Welcome to the post-Thanksgiving, Black Friday, November 28, 2008 edition of On the Moneyed Midways, the only place on the web where you can catch up with the best posts from the best of the past week's money and business related blog carnivals!

Welcome to the post-Thanksgiving, Black Friday, November 28, 2008 edition of On the Moneyed Midways, the only place on the web where you can catch up with the best posts from the best of the past week's money and business related blog carnivals!

And really, what better way to digest Thanksgiving leftovers than by also digesting the best posts we found among the past week's money and business blog carnivals? Here's a quick sample of what you'll find below:

- A tip for how get get a bigger salary offer for a new job.

- Why asking more than the market says your house is worth is worse than the chickenpox! The Best Post of the Week, Anywhere!

- Ideas for how you can stand out and be a better employee.

The best posts of the week that was await you below....

| On the Moneyed Midways for November 21, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Negotiating a New Salary -- Believing You're Worth It | Economic Crunch | Polly Poorhouse tells how she converted an information advantage into a higher salary when negotiating for a new position. |

| Carnival of Personal Finance | Surprising (and Promising) Aspects of the Financial Crisis | The Personal Financier | Finally, science provides the answers! Dorian Wales describes the findings of recent academic research that describes the kinds of songs we listen to, the kind of Playboy playmates we like to look at, and how much laxatives we use in stressful economic times! |

| Carnival of Real Estate | 3 Reasons Overpricing Your Home Is Worse Than Chicken Pox | Exit Real Estate 540 | CoRE host Pat Holkesvig listed this post as an honorable mention. We're just glad she included it, even if it was an afterthought. It's really The Best Post of the Week, Anywhere!, and not just for image of raw chicken pox exposure that leads the post.... |

| Festival of Frugality | How to Save Money on Laundry Day | The Greenest Dollar | Heather Levin has combed the entire blogosphere for tips for saving money on doing laundry, combining the best ideas she found into a very well done post. Absolutely essential reading! |

| Festival of Stocks | More Dark Side Ideas: Oil Stocks | The StockMasters | The StockMasters outline the kinds of plays they'd consider making with oil stocks, describing how the price per barrel of oil would affect the kind of investments they'd consider. Plus, a not to be missed YouTube video: Chad Vader - Day Shift Manager #1. |

| Money Hacks Carnival | Being a Better Employee Series: Go Beyond | The Writer's Coin | Nut hits on the central wisdom for making yourself stand out in the workplace: bring something more to the table than is asked of you. Absolutely essential reading! |

| Carnival of Money Stories | What's Up With Your Pictures, J? Did You Get Them? Tell Us! | Budgets are Sexy | Bad customer service and Internet age retribution are the themes behind J. Money's latest blogging project wherein he seeks to obtain all the wedding pictures he paid for! |

| Festival of Frugality | When Should You Not Save Money? | Studenomics | Martin Dasko weighs in on which times of your life you just need to throw thrift aside and spend what it takes! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Alas, Turkeymania 2008 is coming to an end. In fact, all that's left now are the leftovers, which raises an interesting question.

Alas, Turkeymania 2008 is coming to an end. In fact, all that's left now are the leftovers, which raises an interesting question.

Can you make money from them?

Being too stuffed ourselves to want to put much effort into finding out, we instead filtered through this list of highly questionable ideas for things you can do with Thanksgiving leftovers to filter out just the ones that had some sort of money-making or money-saving potential. Just remember the key words operating here are "highly questionable...."

- Flatten stuffing with rolling pin and bake until hard. Sell to local lumber store as press/compound board.

- Liquefy leftovers according to colors. Sell as organic finger paints.

- Mix whatever doesn’t sell and repackage as vitamin-rich energy juice.

- Glue olives, celery sticks, etc. to create clever and whimsical figurines. Sell at local craft fairs as Christmas ornaments.

- Estimate dollar value of leftovers and send to IRS as “payment-in-kind” like the fishermen do.

- Place into cylindrical containers and sell to the Army as biological weapons.

- Mix with water to make a broth. Serve as “Potluck Surprise” at local church dinner.

- Stitch turkey skins together, stuff with sweet potatoes, sell as organically-created hackysacks.

Is it just us, or are you also making the connection that a lot of so-called "organic" products are really just unattractive and potentially inedible leftover waste that has been repackaged and heavily marketed to ignorant consumers as being either healthy, good for the environment or art?

Labels: none really, thanksgiving, turkey

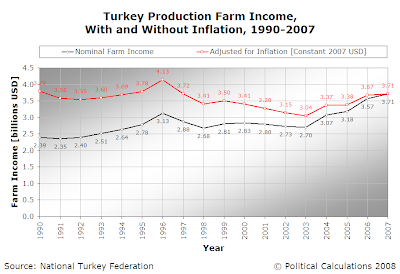

Update: We've corrected the charts and associated text to reflect the correct inflation-adjusted levels of farm income and farm income per turkey!

How much money does Big Turkey make each year? Political Calculations' Turkeymania 2008 continues today with the answer to that question!

First, here's our chart showing total aggregate turkey production farm income, both with and without inflation, from 1990 through 2007:

Next, here's what that means per turkey. We've divided the total production farm income presented in the chart above by the number of turkeys produced in each year, producing the chart below showing the average amount of farm income generated per turkey in the U.S. for each year between 1990 and 2007:

So we confirm that on a per-turkey basis, America's turkey farmers have only done better in just one year, 2006! After adjusting for inflation, we find that the average farm income per turkey produced has fallen a bit since last year, but is still well above all its other recorded values since 1990.

But we wondered how much of that income per bird might come from government agricultural subsidies. To find out, we took advantage of the Environmental Working Group's farm subsidy database to identify turkey producers who have received these subsidies for every year since 1996.

In doing that, we found that Cargill Turkey Products, a subsidiary of the mysterious Cargill Meat Solutions [Ed. Just what problems other than hunger are they solving with meat, anyway? You don't really want the answer for that, do you?] received over $17 million in "disaster subsidies" in 2002 and 2003. The subsidies they received were related to the catastrophic losses the firm incurred as a result of an outbreak of avian influenza (bird flu). Pilgrim's Pride of Virginia received disaster insurance payments totalling $11.4 million for similar losses during that period.

Aside from the disaster-related payments received in those years, it would otherwise appear that the U.S. turkey-industrial complex is blissfully free of corrupting government subsidies.

As we've shown, America's turkey farmers are doing quite well. Perhaps the rest of United States' agricultural welfare class can learn something from them and go cold turkey and go without the subsidies they currently receive.

It has, after all, worked well in other parts of the world.

Labels: business, economics, turkey

We're continuing our descent into Turkeymania 2008 today, revealing the identities of the major companies of the U.S. turkey-industrial complex perhaps better known collectively as "Big Turkey."

Who are these companies and how big are they? The chart below answers in terms of the live weight of the turkeys they processed in 2007:

We've gone the extra mile and created a dynamic table with this data that you can sort alphabetically by company, by the combined live weight of the turkeys they processed in 2007, or by the percentage share of the total live weight of turkeys produced in 2007. You just need to click the column headings to sort the data into the order that you'd like to see it:

| Top U.S. Turkey Processors, 2007 |

|---|

| Company | 2007 Live Weight Processed [millions lbs] | Percentage of Market in 2007 |

|---|---|---|

| Butterball | 1375 | 17.47 |

| Jennie-O Turkey Store | 1255 | 15.95 |

| Cargill Meat Solutions | 1112 | 14.13 |

| Farbest Foods | 271 | 3.44 |

| House of Raeford Farms | 255 | 3.24 |

| Perdue Farms | 252 | 3.20 |

| Foster Farms | 248 | 3.15 |

| Virginia Poultry Growers Coop. | 241 | 3.06 |

| Prestage Foods | 236 | 3.00 |

| Sara Lee | 220 | 2.80 |

| West Liberty Foods | 218 | 2.77 |

| Oscar Mayer | 213 | 2.71 |

| Cooper Farms | 178 | 2.26 |

| Michigan Turkey Producers | 171 | 2.17 |

| Norbest | 150 | 1.91 |

| Dakota Provisions | 145 | 1.84 |

| Zacky Farms | 131 | 1.66 |

| Turkey Valley Farms | 115 | 1.46 |

| Norther Pride | 40 | 0.51 |

| White Water Processessing | 32 | 0.41 |

| Combined Total for Smaller Producers | 1011 | 12.85 |

| Total for 2007 | 7869 | 100.00 |

We find that just three companies process 47.6% of the total mass of turkeys produced in 2007, as measured by their live weight: Butterball, Jennie-O and the mysterious Cargill Meat Solutions*.

* With a name like "Cargill Meat Solutions," it has to be mysterious - to the best of our knowledge, meat only "solves" one problem: hunger! What other problems meat might solve is left to the reader's imagination....

The smaller producers referred to in the table above are those that processed less than 32 million pounds of live turkeys individually in 2007.

Labels: turkey

We have one true annual tradition here at Political Calculations, and that's to celebrate Thanksgiving week in the U.S. by digging into the numbers behind the U.S. turkey-industrial complex!

We'll begin this year by taking a census of turkeys produced in the U.S. in the previous year (obviously, we can't do that for the current year, for the simple reason that the current year isn't over yet!). The chart below provides the number of turkeys produced in each year beginning in 1989:

The National Turkey Federation confirms that the number of turkeys produced in the U.S. in 2007 is 271,685,000, which represents a rebound to the level of turkeys produced by the nation's turkey farmers in the early 2000s.

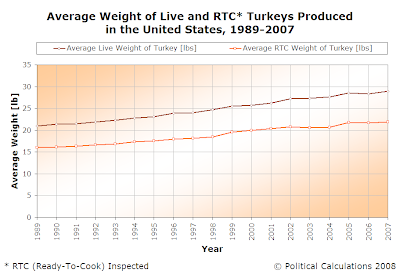

Collectively, these turkeys weighed some 7.869 billion pounds while they were alive, which is trimmed to the 5.958 billion pounds they collectively weight in the Ready to Cook (RTC) Inspected weight in which Americans find them for sale in their local grocery stores! The following chart shows what that means on a per bird basis:

In 2007, the average weight of a live turkey produced by the U.S. turkey industry was 28.96 pounds. The weight of the average Ready-To-Cook turkey delivered to U.S. grocery stores was 21.93 pounds.

Doing the math, we find that compared to the kinds of turkeys produced in 1989, the earliest year for which we have data, 2007's live turkeys are 38.25% larger. When we calculate the compound annual growth rate of live turkeys, we find that the average live turkey is increasing in weight at an average annualized rate of 1.8% per year!

Of course, all those turkeys have a cost! Fortunately for all Americans, the U.S. Bureau of Labor Statistics tracks the price per pound of whole, frozen turkey on a monthly basis. Here's their chart showing this data for each year from 2004 through 2007:

Compared to recent years, 2007 was interesting in that the price of a pound of turkey meat rose sharply from April through June, then remained very high into October of last year. This increase largely corresponds to the increase in government subsidies for ethanol producers during that period, which reduced the supply of available feed corn, making it more expensive, which in turn, made producing turkeys themselves more expensive!

We see though that after October, the price per pound of whole, frozen turkeys dropped to typical levels. We also confirm that the very best time of the year to buy whole, frozen turkeys is the month of December.

Labels: turkey

Welcome to this perfectly normal, regularly scheduled, Friday, November 21, 2008 edition of On the Moneyed Midways, the one place on the web where you can catch up with the best posts from the best of the past week's money and business related blog carnivals!

Welcome to this perfectly normal, regularly scheduled, Friday, November 21, 2008 edition of On the Moneyed Midways, the one place on the web where you can catch up with the best posts from the best of the past week's money and business related blog carnivals!

After two weeks in a row of posting late editions of OMM, we're celebrating our return to our "normal" schedule with some outstanding posts this week! Here's a quick sample of the best of the best:

- Abby finds that being poor also means being virtually recession-proof!

- You might get a 0% interest rate for 6 months on that credit balance you transfer to a new card, but the Art of the Coupon finds that the real cost is about 100 points of your credit rating.

- Want to make money online? Maria shares how much and from where she earns passive income for the things she's written in The Best Post of the Week, Anywhere!

These posts, and the rest of the best of the week that was, await you below!...

| On the Moneyed Midways for November 21, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | What a Balance Transfer Did to My Credit Score | Art of the Coupon | You know those deals where you can get a 0% interest rate for so many months if you switch your balance from one credit card to a new one? Did you know that doing that just once can shave almost 100 points off your credit score? Absolutely essential reading! |

| Carnival of Personal Finance | Finding Your Lifestyle Break-Even Point | How to Make 7 Million in 7 Years | Adrian J. Cartwood explains the math for figuring out how much you need to save and invest to replace the income that supports your lifestyle in retirement. |

| Carnival of Real Estate | Why Home Buyers and Home Sellers are Frozen on the Fence and What You Can Do About It? | Brand Candid | Ken Brand examines why real estate markets in even non-bubble markets are freezing up and advocates a strategy agents can use to generate confidence for their clients. |

| Cavalcade of Risk | Combining Public and Private Health Insurance | Colorado Health Insurance Insider | Louise Norris argues that expanding Medicare to cover more Americans would be more efficient and make private health insurance premiums more affordable and claims that "health care is too important to leave it solely up to market forces." |

| Festival of Frugality | How Regifting Can Help You Save Money | Ready to Be Rich | fitzvillafuerte is a gift recipient's worst nightmare and, quite possibly, evil. Here, he explains the rules for regifting the things you received but don't want to others, whom we'll call "victims"…. |

| Festival of Stocks | CTC Media: Big Gain Potential, Equally Big Risks | MagicDiligence | Steve reviews CTC Media (CTCM) a Russian free-television broadcaster which he considers "an intriguing opportunity, but just carries too much risk to recommend as a Magic Diligence Top Buy." |

| Money Hacks Carnival | Passive Residual Income Monthly Report | My Work at Home Mom Blog | In the month of October 2008, Maria raked in $2,654.18 as the result of her online writing - she shows how much and from where her income originates in The Best Post of the Week, Anywhere! |

| Carnival of Money Stories | Who'd Have Thought Being Poor Was the Way to Go? | I Pick Up Pennies | Abby delivers contrarian wisdom in finding that being poor means that she and her significant other are pretty much recession-proof! Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Coincidence? Yes. All the same, with the stock market breaking new lows today, we're happy to welcome you to your nervous nirvana!

Next stop, the week of 21 January 2009!

Update (20 November 2008, 5:30 PM EST): And now you really can't say you weren't warned! Here's the snapshot of the final carnage in the stock market, as charted by the S&P 500:

Pretty nasty. Today's question of the day comes to us from the government offices of South Australia:

When will the stockmarket [sic] carnage end?

Well, we've already answered above, but perhaps a picture would be more appropriate:

We're leaving it vague for the sake of artificially inflating our readership on 21 January 2009, but if you follow the Wall Street Journal, you'll see that even one of the deans of the Dow Jones believes that there's not much point in paying attention to stock prices until February 2009 anyway....

Labels: none really

Here's the latest (through September 2008) showing how the decelerating economies of both the U.S. and China are resulting in much slower trade growth between the two nations:

For the month of September 2008, we see that the growth rate of China's exports to the U.S. are currently surging, even though the overall growth rate is nearing zero. The current surge is a seasonal pattern - with so many consumer goods produced in China, many are shipped to the U.S. in advance of the Christmas shopping season. Typically, China's exports to the U.S. peak in the month of October for any given year, with September often close behind.

That seasonal surge however is not enough to offset the overall trend we see. Here, we see that the growth rate of China's exports to the U.S. are now approaching a level of zero, which confirms that the U.S. economy has slowed dramatically. By contrast, a growing economy demands more goods, which results in the level of imported goods growing over time.

Looking at the reverse direction, we find that U.S. exports to China plunged in September 2008, with the trailing year growth rate falling in negative territory. This indicates that the value of U.S. goods and services exported to China for September 2008 is less than that of a year prior. As we see, this happens periodically, with the last negative growth rate recorded in July 2007.

Looking at the trend of U.S. exports to China, we find that it is slowing but still in positive territory. This indicates that China's economy is still growing, although at a slower pace than it had been previously.

Elsewhere, Tyler Cowen offers more facts regarding China trade.

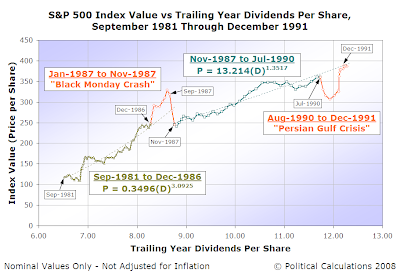

With the stock market having only recently been in free fall, we thought we'd take a closer look at the stock market crash of October 1987, putting it into the context of the market and events around it. In doing that, we'll be covering just over a decade from September 1981 through December 1991. The chart below surveys this full period, which includes two significant disruptive events: the Black Monday crash and the 1990-91 Persian Gulf War:

We'll begin taking a closer look by first examining the period of relative order in the U.S. stock market preceding the Black Monday crash, which approximately ran from September 1981 up to October 1987:

Using the statistical dating technique that we introduced previously in other analysis, we see that stock market crash of October 1987 really began as a positive disruptive event in January 1987. Here, we confirm that investors rapidly bid up stock prices over several months in reaction to accelerating corporate earnings. This is evident in the breaching of the upper limit three standard deviations above the projected central tendency, which confirms a the presence of a disruptive event during this period.

Futhermore, we can see earnings accelerating in the increased horizontal spacing between data points compared to the previous period. Since this data is reported quarterly, for investors to bid stock prices up in the months ahead of actual earnings announcements, they had to be anticipating higher earnings. After reaching a new level of equilibrium in March 1987, approximately centered on the upper 3-sigma limit established in the preceding period, the continued at this level through September 1987.

By mid-October 1987, as companies issued new forward-looking guidance, it became clear that the growth rate of corporate earnings was going to abate and be much reduced from the rate of previous months. Consequently, stock prices crashed, which confirms that this disruptive event was actually a bubble, although one of much smaller scale than that of the late 1990s.

In our next chart, we'll pick up with the remaining portion of the Black Monday stock market crash:

The period spanning from November 1987 thorugh December 1991 begins with the continuation of the crash that began on 19 October 1987. However, there was no erosion in stable component of corporate earnings, which we represent as trailing year dividends per share, so order in the stock market re-emerged quickly at a new, but lower, level.

That order continued all the way through July 1990. On 2 August 1990, the Persian Gulf nation of Iraq invaded neighboring Kuwait, which precipitated a negative disruptive event in the world's stock markets. The decline continued into October 1990 as world leaders formed a coalition to address the issue. Prices began rising in the months that followed and the stock markets recovered to their pre-invasion projected level of equilibrium following January 1991 when the U.S.-led coalition launched extension operations to expel Saddam Hussein's Iraqi forces from Kuwait and to restore Kuwaiti sovereignty.

Following this turmoil, a brief recession ensued which sent dividends into a minor retreat with no significant erosion of stock prices. A stable order re-emerged in the stock market beginning in January 1992.

A Random Black Swan Event?

We're not exactly sure why the Wikipedia article considers the Black Monday stock market crash of October 1987 to be some kind of mysterious black swan event. Perhaps the magnitude and immediate precipitating trigger for the sharp decline might be, but we don't believe there's really much mystery as to why it occurred. Investor expectations of the future value of the stable component of corporate earnings (dividends) did not materialize. Stock prices, which had been bid up in expectation of that future stream of income continuing to grow rapidly, fell sharply as a result. Just like one might reasonably expect that they would in that situation.

In that sense, it was nothing more than a demonstration of Milton Friedman's permanent income hypothesis, simultaneously and independently applied by a multitude of investors who came to the shared assessment that future earnings would be less than they had previously expected in a critical mass, and nothing less.

Previously on Political Calculations

Before today, we had only extended our unique brand of analysis back to December 1991. Here are the posts and direct links to all the charts we've presented to date:

- January 2008 through October 2008

- Chart: January 2008 through October 2008 - A new disruptive event!

- December 1991 through December 2007

- Chart: June 2003 through January 2008 - Order Re-emerges

- Chart: April 1997 through June 2003 - The Stock Market Bubble!

- Chart: December 1991 through April 1997 - Order in the 1990s

Labels: dividends, SP 500, stock market

What is the probability that Senator Norm Coleman is really leading Al Franken in the polls for the U.S. Senate seat now being contested in Minnesota?

To answer that question, we've adapted our tool for finding the odds that a given candidate's lead in the polls reflects what the final outcome of an election will be. That tool reworked the math presented by Supercrunchers' author Ian Ayres in an Excel spreadsheet that, in our view, wasn't the easiest thing in the world to figure out how to use. We did an extreme makeover of Ian's user interface, developing it into a much more user-friendly format!

Today, we're going to rework that tool again to answer our question! First though, let's see where the current vote counts stand:

| Minnesota U.S. Senator Vote Tallies, 15 November 2008 | ||

|---|---|---|

| Candidate | Votes Cast For Candidate | Votes Cast for Others or Unrecorded |

| Norm Coleman | 1,211,565 | 1,708,853 |

| Al Franken | 1,211,359 | 1,709,059 |

| All Others | 462,578 | 2,457,840 |

| All Candidates | 2,885,502 | 34,916 |

Taking the vote tally as of 15 November 2008 as kind of "superpoll," what we're really trying to find is the odds that Norm Coleman will retain his lead after all the ballots ruled valid in the original election count have been recounted.

What makes that less than a sure thing is the possibility of machine error in originally counting the ballots. Here, assuming that all the ballots originally counted for each candidate are valid, we need to take into account the number of ballots for which no vote for any U.S. Senate candidate was recorded, since this provides the pool of votes from which the final vote tallies produced in a recount may be drawn, provided that they contain a clear indication favoring a given candidate. Nate Silver indicates that the number of non-disqualified ballots is 34,916.

Combined with the number of ballots counted for all candidates, 2,885,502, this sum tells us the size of the total population of qualified ballots: 2,920,418. We'll take this total, as well as official vote tallies for both Norm Coleman and Al Franken and use our tool to find the likelihood that Senator Coleman will retain his lead, which has been certified by the state election board of Minnesota:

Using the tool with the vote totals recorded as of 15 November 2008, we find that the probability that Senator Coleman will retain his lead to be 55.8%. We do note that an additional nine votes have been counted in Senator Coleman's favor following an audit of Minnesota's voting machines, which have not been added to his vote total entered in the tool above - you're welcome to modify the values in the tool above to reflect these votes or other potential uncounted vote scenarios!

We find that 55.8% to be a fairly narrow, but positive margin, which perhaps explains why Al Franken has launched a number of lawsuits in an as-yet failing attempt to pad the total ballot count in order to maximize his chances of winning the recount.

Labels: election, politics, tool

Welcome to this special Saturday, November 15, 2008 edition of On the Moneyed Midways, your single source to catch up on all the best posts from the best of the past week's money and business related blog carnivals!

Welcome to this special Saturday, November 15, 2008 edition of On the Moneyed Midways, your single source to catch up on all the best posts from the best of the past week's money and business related blog carnivals!

Yes, once again, "special" equals "late," but does not equal "lame!" We've put our unexpected extra time to good use in compiling this week's edition, uncovering some real gems from the blog carnival midways this week. Here's a quick sample:

- The Super Saver's 529 education savings plan has been hammered by the stock market's decline, but he's holding fast and has adapted his plans.

- The Financial Blogger has been debating it for months, then wrote about it once, now he and his wife suddenly are doing it: launching a home business!

- How exactly is evaluating employee performance like the drunkard's walk? Incentive Intelligence explains....

The best posts we found from the best of the week's business and money-related blog carnivals, including the winner of the title: The Best Post of the Week, Anywhere!, await you below!...

| On the Moneyed Midways for November 15, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Visa Takes Life | Debt Reduction Formula | Ryan Healy puts an entirely new set of twists on the credit card advertising slogan "Life Takes Visa." |

| Carnival of HR | Employee Performance and The Drunkard's Walk | Incentive Intelligence | How should you really look at an individual employee's performance - as a single data point among those of others or as their individual trend over time? |

| Carnival of Personal Finance | Is Spreading Your Wealth Around a Terrible Idea? | StumbleForward | The Best Post of the Week, Anywhere! Christopher Holdheide considers the real implications of spreading the wealth! |

| Carnival of Real Estate | Social Media in Real Estate - Part 2: Facebook | Geek Estate | James Shiner argues that Facebook's social networking capabilities make it an invaluable resource for marketing a real estate agent's services. |

| Carnival of Trust | Work is Personal… Trust Matters | Business Evolutionist | What do we get when we combine a large company's micro-managing impulses and a song by Mark James with Jon Strande's ability to pair the two concepts in a highly entertaining post? Absolutely essential reading! |

| Festival of Stocks | College 529 Savings Account - Significantly Down | My Wealth Builder | The Super Saver set up a 529 investment plan for his son's college education in 2005, but the stock market this year has wiped out his gains, and then some. He's not that worried and describes how this experience will change how he handles the account in the future! Absolutely essential reading! |

| Money Hacks Carnival | E-Trade Bank Online Savings Account Review | StopBuyingCrap | How does E-Trade's online bank compare to others? Cap lays out the pros and cons of opening a savings account with the FDIC-insured arm of the online brokerage. |

| Carnival of Money Stories | We Are Going For It! | The Financial Blogger | The Financial Blogger and his wife had been debating for months on whether to open a daycare business from their home, but after writing about it on his blog, decided to pull the trigger and do it - it's now a go to launch on January 5th! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Whose council do they seek? Ours! (via Google):

Their tool of choice: Should You Apologize?

Oh, we could go on, but we'll stop there for today....

Labels: none really

Who do they go through? Well, once again, us (via Google):

Where they linked:

The tools they should have used:

The first tool provides direct access to historic data and rate of return information. The latter tool provides real investment returns of a hypothetical investment made before the all time bottom of the stock market during the Great Depression using actual historic data.

Labels: none really

Who does the Fed turn to? Would you believe, us (via Google)?

Their tool of choice: Reckoning the Odds of Recession.

Labels: none really

From time to time, we get some pretty high quality e-mail. In response to our post in which we presented a chart mapping the major phases of the Great Depression using stock market dividend data, one of our readers emphasized the role of the Smoot-Hawley tariff in exacerbating the economic conditions that ultimately produced the Great Depression.

The tariff was designed to increase the cost of imported goods to the U.S., imposing duties of more than 60% of the value of these goods, for the purpose of pushing their prices up to "protect" U.S. producers. In the words of the WTO's Pascal Lamy, it was a fantastic success (HT: Carter Wood):

If the idea was to curb imports, Smoot-Hawley was a fantastic success - by 1933 imports had fallen from $4.4 billion to $1.3 billion while exports fell 69% over that same period to $1.6 billion. But there was an unintended consequence to Smoot-Hawley - its contribution to an economic depression. Smoot-Hawley touched off a domino effect of retaliation and counter-retaliation among trading partners which provoked a severe contraction of international trade, depressed growth and rising unemployment around the industrial world. From 1930 to 1932 the unemployment rate soared from 8.7% to 23.6% and remained at more than 14% for the remainder of the decade.

One of the consequences of the prices of all these goods being pushed up is that the prices that U.S. producers charged for their goods also went up substantially. And as most economists know, when the price of something goes up, the quantity demanded goes down - the higher prices they could and were charging for their goods ultimately hurt U.S. producers as consumers demanded less of their products. That loss of demand led to cutbacks in production, which led to greater unemployment, which further reduced the ability of people to buy the products at the higher prices.

Believe it or not, the effect of the Smoot-Hawley tariff was shown on our chart:

Do you see it? It's right there in the bottom left-hand corner, identified as "Oct 1929 Stock Market Crashes"! Thanks to Jude Wanniski's research, the event that immediately precipitated the Great Stock Market Crash of 1929 was traced to the collapse of the coalition opposing the tariff in the U.S. Senate the day beforehand, which would ensure that the tariff would indeed become law (it finally did in June 1930). Investors in the stock market, recognizing the negative impact of the tariff, reacted immediately, sending stocks plunging on what became known as Black Thursday.

But the passage of the Smoot-Hawley Tariff doesn't fully account for all that happened. Another e-mailer asked about the role of inflation and deflation. The Great Depression is, in its essence, a long running deflationary event. To show that, we revisited our chart and plotted the inflation-adjusted values of the S&P 500's dividends per share from January 1925 through December 1949, using the Consumer Price Index of October 1929 as our base for finding the dividends in constant dollars:

The beginning and end of the Great Depression can be identified as the period from October 1929 through June 1943 as the period in which the real (inflation-adjusted) values of the S&P 500's dividends per share consistently exceeded their nominal (historic) values.

Finally, we received another e-mail from a musician, seeking to promote their work - we'll leave you with their music video featuring images from the Great Depression:

Labels: dividends, SP 500, stock market, trade

Yesterday, we featured a chart that shows how the sustainable component of corporate earnings, dividends, maps out the major phases of the Great Depression. Today, we're considering a related question: "What if you were an investor in the stock market through the worst of all that?"

Yesterday, we featured a chart that shows how the sustainable component of corporate earnings, dividends, maps out the major phases of the Great Depression. Today, we're considering a related question: "What if you were an investor in the stock market through the worst of all that?"

To answer that question, we've built a tool to do the math! What we've done is to incorporate our historic data for the S&P 500 and use it to calculate the total value of a series of investments made each month in the months and years containing the worst-ever recorded period of time for investments made in the U.S. stock market.

In doing all that, we've made some assumptions for our hypothetical investment based on actual data:

- The amount invested each month is held constant in terms of inflation. The value you enter in the tool is in constant dollars for the year in which the investment period under consideration ends.

- The price paid each month is the average of that month's closing price per share for the S&P 500.

- All cash dividends are fully reinvested.

- Any commissions, fees, taxes or other transaction costs are paid by the hypothetical investor with money outside the investment.

- The calculated investment values and the average annual rate of return presented are all adjusted for inflation. As with the amount entered, these values are presented in constant dollars for the year in which the investment period under consideration ends.

That might sound complicated, but all you need to do is enter the amount of months and years of investing before the all time bottom of the stock market was hit during the Great Depression, as well as the total number of months and years that you'd like to see the hypothetical investment run in total. Enter the inflation adjusted amount that you would invest in the S&P 500 each month, and we'll do the rest!

As for our default data, there's really nothing special about it. The default data is simply set up to correspond with a period of time consistent with the stock market hitting rock bottom just three years before a hypothetical investor might choose to retire and pull all their accumulated funds out of the market after a long career....

In using this tool, you'll want to tweak the time periods that you enter - you'd be amazed at how much a difference just six months might make!

For an upcoming project, we'll compare this worst actual case of stock market investing with an alternative investment!

Labels: investing, SP 500, worst case

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.