Today we're catching up with the controversy surround the e-mails and other documentation that were exposed in what has become known in the blogosphere as Climategate, although we're going to take a different tack than the kind of sensational discussion that has taken place elsewhere. Or at least as much as we can given the nature of the scandal.

Instead, we're going to apply our guide to identifying whether a given field is a legitimate field of scientific study or if it the field in question qualifies as being "junk science" or a "pseudoscience" to the information that was revealed in the public exposure of the Climatic Research Unit's (CRU) previously shielded e-mails and data. We're going to go line by line through our guide to see if the conduct and practices of the scientists involved in the scandal qualifies as science, pseudoscience, or if no such determination can be made with the available evidence.

In practice this exercise is a kind of high-level quality audit, where each negative indication would communicate a need to perform a much more detailed audit within the identified category. This kind of exercise will also provide an overall impression of the level of quality and integrity of the CRU's products and processes, with an increasing number of negative indications corresponding to an increasingly negative perception of that overall level of quality and integrity.

Let's get started....

| Checklist for Identifying "Junk" or "Pseudo" Science | ||||

|---|---|---|---|---|

| Aspect | Science | Pseudoscience | Applicability to "Climategate" | Is It Pseudoscience? |

| Goals | The primary goal of science is to achieve a more complete and more unified understanding of the physical world. | Pseudosciences are more likely to be driven by ideological, cultural or commercial (money-making) goals. | Ideological, cultural and commercial factors would all seem to be driving modern climate science. While we certainly see all three factors in evidence in former U.S. Vice President Al Gore's advocacy on the issue of Anthropogenic Global Warming (AGW), the Climategate documents suggest that money exerts a strong motivating influence upon the conduct of the climate scientists involved, while others would confirm ideological motives, which is evident in the apparent coordination with political advocacy groups on the release of information to the public. |  |

| Progress | Most scientific fields are the subjects of intense research which result in the continual expansion of knowledge in the discipline. | Pseudoscientific fields generally evolve very little after being first established. What small amount of research and experimentation that is carried out is generally done more to justify the belief than to extend it. | Here, many Climategate documents indicate a very strong effort on the part of several leading climate scientists to conduct research and analysis with the sole purpose of supporting their contention of the so-called "hockey-stick" effect in AGW theory, where global temperatures are presumed to have risen rapidly in the last years of the twentieth century. |  |

| Challenges | Scientists in legitimate fields of study commonly seek out counterexamples or findings that appear to be inconsistent with accepted theories. | A challenge to accepted dogma in the pseudosciences is often considered a hostile act, if not heresy, which leads to bitter disputes or even schisms. | The documents clearly indicate that climate scientists implicated in the Climategate scandal fall strongly in the "Pseudoscience" category, with at least one e-mail communicating the author's fear that one scientist would "react strongly" to contradictory data given their "very thin skin." Others indicate a strong desire to "beat the crap" out of a particular skeptic. And that's not even considering the public calls by some prominent climate scientists for trials of the skeptics criticizing their work for "high crimes against humanity." |  |

| Inconsistencies | Observations or data that are not consistent with current scientific understanding generate intense interest for additional study among scientists. Original observations and data are made accessible to all interested parties to support this effort. | Observations of data that are not consistent with established beliefs tend to be ignored or actively suppressed. Original observations and data are often difficult to obtain from pseudoscience practitioners, and is often just anecdotal. | The Climategate documents clearly indicate that evidence contradicting the outcomes predicted by AGW theory was actively suppressed or manipulated to produce a desired outcome. (In one notable case, to "hide the decline" actually observed in global temperatures in recent years.) Also remarkable is the exceptionally poor quality of the data and models maintained by the CRU, including apparent manipulations and "tricks" to create desired outcomes, such as the "hockey-stick" trajectory for global temperatures in multiple datasets or the apparent destruction of the original raw data used as the basis of the climate scientists work. |  |

| Models | Using observations backed by experimental results, scientists create models that may be used to anticipate outcomes in the real world. The success of these models is continually challenged with new observations and their effectiveness in anticipating outcomes is thoroughly documented. | Pseudosciences create models to anticipate real world outcomes, but place little emphasis on documenting the forecasting performance of their models, or even in making the methodology used in the models accessible to others. | There have been chronic issues with outside researchers not being able to obtain data from the climate scientists involved in the Climategate scandal, with the Climategate documents strongly suggesting a conspiracy from the involved climate scientists to obstruct the release of information subject to outsider requests made through the Freedom of Information Act. |  |

| Falsifiability | Science is a process in which each principle must be tested in the crucible of experience and remains subject to being questioned or rejected at any time. In other words, the principles of a true science are always open to challenge and can logically be shown to be false if not backed by observation and experience. | The major principals and tenets of a pseudoscience cannot be tested or challenged in a similar manner and are therefore unlikely to ever be altered or shown to be wrong. | The alleged obstruction of the release of information we've noted above would suggest that the climate scientists involved in the Climategate scandal are not willing to subject their work to the analysis needed to demonstrate that their findings are valid or false, or if a determination in either direction cannot be made with the available evidence. As such, the alleged obstruction would automatically fail our test for the falsifiability of their data and observations. |  |

| Merit | Scientific ideas and concepts must stand or fall on their own merits, based on existing knowledge and evidence. These ideas and concepts may be created or challenged by anyone with a basic understanding of general scientific principles, without regard to their standing within a particular field. | Pseudoscientific concepts tend to be shaped by individual egos and personalities, almost always by individuals who are not in contact with mainstream science. They often invoke authority (a famous name for example, or perhaps an impressive sounding organization) for support. | The Climategate documents strongly suggest that the involved climate scientists abused their authority and connections to deter or suppress challenges made through the peer review process of various scientific journals, whose findings would contradict their preferred conclusions and outcomes. |  |

| Clarity | Scientific explanations must be stated in clear, unambiguous terms. | Pseudoscientific explanations tend to be vague and ambiguous, often invoking scientific terms in dubious contexts. | This category would apply to the presentation of findings to individuals or groups outside the circle of the climate scientists involved. As the Climategate documents reflect internal communications, no determination of whether the identifying characteristics of a pseudoscience are present can be made. |  |

| Precision | If numbers are presented in support of a scientific explanation, they must be stated with the precision and accuracy required by their level of significance as determined by known measurement error in the data from which are derived, neither more nor less. | Pseudoscience practitioners will often present numbers with a level of precision and accuracy that exceeds that supported by the known accuracy of real world data in order to give the appearance of greater validity for their claims. | This category would apply to the presentation of findings to individuals or groups outside the circle of the climate scientists involved. As the Climategate documents reflect internal communications, no determination of whether the identifying characteristics of a pseudoscience are present can be made. |  |

Bishop Hill has a summary of the contents of a number of the more damning documents released so far and Watts Up With That? reports that someone has set up a search engine for all the e-mails. And if you're a fan of threats of violence, jail, professional career destruction and murder made by leading climate scientists and their supporters against their skeptics, Climate Depot has a nice summary of some of the more prominent ones of recent years. Finally, we believe Willis Eschenbach captures the real essence of the problem with the climate scientists involved in the scandal - their near absolute lack of transparency.

As for our checklist, we find that the so-called field of climate science as practiced by the individuals whose e-mails and data were apparently left exposed on the computer server that also hosts their organization's web site has far more in common with pseudoscience than with real science.

We should note that we would expect even legitimate sciences to have one or two boxes checked if we used this checklist to audit their work-in-process. However, since we've checked nearly all of the boxes in our pseudoscience checklist for the climate scientists involved in the scandal, which includes more than just those of the CRU, that raises a clear red flag that their work and findings should be treated with extreme suspicion, as the checklist indicates that their integrity is compromised. Their work must now either be viewed at best as the inferior result of a highly corrupt and flawed scientific process, or at worst, as outright fraud not to be used as the basis for any public policy decision.

As David St. Lawrence observes, the Climategate scandal perhaps represents the most systematic, top-down misconduct in a scientific field since the 40-year long Piltdown Man hoax corrupted the field of paleontology.

Oh, and for our money, this is perhaps the most interesting of the e-mails, mainly since the chain of discussion captures much of the debate on climate change while also highlighting the mindset of the climate scientists involved in the scandal.

Labels: quality

Welcome to our regular Friday, November 27, 2009 edition of On the Moneyed Midways! After last week's posting mishap, we're back on track with the best posts we found in the best of the past week's business and money-related blog carnivals!

Welcome to our regular Friday, November 27, 2009 edition of On the Moneyed Midways! After last week's posting mishap, we're back on track with the best posts we found in the best of the past week's business and money-related blog carnivals!

This past week was, by far, the best week for posts that we've seen in a very long time. Just about every post qualifies as being Absolutely essential reading! so the criteria for that award came down to the posts that would be very strong contenders for being The Best Post of the Week, Anywhere! in any other week.

As it happens though, this was not any other week. The post winning the title of being The Best Post of the Week, Anywhere! combines the business of fast, fresh food with the cult-like passion for it, and if you're wondering what you'd like to eat after Thanksgiving, it will answer that question for you!

Just scroll down and see for yourself....

| On the Moneyed Midways for November 27, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Slow and Steady Wins the Race | Get Rich Slowly | J.D. Roth continues his series on what works for getting out of the red and into the black, finding inspiration in both Aesop's fable and last season's Biggest Loser. |

| Carnival of HR | How Does HR Add to Profits? | Profitability Through Human Capital | Cathy Missildine-Martin answers the question that has perplexed executives since corporations were first invented and needed to hire people to hire people! |

| Carnival of Personal Finance | How Do You Plan to Manage Your Million Dollars? | Bible Money Matters | What if you won the lottery? What if you finally reached your lifetime savings goal? Would you know what to do with the money once you had it? Jason Price takes lessons from The Millionaire Next Door and How to Debt Proof Your Marriage. |

| Carnival of Real Estate | Home Mortgage Interest Deductions To Be Reduced | San Diego Real Estate Market | Bob Schwartz looks at what the Obama administration is planning for raising tax revenues by progressively doing away with the mortgage interest tax deduction. |

| Festival of Frugality | Opportunity to Pay Zero Federal Income Tax in 2010 | My Wealth Builder | We admit we were hooked by the tiltle of the Super Saver's post. Here, the early-retiree describes how he will manage his income and take advantage of three tax credits to avoid any exposure to federal income taxes next year. If you were looking for lessons on how to "go Galt," this is perhaps a good place to begin.... |

| Festival of Stocks | Quick Take: Time Warner Inc (TWX) | MagicDiligence.com | Steve looks at how media titan Time Warner (TWX) is transforming its business after spinning off Time Warner Cable (TWC) earlier in the year, arguing that its current stock price and earnings prospects makes it "a solid MFI buy". |

| Money Hacks Carnival | Sccusesufl Peosrnal Finnace Deos Not Riqueire Perftceion. | Dough Roller | The Dough Roller delivers Absolutely essential reading! in finding that perfection isn't needed to be successful in personal finance and investing. Or as the Dough Roller might put it, in "presoanl finncae and ivnsetnig." |

| Carnival of Money Stories | Reasons Why I Love In-n-Out Burger: It's No Secret | Good Financial Cents | In-n-Out Burger is a fast-food franchise available in just four states (CA, NV, AZ and UT). If you live anywhere else in the world, Jeff Rose's post will make you wish you had one near you just so you can order off the secret menu! The Best Post of the Week, Anywhere! |

| Best of Money | The X-Men Guide to Unlocking Your Financial Mutant Powers | Man vs Debt | Adam Baker explains how Wolverine is the "Dave Ramsey" of the X-Men world in dividing the X-men universe between its personal finance heroes and villains. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Before celebrating the holiday, let's first set some ground rules (HT: Michael Wade):

- Thou shalt not discuss politics at the dinner. There is next to no chance that you'll convert anyone and any hard feelings that are generated may last long after the pumpkin pie is finished. Why spoil a good meal?

- Thou shalt limit discussion of The Big Game. This is mainly directed at the men who choose to argue plays, records, and coaches while their wives stare longingly at the silverware. The sharp silverware.

- Thou shalt say nice things about every dish. Including the bizarre one with Jello and marshmallows.

- Thou shalt be especially kind to anyone who may feel left out. Some Thanksgiving guests are tag-alongs or, as we say in the business world, "new to the organization." Make a point of drawing them in.

- Thou shalt be wary of gossip. After all, do you know what they say when you leave the room? Remember the old saying: All of the brothers are valiant and all of the sisters are virtuous.

- Thou shalt not hog the white or dark meat. We know you're on Atkins but that's no excuse.

- Thou shalt think mightily before going back for seconds. Especially if that means waddling back for seconds.

- Thou shalt not get drunk. Strong drink improves neither your wit nor your discretion. Give everyone else a gift by remaining sober.

- Thou shalt be cheerful. This is not a therapy session. This is not the moment to recount all of the mistakes in your life or to get back at Uncle Bo for the wisecrack he made at your high school graduation. This is a time for Rule #10.

- Thou shalt be thankful. You're above ground and functioning in an extraordinary place at an extraordinary time. Many people paid a very heavy price (and I'm not talking about groceries) to give you this day. Take some time to think of them and to express gratitude to your friends and relatives. Above all, give special thanks to the divine power who blesses you in innumerable ways.

Image Source: Vernon County, Wisconsin November Mini-Bus Schedule

Labels: thanksgiving

One of the trends we've noted in the world of commercial turkey evolution in past years is the one toward producing ever bigger birds, which we've humorously called the turkey industry's (aka "Big Turkey's") "Super Turkey" project.

But something happened in 2008 to reverse the growth trend we've observed toward the ever meatier Ready-To-Cook (RTC) turkeys that American consumers are most likely to encounter in their local grocery stores and megamarts. The turkeys got bigger in 2008, but they didn't get any meatier.

What we find in the latest data is that the average live weight of U.S. produced turkeys reached a new high in 2008, but that the Ready-To-Cook weight dropped for the first time ever since our available data records begin in 1989. We see that the average live weight of a U.S. turkey has climbed to 29.02 pounds, a 2.5% increase over the figure for 2007, but that the RTC weight declined by nearly 1% to 22.11 pounds in the same year-over-year period.

More than that, the drop in the RTC weight of turkeys produced in the United States was large enough to erase the gains realized in the yield of turkeys in both 2006 and 2007.

We have a hypothesis for how that might have happened.

In late 2007, petroleum prices in the U.S. were on a sharp upward trend, which continued well into 2008. In response, the U.S. government expanded the subsidies it provides from taxpayers to ethanol producers who cranked up their production, seeking to reduce the price of gasoline by substituting a larger portion of it with price subsidized ethanol. Motivated by the easy profits created by increased taxpayer subsidies, U.S. ethanol producers then scoured the available U.S. corn crop to support their increased rate of production.

That's significant because while ethanol is more efficiently produced using sugar cane, in the U.S., ethanol is more economically produced from corn thanks to the country's high tariffs on imported sugar, which double what U.S. consumers must pay for sugar above the world price for the commodity.

Going back to our story, that subsidized surge in the quantity demanded for corn to support the increased production of subsidized ethanol also significantly increased the price of corn. That increase in price was felt by every other consumer of corn, including turkey producers who use the grain to feed their birds.

Going back to our story, that subsidized surge in the quantity demanded for corn to support the increased production of subsidized ethanol also significantly increased the price of corn. That increase in price was felt by every other consumer of corn, including turkey producers who use the grain to feed their birds.

Seeing as turkey production has fairly low profit margins, turkey producers reacted by substituting other less expensive types of feed for a portion of the corn they would otherwise have used, needing to satisfy consumer demand for the number of turkeys they would produce. We suspect that less expensive feed resulted in larger turkeys, but with a lower yield of meat as compared to purely corn-fed birds.

That would also explain a good portion of the increase in price we've observed from 2008 to 2009. While the number of turkeys produced has increased, their RTC weight per turkey has declined, which suggests the relative supply of turkey meat available for consumption has decreased (as RTC turkeys have become skimpier) while the quantity of turkeys demanded by consumers has increased.

And that would be why frozen turkeys have outperformed gold as an investment over much of 2008 and 2009.

Labels: economics, thanksgiving, trade, turkey

In 2008, their tab for Thanksgiving dinner came in at $44.61, which was up $2.35 (or 5.6%) from what they found in 2007. Their press release describes the big movers:

The cost of a 16-pound turkey, at $19.09 or roughly $1.19 per pound, reflects an increase of 9 cents per pound, or a total of $1.46 per turkey compared to 2007. This is the largest contributor to the overall increase in the cost of the 2008 Thanksgiving dinner.

"Food prices rode the energy price roller coaster up during the first half of 2008, and as the year winds down, energy prices have moderated somewhat but food prices have not come down," said Jim Sartwelle, an AFBF economist.

For 2009, the AFBF is reporting that assembling their classic Thanksgiving dinner costs 4% less than in 2008:

AFBF's 24th annual informal price survey of classic items found on the Thanksgiving Day dinner table indicates the average cost of this year's feast for 10 is $42.91, a $1.70 price decrease from last year’s average of $44.61.

[...]The cost of a 16-pound turkey, at $18.65 or roughly $1.16 per pound, reflects a decrease of 3 cents per pound, or a total of $.44 per turkey compared to 2008.

Milk, at $2.86 per gallon, dropped $.92 and was the largest contributor to the overall decrease in the cost of the 2009 Thanksgiving dinner.

"Consistent with the retail food price declines seen throughout the year, consumers will pay just a bit less for their Thanksgiving feast this year," said Jim Sartwelle, an AFBF economist. "Consumers are benefiting at the grocery store from significantly lower energy prices and the effects of the economic slowdown. Again this year, the cost per person for this special meal is less than a typical 'value meal' at a fast-food outlet," Sartwelle said.

So we find that even though the price of Thanksgiving dinner has decreased, the price of turkey would appear to not really have budged much from its 2008 price.

To put that price in context for recent years, we next turned to the Bureau of Labor Statistics, who also has an annual tradition of tracking the average price of a whole, frozen turkey in U.S. cities. Our next chart shows their data from January 2004 through September 2009.

To put that price in context for recent years, we next turned to the Bureau of Labor Statistics, who also has an annual tradition of tracking the average price of a whole, frozen turkey in U.S. cities. Our next chart shows their data from January 2004 through September 2009.

What we see in this chart is that the average price of turkey has been really elevated for much of 2009, as compared to the prices recorded each month from 2004 through 2008. In fact, comparing the average price for 2008 of $1.25 per pound with the average price of whole, frozen turkeys from January through September 2009 of $1.40 per pound, we see that prices have risen in value by 11.8%.

We also see that there is a seasonal pattern in most years where the price of turkey falls dramatically between October and November, so perhaps we'll find when that data becomes available for October and November 2009, we'll that the price of turkey has indeed dropped slightly below the level set in 2008, confirming the AFBF's informal observation. At present however, it would seem that the price of turkeys in 2009 are contradicting the trend observed by AFBF economist Jim Sartwelle.

The question is why?

We wonder if perhaps turkey has become one of those commodities like gold or stocks that have increased in relative value as the U.S. dollar has fallen in value.

Looking just at the change in the price of gold in 2008, using the data we found in Kitco's historical gold price charts, we find the average price of gold in 2008 to be $871.96 and the average price of gold from 1 January through this point in 2009 to be $954.33. That works out to be an average annualized increase in price of 9.4% for the precious metal.

That's less than the 11.8% increase in price we've calculated for whole, frozen turkeys for the period from January 2008 through September 2009, which is really impressive considering that gold is now near its highest values for the year.

So we find that turkeys have outperformed gold as an investment over much of the past year. Who would have ever thought such a thing was possible?!

Labels: food, thanksgiving, turkey

It's Thanksgiving week in the U.S. and here at Political Calculations, that means one thing: it's time for our annual Turkey Week!

What's Turkey Week, you ask? It's our unabashed celebration of the big business of feeding hungry Americans the one item that roughly 82% of them will consume on the fourth Thursday of November: turkey! That is, if WikiAnswers is to be believed....

We see that in 2008, the number of turkeys produced in the U.S. rose to 273 million from 268 million the year before, representing a percentage increase of 2.2%. What's more, we find that this number is the same as that for 2001. We find that informational tidbit interesting because both years represent years in which the U.S. economy was in recession. Perhaps even more interesting is that we see that we see turkey consumption drop as the economy improved from 2003 to 2005, only beginning to improve again in 2006, the same year as when the U.S. housing bubble began to dissipate.

Note: In the positive GDP growth rate years of the 1990s, turkey consumption boomed due to its perceived health benefits as a low-fat source of protein during the low-fat diet craze of the era. But then, we see turkey production booming in 1990 over 1989's level, which again coincides with a recession year.

Perhaps that's to be expected though, as one might expect people to turn to traditional or comfort foods at times of economic stress.

As the recession has continued into 2009, we were next curious to see how that might affect the price of turkey in the United States. We'll pick up the story with 2009's Thanksgiving grocery bill tomorrow....

Labels: economics, food, thanksgiving, turkey

Welcome to this "special" Sunday, November 22, 2009 edition of On the Moneyed Midways, where in each week's edition, we present the best posts we found among the best of the previous week's business and money-related blog carnivals!

Welcome to this "special" Sunday, November 22, 2009 edition of On the Moneyed Midways, where in each week's edition, we present the best posts we found among the best of the previous week's business and money-related blog carnivals!

Longtime OMM readers will recognize what we really mean by "special" - it's our synonym for "late." Long story short, the edition you see below was all set to post on last Friday, but a technical glitch derailed the best laid plans of our editorial team of mice and men, who all opted to take a long weekend and therefore didn't notice that things had not gone according to plan.

The good news is that at least the mice are back at work, spinning the exercise wheels that power each edition of On the Moneyed Midways. The best posts of the week that was are finally ready for your review....

| On the Moneyed Midways for November 22, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Debt Collection Practices: Going from Debtor to Debt Collector | The Smarter Wallet | If the debt collectors are hounding you, you might want to read Emiley Thacker's post on what debt collectors can and can't do. And she should know because she's been on both sides of those phone calls! Absolutely essential reading! |

| Carnival of Personal Finance | 10 Things Your Baby Doesn't Need That Can Fund Their College Education | Fiscal Geek | The trick, of course, is to actually save the money you don't spend for excessively faddish baby items of questionable necessity, but FiscalGeek lists the things expecting parents ought to remove from their baby registry. |

| Carnival of Real Estate | Not All Cheap Houses Are True Bargain Homes | Digerati Life | With home prices having fallen so far following the bursting of the housing bubble, you might think there are a lot of good deals out there, especially for investors. The Silicon Valley Blogger offers second thoughts that might help you avoid some hidden money traps. |

| Carnival of the Capitalists | Making Business Too Hard | Coyote Blog | Why not do business in the state of Washington? Warren Meyer explains why he doesn't anymore and links to why Boeing won't be doing as much business there either. |

| Festival of Frugality | How to Roast a Butternut Squash | Family Balance Sheet | We're right around the corner from Thanksgiving, FBC offers her recipe for roasting the Vitamin A-loaded vegetable. |

| Money Hacks Carnival | 10 Stocks Taking Their Dividend Up a Notch | Dividends Value | Dividends4Life identifies ten small companies that appear to be weathering the recession well enough to be able to increase their dividend payments. |

| Carnival of Money Stories | Why "Coke Rewards" Is for Suckers | Len Penzo dot Com | Bottle cap inflation?! That summarizes Len Penzo's rationale for finally turning away from his obsessions with the soft drink company's "Rewards" promotion in The Best Post of the Week, Anywhere! |

| Cavalcade of Risk | Drugs for Cancer Prevention - NY Times Misses the Point | The Blog That Ate Manhattan | Both the New York Times and Big Pharma would seem to advocate that high risk women take raloxifene or tamoxifen to prevent breast cancer for the potential cost savings over other treatments. Peggy Polaneczky (MD) notes that's really trading one kind of risk for others, given the elevated risk of other cancers and side effects that may require treatment due to taking these particular medications. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Even though the government collects all this data each year in the Consumer Expenditure Survey (CES), the answers to these questions aren't necessarily easy to extract. The government sorts the individuals and households who make up the so-called consumer units by what age range they fall into, or by what income range they earn, or by education level or a whole bunch of other basic categories, but they don't narrow the data down enough to isolate the people between Age 25 and 34 who earn between $30,000 and $39,000 before taxes, for example. Instead, we get a picture that includes everyone who falls in a given age range or whose annual income falls inside a given range, and that's as close as we can get from the data that's made freely available.

Until now. We've mined the Consumer Expenditure Survey and identified the kinds of spending that are driven by income and that are driven by age. We did this by first identifying where we saw the widest spreads in the datapoints for either income or age-based variation in the CES, and then by using the data regression tools at Zunzun to create a mathematical model for each major expenditure item.

We've put the outcome of our analysis at your fingertips in the tool below, in which you can simply enter the age of the "reference person" (another BLS term of endearment) and their annual before-tax income to calculate how much such an individual spends on any of the major expenditure categories we've listed. We'll also determine what percentage of the total spending that each category represents.

Each of the categories listed above correspond to the top line data for each presented in the 2008 CES data tables from which we obtained the data used in our regression analysis, except as follows:

- Food and Alcoholic Beverages. Here we combined the top line expenditures from the 2008 CES income table for both Food and Alcoholic Beverages.

- Personal Taxes. We added the average amount of Federal, State and Local, and Other taxes as taken from the 2008 CES income table, along with our estimate of the average Social Security taxes paid by each age group. We determined this latter figure by multiplying the indicated annual income provided by Wages and Salaries data by 6.2%. While there is a cap on the amount of income subject to Social Security taxes, we neglected to consider it for this application because the income ranges that would be affected are in part produced by combining the incomes earned by the members of the average CES' consumer unit for each income level. As a result, it would be very easy for a consumer unit with two incomes to be above that individual income threshold without being affected by Social Security's income cap. Finally, we omitted the effect of the 2008 stimulus tax credit upon personal income taxes paid altogether, since this represents a factor unique to 2008.

- Entertainment and Reading. Here, we combined the top line expenditures for both Entertainment and Reading that we obtained from the 2008 CES income table.

- Retirement Savings. This is a hybrid of both income-driven and age-driven spending patterns. For this category, we started with the top line data for Personal Insurance and Pension expenditures that we found in the 2008 CES income table and subtracted the expenditures for Life and Other Personal Insurance from it, along with our estimate of Social Security taxes, which we described above. Then, using the data we obtained in the 2008 CES age table, we accounted for the draw-down in retirement savings that we observed corresponds to approximately when the reference person in a consumer unit reaches the ages where they no longer save for retirement, but instead begin taking it (that transition begins approximately at 59.5 years of age.)

- All Other Expenditures. For this category, we combined the expenditures for Life and Other Personal Insurance with the top line expenditures that we found in the 2008 CES income table for Personal Care Products and Services, Tobacco Products and Smoking Supplies and also Miscellaneous expenditures.

What can you do with this information? Well, if you were ever curious to see how your consumer unit's spending compares to that of the average American consumer unit, at least of similar age and income, our tool's output will show you what that average level of spending is!

Data Sources

Bureau of Labor Statistics. "Table 3. Age of reference person: Average annual expenditures and characteristics, Consumer Expenditure Survey 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/age.txt. Accessed 16 November 2009.

Bureau of Labor Statistics. "Table 2. Income before taxes: Average annual expenditures and characteristics, Consumer Expenditure Survey, 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/income.txt. Accessed 16 November 2009.

Bureau of Labor Statistics. "Table 2301. Higher income before taxes: Average annual expenditures and characteristics, Consumer Expenditure Survey, 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/higherincome.txt. Accessed 16 November 2009.

Labels: demographics, economics, income, tool

Here, we combined the 2008's data for those with average annual incomes below $70,000 and those above $70,000, keeping our major expenditure categories to produce the chart to the above right, which shows the percentage of average annual major expenditures according to annual income level.

As with our chart showing similar categorical expenditure percentages by age group, the key to understanding the significance of income is measured by the spread in the data points for each category and their order.

Here, we find that income is a major driver of Housing, Food and Beverage consumption, Personal Taxes, and Retirement Savings, given the wide spreads the data points in each category and the order we observe for each, either running from low to high income (as as we see for Personal Taxes and Retirement Savings) or from high to low income (as we see for Housing and Food and Beverages.)

We see that income is a weaker driver of Transportation and Health Care expenditures and most remarkably, we see that income has very little effect upon the percentage of American consumers' budgets covering Entertainment, Apparel and Services, Cash Contributions, Education and All Other Expenditures. Or rather, these things may be found simply as a straight percentage of income, regardless of income level.

Descriptions of these different kinds of expenditures are provided by the BLS.

Data Sources

Bureau of Labor Statistics. "Table 3. Age of reference person: Average annual expenditures and characteristics, Consumer Expenditure Survey 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/income.txt. Accessed 16 November 2009.

Bureau of Labor Statistics. "Table 2301. Higher income before taxes: Average annual expenditures and characteristics, Consumer Expenditure Survey, 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/higherincome.txt. Accessed 16 November 2009.

Labels: data visualization, demographics, income distribution

Each year, millions of Americans engage in trillions of transactions. But did you ever wonder where the money goes? And if you did, did you ever wonder what affects where the money goes?

We have and we did, so we went data mining in the Bureau of Labor Statistics' Consumer Expenditure Survey for 2008, which has only been available since 6 October 2009. Since we've previously looked at how income is distributed by age group in the U.S., it was natural for us to start by considering spending based on this criteria.

- Food and Beverages. Here we combined the top line expenditures for both Food and Alcoholic Beverages.

- Personal Taxes. We added the average amount of Federal, State and Other taxes together, along with our estimate of the average Social Security taxes paid by each age group. We determined this figure by multiplying the indicated annual income provided by Wages and Salaries data by 6.2%. Finally, we omitted the effect of the 2008 stimulus tax credit upon personal taxes paid altogether, since this represents a factor unique to 2008.

- Entertainment. Here, we combined the top line expenditures for both Entertainment and Reading.

- Retirement Savings. For this category, we started with the top line data for Personal Insurance and Pension expenditures and subtracted the expenditures for Life and Other Personal Insurance from it, along with our estimate of Social Security taxes, which we described above.

- All Other Expenditures. For this category, we combined the expenditures for Life and Other Personal Insurance with the top line expenditures for Personal Care Products and Services, Tobacco Products and Smoking Supplies and finally, Miscellaneous expenditures.

We then ranked the expenditures from high to low value according to each category's percentage of total expenditures, leaving the "All Other Expenditures" category at the end.

The neat thing about this approach is that we can get a very good sense of not just relatively how much money goes where in the U.S., but also what factors drive Americans' spending. We can do that by looking more closely at the size of the spread of the data points for each category and the order in which they're ranked.

Here, for example, we see that age is a primary driver of expenditures for both Health Care and Cash Contributions (see the BLS' definition for each of these categories here), which we see both a wide spread in the data and that the percentage of total expenditures is ranked in order from youngest to oldest.

Meanwhile, we see that spending on education is also age driven, but not in the same way. Here, we see that those under Age 25 and the Age 45-54 group are widely separated from all the others, which fall into an otherwise very narrow spread. What we're most likely seeing here is the impact of education spending incurred by students (those under Age 25) and their parents (Age 45-54). The education expenditures of all the other age groups is much less significant in comparison.

Speaking of narrow spreads, we see in both the narrowness of spreads and apparent random order of the data points for the categories of Entertainment, Apparel and Services and All Other Expenditures that these factors may be almost be simply taken as a straight percentage of total expenditures for each age group.

Knowing that ranking, we can see by the spreads in the data points for the categories of Personal Taxes and Housing would appear to be highly influenced by income. Retirement Savings is also highly affected by income, but also by age. Here, we see the relative ranking of age groups by income from young to old, but we also see those age groups who are taking retirement rather than saving for it at the very bottom, which makes sense.

We'll take a closer look at the spending by Americans that would seem to be driven by their income next.

Data Sources

Bureau of Labor Statistics. "Table 3. Age of reference person: Average annual expenditures and characteristics, Consumer Expenditure Survey 2008". ftp://ftp.bls.gov/pub/special.requests/ce/standard/2008/age.txt. Accessed 16 November 2009.

Labels: data visualization, demographics, income distribution

We were shocked, shocked to find that Nobel prize winning economist Paul Krugman positively endorsed a portion of our work last week on his New York Times' blog. Let's pause a moment and soak that experience in, as Krugman considers the inflation-adjusted stock market returns spanning several recent U.S. presidential administrations:

Look back at stock returns under recent presidents, which is easy using a clever gadget at Political Calculations. Taking real, dividend-inclusive annual returns on the S&P 500, I get:

Reagan: 10.08%

Bush I: 10.16%

Clinton: 14.35%

Bush II: minus 5.81%

Don't worry, it won't go to our heads. NewsBusters' Jeff Poor saw to that as he demoted our work from being clever to just being a location on the World Wide Web:

Krugman uses a "clever gadget," also known as a Web site, which is able to calculate S&P 500 returns over periods of time.

Poor then used our apparently not-so-clever web site to find the inflation-adjusted stock market returns spanning the terms of several recent Speakers of the U.S. House of Representatives:

But this sort of "economic shorthand" could be applied to anything to make a partisan case, which Krugman is trying to do. Based on his same criteria, you could make the case that the S&P 500 has done much better when the U.S. House of Representatives has been controlled by a Republican versus a Democrat over the same time frame:

Tip O'Neill (D) (Jan. 1981-Jan. 1987): 12.61%

Jim Wright (D) (Jan. 1987-June 1989): 7.33%

Tom Foley (D) (June 1989-Jan. 1995): 6.31%

Newt Gingrich (R) (Jan. 1995-Jan. 1999): 27.62%

Dennis Hastert (R) (Jan. 1999-Jan. 2007): 0.57%

Nancy Pelosi (D) (Jan. 2007-present): minus 11.05%

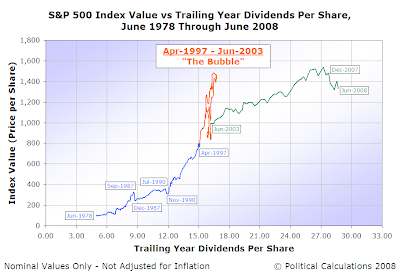

Whatever. Leaving the politics out of it, both Krugman and Poor are making a rather huge error in their assumptions: that the point-to-point rates of return for the stock market between any two arbitrary points in time is representative of how it behaved in between. To be fair, that kind of linear thinking can work a lot of the time, but not always.

Here, if you were to choose any two points along the blue portion of the data spanning within the period from June 1978 through April 1997 and connect the dots, the straight line connecting them might be an okay depiction of how stock prices changed with respect to their underlying dividends per share during that time. The same might also be true for any two points you might choose in the period shown by the green portion of the data, which covers the time from June 2003 to June 2008 (at least up to December 2007!)

But if you're going to choose endpoints where either endpoint falls anywhere between April 1997 to June 2003, or if the points you choose include this data in the middle, you've flunked the test for linearity. Duke professor Robert Nau describes the impact if the assumption that a straight line describes data doesn't hold:

If any of these assumptions is violated (i.e., if there is nonlinearity, serial correlation, heteroscedasticity, and/or non-normality), then the forecasts, confidence intervals, and economic insights yielded by a regression model may be (at best) inefficient or (at worst) seriously biased or misleading.

Looking at Krugman's presidential stock market return data, we see exactly that. Since Bill Clinton's term of office concluded shortly after the Dot-Com Bubble peaked in August 2000, the rate of return between January 1993 and January 2001 is highly inflated because of the effect of the bubble. Likewise, since George W. Bush's presidency began with the stock market at such an unsustainably elevated level, it was virtually guaranteed that stock returns during his presidency would be lackluster in comparison.

Is there a better way to measure how the stock market performed over a defined period of time? One that incorporates all the data in between the endpoints of that period?

Ideally, what we would want would be to calculate the average rate of return for investments of any length in between the starting and ending points of the period in question. But, depending upon how long a period we're talking about, that can be a very large number of calculations to have to run.

Alternatively, we could see how a series of investments made at regular intervals during the course of a period have performed at its endpoint. The returns we would calculate using this approach would be similar to what a real life investor, say an individual who invests in an S&P 500 index fund through their 401(k) or 403(b) defined contribution retirement plan, would see.

It's not perfect, but we do have a tool that can do the math. Our Investing Through Time S&P 500 investment simulator can find out how much a series of equal investments made each month between any two points in time would be worth at the end (adjusted for inflation, indexed to the final month of the period), as well as calculate what the effective rate of return would be.

Doing that for all the presidential administrations going back to 1948, which contains the period of time we've identified as the modern era for the U.S. stock market, we found the following:

| Stock Market Performance, U.S. Presidential Administrations, 1949-2009 | ||||

|---|---|---|---|---|

| President | Period | Money Invested During Period | Investment Value with No Dividend Reinvestment (Rate of Return)* | Investment Value with Fully Reinvested Dividends (Rate of Return)* |

| Harry S Truman (D) | January 1949 - January 1953 | $4,800 | $6,133.04 (5.32%) | $7,226.04 (10.77%) |

| Dwight D. Eisenhower (R) | January 1953 - January 1961 | $9,600 | $13,559.17 (4.41%) | $16,469.01 (6.98%) |

| John F. Kennedy / Lyndon B. Johnson (D) | January 1961 - January 1965 | $4,800 | $5,896.63 (5.28%) | $6,342.49 (7.21%) |

| Lyndon B. Johnson (D) | January 1965 - January 1969 | $9,600 | $5,015.40 (1.10%) | $5,363.30 (2.81%) |

| Richard M. Nixon / Gerald R. Ford (R) | January 1969 - January 1977 | $9,600 | $5,257.42 (-1.87%) | $9,484.52 (-0.15%) |

| James E. Carter (D) | January 1977 - January 1981 | $4,800 | $4,967.29 (0.86%) | $5,524.46 (3.58%) |

| Ronald W. Reagan (R) | January 1981 - January 1989 | $9,600 | $13,429.84 (4.29%) | $16,316.72 (6.86%) |

| George H. W. Bush (R) | January 1989 - January 1993 | $4,800 | $5,434.07 (3.15%) | $5,838.54 (5.02%) |

| William J. Clinton (D) | January 1993 - January 2001 | $9,600 | $16,535.93 (7.03%) | $18,162.69 (8.30%) |

| George W. Bush (R) | January 2001 - January 2009 | $9,600 | $6,742.05 (-4.32%) | $7,247.19 (-3.45%) |

| All | January 1949 - January 2009 | $72,000 | $147,888.67 (1.21%) | $586,693.67 (3.56%) |

While these rates of return provide a better sense of the average "temperature" of the investing climate during each of the post-World War II presidencies, they still don't tell us much about the highs and lows, volatility, or events surrounding and even driving the market during the periods in question. For that, we'll point you to our quick overview of stock market history and mathematics, with the links in that post taking you to a more detailed history of market events.

As for the corresponding data for the U.S. Speakers of the House of Representatives, well, we'll leave that as an exercise for Jeff Poor, who we believe is clever enough to find the web site he'll need to do the math.

Labels: math, politics, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.