Welcome to the Friday, February 26, 2010 edition of On the Moneyed Midways! Each week, we bring you the best posts we found among the best of the week's business and money-related blog carnivals.

Welcome to the Friday, February 26, 2010 edition of On the Moneyed Midways! Each week, we bring you the best posts we found among the best of the week's business and money-related blog carnivals.

This was definitely one of those editions that falls into the gap between the biweekly and monthly editions of many carnivals. As a result, we're featuring fewer posts than normal.

But that doesn't mean they're any less essential to your weekend reading plans! Just scroll down for the best posts that we found in the week that was....

| On the Moneyed Midways for February 26, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Cutting the Biggest Expense of All | Miss Bankrupt | Christina is looking to trim her budget to more affordable levels, and has already either made or identified cuts to her spending, but it's not enough. Here, she contemplates making the biggest cut she's ever considered in Absolutely essential reading! |

| Carnival of Personal Finance | Financial Lessons of a Cheese Pedlar | Magical Penny | Adam Piplica has been paying extra close attention to how Subway's "sandwich artists" seek to extract just a bit more money from their patrons and looks to apply the psychology involved to his own benefit in The Best Post of the Week, Anywhere! |

| Cavalcade of Risk | Cost of Drug Development: $1 Billion | Healthcare Economist | Jason Shafrin highlights two academic papers into how much it costs to successfully bring a new medicine to the market - one from 2003 which says its $802 million and one just published that ups the figure to $1 billion. |

| Festival of Frugality | How to Use Electronic Coupons with Your Grocery Card | Digerati Life | The Silicon Valley Blogger discovers how to "load" coupons onto her grocery store affinity card and takes it for a test drive! |

| Money Hacks Carnival | How to Find Free Stuff Online Without Getting Spammed | PT Money | Ann Smarty reveals all the ins and outs to finding out which free offers won't come with strings attached. |

| Carnival of Money Stories | Warning Signs You Ned to Fire Your Financial Advisor | Good Financial Cents | Jeff Rose provides a checklist to use for determining whether your financial advisor is really the one for you. |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Better yet, can you tell from the Case-Shiller Home Price Index when it began?

Take a look for yourself. Could it have begun in 1997, when house prices, after adjusting for inflation, bottomed? Could it have been in 2000, when these real house prices exceeded rents? Or was it in 2003, when real house prices began growing even faster than they had in the period from 1997 up to that point?

Here's what James R. Hagerty found when he asked the question of two housing and mortgage industry experts in November 2009. First, he asked Edward Pinto:

Edward Pinto, a mortgage-industry consultant who was the chief credit officer at Fannie Mae in the late 1980s, argued in a WSJ op-ed essay Friday that "most agree that the housing bubble started in 1997."

I asked Mr. Pinto why he chose 1997. He pointed to a chart of long-term home prices patched together by Robert Shiller, a Yale economist. The chart shows inflation-adjusted house prices starting to move up sharply in the late 1990s.

Mr. Pinto believes misguided government efforts to promote homeownership were largely to blame for the bubble. He particularly points to the 1992 legislation that required the government-backed mortgage investors Fannie Mae and Freddie Mac to guarantee more loans for people with shaky credit and an inability to make substantial down payments. That legislation also created a weak regulator for Fannie and Freddie.

He next asked economist Tom Lawler:

Tom Lawler, an independent economist who worked at Fannie Mae from 1984 to 2006, says few housing gurus think the bubble began as early as 1997. In his view, the bubble began around 2002. The collapse of the tech-stock bubble in the year 2000 prompted many people, searching for other types of investments, to focus on real estate. The Federal Reserve’s policy of keeping interest rates unusually low made property investments even more attractive. Once house prices reached levels that most ordinary people couldn’t afford, Wall Street and mortgage banks responded by relaxing lending standards further with loans that kept payments very low in the initial years and let people lie about their incomes. That helped push home prices up much higher till the bubble began to deflate in 2005 and 2006.

For his part, Case-Shiller House Price Index co-creator Robert Shiller identified 1998 as the beginning of the boom in U.S. house prices in a 2007 paper, in which he describes how rising house prices became a widespread phenomenon in the United States:

The boom showed its first beginnings in 1998 with real (inflation-corrected) home price increases first exceeding 10% in a year on the West Coast, in the glamour cities San Diego, Los Angeles, San Francisco and Seattle. The incipient boom then attracted only moderate attention since it was confined to the West Coast, and the cumulative price gain was still not dramatic. But the boom quickly spread east, with 10% one-year real home price increases appearing in Denver and then Boston in 1999. These cities kept on appreciating at a high rate.

As years went by, new cities started seeing substantial real home price increases. Even though it was a recession year, Miami, Minneapolis, New York and Washington, D.C., began to see 10% real price increases in 2001. Then there arrived the late entrants, who compensated for their delay with the intensity of their price boom.... The result of this succession of booms, in so many places has been a massive increase in national home prices over a period of nearly a decade.

Shiller's description gives us an idea of how rising house prices propagated across the U.S., but it doesn't really tell us when it changed from a local or regional phenomenon into a national one.

Worse, the Case-Shiller House Price Index, by itself, is not able to be used to identify if an economic bubble in the U.S. national housing market exists, only the potential that one exists. An economic bubble, by our operational definition, "may be said to exist whenever the price of an asset or assets that may be freely exchanged in a well-established market first soars then plummets over a sustained period of time at rates that are decoupled from the rate of growth of the income that might be realized from owning or holding the asset(s)."

For an asset like houses, the income that might be realized from owning or holding the asset is called rent, for which Shiller utilizes the inflation-adjusted Owner's Equivalent Rent measure produced by the U.S. Bureau of Labor Statistics.

There's a problem though when we adjust housing prices for inflation as is done for the Case-Shiller house price index. The Consumer Price Index doesn't incorporate actual changes in housing prices over time. Instead, it uses the Owner's Equivalent Rent measure to represent the housing component of consumer prices (it's the largest single component of the measure), so using this data to correct house prices for the effects of inflation fails to account for the actual changes in house prices.

You see the vicious circle! The Case-Shiller real house price index isn't really telling us what we'd like to think it is.

But what would be a better method for determining whether house prices might be in a bubble? Is there a way to detect a bubble forming in its earliest stages?

We think we've developed a better method, which is in part based upon our observations of age and income driven spending. What we found is that personal spending for housing was a very strong function of personal income.

That observation gives us an alternative way to determine how much Americans of a given income spend on housing and given the strong correlation between income and housing expenditures, we can substitute personal income in place of the measure of rent used by the federal government. We can then plot non-inflation-adjusted house prices against that personal income, which would give us insight into not just whether house prices have decoupled from the economic fundamentals supporting them, but when as well.

The first of those linear trends runs from 1970 through 1986. We can likely attribute the shift we observe in the linear trends we observe from 1986 to 1988 to the Tax Reform Act of 1986, which "increased incentives favoring investment in owner-occupied housing relative to rental housing by increasing the Home Mortgage Interest Deduction."

Those changes however did not contribute to the building of the housing bubble, which we confirm through the linear trend that appears to have held from 1988 through 1998 (or 1999 as the case may be - in generating the linear trendline for this period, we utilized Shiller's proposed 1998 date as the cutoff, but it doesn't make much difference).

We do observe a dramatic break in that latter linear trend beginning in 2000. That corresponds with the peak of the stock market bubble, which began its deflation phase following August of that year, which continued into early 2003.

What we then suspect is that Tom Lawler's basic theory of the housing bubble is correct, but his timing is off. People didn't wait until 2002 to begin pulling money out of stocks to put toward housing - they started in 2000, just as the stock market bubble began deflating.

And we now have what the Case-Shiller house price index doesn't provide: a tool we can use to determine if house prices are genuinely supported by fundamental economic measures that can quickly identify if such a bubble exists on a national scale.

Labels: data visualization, economics, real estate

Sure, we could tell you about a handmade ground beef hamburger patty, covered with extra sharp cheddar cheese, which is then wrapped in a weave made from bacon, to which three hot dogs are added to create the visual impact of a turtle, which is then loosely wrapped in aluminum foil and baked in an oven at 400 degrees Fahrenheit for 20-30 minutes. But it's sooooo much better to show you!

As described at Foodbeast: "little crispy, not too crunchy - just how a turtle should be, no?"

HT: Core77, who prefers to call it the "Bacon Cheeseturtle".

Labels: none really

What's the biggest age difference you should have with the person you're dating?

What's the biggest age difference you should have with the person you're dating?

Don't think the answer to that question doesn't matter! The truth is that if the age difference between you and your date is too great, you'll probably end up triggering society's collective gag reflex. It's just not cool to be viewed as either robbing the cradle or the grave.

Thanks to the Money Grubbing Lawyer however, we finally know the formula for defining the boundary between people saying "Cool" or saying "Ewww!": the "Half Plus Seven" rule:

I witnessed a mini-scandal recently when a recently-divorced 34 year old colleague brought his new 23 year old girlfriend to an event. He thought it was fine- they were both adults and she had just graduated from university. Others disagreed, arguing that it was a clear violation of the undisputed rule of inter-age dating, the "Half Plus Seven" rule. Under this clever formula, the youngest permissible age to date is half your own age plus seven, meaning that he couldn't date anyone younger 24. For you Excel geeks out there, the rule is if(partner age<((your age/2)+7), gross, cool).

We're here to save you the trouble of running the Excel spreadsheet calculation. Just enter the indicated data in the tool below and we'll tell you the minimum age of the person you should be dating:

Now that you know, you have no excuses for ever crossing that line! Better yet, as members of society, we won't ever have to say "Ewww!"

Previously on Political Calculations

- Men: Are You Old Enough to Propose Yet?

- What Are the Chances Your Marriage Will Last?

- Picking the Right Date for Valentine's Day

- Should You Become Intimate with a Coworker?

- Should You Start or Stop Procrastinating?

- Should You Apologize?

- Should You Lie?

- Is Your Personal Grooming Adequate?

- How Many Hours of Sports Can You Watch (Without Her Getting Angry?)

- Are You Whipped?

Labels: geek logik, tool

Are you one of those people who are looking for something extra when you travel? Are you tired of all the usual exotic locations? Perhaps you're seeking to do something more adventurous for your next trip?

Are you one of those people who are looking for something extra when you travel? Are you tired of all the usual exotic locations? Perhaps you're seeking to do something more adventurous for your next trip?

If so, we think we've found just the vacation package for you! A bus tour of the grittiest, most crime-ridden neighborhoods of Los Angeles, with a special focus on street gangs and their crime activity.

Really! We're not making this up!

A group of civic activists, united by faith and a belief that the poor economy in the interior of Los Angeles is a social injustice, is preparing to offer bus tours of some of the grittiest pockets of the city, including decayed public housing, sites of deadly shootouts and streets ravaged by racial unrest.

After a VIP preview last weekend, L.A. Gang Tours expects to open to the public in January, giving tourists a look at the cradle of the nation's gang culture -- the birthplace of many of the city's gangs, including Crips and Bloods, Florencia 13 and 18th Street.

"This is ground zero for a lot of the bad in this city. It could be ground zero for a lot of the good too," said Alfred Lomas, a former Florencia member who has become a leading gang intervention worker in South Los Angeles and is spearheading the tours. "This is true community empowerment."

How much money might be made from such tours? Financial backer Terry Jensen speculates:

Jensen, also a minister, has allowed Lomas to use his accountants and marketers. The team, he said, believes the tours could generate $1 million in profit in the first year, and that it would compete for customers with operators of celebrity-home tours in Hollywood.

"I think this will be a destination tour," Jensen said. "I think people will come to Los Angeles to take this tour."

But how will the tourist experience compare?

Jensen acknowledged that customers will have to sign a watertight legal waiver. He said that's why it's important to spread the word through affected neighborhoods that the tour is coming -- and, eventually, generating jobs, grants and loans. For example, Jensen said he'd like to see some early profits send a graffiti "tagger" to art school.

"We all know that the day somebody gets hurt, it's over," he said. "We're counting on the fact that the gangs aren't going to mess in their own beds."

Alfred Lomas notes the unique challenges that go beyond the local government's requirements that many businesses face in setting up shop:

In recent weeks, The Times was granted access to a series of "sit-downs" -- meetings -- seeking understandings between gangs that have historically warred: Florencia, 18th Street and Grape Street, the dominant gang in the Jordan Downs public housing development.

Other gangs are being added to the talks and will shape tour routes down the road. Lomas, for instance, hopes to include the South L.A. bus stop where five children and three adults were shot in gang crossfire last year, but needs the local gangs to sign off, giving him "safe passage."

One "sit-down" took place in a Jordan Downs apartment that serves as the hub of the small nonprofit empire of Fred "Scorpio" Smith. The 38-year-old Smith said he joined Grape Street when he was 11 and recently completed a 13-year prison term on drug charges. Influential in Jordan Downs, he now runs a charitable organization, including a program for kids who have dropped out or have been kicked out of local schools.

A small group, led by Lomas, went to the apartment seeking approval to run the tour through Jordan Downs. At first, Smith sounded skeptical.

"A tour?" he asked incredulously. "Of the 'hood?"

Lomas offered to hire two teens from the housing development as part-time tour employees.

"I'm not saying you have to stop shooting each other," Lomas said. "Just allow me a certain time in the day. . . . Just let the bus go through."

"Safe passage is a guarantee," Smith said.

Tell Alex Tabarrok to call his travel agent and pack his bags!

We'll close by observing that the inaugural bus tour of gangland L.A. was sold out, earning the operation special notice on the Titanic Awards, a blog dedicated to "celebrating the dubious achievements of travel."

Labels: none really

Welcome to our regularly scheduled, Friday, Febraury 19, 2010 edition of On the Moneyed Midways! OMM is the one place you can count on to find the best of the previous week's money and business-related blog posts contributed to the best of the previous week's blog carnivals.

Welcome to our regularly scheduled, Friday, Febraury 19, 2010 edition of On the Moneyed Midways! OMM is the one place you can count on to find the best of the previous week's money and business-related blog posts contributed to the best of the previous week's blog carnivals.

How do you rack up $90,415 in debt without a mortgage? And if you did, what would you need to do to pay it all off? If you're saving for retirement, should you choose a Roth or go with a Traditional investment vehicle? Should you get your news about mortgages from the newspaper? How can you make your clothes last longer? And what does Haiti really need in the aftermath of its recent tragic earthquake?

The answers to these questions, and more, await you below with the rest of the best posts from the week that was!...

| On the Moneyed Midways for February 19, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How My Family and I Paid Off $90,415 of Consumer Debt in Two Years: Part 1 | Trees Full of Money | You read that right. Ben explains how he and his family racked up $90,415 in just consumer debt beginning with student loans in college, before reaching the tipping point where they had to do something to get it under control. |

| Carnival of HR | A Big Problem: Obesity and Employee Rights | Omaha.Net | Kathleen Nicolini considers the impact of obesity in the workplace from both employee and employer perspectives. |

| Carnival of Personal Finance | Roth 401(i) and Roth IRA's - Why the Roth Kicks Traditional Butt | Personal Finance Ninja | Mike explains why Roth retirement accounts, whether 401(k) or IRA, kicks their Traditional counterparts' proverbial asses, especially for young people. We'll go a step further - everyone should get one and fully fund it while the government still allows them to exist. |

| Carnival of Real Estate | You Can't Get Your Mortgage News from a Newspaper. And Here's the Proof. | Daily Mortgage Reports | Question: What happens when mortgage loan officer and blogger Dan Green takes apart an article about mortgages from his local newspaper's business section? Answer: You learn more about how mortgage rates work than you would from the dead-tree news in Absolutely essential reading! |

| Carnival of Taxes | Why I Report My Daughter's Babysitting Income to the IRS | Free Money Finance | CPA Carol Topp explains why she filed a tax return for her 16-year old daughter to report her babysitting income, even though she owed no self-employment or federal income taxes on the $1,200 she made during the year. |

| Festival of Frugality | How to Extend the Life of Your Clothes | Chasing Prosperity | The ThriftyGal challenged herself to not buy any clothing for a year, which meant the clothes in her closet had to hold out. She lists the six things you need to do to make your clothes last longer in The Best Post of the Week, Anywhere! |

| Money Hacks Carnival | Single Country Investing - Equity or Currency??? Surprising Conclusion | Intelligent Speculator | If you've been worried about the value of a dollar over the past year, which should you have been investing in: the equities of foreign nations or their currencies? The Intelligent Speculator finds a definitive answer. |

| Best of Money | Reflections on My Short-term Mission Trip to Haiti | Provident Planning | Paul Williams broke away from his comfortable life in the U.S. to travel to Haiti to help in the aftermath of the earthquake that devastated this extremely impoverished nation. He compares and contrasts what he saw there with life in the U.S. and finds that while quick fixes have their place, they won't solve Haiti's greatest problems. Absolutely essential reading! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

You know, we just don't receive the same high quality spam that we used to get.

You know, we just don't receive the same high quality spam that we used to get.

The reason why that's the case today likely goes to the dismantling of McColo's spam servers back in late 2008, which sharply reduced the quantity of spam being disseminated on the Internet, especially in the United States.

And with the reduced quantity of spam, we've seen a corresponding decline in the quality of spam! These days, our spam filter largely fills up with solicitations for discount Viagra, which in the absence of evidence to the contrary, we'll assume is the most profitable form of spam these days.

But today was different, because we found a great offer to rent an apartment in Ulan Bator, Mongolia!

Or as our spammer, Ulana of MongolianRealEstate.com, might spell it, Ulaanbaatar. Going from their web site, we find that the fine folks at Mongolian Real Estate dot Com understand the kinds of problems we have in finding a place to hang our hats in Mongolia:

Finding a place in Ulaanbaatar can be a challenge. MongolianRealEstate.com has the kind of expertise in real estate acquisition that is only gained from experience.

Well, that's exactly the kind of experience-based expertise we can use! Let's see just what deals they e-mailed us about!

Fully Furnished Apartment For Rent in Ulaanbaatar 3 Bedrooms, Study, 2 Bathrooms, 2nd floor, 200 m2, Garage, Located Near Millie's Espresso 2 Bedrooms, 2 Bathrooms, 3rd floor, 130m2, Garage, Located Near Grand Khaan Irish Pub 3 Bedroom, Study, 2nd floor, 240 m2, Located in Royal Casttle, Near Chingis Khaan Hotel 2 Bedrooms, 2 Bathrooms, 3rd floor, 86 m2, Behind The State Department Store, $500/mo 2 Bedrooms, Study, 2 Bathrooms, 3rd floor, 100 m2, Located Next to Russian Embassy 1 Bedroom, 9th floor, 40 m2, Next to Grand Khaan Iris Pub, $350/mo Office for Rent in "Monnis Tower" , 7th floor, 150 m2 Office for Rent in "Grand Office Building" , 4th floor, 120 m2 Etc., Etcetera. Contact Ulana at (976-11) 310445 or (976) 99142710

So many great locations to choose from! But how to decide? We're tempted get the 2-bedroom near the Grand Khaan Irish Pub, but we're concerned that might put us too far away from The State Department Store. Then again, how could we turn down the 2-bedroom next to the Russian embassy? Sure, it's a bit small at just 100 m2, but the much larger 3-bedroom inside the Royal Casttle likely has a rent to match.

We'd call, but because we avoid dialing any premium rate 976 telephone numbers, we'll wait for Ulana to follow up again through e-mail.

Labels: none really

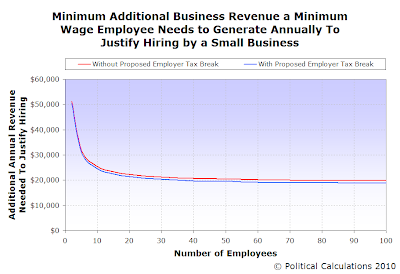

Right now, the U.S. Congress is working to rapidly advance new legislation that is intended to create new jobs, in part driven by the failure of last year's "stimulus package" to achieve that result. As part of this new effort to actually stimulate job creation, a bipartisan proposal in the U.S. Senate to provide a tax break to employers hiring new employees by eliminating the employer's portion of Social Security payroll taxes is being considered. This proposal would reduce the cost to employers by 6.2% of their new employee's pay.

Right now, the U.S. Congress is working to rapidly advance new legislation that is intended to create new jobs, in part driven by the failure of last year's "stimulus package" to achieve that result. As part of this new effort to actually stimulate job creation, a bipartisan proposal in the U.S. Senate to provide a tax break to employers hiring new employees by eliminating the employer's portion of Social Security payroll taxes is being considered. This proposal would reduce the cost to employers by 6.2% of their new employee's pay.

That might sound like quite a bit, but as we'll show you, it will have a minimal effect upon hiring activity.

Let's start by considering the least expensive employees that can be hired: those earning the federal minimum wage of $7.25 per hour. Let's next look at the employers most likely to hire them: small businesses, or rather, businesses with fewer than 100 employees.

We next used our tool to estimate the total hourly employment cost for employing a new worker at the federal minimum wage for small businesses ranging in size from two to 100 employees. By definition, the first employee of a small business is the boss, so we're looking purely at the cost for an existing business to hire an additional worker.

The following charts show what we found. The first chart shows the total hourly cost, including typical overhead expenses, of employing a new worker for small businesses ranging in size from two to 100 employees:

Our second chart reveals how much additional business revenue that employee has to generate annually to justify their hiring by the small businesses:

What we see is that the proposed tax break will do little to justify the hiring of an additional employee at the federal minimum wage. In looking at the difference between the annual revenue amounts that must be generated by the minimum wager earner to justify their hiring, the employer's annual tax break of $936 represents just a drop in the bucket. Even for the largest of small businesses, which would see the greatest benefit from the proposal given their lower overhead costs per employee, the minimum wage earner must generate at least $18,907 annually to justify their hiring with the proposed tax break. And we also confirm that the smaller the business, the higher the amount of revenue that must be generated.

That's significant because the smallest businesses are the biggest employers in the United States. The following two charts, which we found in Register.com's Web Business Monthly newsletter, show just how big U.S. small businesses are:

|

|

|

Source: SBA, Small Business by the Numbers, April 2003

** SBA, Small Business Economic Indicators for 2002, June 2003 |

Source: IDC, Small Business Forecast, 2002

** Total Small Businesses: 7.9 million |

For what it's worth, the federal government could avoid incurring the higher deficits that such proposals would entail and deliver the same marginal benefits for employers by simply reducing the federal minimum wage from $7.25 per hour to $6.85 per hour. Or perhaps if we went by President Barack Obama's tax credit proposal of $5,000 per newly-hired employee, achieving the same benefit as that proposal might be realized by reducing the minimum wage further to $4.85 per hour.

Politicians sure have a funny way of admitting they jacked up the federal minimum wage by way too much. It's just a shame they can't come out and say so without also jacking up the national debt!

Labels: jobs, minimum wage, politics

Let us tell you a story from the world of science that has barely received much attention from the U.S. media, but which seriously undermines what has come to be commonly accepted as incontrovertible fact by scientists and laypeople alike. Decades of data and observations were held up as proof of the fact, and the fact, having been peer-reviewed and disseminated through countless journals and incorporated into basic science textbooks, was such that the science was believed to be settled and the time for debate about its validity over.

Let us tell you a story from the world of science that has barely received much attention from the U.S. media, but which seriously undermines what has come to be commonly accepted as incontrovertible fact by scientists and laypeople alike. Decades of data and observations were held up as proof of the fact, and the fact, having been peer-reviewed and disseminated through countless journals and incorporated into basic science textbooks, was such that the science was believed to be settled and the time for debate about its validity over.

And then, just earlier this year, the fact simply stopped being true. The scientific analysis supporting it could no longer be supported by the available data and evidence. Instead, it turned out that the widely believed scientific fact had been based upon some not so great data and some pretty sloppy analysis. But it produced a compelling relationship that seemed to describe things that were being observed in the real world that could also be used to make predictions.

The only problem though was that nobody could quite figure out the fundamental reasons behind it. Worse, as more research was done, real world observations weren't agreeing with what the mathematical model behind the scientists' compelling relationship would predict.

Believe it or not, we're not talking about the theory of Anthropogenic Global Warming (AGW), where the evidence of an increasing amount of carbon dioxide (CO2) in the atmosphere is believed to be a prime driver of climate change on a global scale, which then impacts virtually every living creature on the planet Earth. While this seemingly simple relationship between the change in the levels of atmospheric CO2 and average global temperatures and the scandals now coming to light related to it certainly has parallels to the story we're telling today, we're instead talking about a simple scientific fact that has enjoyed even stronger support from the scientific community over a longer period of time, while also applying to virtually every living creature on the planet Earth.

We're talking about the relationship between an animal's body mass and its resting metabolism. Physorg's Joshua E. Brown explains (we've added the links for reference):

Apparently, the mysterious "3/4 law of metabolism" -- proposed by Max Kleiber in 1932, printed in biology textbooks for decades, explained theoretically in Science in 1997 and described in a 2000 essay in Nature as "extended to all life forms" from bacteria to whales -- is just plain wrong.

"Actually, it's two-thirds," says University of Vermont mathematician Peter Dodds. His paper in the January 29 edition of Physical Review Letters helps overturn almost eighty years of near-mystical belief in a 3/4 exponent used to describe the relationship between the size of animals and their resting metabolism.

That does sound quite a bit like the recent Climategate scandal. As you'll see next, the parallels regarding the handling, or mishandling of data are indeed very close. The following discussion will also hopefully explain the image we posted in the upper right hand corner of our post today!

To understand the debate between 2/3 and 3/4, assume a spherical cow. "That's what a physicist would do," Dodds says, laughing. Basic geometry shows that the surface area of this difficult-to-milk creature would increase as the square of its radius while the volume would increase as the cube of the radius. In other words, the exponent that describes the ratio of surface area to volume is 2/3.

Next, assume a spherical mouse. OK, now compare the resting metabolic rates of these sorry animals. Since the point of resting metabolism is to keep a warm-blooded animal warm (and alive!) with the lowest necessary energy use, both geometry and common sense suggest that the cow would have a lower rate of metabolism per cell than the mouse: the mouse, with more surface area relative to its volume, would lose heat faster than our cartoon cow.

And what about in real animals? In 1883, a German physiologist named Max Rubner measured the heat output of some dogs ranging from a few pounds to nearly seventy. He plotted these numbers to show that the dog's metabolic rates were proportional to their mass with an exponent of 2/3 -- just like the geometry of an imaginary spherical beast would suggest.

But, in 1932, Swiss agricultural chemist Max Kleiber presented a paper with a now-famous graph. It plotted, on a logarithmic scale, the body weight of 13 mammals, ranging from rats to cows, against their resting metabolism. Strangely, the line traced through the data points did not conform to Rubner's observation nor common sense. Instead, it hewed to a line with a somewhat steeper slope of about .73. To make it easier for slide rule use, he rounded the exponent to a neat .75. Kleiber's 3/4-power law was born.

"Kleiber's original data is a mess, a complete mess," says Dodds, "but it became something everyone believed in. The idea of quarter-powers begins to take on this spooky, magical quality. Nobody can explain it, but it's a secret law of the universe. It's quarterology!"

Again, we're amazed by the parallels with the Climategate scandal. Next, we'll see otherwise rational scientists fall into line over the apparent relationship. Again, we've added the links for reference:

Over the next decades, hundreds of animals' resting metabolisms were measured or estimated, from microbes to whales. The results in various groups of animals ranged from slopes of less than 2/3 to greater than 1. But as Vaclav Smil wrote in a sweeping "millennium essay" for Nature they were "close enough to the 0.75 line," and concluded that "the 3/4 slope is representative for all" animals.

"Some data seems to fit this 3/4 line -- if you're looking for it!" says Dodds. "It was pre-supposed to be true -- and became a universal overarching law that somebody needs to explain."

Instead of explaining it, in the 1960s a Scottish conference on energy metabolism simply voted, 29-0, to enshrine 3/4 as the official exponent. Then, in 1997, an elegant, though controversial, paper by Geoffrey West and colleagues was published in Science that claimed to derive 3/4 from first principles, drawing on ideas about fractals in networks and the growing length of tubes.

"The problem is their paper fell to pieces mathematically. It just didn't work. Unfortunately, I showed that and published a paper with my advisor and a fellow student in 2001," Dodds says. They also reanalyzed data from Kleiber and six other scientists and concluded that there is little empirical evidence for rejecting 2/3 in favor of 3/4. "But we didn't have a better theory," Dodds says, "or some way to clean it all up."

Until now. Dodds's new paper explores the geometry of branching networks -- like blood supply -- to show how a material, like blood, can be most efficiently delivered. "If you're going to build organisms with a central source, like a heart, that places physical constraints that evolution has to run up against," he says. "These constraints won't let the ratio be too far away from 2/3."

"My new paper follows the argument that was put forth in 1997 -- that, somehow, networks give rise to the 3/4 law. They were right that supply networks are key to understanding the metabolic limitations of animals. Except my paper shows that networks give rise to the 2/3 law, actually," Dodds says, "If you do the math properly."

And here's the deviation from the Climategate scandal. Where animal body mass and metabolism are concerned, science worked actively to correct itself in the light of new data and stronger analysis.

But then, the financial incentive for those involved in promoting the flawed "3/4 law of metabolism" aren't anywhere near the level of those promoting the AGW climate change theory....

Previously on Political Calculations

Labels: quality

Welcome to this special, Febraury 13, 2010 edition of On the Moneyed Midways, your one stop shop for finding the best posts from the previous week's business and money-related blog carnivals!

Welcome to this special, Febraury 13, 2010 edition of On the Moneyed Midways, your one stop shop for finding the best posts from the previous week's business and money-related blog carnivals!

What makes this issue "special" (or to translate into our meaning of the word: "late")? We made a late editorial decision to bump the post to today so we could feature a public service to every bachelor who might be considering ending their bachelorhood this Valentine's Day weekend.

Otherwise, there's absolutely nothing out of the ordinary about this week's edition of OMM! The best posts we found in the week that was await your attention below!...

| On the Moneyed Midways for February 13, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | What the New Credit Card Act Means to You | Studenomics | If you're under 21, the new law will make it tougher to get a credit card. But MD notes that the new law "really sucks" if you're an aspiring entrepreneur or if your parents have bad credit. |

| Carnival of Personal Finance | Two Views on the Economics of Dating | Four Pillars | Mr. Cheap spills the inside story of a male friend who tracks every penny he spends on the women he dates with a goal of getting the number to zero and a female friend who's goal in dating is to get the guy to spend as much as possible on her without giving up much in the way of physical affection. Oddly enough, they don't date each other.... |

| Carnival of Trust | America's Most Despised Companies | The Corner Office | Steve Tobak names the least trusted among America's big businesses and offers advice for what they can do to turn their situations around. Absolutely essential reading! |

| Cavalcade of Risk | Maternity As an Option Rather Than a Mandate | Colorado Health Insurance Insider | Louise Norris considers a bill making its way through the Colorado state house that would require health insurers to offer at least one policy with maternity coverage - wondering instead why not just make it an ala carte option that could be added to any policy. |

| Cavalcade of Risk | Falling Objects Pose Serious Hazards | Risk Management for the 21st Century | Nancy Germond's recent search of recent jury verdicts finds danger falling from the sky in the form of cardboard, countertops, wheelbarrows and couches. She lays out what the potential consequences are to businesses and how they might avoid the risks in Absolutely essential reading! |

| Festival of Frugality | How Much Could You Reduce Your Budget If You Get Laid Off? | Darwin's Finance | Darwin isn't in immediate danger of being laid off, but he goes through his own budget to illustrate what kind of expenses will have to be pared should the worst happen. The Best Post of the Week, Anywhere! |

| Money Hacks Carnival | Donating an Old Car May Not Be Tax Deductible | FIRE Finance | The folks at FIRE Finance find the IRS' fine print for deducting the fair-market value for a formerly fine form of four-wheeled transportation may make it not worth the fuss. |

| Best of Money | How to Benefit from Chaos in Your Life | The Financial Blogger | Can chaos send you in a better direction? The Financial Blogger finds it can if accepting it allows you to break out of a box that was constraining you. |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

What is the optimum age a man should be before seriously proposing marriage?

What is the optimum age a man should be before seriously proposing marriage?

It's not a question that we were looking to answer, yet it is one that the Daily Mail reports that Australian mathematicians have been working hard to solve. Their work has produced a mathematical formula that reveals a man's optimal age for proposing marriage:

"Applying maths to matters of the heart is always a dangerous prospect," said Professor Tony Dooley from the University of New South Wales School of Mathematics and Statistics.

"But if you want to work out the right moment to start getting serious, then this actually gives you a mathematical framework to think about it.

"The result is your Optimal Proposal Age.

"Ideally you should not propose to anyone before you hit this age, but afterwards you should prepare to pop the question to the very next girl you date – as long as she's the best of the bunch so far!"

Alright then. If you're a man and you're ready to reckon whether you're ready to pop the question, we've got the ready reckoner for you.

Just enter the indicated data in the tool below - we'll do the math that will determine if you've reached the minimum age you need to be to go on the marriage ride....

Yes, it's that simple. If you're over the age indicated above, you should be ready to pop the question. What could possibly go wrong?

The Daily Mail continues:

The formula is based on a similar equation used in the finance and medical sectors to pinpoint when to take action to maximise rewards and minimise costs.

And if you think a mathematical equation takes all the romance out of Valentine's Day, you may be right.

The researchers claim a 37 per cent success rate, which doesn’t sound very impressive.

But they say traditional ways of picking a bride don't guarantee a successful marriage, either.

"Although probability isn't the most romantic basis for a marriage, the formula does seem to fit a lot of couples, whether through accident or design," Prof. Dooley said.

"One could argue that the current, less structured approach to picking a marriage partner hasn't been 100 per cent successful, so perhaps it's time for men to consider following a stricter set of rules when it comes to marriage planning."

Happy Valentine's Day!

Previously on Political Calculations

- What Are the Chances Your Marriage Will Last?

- Picking the Right Date for Valentine's Day

- Should You Become Intimate with a Coworker?

- Should You Start or Stop Procrastinating?

- Should You Apologize?

- Should You Lie?

- Is Your Personal Grooming Adequate?

- How Many Hours of Sports Can You Watch (Without Her Getting Angry?)

- Are You Whipped?

Labels: geek logik, tool

Before we go any further, we'd like to make something very clear. We're not making this up. Really. What you're about to review is a completely authentic solution that has been proposed for doing away with homelessness, one homeless person at a time, by artist James Westwater.

His solution? The Homeless Chateau:

Here's how he describes it:

Homeless Chateau is a prefab one-person living module designed to be used inside a building. It is fully self-contained, including cooking and toilet facilities. A rubber flap over the entrance provides privacy, and one end is made from translucent polyethylene to let in natural light. It can be transported flat, erected quickly with just a screwdriver, and moved around the host space on its casters.

Taking a closer look at the picture above, we're impressed by the subtle use of messaging provided by the "No Outlet" and downward pointing "Detour" road construction sign elements to better communicate the negativeness of homelessness to the homeless.

Let's take a look at the inside:

|

|

Taking a closer look at the photos, we find that our homeless connoisseur of literature would appear to be enjoying Kenneth Grahame's The Wind in the Willows at their bedside.

The other photo reveals the well-stocked pantry, kitchen and toiletry features of the Homeless Chateau, complemented by a book rack, upon which we find the essential reading of the homeless everywhere, Chateaux and Villas (The Worlds of Architectural Digest), *the* guide to potential host spaces for the Homeless Chateau.

Did we say we couldn't make this up?

HT: Core77 (who else?!)

Labels: none really, satire

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.