctors:

A cancer epidemiologist would probably explain the data this way: In the U.S., we conduct far more tests, which turn up many more cancers. That in turn leads to higher survival rates because we wind up treating some cancers at an earlier stage. It probably even saves some lives that otherwise would have been lost to the disease.

But there's a downside to all those tests. They have relatively high false positive rates. In other words, they turn up minor cancers that may never have progressed to full-blown neoplasms. Yet, they are treated anyway since determining which ones will progress is impossible at that early stage.

All in all, the quality of cancer treatment in the United States offers a powerful indication why high-ranking individuals in other nations might pass up the health care systems in their own countries and travel to the U.S. for treatment.

Previously on Political Calculations

- Natural Life Expectancy in the United States

Where would the U.S. rank in the world if fatal injuries that are independent of the health of individuals who die from them, such as those from motor vehicle accidents and homicides, are taken into account in international life expectancy data?

- Estimating Your Life Expectancy

Our tool can help you estimate how many more years you can statistically look forward to! Plus, we link to other tools that let you account for the things that can affect your health.

- Redefining the Health Care Debate - Part 1

We broke apart the United States to better describe the relationship between health care spending and national economic output.

- "Fighting Malaria with Math"

We took on the scourge of malaria with a tool based on math that can help better target malaria control efforts.

- The Cost of Risk vs. Benefit

When is it worth taking a medical test for which there's little chance that you'll benefit? Our tool can help you answer the question - plus the same math applies if you're looking to play the lottery!

- Pigou Taxing Your Food

u.K.-based researchers have proposed an excise tax for food they deem unhealthy. We run the numbers to find out how much money U.K. taxpayers would have to shell out and also find out how much it will cost to delay one obesity-related death by one year!

- A Clouded Eye on Socialized Health Care

What happens when a national health care bureaucracy gets to define what constitutes medical necessity? We tell the story of an elderly woman with cataracts....

- Should You Go To the Doctor?

Our very much tongue-in-cheek tool can help you decide if you should seek medical treatment for that embarrassing condition of yours!

Labels: health care

We've just updated our signature tool The S&P 500 at Your Fingertips to incorporate all the latest stock market and inflation data through August 2007.

Why do we wait so long to update the tool? After all, August ended nineteen days ago. As it happens, we are, more or less, held hostage to when the U.S. Bureau of Labor Statistics releases their inflation data for the previous month. It just wouldn't do to only make partial updates for the The S&P 500 at Your Fingertips tool!In any case, here is the S&P 500's compound annual growth rates Since January 1871, Since August 2006 (Year over Year) and Since January 2007 (Year to Date):

| Selected S&P 500 Performance Data, January 1871 through August 2007 | |||

|---|---|---|---|

| Annualized Rates | Nominal Rate of Return (%) | Rate of Inflation (%) | Real Rate of Return (%) |

| Since January 1871 | 9.15 | 2.08 | 7.07 |

| Year over Year | 15.17 | 1.97 | 13.20 |

| Year to Date | 5.53 | 4.70 | 0.83 |

For fans of dividends, the following chart shows the annual dividends per share (not adjusted for inflation) for the S&P 500 since January 1871:

Since January 1953, Annual Dividends per Share in the S&P 500 have grown at a very stable average annualized rate of 5.4%.

The following chart shows where that probability stood with the FOMC meeting today, using the one-quarter averages of the Federal Funds Rate and spread between the 10-Year and 3-Month Treasuries as of the close of business yesterday (17 September 2007):

The change in target rate occurs as the Fed has already effectively reduced the one-quarter average of the Federal Funds Rate to 5.16%, which means that we're already well on the way the newly official target rate. With the one-quarter average of the 10-Year and 3-Month Treasury yield spread at 0.24%, our recession probability tool finds the probability of a recession occurring in the U.S. in the next 12 months is now 29.1%.

When the Fed Didn't Duck

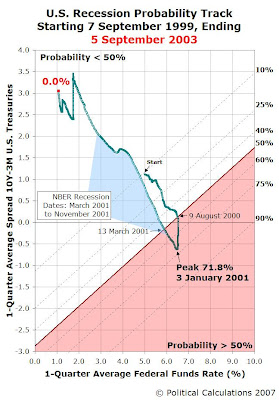

Just for fun, we thought we would revisit the recession probability tracks of the last two most recent recessions. The first chart below spans the four years from 7 September 1999 through 5 September 2003, which includes the recession that ran from March 2001 through November 2001:

In this chart, we find that the recession probability threshold breached the 50% probability threshold on 9 August 2000, roughly 7.5 months before the National Bureau of Economic Research's start date for the recession in March 2001. The probability of recession peaked at 71.8% on 3 January 2001, and dropped below the 50% threshold on 13 March 2001, about 8 months before the recession officially ended.

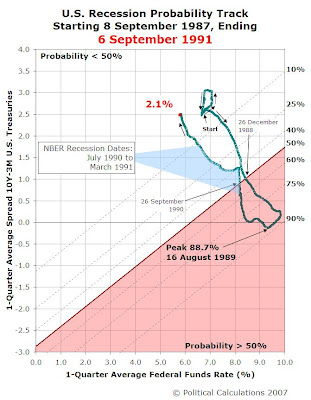

The next chart shows the recession probability track from 8 September 1987 to 6 September 1991, which includes the second most recent recession, which ran from July 1990 to March 1991:

This chart shows that in this four year timeframe, the probability of recession first broke through the 50% level on 26 December 1988 (some 16 months before the NBER's start date for the recession) and stayed well above this level until peaking at a probability of 88.7% on 16 August 1989. The probability of recession dropped below the 50% level on 26 September 1990, just five months before the official end of the recession.

This period is somewhat remarkable in that the Treasury yield curve did not invert until late-May 1989, still over a year before the NBER's official start date for this recession.

Labels: recession forecast

The average U.S. college student in 2007 can expect their cost of a college education to go up by 6.23% compared to what they paid in 2006.

The average U.S. college student in 2007 can expect their cost of a college education to go up by 6.23% compared to what they paid in 2006.

We determined this figure using data collected by the U.S. Bureau of Labor Statistics. The seasonally-adjusted rate at which college tuition and fees increased from July 2006 to July 2007 was 6.23%, while the seasonally adjusted rate of inflation for all items in the Consumer Price Index over the same period increased by 2.38%.

That means that the average rate at which college tuitions and fees increased for all cities in the United States was 2.62 times the rate of general inflation in the U.S. economy. Over the past 20 years, the cost of college tuition has generally increased at a rate of twice that of inflation, with increases typically ranging between 6-7% per year.

Previously, we established that the key driving factor behind the skyrocketing rate of college tuition in the U.S. is the financial aid provided by the government in the form of grants and student loans that are intended to reduce the cost of college education, especially for poor students. Rather than reducing costs however, these government-sponsored financial aid subsidies instead underwrite the massive growth in the prices U.S. colleges and universities charge for tuition.

Another downside to these programs is that they also make it difficult for students to establish just how much they'll have to pay for their college education. Since the amount of needs-based financial aid a student receives varies from student to student and year to year, the subsidy programs add a significant element of uncertainty for many economically disadvantaged students.

But, what if this weren't the case? What would happen if U.S. colleges and universities instead did away with these government-sponsored needs-based education subsidy programs and just lowered their tuitions to accommodate poor students instead?

We now know the answer. In 2004, Eureka College, a small liberal arts university in northwestern Illinois, announced that it would eliminate its needs-based financial aid programs and instead would dramatically reduce its tuition by just over 30%. Called "The Eureka Idea", Eureka College's administrators described what they hoped would be the benefits:

Eureka administrators said they hope to increase the size of the college's applicant pool by offering a tuition price significantly less than other private four-year universities.

Ellen Rigsby, Eureka's director of financial aid, said the new system is more user-friendly, offering applicants a standard tuition fee free of the number crunching that need-based tuition adds to the financial aid package.

"It's more straightforward," Rigsby said. "Instead of getting more (need-based) aid, you'll know exactly what you'll be paying."

The easiest way to measure the success of the program is to examine the school's level of enrollment. The following table extracts data from the Illinois Board of Higher Education's enrollment profile for Eureka College for 2002 through 2006. We've highlighted the years since the program took effect in the 2005-06 school year and calculated the percentage changes in enrollment from each previous year:

| Eureka College Enrollment 2002 through 2006 | ||

|---|---|---|

| Academic Year | Enrollment | Percentage Change |

| 2002-03 | 555 | N/A |

| 2003-04 | 490 | -11.7% |

| 2004-05 | 520 | + 6.1% |

| 2005-06 | 537 | + 3.3% |

| 2006-07 | 575 | + 7.1% |

Remarkably, in rising to an enrollment level of 575 students in 2005, the school broke its previous enrollment record set in 1971 of 566 students.

But that's not all.

On September 7, 2007, the Peoria Journal Star reported that the college broke its enrollment level again, increasing 17% over its record 2006 enrollment. The PJStar's Clare Jellick describes the school's reaction:

Eureka College is basking in its second year of record enrollment. The newest enrollment numbers show the student body increased by about 17 percent.

That is the equivalent of about 100 additional students. Assistant Dean Scott Wignall said this is the biggest increase from one year to the next in recent memory.

He said the news shocked faculty members who asked him about enrollment at the start of the school year.

"Their jaws kind of dropped. They couldn't quite believe it. Six hundred (students) was this unachievable goal, this mythological number. . . . To cross it and then some was just great news for everybody here," Wignall said.

By replacing student needs-based financial aid subsidies with lower and more transparent tuition costs, Eureka College is succeeding in boosting its enrollment, with a rate of growth significantly outpacing other higher-education institutions in central Illinois:

Eureka College is the only area school contacted that saw an increase in fall enrollment over last year. Other colleges and universities in central Illinois either stayed about the same or had decreases in enrollment of between 1 and 2 percent.

It would seem that the combination of cost transparency and low tuition rates is a winning formula for students and schools in the world of higher education.

Labels: education

Welcome to this special Saturday, September 15, 2007 edition of On the Moneyed Midways, the blogosphere's only collection of the top posts from this week's best business, economics, investing and otherwise money-related blog carnivals!

Welcome to this special Saturday, September 15, 2007 edition of On the Moneyed Midways, the blogosphere's only collection of the top posts from this week's best business, economics, investing and otherwise money-related blog carnivals!

We're happy people this week! Normally, when we track down the blog carnivals we cover for each edition of OMM we use Blog Carnival as our primary tool for finding the past week's something-to-do-with-money-related blog carnivals. It gets the job done, but Blog Carnival's clumsy user interface, sluggish response times, and sporadically-updated listings of the most recent carnivals have caused us to grow to hate Blog Carnival.

What makes us happy this week is that we've found an alternative! Google's Advanced Blog Search makes the job of finding the most recent versions of the blog carnivals we scan to produce each edition of OMM a lot easier. It's not perfect, as we find a lot of scrolling is involved to find good results in a general search, but finally, there's competition out there with a new, highly useful product!

We realize we may be the only people using Google's Advanced Blog Search for this purpose right now, but hopefully, the people behind Blog Carnival will take this as a clear signal that they need to start some serious innovating to stay relevant.

And that's all our commentary this week! The best posts of the week that was await you below....

| On the Moneyed Midways for September 15, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Personal Finance | Not Overpaying When Buying a Home | Silicon Valley Real Estate Blog | Steve Leung argues that the best way to avoid paying too much for a house is to read the signals being sent by your potential neighbors, and offers tips for negotiating a satisfactory deal. |

| Carnival of Real Estate | Attn. Market Timers! The EXACT Best Day to Buy! | Blog.FranklyRealty | Frank Borges Llosa cuts through the real estate market noise and has, in our view, outlined an ideal method prospective home buyers can use when deciding when they should buy their next home. |

| Carnival of the Capitalists | Insiders Tripping Over Each Other to Buy | Trader's Narrative | How should we read the signals being sent by company insiders with their recent stock trades? Babak examines the psychology of insiders in reading the tea leaves and what it might mean for the future of the stock market. |

| Carnival of the Recruiters | What I Wish Recruiters Knew | JibberJobber | Jason Alba worked with a lot of recruiters in his job search after being laid off and describes what those in the business of hooking up job seekers with job providers really ought to be doing for their opportunity seeking clients. Absolutely essential reading! |

| Carnival of Trust | Why Social Networks Don't Work for Business | Oracle AppsLab | Paul Pedrazzi discusses why the concepts of Web 2.0 won't cut it when it comes the relationships needed in a business to get things done. |

| Cavalcade of Risk | WSJ on the Dutch Health Care System | Healthcare Economist | The Dutch have begun implementing free market reforms to their national health care system. Jason Shafrin praises the elimination of centralized pricing and rationing, but worries over what type of basic health insurance will be mandatory and is concerned over the private insurer's lack of negotiating power. |

| Festival of Stocks | S&P 500 Next Gen Volatility Model Results | Neural Market Trends | Tom Ott reports that the model he's developed to predict the direction of the S&P 500's Historical Volatility is achieving an accuracy between 60-70% (and shares a link to his results.) |

| Odysseus Medal (Real Estate) | New You Can Use - Real Estate Is a Business | BloodhoundBlog | Kris Berg describes not just what it takes to achieve long term success in real estate, but in any business in The Best Post of the Week, Anywhere! |

| Small Business Issues | The Powerful (and Addictive) Nature of Giving | Millionaire Mommy Next Door | The Millionaire Mommy Next Door is inspired by Oprah and former President Bill Clinton's highlighting of charitable donors on a recent show and enters the world of micro-financing third-world entrepreneurs through Kiva. |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

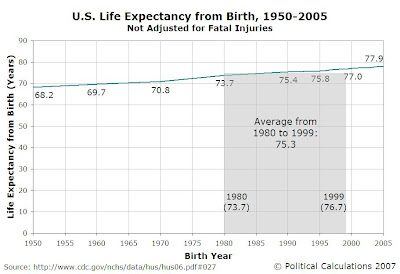

Yesterday, Reuters reported that the U.S. Centers for Disease Control had projected that U.S. children born in 2005 are expected to live for 77.9 years, continuing a decades-long trend of increasing life expectancy from birth in the U.S. We thought we'd take a moment to show how U.S. life expectancy from birth has changed from 1950 through 2005:

Reuters goes on to say that the death rates from the top three natural causes of death in the United States, heart disease, cancer and stroke, all decreased in 2005 compared to the previous year, helping to contribute to the increase in U.S. life expectancy. What the Reuters article doesn't tell us is something we find more interesting. Here, what they don't tell us is that the CDC's life expectancy figures also incorporate non-natural causes of death, such as those resulting from fatal injuries, which include motor vehicle accidents, falls, accidental poisonings, homicides, et cetera.

This is important because these factors represent the leading causes of premature death in the United States for all ages up through 44 years old. Premature deaths caused by these non-natural factors result in a lower life expectancy figure for the U.S., which gives a somewhat misleading picture of the general health of U.S. individuals.

What makes this relevant is that the Reuters article also had this to say:

The United States, a country of 300 million people, ranks 42nd in the world in life expectancy, according to previously released data.

This low ranking in life expectancy is often pointed to as being the result of the deficiencies of the health care system in the U.S. The problem with this thinking however is that it does not account for the fact that the U.S. has a disproportionate number of individuals who die as the result of fatal injuries compared to the other wealthy nations of the world. This does not reflect upon the quality of health care in the U.S., in that these events almost universally occur independently of the condition of health of the individuals who die as a result of these factors.

Two University of Iowa researchers, Robert L. Ohsfeldt and John E. Schneider, reviewed the data for the nations of the OECD to statistically account for the incidence of fatal injuries for the member countries. The dynamic table below presents their findings, showing both the average life expectancy from birth over the years 1980 to 1999 without any adjustment (the actual "raw" mean), and again after accounting for the effects of premature death resulting from a non-health-related fatal injury (the standardized mean). You may sort the data in the dynamic table from low to high value by clicking on the column headings, or from high to low value by clicking a second time.

| Table 1-5: Mean Life Expectancy at Birth, OECD Countries, Actual and Standardized by OECD Mean Fatal Injury Rates, 1980-99 |

|---|

| OECD Nation | Actual (Raw) Mean (Does Not Account for Fatal Injuries) | Standardized Mean (Accounts for Fatal Injuries) |

|---|---|---|

| Australia | 76.8 | 76.0 |

| Austria | 75.3 | 76.0 |

| Belgium | 75.7 | 76.0 |

| Canada | 77.3 | 76.2 |

| Denmark | 75.1 | 76.1 |

| France | 76.6 | 76.0 |

| Germany | 75.4 | 76.1 |

| Iceland | 78.0 | 76.1 |

| Italy | 76.6 | 75.8 |

| Japan | 78.7 | 76.0 |

| Netherlands | 77.0 | 75.9 |

| Norway | 77.0 | 76.3 |

| Sweden | 77.7 | 76.1 |

| Switzerland | 77.6 | 76.6 |

| United Kingdom | 75.6 | 75.7 |

| United States | 75.3 | 76.9 |

If you've sorted the data in the dynamic table, you find that without accounting for the incidence of fatal injuries, the United States ties for 14th of the 16 nations listed. But once fatal injuries are taken into account, U.S. "natural" life expectancy from birth ranks first among the richest nations of the world.

Previously on Political Calculations

- Estimating Your Life Expectancy

Our tool can help you estimate how many more years you can statistically look forward to! Plus, we link to other tools that let you account for the things that can affect your health.

- Redefining the Health Care Debate - Part 1

We broke apart the United States to better describe the relationship between health care spending and national economic output.

- "Fighting Malaria with Math"

We took on the scourge of malaria with a tool based on math that can help better target malaria control efforts.

- The Cost of Risk vs. Benefit

When is it worth taking a medical test for which there's little chance that you'll benefit? Our tool can help you answer the question - plus the same math applies if you're looking to play the lottery!

- Pigou Taxing Your Food

u.K.-based researchers have proposed an excise tax for food they deem unhealthy. We run the numbers to find out how much money U.K. taxpayers would have to shell out and also find out how much it will cost to delay one obesity-related death by one year!

- A Clouded Eye on Socialized Health Care

What happens when a national health care bureaucracy gets to define what constitutes medical necessity? We tell the story of an elderly woman with cataracts....

- Should You Go To the Doctor?

Our very much tongue-in-cheek tool can help you decide if you should seek medical treatment for that embarrassing condition of yours!

Labels: health care

Today, we're going to redefine the way you look at health care spending among the nations of the world.

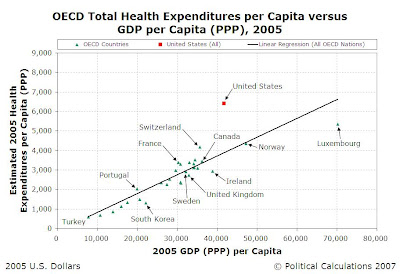

We're going to start by looking at the total Health Expenditures per Capita across the member nations of the Organisation of Economic Co-operation and Development (OECD) against their Gross Domestic Product per Capita, adjusted for Purchasing Power Parity, for 2005:

The chart above presents the data with a linear regression to show the traditional correlation between national economic output and health care spending. In it, we see that the United States appears to spend a disproportionate amount of money upon health care, especially as compared to the other member nations of the OECD.

Since many of the other OECD nations have national health care programs, it is often argued that the lack of such a comprehensive program in the United States accounts for the reason why its health care expenditures are so disproportionate with respect to its economic output per capita compared to those other nations. Advocates for such a program frequently cite this disparity as a reason why a universal health care program should be enacted in the U.S., where presently, such spending is comparatively unconstrained with respect to other nations of the world.

What's Wrong with That?

The problem with this view is that the analysis upon which it is based is flawed. For any comparative analysis to be valid, care must be taken to ensure that the fundamental units behind the analysis are directly comparable. Where a comparison between the United States and the other member nations of the OECD is involved, that means we must consider the size of the economic output of each nation, the total health expenditures for each, and the size of their populations.

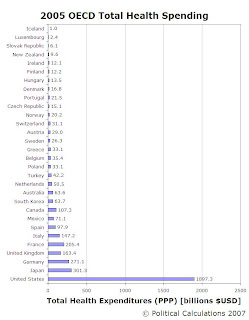

Our following chart shows the total GDP (adjusted for PPP) for the member nations of the OECD for 2005, ranking the nations from low to high according to their 2005 GDP (PPP):

The next chart shows the total public and private Health Expenditures (adjusted for PPP) for the OECD nations. We obtained these figures by multiplying the 2005 Health Expenditures per Capita (from above) by the Population for each nation for that year. Again, the nations are ranked from low to high according to their 2005 GDP (PPP):

The third chart shows the total Population for the member nations of the OECD. As with the other two charts, the nations are ranked according to their 2005 GDP (PPP):

What all three of these charts demonstrate is that the United States' economic output, health expenditures and population all completely dwarf those of the other nations, often by several orders of magnitude. These factors alone make nation-to-nation comparisons dicey at best, and outright misleading at worst. It would be more valid to compare individual states within the United States against many, if not all, of the other OECD member nations.

A Better Comparison

So, why don't we do that? After all, it has been observed that the economic output of each of the U.S. states is comparable to that of other nations. Comparisons between the populations of individual U.S. states and OECD nations would certainly be more consistent.

So, why don't we do that? After all, it has been observed that the economic output of each of the U.S. states is comparable to that of other nations. Comparisons between the populations of individual U.S. states and OECD nations would certainly be more consistent.

It also makes sense in how the government health care programs that the United States does have are administered. Here, while the U.S. does not have a universal health care program covering its entire population, it does have several large-scale national health care programs, such as Medicare for the elderly, Medicaid for the poor, and the State Children's Health Insurance Program (SCHIP) (originally intended for poor children but being expanded to include children whose families can easily afford health care), among others. Many of these programs are administered at the state government level, which helps make a U.S. state to OECD nation comparison of more valid.

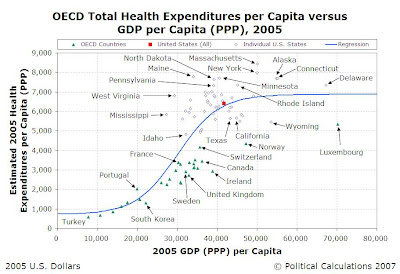

Our next chart takes our first chart showing the 2005 OECD Nations' Health Care Expenditures per Capita vs GDP (PPP) per Capita, and simply adds some fifty data points for the individual U.S. states (see Note 1 for a discussion of how we found these figures for 2005):

We can see from this chart that the linear regression no longer does such a good job in describing the relationship between total health expenditures per capita and GDP (PPP) per capita for the set of data. We next sorted all our individual U.S. state and OECD member nation data from low to high on the basis of their GDP (PPP) per capita and used ZunZun's 2-D function finder to find a better regression model. We selected a sigmoid with offset function as being the best fit for the data, which we've shown in the chart below (we've also identified a number of the individual U.S. states in the chart, as well):

Our tool below takes the formulation we found for our sigmoid regression model and provides the corresponding expected level of health expenditures for a given level of GDP (PPP):

We believe the sigmoid regression model provides a significantly better representation of the relationship between health care expenditures and economic output. While built from empirical data, it has an advantage over the linear regression model in that it better agrees with established economic theory.

The main weakness of the linear regression model is that it assumes that with increasing economic output (or income), increasing health care expenditures will result. The problem with this model however is that it also assumes that there are no diminishing returns to additional health expenditures. The economic "law" of diminishing marginal utility suggests that there is a limit to how much additional benefit an individual or a population may receive from additional spending for health care.

After a certain point, it's not worth spending more for additional health care because you're not getting the same bang for the buck.

These diminishing returns are reflected in the sigmoid regression model we've illustrated above. Instead of health expenditures forever escalating with increasing economic output (or national income), we instead find that amount of expected health expenditures for a given level of GDP (PPP) follows an S-shaped curve, one that rises with growing GDP (PPP) at the low range and transitions to a relatively fixed level at higher ranges of GDP (PPP), corresponding with the diminishing returns one should expect from additional health care spending.

Coming Soon

We'll discuss what this relationship really means for the U.S. and the nations of the world. A quick preview: the United States is, collectively, spending about as much as we should expect on health care with respect to its economic output. Nations with long established universal health care programs are, in effect, achieving their lower expenditures by suppressing the amount of health care their populations may receive below the more natural, unconstrained levels that we see in nations without such established national health care programs.

Notes

[1] Total health expenditures may be found by adding Personal Health Care Expenditures with the expenditures associated with government program administration, public health programs and investments. We were only able to find a projected value of Personal Health Care Expenditures of 1.6778 trillion US dollars for 2005 from Table 125 of the U.S. Census Bureau's 2007 Statistical Abstract of the United States, so we had to estimate this component for each of the states for 2005.

We did this by extracting the Personal Health Care Expenditures by State for 2004, which provided this component of the Total Health Care Expenditures for all 50 states and the U.S. as a whole. We found the percentage of each state's personal health expenditures with respect to that of the entire U.S. We then assumed that these percentages from 2004 would be relatively unchanged in 2005, and multiplied these percentages by the $1.6778 trillion projected national personal health expenditures we found earlier to approximate the state personal health expenditures.

We then divided all these figures by the populations of each state to find the Personal Health Expenditures per Capita for each of the states. We next took the OECD's projected value of U.S. total health expenditures per capita for 2005 of $6,401 and divided it by the U.S. personal health expenditures per capita of $5,660.40 (this figure is obtained by dividing the $,6778 trillion personal health expenditures by the 2005 U.S. population estimate of 296,410,404). This gives us a multiplication factor of 1.131, which represents the portion of total health expenditures associated with government program administration, public health programs and investments.

These costs were distributed among all the states by multiplying this factor by each state's estimated Personal Health Expenditures per Capita for 2005, thereby providing our estimate of the Total Health Expenditures per Capita for each individual state in the U.S.

Labels: health care, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.