We've also projected into September 2009, where we would expect that, at best, the S&P 500 will be mostly flat with respect to its average value in August 2009.

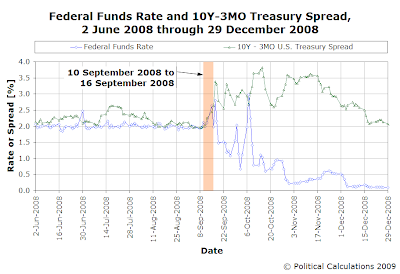

But that ignores the effects of what we've hypothesized to be a predictable source of noise that can affect the level of stock prices: the unwinding of the hedging strategy of bond traders in response to a narrowing of the spread in U.S. Treasuries.

Here, we anticipate that the narrowing of the Treasury yield spread of a year ago, for which bond market traders utilized stock options and stock purchases as a means of hedging against the implicit inflation risk implied by such a change, will result in a larger than average number of shares being sold in the stock market as the related options and bond required holding periods expire. The resulting increase in the quantity of shares being sold will, without a corresponding increase in the quantity demanded for shares, result in falling stock prices.

We last saw this kind of activity take place in June 2009, the noise from which resulted in the S&P 500 just missing our target range for the month. Consequently, we expect a similar outcome in this month, as this event would appear to be scheduled to occur around the dates from 10 September 2009 to 16 September 2009.

Suspecting then that stock prices can be expected to go significantly lower during this month, we plan to sell the index fund that closely tracks the S&P 500, which also represents all our retirement savings, later this week. We suppose we could wait for next week, but we don't expect much in the way of additional gains by holding out that much longer. We'll likely do so this Thursday, as we plan for an extended holiday weekend and would rather not have to worry about the market.

We'll look at resuming our investment after the dust clears....

Which, as our chart indicates, they did....

We think that would be the equivalent of reversing the polarity on Star Trek - instead of stock prices falling a year later as bond traders unwind their hedged positions, we would expect that additional funds would come out of the bond market to buy stocks, driving their prices upward.

It's still a disruptive noise event, in that this change in stock prices is not (as yet) supported by a corresponding change in the expected future growth rate of their dividends per share, so the effect of this noise upon stock prices will have an expiration date.

Which suggests to us that the market will have a significant selling opportunity in the near future, sometime soon after 16 September 2009.

We'll just have to wait and see....

Labels: chaos, forecasting, SP 500

Welcome to the Friday, August 28, 2009 edition of On the Moneyed Midways! Here, we present the best posts we found in the past week's business and money-related blog carnivals and declare one to be The Best Post of the Week, Anywhere!

Welcome to the Friday, August 28, 2009 edition of On the Moneyed Midways! Here, we present the best posts we found in the past week's business and money-related blog carnivals and declare one to be The Best Post of the Week, Anywhere!

The top posts from other carnivals that come close to that level earn the title of being Absolutely essential reading! But make no mistake, every post that appears in each edition of OMM ranks as being the best post we found in the particular blog carnival.

The proof of that claim can be found by simply scrolling down and clicking the appropriate post titles. Enjoy, and see you next week!....

| On the Moneyed Midways for August 28, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Debt Collection Statute of Limitations | Damon Day & Associates | If you're in debt and can't make good on it, how long do you need to hold out before your creditors can no longer collect damages from you in court? Damon Day provides the state-by-state information you need. |

| Carnival of Personal Finance | Bank Fees and Billing Errors | Beyond Paycheck to Paycheck | Michael was shocked to find his local bank charging fees for things they never had before. Here, he tells the whole story and compares the customer service he received from the bank to that of Fedex after they made an error. |

| Carnival of Real Estate | Las Vegas Property Auctions - Deal or No Deal? | Jacqulyn Richey | Jacqulyn Richey doesn't think real estate auctions offer the deals they used to when they weren't held as often, but is looking forward to two coming up in Las Vegas. Here, she offers useful advice to anyone considering participating in a real estate auction. |

| Cavalcade of Risk | Hurricane-Proof your Roof: Insurance, Inventories and Adjusters | The Roofery | A very authoritative post that answers the questions of what kind of insurance do you need and what do you need to do and what can you expect after your house is damaged by a hurricane. If you live anywhere near a hurricane-ravaged coast, Chris Brooks' post is Absolutely essential reading! |

| Festival of Frugality | Credit Crunch: Luxuries We Won't Say No To… | One Advice | When money's is tight, where are you unwilling to compromise? OneAdvice reviews the findings of research by British Telephone that suggests that broadband, fresh produce and mobile phone service are *the* three things people on all budgets "must-have." |

| Carnival of Money Stories | If You Want to Get Ahead, Stop Taking This Path! | Redeeming Riches | Jason Top tells the story of Tom and Sue, who had some specific financial goals, but lacked the discipline to reach them. The Best Post of the Week, Anywhere! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

When GM (formerly known as "General Motors") joined with its sister government entity, the EPA (rumored to be some sort of "Environmental Protection" Agency), and announced that its Chevrolet Volt vehicle would get the equivalent of 230 miles to the gallon of gas, many people were highly skeptical of this performance claim.

When GM (formerly known as "General Motors") joined with its sister government entity, the EPA (rumored to be some sort of "Environmental Protection" Agency), and announced that its Chevrolet Volt vehicle would get the equivalent of 230 miles to the gallon of gas, many people were highly skeptical of this performance claim.

They were right to be. Tim Haab, for one, did the math and worked out that this level of mileage corresponded to just a 51.11 mile long trip in the Chevy Volt - the first 40 miles powered by the vehicle's battery, with the remainder provided by the vehicle's 50-MPG gasoline-powered engine, which would consume about 0.22 gallons of gasoline.

Clearly, the insider collaboration between the government's motor vehicle production unit and its environmental regulation enforcement unit has failed to produce a useful measure that consumers can use to reasonably compare the fuel economy performance of alternative fuel and hybrid vehicles.

There's a better way. The organization behind the Progressive Automotive X-Prize has employed a metric known as the Miles-Per-Gallon-Energy Equivalent (MPGe) specifically to compare the fuel economy of alternative-fuel powered and hybrid vehicles. Better yet, they've posted a spreadsheet for doing the necessary math to compare the fuel economy of these kinds of vehicles with respect to ones just powered by gasoline, with which most consumers are familiar.

And now there's us. We've adapted the X-prize's spreadsheet calculator into an easier to use online tool, one that allows you to find the MPGe of a vehicle that is powered just by gasoline or an alternative fuel or a hybrid that uses any two of the common conventional or alternative fuel technologies in development today. Select the fuel type in the tool below and we'll find the comparable fuel economy metric for the fuel consumed and travel distance you also enter.

The default values we've provided in the tool above are those we've found for the Chevy Volt, taking the distance Tim Haab found to correspond with the 230 MPG figure, with the amount of gasoline used we found earlier in this post that corresponds to that figure as well as the energy capacity of the vehicle's lithium ion batteries, which are assumed to be fully expended in the vehicle's first 40 miles of driving.

At the resulting 74 MPGe, the Chevrolet Volt is much less impressive than the government-owned carmaker and environmental agency would have us believe.

More About the Results and a Quick Guide to Abbreviations

The results in the tool above are given with respect to gasoline as the energy equivalent. In the notes for their spreadsheet, the automotive X-prize people indicate that the units of fuel used is "the amount of fuel delivered from the pump (or plug) to the vehicle." They also state that "in the case of electricity, this is measured from the wall plug - i.e., prior to any losses incurred during battery charging."

The units "kWh" for Electricity stand for "kilowatt hours". The units "SCF" for H2-Gas and H2-Liquid are "Standard Cubic Feet". E85 is a gasoline-ethanol mixture, which is 85% ethanol/15% gasoline. "CNG" stands for "Compressed Natural Gas", while "LPG" is "Liquified Petroleum Gas" and "H2" indicates "Hydrogen".

Previously on Political Calculations

Labels: environment, tool

Welcome to the August 26, 2009 edition of the Cavalcade of Risk! For those of you joining us for the first time, we here at Political Calculations are mostly known in the blog carnival world as the home of On the Moneyed Midways, an "über-carnival" where each week, we present the best posts we found in our review of the week's business and somehow-money-related blog carnivals.

Welcome to the August 26, 2009 edition of the Cavalcade of Risk! For those of you joining us for the first time, we here at Political Calculations are mostly known in the blog carnival world as the home of On the Moneyed Midways, an "über-carnival" where each week, we present the best posts we found in our review of the week's business and somehow-money-related blog carnivals.

In our last edition of OMM, we featured excerpts from another blog carnival host's rant about off-topic contributions to blog carnivals, which appears to have really hit home with this week's contributors. The last time we hosted the Cavalcade of Risk, we had 48 contributors. This time, 30. And that's counting the clueless goons who apparently didn't get the memo....

Well, non-memo reading clueless goons, welcome to Political Calculations' edition of the Cavalcade of Risk. In addition to that "über-carnival" thing we mentioned earlier, we're also very specifically known by fans of the Cavalcade of Risk as being the people who created the Cavalcade of Risk Contributed Blog Post Rating System, which we last deployed in a special double issue of the Cavalcade of Risk (Part 1 and Part 2).

You see, we believe that one of the best ways to discourage people from making bad decisions is to make them feel the pain from making a bad decision. If, for example, you've contributed an off-topic post to this edition of the Carnival of Risk, or just a really badly written one, we're going to make it hurt. How? Well, let's let the Cavalcade of Risk Blog Post Rating System do the talking for us. Here's how to interpret the ratings:

| Blog Post Rating System for Blog Carnivals | ||

|---|---|---|

| Topicality [Capital Letter] |

Information Quality [Small Letter] |

Readability [Number] |

| A - Fully On Topic B - Related Topic C - Way Off Topic D - Spam |

a - Makes You Smarter b - Makes You Informed c - Makes You Stupider |

1 - Highly Readable 2 - Average Quality 3 - Potentially Painful |

So, in using this system, a post with the ranking Aa1 is one that is fully on topic, will make you smarter and is highly readable. By contrast, reading a post with the ranking Dc3 would be like jabbing bamboo splints under your fingernails and then using them to hammer railroad spikes, but less pleasant. And before you say anything, we do know that "c" should say "Makes you more stupid," but we figure that if you have read or have written enough of those kind of posts that your language processing skills will be shot anyway.

Who knew that just contributing a post to the Cavalcade of Risk could be so, well, risky?

We won't keep you waiting any more. We've presented all the contributed posts below in the chronological order we received them in the dynamic table below. You can click the column headings to sort them either from best to worst or vice versa if you'd prefer to filter the wheat from the chaff. Non-memo reading clueless goons, you asked for it....

| Cavalcade of Risk for 26 August 2009 |

|---|

| Date Contributed | Post | Blog | Rating | Remark |

|---|---|---|---|---|

| 2009-08-11 | Sugar ETF Surges On Supply Concerns | ETF Database | Cb2 | Submitted by Jimmy Atkinson, this post by Michael Johnston considers the reasons for the recently rising price of sugar and what Exchange Traded Funds might be worthy of investment at this time. Johnston discloses at the end of the article that he has holds no positions. We have no interest.... |

| 2009-08-11 | 100 Money-Saving Hacks for Living Large on a Student Budget | Online Courses | Dc2 | Barbara Williams submitted this article by Rose Jensen, which literally lists 100 hacks for college students to save money. Things like: "get a job" and "live at home". You would think a list like this might qualify as being informative. You'd be wrong.... |

| 2009-08-11 | 100 Productive Ways to Spend Your Summer Vacation | Online Courses | Dc3 | Barbara Williams strikes again with another article by Rose Jensen - this time though, it's all about 100 productive ways for students to spend their summer vacation. Really timely news just as school is resuming…. |

| 2009-08-13 | Things That Make a Trade Show Rental Service a Quality One | Trade Show Rental Service | Db2 | Ramil Parkson has a short checklist that you, dear reader, should consider in making sure your trade show rental service experience is a quality one. Say what you will, at least it's not 100 items long…. |

| 2009-08-14 | New Money Rules for Financial Security - #1. Handling Risk | FIRE Finance | Ab2 | FIRE Finance provides the first post submitted to the Cavalcade of Risk that deals with risk! Here, the FIRE team offers their take on Rule #1 for CNN's 7 new rules of financial security. |

| 2009-08-15 | Insurance You Can Do Without - Identity Theft Insurance | Canadian Finance | Ab2 | Tom argues that identity theft insurance offers too little benefit to justify purchasing it and suggests some pretty straightforward steps to protect your interests. |

| 2009-08-16 | An Emergeny Fund for Every Emergency | Cash Money Life | Db2 | No Debt Plan's Kevin describes in this guest post how he and his wife use multiple emergency funds (car maintenance, home maintenance, etc.) to be sure they have money for certain things when they unexpectedly might need it. Sounds good, right? And then it goes straight to spam as he describes how to set up multiple emergency fund accounts at ING Direct so you can too. |

| 2009-08-19 | Do Leveraged ETFs Have a Place in Client Portfolios? | ETF Database | Db3 | Jimmy Atkinson submits another post from the ETF Database, but this time, after establishing that leveraged ETFs are controversial as they are being banned by "firm after firm" and suggesting that the dangers from not recognizing their "risk profile" might obscure their "potential upsides", the post requires "Free Registration" to "Continue Reading".... |

| 2009-08-20 | Option Hedge Strategy: 2 by 1 Put Spread is Cheap and Effective | Everyday Finance | Bb2 | Dan describes how a sophisticated trader might hedge their investments from the risk of losses by using put options. |

| 2009-08-20 | Your Home Is Not An Investment | Bargaineering | Ba1 | Jim Wang picks up his pitchfork in this devil's advocate post arguing many reasons why your home should not be considered to be an investment. |

| 2009-08-21 | Dealing with Collection Agencies- Tips on Handling Collection Agencies | Financial Highway | Cb2 | If the debt collectors are after you, Ray's post will tell you what you need to know to keep them from being too intrusive. |

| 2009-08-21 | Looming Threat: H1N1 Outbreak in the Fall | Healthcare Economist | Ab2 | Jason Shafrin's advises that it's not worth getting worked up about the swine flu because there's so little you can do to avoid it. He lists the few things that the CDC recommends. |

| 2009-08-21 | Two-wheeled Risk (You Want Fries With That?) | InsureBlog | Aa2 | Henry Stern wonders if Burger King's recent decision to allow bicycle riders to use the drive-thru in response to bad publicity might not inadvertently increase the franchise's exposure to other risks. |

| 2009-08-22 | Accountable Care Organizations: The Good, the Bad and the Better Thanks to Health Affairs | Disease Management Care Blog | Aa2 | Jaan Siderov discusses what's potentially bad, good and better about a new option for health care coverage: the Accountable Care Organization (ACO). |

| 2009-08-22 | Depression and Debt a Dangerous Combination Article Blog | Debt Kid | Cb2 | Does debt have you feeling down? Really down? The Debt Kid deals with debt-driven depression. |

| 2009-08-22 | When To Get Personal Property Insurance | Digerati Life | Aa2 | Jacques Sprenger rented an apartment where the landlord carried insurance to cover most incidents related to the apartment's structure. Unfortunately, it only covered the structure - after a storm's water damage, Jacques was disappointed to find that policy didn't cover his family's possessions. |

| 2009-08-22 | Protect Your Brand Identity | Cash Money Life | Bb2 | What risks do companies have when it comes to their brand? Patrick identifies where danger lurks and the things a business owner can do to protect their brand. |

| 2009-08-22 | How Safe Is Your Retirement Fund? | Banker Saver | Bb2 | Saver Banker says that "we need to ensure that our 401Ks are safe from our own faulty decision-making" in this post which considers the impact of unsound reactions to market conditions. |

| 2009-08-22 | Insurance You Can Do Without - Credit Life Insurance | Canadian Finance | Ab2 | Tom names another candidate for insurance that just isn't worth buying: credit life insurance. He argues that it just makes more sense to go with "regular" life insurance! |

| 2009-08-22 | How to Find Affordable Health Insurance Online | The Dough Roller | Ba2 | DR reviews eHealthInsurance, an online tool for shopping health insurance quotes. |

| 2009-08-22 | College Students At Risk For Identity Theft | Blogger News Network | Ab2 | With college students being prime prey for identity theives, Robert Siciliano's "back-to-school" suggestions for how to best protect themselves from this risk is very timely. Take note, Barbara Williams and Rose Jensen…. |

| 2009-08-22 | Sleep Apnea Raises Death Risk 46%: Study - Yahoo! News | The Dream Factory | Cb2 | Tom Sims comments on a recent news article detailing the potential dangers of sleep apnea. |

| 2009-08-22 | Employment Practices & Risk Management | Specialty Insurance | Aa2 | How important is properly maintaining personnel records? The folks at Tennant Capital Partners explain how the things you do right can save your company time and money (in the form of employment practices liability insurance premiums), not to mention wasteful litigation should it come to that! |

| 2009-08-22 | Daily Drinking May Raise Risk of Several Cancers | Jazba | Ab2 | Abbas Mushtaq points to new research that suggests that the price of regular beer and liquor consumption may be an elevated risk of cancer. |

| 2009-08-23 | Tips on Maintaining Exhibition Security | Exhibition Security | Dc2 | OMG! Philip Rose submits a post with identical pictures as Ramil Parkson's "Trade Show Rental Service" post, but with tips describing what you can do to protect your exhibition at, say, a trade show! What are the odds? |

| 2009-08-23 | What Canadians Think of Their Health Care | Colorado Health Insurance Insider | Ab2 | Louise reviews the dismal findings of the Canadian Medical Association's 9th Annual National Report card on Health for Canada before arguing that uninsured Americans would be better off with the same kind of system, even if it means delivering less access to health care for all other Americans compared to what they have today. |

| 2009-08-24 | New !! Prenup !! Should I Sign a Prenuptial Agreement? Do I Need a Prenuptial Agreement? | Surfer Sam and Friends | Cb2 | If you're thinking about getting married, Surfer Sam explains why the next person you might want to talk to is a lawyer. |

| 2009-08-24 | Hurricane-Proof your Roof: Insurance, Inventories and Adjusters | The Roofery | Aa2 | If your home might at risk of having its roof torn off or damaged in a hurricane, Chris Brooks describes what you need to look for in terms of insurance and what to do after a storm if you do have damage. |

| 2009-08-24 | The Cost of Employers Waiting for Heathcare Reform | Clarifying Health | Ab2 | Paul Zane Pilzer is impatient with employers holding off making money-saving changes to their health coverage today on account of the uncertainty they face due to potential changes in the laws regulating health insurance now being discussed in Washington D.C. |

| 2009-08-24 | Hire Strategically and Reap Big Benefits Article Blog | Risk Management for the 21st Century | Cb2 | Nancy Germond has a plan to put highly talented people put out of work due to the current recession back to work as consultants or in part-time positions to improve organizations than might benefit from their knowledge. |

Labels: carnival

But Earns Partial Credit from Blogging Physicist!

We've been following the story of Didier Sornette and his colleagues' prediction that the Shanghai Stock Exchange was in the throes of a building bubble, which would soon implode, most likely between the dates of 17 July 2009 and 27 July 2009.

We've been following the story of Didier Sornette and his colleagues' prediction that the Shanghai Stock Exchange was in the throes of a building bubble, which would soon implode, most likely between the dates of 17 July 2009 and 27 July 2009.

Well, those dates came and went, and as noted by the intrepid blogging physicist of MIT's Technology Review arXiv blog, KentuckyFC, the hypothetical bubble didn't pop.

In July, he and his buddies pointed out that the Shanghai Composite stock market index was following exactly this kind of trend. But they also made an extraordinary prediction. They said that this bubble would burst between July 17 and 27.

That's a very specific prediction of the kind that economists almost never make. How they came to their conclusion wasn't clear, and I, for one, was very skeptical. In fact, I bet he was wrong and promised him an arXivblog T-shirt and baseball cap if the market proved otherwise.

So I kept an eye on the index, and on July 27 noted that it was still going strong. In fact, between July 17 and 27, the index rose by 251 points, or about 8 percent. So much for the crash.

So you might think. As we noted in originally commenting on Sornette's prediction however, those were merely the dates he and his colleagues indicated would be the most likely for which stock prices might begin falling. The full range of dates for which they indicated such a fall might occur ran from 10 July 2009 through 10 August 2009.

There was no crash between 17 July 2009 and 27 July 2009. But what about the days from 27 July 2009 through 10 August 2009:

Then something strange happened. On August 4, the market hit a peak of 3,471, and then it dropped. Dramatically. By August 19. it had fallen to 2,786, a drop of about 20 percent.

Several questions come to mind. Is this the fall that Sornette and company were predicting or just a coincidence, a regression to the mean? And if the fall is related to their prediction, could the drop have been caused by it?

There's no way of knowing, really. But it's too close to Sornette's original prediction to be ignored. If he has found a way to predict (or trigger) crashes of one kind or another, then it's hard to underestimate the significance of such a breakthrough.

We can answer some of these questions. First, no, Sornette and his team did not trigger the 20% fall in the Shanghai Stock Exchange (SSE) index with their prediction. In our previous coverage of this story, we noted that Sornette had erred in identifying the relatively rapid rise in stock prices on the SSE from November 2008 into July 2009 as evidence that a bubble had formed in that stock market.

Instead, we had found that the growth of the SSE's stock prices were primarily driven by the expectation that the business situation of Chinese companies was becoming less bad. Given that we've seen the same, mostly parallel dynamic in the U.S. stock markets since they bottomed on 9 March 2009, this close coupling of change in stock prices with the observed change in fundamental business performance provides a clear indication that a bubble had not formed on the Shanghai exchange, since a bubble may be said to exist in a stock market if, and only if, the value of stock prices have become decoupled from the value of their underlying dividends per share.

Recognizing that reality, we offered a prediction of our own:

That's not to say that stock prices might not crash on the exchange. Instead, if they do, it will be because of fundamental changes in the outlook for the companies on the exchange, which would be driven by factors that would change the amount of dividends they pay to their shareholders in the future. Not a fun situation, but still, not the result of having a bubble form, then pop.

As it happens, that's *exactly* what happened to the Shanghai Stock Exchange index following it's peak on 4 August 2009 (or more accurately, beginning on 6 August 2009). We found the fall in the value of the SSE index coincided with a very definite change in the amount that a Canadian-based insurer with a very large exposure to China's economic situation would pay out in dividends per share to its stockholders going forward, Manulife.

Finally, we observe that both MFC's and the SSE index finally bottom and begin largely moving in tandem again beginning 17 August 2009 - we do note the SSE deviated from that track on 19 August 2009, which appears to us to be the result of unique, short-lived noise within China's stock markets.

Being the result of a defined change in investor outlook, we can completely rule out the Sornette team's prediction as being a trigger for the event. Looking at KentuckyFC's other questions, we can also largely rule out the possibility that the change in value of the SSE index is the result of reversion or regression to the mean - what we observe instead is consistent with a "unit root process," where a shock (in this case, a change in fundamental investor expectations) has a permanent effect that effectively "resets" the level of stock prices. This differs from what we would call a "noise-driven event," such as we observe in the SSE index on 19 August 2009, where stock prices will resume pacing a given trajectory.

The only question we can't answer is the one that asks whether the crash in stock prices that we observe in the SSE index in August 2009 is the one that Sornette's team predicted or just a coincidence.

That will require a new batch of predictions.

In the meantime though, the prediction Sornette and his colleagues did make is enough to claim partial victory - and a free arXivblog hat from our blogging physicist!

Labels: forecasting

The news is out for the latest business quarter, and it's bad. The company's performance fell well short of expectations. What price is likely to be paid by the company's chief executive and financial officers?

The news is out for the latest business quarter, and it's bad. The company's performance fell well short of expectations. What price is likely to be paid by the company's chief executive and financial officers?

If a recent working paper by Harvard Business School's Richard D. Mergenthaler, Shiva Rajgopal and Suraj Srinivasan is any indication, there will be a significant hit taken by the company's top brass, and maybe even some heads that roll (HT: Leon Gettler). In CEO and CFO Career Penalties to Missing Quarterly Analysts Forecasts, the authors document what happened to the earnings or the employment status of the CEOs and CFOs of companies whose quarterly financial statements fell outside the consensus forecast of industry analysts in the years from 1993 through 2004.

That 0.67% increase in the probability of being dismissed may not sound like a great penalty, but it does mark a significant increase in the relative risk for both CEOs and CFOs of being fired. The authors report that the unconditional probability of a CEO or CFO being fired is 3% and 5% respectively, so an increase of 0.67% in these figures marks an increase in the relative risk of being replaced of 22.3% for CEOs and 13.4% for CFOs, at least as compared to their peers at firms whose performance met expectations.

We see that as the authors note a trend that suggests that these financial penalties and executive suite turnovers have become much more common following the passage of the Sarbanes Oxley Act, which indicates that corporate boards have become much more risk-averse in response to the Act's potential legal penalties.

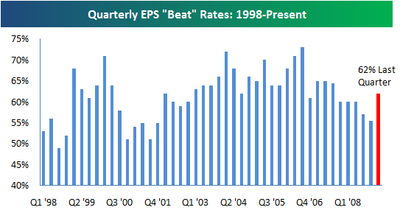

From the observations made in this paper, it would seem that the challenge for CEOs and CFOs seeking maximum financial rewards while securing their positions is to do what it takes to hit the analyst estimates their corporate boards use in assessing their performance, while also doing what it takes to make sure those analyst estimates are things they can hit. We would then anticipate that most CEOs and CFOs would adopt a strategy that would tend to understate their actual performance, which would steer analyst projections lower and create easier targets to hit.

Lo and behold, we would appear to be right (HT: Bespoke)!

Lo and behold, we would appear to be right (HT: Bespoke)!

With the Sarbanes-Oxley Act having been enacted in 2002, we observe that the percentage of companies that "beat" their analyst earnings estimates has been consistently higher since the legislation was first introduced in the U.S. House of Representatives in January 2002 (the bill became law on 30 June 2002, at the end of the second quarter of that year). This effect is consistent with our own observations in other matters that suggest that firms begin altering their behaviors and strategies in reaction to legislation that has a high likelihood of passage well before it becomes law.

We'll leave it as an exercise to our readers to determine how trustworthy the CEOs and CFOs who consistently understate their projected earnings performance might be and how long it might be before all firms are above average in this regard....

Labels: business, management, risk

Welcome to the Friday, August 21, 2009 edition of On the Moneyed Midways! Here, you'll find the best posts we found in our weekly search for the best of the past week's business and money-related blog carnivals.

Welcome to the Friday, August 21, 2009 edition of On the Moneyed Midways! Here, you'll find the best posts we found in our weekly search for the best of the past week's business and money-related blog carnivals.

This week, Jake of Debt Sucks hosted this week's Carnival of Debt Management and did a remarkable thing: he cut out all the topically unrelated crap that so many other blog carnival hosts tend to let dominate the editions of the various carnivals they assemble. [Note: We use the word "assemble" instead of "edit" - editing involves some sort of judgment and human intervention.] He writes of his recent blog carnival editing experience in his post Blog Carnivals Suck:

I am officially never hosting a blog carnival, ever again.

I read a really good blog post a while back detailing the ways in which hosting blog carnivals sucks, but can’t find it now. But I’ll share with you my experience.

This carnival I just posted tonight ended up with a grand total of 4 links. Pretty piss poor for a carnival, and I readily – no, happily – admit that. There were over 30 submissions. The vast majority of them had nothing to do with debt reduction, which is the topic at hand for the Carnival of Debt Reduction. DUH! Out of those 30, I narrowed them down to 7 or 8 that were decent and focused on debt reduction in one way or another. Of those, the ones I didn’t include were either commercial in nature, were more than a week old, or had already been included in another carnival. One really good submission I actually did include in my draft, with a nice little write-up, until I saw a trackback from another carnival.

Am I a hard ass? Yes. But the rules and the theme are pretty freakin’ simple, and that’s pretty much the best way I can put it. I don’t include random personal finance entries, because there are other carnivals for that. I don’t include entries that are already in another carnival, because that’s the rule and you’ve gotten enough promotion for that post already, and you’re just being greedy now.

Jake, we feel your pain. We really do. (You'll need to scroll down past the first three search results to see the kind of pain we're talking about.)

But before we move on, we should also highlight Kelly of Almost Frugal's edition of the Carnival of Money Stories, which really shows what can happen when a carnival host actually reads the contributed posts. Clearly, this effective editing thing might just be starting to catch on! We hope!

And now, onto the best posts of the week that was, including The Best Post of the Week, Anywhere!...

| On the Moneyed Midways for August 21, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | One Medical Bill Down Sort Of | Miss Bankrupt | Christina was surprised to get a phone call to tell her that a medical debt she had set up on a payment plan was almost completed. |

| Carnival of HR | Why Your Job Is Like a Hollywood Movie | The Human Race Horses | What can we learn about how to interview for a job from how Hollywood writers pitch screenplays? Mike Vandervort presents tips from entertainment industry insiders in Absolutely essential reading! |

| Carnival of Personal Finance | The Informercial Copycat Method of Debt Reduction | Realm of Prosperity | Simon Zhen pitches a brand new way to put psychology to work on those tough debts staining your personal finances. Here's how to order The Best Post of the Week, Anywhere! |

| Carnival of Real Estate | Two Things Sellers Need to Understand About Buyers | Searchlight Crusade | Dan Melson nudges home sellers to better recognize what motivates buyers in determining what kind of home they're willing to buy in today's market. |

| Festival of Frugality | Mmmm, Seafood! | Modern Tightwad | a.b. (no, not Alton Brown), notes that seafood may not be as expensive a source of protein as many people think. |

| Carnival of Money Stories | Penetrating the Packing Fine Print | Tough Money Love | Mr. ToughMoneyLove went on a mission to buy a new string trimmer for his yard and describes his experience in paying close attention to packaging to work out if he was really getting the best deal for the money. Absolutely essential reading! |

| Carnival of Pecuniary Delights | A College Debt Nightmare | Free Money Finance | FMF offers his thoughts on the case of a college graduate in Pittsburgh whose financial planning skills and overall judgment is, shall we politely say, lacking. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

If your organization is going through rough times, how beneficial would it be to replace the boss?

If your organization is going through rough times, how beneficial would it be to replace the boss?

If the findings of research into the sacking of managers in the English Premier League holds, the answer is "not very." Especially for those organizations that might change managers frequently in pursuit of the tremendous rewards of having been elevated into the Premiership, perhaps the most lucrative football (soccer) league in the world (HT: Physorg):

The average tenure for a Premiership manager is now 1.38 years, compared to 3.12 years in 2002, with many departures attributed to the fear of relegation to the Football League Championship. This can create a revenue gap of £56- £70 million, according to figures from Deloitte.

Research shows that because of this, there is immense pressure on managers to succeed in the Premier League, with poor results typically resulting in a scapegoating reaction by sacking the manager. Scapegoating theory holds that changing managers will not affect performance and is simply a ritual to apportion blame.

Mat Hughes, one of the researchers, identifies the loss of specialized knowledge as the primary reason why organizations should seek to avoid firing a manager as a primary response to the organization's poor performance:

"The research leads us to question how effective sacking a manager really is to teams. Getting rid of the manager means clubs lose a lot of tacit knowledge and although the new manager will quickly change things, those changes might not be the best or right ones.

"Football managers forever state that they need more time in the post to have an effect and our findings show there is much truth to their arguments. It takes time for the managers to reshape the team, its infrastructure, the scouting network, learn about players and the opposition. One of the dangers is that sacking the manager, and the almost inevitable rotation of the coaching staff that goes with that event, causes a lot of important knowledge about the team's strengths, weaknesses, preferences and capabilities to be lost. While the new manager comes in and will quickly seek to reshape the team's style and tactics to suit the new manager's preferred style and ways of doing things, that initial 'shock' does seem to jolt performance away from the rate of decline seen previously.

Aside from the loss of accumulated expertise, the danger of frequently replacing managers is that this action does not necessarily address other problems that exist within the organization, which might instead account for much of the organization's performance issues.

Paul Hughes, another of the researchers, addresses this point:

"Clubs who chop and change their managers — often with no opportunity for the manager to implement real change — tend to experience a long-term downturn in results, even if they have initially experienced success following the appointment of a new manager.

"Our findings suggest that sacking a manager often deflects from the real underlying issues at clubs, which need to be addressed before continuity and success will be achieved."

And there lies the rub, as it is a lot easier to change the coach than it is to do what it takes to fix a broken institution. Especially when the institution knows it only has to outlast the boss.

Image Credit: Daily Mail

Labels: business, management, sports

Every day, people everywhere are bombarded by messages in the media that suggest that they need to drastically change how they live their lives or to take some particular action due to some sort of scientific finding. But do they really?

Every day, people everywhere are bombarded by messages in the media that suggest that they need to drastically change how they live their lives or to take some particular action due to some sort of scientific finding. But do they really?

The short answer is "it depends." Most often, it depends upon the quality of the science or evidence supporting the action that is being promoted, and the only way to avoid serious disruption to one's daily life is to develop the ability to determine the difference between good science and bad science.

That's not necessarily easy, since bad science comes in many different forms. For instance, there's the "defective" variety, where otherwise good scientists have made an error in their methods that leads to incorrect conclusions, and which is probably the least harmful as it is likely to be quickly corrected, often by the scientists who made the error.

Then there's "deceptive" or "junk" science. Here, we find the veneer of good science, but twisted in a way to support a particular outcome. Taken to the extreme, junk science transforms into outright pseudoscience (or "false" science), where science is just used as a prop to support whatever outrageous claim is being made.

The trick then is to work out what is science and what is pseudoscience. To that end, we've adapted Steve Lower's invaluable guide for recognizing the differences between good and bad science, organizing it by distinguishing aspects and updating it while adding a number of our own observations and comments.

| How to Distinguish "Good" Science from "Junk" or "Pseudo" Science | |||

|---|---|---|---|

| Aspect | Science | Pseudoscience | Comments |

| Goals | The primary goal of science is to achieve a more complete and more unified understanding of the physical world. | Pseudosciences are more likely to be driven by ideological, cultural or commercial (money-making) goals. | Some examples of pseudosciences include: astrology, UFOlogy, Creation Science and aspects of legitimate fields, such as climate science, nutrition, etc. |

| Progress | Most scientific fields are the subjects of intense research which result in the continual expansion of knowledge in the discipline. | Pseudoscientific fields generally evolve very little after being first established. What small amount of research and experimentation that is carried out is generally done more to justify the belief than to extend it. | The search for new knowledge is the driving force behind the evolution of any scientific field. Nearly every new finding raises new questions that demand exploration. There is little evidence of this drive in the pseudosciences. |

| Challenges | Scientists in legitimate fields of study commonly seek out counterexamples or findings that appear to be inconsistent with accepted theories. | A challenge to accepted dogma in the pseudosciences is often considered a hostile act, if not heresy, which leads to bitter disputes or even schisms. | Science advances by accommodating change as new information is obtained. Frequently, the person who shows that a generally accepted belief is incorrect or incomplete is more likely to be considered a hero than a heretic. |

| Inconsistencies | Observations or data that are not consistent with current scientific understanding generate intense interest for additional study among scientists. Original observations and data are made accessible to all interested parties to support this effort. | Observations of data that are not consistent with established beliefs tend to be ignored or actively suppressed. Original observations and data are often difficult to obtain from pseudoscience practitioners, and is often just anecdotal. | Providing access to all available data allows others to independently reproduce and confirm findings. Failing to make all collected data and analysis available for independent review undermines the validity of any claimed finding. Here's a recent example of the misuse of statistics where contradictory data that would have avoided a pseudoscientific conclusion was improperly screened out, which was found after all the data was made available for independent review. |

| Models | Using observations backed by experimental results, scientists create models that may be used to anticipate outcomes in the real world. The success of these models is continually challenged with new observations and their effectiveness in anticipating outcomes is thoroughly documented. | Pseudosciences create models to anticipate real world outcomes, but place little emphasis on documenting the forecasting performance of their models, or even in making the methodology used in the models accessible to others. | Have you ever noticed how pseudoscience practitioners always seem eager to announce their new predictions or findings, but never like to talk about how many of their previous predictions or findings were confirmed or found to be valid? |

| Falsifiability | Science is a process in which each principle must be tested in the crucible of experience and remains subject to being questioned or rejected at any time. In other words, the principles of a true science are always open to challenge and can logically be shown to be false if not backed by observation and experience. | The major principals and tenets of a pseudoscience cannot be tested or challenged in a similar manner and are therefore unlikely to ever be altered or shown to be wrong. | Pseudoscience enthusiasts incorrectly take the logical impossibility of disproving a pseudoscientific principle as evidence of its validity. By the same token, that scientific findings may be challenged and rejected based upon new evidence is taken by pseudoscientists as "proof" that real sciences are fundamentally flawed. |

| Merit | Scientific ideas and concepts must stand or fall on their own merits, based on existing knowledge and evidence. These ideas and concepts may be created or challenged by anyone with a basic understanding of general scientific principles, without regard to their standing within a particular field. | Pseudoscientific concepts tend to be shaped by individual egos and personalities, almost always by individuals who are not in contact with mainstream science. They often invoke authority (a famous name for example, or perhaps an impressive sounding organization) for support. | Pseudoscience practicioners place an excessive amount of emphasis on credentials, associations and recognition they may have received (even for unrelated matters) to support their pronouncements. They may also may seek to dismiss or disqualify legitimate challenges to their findings because the challengers lack a certain rare pedigree, often uniquely shared by the pseudoscientists. |

| Clarity | Scientific explanations must be stated in clear, unambiguous terms. | Pseudoscientific explanations tend to be vague and ambiguous, often invoking scientific terms in dubious contexts. | Phrases such as "subtle energy fields" and "sustainable development" may sound impressive, but they are essentially meaningless. |

| Precision | If numbers are presented in support of a scientific explanation, they must be stated with the precision and accuracy required by their level of significance as determined by known measurement error in the data from which are derived, neither more nor less. | Pseudoscience practitioners will often present numbers with a level of precision and accuracy that exceeds that supported by the known accuracy of real world data in order to give the appearance of greater validity for their claims. | A recent example of pseudoscientific deception by precision include certain economists suggesting that "a Keynesian multiplier of 1.57" specifically applies for government stimulus spending, when a wide range of studies suggest the actual multiplier may be "anywhere from 0 to 1.5" (note the difference in the number of decimal places and potential range of values!) |

Other Useful Guides to Identifying Pseudoscience

Here's a short sampling of additional questions you can ask to help determine if you're confronting a claim based on science or pseudoscience.

- How to Recognize Pseudoscience - Part of the entertaining guide to the world of paranormal phenomena, the Paranormal Encyclopedia!

- What Is Pseudoscience? - Stephen G. Saupe's list of questions that need to be asked to separate the science from the pseudoscience.

- Questions to Help Distinguish a Pseudoscience from a Protoscience - Lee Moller's list of 16 questions to ask if you're dealing with a pseudoscience or a new legitimate field of science that isn't yet well established.

- Debunk the Junk - Added 19 September 2015 - Tufts University's Julie Flaherty's summary of the "10 Red Flags of Junk Science" put forth by the Food and Nutrition Science Alliance, a partnership of several professional scientific associations, including the Academy of Nutrition and Dietetics, the American College of Nutrition and the American Society for Nutrition, to help repair the reputation of a field of study that has been badly damaged by numerous questionable and unsupported scientific claims, many of which stood as its near universal consensus for decades, where the field's leading practicioners even actively worked to suppress research that could contradict the core tenets of their so-called "settled" science.

- The Proxmire Amendment May Be the Most Anti-Science Law Ever Passed. It's Still in Effect Today - Added 19 September 2015: Of course, the problems of producing valid science in the field of nutrition didn't happen by accident. RealClearScience's Ross Pomeroy describes how one influential politician made it possible.

Documented Debunkings

Sometimes, those claims you're hearing for the first time are things that have actually been around in one form or another for a long time. Here's a short list of sites that have already done the trustworthiness legwork for you!

- Snopes.com - The Internet's premier reference for urban legends, folklore, myths, rumors and misinformation. Update 31 July 2016: Over time, the quality of Snopes' debunkings has proven to be mixed.

- Quackwatch - If it's medical or health-related and not for real, you'll likely find it here.

- Climate Skeptic - Like Quackwatch, but aimed at the poorly supported aspects of global climate change science.

- JunkScience.com - Steven Milloy's site surveying a number of highly questionable scientific claims made in today's media reporting. Update 19 September 2015: Over time, we find that the site's quality in critiquing a number of science reports is mixed overall, combining a number of valid analyses with others that fall somewhat short. For an example of the latter, see John Whitehead's recent discussion of the site's coverage on the topic of contingent valuation, where negative conclusions about particular studies would appear to have been reached without necessarily being backed by sound evidence, or without consideration that the scientists behind the studies being criticized had addressed their points of criticism.

- Junkfood Science - Sandy Szwarc's blog covering ongoing issues with media reporting of nutrition-based junk science.

- Mythbusters - did you think we'd create a list like this and forget the Mythbusters?

- John Stossel - the media's leading questioner of questionable claims, from consumer issues through politics, who also blogs.

- Biggest Junk Science Stories of 2014 - Added 19 September 2015: Hopefully an annual tradition. RealClearScience offers a summary of the biggest junk science stories of 2014. (Here's 2013's edition.)

- Bad Science - Added 19 September 2015: UK science columnist's Ben Goldacre's site on the topic of science that doesn't measure up.

- Retraction Watch - Added 19 September 2015: An invaluable site that didn't exist when we first began assembling our list of resources. Retraction Watch focuses on the mistakes made by scientists who published erroneous results that subsequently required them to alert their peers and to withdraw their findings by retracting them. That, in itself, is the process of science working as it should, but the reasons for a number of retractions will periodically overlap into junk science territory (for example, conclusions based upon overly small sample sizes for statistical studies is a common theme). Of course, the difference between a real scientist and a junk scientist is that the real scientist has the honesty and integrity to own up to their errors in the interest of advancing understanding and progress within their fields of study. By contrast, the junk scientist will seek to sustain their flawed findings, even when confronted by directly contradictory evidence.

- Wrongful Convictions (Junk Science Category) - Added 19 September 2015 - The negative effects of junk science don't just show up in scientific papers - they also show up in civil and criminal courtrooms. The lawyers behind the Wrongful Convictions blog discuss its impact and how to mitigate against it when it can affect real world judgments of innocence, guilt and liabilities.

- Metabunk.org - Added 19 September 2015: A discussion forum "dedicated to the art and pastime of honest, polite, scientific investigating and debunking". If you've just seen it in the media, it is likely being discussed here!

- Improbable Research - Added 19 September 2015: The home of the Ig Nobel Prize! This site is not about junk science at all, but is instead about recognizing valid scientific studies that would appear to offer precious little value in meeting any of humanity's needs.

Image credit: J.J. at the English language Wikipedia, per the terms of the GNU Free Documentation License, Version 1.2.

Labels: quality

Barry Ritholtz looks at China's stock market and comments: "Today we will get a real test for whether the recent pullback is merely a buying opportunity, or the start of something more serious."

The answer to both questions inherent in Barry's comment is: yes.

A Buying Opportunity?

Where the U.S. stock market is concerned, the answer to this question in the very short term is yes. As we've demonstrated the role of dividend futures in determining the level of stock prices throughout much of this year, we find today that the level of expected future dividend payments ended last week by ticking upward, which contradicts today's drop in stock prices.

What that tells us is that the stock market's drop today is the result of noise. Without a corresponding drop in the expected level for future dividend payments, we would anticipate that today's drop in stock prices will be short lived, which would make today a short-term buying opportunity. But before you consider running out and buying U.S. stocks today, understand that we *really* mean short term, as measured in days, possibly in weeks, but not much more than that at this time, for reasons we've already stated....

Something More Serious?

The question, whenever we see this kind of noisy action in the market, is "what's behind it?" In this case, we believe the source of noise is emanating from China's stock markets.

Previously, we had found that there was no bubble in China's Shanghai stock exchange, as the growth rate of its stock prices have largely paralleled those of the U.S., where we've demonstrated the rise in stock prices since 9 March 2009 has been driven by the expectation that the economy is becoming "less bad." We believe the same outlook applies to investors in the Shanghai market.

So, without a bubble where stock prices have become decoupled from their fundamental drivers, the primary factor affecting stock prices are changes in what investors expect for the future level of dividend payments.

Here, looking at China's stock prices, we find that the Shanghai Composite index has recently dropped quite a bit in recent trading. Unfortunately, we don't have any information on that market's dividend futures (or dividends per share for the index itself) and we have not found any specific news related to companies that are listed on the exchanges as having cut their dividends in the past week, so we can't directly tell if a change in that aspect of the Chinese market is driving the drop in stock prices there. So, once again, we have to do our analysis of China's stock markets by proxy.

We can't use Greater China Holdings (GCH) this time, as the U.S.-based stock had slashed its dividend payout to zero last year. So, scanning the world of companies that have strong links to businesses in China, we found news that Manulife, a Canadian insurer that has the most exposure of all international insurers to China, had cut its dividend by 50% on 6 August 2009.

Barry Critchley of the Financial Post reports:

Manulife justified the dividend cut as part of its plan to "remain focused on achieving fortress levels of capital in all of our operating businesses, as well as at the consolidated Company." The cut will save about $800-million.

That plan sounds very familiar to observers of the U.S. banking and financial companies that have been the most exposed to fallout from the aftermath of the U.S. housing bubble.

We believe the fall in stock prices in Shanghai first, and now in U.S. stock markets, is directly tied to speculation that Manulife is attempting to protect itself from its large exposure to the health of the Chinese economy. With that economy believed by many observers to be artificially inflated as the result of immense levels of stimulus spending by the Chinese government, Manulife's action to halve its dividend would be an indication that the company is looking to build up its capital in anticipation of a declining economic situation in China.

That, if it comes to pass, would be a very serious thing indeed. At present, without a clear signal that cuts in dividends in China's stock market are in the works, speculative noise may be assumed to be behind the drop in stock prices, both here and in Shanghai.

And thanks to the noise that the U.S. stock market would appear to be importing from China, we have both a buying opportunity and the start of something potentially more serious. Welcome back to your nervous nirvana!

Labels: chaos, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.