We're going to do our best to tell the story of what happened for the distribution of income by age group between 1995 and 2005 in pictures, simply by comparing the number of people of a given age at given income levels for both years, after adjusting for inflation. Beginning with the Age 15-24 group:

Now, the Age 25-34 group:

The Age 35-44 group:

Next, the Age 45-54 group:

The Age 55-64 group:

And finally, the Age 65-74 group:

Common Threads

A surprising amount of upward income shifting has occurred at the lower end of the income spectrum in the time between 1995 and 2005. We see this change clearly in the rightward shift of the "peak" number of individuals at a given annual income. We also see this more generally in the 2005 distributions being to the right (greater income) of the 1995 distribution for equivalent numbers of individuals.

For the Age 25-34 and Age 35-44 age groups, there have been substantial decreases in the number of individuals earning low incomes, even though the number of individuals at higher incomes has remained relatively stable for these groups.

For all age groups, we really don't see a significant increase in the number of top income earning individuals, with the exception of the Age 45-54 and Age 55-64 ranges, likely due to the influx of the "Baby Boomers" into these age groups.

For all age groups, the trend from 1995 to 2005 is to have fewer individuals at the lowest end of the income spectrum and substantially more at the mid-to-high end.

Preliminary Conclusions

The net result of these changes suggests that the increase in income inequality in the United States from 1995 to 2005 is primarily driven by reductions in the numbers of low income-earning individuals combined with an upward shift in the number of individuals earning middle-to-high end incomes, as we've demonstrated above in the charts for the Age 15-24, Age 25-34, Age 35-44 and Age 65-74 age groups.

Meanwhile, the impact of the baby boom generation is being felt as the leading edge of this generation entered the Age 55-64 group and continued to grow in the Age 45-54 group. In both these age groups, significant increases in the number of individuals at nearly every income level occurred, most remarkably in the Age 55-64 group, which saw proportionately more high income-earning individuals join its ranks.

Labels: demographics, income, income distribution, income inequality

Since we've been comparing income distributions for various age groups in both 1995 and 2005, we thought we'd take the opportunity to present some basic snapshot data before getting into the real data-lifting portion of our ongoing exercise.

Counting Income Earners by Age Group

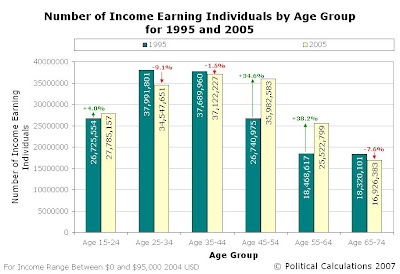

Our first snapshot reveals the number of income-earning individuals by age group in the U.S. for both 1995 and 2005 who fall within the income range of $0 to $95,000 in constant 2005 U.S. dollars:

Overall, the number of U.S. individuals earning annual incomes between $0 and $95,000 in constant 2004 U.S. dollars increased from 165,937,163 in 1995 to 176,929,886 in 2005, a 6.6% increase. The greatest increases within the different age groups occurred in the Age 55-64 group (37.6%) and the Age 45-54 group (33.6%). The age 25-34 group saw the greatest decrease (-10.5%), while all the other age groups saw modest changes of less than 3% (positive or negative.)

Note: We've tweaked the data provided in this chart from our previous presentation, as we've modified how the data was calculated to directly correspond with how we determined the total income earned by each age group within our annual income spectrum. Now, these figures are based upon adding the number of people we calculated would be between each consecutive $100 interval from $0 to $95,000, where before, we had simply run our calculation at these extreme limits.

Totaling Income by Age Group

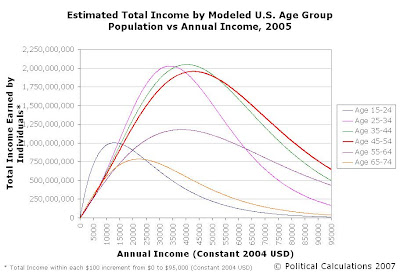

How much income did all the individuals within our income spectrum of $0 to $95,000 2004 U.S. dollars for each age group take home in 1995 and 2005? The chart below reveals the answer:

All together, income-earning individuals raked in some 4.23 trillion 2004 U.S. dollars in 1995 and 4.89 trillion 2004 U.S. dollars in 2005, an increase of 15.7%. Once again, the greatest gain by age group was the Age 55-64 group, which gained some 58.1% over the decade from 1995 to 2005, rising from $492 billion to $777.9 billion. Second place was again taken by the Age 45-54 group, who saw their total income earned increase by 35.7% (from $897.3 billion to $1.218 trillion).

The next largest gain was taken in by the Age 15-24 group, who increased some 15.9% from $302.6 billion in 1995 to $350.8 billion in 2005, followed by the Age 65-74 group, who increased 8.6% from $327.1 billion to $355.3 billion in that time.

The only decrease in total income accumulated within the various age groups was realized by the Age 25-34 group, who declined 3.1% from 1995's $1.016 trillion to 2005's $985.3 billion.

Average Income per Capita Income-Earner

Correction: A sharp-eyed reader caught an error we made in describing what our data is actually showing. Average income per capita would apply to all people within a population (those who earn incomes as well as those who do not), while what we're actually doing in our ongoing analysis is looking only at the subset of the whole population who earn income and were counted as doing so in the Current Population Survey for both 1995 and 2005! We have also modified the title of our chart below to clarify exactly whose average income is being considered. Such are the perils of doing "live" analysis on the web!....

Since we now have the totals for number of income earners within each age group as well as the total amount of income that they accumululated for each year, we can now find the average income earned by these individuals within each age group! The following chart presents the average income per capita income-earner results:

This is maybe the most remarkable result that we've seen to date. First, we confirm that the ages from 45 to 54 years old represent the peak earning years for all age groups, as this age range tops the average annual income for both 1995 and 2005.

Second, we find that from 1995 to 2005, after having adjusted for inflation, the Age 45-54 group's average income only increased by 1.6%, from $33,556 to $34,088 in constant 2004 U.S. dollars.

By comparison, every other age group saw the average income per capita income-earner increase more. The top growth rate is claimed by the Age 55-64 group, which rose from $26,637 to $30,614, an increase of 14.9%. Second place was the low income earning Age 15-24 group, who increased 13.7% from $11,320 to $12,875 in the ten years from 1995 to 2005.

Likewise, the Age 65-74 group grew it's average annual income by 10.8% (from $17,855 to $19,787), and the Age 25-34 group, which had seen significant declines in number of income earners and total income earned, rose some 8.5% in the per capita income-earner measurement.

For all Age Groups (or rather, Age 15-74), the average annual income per capita income-earner rose from $25,487 in 1995 to $27,648 in 2005, an increase of 8.5%!

How funny that the "richest" age group in the U.S. grew richer so much more slowly than all the other age groups during these 10 years!

Labels: demographics, income, income distribution

The baby boomers, or rather, those born in the United States in the years from 1946 through 1964, represent the largest single generation to date in the U.S. So, we wondered what impact the members of this generation has had on the U.S. economy as they've fully moved into their peak earning years (45 to 54 years old) in the years from 1995 to 2005 (click for a larger chart).

To find out, we went to our recently created population distributions of income by age group, and generated the total income earned by individuals in each $100 increment for each age group for annual incomes from $0 to $95,000 (in 2004 U.S. dollars). We can then use the total income earned by age group as a key measure in evaluating the impact of the baby boomers, or other generations and age groups, upon the economy.

The math behind this analysis is pretty simple. We took the number of people in each of the $100 increments we considered, which we found by simply subtracting the cumulative number of people at the lower income level from the cumulative number of people at the higher income level. We then multiplied that difference by the midpoint of the income range under consideration.

We arbitrarily selected the $100 increment for the sake of keeping the number of calculations relatively low while still providing really good insight into how the number of people earning a given annual income is distributed across the entire income spectrum for each age group. We'll note that greater accuracy may be achieved by reducing the size of the increment, but that for our purposes, the $100 interval worked really well.

The practical upshot is that all this math allows us to generate the following two charts, which show the respective distributions of the total income earned by individuals at each $100 income increment from $0 to $95,000, all in constant 2004 U.S. dollars. First, here's our chart showing the distribution of total income earned by age group for 1995:

Now, here's the companion chart for the distribution of total income earnd by age group for 2005:

In these charts, we see a really remarkable shift in the income earned from 1995 to 2005 in both the 45-54 age group and the 55-64 age group, which covers the entire baby boom generation to a large extent. The following chart directly compares the total income earned for each age group for both 1995 and 2005:

In this chart, we see that the total income earned by nearly all age groups increased in the period from 1995 to 2005, with the exception of the Age 25-34 group, which saw it's total earned income decrease by 3.1%. (We'll note that we previously showed that the number of income-earning individuals in this group declined by 9.1% from 1995 to 2005. We'll have more on this later....)

Otherwise, the main story is the massive increase in the totals for the amount of income earned for both the Age 45-54 group and the Age 55-64 group, which saw their total incomes earned grow by 35.7% and 58.1% respectively.

We'll ask again - just what do you suppose the impact has been upon the overall distribution of income in the United States after having so many people in the working population of the United States move into their peak earning years?

Coming soon: A quick calculation to see what's happened to the average income per person for each age group over this period, followed by side by side comparisons for each age group (and tools you can use to run your own numbers, we promise!), and then a progressive comparison by age group, since we can, after all, compare the income earned by one age group in 1995 to the 10-year older group in 2005!

Labels: income, income distribution

Welcome to the May 26, 2007 Memorial Day Weekend edition of On the Moneyed Midways, the blogosphere's weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Welcome to the May 26, 2007 Memorial Day Weekend edition of On the Moneyed Midways, the blogosphere's weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Each week, we seek out the best post from the hundreds contributed to the dozens of money-related blog carnivals, which we award the title of being The Best Post of the Week, Anywhere!(TM) For those that come close, but not quite, we award the title of being Absolutely essential reading!(TM)

We're beginning to see a pattern in which blog carnivals are most worth reading each week, which we'll feature in an upcoming special edition of OMM. In the meantime, the best posts of the week that was await you below....

| On the Moneyed Midways for May 26, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Employee Benefits | Leave It? Or Roll It Over? | The Float | Interlake Capital Management examines whether people should roll their 401(k) balances to an IRA when changing jobs or retiring, coming strongly down on the side of rolling them over. |

| Carnival of Fraud | Dewey, Cheatham and How | Trusted Advisor | Your lawyer may be shafting you. Charles H. Green comments upon a piece that appears in the Wall Street Journal's law blog that suggests the legal industry's billing practices are crossing into unethical territory (and that those in the legal profession don't seem to have a problem with that!) Absolutely essential reading! |

| Carnival of Real Estate | By Withholding the Secrets of the Mystical MLS System Are We Betraying the Home-Buyer's Interests? | BloodhoundBlog | Gregg Swann uncovers why the rules that govern the MLS have evolved the way they have and advocates for a major change that would eliminate the need for secrecy and really benefit the consumer. |

| Carnival of Shopping | This Lazy Woman's Used Car Buying Method | Wisdom from Wenchypoo's Mental Wastebasket | Nobody enjoys the process of buying a used car, but Wenchypoo reveals how she gets the upper hand when negotiating! |

| Carnival of the Capitalists | The 4 C's - The New Marketing Mix | A New Marketing | The 4 P's (Product, Price, Place and Promotion) have long dominated the practice of marketing, but Matt McDonald notes the appearance of a new paradigm: The 4 C's (Create, Connect, Correct and Cancel). Absolutely essential reading! |

| Cavalcade of Risk | Workplace Disabilities Are on the Rise | Worker's Comp Insider | Unhealthy worker lifestyles and aging baby boomers are combining to threaten trouble for U.S. employers. Julie Ferguson looks at the magnitude of the problem and at how companies are adapting to keep ahead of the curve. |

| Festival of Frugality | Common Myths About Traffic Tickets | Broken Arrow | The former police officer busts the commonly held myths about what motivates the police to write up so many traffic tickets and offers tips for staying on the right side of the law! Absolutely essential reading! |

| Festival of Frugality | Free Food! | My Money and My Life | The Story Girl shares how she cut her grocery bill by taking advantage of free food offers - perhaps some grandstanding politicians seeking to make headlines by feeding themselves only off the supplemental portion of the food stamp program should take note! |

| Festival of Stocks | Is Early Release of Study Data to Doctors Unfair? | BioHealth Investor | Do doctors unfairly benefit from having early access to research data about new and upcoming drugs? Hisham Ayoub wonders if the release of these early results doesn't trip over insider trading regulations. Absolutely essential reading! |

| Festival of Stocks | Chasing 39% Profit a Year | Interactive Investor Blog | Richard Beddard reports on University of Durham's Keith Anderson's research into what might be described as the ultimate criteria in value investing: the "Naked PE Ratio!" Absolutely essential reading! |

| Personal Development Carnival | Jack of All Trade vs Specialization | Ultracrepidate | Causalien balances specialization and generalization in a wide ranging, yet short post that provides unexpected insights into the nature of innovation and the benefits of networking. We feel this is The Best Post of the Week, Anywhere!, but then again, we're partial to these topics, so we may be biased! |

| Personal Growth Carnival | Why Reaching Your Goals Will Never Make You Happy | Steve-Olson.com | "Accomplishment isn't what you really want. It's a hoax" is the leading idea Steve introduces in identifying where happiness really resides. |

| Real Estate Investing | How to Get Cash from a Previous Owner for Repairs | MichaelEmilio.com | South Florida Realtor Michael Emilio Rodriguez explains what steps a new homeowner needs to take if they find significant problems in their home after buying. |

| Small Business Issues | Business Failure | Business Advice Daily | John van der Graaf and Ralph Blakely share the lessons they learned from their failures in running their small business - including learning how to "fire" their more overly-demanding clients! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

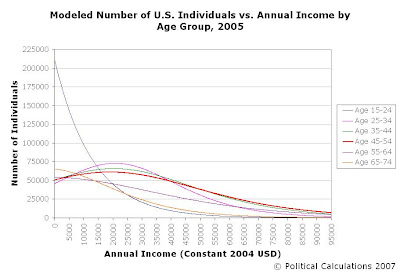

Using the distributions we previously created to model the cumulative representation of income-earning individuals by age group for both 1995 and 2005, we've now extracted the number of income-earners by annual income! First, here's the distribution we've modeled for 1995:

And here's the distribution we've modeled for the same age groups and constant 2004 U.S. dollar income range for 2005:

We'll be comparing each age group's distribution in a later post (and introducing a tool that will allow you to find the number of income earners within any income range from $0 to $95,000 constant 2004 U.S. dollars, but in the meantime, here's a direct comparison of the totals for each age group across our income spectrum:

Here's something to think about over the Memorial Day Holiday - in this last chart, we see that a major demographic shift in the number of income-earning persons in the U.S. has occurred in this 10-year period, primarily in the Age 45-54 and Age 55-64 groups, which both saw the number of individuals within each age range leap by 34.6% and 38.2% respectively. Meanwhile, we see that by comparison, the number of income-earning individuals in the other age ranges were either flat or saw moderate decreases.

Since we've already established that the Age 45-54 range for both 1995 and 2005 represents the peak earning years for U.S. individuals, what do you suppose the effects of this demographic change would be upon the distribution of income within the United States during this period? In other words, what effect would this change within the U.S. workforce have upon income inequality in the United States?

Update: For the curious, the two charts at the top of this post show the number of individuals within each consecutive $100 interval from $0 to $95,000 in constant 2004 U.S. dollars!

Labels: income, income distribution, income inequality

No, this post is not about Freakonomics, even though we've borrowed the cover art! Instead, we're referring to the challenge of comparing income data by age group for the years 1995 and 2005.

No, this post is not about Freakonomics, even though we've borrowed the cover art! Instead, we're referring to the challenge of comparing income data by age group for the years 1995 and 2005.

Just how do you compare the income data, and the 10 years worth of change between them, for the two years of our interest?

It's a bit like comparing apples and oranges. Inside a paper bag, they might be superficially similar (size, shape, weight, etc.), but outside the bag, they're so distinct from one another that no one would ever mistake one for the other.

The income data we've been looking at for 1995 and 2005 is a lot like that. To make a solid comparison between these two years, we need to change one of them from an apple into a much more directly comparable orange. This post is about how we've done it.

Factoring in Inflation

We started by taking the monetary figures within the 1995 data and simply adjusting them for inflation. Since our 2005 data is presented in 2004 U.S. dollars, and likewise, the 1995 data is presented in 1994 U.S. dollars, our first adjustment was to convert the 1995 data to constant 2004 U.S. dollars.

We did this using Oregon State's Robert Sahr's inflation conversion factors for 2004 U.S. dollars (available in this PDF document), which provides the means for converting the value of U.S. dollars in any year from 1800 through the current year as well as projections out to 2015 into 2004 U.S. dollars!

Essentially, using these factors, we recognized that thanks to inflation, a 2004 U.S. dollar is worth just 78.5% of the value of a 1994 U.S. dollar. So, we divided each monetary figure in the 1995 data by the conversion factor of 0.785 to obtain its 2004 equivalent!

Distributions R Us

Doing that created a new problem. Instead of having directly comparable income ranges between the two years, we were left with comparing the ranges that didn't exactly match up. For instance, the lowest income range for 2005 is $1 - $2,499, while our inflation converted data for 1994 had changed from these figures in 1994 U.S. dollars to be $1.27 - $3,183.44 in 2004 U.S. dollars! While it's nice that they're all in the same valued money terms, it would be really great if we could directly compare the ranges.

What we needed was something like a distribution that would allow us to directly match up the data for both years in 2004 U.S. dollars. So, we created a distribution for each year. Going back to the original data for each year, we recognized that each income range in the Current Population Survey's income data really represents two things.

First, the obvious - it provides the number of persons in each age group who have annual income within the indicated range. Next, the not-so-obvious - if we progressively add up all the people in each of the individual age ranges, it provides the number of persons who earn the income at the top of the indicated income range, or less.

So, for instance, if we look at the 2005 data for the Age 15-24 group and look at the first two income ranges, we find that 6,059,000 persons within this group had annual income with the range of $1-$2,499 and that 3,432,000 persons earned income within the next higher level of $2,500-$4,999.

But, if we progressively add the persons in the higher level to the lower level, we obtain a distribution that tells us that there are 6,059,000 persons earning up to $2,499, and that there are 9,491,000 persons earning $4,999 or less. And so on all the way up to the top income level in the report of $95,000.

We can then take this data and create a mathematical representation of it. We observed that the raw data points seems to follow a sigmoidal distribution, so we used ZunZun's online 2-D curve-fitting tools to create formulas to represent each set of our data (one for each age group in both 1995 and 2005.) Our sigmoid functions follow the basic form:

Where a, b, c and d are unique values for each age group, e is a mathematical constant, Income is a given annual income amount and the Number of Individuals is that for those who make a given annual income, or less. We can find the number of individuals in a given income range by subtracting the value obtained using the lower income level from the value obtained using the higher one.

The chart below represents our effort for the 1995 data, converted to constant 2004 U.S. dollars:

And here's our chart for the 2005 data, for which we followed the same procedure, omitting only the inflation adjustment since it's already expressed in 2004 U.S. dollars:

We can now directly compare income data from 1995 and 2005, at any income level from $0 to $95,000 in constant 2004 U.S. dollars.

The Next Level

The other cool thing about now having this data being described by mathematical functions is that we can now precisely calculate the total amount of income earned by all individuals within the various age groups for a given income range by integrating our formula above, which we obtained using Wolfram's Integrator:

We can now find the total income earned for each age group between any two income levels by subtracting the value obtained in this formula from the lower income level from that obtained using the higher income level.

These Are Not the Droids We Were Looking For

Update: Ah, if finding the total income earned by the number of individuals between a given annual income range by simply integrating our sigmoidal function were that easy!

As it happens, the error is that we're considering the cumulative total of individuals making a given income or less within an income range, rather than the number of individuals within the income range. So, we're going to take a brute force approach to calculating the total income produced by individuals within a given income range.

We'll do this by taking our cumulative number distributions, and subtracting the cumulative total at a lower income from the cumulative total at a higher income, which will provide the number of individuals within a given income range. Then, we'll use a numerical method to determine the total amount of income produced by the individuals within our income range of consideration.

It's not hard, it's just not as easy as we had hoped!....

What's Wrong with What We've Done?

Our distribution for the Number of Individuals of each age group is really good, except at the low end of the income spectrum. This problem arises from the lack of good data here, primarily due to how the Current Population Survey actually grouped people at the lowest end of the annual income earning level.

While we've made frequent reference to the $1-2,499 income range, the raw data for this range also includes those who earned less: either those who earned no income (such as Will Smith's character in The Pursuit of Happyness, congressional pages, unpaid interns, and generally anybody trading income for experience or networking contacts) and those who worked but had a net loss (budding entrepreneurs getting their businesses off the ground, etc.)

The problem with that is we don't know how many people fall into those groups, since they fall in with the part-timers who predominate in this lowest annual income range. So, we set our curve-fitting distribution data at 0 individuals at $0 annual income.

Because of that, our modeled distribution curve has the greatest error from the actual data we had to work with at this lowest end of the income spectrum. The good news is that our distributions become better (low errors compared to actual data figures) at annual income levels above $7,500 (off by less than 3%), and get better and better as the income levels increase.

What's Next

A lot of analysis, followed by a bit of mythbusting, and along the way, some new tools (this is Political Calculations, after all!) Stay tuned….

Labels: income, income distribution, math

Welcome to the May 18, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Welcome to the May 18, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Each week, we seek out the best post from the hundreds contributed to the dozens of blog carnivals, which we award the title of being The Best Post of the Week, Anywhere!(TM) For those that come close, but not quite, we award the title of being Absolutely essential reading!(TM)

Wow! This has been a unusually good week for posts - there's very little that separates The Best Post of the Week, Anywhere! from the post we identified as being Absolutely essential reading!, and for that matter, each of the posts we selected for this week's edition of OMM. Don't take our word for it - the best posts of the week, anywhere, await you below....

| On the Moneyed Midways for May 18, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Financial Planning | Are Your Friend's Investments Performing Better Than Yours? | Money $mart Life | A 29-year old software engineer compares his retirement funds to those of his co-workers in a discussion of risk and return, and wonders how discussing investments with others might change one's investing decisions. |

| Carnival of Financial Planning | Why Aren't Money Mangers Paid Purely on Performance? | My Money Blog | What if, the 28-year old blogger behind My Money Blog wonders, an investment manager had to take all the risks to manage your investments? Absolutely essential reading! |

| Carnival of Real Estate | Unarmed Robbery - Broker Style | Larry's Take on the Cocoa Beach Real Estate Market | A listing broker with whom Larry Walker was negotiating a transaction for his client tacked on a "regulatory compliance fee" to the settlement statement. Larry explains what it is and why it stinks. |

| Carnival of Small Business Issues | Is the Manager Obsolete? Or When Does Consensus Stop? | Reasoned Audacity | Jack Yoest identifies what makes a "management-free" business structure attractive (and to whom), and explains why it won't work for the vast majority of businesses. |

| Carnival of the Capitalists | Screwing Performance Review | Software Project Management | End of quarter performance reviews can be tough on employees, but Pawel Brodzinski notes they're tough on managers too and offers five suggestions for how managers should approach these events to make them go easier for themselves. Yes, it's tongue in cheek!... |

| Festival of Stocks | Beat the Market with Only 15 Minutes of Work per Year | Project Stocks | Chris Burress reviews research that finds that buying the Number 1 diversified equity fund in the past 12 months, holding it for one year and then selling it to buy the new Number 1 fund at that time would have beaten the stock market by a wide margin over the past 20 years. |

| Lead Optimize! | Trust-Destroying Selling | Trust Matters | Charles H. Green relates an anecdote on how two different salesmen destroyed their respective companies' potential for future business with a customer through late-in-the-game manipulations for a single sale. |

| Personal Growth Carnival | Corporate Fear and Performance Anxiety | Trust Matters | Charles H. Green comments upon a Harvard Business School professor's "discovery" that "fear is endemic in modern corporate life." Charles has written two very, very good posts this week, but this one is The Best Post of the Week, Anywhere! |

| Real Estate Investing | Subprime Mortgage Apocalypse | Salt Lake Real Estate Blog | Nigel Swaby has been accused of being overly optimistic regarding the economy, so imagine his surprise that billionaire Warren Buffett shares his views on the potential impact that the "subprime meltdown" will have on it. |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Should you invest in a tax-free municipal bond this year? Or would a taxable investment make more sense for you?

Should you invest in a tax-free municipal bond this year? Or would a taxable investment make more sense for you?

It's a classic investing question, which is why we've updated our tool for helping you make your choice for 2007! Our tool will take your basic data regarding how much income you expect to earn and how much you'll have to pay in taxes, to determine if that tax-free investment you might be considering is actually worth it.

Along the way, our tool will provide a good first approximation of your marginal tax rate. This calculation is only a first approximation since things like the phase out of tax credits at higher income levels can affect what tax bracket you'll actually find yourself in when you file next year.

To use our tool, you'll need a copy of your tax return for 2006 (remember all that cussing and yelling you were doing back in April?!), since you'll already have done some of the math needed to use our tool - all you need to do now is plug in the numbers you found then. If you expect your numbers will be significantly different this year, then go with what you expect:

The tool above is based upon math outlined by columnist Bruce Bartlett in his March 2005 column Tax Rates. Bruce just recently opened his own blog over at Townhall.com!

Labels: investing, taxes, tool

Mostly for the sake of presenting the nominal (non-inflation adjusted) income data we have for 1995, we're going to offer a look at two other area strata charts for that year. The first chart provides an estimate of the distribution of total income earned in 1994, which we approximated by taking the midpoint of our income ranges and multiplying it by the number of people within the indicated income ranges for that year:

The chart provides a measure of the relative economic clout of each age group in 1994. Here, we see pretty much what we would expect - the Age 15-24 group has the lowest collective income, as large numbers of people within this group only work part time, are actively engaged in their schooling (both high school and/or college), or don't earn much income given their low levels of experience and training.

The next lowest group on the economic clout scale is in the Age 65-74 bracket. Here, the wide majority of individual in this group is retired.

By far, the group with the greatest collective economic impact is the Age 35-44 cohort, who altogether aggregated over $1 trillion (in 1994 US dollars.) But, as we saw in the data for 2004, it's the Age 45-54 period where individuals rake in the most money per person! Even though this age group only accounts for just over 77% of the income accumulated by those in the Age 35-44 bracket, they take home an average $26,318 per capita, compared to the average $24,783 for the 35-44 year olds (again, these figures are 1994 US dollars!)

We can see the reason why this occurs in the chart's income level strata - within the 45-54 age group, a higher proportion of individuals earn higher incomes than those in the 35-44 age group, as the income bands are proportionately wider at these income levels.

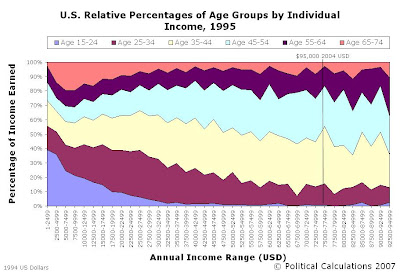

We can confirm this using our next chart, which reveals the relative percentages of individuals by age group for each of the income ranges:

Here, as we saw in similar 2004 data, we see that as income increases, the proportion of people in the older age groups also increases.

In the chart above, we added a vertical line to represent the effect of inflation from 1994 to 2004. We'll soon be making direct comparisons between these two years after accounting for inflation, and since the data we have for 2004 only goes up to $95,000 (in 2004 U.S. dollars), we wanted to show where the equivalent cut-off will be (the cut-off is at $74,575 1994 U.S. dollars.)

Previously on Political Calculations

- The Distribution of Income by Age in 1995

- Income Distribution Percentages by Age in the U.S. (2005)

- Peak Earning Years for U.S. Individuals (2005)

- The Distribution of Income by Age in the U.S. (2005)

- Generations

Labels: income, income distribution

Having recently looked at the distribution of the number of U.S. income earners by age and income level for 2005, we thought it might be fun to create a similar chart looking at the same data, but from 10 years earlier. The following chart is generated from data provided by the U.S. Census' Current Population Survey from March 1995 and shows the distribution in the number of U.S. income earners by age and income level for 1994:

The income ranges in the chart above reflect 1994 U.S. dollars. Now, for the sake of comparison, here's our previous chart, which shows the distribution in the number of U.S. income earners by age and income level for 2004:

Since the income ranges in this chart reflect 2004 U.S. dollars, it's not possible to do more than directly compare the number of U.S. income earners in each age bracket for 1994 and 2004. Never-the-less, we find that there has been a substantial increase in the number of income earners in the higher age brackets. Our table below summarizes our findings:

| Comparison in Number of U.S. Income Earners by Age Bracket for 1994 and 2004 | |||

|---|---|---|---|

| Age Bracket | 1994 | 2004 | Percentage Change |

| Age 15-24 | 27,026,000 | 27,697,000 | + 2.42% |

| Age 25-34 | 39,150,000 | 34,710,000 | - 12.79% |

| Age 35-44 | 40,517,000 | 37,326,000 | - 8.55% |

| Age 45-54 | 29,380,000 | 36,061,000 | + 18.53% |

| Age 55-64 | 19,652,000 | 25,538,000 | + 23.05% |

| Age 65-74 | 17,886,000 | 17,176,000 | - 4.13% |

| Total Age 15-74 | 173,611,000 | 178,508,000 | + 2.74% |

Pretty remarkable! Although the total number of U.S. income earners between the ages of 15 and 74 only increased by 2.74% from 1994 to 2004, a substantial amount of shifting around between age brackets has occurred in that time.

Most notably, the growth in the number of income earners in the Age 55-64 bracket in 2004 exceeded all other brackets on a percentage basis, at an increase of 23.05% over 1994 levels, as 5,886,000 income earners were added to this group.

Second place in percentage growth between 1994 and 2004 belongs to the Age 45-54 bracket, as this group increased by 6,681,000 from 1994 to 2004, a 18.53% increase.

Meanwhile, the only other increase was the relatively flat growth in the number of income earners in the Age 15-24 bracket. All other age groups saw substantial decreases in the number of income earners in each bracket.

We'll be taking a closer look at this data in the days ahead....

Update: We should note that even the direct number comparison in the number of income earners from $1 to $95,000 between 1994 and 2004 is somewhat off, as the income ranges have not been adjusted for the effect of inflation over this time. As such, our post above only reflects raw number comparisons between these two years.

If we were to present this information in constant 2004 US dollars, and only look at the adjusted range between $1 and $95,000 for each year, there would be fewer income earners counted in 1994, as the effects of inflation make 1994 US dollars worth more in comparison. Consequently we would only be counting individuals in 1994 up to an income in that year of $74,575 ($95,000 2004 USD). We'll make these adjustments as part of our upcoming analysis.

Labels: income, income distribution

Stayed up later than you should have, did you? Or maybe you're just not a "morning person?" Either way, now that you're awake, somebody is probably expecting you to be functional, and for many of you, that means coffee!

Stayed up later than you should have, did you? Or maybe you're just not a "morning person?" Either way, now that you're awake, somebody is probably expecting you to be functional, and for many of you, that means coffee!

But that only answers the question of what you're going to do to become functional. You still need to know how much coffee you're going to have to drink to fully rejoin the world of the living and the productive.

Fortunately, Geek Logik's Garth Sundem faces a similar problem every day and has worked out the formula for helping you figure out how many cups of joe it's going to take to get you going this morning. Our tool below automates the early-morning head-throbbing algebra for you:

For those of you who drink regular drip or brewed coffee, a cup of coffee would be the rough equivalent of one shot of espresso. From the FAQ for Caffeine:

Is it true that espresso has less caffeine than regular coffee?

Yes and no. An espresso cup has about as much caffeine as a cup of dark brew. But servings for espresso are much smaller. Which means that the content of caffeine per millilitre are much higher than with a regular brew. Moreover, caffeine is more quickly assimilated when taken in concentrated dosages, such as an espresso cup.

...

Here's the caffeine content of Drip/Espresso/Brewed Coffee:

Drip 115-175 Espresso 100 1 serving (1.5-2oz) Brewed 80-135

And that's that! The only questions left are: cream and sugar?

Labels: food, geek logik, tool

Bartlett's Notations is now up and running over at Townhall, for the initial purpose of responding to his critics and offering other observations, analysis and commentary.

The Political Calculations connection? Bruce provided the initial background data and inspiration for our tool for helping decide whether investing in a taxable or tax-free investment might be better for you (which we updated for 2006, and which will be updated later this week for 2007!)

Labels: none really

Welcome to this Saturday, May 12, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Welcome to this Saturday, May 12, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the best-hosted of the week's major business and money-related blog carnivals!

Each week, we seek out the best post from the hundreds contributed to the dozens of blog carnivals and proclaim it to be The Best Post of the Week, Anywhere!(TM) For those that come close, but not quite, we declare those posts to be Absolutely essential reading!(TM)

Since we're late already, let's get right to it! Here are the best posts of the week that was....

| On the Moneyed Midways for May 12, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Employee Benefits | Sell Your 401(k) Company Stock Right Now! | Blueprint for Financial Prosperity | The Pension Reform Act of 2006 made it possible for 401(k) investors holding significant amounts of their company's matching stock in their accounts to sell it off. KMC describes how it works and argues that you should do so for the sake of diversification. |

| Carnival of Financial Planning | Ten Questions to Ask Before Getting Hitched | Consumerism Commentary | Flexo lists ten hard-core business questions you should ask and answer when considering the most important partnership you'll form in your life! |

| Carnival of Fraud | Why the Overstock Inventory Issue Matters | FRAUDfiles Blog | Carnival host Tracy Coenen explains how a company's inventory numbers can be used to manipulate potential investors' view of its financial health and develops some questions that will likely keep dogging Overstock.com's CEO. |

| Carnival of Real Estate | Agent Photos - Do You Really Need a Head Shot? | Real Estate Convergence | Why do real estate agents, alone among all other people who have business cards, insist on putting their pictures on them? Jeff Brooks says it's just not worth it! |

| Carnival of Small Business Issues | Growing Business - Three Decisions for Growth | Business Advice Daily | What does it take to keep growing your small business after its begun verging on something much bigger? Linda Nash finds three critical factors that can dictate your company's future: who you hire, your willingness to change and your role as a leader. The Best Post of the Week, Anywhere! |

| Carnival of the Capitalists | Top Management Dis's the Importance of Managerial and Supervisory Skills | Wally Bock's Three Star Leadership | Wally Bock observes that your immediate boss has the single most powerful impact on your morale and productivity in your work. So why, he wonders, doesn't top management invest more in developing the abilities of its front line supervisors? |

| Festival of Stocks | Unconventional Use of Moving Averages | Trader's Narrative | Babak doesn't use the moving averages of stocks the way chartist's do to show levels of support and resistance. Instead, he uses them "find areas of extreme expansion" through the miracle of mean reversion - and he makes money doing it! |

| Personal Development Carnival | Why Affirmations Sometimes Fail | Debra Moorhead | For many people, affirming what kind of people they want to be leads to becoming that kind of person. Often it works, but sometimes it doesn't. Debra Moorhead says writing down a directive affirmation may be what's called for in those circumstances. |

| Personal Growth Carnival | Dealing with Energy Vampires | Renovate Your Life with Craig | Craig Harper lists eight things you can do to counteract those who are "relentless in their negativity and their 'woe-is-me'-ness." Absolutely essential reading! |

| Real Estate Investing | It's Turnover Time for College Rentals | TheLandlordBlog | Anesia Springborn discusses how the end of a college student's lease at the end of the school year can be timed to the landlord's greatest benefit. |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Courtesy of the National Association of Realtors blog (aka the NARblog), we've learned that the major factor that led to the expansion in the number of Realtors in 1975 was the creation of a new class of membership in the organization, the REALTOR-Associate®, as opposed to what had been our working theory that the computerization of the MLS was the driving factor:

Technological improvements have made it easier for more people to become real estate agents and brokers, according to PoliticalCalculations, and those same innovations may work in reverse to reduce the numbers of real estate professionals as consumers gain greater access to property information.

The theory certainly has merit, although technology is only part of the story behind the growth of real estate as a career. Lower interest rates and the general demand for housing are also significant factors, among others. And it's worth noting that 1975, the year noted by PoliticalCalculations for both the launch of computerized multiple listing systems and massive growth in NAR's membership, was also the year that NAR began offering a REALTOR-Associate® category of membership. NAR had primarily been an organization for brokers before 1974, but the new category opened membership to hundreds of thousands of sales agents. That change was the major force behind NAR's sudden exponential growth in 1975.

This would also explain why changes in the number of Realtors would seem to have suddenly become affected by market conditions after 1975, whereas before, these effects went unseen as the larger number of people engaged as agents in real estate transactions was effectively hidden before the NAR created the new membership classification. Our thanks to NAR's Information Central for filling in this missing piece of information!

Labels: real estate

We'll have a special Saturday edition of On the Moneyed Midways this week. (Okay, it's not really "special" so much as "delayed," but we're just applying the lessons we've recently learned on how to completely spin a different reality from Hollywood's trailers!)

Labels: none really

The best advertising in the world is dedicated to convincing potential consumers that they should consume a particular kind of beer.

Don't believe us? Try Dos Equis' new Most Interesting Man in the World marketing campaign, which "establishes a distinctive personality in the Most Interesting Man to help premium beer and spirits drinkers in their quest to live more interesting lives, reinforced by his catchphrase: 'Stay thirsty my friends.'"

The agency behind the ads, EURO RSCG, has deliberately aimed at the upscale beer consumer:

For Euro RSCG, the spot is a conscious attempt to elevate the often-lowbrow imagery associated with beer ads. "The stain of the Swedish bikini teams still lingers. Those kinds of ads are targeted at beer-drinking morons," said Jeff Kling, ecd at Euro RSCG in New York. "We saw this as an opportunity to talk to people a little differently. It portrays a different kind of drinker."

Not everyone thinks the ads will succeed in establishing Dos Equis' desired brand identity. In our view, the pacing of the ads themselves stand out among other beer commercials and the content offers insights into the Hemingwayesque character of the Most Interesting Man in the World and his views, which we believe is right in line with Dos Equis' targeted market. Here's a sampling of those insights and views:

On careers: "Find out what it is that you don't do well, and then don't do that thing."

About him: "He's a lover, not a fighter. But he's also a fighter, so don't get any ideas."

"His beard alone has experienced more than a lesser man's entire body."

"And when he orders a salad, he doesn't get the dressing on the side, he gets it right on top of the salad. Where it belongs. Where there's no turning back."

And, here's one of the television commercials:

What else can we say? Stay thirsty, my friends!

Labels: business, food, marketing

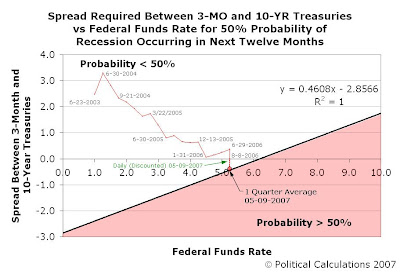

2007 is shaping up to be a recession proof year, much as our interpretation of Paul Krugman's prediction of recession back in December of 2006 suggested it would be! Here's our latest update of our recession probability tracking chart:

With today's action, or rather, non-action by the Federal Reserves' Open Market Committee, the Federal Funds Rate target remained at 5.25%. Using our recession probability tool, taking a 1-quarter rolling average of the daily closing values for the 3-month Treasury, the 10-year Treasury and the Federal Funds Rate, we find the current probability of recession occurring in the next year to be 49.3%. This probability represents a decline from the peak value of 50.1% that we saw from March 30 through April 2, 2007.

With the daily discounted yield rates for the 3-month and 10-year U.S. Treasuries having closed at 4.72% and 4.64% respectively, combined with the unchanged Federal Funds Rate of 5.25%, all these rates together produce a probability of recession occurring in the next 12 months of 39.3%. As the daily discounted Treasury yields lead the 1-quarter averaged values, this suggests that a recession is growing more and more unlikely for 2007.

Labels: recession forecast

Just to underscore the effect of age (or rather, the combination of education, experience and work status) upon individual income in the U.S., we came up with the following chart that shows how income within a given range is distributed among individuals within a given age range on a percentagewise basis:

In the chart above, the relative concentration of U.S. individuals by age for a given income range is indicated by the relative width of the corresponding age strata. Here, a wider band indicates that the indicated age bracket has a higher percentage of members within the indicated income range.

What We See

At the low end of the income scale, we find that those Age 15-24 make up the largest share, followed by those Age 65-74. This may be explained by those in the Age 15-24 group largely participating in educational pursuits (high school, college) and their low levels of experience and training for those participating in the workforce. For those in the Age 65-74 bracket, retirement accounts for the relatively higher level of low income among this age group.

As income increases, we find that as age increases, so does the relative share of income earned. In other words, the older the American, the more money they make, at least through their prime working years from Age 25-64!

Previously on Political Calculations

Labels: demographics, income distribution

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.