Welcome to our regularly scheduled Friday, January 23, 2010 edition of On the Moneyed Midways, the one place where you'll find the best posts contributed to the best of the past week's money or business-related blog carnivals!

Welcome to our regularly scheduled Friday, January 23, 2010 edition of On the Moneyed Midways, the one place where you'll find the best posts contributed to the best of the past week's money or business-related blog carnivals!

Do you want a raise? What does it take to get out from having to pay a parking ticket? Do older workers rack up more expensive workers' compensation claims? And what do you need to know to set up a side business buying and selling textbooks while you're still in college?

The answers to these questions, and the rest of the best posts of the week that was, await you below....

| On the Moneyed Midways for January 29, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Convenience Tax: You're Only Charging Yourself | Engineer Your Finances | The Fin Engr finds a different kind of debt that falls between the extremes of "good" and "bad" debt: the "Convenience Tax," or rather, the extra money you end up spending or charging for the sake of making life easier for yourself. |

| Carnival of Personal Finance | Buffett the Dividend Investor | Dividend Growth Investor | The Dividend Growth Investor digs into Warren Buffett's portfolio and argues that the "Sage of Omaha" is really a "closet dividend investor." |

| Carnival of Personal Finance | When Pigs Fly: How I Fought My Parking Ticket and Beat City Hall | Len Penzo dot Com | It took his wife getting a parking ticket to spur Len into action to fight City Hall, which resulted in his winning the case in court. The story of what it took to beat City Hall at its own game is Absolutely essential reading! |

| Carnival of Real Estate | Surprise! Government Report on Negative Equity Gets It Wrong | Altos Research | Scott Sambucci dissects a Government Accounting Office (GAO) report on the extent of negative equity in 16 major U.S. real estate markets and finds that it really missed the mark for most, which could have major implications for loan modifications in many. |

| Cavalcade of Risk | Older Workers and Comp: Low Risk and a Few Surprises | Workers' Comp Insider | Jon Coppelman reviews a new insurance industry study that shows workers Age 65 or older are more safety conscious and less expensive in terms of workers comp than their younger peers. |

| Best of Money | How to Get a Raise or Promotion | Free Money Finance | FMF reviews an MSNBC article that discusses how to get a raise or promotion in 2010. Oddly though, regardless of whose story is being told, FMF can express the lesson to be learned from the article in the same simple sentence! |

| Carnival of Money Stories | The Extensive Guide to Starting a Textbook Side Hustle in College | Foreigner's Finances | Austin Morgan ran a side business while in college and managed to earn more than any student with an on-campus job. In The Best Post of the Week, Anywhere!, he describes how it worked! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Let's begin by outlining three scenarios for why the stimulus failed to deliver on its backers' best thinking, based upon the potential effectiveness of the stimulus bill's ability to stimulate the economy:

- The stimulus had a positive effect, but the economy performed much worse than was forecast. In this case, the economy performed much better than it would have without the stimulus.

- The stimulus had little or no effect, so the economy performed just as it would have if the stimulus bill had never been passed, which turned out to be worse than was forecast.

- The stimulus had a negative effect, making the economy perform worse than had been forecast. In this case, the economy would have performed much better without the stimulus.

Before we go any further, let's make something very clear. Regardless of which of these possible scenarios might actually apply, the stimulus failed because of a lack of effective leadership by President Obama.

Here's how we know. Each of these scenarios has one thing in common - the economy performed worse than expected. The hard evidence of that fact, perhaps most easily measured by the government's tax collections, but to a lesser degree by the nation's employment situation, piled up month after month after month.

And yet, there was absolutely no follow through on the part of the President or his administration to adapt to the worse-than-expected situation. Other than to blame the worse-than-expected economy, which much surely have been the fault of the previous administration, or to proclaim the success of jobs having been "created or saved" through the stimulus, a measure so open to interpretation to its meaning to actually have none.

You see the problem. No follow through. And without the follow through to make sure that things are going as they should be, and the response to set things back on track if things are not, the failure of the stimulus bill to work as intended was ensured.

That's not effective management. That's an absence of effective leadership. Specifically, it's the absence of the most crucial aspect of effective leadership: the ability and commitment to act to set things back on track when they don't go as needed.

To see why, let's turn to the work of Walter Shewhart, the father of modern statistical quality control. Shewhart identified four crucial steps that repeat in a never-ending cycle to achieving success after setting a goal to improve quality in an industrial process, which we'll adapt to simply achieving success after setting a goal: the Plan-Do-Check-Act cycle.

To see why, let's turn to the work of Walter Shewhart, the father of modern statistical quality control. Shewhart identified four crucial steps that repeat in a never-ending cycle to achieving success after setting a goal to improve quality in an industrial process, which we'll adapt to simply achieving success after setting a goal: the Plan-Do-Check-Act cycle.

- Plan: Establish a goal and define the steps needed to achieve it within a given time frame, including how to effectively measure progress.

- Do: Systematically work through the steps needed to achieve the goal.

- Check: Systematically measure the progress being made toward achieving the goal.

- Act: If the results are significantly off-target from where they should be to achieve success within the given time frame, adapt the plan to put them back on target.

Applied to the President's stimulus bill, we see problems beginning almost immediately in the planning phase, in that "jobs saved or created" was clearly not an effective measure. However, that's not a show-stopper, since there were other, more effective measures that clearly communicated things weren't going as planned.

Instead, we observe that at no time in the past year did the President or his economic team act to adjust to an economic situation that was worse than they expected, as the situation was developing. It was only in last night's State of the Union address that the President finally began to adapt to a situation that he and his advisers sat by and watched grow worse than they expected for each of the last ten months with his call for a new "jobs" (aka "stimulus") bill.

Only now, the President will have a much more difficult task in gaining approval for the new measure, given his demonstrated inability to deliver promised results. It's a lot harder to get a hit when you take your eye off the ball.

Image Credit: Wikipedia

Labels: management, politics, quality

With President Barack Obama's first official State of the Union address scheduled for this evening and as it happens, nearly a year after President Obama's first address to a joint session of the U.S. Congress, we thought we'd take a look back at the biggest single achievement of the first year of his administration and a principal reason for his first major address as President: the American Recovery and Reinvestment Act of 2009. Or as most people have come to call it, "the stimulus package." Namely, how well did it work in stimulating the U.S. economy?

With President Barack Obama's first official State of the Union address scheduled for this evening and as it happens, nearly a year after President Obama's first address to a joint session of the U.S. Congress, we thought we'd take a look back at the biggest single achievement of the first year of his administration and a principal reason for his first major address as President: the American Recovery and Reinvestment Act of 2009. Or as most people have come to call it, "the stimulus package." Namely, how well did it work in stimulating the U.S. economy?

Let's revisit what the President said and then we said on the topic back on 10 February 2009:

In his response above, President Obama named three things he would use to determine if the economic spending plan he's currently promoting will have been effective:

- Creating or "saving" four million jobs.

- The credit markets making loans to people and to businesses.

- The stabilization of housing prices.

Now ask yourself: Would any of these things not happen anyway? Even without such a massive spending package? And if these things would happen anyway, how is their happening proof, in any way, that the government's proposed nearly trillion dollar spending spree is what worked to make them happen?

No, President Obama just doesn't understand money. Otherwise, he would know that he would have a very easy way to demonstrate that the "investing" he wants to have happen via the so-called "stimulus package" is producing positive returns for the taxpayers of the United States. He would see the benefit of the proposed spending in the form of higher tax collections stemming from increased economic activity.

We then went on to create a tool to run the numbers for what kind of tax collections it would take for the President to be able to claim that the stimulus package really worked. Here was our conclusion:

Doing the math, we find that in order for the spending of the stimulus package to be judged to be successful, it will need to increase federal tax collections over what they would be otherwise by at least $15,888,600,000 (just a bit under 16 billion USD).

See? Not so hard! Of course, if President Obama were smarter about money, we're sure he would have worked this out on his own! And now that he only has to have federal government tax collects rise over what they would be otherwise by just $16 billion, surely the President will be able to trumpet his grand achievement!

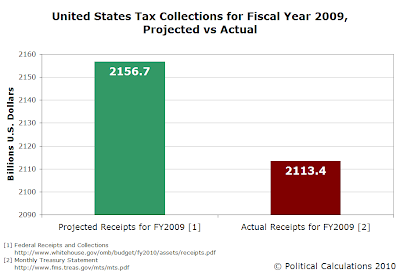

So how did those tax collections work out for President Obama? Let's answer that today by comparing what the White House's Office of Management and Budget projected would be the total of tax receipts in the United States for Fiscal Year 2009 against what the U.S. Treasury reports to have been the actual total of tax receipts over the period:

Noting that U.S. fiscal year 2009 ran from 1 October 2008 through 30 September 2009, we find that total tax collections fell some 43.3 billion dollars below where they were projected to be for the year. It would seem then that the stimulus was ineffective.

But before we draw that conclusion, let's look to see the quarter-by-quarter breakdown of the federal government's tax collections and match that against the timing of the expenditures for which it provides. After all, the stimulus bill didn't pass until the end of February 2009, with much of the associated spending not scheduled to take place until much later. Here's our chart showing the quarter-by-quarter tax collections from the first quarter of Fiscal Year 2009 through the available figures of Fiscal Year 2010:

Using the federal government's tax collections as a proxy for the performance of the U.S. economy, we see that the second quarter of Fiscal Year 2009 (January through March 2009) was the worst, followed by a strong increase in the third fiscal quarter (April through June 2009), but has fallen back since. Looking at a year-over year comparison between Fiscal Year 2009's first quarter and Fiscal Year 2010's first quarter, we confirm a significant decline has occurred during President Obama's first year in office, despite the President's stimulus spending initiatives. Could most of the benefit of the stimulus spending have occurred from April through June 2009?

Here's how Keith Hennessey described the timing of the stimulus' package spending initiatives, which perhaps explains why that's not the case (emphasis ours):

Fortunately, CBO Director Doug Elmendorf just gave a presentation titled "Implementation Lags of Fiscal Policy" to the IMF's conference on fiscal policy. All of the following data are from his presentation.

The final 2009 stimulus law broke down like this:

10-yr total % of total Discretionary spending (highways, mass transit, energy efficiency, broadband, education, state aid) $308 B 39% Entitlements (food stamps, unemployment, Medicaid, refundable tax credits) $267 B 34% Tax cuts $212 B 27% Total $787 B 100% The problem is that only 11% of the first line (discretionary spending) will be spent by October 1 of this year. In contrast, 31-32% of the entitlement and tax cuts lines will be out the door by that time. (I have questions about the speed of the entitlement part. The bulk of that is Medicaid spending, and it's not clear to me that a Federal payment to a State means the cash is immediately flowing into the private economy.)

If we extend our window to October 1, 2010, then less than half the discretionary spending will be out the door, while almost 3/4 of the entitlement spending and all of the tax cuts will be out the door and affecting the economy. The largest part of the stimulus law is therefore also the slowest spending part. This is fine if you’re trying to increase GDP growth over the next 2-4 years. If you're going for short-term GDP growth, it makes no sense.

We find then that the President's signature economic achievement to date has failed to achieve its stated purpose of stimulating the U.S. economy.

Image Source: Wikipedia

Previously on Political Calculations

- Stimulus Package: Our Entry for Worst Idea Competition

- Always Behind the Curve

- Better Ideas for Fiscal Stimulus Packages

- Where the Stimulus Money Is Going

- How to know If the "Stimulus" Worked

- Sports Stadium Stimuli?

- Pouring Taxpayer Money Down the Drain

- Simulating Stimuli

- The Porkulator

Update 27 January 2010, 2:10 PM PST: A sharp-eyed reader makes a very good point:

I think it would help if your article had clarified that the projected tax receipts for 2009 had already taken into account the projected reduction in tax receipts from ARRA. That's not the way I originally interpreted it, and it took some digging to find where in the linked PDF it actually said the projection included the impact of ARRA. If one misinterprets it the way I did, then saying tax collections are down in a year in which there were cuts to tax rates seems tautological.

As our reader notes, the comparison of projected vs actual tax collections do indeed incorporate the projected effects of the ARRA stimulus package spending and tax cuts. As such, it's as close to an apples-to-apples comparison as we can get!

Labels: economics, politics, taxes

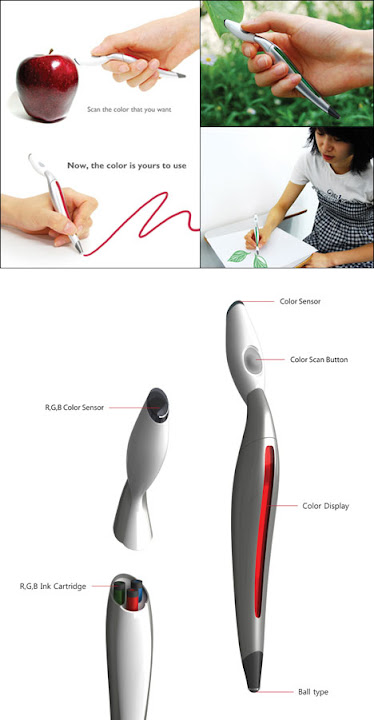

What if you combined a color sensor, similar to those that are used in the color matching devices at paint stores, with color inkjet technology? And then made the whole package fit within the space envelope of a magic marker?

What you might get is Jinsun Park's concept for a single magic marker that draws all colors, the Color Picker! (HT: Core77)

We would suggest that a multi-colored pen box to provide a basic palette for the Color Picker would be an essential accessory to include with the product. Keeping with the theme, it would be really cool to incorporate a color LCD screen and sufficient memory to store all the colors the Color Picker samples in the pen box!

Labels: none really, technology

We've been doing some economic detective work and we believe we found the exact trigger behind the stock market's sell-off last week. Along the way, we found out just how long it takes for the stock market to react to news it wasn't expecting.

Let's start by examining the forensic evidence, the 5-day chart of the S&P 500's action from Friday, 15 January 2009 through Friday, 22 January 2010:

In examining the chart, we find two potential trigger points:

- The 9.08 point gap down on Wednesday, 20 January 2010 from the S&P 500's closing value of 1050.23 on Tuesday, 19 January 2010, a drop of 0.8%.

- The 14.59 intraday drop on Wednesday, January 2010, during which the S&P 500 lost 1.3% of its value in the fourteen minutes from 10:20 AM to 10:34 AM.

Now let's line up our mostly likely suspects, which we've identified by scanning the market commentary of the past week, starting with our own favorite usual suspect:

- A fundamental change in market outlook, as measured by a change in the value of expected future dividends per share.

- President Barack Obama's announcement of proposed new restrictions on banking and financial companies.

- Speculation on the status of Federal Reserve Chairman's Ben Bernanke reconfirmation.

- Constraints being placed on new home loans in China that spooked investors, first in China's stock markets, then internationally.

Let's now see where our suspects were on the two days in question:

Change in Market Fundamentals: The table below shows what the S&P 500's dividend futures expected for each of the five days in our data sample.

| Expected Future Trailing Year Dividends per Share | ||||||

|---|---|---|---|---|---|---|

| Date | 2010Q1 | 2010Q2 | 2010Q3 | 2010Q4 | Direction of Force on Stock Prices | Observed Change in Stock Prices |

| 15 January 2010 | 21.801 | 21.799 | 22.022 | 22.517 | Neutral | Down in First Hour, Otherwise Flat |

| 19 January 2010 | 21.801 | 21.732 | 21.963 | 22.466 | Downward | Up Throughout Day |

| 20 January 2010 | 21.801 | 21.732 | 21.964 | 22.467 | Neutral | Gap Down on Open, Otherwise Flat |

| 21 January 2010 | 21.801 | 21.732 | 21.964 | 22.467 | Neutral | Flat After Open, Sharp Drop at 10:20 AM, Down After 10:34 AM |

| 22 January 2010 | 21.801 | 21.733 | 21.966 | 22.471 | Neutral | Down Throughout Day |

In the table above, we see a contradiction on 19 January 2010. Here, the day's projected dividend futures suggest that stock prices would push lower, but instead, the S&P 500 rose on the day. Applying our analytical methods, this outcome suggests the influence of noise, where a non-dividend related news event drove the level of stock prices. And as it happens, that's exactly what we find: stock prices, particularly those related to health companies, pulled the entire S&P 500 index upward on the day with the election of Scott Brown to the U.S. Senate from Massachusetts, greatly diminishing the chances of the Democratic Party's health care reforms passing through the U.S. Congress in their current form.

And since these kinds of news-driven noise events are short-term events, this also explains for the gap down on the following day, as the principal signal driving stock prices would not be denied!

But after that point, we see that the direction of dividend futures bear little pressure on stock prices. This observation eliminates the fundamental force that drives the stock market from being a contributing factor to the change in stock prices for the rest of the week.

Obama's Proposed Restrictions on Banks: Here, we find from a cached version of The Political Schedule that President Obama delivered his remarks on financial reform at 11:40 AM on Thursday, 21 January 2010, too late to have triggered the sudden sell-off that began at 10:20 AM and ended by 10:34 AM.

We should also recognize that by the time President Obama delivered his remarks, they were old news. The New York Times had posted the story at 2:26 AM, some eight hours in advance of the market's reaction.

While it may be possible that President Obama's proposed banking restrictions are contributing to a negative sentiment among investors, which may have contributed to lower stock prices, we find they had no role in triggering the sharp decline on 21 January 2010 at 10:20 AM and only a slight impact, if any, for the rest of the day or the days that followed.

The Renomination of Ben Bernanke: Given the influence of the Fed Chairman over the U.S. banking and financial industries, as well as the U.S. economy, there's little question that even a hiccup in the renomination of Ben Bernanke to fill this role would greatly affect investor sentiments, which Warren Buffett confirmed in a CNBC interview that morning. The question though is what news about Bernanke's renomination possibly hitting a snag might have occurred to knock stock prices off their perch?

As it happens, we found what appears to have been the specific trigger for the otherwise unexplained sudden sell-off on Thursday, 21 January 2010. Using Google's cache, we found a Reuters news flash that hit its mobile network at 10:18 AM on 21 January 2010 (Reuters has since removed the headline from the mobile network - Update 1 February 2010: Here's the original news headline flash, which was posted on Reuters' network at 10:17 AM), with the headline "Senate won’t vote on Bernanke this week: aide". The rest of the story wasn't fleshed in until 12:44 PM, however, we believe this headline flash directly sparked the sell-off at 10:20 AM, just two minutes after the headline broke. That two minutes then is all the time it takes for the stock market to react to significant news breaking that it wasn't previously expecting! (Update 1 February 2010: Make that three minutes - we found the original headline that posted at 10:17 AM on 21 January 2010.)

On a side note, reading the transcript of Warren Buffett's interview, we can't help but feel sorry that he didn't get his day's worth of notice that Bernanke's reconfirmation was running into some trouble!

On a side note, reading the transcript of Warren Buffett's interview, we can't help but feel sorry that he didn't get his day's worth of notice that Bernanke's reconfirmation was running into some trouble!

We also note that the continuing decline in stock prices observed on Friday, 22 January 2010 would also appear to be largely influenced by news of political obstructions to the Fed Chairman's renomination, as several U.S. Senators indicated they would not support Bernanke's continuation in the role during the day. The effect of this news is very evident in Intrade's prediction market for Chairman Bernanke's renomination.

Building Trouble in China: Although we've previous found an instance where trouble in China's stock markets influenced U.S. stock prices, here, we don't find the news of restrictions on China's bank lending to be a significant contributing factor influencing U.S. stock prices from 15 January 2010 through 22 January 2010.

Scanning the world's news, we see that this news from China certainly does appear to have affected stock prices in Australia, the story for which was posted by the Wall Street Journal at 6:04 AM, as this cached version of Global Fundwire's headlines indicates. With such an early headline, before the U.S. stock market opened at 9:00 AM on 21 January 2010, this news would have affected the level of stock prices at the opening. Instead, we see that U.S. stocks gapped slightly up from where they closed on Wednesday, 20 January 2010, and were largely flat until they plummeted at 10:20 AM. The news from China simply wasn't a factor in the sell-off of U.S. stocks on Thursday, 21 January 2010.

Conclusions

And there you have it! We find that the change in stock prices on Wednesday 20 January 2010 to be a delayed reaction to a small change in the fundamental driver of stock prices, which was put off from occurring sooner by the outcome of the special election for the U.S. Senate in Massachusetts, while the more dramatic plunge in stock prices on Thursday, 21 January 2010 was sparked by the reaction by investors to the unexpected news that Federal Reserve Chairman's renomination to the post was going to be delayed.

We also find that the stock market reacted efficiently to the news, with the Reuters headline providing just a two-minute warning to investors to sell stocks.

As a noise-driven event however, we believe that this drop in stock prices represents a short-term buying opportunity, as we find that all such news-driven noise events in the stock markets have expiration dates.

Update: Cool! We checked Seeking Alpha's market currents timeline for market activity on Thursday, 21 January 2010 - here's what they indicated for the plunge in stock prices:

10:32 AM Stocks have pitched lower over the past 10 minutes, with no apparent catalyst. Dow -1.1% to 10483. S&P -1% to 1127. Nasdaq -0.7% to 2274.

It looks like they were looking in the wrong place!

Update 28 January 2010: The buying opportunity existed briefly from Friday, 22 January 2010 through Tuesday, 26 January 2010 (such is the nature of noise). The market has bigger worries now that oil-producer Valero has acted to cut its dividend, while tech stocks are being hammered with Motorola's small profit on poor sales suggesting that the industry might underperform investor expectations. We'll need to see how things look after the dust clears on the dividend side to know how the fundamental driver for the market is being affected, but right now, it looks a lot like noise.

Labels: chaos, stock market

Welcome to this special Saturday, Janaury 23, 2009 edition of On the Moneyed Midways, where each week, we present the best posts we found in our review of the past week's business and money-related blog carnivals!

Welcome to this special Saturday, Janaury 23, 2009 edition of On the Moneyed Midways, where each week, we present the best posts we found in our review of the past week's business and money-related blog carnivals!

As our long-time readers know, we define the word "special" to actually mean "late!"

So let's just get right to it, shall we? The best posts of the week that was, including The Best Post of the Week, Anywhere! await you below....

| On the Moneyed Midways for January 23, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Get Control with Plan-Do-Check-Act | Eliminate the Muda | What can an innovation in industrial process quality control from the 1920s do to help you get a better handle on your debt today? The LeanLifeCoach puts the Plan-Do-Check-Act cycle to work in a personal finance setting! |

| Carnival of HR | No More Stars | Working Girl | Can a team be too dependent upon its star performers? HoneyPieHorse argues that the real problem may not be with the dependence upon the stars but rather with management. |

| Carnival of Taxes | Business Use-of-Home Expenses | Canadian Finance | Tom Drake identifies the expenses that people doing business from their homes can claim on their taxes. While his discussion focuses on Canadian tax rules, most if not all of the same considerations apply for people working from home in the U.S. |

| Carnival of Personal Finance | Your Financial Hierarchy of Needs | Balance Junkie | 2 Cents explores how to apply psychologist Abraham Maslow's "Hierarchy of Needs" to personal financial security. |

| Cavalcade of Risk | Health Insurance and Workers Comp Claim Frequency | Managed Care Matters | You might expect that people without health insurance coverage would be more likely to file workers' comp claims, since that would be a way for them to cover the costs of health care related to a workplace injury. Joe Paduda cites the findings of a study that found the opposite is true because of complicating factors in The Best Post of the Week, Anywhere! |

| Money Hacks Carnival | Roth IRA: To Convert or Not to Convert | My Wealth Builder | The Super Saver identifies three criteria to use in deciding whether to convert your Traditional IRA into a Roth IRA in 2010: Expected higher future tax rates, expected tax planning needs after Age 70 1/2 and the availability of money outside the IRA to pay the early withdrawal penalty. |

| Carnival of Money Stories | Taylor Bean & Whitaker Bankruptcy: Who Is Representing the People? | Being Frugal | Absolutely essential reading! When mortgage company Taylor Bean & Whitaker filed for bankruptcy in August 2009, it left its customers in a bad spot, since it failed to pay their property taxes from their escrow accounts. Now, their customers are exposed to having their credit status whacked because of the company's failure. As a customer, Lynnae is distressed by the lack of clarity for how the situation will be resolved. |

Previous Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Since April 2009, we've been measuring our ability to predict the future by using the plus-minus statistic from hockey and basketball, where we gain a point if we're right and lose a point if we're wrong, and score a zero for when the outcome of a prediction cannot yet be determined, or when we make multiple predictions that cancel each other out.

The cool thing about this approach is that if our predictive ability is no better than the random outcome determined by a coin toss, our plus-minus score will drift toward a value of zero over time. If we're better at making predictions than simple randomness would suggest, then our plus-minus score will grow higher in value over time. If we're wrong, then our plus-minus score will fall in value. If we're really bad, then our plus-minus score will plunge into deep negative territory!

So how did we do in the last three months since our last update?

Our plus-minus score for predictions has risen to +20! The table below details how our score rose from our previous score of +18:

| Political Calculations' Plus-Minus Score Update, 15 October 2009 | |||

|---|---|---|---|

| Date | Prediction | Outcome | +/- Score |

| 13 August 2009 | We make fun of 47 economists for predicting that the U.S. recession would end in the third quarter, based on the "Cash for Clunkers" program. We point out that the dividend futures data for the S&P 500 has been saying the recession would be over in 2009Q3 for months, long before C4C even became legislation! | Too soon to tell. This prediction looks pretty likely, but we'll have to wait for the NBER to get around to declaring the date of the end of the recession. Update: Looking more and more likely. | +0 |

| 8 September 2009 | We suggest that teen employment figures might soon begin to improve provided no further minimum wage increases are in the works. | Too soon to tell. Since the data comes out monthly, it may not be until early January (when December 2009's jobs data is released) where we'll have an answer. Update: At this writing, December 2009's jobs data indicates that teen employment figures are continuing to stabilize, or rather, have stopped their descent, which would indeed be an improvement. | +0 |

| 30 September 2009 | We come to the fork in the road for our method of forecasting the direction of the S&P 500. Option A puts the average for the index in October 2009 between 867 and 892. Option B puts the average for the index between 1089 and 1106. | Too soon to tell. Right now, it's looking like investors have chosen Option B! Update: It was indeed Option B. However, Option A was a miss, so this forked prediction nets us a big fat goose egg! | +0 |

| 8 October 2009 | We take a closer look at what we believe drove stock prices up in September 2009, finding that those forces are still at work in October. In a chart, we identify two approximate dates where the upward ride provided by our suspect source of market noise might come to an end: 15 October 2009 and 17 November 2009 (both one year after the actual indicated dates shown on the chart.) | Too soon to tell. At this writing, we would say that 17 November 2009 looks more likely, mainly because of the sustained fall-off in the year-ago 10-Year/3-Month spread in U.S. Treasuries. We'll find out within the next several days if there's anything to the large drop in the year-ago spread that we see after 15 October. Update: The market noise did indeed come to an end, as the stock prices resumed more closely following where the expected future change in the growth rate of dividends per share would place them. We also observed that stock prices began a general drop off following 15 October 2009, which lasted a month (they dipped initially on 16 October, peaked at just a point above where they were on the 15th on 17 October, then didn't revisit that level again until 16 November 2009.) We get the deuce! | +2 |

| 2 November 2009 | After reflecting upon the most dramatic confirmation yet of our model for predicting stock prices, we realized that the market was in transition regarding where investors were focusing their forward-looking attention (we weren't sure if investors were focusing on the third or fourth quarter of 2010.) So we split the difference and predicted the market would range between 936 and 1074 during the month of November. | Splitting the difference got us close to where stock prices went in November 2009, but no cigar! With an average daily closing price of 1087.66 during November 2009, the S&P 500 exceeded the upper end of our original prediction for the month by 1.3%. Fortunately for us though, we revised our original prediction for the month!... | -1 |

| 10 November 2009 | A week later, we confirm that investors shifted their focus to the fourth quarter of 2010 and adjust our prediction for the month of November accordingly - anticipating the average for the S&P 500 during the month would range between 959 and 1098. | In November 2009, the S&P 500 averaged 1087.66. Good thing we updated our outlook! | +1 |

| 1 December 2009 | We ran up to the very edge of what we can predict using our forecasting model for stock prices, as we recognized that investors were transitioning way from focusing on where the level of dividends per share would be in 2010Q4. We weren't sure if they were looking backward or forward from that point, but put forward a prediction never-the-less based upon using the data for 2010Q4, anticipating that the S&P would fall between 1032 and 1094 during December 2009. We recognized that with investors shifting their forward-looking time focus, we would likely be revising our prediction! | Good thing we revised that prediction once we figured out which point in time investors were focusing! We score this prediction as a miss, since the S&P 500 averaged 1110.38 for the month of December 2009, some 1.5% above the upper end of our forecast range. | -1 |

| 3 December 2009 | Noting that the dividend futures projected for the S&P 500 on 4 December 2009 ticked upward, and that the U.S. dollar had dipped in foreign exchanges, we anticipated that U.S. stock prices would increase on that day in a coin-toss prediction. In an update on 4 December 2009, we note that a better-than-expected jobs report would produce an short-lived, noisy, upward reaction for stock prices. | Right on both counts! As it happened, the "short-lived, noisy, upward reaction" lasted for just the morning of 4 December 2009! | +2 |

| 9 December 2009 | Seeing conflict between what dividend futures (up) and stock futures (down) were anticipating for stock prices on 9 December 2009, and recognizing that the odds really were 50-50, we bet that the dividend futures would carry the day! | Dividend futures won the kickoff and held the lead for most of the day, but ultimately, new information late in the day brought stock prices down! | -1 |

| 21 December 2009 | Using incomplete data for the month of December 2009, economy would dip in the second quarter of 2010, with a slow recovery afterward. We anticipate that meaningful growth in the number of jobs would likely begin with the third and fourth quarters of 2010. We anticipate that the NBER will declare the recession they found to have begun in December 2007 to have ended in the third quarter of 2009, but we make a case for 2010Q2 as a more realistic alternate. | Too soon to tell. It will be a while before we get a full confirmation for these predictions. On the potential plus side for us, different branches of the Federal Reserve have used their own models for predicting what the NBER will do to find that July 2009 is the month they will most likely declare to be the ending date for the recession. | +0 |

| 23 December 2009 | Again using incomplete data for the month of December 2009, we refine our prediction for December 2009 to indicate that the S&P 500 will average between 1101 and 1115, and project that January 2010 will see stock prices average between 1110 and 1123. | Stock prices averaged 1110.38 in December 2009, but clearly, when predicting where stock prices will be in the next month, we should avoid making predictions with partial-month data from the current month! This nets out as a zero for us! | +0 |

| 4 January 2010 | Using all the data through the end of December 2009, we updated our preliminary forecast for January 2010 to put the average level of the S&P 500 between 1131 and 1165. | Too soon to tell. The month's not over yet, but so far, we're on track! | +0 |

Previously on Political Calculations

- Plus-Minus for Predictions - 16 April 2009

- Our Plus-Minus Is Now Seventeen! - 16 July 2009

- Predictions Plus-Minus Update - 15 October 2009

- Predictions Plus-Minus Update - 21 January 2010

Labels: forecasting, track record

Just for fun, we took the data from the dynamic table of the individual states of the United States versus European Union nations that we posted yesterday, uploaded it to ManyEyes, then used the visualization tools at that site to create maps showing the relative size of the Gross Domestic Product per capita of each, adjusted for Purchasing Power Parity, for each region.

We next scaled the map of the E.U. to be in the same scale with respect to that measure of the map we produced for the United States, plus or minus a pixel or so, to produce the combined side-by-side map below. (And before anyone says anything, yes, it's not to geographic scale - think of it instead as being kind of a cartogram....)

All just to better visualize the relative level of living standards between individual U.S. states and E.U. nations!

Since we posted the data publicly on ManyEyes, it's available for you to create your own visualizations. If you do, please drop us a line and we'll be happy to feature your work here!

Update: 22 January 2010

Paul Kamp at dqydj.net (aka "don't quit your day job".net) adds unemployment numbers to the cross-country comparison!

|

|

Follow this link for more information.

Labels: data visualization, gdp

It's on! Again! Only now, instead of just pitting the nations of the European Union against the individual states of the United States, the ongoing battle for the title of being the world's top GDP generator per capita has erupted on a new front with two heavyweights from the econoblogosphere pitted against each other: Paul Krugman vs Mark Perry!

It's on! Again! Only now, instead of just pitting the nations of the European Union against the individual states of the United States, the ongoing battle for the title of being the world's top GDP generator per capita has erupted on a new front with two heavyweights from the econoblogosphere pitted against each other: Paul Krugman vs Mark Perry!

It seems that Krugman launched the first salvo by praising the economies of Europe:

The real lesson from Europe is actually the opposite of what conservatives claim: Europe is an economic success, and that success shows that social democracy works.

Since 1980 — when our politics took a sharp turn to the right, while Europe’s didn’t — America’s real G.D.P. has grown, on average, 3 percent per year. Meanwhile, the E.U. 15 — the bloc of 15 countries that were members of the European Union before it was enlarged to include a number of former Communist nations — has grown only 2.2 percent a year. America rules!

Or maybe not. All this really says is that we’ve had faster population growth. Since 1980, per capita real G.D.P. — which is what matters for living standards — has risen at about the same rate in America and in the E.U. 15: 1.95 percent a year here; 1.83 percent there.

[...]

The point isn’t that Europe is utopia. Like the United States, it’s having trouble grappling with the current financial crisis. Like the United States, Europe’s big nations face serious long-run fiscal issues — and like some individual U.S. states, some European countries are teetering on the edge of fiscal crisis. (Sacramento is now the Athens of America — in a bad way.) But taking the longer view, the European economy works; it grows; it’s as dynamic, all in all, as our own.

But is it really? Mark Perry takes a different view, arguing that Europe's socialist policies have noticeably depressed Europe's living standards, even in physical terms. So much so, that on Krugman's preferred measure of real per capita GDP, European nations compare only to the poorest of U.S. states.

And that's where we come in. We've updated our ranking of individual European nations with respect to individual U.S. states and constructed a dynamic table in which all the players can be ranked according to their Gross Domestic Product (GDP) adjusted for Purchasing Power Parity (PPP), population and their GDP-PPP per Capita for 2008.

We've put this data into the dynamic table you see below, which will allow you to sort the data in the table by clicking on the various column headings. Doing so will almost instantaneously sort the data in the table from low to high value or from high to low (by clicking a column heading a second time.) To restore the original order, you'll need to refresh this page in your web browser.

How do real living standards in Europe's socialist democratic economic powerhouses rank with respect to individual U.S. states? Scroll down and click the column heading for "GDP-PPP per Capita" to find out!

| U.S. States vs E.U. Nations: 2008 GDP-PPP Rankings |

|---|

| US State or EU Nation | 2008 GDP-PPP [billions USD] | 2008 Population | 2008 GDP-PPP per Capita [USD] |

|---|---|---|---|

| United States - All | 14,165.6 | 304,059,724 | 46,588.10 |

| US - Alabama | 170.0 | 4,661,900 | 36,468.82 |

| US - Alaska | 47.9 | 686,293 | 69,812.75 |

| US - Arizona | 248.9 | 6,500,180 | 38,289.40 |

| US - Arkansas | 98.3 | 2,855,390 | 34,436.98 |

| US - California | 1,846.8 | 36,756,666 | 50,242.78 |

| US - Colorado | 248.6 | 4,939,456 | 50,330.04 |

| US - Connecticut | 216.2 | 3,501,252 | 61,741.91 |

| US - Delaware | 61.8 | 873,092 | 70,814.99 |

| US - District of Columbia | 97.2 | 591,833 | 164,294.66 |

| US - Florida | 744.1 | 18,328,340 | 40,599.42 |

| US - Georgia | 397.8 | 9,685,744 | 41,066.13 |

| US - Hawaii | 63.8 | 1,288,198 | 49,563.03 |

| US - Idaho | 52.7 | 1,523,816 | 34,615.07 |

| US - Illinois | 633.7 | 12,901,563 | 49,117.85 |

| US - Indiana | 254.9 | 6,376,792 | 39,966.96 |

| US - Iowa | 135.7 | 3,002,555 | 45,195.51 |

| US - Kansas | 122.7 | 2,802,134 | 43,799.12 |

| US - Kentucky | 156.4 | 4,269,245 | 36,642.54 |

| US - Louisiana | 222.2 | 4,410,796 | 50,380.48 |

| US - Maine | 49.7 | 1,316,456 | 37,759.71 |

| US - Maryland | 273.3 | 5,633,597 | 48,518.38 |

| US - Massachusetts | 365.0 | 6,497,967 | 56,169.57 |

| US - Michigan | 382.5 | 10,003,422 | 38,241.31 |

| US - Minnesota | 262.8 | 5,220,393 | 50,350.04 |

| US - Mississippi | 91.8 | 2,938,618 | 31,233.05 |

| US - Missouri | 237.8 | 5,911,605 | 40,225.45 |

| US - Montana | 35.9 | 967,440 | 37,098.94 |

| US - Nebraska | 83.3 | 1,783,432 | 46,692.56 |

| US - Nevada | 131.2 | 2,600,167 | 50,470.99 |

| US - New Hampshire | 60.0 | 1,315,809 | 45,603.12 |

| US - New Jersey | 474.9 | 8,682,661 | 54,699.36 |

| US - New Mexico | 79.9 | 1,984,356 | 40,265.46 |

| US - New York | 1,144.5 | 19,490,297 | 58,720.55 |

| US - North Carolina | 400.2 | 9,222,414 | 43,393.41 |

| US - North Dakota | 31.2 | 641,481 | 48,649.92 |

| US - Ohio | 471.5 | 11,485,910 | 41,050.99 |

| US - Oklahoma | 146.4 | 3,642,361 | 40,206.89 |

| US - Oregon | 161.6 | 3,790,060 | 42,630.72 |

| US - Pennsylvania | 553.3 | 12,448,279 | 44,447.99 |

| US - Rhode Island | 47.4 | 1,050,788 | 45,074.74 |

| US - South Carolina | 156.4 | 4,479,800 | 34,908.70 |

| US - South Dakota | 37.0 | 804,194 | 45,957.82 |

| US - Tennessee | 252.1 | 6,214,888 | 40,568.23 |

| US - Texas | 1,223.5 | 24,326,974 | 50,294.42 |

| US - Utah | 109.8 | 2,736,424 | 40,116.96 |

| US - Vermont | 25.4 | 621,270 | 40,951.60 |

| US - Virginia | 397.0 | 7,769,089 | 51,103.16 |

| US - Washington | 322.8 | 6,549,224 | 49,284.92 |

| US - West Virginia | 61.7 | 1,814,468 | 33,978.00 |

| US - Wisconsin | 240.4 | 5,627,967 | 42,720.40 |

| US - Wyoming | 35.3 | 532,668 | 66,288.95 |

| European Union - All | 15,311.2 | 491,018,683 | 31,182.49 |

| EU - Austria | 331.2 | 8,205,533 | 40,363.01 |

| EU - Belgium | 390.2 | 10,403,951 | 37,504.98 |

| EU - Bulgaria | 94.0 | 7,262,675 | 12,940.14 |

| EU - Cyprus | 22.8 | 792,604 | 28,715.47 |

| EU - Czech Republic | 264.8 | 10,220,911 | 25,907.67 |

| EU - Denmark | 204.1 | 5,484,723 | 37,212.45 |

| EU - Estonia | 28.0 | 1,307,605 | 21,436.14 |

| EU - Finland | 194.0 | 5,244,749 | 36,989.38 |

| EU - France | 2,133.0 | 64,057,792 | 33,298.06 |

| EU - Germany | 2,925.0 | 82,369,552 | 35,510.69 |

| EU - Greece | 343.8 | 10,722,816 | 32,062.47 |

| EU - Hungary | 196.7 | 9,930,915 | 19,806.84 |

| EU - Ireland | 189.0 | 4,156,119 | 45,475.12 |

| EU - Italy | 1,827.0 | 58,145,320 | 31,421.27 |

| EU - Latvia | 39.0 | 2,245,423 | 17,346.40 |

| EU - Lithuania | 63.4 | 3,565,205 | 17,774.57 |

| EU - Luxembourg | 39.5 | 486,006 | 81,212.99 |

| EU - Malta | 9.9 | 403,532 | 24,615.15 |

| EU - Netherlands | 673.5 | 16,645,313 | 40,461.84 |

| EU - Poland | 670.7 | 38,500,696 | 17,420.46 |

| EU - Portugal | 237.3 | 10,676,910 | 22,225.53 |

| EU - Romania | 272.0 | 22,246,862 | 12,226.44 |

| EU - Slovakia | 119.8 | 5,455,407 | 21,959.86 |

| EU - Slovenia | 59.5 | 2,007,711 | 29,630.76 |

| EU - Spain | 1,402.0 | 40,491,052 | 34,624.93 |

| EU - Sweden | 345.1 | 9,045,389 | 38,152.04 |

| EU - United Kingdom | 2,236.0 | 60,943,912 | 36,689.47 |

Sources and Acknowledgements:

- 2008 US State GDP Data: Bureau of Economic Analysis, U.S. Department of Commerce, All Industry Total

- 2008 US State Population Estimates (July 1, 2008): US Census [Excel spreadsheet]

- 2008 EU Nation GDP-PPP Data: The World Factbook, 2008

- 2008 EU Nation Population Estimates (July 1, 2008): The World Factbook, 2008

- Dynamic Table Sorting Function: The Daily Kryogenix.

The GDP and population data for the United States as a whole, as well as for the European Union as a whole, was obtained by adding up the state and national values we found for each. GDP-PPP per capita was found by dividing each region's 2007 GDP figure by its population estimate as of July 1, 2007.

Previously on Political Calculations

2007 Economic and Population Data

2006 Economic and Population Data

- 2006 GDP-PPP EU vs US Smackdown!

- Africa GDP Rankings for 2006

- Asia GDP Rankings for 2006

- 2006 GDP Rankings for the Americas

- 2006 GDP Rankings for Europe

2004 Economic and Population Data

- Pacific Rim: 2004 GDP Rankings

- GDP Rankings in Muslim Nations

- 2004 GDP Rankings for Asia

- European Union 2004 GDP Rankings

- GDP in Africa: 2004

- GDP Rankings of the Americas: 2004 Edition

- EU vs US: Two Years of Economic Data Later....

2002 Economic and Population Data

- EU vs USA

- Cool Tools and GSP

- GDP of the Americas

- GDP in the Muslim World

- GDP in Europe

- GDP: Africa

- GDP Along the Pacific Rim

- GDP in Asia

- GDP: And the rest...

Labels: gdp

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.