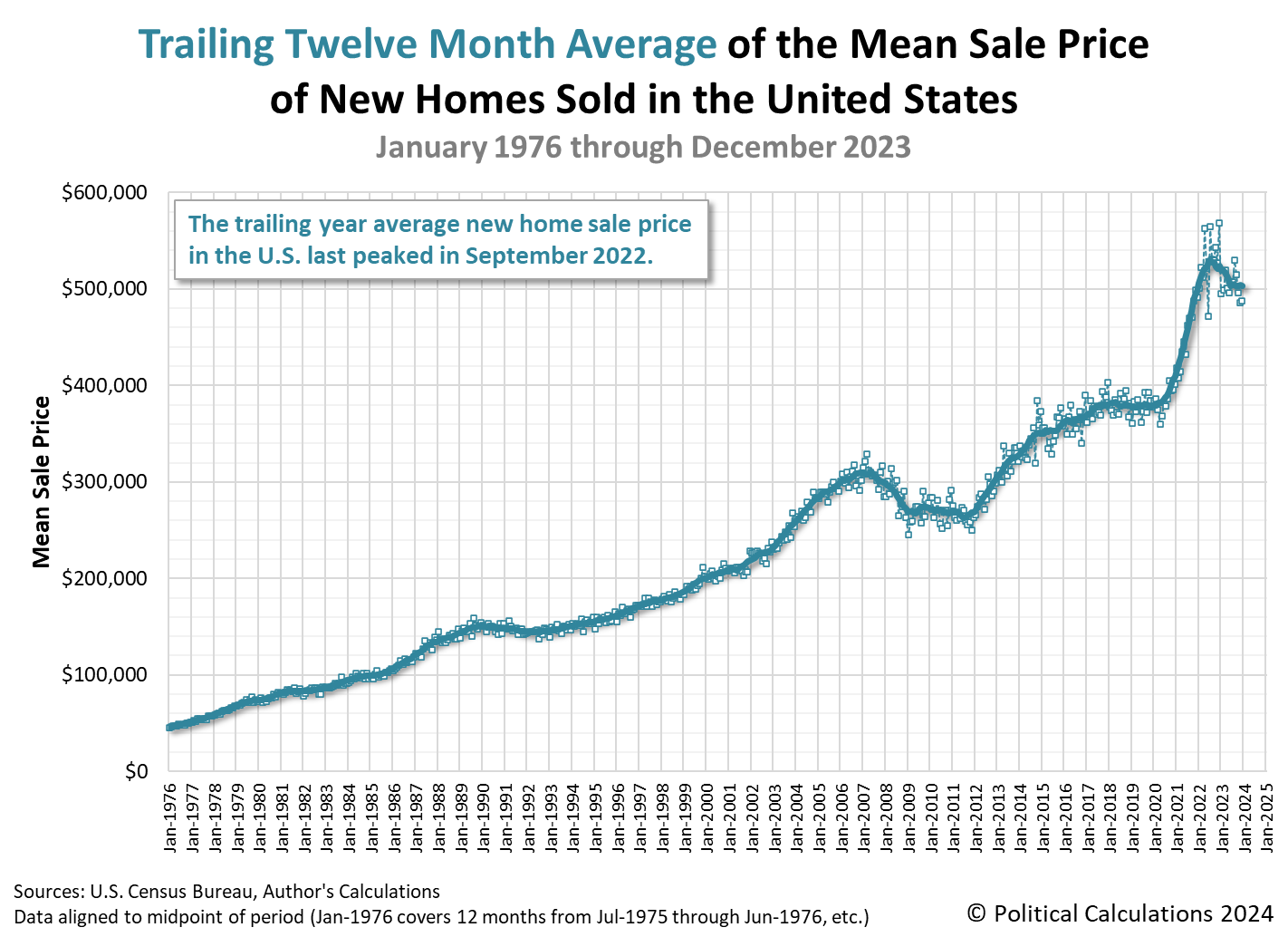

The negative implications that began with October 2023's new home sales reports continued through the end of 2023.

Since the last time we reported on the size of the new home market in the United States two months ago, annualized sales fell off sharply in November 2023 before going on to recover in December, though to a level lower than they were in October 2023.

A similar pattern held for the average sale prices of new homes in the U.S. The combination of net declines in the number of new homes sold and the prices for which they sold resulted in a declining trend for the market capitalization of new homes.

All these changes together indicate that what had been an upward trend for the U.S. new home market has broken. Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market since January 1976:

The next two charts show the latest changes in the trends for new home sales and prices:

New home sales typically contribute about 3 to 5% to the nation's Gross Domestic Product. The negative change in trend for the U.S. new home market suggests 2024 has begun with the market contributing a headwind to the U.S. economy.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 January 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 January 2024.

Image Credit: Microsoft Bing Image Generator. Prompt: "An aerial photograph of a neighborhood filled with new homes under construction. Highly detailed, photo realistic, 4k."

Labels: real estate

With all the talk of a "soft landing" for the U.S. economy in the media in recent weeks, we half-expected to find the odds of a recession for the U.S. economy had continued to recede over the past six weeks.

But that's not what has happened. Instead, we find the probability of recession has resurged since our previous report. After bottoming at 67% in the period from mid-November to mid-December 2023, the odds of recession have increased to over 74% as of 29 January 2024.

The change reverses what had been a declining trend in the probability of recession that had begun after it peaked at nearly 81% on 25 July 2023.

The change is not entirely unexpected as we had anticipated the recession odds could see such a reversal in our previous update. The cause of the change is a deeper inversion of the U.S. Treasury yield curve over the last six weeks, where the yield of the constant maturity 10-year U.S. Treasury has fallen as the 3-month U.S. Treasury has held relatively steady.

Here is the newest update to the Recession Probability Track illustrating how things stand going into the Federal Reserve's Federal Open Market Committee's first two-day meeting of 2024. The committee is expected to hold the Federal Funds Rate steady at this meeting, but is also expected to start lowering this core interest rate at later meetings in 2024. What the Fed plans to do with interest rates will have a lot to do with how the U.S. economic situation develops this year:

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 29 January 2024 and 29 January 2025.

Even with the recent resurgence, the probability of recession peaked at nearly 81% on 25 July 2023, which makes the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have provided a tool to make it easy to do.

We will continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- Probability of U.S. Recession Resurges to Nearly 75%

- U.S. Recession Odds Recede to Two Out of Three Chance in 2024

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Microsoft Bing Image Creator. Prompt: "Editorial cartoon illustrating how the economy will respond when the Federal Reserve changes interest rates." We modified the image to add readable text to the signs, though you may have to click the image for a larger version to read it!

Labels: recession forecast

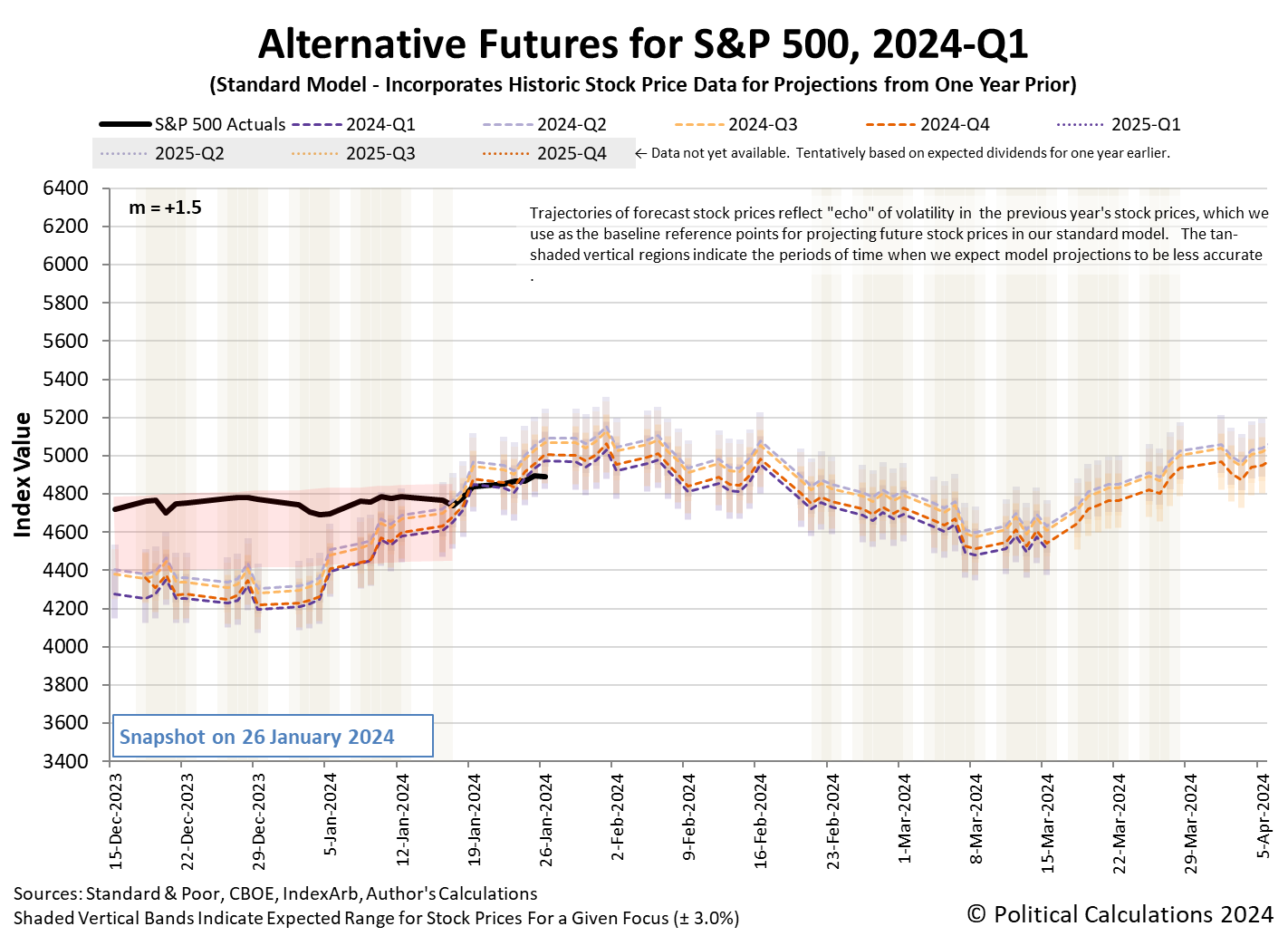

After breaking through it's previous record high last week, the S&P 500 (Index: SPX) continued rising slowly to record a series of new highs for another four days before dipping 3.19 points to close out the trading week ending on Friday, 26 January 2024 at 4,890.97. Overall, the index was up a little under 1.1% for the week.

While the index rose during the past week as expected, the amount of the increase is not consistent with investors having shifted their forward-looking focus from the current quarter of 2024-Q1 to the more distant quarter of 2024-Q2. Even though expectations of the timing in which the Fed will start cutting interest rates slipped from 2024-Q1 to 2024-Q2 last week, stock market investors are so far remaining focused on the current quarter of 2024-Q1.

That's the conclusion we're drawing from the latest update to the dividend futures-based model's alternative futures chart. In it, we find the trajectory of the S&P 500 is much more consistent with investors focusing their attention upon 2024-Q1 in setting current day stock prices.

Had investors definitively shifted their attention toward 2024-Q2, we could have very optimistically seen stock prices increase by as much as another four percent.

It is possible however that other factors contributed to investors keeping their attention on the current quarter of 2024-Q1. Earnings season is now underway for the U.S. stock market, where several large components of the S&P 500 index reported lackluster results that made the week's market-moving headlines. Here are those headlines for the week that was:

- Monday, 22 January 2024

-

- Signs and portents for the U.S. economy:

- Oil rises 2% on supply disruptions in Russia, U.S.

- January set to break record as busiest for new US corporate bonds

- Fed minions say China's growing troubles "not having strong effect" on U.S.

- China's 'lackluster recovery' not having strong effect on US economy -Brainard

- Fed's inflation puzzle still missing a piece or two

- Bigger trouble, stimulus developing in China:

- BOJ minions expected to keep never-ending stimulus alive a little longer:

- Nasdaq, S&P, Dow ended in the green and scaled to new all-time highs

- Tuesday, 23 January 2024

-

- Signs and portents for the U.S. economy:

- Unemployment rises in nearly a third of US states in December

- Oil prices settle down slightly on more supply in US and abroad

- Expected timing of Fed minions' first 2024 rate cut slips to 2024-Q2:

- Bigger stimulus, trouble developing in China:

- China weighs stock market rescue package backed by $278 bln - Bloomberg News

- Exclusive: China moves to support yuan as stock markets tumble

- Mixed economic signs in Japan, BOJ minions to keep never-ending stimulus alive, but thinking about their exit plan:

- Japan Jan factory activity languishes, but service sector picks up - PMI

- BOJ signals conviction on hitting inflation goal in hawkish tilt, stands pat for now

- When and how would BOJ exit ultra-loose monetary policy?

- S&P 500 notches third straight record high close

- Wednesday, 24 January 2024

-

- Signs and portents for the U.S. economy:

- Oil steadies near $80 as China announces stimulus

- Rate cut hopes fuel bets real estate crisis is easing

- Bigger stimulus, trouble developing in China:

- China cuts bank reserves to defend markets, spur growth

- China's attempts to lift confidence in economy fall flat

- Exclusive: China regulators ask funds to curb short selling of stock index futures

- Recovery sign seen in Japan:

- ECB minions start worrying about possibility of bank runs:

- Nasdaq, S&P, Dow end mixed as Netflix-inspired gains fizzle out; Tesla results in focus

- Thursday, 25 January 2024

-

- Signs and portents for the U.S. economy:

- Oil jumps, settles up 3% on strong US economy, Red Sea tensions

- US new home sales rebound in December as mortgage rate retreat

- Fed minions see no need to continue bank bailouts:

- ECB minions claim they'll keep rates higher for longer as Eurozone economy slows, markets think they'll be forced to do rate cuts sooner:

- ECB sticks to inflation fighting even as rate cuts loom

- Traders step up ECB rate cut bets, sensing shift on inflation front

- ECB open to March pivot, possible June cut if data allow -sources

- S&P 500 extends streak of record highs; Tesla tumbles

- Friday, 26 January 2024

-

- Signs and portents for the U.S. economy:

- Oil settles at highest in nearly 8 weeks on strong economic growth

- US prices rise moderately in December; inflation trending lower

- U.S. home sales rise by most in over 3 years

- Markets gearing up early for Fed minions' expected interest rate cuts:

- BOJ minions discussing ending never-ending stimulus:

- Nasdaq, S&P, Dow end mixed, but Wall Street posts third straight weekly gain ahead of Fed

Overall, we can't complain too much because the market did rise and the stock market bull is looking out from a newer, higher vantage point than it did a week ago.

The CME Group's FedWatch Tool continued to signal investors expect the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 1 May 2024 (2024-Q2). This date marks the anticipated beginning of a series of quarter point rate cuts that are expected to take place at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's first "nowcast" estimate of real GDP growth for the first quarter of 2024 (2024-Q1) is a bold +3.0%. This forecast compares to an initial "Blue Chip Consensus" real GDP growth forecast centered on +1.0% for 2024-Q1 (the range of forecasts in the consensus range from a low of 0% to a high of +2.0% growth for the quarter).

Image credit: Microsoft Bing Image Creator. Prompt: "A bull standing on a mountain looking out over distant mountains. Nature photography. Highly detailed. Photo realistic. 4k."

There are all kinds of numbers. Natural numbers, which are also called counting numbers, are familiar to young children. Whole numbers adds the number zero to the list of natural numbers. Integers go a step further, adding negative numbers to the list of whole numbers.

Then we get to rational numbers. Calling a number rational is a fancy way of saying that its value can be precisely defined with a fraction made up of integers. As such, rational numbers fill in the spaces between the integers.

But not all fractions whose values fall in between the integers are rational. Some of these fractions cannot be written using integers at all. Long ago, mathematicians decided to call these numbers irrational because there is no way to use fractions using integers to express their exact value.

One of the earliest of the list of irrational numbers to be discovered is the square root of 2. While you might be able to approximate the square root of two using fractions with integers, you'll always come up short of expressing its exact value because it just doesn't work, no matter what integers you might use.

That scenario leads to an interesting question. How do we know that the square root of 2 is an irrational number? The answer lies is some clever thinking, as illustrated in the following two-minute video that features Taylor Swift proving the square root of 2 is irrational!

And that's how we know the square root of 2 cannot be exactly expressed using fractions made up of integer values.

On a closing note, although we recognize Taylor Swift as incredibly talented, credit for the discovery probably lies with Hippasus of Metapontum, who had to deal with his day's own version of irrational fandom.

Momentum. If you ever wondered what the single biggest factor that sets the trajectory of economic growth is, that's the answer. It's momentum.

For example, let's say you wanted to predict how big the U.S. economy would grow to be over the next few quarters, but you didn't know anything more than what the nation's GDP was during the last few quarters. More often than not, that's enough information to put you within a few percent of the actual GDP result. Even when the projection is off by more than that, it still tells you something useful about how the economy is performing.

That's the thinking behind the "Climbing Limo" forecasting method, which is a very simple approach to reasonably project what to expect for GDP. Here's how it works. Start with the most recently finalized quarterly GDP data you have available and the GDP recorded two quarters before that and draw them on a chart with GDP on the vertical axis and quarters on the horizontal. You would next connect those dots with a straight line, then extend that line three quarters into the future to draw a new dot at the end of that line. That's your forecast for that future quarter.

We've done that exercise in the following chart with the available GDP data for the period running from the first quarter of 2021 through the third quarter of 2023. In the chart, the blue solid line represents that actual nominal GDP data, while the orange dashed line represents the forecasted GDP, which starts at the second quarter of 2022 and run through the second quarter of 2024.

All but one of the forecast values on this chart are within three percent of the actual quarterly result after it was finalized in the Bureau of Economic Analysis' third estimate a few months after the quarter ended. As you can see, some forecast results are very close to the officially recorded finalized value.

The largest deviation between forecast and actual GDP is for the second quarter of 2022 (2022-Q2), where the forecast value is 3.3% higher than the actual value. That forecast is based on the actual GDP datapoints for 2021-Q1 and 2021-Q3 and represents how much larger GDP could have been if economic growth sustained the momentum it recorded between these two quarters.

That it isn't tells us something changed between 2021-Q3 and 2022-Q3 to affect the growth path for the U.S. economy. That's the kind of useful information we can extract from the chart whenever we see the deviation between forecast and actual data gets larger than a three percent threshold. It often signals a turning point.

In this case, 2022-Q3 represents when the Federal Reserve's actions to increase interest rates to combat the inflation unleashed in the U.S. economy between 2021-Q1 and 2021-Q3 started making their presence felt as a change in momentum for GDP.

The chart is unusual in that all the forecast values have run higher than the actual GDP figures. When we've done similar exercises in the past, we've typically seen the two data series cross over each other, with the data points well within that three percentage point margin. That pattern is what you would expect during periods when economic growth momentum is relatively consistent.

But instead of that pattern, the chart shows the period between 2022-Q2 and 2023-Q3 has been one in which the U.S. economy has experienced fading momentum.

The first estimate for GDP during the fourth quarter of 2023 will be released on Thursday, 25 January 2024. While not the final value, where it falls with respect to the forecast will give an idea of whether that fading momentum pattern continued through the end of 2023. We timed this article so you wouldn't have to wait long to find out. The references below will take you to where you can access the data you need and our climbing limo tool where you can do the math for yourself.

Update 26 January 2024

The first estimate of the United States' GDP in 2023-Q4 is now available, with nominal GDP being initially reported at $27,938.8 billion, which is 0.5% below the climbing limo estimate. The nominal GDP estimate for this quarter will be revised twice more before it is relatively finalized (outside of annual revisions) in March 2024. The climbing limo estimate for 2023-Q4 is based on the non-inflation adjusted GDP figures reported for 2022-Q3 and 2023-Q1.

References

U.S. Bureau of Economic Analysis. National Income and Product Accounts. Table 1.1.5. Gross Domestic Product. [Online Database]. Accessed 20 January 2024.

Political Calculations. Forecasting GDP Using the Climbing Limo. [Online Tool]. 10 May 2005.

Image credit: Microsoft Bing Image Creator. Prompt: "The side view of a limousine driving on bumpy rocks, highly detailed, 4k, award winning automobile magazine photography."

Labels: gdp forecast

When President Biden was sworn into office on 20 January 2021, the U.S. national debt stood at $27.75 trillion. Three years later, as President Biden celebrated his third anniversary in the White House, the U.S. national debt was sitting at $34.07 trillion. That's an increase of 6.32 trillion dollars or 22.8% in three years.

These are all very big numbers that are hard to appreciate on a human scale. But they become a lot easier to understand when we divide them up equally among all the households in the United States.

When we do that math, 2021's national debt total of $27.75 trillion becomes $216,050, which represents the national debt burden per household before any of President Biden's spending initiatives were implemented.

Three years of President Biden's spending initiatives later, we find the household burden of 2024's national debt total of $34.07 trillion is $259,235. The burden of the national debt per household has increased by $43,185, or 20%, during President Biden's three years in office.

The following chart shows the level of the household burden of the national debt at each of President Biden's anniversaries in the White House. In it, we've also shown how much of the nation's debt is owed to its creditors by major category.

The year-over-year increase in the national debt burden per household in President Biden's third year in office is the largest of his presidency.

Keeping the discussion at the human scale, last year, we found that the increase in the national debt through President Biden's first two years in office would be enough to pay for what was then a brand new 2023 Suburu Impreza.

One year later, we find the national debt increase under President Biden is almost the equivalent of buying a brand new 2024 Toyota RAV4 Hybrid for every one of the estimated 131,434,000 households in the United States. Plus an extra $137 in cash. As automobiles go, it sounds like an upgrade and who doesn't like the idea of the government borrowing money if it means you get cash too?

But do you feel like your household has received that much value from three years worth of President Biden's debt-fueled spending? And how well does that extra debt fit with all the other debts your household has? Can your household afford that extra debt bill on top of all the others?

Exit question: What kind of car do you think President Biden's contributions to the national debt burden per household would be able to buy for every single U.S. household next year?

References

U.S. Census Bureau. Historical Households Tables. Table HH-1. Households by Type: 1940 to Present. [Excel Spreadsheet]. 21 November 2023. Accessed 23 January 2024.

U.S. Treasury Department. Debt to the Penny. [Online Database]. 19 January 2024. Accessed 22 January 2024. Note: As 20 January 2024 fell on a Saturday when the U.S. Treasury Department's debt window is closed, with no changes to national debt taking place, the national debt recorded for 19 Janaury 2024 is the appropriate reference for President Biden's third anniversary in office.

U.S. Treasury Department. Major Foreign Holders of Treasury Securities. [Online Data]. Accessed 23 January 2024.

U.S. Treasury Department. Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2024 Through December 31, 2023. [PDF Document]. 11 January 2024.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon illustrating the burden of the national debt on American households."

Labels: national debt

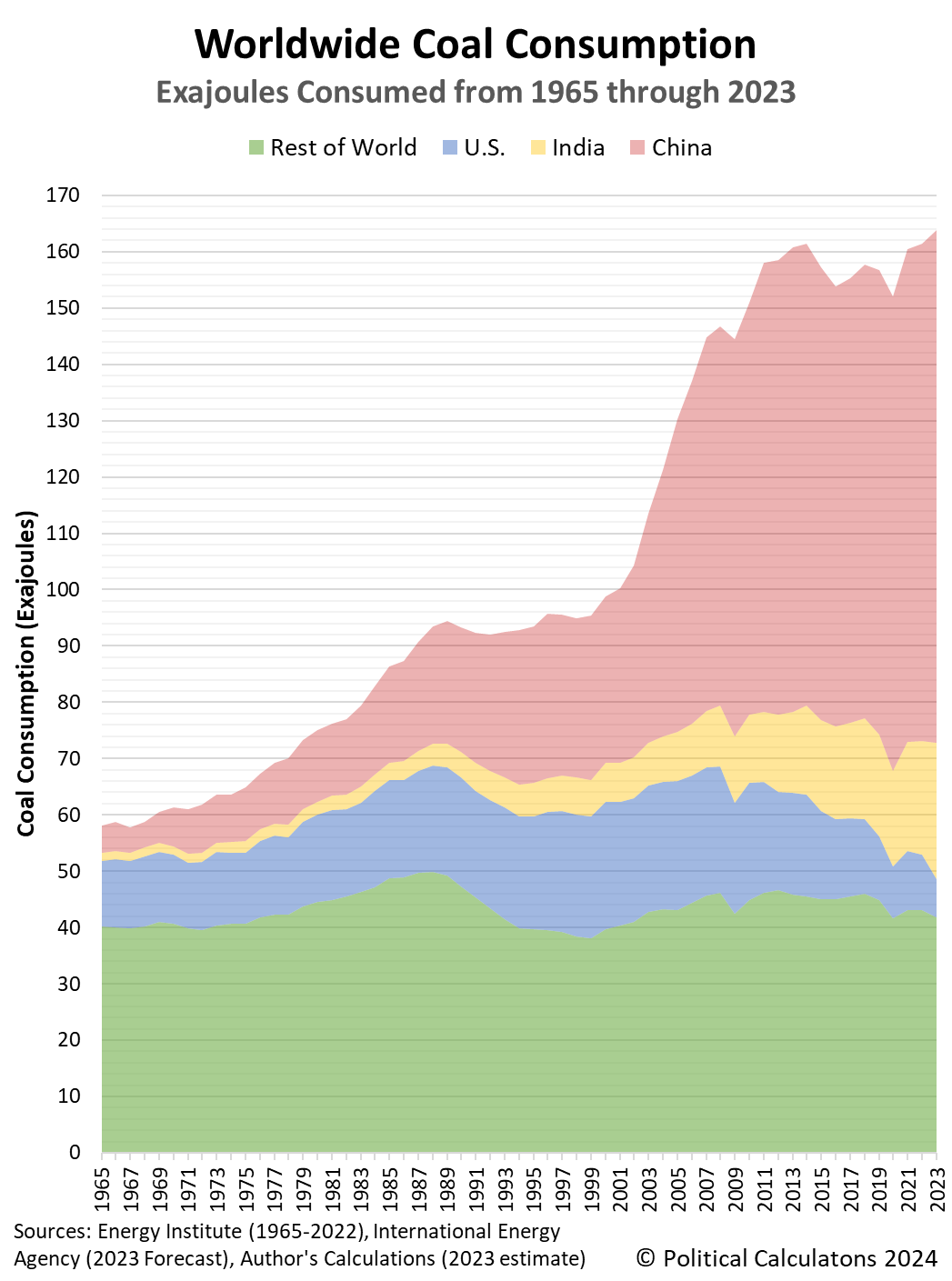

From time to time, we come across data that's interesting in and of itself as we work on various projects. Worldwide coal consumption is one such data series that stands out because coal is a leading source of carbon dioxide in the Earth's atmosphere, which we pay attention to because of its value as an economic indicator.

We've explored worldwide coal consumption before, but only over the last few years worth of available data. So today, we're going to extend the limited picture we've presented all the way back to 1965, which is long enough to capture a number of interesting trends.

As a bonus, we'll tack on the latest estimates for 2023's worldwide coal consumption, which will make the data series as completely current as we can make it. The following chart illustrates the total number of exajoules of energy extracted from coal consumption for the world's top three national consumers of coal and the rest of the world from 1965 through 2023.

Starting with the big picture, based on current estimates, more exajoules of coal were consumed in 2023 than any other in history. Coal consumption has been rising in each year since the global coronavirus pandemic year of 2020. If its projection holds, 2023's worldwide coal consumption breaks the record set in 2013.

China is, by a very wide margin, the world's largest consumer of coal. China's consumption of coal exploded after 1999 and has more than tripled through 2023.

India has expanded its consumption of coal much more slowly over the decades covered in the data, but has more than quadrupled its consumption since 1996. Although its population has grown to exceed that of China, India recorded a little over 26% of China's total consumption of coal in 2023.

The United States is historically the world's largest consumer of coal, but the nation has greatly reduced its consumption since it peaked in 2005. In 2023, U.S. annual coal consumption has dropped by 70% from that peak.

Meanwhile, the rest of the world looks like its coal consumption has mostly been flat over the past six decades. In truth, that lack of apparent growth hides several major factors that have affected the world's coal consumption. For example, the collapse of the Soviet Union and the dissolution of its empire in 1991 reversed what had been a rising trend before that time. Meanwhile, the nations of the European Union have collectively reduced their coal consumption since it peaked in 1985.

But to make for an apparently flat trend, other nations have increased their consumption of coal over this period. In recent years, Indonesia and Vietnam stand out for the growth of their coal usage.

All these subglobal trends have combined to produce the overall pattern for worldwide coal consumption. The period from 1965 through 1991 saw a rising trend, which flattened out between 1991 and 1999, only to see coal consumption expand rapidly because of China's explosive growth up through 2011. The period since 2011 however has been generally flat with the world ranging between 152 and 164 exajoules worth of annual coal consumption.

2023's estimated worldwide coal consumption is over 2.8 times higher than 1965's coal consumption.

Reference

Energy Institute. Statistical Review of World Energy (2023). [Excel Spreadsheet]. 26 June 2023.

International Energy Agency. Coal 2023. [PDF Document]. 15 December 2023.

Labels: data visualization, economics, environment

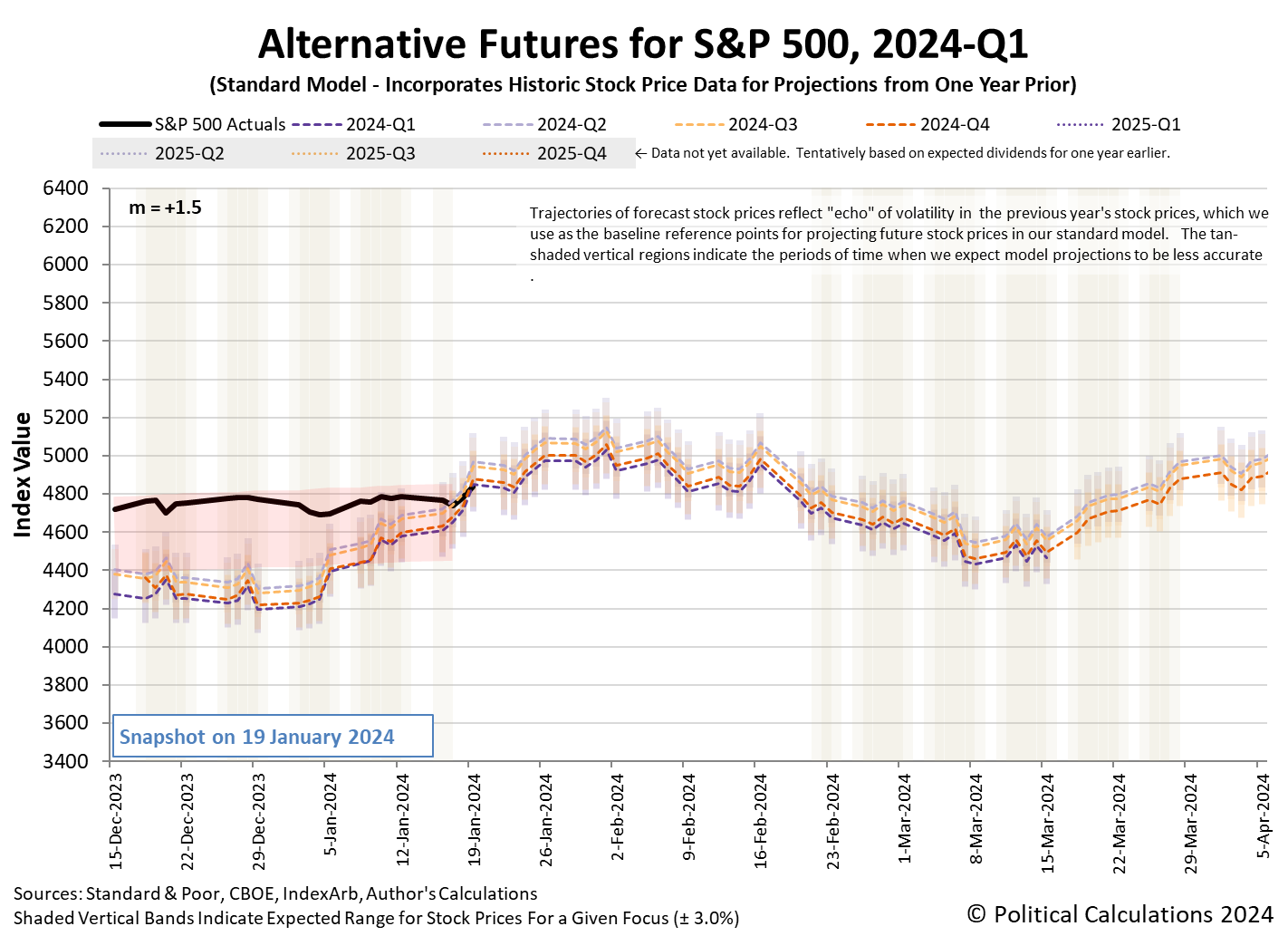

After weeks of hovering within easy striking distance of its old record high close, the S&P 500 (Index: SPX) finally broke through and set a new record! The index reached its new record on Friday, 21 January 2024, closing out the trading week at 4,839.81. The new record is almost 1.2% higher than where it closed the previous week and is 0.9% higher than the old record of 4,796.56 that had been set over two years earlier on 3 January 2022.

The record was broken as investors may have shifted their forward-looking focus from 2024-Q1 to the more distant future quarter of 2024-Q2. This change would coincide with changes in the expected timing for when the U.S. Federal Reserve will begin cutting interest rates. If so, the jump in stock prices accompanying the change in expectations would qualify as a Lévy flight event for the dividend futures-based model, but we'll need another week to verify if that is indeed what happened.

Speaking of changes in expectations, the CME Group's FedWatch Tool’s updated projections indicate investors now anticipate the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 1 May 2024 (2024-Q2), six weeks later than projected last week. This date marks the expected beginning of a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

These changes occurred as the last redzone forecast period of the dividend futures-based model's alternative futures chart came to an end. Based on what the latest update to the chart suggests, there would seem to be upside potential for the S&P 500 to continue setting new record highs in the short term. That's because the chart indicates investors were focusing on 2024-Q1 through the end of the trading week, where the alternative trajectory the S&P 500 would follow as investors focus on 2024-Q2 is higher.

The downside to focusing on 2024-Q2 is that investors will only hold their attention on this quarter until they have reason to shift their attention to another point of time in the future, which can happen with little warning. How stock prices might change also depends upon how investors expect the growth rate of trailing year dividends per share will change for the future quarters on which they might focus their attention.

For example, if investors were to suddenly shift their attention to the even more distant future quarter of 2024-Q3, this hypothetical Lévy flight event would be accompanied by a downward shift in the S&P 500's trajectory.

What would cause such a change? It will happen in response to the random onset of new information, much like what can be seen to have happened with the market-moving headlines during the holiday-shortened trading week that was:

- Tuesday, 16 January 2024

-

- Signs and portents for the U.S. economy:

- Tech layoffs continue after 'Year of Efficiency'

- Google lays off hundreds of employees in advertising sales team

- Fed minion opens mouth, creates doubt about when Fed will start cutting rates this year:

- Bigger trouble developing in China:

- China growth seen slowing to 4.6% in 2024, raising heat on policymakers

- Some wealthier Chinese say they can't afford marriage as economy slows

- BOJ minions get data to justify keeping never-ending stimulus alive for longer:

- Wall Street ends down as Apple weighs

- Wednesday, 17 January 2024

-

- Signs and portents for the U.S. economy:

- Oil near flat as extreme cold's hit to U.S. output offsets China data

- US bank profits fall as competition for deposits erodes lending margins

- US manufacturing output ekes out small gain in December

- Fed minions not gaining converts in their claim they won't cut rates soon:

- Fed still seen starting rate cuts in March, traders bet

- Fed Pressing Higher-For-Now Against Market's Lower-And-Sooner

- Bigger trouble, stimulus developing in China:

- China's 2023 GDP shows patchy economic recovery, raises case for stimulus

- China's property market slide worsens despite government support

- BOJ minions say they'll gently ease out of never-ending stimulus:

- ECB minions claim they're not done fighting inflation:

- Wall Street ends down as US retail sales data crimps rate cut bets

- Thursday, 18 January 2024

-

- Signs and portents for the U.S. economy:

- Oil prices settle higher global demand forecasts, US crude stock draw

- US single-family housing starts plunge in December

- US mortgage rates fall to 8-month low, says Freddie Mac

- More junk-rated US companies to default in Q1, Moody's forecasts

- Fed minions put prospect of faster rate cuts back on the table:

- Bigger trouble developing in China:

- ECB minions not happy to see Eurozone wages rising:

- Nasdaq, S&P, Dow notch second best day of 2024, boosted by chip stocks and Apple

- Friday, 19 January 2024

-

- Signs and portents for the U.S. economy:

- Oil heads for weekly gain, supported by Middle East tensions

- US banks warn costly deposits to weaken interest income in 2024

- US existing home sales fall in December, supply shows signs of improvement

- Fed minions expected to hold off rate cuts until May:

- Bigger trouble developing in China:

- China flirts with Mao era growth

- Exclusive: China orders indebted local governments to halt some infrastructure projects-sources

- S&P 500 closes at record high, Nasdaq and Dow also surge as Wall Street finds footing

The Atlanta Fed's GDPNow tool's final nowcast estimate of real GDP growth for 2023-Q4 was +2.4%, up slightly from last week's +2.2% growth estimate. The BEA's initial estimate of that growth during 2023-Q4 will be released on Thursday, 25 January 2024. The Atlanta Fed's nowcast of the GDP growth rate of the current quarter of 2024-Q1 will begin on Friday, 26 January 2024.

Image credit: Microsoft Bing Image Creator. Prompt: "A fireworks celebration on Wall Street after the S&P 500 closes at a new record high value. Highly detailed, photo realistic, 4k."

It takes 687 Earth days for the planet Mars to complete an orbit around the Sun. That's not quite two Earth years, it's a little under one Earth year and 11 Earth months.

Which is relevant today because of a unique project we launched a little over two years ago. We recognized the arrival of the Mars Perseverance Rover on the planet with its ambitious plan to drill and collect rock samples represented something more than an expensive science experiment. It represented the birth of the Martian economy.

That's because the plan for rock samples drilled by the rover was to store them in special containers on the surface of Mars for eventual return to Earth for scientific study. Or rather, these valuable goods produced by the rover would be placed into an inventory prior to being exported to Earth. These are all economic activities in which value is added to a raw product that can be accomplished by remotely operated or automated equipment.

But how much value has been added by these activities over the past Martian year? That's a big question because the answer represents the gross domestic product for Mars. We were able to estimate a market value for the rock samples based on the auction prices of samples of meteorites found on Earth that were determined to have originated from Mars, so all we have to do is add up the number of samples that have been produced over the span of a Martian year.

For our purposes, we're looking at a 687 day long period that runs from 12 July 2021 through 30 May 2023. During that period, Mars Perseverance Rover drilled and packaged 19 samples for future export to Earth. The following table tallies up the value of those future exports currently stored in inventory by the Martian quarter in which they were produced.

| Martian GDP Estimates (Constant 2021 U.S. Dollars) | ||||

|---|---|---|---|---|

| Martian Quarter | First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

| Approximate Earthdates | 12 Jul 2021 - 31 Dec 2021 | 1 Jan 2022 - 21 Jun 2022 | 22 Jun 2022 - 11 Dec 2022 | 12 Dec 2022 - 30 May 2023 |

| Estimated GDP | $494,430 ($110,780 - $878,080) |

$296,658 ($66,468 - $526,848) |

$889,974 ($199,404 - $1,580,544) |

$98,886 ($22,156 - $175,616) |

| Revision Level | Final | Third | Second | Initial |

With only one sample collected during the entire Martian fourth quarter, we estimate the amount of Martian GDP for the entire Martian year is $1,779,948, which represents the average of the low and high end estimates we have for the value of the rock samples collected and stored by the rover, which range from $398,808 to $3,161,088.

Looking ahead to Mars' future export economy, NASA and the European Space Agency reached an agreement to establish a sample transfer depot at the Three Forks location within Mars' Jezero Crater. The Perseverence Rover will cache its full inventory of rock and atmospheric samples at the Three Forks Depot before their future export.

But that's as far as they've gotten because of what has proven to be very bad planning by government space agencies, who failed to develop a viable plan for their export from Mars to Earth.

NASA’s audacious Mars Sample Return (MSR) mission has serious technical flaws and “unrealistic” assumptions about its budget and timetable, an independent review found in a report released yesterday. Originally estimated to cost some $4 billion, the reviewers found that NASA’s share of the mission could end up costing between $8 billion to $11 billion, and that launch could happen no sooner than 2030, 2 years later than now planned.

A joint project between NASA and the European Space Agency (ESA), MSR would gather rocks collected by the Perseverance rover, which has been drilling samples since it landed on Mars in 2020. MSR would then rocket the samples off the planet and ferry them to Earth, where scientists would study them for signs of past life and planetary evolution. The top priority of planetary science for several decades, it remains a worthy goal and one still worth pursuing, especially in light of similar sample return plans for Mars planned by China for later this decade, according to the review report, which was commissioned by NASA.

But NASA won’t get there without dramatically rethinking how it runs the program and accepting the true cost. “MSR was established with unrealistic budget and schedule expectations from the beginning,” the report says. “As a result, there is currently no credible, congruent technical, nor properly margined schedule, cost, and technical baseline that can be accomplished with the likely available funding.” And proposed NASA budgets simply do not provide the funding needed to make the mission happen, it adds.

To put it simply, the space agencies' sample return plan for the Martian rock samples was modeled on South Park's underwear gnomes' business plan:

- Phase 1: Collect Martian rock samples.

- Phase 2: ?

- Phase 3: Profit!

The space agencies are expected to present a recovery plan sometime later this year. For what it's worth, they do believe the collected rock samples are valuable. The following short video describes what they hope to learn from them:

Previously on Political Calculations

- Meanwhile, on Mars...

- The Birth of the Martian Economy

- Mars Recovers from First Recessionary Event

- Mars' GDP Triples in Martian 3Q

And just because Martians play a key role in it, here's one more for fun!

Labels: ideas

2024 finds the state of teen employment within the United States coming into the year on a slow downtrend. The following charts shows the seasonally-adjusted data for the number of employed teens and also the teen employment-to-population ratio from January 2016 through December 2023.

The charts reveal that overall teen employment peaked in April 2023. The number of 16-19 year olds with jobs then fell through July 2023 before recovering in the second half of 2023. That recovery topped out in October 2023 and the number of teens with jobs then fell slowly through the end of the year.

Splitting the teen population between younger teens (Age 16-17) and older teens (Age 18-19), we see similar patterns with one main difference. The employment figures for younger teens peaked earlier than it did for older teens. The maximum number of younger teens was recorded in December 2022.

The U.S. teen employment-to-population ratio shows the same patterns for each age group and confirms the employment situation for American teens has been slowly declining since peaking in the period from December 2022 to April 2023.

Sharp-eyed readers will notice several of the figures presented in the chart have changed from the last time we visited these trends in October 2023. The figures from Janaury 2020 onward have been revised and updated according to the latest Census population controls by the Bureau of Labor Statistics' analysts.

Readers will also catch that adding the indicated numbers of younger and older working teens together doesn't necessarily add up to the numbers of all working teens. That's because each of these data series has been run through its own seasonal adjustment. If you are looking for numbers that do add up, you'll want to access the non-seasonally adjusted data available at the BLS' data site.

Reference

U.S. Bureau of Labor Statistics. Labor Force Statistics (Current Population Survey - CPS). [Online Database]. Accessed: 5 January 2024.

Labels: jobs

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.