Are you afraid of trolls? Vampires? Matrices?

For your Halloween pleasure, Matt Parker takes on all three fearsome concepts in the following 12 minute video:

If you're looking for more math to be scared by, since it was referenced in the video, here's Numberphile's five-and-a-half minute video on Vampire Numbers.

It's amazing how dated all the featured vampires other than Count von Count look in the videos....

Previously on Political Calculations

Labels: math

The Biden administration has taken a strange view that the rising prices many American households have faced throughout 2021 are a good thing because more people are buying goods.

Watch the following exchange between CNN's Jake Tapper and White House Press Secretary Jen Psaki in this short video clip from 15 October 2021:

Jen Psaki Defends Rising Prices: 'Good Thing' Because it Means 'More People are Buying Goods' pic.twitter.com/IaKVYVSCbR

— Jason Rantz on KTTH Radio (@jasonrantz) October 15, 2021

If prices are rising because more people are buying goods, the economic law of supply says we should also be seeing the supply of those goods increase. That's because rising prices, all things being equal, gives producers an incentive to sell more of the things they produce. More importantly, rising prices give marginal producers who can dial up their production a very strong incentive to produce more. Otherwise, they're losing out on easy profits.

For much of 2021, you can see the Law of Supply at work, with some very noticeable exceptions, in the following diagram charting the weekly price and quantities of crude oil being processed at U.S. refineries throughout 2021.

Those very noticeable exceptions include:

- Supply disruptions related to the February 2021 Cold Weather Event that shut down oil production and refining in the U.S.' gulf coast states.

- Supply disruptions from the impact of Hurricane Ida in September 2021.

In the case of the February 2021 Cold Weather Event, oil production in the U.S. fully recovered, with rising prices coinciding with rising supplies. The recovery from Hurricane Ida looks similar, up to a point. We see that something went very awry after 1 October 2021. Instead of the supply of crude oil rising with rising prices as it did earlier in the year, the supply of crude oil going into U.S. refineries has fallen, while prices have continued to escalate. Not only that, refineries never recovered to the levels they were producing before Hurricane Ida disrupted production.

Since 1 October 2021, something very different is at work in the U.S. economy. To confirm that's the case, here's our tool for determining whether supply or demand is behind changes in price. We've set the default entries to apply to the situation with oil being processed at U.S. refineries since 1 October 2021.

We confirm that oil prices are rising now because the supply of crude oil being processed at U.S. refineries has fallen. That is something that's now showing up across the U.S. in the form of rising gasoline prices.

The U.S. Energy Information Administration is claiming that demand is rising faster than supply, but their own data says otherwise. We also looked at the weekly number of barrels of crude oil from U.S. field production and being imported into the U.S., and find they have recovered to pre-Hurricane Ida levels.

The only explanation we've found that correlates with the price and quantity data points to refineries temporarily shutting down to change over to approved winter blends of petroleum products. If that's indeed all it is, that environmental regulation-driven change has a negative economic effect similar to a sustained, small-scale supply disruption caused by a natural disaster.

References

U.S. Energy Information Administration. Petroleum & Other Liquids: Weekly Crude Oil Spot Prices (West Texas Intermediate). [Online Database]. 27 October 2021.

U.S. Energy Information Administration. Petroleum & Other Liquids: Weekly U.S. Refiner Net Input of Crude Oil. [Online Database]. 27 October 2021.

U.S. Energy Information Administration. Petroleum & Other Liquids: Weekly U.S. Field Production of Crude Oil. [Online Database]. 27 October 2021.

U.S. Energy Information Administration. Petroleum & Other Liquids: Weekly U.S. Imports of Crude Oil. [Online Database]. 27 October 2021.

Labels: economics, environment, gas prices, tool

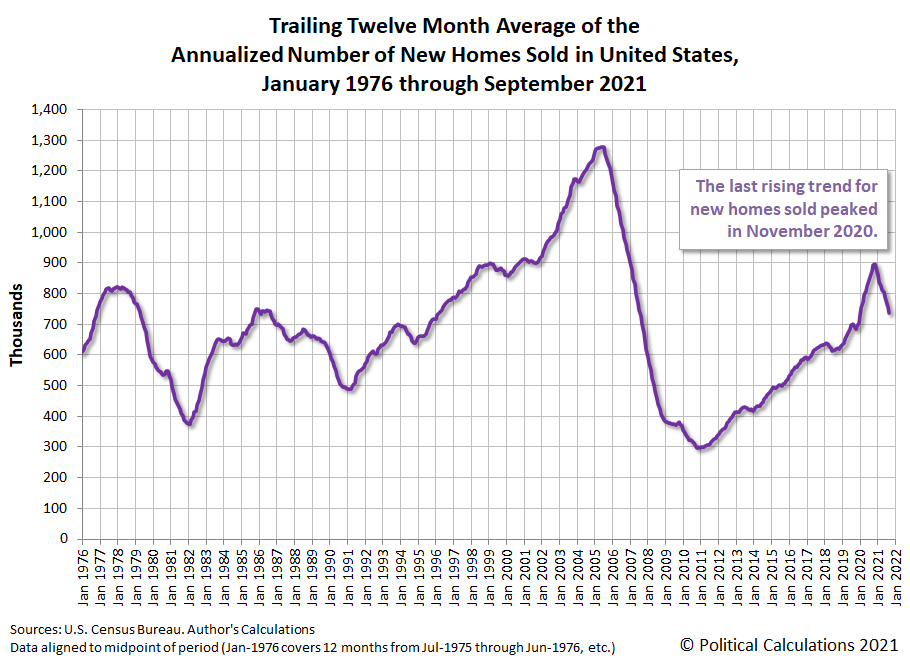

The U.S. new homes market is showing signs of stagnation. That can be seen in the trend for the market capitalization of new homes sold in the U.S., which moved sideways from August to September 2021. The initial estimate of the market cap itself for September 2021 is $29.35 billion.

By this measure, the U.S. new home market last peaked in December 2020 at $30.12 billion. Since then, the market for new homes in the U.S. has shrunk in both real and nominal terms.

Speaking of real shrinkage, the number of new homes being sold in the U.S. has continued to decline from its November 2020 peak.

The market cap for new homes however is only managing to tread water because the average prices of new homes sold is escalating at its fastest pace on record.

The new home market has become a source of headwinds for the U.S. economy in 2021.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 September 2021.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 September 2021.

Labels: market cap, real estate

When Joe Biden was sworn in as President of the United States on 20 January 2021, the U.S. national debt had reached $27.8 trillion. Through the end of the U.S. government's fiscal year on 30 September 2021, the total public debt outstanding increased to $28.4 trillion.

The following chart identifies the entities who have loaned the most money to the U.S. government. The percentage shown for each indicates how big each entity's share of the U.S. national debt is as of 30 September 2021.

The values for foreign nations shown on the chart represent a first estimate because the U.S. Treasury Department's data for the amount of U.S. government-issued debt held by foreign entities only reflects its estimates through August 2021. Data through September 2021 will become available next month, which will be subject to revision before being finalized sometime in 2022.

Once again, the U.S. Federal Reserve is Uncle Sam's largest single entity creditor, outranking its former top creditor, Social Security's Old Age and Survivors Insurance Trust Fund, by a widening margin. That margin is widening because Social Security is running in the red, which means it has to cash in its holdings of U.S. Treasuries to keep paying benefits to Social Security beneficiaries at promised levels.

But what is really remarkable is the extent to which the U.S. Federal Reserve is funding the U.S. government's spending above and beyond what it collects in taxes that has taken place during Joe Biden's tenure in office. Since 20 January 2021, the U.S. national debt has increased by $669.3 billion, but the U.S. Federal Reserve's holdings of U.S. government-issued debt securities has increased by $687.5 billion.

That's possible because the U.S. Federal Reserve has more than offset a net reduction of $520.4 billion in the amount of money other U.S. entities have loaned to the U.S. government during this time. At the same time, foreign entities have boosted the amount of money they've loaned to the U.S. government by $502.2 billion, which when combined with the other figures, accounts for the overall net change since 20 January 2021. Here's a visual rundown of the net national debt change math as presented using a waterfall chart:

As of the end of the U.S. government's 2021 fiscal year, the Federal Reserve had loaned nearly one out of every five dollars the U.S. government owed through the end of September 2021.

About the Data

These figures represent the most current information available as of 30 September 2021, which for the total public debt outstanding and data on U.S. government entity holdings is current through that date. The Federal Reserve's holdings is fully current through 29 September 2021. Data for foreign holdings is based on estimates through August 2020 that were published on 18 October 2021.

Labels: data visualization, national debt

Given all the issues that are dominating the news, would you have guessed the S&P 500 (Index: SPX) would reach a new record high?

The index closed at a record high of 4,549.78 on Thursday, 21 October 2021, which puts the trajectory of the index into the upper half of the latest redzone forecast range:

Sharp-eyed readers will catch that the trajectory of the range has itself shifted upward, which is a result of the 'dynamic' method we use to set it. When we bridge across periods where the echoes of past volatility in stock prices affect the dividend futures-based model's projections, the past end of the range is fixed while the future end 'floats' with changes in expectations.

For the chart, the rising expectations for the future now means parts of the S&P 500's actual trajectory that were once within the redzone forecast range now fall outside of it. That's visible by design in this period because we set the total width of this forecast range to be plus-or-minus three percent of the historic typical level of volatity for stock prices.

Under typical volatility levels, the trajectory of the index should generally fall well within that statistically-determined range. But as the chart visually confirms, the market is experiencing greater than typical levels of volatility.

For us, what that means is that when we get around to projecting the S&P 500's future trajectory for 2021-Q4, we'll need to generate a new redzone forecast, since today's stock prices will become the base reference points from which we project the future for the index in that period. The echoes of today's volatility will affect the accuracy of the dividend futures-based model's projections a year from now.

The market moving headlines of the week point to several contributing factors for what new information has contributed to improving the outlook for investors. Pay particular interest to the signs and portents for the U.S. economy in the latter half of the week that was:

- Monday, 18 October 2021

- Signs and portents for the U.S. economy:

- U.S. homebuilder confidence unexpectedly rises in October, survey shows

- 'Enough's enough': tight U.S. job market triggers strikes for more pay

- Oil prices ease off highs as U.S. factory data weighs on market

- Chip shortages, Hurricane Ida weigh on U.S. factory output; demand remains strong

- Another Fed minion caught trading while central banking:

- Bigger trouble developing in China:

- China's economy stumbles on power crunch, property woes

- China's plunging construction starts reminiscent of 2015 downturn

- Instantview: China Q3 GDP growth hits 1-year low, raising heat on policymakers

- China's Sept industrial output rises 3.1% y/y, misses forecasts

- China faces challenges from 'mismanagement' at certain firms, says PBOC head

- Bigger inflation developing all over:

- New Zealand inflation surges at fastest pace in over a decade

- No place to hide: investors to trawl Europe's Q3 earnings for inflation clues

- S&P, Nasdaq enjoy boost from big tech firms, Dow ends a hair lower

- Tuesday, 19 October 2021

- Signs and portents for the U.S. economy:

- Oil remains near multi-year highs as energy crunch continues

- U.S. housing starts fall; permits hit one-year low as shortages bite

- Fed minions becoming concerned about inflation:

- Bigger trouble developing in China is home made in China:

- China's economic wobbles cast long shadow for Asia

- Analysis-China's self-inflicted slowdown tests Beijing's reform resolve

- ECB minions see no reason to hike interest rates soon, are concerned by rising inflation:

- No reason for the ECB to increase rates by end of next year, Villeroy says

- ECB's Rehn warns of risk if inflation surge lasts much longer

- Risk of higher euro zone inflation on the rise: ECB's Vasle

- Wall Street ends higher as investors bet on positive earnings season

- Wednesday, 20 October 2021

- Signs and portents for the U.S. economy:

- U.S. mortgage rates surge to 6-month high -MBA

- California ports, key to U.S. supply chain, among world's least efficient

- Oil rallies as U.S. crude stocks decline in tight market

- Pandemic fallout could slow U.S. online holiday spending growth: report

- Fed minion says Fed's policies are perfect:

- Fed's Quarles: taper test is met, Fed not behind curve

- Fed report shows wage pressures amid 'modest to moderate' economic growth

- Bigger trouble developing in China:

- Bigger inflation developing all over:

- UK house prices rise 10.6% in year to August - ONS

- Energy, services boost euro zone inflation as expected in Sept

- Canada's annual inflation rate hits 4.4% in September, highest since 2003

- Supply chain chaos set to extend further, port operator ICTSI says

- German regulator cuts power, gas grid earnings to protect consumers

- ECB minions, having solved all problems of jobs and inflation, turn attention to climate change:

- Euro zone banks should be legally bound to climate transition plans, ECB says

- Bundesbank chief Weidmann quits early with one last inflation warning

- Wall Street closes higher as earnings reports soothe investor fears

- Thursday, 21 October 2021

- Signs and portents for the U.S. economy:

- U.S. weekly jobless claims hit 19-month low as labor market tightens

- U.S. existing home sales surge to 8-month high in September

- White House tells Democrats that corporate tax hike unlikely in current bill -source

- Biden, Democrats shred spending, tax plans to get a deal done

- Fed minions want to stop holding so many U.S. Treasuries, get new rules to minimize potential for insider trading:

- Fed should let its balance sheet shrink over next couple of years - Waller

- Fed puts 'tough' investment limits on top officials in aim to staunch scandal

- Bigger inflation developing all over:

- World Bank sees 'significant' inflation risk from high energy prices

- Soaring prices dampen consumer mood in India's festival season

- UK manufacturers raise prices by most since 1980 - CBI

- BOJ minions want to stop doing so much stimulus, says Japan's banks are stable:

- Exclusive-BOJ discussing phasing out pandemic support as economy reopens - sources

- BOJ says Japan's banking system stable, warns of risks

- IBM weighs on the Dow; Nasdaq and S&P gain ground

- Friday, 22 October 2021

- Signs and portents for the U.S. economy:

- U.S. business activity accelerates in October, shortages hamper factories - IHS Markit survey

- Biden backs down on corporate tax hikes, open to altering filibuster

- Chief Fed minion says its time to taper stimulus bond buys while facing forced stock sale, another minion says Fed should keep stimulus going:

- Time for Fed to taper bond purchases but not to raise rates, Powell says

- Fed's Daly: standing pat is right course for monetary policy now

- Bigger inflation developing all over:

- Exclusive-UK public's inflation expectations rocket to record high: GfK

- China's soyoil hit near 10-year high, crush margins swing back to profit

- Euro zone business growth slowed in October, prices soared -PMIs

- Japan's consumer inflation turns positive as energy costs rise

- Euro zone inflation expectations hit ECB target of 2%

- Mixed economic picture emerging in Asia:

- Japan's private-sector activity grows for first time in 6 months - PMI

- South Korea's economy likely lost some steam in Q3, cooling China a worry: Reuters poll

- ECB minions want to be last in line to hike interest rates, may get new ethics rules like Fed:

- ECB to raise rates in 2024, but risk remains of earlier hike: Reuters poll

- ECB urged to tighten trading rules for policymakers

- Nasdaq, S&P 500 end lower, dragged down by communications services

If you haven’t already guessed it by clicking through the headlines, Reuters is a terrific resource for business and markets news, with a higher-than-average signal to noise ratio for picking up on market-moving news items.

The Inventions in Everything team has seen a lot of really strange inventions over the years, but today's featured invention is the only one that truly creeps us out. Which is why we're featuring it just ahead of Halloween!

We're referring of course to U.S. Patent 112,550, issued to Robert J. Clay on 14 March 1871. If you read the patent, the description of the invention sounds rather innocent:

This invention relates to a new doll, which is provided with a concealed clock-work and mechanism, whereby its limbs are moved in imitation of those of a creeping baby while the doll itself is being propelled on the floor by concealed rotating wheels which support it. A very amusing toy is thus produced at small cost.

What could possibly be wrong with that? Well, the title of the invention is "Improvement in Creeping Dolls", which should start sending up warning flags on its own, but wait, there's more. Prior to 1880, in order to be issued a patent, inventors were required to submit a physical model of their invention as part of the patent examination process. The model Clay submitted of an "Improved Creeping Baby-Doll" still exists and is in the possession of the cryptkeepers at the Smithsonian Institute.

Think of every horror movie you've ever seen and let us know what your reaction would be if you suddenly saw this thing in action on the screen. Or better still, what if you saw it in your home, coming toward you?

"Pure nightmare fuel" is how the IIE team has come to describe this invention, where the patent's illustrations fail to do justice to what the real-life thing looks like.

Within a decade after it was delivered to the U.S. Patent Office, the U.S. Patent Office discontinued its requirement for inventors to provide models of their inventions, perhaps motivated by the possibility they might receive more things like the physical model of U.S. Patent 112,550.

We're being a bit facetious in saying that. In truth, the U.S. Patent Office started running out of space to store all the stuff they were getting, so they dropped the requirement except in the case of flying machines and perpetual motion machines, preposterous and impossible inventions that demanded a higher level of examination to be considered for a patent.

After the Wright brothers earned U.S. Patent 821,393 on 22 May 1906, the requirement for inventors of flying machines to deliver working models of their inventions to the U.S. Patent Office was dropped. But should you invent a perpetual motion machine, you will need to provide your working model to the U.S. Patent Office when you submit your patent application.

The IIE team is aware of other creepy inventions, but subjectively, we rank this one the creepiest. Pleasant dreams, and happy Halloween!

Labels: technology

How does your household compare to the average American household when it comes to spending for food at home?

Answering questions like that takes data, and for that, the Consumer Expenditure Survey has detailed the average amount of money spent by American household "consumer units" in each year from 1984 through 2020. In the following chart, we've extracted the survey's data for expenditures by food category, showing the data for each year to show the trends for each.

In 2020, the average total amount of food-at-home expenditures for American households was $4,942. Here's how that breaks down into major food categories:

- Meats, poultry, fish, and eggs: $1,075

- Fruits and vegetables: $977

- Miscellaneous foods: $973

- Cereals and bakery products: $640

- Dairy products: $474

- Nonalcoholic beverages: $455

- Other food at home: $348

This list brings up a good question: what's the difference between "Miscellaneous foods" and "Other food at home". Here's how the Bureau of Labor Statistics defines both of them (we've added the additional examples in parentheses):

Miscellaneous foods includes frozen prepared meals and other foods; canned and packaged soups; potato chips, nuts and other snacks; condiments and seasonings, such as olives, pickles, relishes, sauces and gravies, baking needs and other specified condiments; and other canned and packaged prepared foods, such as salads, desserts, baby foods, and vitamin supplements. Other food at home primarily represents sugar and other sweets (such as sugar, candy and chewing gum; artificial sweeteners; and jams, jellies, preserves, fruit butters, syrup, fudge mixes, icings, and other sweets), and also fats and oils (including margarine, shortening, and salad dressings, vegetable oils, nondairy cream substitutes and imitation milk, and peanut butter).

Since food prices have been rising, you can use these average 2020 expenditures to benchmark how much more money you're having to spend on these items in 2021.

References

U.S. Bureau of Labor Statistics. Consumer Expenditure Survey. Multiyear Tables. [PDF Documents: 1984-1991, 1992-1999, 2000-2005, 2006-2012, 2013-2020]. Accessed 9 September 2021.

Labels: food, inflation, personal finance

We've updated our chart tracking the periods of order and chaos that have characterized the S&P 500 (Index: SPX) over the past 30 years.

It won't be a surprise, but the index entered into a period of chaos with the arrival of the coronavirus pandemic in March 2020. Through eighteen full months later, the index is still characterized by chaos.

The big question: Is the U.S. stock market in an economic bubble?

- Pro: Jeremy Grantham says U.S. stocks are in a ‘magnificent bubble,’ crazier than 1929 and 2000

- Con: The stock market is not in a bubble as tech innovation drives rapid growth, according to Cathie Wood

If you want to know where we stand on the question, we wrote the definition of an economic bubble.

Labels: chaos, data visualization, SP 500

We are seeing an unexpected development in Arizona's experience with the coronavirus pandemic. While the trends for the number of cases and deaths in the state are showing a slow, steady decline, the number of new hospital admissions in the state have plunged by a much larger amount by comparison.

The following chart shows the state's data for all three of these COVID-19 data series from 15 March 2020 through 15 October 2021, or rather, their rolling seven-day moving averages for which the data is at least 95% complete:

According to the state's data, the number of new hospital admissions has fallen by over 57% from their third-wave peak during the week of 14 through 22 August 2021. That figure applies for 20 September 2021, which meets the 95% complete threshold at this writing. By contrast, Arizona had only seen a 23% decline in cases at the same point in time, which has grown to a nearly 33% reduction through 3 October 2021. The data for deaths through 20 September 2021 will be too incomplete to provide an additional point of comparison for another two weeks.

The Arizona Department of Health indicates their COVID dashboard is undergoing scheduled database maintenance, so this is the most current information available for the state until it might update it later today. We're curious to see if the state's data for COVID hospital admissions might be subject to revision when that work is complete.

If the hospital admission data is unchanged or only sees minor revisions, it suggests Arizona's experience with the coronavirus pandemic as its third wave recedes is very different from what it saw during its first two waves.

But if there's been a reporting glitch for new COVID admissions from Arizona's hospitals to Arizona's DHS, we would expect the states datatrend for COVID hospitalizations to follow the same basic pattern for as for cases. We'll update the original article on our site with what we find after the state's next COVID data update.

Update 19 October 2021, 11:15 PM EDT: The patterns we've described above have held through the latest daily update, which covers available data through 18 October 2021.

Previously on Political Calculations

Here is our previous coverage of Arizona's experience with the coronavirus pandemic, presented in reverse chronological order.

- All Indicators Confirm COVID Third Wave Receding in Arizona

- Arizona's Third COVID Wave Peaks and Begins to Recede

- Arizona COVID Cases Rising in Third Wave

- Arizona COVID Cases on Slow Uptrend in Summer 2021

- Increase in Arizona COVID Cases from Border Migration Crisis Stabilizing

- COVID-19 and the 2021 Border Migration Crisis in Arizona

- Improving COVID Trends Bottom and Flatline in Arizona

- Surge of Migrants, Lifting of Business Capacity Limits Change Arizona COVID Trends

- COVID-19 in Retreat in Arizona With Vaccines Gaining Traction

- The Ebb and Flow of COVID-19 in Arizona's ICUs

- Arizona's Plunging COVID-19 Caseloads and the Vaccines

- Arizona Enters Downward Trend for COVID-19 After Second Peak

- Arizona Passes Second COVID-19 Peak

- A Tale of Two States and the Coronavirus

- COVID-19 Questions, Answers, and Lessons Learned from Arizona

- The Deadly Intersection of Anti-Police Protests and COVID-19

- 2020 Campaign Events Drive Surge in Arizona COVID Cases

- Arizona Arrives at Critical Junction for Coronavirus Cases

- Arizona To Soon Reach A Critical Junction For COVID-19

- Getting More Than Care from Arizona's COVID ICU Beds

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

Political Calculations has been following Arizona's experience with the coronavirus experience from almost the beginning, because the state makes its high quality data publicly available. Specifically, the state's Departent of Health Services reports the number of cases by date of test sample collection, the number of hospitalizations by date of hospital admission, and the number of deaths by date recorded on death certificates.

This data, combined with what we know of the typical time it takes to progress to each of these milestones, makes it possible to track the state's daily rate of incidence of initial exposure to the variants of the SARS-CoV-2 coronavirus using back calculation methods. Links to that data and information about how the back calculation method works are presented below:

Arizona Department of Health Services. COVID-19 Data Dashboard: Vaccine Administration. [Online Database]. Accessed 16 October 2021.

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. 10 September 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus, data visualization

The arrival of earnings season with a strong showing for several large banks sparked a small rally for the S&P 500 (Index: SPX). The index' trajectory has risen back to the middle of the redzone forecast range:

The S&P 500's trajectory is consistent with the projections for investors focusing on either 2021-Q4 or 2022-Q1, which have largely merged over the last several weeks. Between the two, the information provided by the week's news stream points to 2021-Q4 having the edge in drawing the focus of investors' forward-looking attention, thanks to the arrival of its earnings season and the confirmation of the Federal Reserve's plan to start tapering its purchases of U.S. government-issued securities in the next month.

Here's the week's market-moving news:

- Monday, 11 October 2021

- Signs and portents for the U.S. economy:

- Fed minion says no way job market is stalling:

- Bigger trouble developing in China:

- Bigger inflation to finally develop in Japan?

- ECB minion worried about higher inflation:

- Wall St ends choppy session lower on earnings jitters; financials down

- Tuesday, 12 October 2021

- Signs and portents for the U.S. economy:

- Oil steadies as energy crunch stirs up volatility, recovery concerns

- U.S. job openings fall to a still-high 10.4 million in August

- "There will be things that people can't get," at Christmas, White House warns

- Fed minions post help wanted sign, want to start taper in November, and start coming clean on inflation:

- Boston Fed launches search for new president, hires exec. talent firm

- Fed policymakers hone in on November taper timeline

- Fed's Bostic says pandemic pressures pose risks for long-term inflation expectations

- Bigger trouble developing in China:

- China's export growth likely eased in Sept on electricity curbs: Reuters poll

- Chip shortage and power crunch hit China auto sales in 'Golden September'

- Bigger inflation developing all over:

- Energy crunch stokes inflation, economic recovery concerns

- Money markets ramp up global rate hike bets, add pressure on central banks

- Inflation jitters take toll on European stocks ahead of earnings

- Japan premier warns of negative impact on companies from weak yen

- Central bank minions queuing up rate hikes to quell inflation, ECB minion in big trouble:

- S.Korea central bank holds rates, flags a hike in November

- UK jobs hit record high as Bank of England weighs up rate hike

- ECB policymaker Kazimir charged with bribery, denies wrongdoing

- Wall Street closes lower on jitters ahead of earnings, Fed minutes

- Wednesday, 13 October 2021

- Signs and portents for the U.S. economy:

- Instant View: U.S. consumer prices increase solidly in September

- Higher inflation squeezing U.S. consumers as food prices, rents accelerate

- U.S. Social Security benefits to rise by most since early '80s

- Oil eases on profit taking, demand jitters; stays near highest in years

- Fed minions ready to taper stimulus bond buys, test "inflation is good" message:

- Fed's Bowman 'very comfortable' with November taper, sees inflation risks

- Fed lays out plan to reduce bond purchases, flags inflation worries

- Bigger trouble developing in China, Eurozone:

- China's growth seen slowing to 5.5% in 2022, modest policy easing expected: Reuters poll

- Exclusive-German institutes to slash growth outlook on bottlenecks-sources

- Bigger inflation developing all over:

- Rising German inflation calls for 'noticeable wage gains', union chief says

- UK house price climb slows, homes shortage deepens - RICS

- ECB minions told to rethink loose money policies contributing to inflation:

- S&P 500, Nasdaq rise with growth stocks; JPMorgan a drag

- Thursday, 14 October 2021

- Signs and portents for the U.S. economy:

- Biden enlists Target, Walmart to fix bottlenecks threatening holiday sales

- U.S. weekly jobless claims fall below 300,000 in boost to labor market recovery

- Oil prices rise, as Saudis dismiss supply concerns as demand grows

- Fed minions ready to taper and have their ethics reviewed!

- Fed, nearing bond-buying 'taper,' remains divided on inflation

- Exclusive-Fed bank chiefs, in letter to Senator Warren, pledge to comply with ethics review

- Bigger inflation developing all over:

- Column: Global economy faces biggest headwind from inflation

- Argentina inflation spikes sharply despite battle to curb prices

- Singapore tightens monetary policy in surprise move as price pressures grow

- From beef bowls to coffee, cost surge squeezes Japan's salaryman staples

- Spain September inflation at 13-year high on soaring energy prices

- China's record factory gate inflation stokes policy dilemma

- BOJ minion says MOAR STIMULUS FOREVER! ECB minion wants to stop stimulus:

- BOJ policymaker rules out stimulus withdrawal even after economy recovers

- Europe at risk of higher inflation; ECB'S PEPP should end in March: ECB's Knot

- Wall St ends up sharply as earnings, economic data lift optimism

- Friday, 15 October 2021

- Signs and portents for the U.S. economy:

- Oil prices rise to three-year high on back of supply deficit forecasts

- U.S. banks see wealth management boom on borrowing, new assets

- Rising prices flatter U.S. retail sales; demand for goods remains strong

- U.S. business inventories rise solidly, but auto stocks fall

- Food, fuels lift U.S. import prices in September

- China scrambling to get fossil fuels, Eurozone scrambling to hide fossil fuel inflation:

- Hungry for fuel, China looks to the U.S., Europe eyes relief plans

- Germany slashes energy surcharge to help consumers weather soaring prices

- Bigger inflation developing all over:

- Wall St tracks weekly gains on strong banks earnings, retail sales data

The Federal Reserve Bank of St. Louis has a marvelous resource for economic and business data. If you haven't yet met FRED (Federal Reserve Economic Data), allow us to make the introduction!

How can starting with a guess and using Isaac Newton's iterative solving method to find the roots of polynomial equations produce fractals?

3Blue1Brown's Grant Sanderson explains in the following 26 minute video. That may sound like a lot, but it is one of the more visually captivating maths explainers we've come across in quite a while, which really takes off at about the halfway point when chaotic boundaries emerge.

Newton's method is also known as the Newton-Raphson method, which is one of the tools that make it possible to come up with approximate numerical solutions to equations where direct, exact solution aren't an option. Here's a nice written introduction to how the method works, where step one involves making your best guess at the answer!

Update 16 October 2021: The sequel, Where Newton meets Mandelbrot (or more fancifully, “holomorphic dynamics”), is out!

Labels: math

The median sale prices of new homes sold in the U.S. rose faster than median household income in August 2021. That combination has put the median new home sale price at near record low levels of affordability.

Median household income in August 2021 is 18.4% of the median new home sale price. The record low for this measure is 18.3%, so we may soon be breaking records for unaffordability.

That's a way to measure the raw affordability of new homes, but what if we take today's near record-low mortgage rates into account? In the next chart, we've calculated the percentage of median household income that would be consumed by mortgage payments from January 2000 through August 2021.

This chart suggests the mortgage payment for a median new home is generally more affordable than in the past, which is largely attributable to falling mortgage rates over time.

If you look closely at recent trends however, a somewhat different picture is emerging. A mortgage payment for a median new home has been rising faster than median household income since the Coronavirus Recession bottomed in April 2020. That reverses the pattern from October 2018 to February 2020, when household incomes generally rose faster than new home prices, a rare period of improving relative affordability outside periods of recession. It has also occurred at a time when record low mortgage rates should be reducing the portion of household income taken up by mortgage payments.

It's not and we suspect that will be a problem going forward.

Labels: real estate

On 6 October 2021, we took snapshots of the sale prices of the iconic 10.75 oz can of Campbell's Condensed Tomato Soup at several major grocers around the United States. Shoppers are seeing upward price pressure in the first week of soup season in the U.S.

For the latest in our coverage of Campbell's Tomato Soup prices, follow this link!

That pressure is most visible at Amazon, which we've presented in the following screen shot along with Microsoft Edge's records of its recent price history at the online retailer:

Here's a summary of prices at other retailers, ranked from high to low:

- Amazon: $1.67

- Safeway: $1.49

- Walgreens: $1.49 (discounted to $1.25 with purchase of 2 cans)

- Meijer: $1.09

- Albertsons: $1.00

- Kroger: $1.00

- Target: $0.99

- Acme: $0.98 (discounted from $1.29)

- Walmart: $0.98

If you happen to live near one of the 248 Meijer grocery stores in Wisconsin, Illinois, Indiana, Kentucky, Michigan, or Ohio, you should move quickly this week to take advantage of the chain's sale on Campbell's Condensed Tomato Soup, where they've discounted the price from the $1.09 we indicated above to just $0.79 per can from Sunday, 10 October 2021 through Saturday, 16 October 2021.

You should also know it's not just Campbell Soup's prices that are seeing upward price pressure. Consumer prices for food products will be rising across many producers, including ConAgra, Kraft Heinz, and PepsiCo, to name just three major food producers in the U.S. who have announced more price hikes are coming for their products in since the start of October 2021.

Update: As of this morning, Amazon has dropped their price of Campbell's Condensed Tomato Soup to $0.95 per can. Amazing what a little visibility can do! But really, the question is how long will that price last?

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.