Just because we can, we thought it might be fun to take a look at how much finished oil products are supplied to people in the United States every day. The following chart shows what we found when we took the U.S. Energy Information Agency's figures for the average number of thousands of barrels of Finished Petroleum Products Supplied to the U.S. per day, converted those figures to the equivalent number of U.S. gallons, then divided that result by the number of people within the United States, as measured by the U.S. Census' Resident Population Estimate for each month from January 1982 through March 2008 (we found that data in two places - here it is for between April 1980 through November 2000, and for April 2000 through the present):

Finished petroleum products include things like gasoline, heating oil, plastics, etc. Basically everything that can be made from a barrel of crude oil.

We can easily see that the amount of finished petroleum products has held fairly constant over the past 26 years, with people within the United States consuming an average of 2.58 gallons per day, plus or minus 0.13 gallons per day (as mapped out by the high and low extremes of the trailing 12-month moving average).

In simpler words, we confirm that individual Americans are not consuming an ever-increasing amount of oil. We can therefore eliminate increased U.S. consumption of petroleum-based products as a significant contributor to the recent spike in the world price of oil, which has increased from $52.11 per barrel to $102.03 per barrel in the time from February 2, 2007 through March 2008, the last month covered in the currently available data for average daily oil consumption. As we see in the chart above, the amount of finished petroleum products consumed by U.S. residents started at 2.572 gallons per day in February 2007 and peaked at 2.661 gallons per day in August 2007 before plunging to 2.443 gallons per day in March 2008.

There are people who may want to blame the current world price of oil on the collective buying habits and lifestyles of American consumers, but this is one dog that just won't hunt! You can safely rest assured that anyone who does so is just looking for an excuse to screw the American consumer over for their own personal benefit.

Labels: data visualization, gas consumption

Welcome to the Saturday, June 28, 2008 edition of On the Moneyed Midways, the only place on the web where you'll find the best posts from the best of the past week's business and money-related blog carnivals!

Welcome to the Saturday, June 28, 2008 edition of On the Moneyed Midways, the only place on the web where you'll find the best posts from the best of the past week's business and money-related blog carnivals!

Every now and again, we come across a blog post in our other reading that, if contributed to a blog carnival, would easily rank as being among being the best of the week, if not the The Best Post of the Week, Anywhere!. This week, we'll nominate Stumbling and Mumbling's Chris Dillow's post Hiding Bad Hiring Decisions as fitting that category.

It's a marvelous piece of subversive writing, aimed at a well known political figure, that outlines the options for gaming the system that are open to incompetent individuals who know they are out of their element, so they might keep collecting a paycheck or enjoy the benefits of their position for as long as possible before they're either found out or forced out.

It's an absolutely brilliant post that naturally sparks new questions. If you were that individual's manager or co-worker, how would you deal with them? Better still, if you could vote against them (as in the case of a political figure), when would you recognize their deficiencies and do so?

Meanwhile, the post we found in the world of business and money-related blog carnivals and identified as being The Best Post of the Week, Anywhere! is very worthy of that title, offering a unique and highly personal look at the circumstances that led someone who knows better into a potentially worse situation.

That post, and the rest of the best of the week that was, await you below!

| On the Moneyed Midways for June 28, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Careers | Managers Build Trust and Respect by Letting Go | Andrew Rondeau | Andrew Rondeau suggests that for the big boss, the path to building trust within an organization will not be found in having frequent meetings with subordinates. |

| Carnival of Debt Reduction | Payroll Advance: Hitting Rock Bottom | too smart to live like this | Squawkfox selected Too Smart's post as being one of the best of the week, and we fully agree. What circumstances can lead an otherwise rational person to write a payroll advance check that comes with an interest rate of 400% APR? The Best Post of the Week, Anywhere! |

| Carnival of HR | Talent Glocalisation | HR Bytes | Amit Avashthi reflects on a McKinsey study that reveals that the biggest problem that multi-national corporations have is moving employees across global geographies, which has in turn, driven them to seek top local talent to staff their firms where they seek to operate: Glocalization! (as we would spell it in the U.S.!) |

| Carnival of Personal Finance | Monopoly Game Expansion #1: Personal Savings Account | Our Fourpence Worth | Penolope Pince addresses one of the great board game Monopoly's greatest deficiencies - the lack of a personal savings account to put the money you have to work for you as you circle the board! |

| Carnival of Real Estate | Simple Foreclosure Solutions | Everything Finance | Everything Finance identifies the two most useful things that you can do to get out from under having your home go into foreclosure: talk to your lender, or sell. |

| Festival of Frugality | Secret Food Increase | LivingAlmostLarge | Food producers and restaurants are dealing with higher operating and food costs by reducing the size of packaging and portions, but not prices - in effect, a "secret" increase in the price of food that you buy! |

| Money Hacks Carnival | Avoid Baggage Fees: How to Pack a Suitcase | Sound Money Matters | Several troubled airlines are now charging passengers for each bag they check. Aryn provides invaluable how-to advice for packing your bags to minimize your costs! Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

That we'll have a late "special" Saturday edition of On the Moneyed Midways this week. In the meantime, the dog's going fishing in South Carolina, while I've got other fish to fry!...

Labels: none really

Craig Newmark posted the words a little over a year ago, but here's Danny Devito's speech from Other People's Money, via YouTube:

Inspired by BusinessPundit's list of the top 50 business movies, which entirely missed this gem!

Labels: business, investing, none really

When we last looked at the present odds of the U.S. being in recession, we found that the likelihood of a recession was beginning to wane. Two weeks later, the odds as determined one year ago using a method developed by Jonathan Wright that the U.S. would be in recession right now has plunged below 40%, after previously peaking at 50% back on 4 April 2008:

More about Wright's Model B method for determining the probability of recession one year into the future here.

Betting prediction market Intrade's 2008 recession contract is available here.

Labels: recession forecast

We're stealing part of our post title from Jim Hamilton, as he unofficially commissioned this tool in the comments section of his blog post!

We're stealing part of our post title from Jim Hamilton, as he unofficially commissioned this tool in the comments section of his blog post!

In his post, Jim ran very convincing numbers that fly in the face of what Tim "Drive Less" Haab might prefer as a course of action and in doing so, provided a workable solution for those for whom less driving may not be a viable option.

Drawing on a 1998 study by the U.S. Department of Energy, Jim recognized that most gasoline-powered vehicles in the U.S. are operated at speeds at which they do achieve their peak level of fuel efficiency. At highway speeds, for instance, the forces of aerodynamic drag can substantially increase the amount of fuel an automobile engine has to burn in order to sustain a high velocity. A quick back-of-the-envelope calculation reveals that the amount of drag force that a car being driven at 75 miles per hour sees is some 33% higher than the same car being driven at 65 miles per hour would see.

Meanwhile, as Jim notes, your car will burn more fuel at slower speeds compared to higher speeds, as automakers have optimized your car's engine to operate most efficiently at higher speeds.

Somewhere in between lies a sweet spot into which you can get the most distance driving out for your fuel consumption dollar. And you can do so all without having to spend any extra out-of-pocket money. As an added bonus, if you do it right, you would even come out ahead of where you do today!

Somewhere in between lies a sweet spot into which you can get the most distance driving out for your fuel consumption dollar. And you can do so all without having to spend any extra out-of-pocket money. As an added bonus, if you do it right, you would even come out ahead of where you do today!

And that's where the tool we're introducing today comes in! We've reverse-engineered the Fuel Economy vs Speed average vehicle profile developed by the U.S. Department of Energy and combined it with Jim's math to demonstrate how you can either positively or negatively affect your pocketbook by driving either faster or slower than you do today.

Just enter your driving data into the tool below. We'll assume that your standard (non-hybrid) automobile shares the same fuel economy vs speed profile as the DOE's average vehicle, and then show how driving at a different speed than you do today for a given trip might affect your personal finances:

The cool thing about this tool is that you now have more weapons in your arsenal to help fend off the effects of higher gasoline prices! Armed with this information, you can now make whatever trade-offs you might need to your greatest advantage. For example, if getting the greatest possible savings is most important to you, you'll want to drive at speeds that produce the lowest equivalent cost per gallon of gas compared to your normal driving speeds. If you want to save gas money and time, you'll want to drive at speeds that give you the greatest equivalent "tax free" income compared to how you drive today.

Speaking of which, if you want to find out what fuel saving tips really work, Edmunds.com has done a number of real world tests to find out. Here's the short list of what really works, with our brief comments:

- Stop driving like a maniac. Moderate driving is better than aggressive (fast accelerating, brake slamming) driving. Update: Aaron notes in the comments at Jim Hamilton's original post that brisk acceleration, as perhaps opposed to "aggressive" acceleration is desirable from a fuel economy perspective.

- Lower speeds save gas. Not necessarily. The real secret is to drive consistently at speeds that enhance your vehicle's fuel efficiency, compared to either driving much faster or slower, which is the whole point being made by our tool above!

- Use cruise control. You just can't adjust your speed as often or as efficiently as your car's computer can!

- Don't idle your car for more than a minute. Going nowhere burns a lot of gas....

And here's what doesn't work:

- Turning your car's air conditioning off and opening windows. People who suggest this option in the summer are not your real friends. They really just want to see you suffer.

- Inflating tire pressure to maximum recommended levels. This is supposed to reduce your car's rolling friction. In reality, where fuel efficiency is concerned, your car just doesn't notice it that much.

And that concludes our contribution to Jim's public service announcement. And Art Carden's. And Bryan Caplan's. Etc....

Update 9 July 2008: Added a new results field to provide our approximation of your vehicle's mileage for driving at the alternate speed you entered!

Labels: economics, gas consumption, personal finance, tool

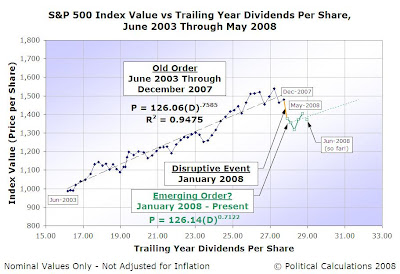

What if we treated the relationship that we've uncovered between stock market prices and dividends as if it were determined by a normal distribution? Could generating something like a control chart based our model of that relationship tell us something about the stock market?

What if we treated the relationship that we've uncovered between stock market prices and dividends as if it were determined by a normal distribution? Could generating something like a control chart based our model of that relationship tell us something about the stock market?

Those are the questions we began asking after we unable to rule out the possibility of a normal distribution defining periods in which a stable order exists between stock prices and dividends after using a number of statistical normality tests. Having explored how to recognize disorder and later how to recognize the emergence of order when it appears in the stock market, we described stock price changes as seeming to be "the result of normal variation until they're not."

Let's Do Something Wrong!

Confusing? You bet! That's why we've decided to deliberately do something wrong in our analysis. We already know with some certainty the variation we observe between the index value of the S&P 500 and the index' dividends per share stock market is really driven by a kind of power law distribution - the equation we've developed describing the relationship between the two makes that clear. So why would we knowingly do something that's perhaps inappropriate?

Confusing? You bet! That's why we've decided to deliberately do something wrong in our analysis. We already know with some certainty the variation we observe between the index value of the S&P 500 and the index' dividends per share stock market is really driven by a kind of power law distribution - the equation we've developed describing the relationship between the two makes that clear. So why would we knowingly do something that's perhaps inappropriate?

In deliberately doing something we know is wrong, we're going to apply the immortal words of George Box, "all models are wrong, but some are useful." In this case, we're going to specifically explore whether using the well-defined techniques of common statistical analysis can help us identify when order exists in the stock market and when order breaks down. Why not exploit our inability to completely rule out the existence of a normal distribution defining the variation of stock prices vs dividends per share during periods of relative stability to our advantage?

Since we've already charted the most recent multi-year period of order in the stock market, beginning in June 2003 and continuing through December 2007, we chose this period as the ideal place to begin. The following chart shows what happened when we found the standard deviation between the average of the S&P 500's daily closing value for each month in this period and plotted it versus the index' corresponding trailing year dividends per share, using it to define control chart type features:

The period extending from June 2003 through December 2007 contains some 55 individual data points. Of these, some 40 fall within the plus-and-minus one standard deviation, or 73%. For a normal distribution, we would expect 68% of the individual data points to fall within this range, so the incorrect assumption of a normal distribution for our purposes may not be that bad. All of the remaining points, until this period of order ended in January 2008, fall within the plus-and-minus three standard deviation "control limits," which compares to 99.7% for a true normal distribution. Again, this is pretty consistent with what we could reasonably expect with our deliberately wrong assumption.

Wrong, But Useful

We also notice something interesting, which hints at why using a normal distribution to analyze the variability of stock prices with respect to dividends per share may be useful. Toward the end of the period of stability covered by this data, we notice a number of downward shifts in stock prices that are not consistent with previous variation. Roughly at a trailing year dividend per share value of $26.50, we see a greater than two-standard deviation shift downward in the average monthly value of stock prices in going from July 2007 to August 2007.

Stock prices rebounded, but we see another similar two-standard deviation shift again between October 2007 and November 2007. We finally see a slightly bigger shift coinciding with the downward plunge that occurred from December 2007 to January 2008.

It occurs to us that this two-standard-deviation downward shift may be a useful indicator for anticipating when order may be beginning to break down in the stock market.

Where We're Going From Here

We're going to back in time to find out if that hypothesis holds water. Over the weeks ahead, we'll progressively go back and identify previous states of order that have existed in the stock market that are defined by our derived relationship to see if similar "signals" were sent prior to their breaking down.

But for our next post on the topic, we'll close the books on June 2008 and review apparent order that may have taken hold since the disruptive events of January 2008. With corporate earnings expected to rise in the third quarter, we'll see if June 2008 represents the last of the fallout among the S&P 500's financials, and what we might reasonably be able to expect for the rest of the year if the current state of order continues.

Labels: data visualization, dividends, SP 500, stock market

Are you one of those people who feel their blood pressure rising every time you drive past a gas station and see that the price of a gallon of gas is higher than the last time you filled your tank? Would you like to go tell the so-far ignored by the news media Env-Econ's Tim Haab what he can do with those prices that are compelling you to do whatever he subliminally suggests as if you have no free will?

Are you one of those people who feel their blood pressure rising every time you drive past a gas station and see that the price of a gallon of gas is higher than the last time you filled your tank? Would you like to go tell the so-far ignored by the news media Env-Econ's Tim Haab what he can do with those prices that are compelling you to do whatever he subliminally suggests as if you have no free will?

If either of those things describe you, it's time to take a deep breath and put some things in perspective.

Let's recall, for instance, that the price of a gallon of gas has increased fairly consistently between 2002 and 2008. And as recently as a year ago, with prices about one dollar less per gallon than they are today, most people really weren't all that worked up about the price of gas. It really has only been between 2007 and 2008 that the change in the price of gas has become a truly hot topic, as the approximately $1 per gallon increase over this time has gotten consumers especially excited.

Brian Chin, for one, says that people are getting way too worked up about gas prices:

With crude oil hovering at $130 a barrel, almost every personal finance article I’ve read has been about how you can conserve gas usage or save money on gas prices. Granted, it’s fun to jump on the bandwagon with whatever todays "hot topics" are. But when you really break down your gas spending each month, it's not really as big of a deal as everyone is making it out to be.

Or is it? If you haven't yet done the math for yourself, you really have no business getting all worked up into a frothing lather now, do you?

And that's where we come in! After we're done with you, you can walk away from your Internet access point secure in the knowledge that you're either completely justified in your foaming-at-the-mouth rants against all things oil-related or that you maybe ought to put a sock in it. It really doesn't matter to us which because we'll be entertained either way.

So, let's get right to it! We'll just need to get some information about your driving habits first, then we'll work out how much of your money is really at stake for you, at least as compared to a year ago....

In the tool above, you can quickly get the price change in pennies per gallon from a year ago from the Energy Information Administration's Gasoline and Diesel Fuel Update for either your region or the U.S. as a whole. If you're not sure of your vehicle's average mileage, the government's Fuel Economy web site can provide average Miles-per-Gallon Estimates shared by those who drive the same make and model vehicle as you.

For the default numbers, we took the year-over-year change in the price of gasoline in the U.S. as of 16 June 2006 and Brian Chin's 2005 Acura RSX, for which we assume he falls into the middle of the shared average MPG estimates with 25 MPG. We'll also assume that he drives some 12,000 miles per year (or 1000 miles per month).

Using these values in our tool above, we find that today's higher gas prices divert nearly $1.41 per day, $10 a week, $43 a month, or $515 a year from where Brian might otherwise choose to spend it. Good thing he has a plan to free up the money from other places in his expenses:

Some easier ways to save $43 a month:

- Stop eating out so much. Cook at home instead (it's probably healthier too)

- Buy in bulk. There are certain items you KNOW you’re going to need in the future (toilet paper, shampoo etc). Why not save money by buying in bulk (And save an extra trip to the store while you're at it).

- Stop impulse buying. I guarantee for most of us, impulse buys amount to way more than $43 a month.

Our point, and we do have one, is that if the dollar amount change in what you pay for gas from last year to this year is what you're really upset about, you have a lot of different ways in which you can adjust other factors you can control without seriously denting your lifestyle. Like Brian, you too can get savings from other places to offset higher gas prices, so they don't have any more effect over you today than they did a year ago.

Then again, you could be like the millions of Americans who are doing exactly what Tim Haab is telling them to do without realizing it and "Drive Less!" You can just hear the evil laughter from here....

Update: Tim provides another example of his power.... Meanwhile, his co-blogger John Whitehead puts things in a longer term perspective, comparing today's hotheads to 1979's!

Labels: gas consumption, personal finance, tool

Welcome to the Friday, June 20, 2008 edition of On the Moneyed Midways! Each week, we find the best posts from the best of the past week's business and money-related blog carnivals and link them all in one place for your weekend edutainment!

Welcome to the Friday, June 20, 2008 edition of On the Moneyed Midways! Each week, we find the best posts from the best of the past week's business and money-related blog carnivals and link them all in one place for your weekend edutainment!

We're please to welcome a new business-related blog carnival this week: The Carnival of Careers! We've just found it in its third edition and if the quality of the carnival is any indication, we'll be featuring it often in the months ahead.

In news beyond the new addition to our weekly wrap-up of the best of the best, we're also pretty pleased that this was very much an above average week for the business end of the blogosphere.

To see why, just keep scrolling down!...

| On the Moneyed Midways for June 20, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How to Handle Late Credit Card Payments | Cash Money Life | What do you do when you don't have enough money to make the minimum payment on your credit card balance? Cash Money Life lays out the options that you've already waited too long to get started doing… |

| Carnival of Careers | The Job Interview: To Shave Or Not To Shave? (That Is The Question) | I Am Sheamus | Sheamus is writing just six days before going into a job interview, where either having a beard may cost him the job or the possibility of the job will cost him his beard! |

| Carnival of Personal Finance | Become Rich By Helping Others | Transcendental Success | Alex keys in on the real secret to becoming wealthy: To become rich, you have to help make other people better off! |

| Carnival of Real Estate | You Don’t Write, You Don’t Call. Toronto Real Estate Market Checks Its Messages | Living in the Neighbourhood | Lauren Mitchell writes up a real estate market report for Toronto, Ontario. Looks like the deteriorating Canadian market Brian Brady wrote about last week is beginning to get some traction. |

| Carnival of Money Stories | From a Sale to An Experience | Internet Business Coaching by Terry Dean | Terry Dean makes a compelling case for how Disney or a children's dentist can set themselves apart by focusing on providing an outstanding customer experience. The Best Post of the Week, Anywhere! |

| Cavalcade of Risk | Accident By Construction - Why Technology and Regulations Increase Risk | Early Retirement Extreme | Jacob argues that increasing the number of rules or reliance on technological control systems can actually make people less safe than they were without them. Absolutely essential reading, which earns bonus points for the video linked in an older post! |

| Festival of Frugality | How I Lived in Million Dollar Homes for Free | SavingAdvice | S. Shugars has lived in several million dollar homes without paying a dime in rent or mortgage payments to do so, and he did it for nearly nine years so he's not one of those housing bust foreclosure squatters! Follow the link to find out how… |

| Money Hacks Carnival | Why Gas Price Increases Aren’t Really Affecting Your Finances | beechin | Absolutely essential reading! Brian Chin did the math and realized that the difference between tanking up his 2005 Acura RSX four times a month at $2.90 per gallon a year versus $3.80 per gallon today comes to $43 a month. Better yet, he finds where he can scrounge $43 a month without really even straining! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We only hinted at it previously, as we were focused more on the health of the U.S. economy, but as Jim Hamilton notes this morning, and Calculated Risk noted several days ago, China's economy is indeed slowing down.

What's more, as measured by international trade between the U.S. and China, China's economy has been decelerating since peaking in January 2006. Here's the evidence, shown as the blue curve representing U.S. exports to China:

One of the more interesting discoveries that we've stumbled into is that the growth rate of trade between countries can provide an indication of its overall economic health. In our working hypothesis, once trade between nations is well established, should the annualized growth rate of a what a nation imports into its domestic economy drop to zero or become negative for an extended period of time, the likely cause of that result is that the nation is experiencing a significant economic slowdown.

According to our hypothesis, as the economy slows, the rate of growth of imports should also slow as people tighten their belts and spend less of their disposable income on consumer goods while domestic manufacturers also reduce their consumption of imported unfinished goods, to coincide with their lower rate of economic production.

As we see in our chart above, the compound annual growth rate at which China has been importing goods and services from the United States has been slowing since peaking in January 2006. We also see that the rate of decline is becoming more steep as time passes.

This steepening decline correlates well with the increase in transportation and shipping costs as international trade becomes more expensive with higher oil prices. Meanwhile, we do see that China's stock market would seem to be anticipating much less growth:

We'd really like to weigh in on whether China's Shanghai Composite stock index is going through the burst of a bubble, but at this writing, we lack the necessary historic dividend data to accurately make that determination.

Update: After being shielded from world market prices for years, the spike in gas prices is about to hit the Chinese consumer. It would seem the Chinese economy is about to slow down much faster. (HT: King Banaian)!

Labels: recession forecast, stock market, trade

Via The Door this morning comes this commentary on mandatory liberal arts requirements from the Adjunct Professor of English "X" (emphasis ours):

My students take English 101 and English 102 not because they want to but because they must. Both colleges I teach at require that all students, no matter what their majors or career objectives, pass these two courses. For many of my students, this is difficult. Some of the young guys, the police-officers-to-be, have wonderfully open faces across which play their every passing emotion, and when we start reading “Araby” or “Barn Burning,” their boredom quickly becomes apparent. They fidget; they prop their heads on their arms; they yawn and sometimes appear to grimace in pain, as though they had been tasered. Their eyes implore: How could you do this to me?

The reason many colleges mandate that students take courses such as these that offer very limited, if any, utility to the academic path chosen by the students is because if they didn't, the academic disciplines in question would not be able to support themselves. Only by subsidizing these academic departments by requiring that all students at a university take them can they justify continuing the level of funding needed to provide the payroll for these departments at the levels they do.

The reason many colleges mandate that students take courses such as these that offer very limited, if any, utility to the academic path chosen by the students is because if they didn't, the academic disciplines in question would not be able to support themselves. Only by subsidizing these academic departments by requiring that all students at a university take them can they justify continuing the level of funding needed to provide the payroll for these departments at the levels they do.

One way to measure the value of a given academic discipline is to examine the starting salaries of those who graduate with degrees in given fields, which we recently did for the graduating class of 2008. Here, we can see that the so-called liberal arts disciplines would appear to be less valued by employers than more practical or productive fields.

As a side note, we do recognize Daniel Hamermesh's findings that a good portion of the discrepancy between the starting salaries of various academic disciplines may be due to certain fields drawing students with higher demonstrated levels of academic performance, as may be indicated by higher SAT scores when entering college, and also that many of these higher paying fields require greater levels of work from those entering them, in the form of longer hours and greater productivity, than those that typically correspond to the liberal arts. In short, starting salaries tend to be proportional to a student's innate abilities and willingness to execute and perform at the levels demanded by their employers, in addition to the value employers or society places upon the academic discipline itself.

So if we want to find out how valuable a particular discipline is with respect to another, we need to look beyond starting salaries. And one way we might be able to do that is to see to what extent those majoring in one academic discipline are mandated to take classes in other academic disciplines. Using this approach, we can see how university administrators themselves value the various academic disciplines.

For example, if an Engineering major is required to take two English classes, but an English major is not required to take any Engineering classes, we can verify that the engineering student is being effectively required to subsidize the operation of the university's English department. The more one-way the mandated class requirements are for outside-of-major courses, the less valuable the particular field is, otherwise campus administrators would not need to effectively subsidize it so heavily to support its continued operation.

Since Craig Newmark led off his post with a humorous complaint written to Arizona State University President Michael Crow, we thought we'd take a look at the undergraduate outside of major course requirements for students in ASU's Engineering department, since Engineering majors often rank at the top for real-world starting salaries for college graduates. The table below presents the out-of-major class requirements we identified for ASU's general Civil Engineering program and ASU's English degree. To be included in this table, the out-of-major classes could not be a prerequisite for an in-major class. Some may overlap with in-major elective offerings.

| Out-of-Major Course Requirements | ||

|---|---|---|

| Category | Civil Engineering (Credits) | English (Credits) |

| Basic (Lab) Science | 3 Recommended options applicable to Civil Engineering, but not mandated. |

3 |

| "Cultural Diversity" Awareness | 3 | 3 May be satisfied by overlap with In-Major electives. |

| Computing/Statistics | In-Major | 3 |

| English | 6 | In-Major |

| "Global" Awareness | 3 May be satisfied by overlap with Humanities requirements. |

3 May be satisfied by overlap with Second Language requirements. |

| "Historical" Awareness | 3 May be satisfied by overlap with In-Major elective. |

3 May be satisfied by overlap with In-Major electives. |

| Humanities | 6 | 6 May be satisfied by overlap with In-Major electives. |

| Mathematics | In-Major | 3 |

| Second Language | None | 9 |

| Social Behavorial Sciences | 6 Economics (3) is required. |

6 |

| Total Out-of-Major Credits Required (Adjusted for Elective Requirement Overlaps) | 24 | 27 |

If we exclude the second language requirement for ASU's English majors, which does not apply for ASU's engineering students, we find that ASU's Engineering majors are required to earn far more credits outside their discipline than are English majors, at 24 credits as opposed to 18. This difference demonstrates that English majors do not have to go as far outside their discipline to fully satisfy their academic program's degree requirements.

Altogether, these requirements would suggest that ASU's academic administrators rank the school's Engineering programs above its English program, with little requirement to subsidize the engineering programs by compelling students outside the discipline to take classes within it.

Going back to the second language requirement for English majors, we do find that, in effect, English majors have to "pad out" their schedules to support/subsidize the school's second language programs, with nearly the equivalent of an extra semester of work. Meanwhile, the school's "Awareness" requirements for both Engineering and English degrees (spanning course topics involving Global, Historical, or Cultural Diversity "awareness") would seem to be a strong indication that without such mandates from the school's administration, students would not pursue classes focusing on these areas, recognizing they possess little real benefit for progressing toward their academic goals.

The university could, we suppose, discontinue its efforts to offer such lowly-valued degree programs, eliminating the need to subsidize these academic departments through forcing students outside these disciplines to take classes within them. For many university administrators however, this would mean acknowledging that their vision of being a "world-class" institution is flawed, which we suspect makes this otherwise reasonable and realistic step unlikely to occur. Never mind that sustaining such programs does at least as much damage, if not more damage, to their institution's "world-class" aspirations.

Labels: education

Will Franklin finds the political climate being faced by the Republican Party this year to be, in a word, terrible.

Will Franklin finds the political climate being faced by the Republican Party this year to be, in a word, terrible.

But how bad is it really? To quantify the odds, Will turned to the Electoral Barometer, which was recently featured in an article by Alan Abromowitz at Larry Sabato's Crystal Ball '08.

The Electoral Barometer is a mathematical formula that features the things we need to stand back and objectively account for two key factors when looking at the U.S. presidential campaign: the popularity of the incumbent, as measured by their Net Approval Rating (the spread between the President's favorable and unfavorable job approval rating) and the strength of the economy, as measured by the annualized real (inflation-adjusted) growth rate of GDP.

If you know us, you know where this is going! All you need is to enter the appropriate data into the tool below - we'll do the math so you can see how likely the likelihood of either the candidate of the current incumbent presidential party or the candidate of the challenging political party will go on to the White House:

The default data in the tool is current as of 17 June 2008. As such, the GDP data is that for the most current revision of the first quarter of 2008.

In the results above, a negative result indicates that the political climate favors the candidate of the opposing political party, rather than the the candidate hailing from the same political party as the current President. Likewise, a positive result suggests that the incumbent President's political party is favored to win the Presidency in the November elections.

Now, here's the thing. The data that drives this math changes frequently, so you'll definitely want to check back often as the political weather changes!

Labels: election, politics, tool

In our post, Your Congressional ROI, we built a tool to find what return on investment (ROI) that a corrupt rent seeker might gain by throwing some money into a politician's coffers in return for earmarking some pork barrel spending their way. Today, we're considering the other side of that transaction: the "dividend yield" collected by an elected official in return for "investing" in the spending directed to the rent seeker, for whose benefit they've used their authority to exempt such spending from the oversight of their Congressional peers.

In our post, Your Congressional ROI, we built a tool to find what return on investment (ROI) that a corrupt rent seeker might gain by throwing some money into a politician's coffers in return for earmarking some pork barrel spending their way. Today, we're considering the other side of that transaction: the "dividend yield" collected by an elected official in return for "investing" in the spending directed to the rent seeker, for whose benefit they've used their authority to exempt such spending from the oversight of their Congressional peers.

Today's real life example comes to us from the Contra Costa Times' Lisa P. White, who uncovered how California Democratic Party Rep. George Miller delivers millions for campaign contributor. The data we'll be presenting below is taken from figures given in the article.

First, here's a table listing campaign contributions, or in our terminology, "dividend payments," received by U.S. Representative George Miller's (D-CA) political action committee (PAC) and personal election campaign by individuals closely associated with the leadership of defense contractor SecuriMetrics from 2004 through 2007, as well as the amounts of federal contracts that Miller earmarked for SecuriMetrics during that period:

| Campaign Contributions to Funds Benefitting Rep. George Miller (D-CA) | |||

|---|---|---|---|

| Year | Contributions to Miller's PAC |

Contributions to Miller's Election Campaign |

Total Contributions for Miller |

| 2004 | $ 5,000 | - | $ 5,000 |

| 2005 | $ 5,000 | $ 790 | $ 5,790 |

| 2006 | $ 5,000 | $ 790 | $ 5,790 |

| 2007 | - | $ 790 | $ 790 |

| Totals | $ 15,000 | $ 2,370 | $ 17,370 |

SecuriMetrics was acquired by Connecticut-based L-1 Identity Solutions in 2006. In 2007, the now current CEO donated a total of $300 to Miller's Congressional election campaign after taking the top position at SecuriMetrics, which we're omitting from these totals.

Since military spending is budgeted once every two years, we'll next allocate these contributions with the spending earmarks Rep. George Miller (D-CA) inserted into the defense appropriations bills for 2006 and 2008. In allocating these amounts, we'll assume that the contributions made in 2004 and 2005 went toward the 2006 Defense appropriations bill, while the 2006 and 2007 contributions went toward the 2008 Defense appropriations bill. And then, we'll find the corresponding "dividend yields" for each earmark (campaign contributions divided by the earmarked amount, expressed as a percentage)!

| Total Contributions, Earmark Amount and Dividend Yield for Rep. George Miller (D-CA) | |||

|---|---|---|---|

| Defense Appropriation Bill | Total Contributions for Miller |

Earmark for Campaign Contributor |

"Dividend Yield" |

| 2006 | $ 10,790 | $ 3,000,000 | 0.36% |

| 2008 | $ 6,580 | $ 1,600,000 | 0.41% |

| Combined | $ 17,370 | $ 4,600,000 | 0.38% |

While some might argue that these "dividend yields" are embarrassingly low, when you consider that Rep. George Miller (D-CA) didn't risk any of his own money by investing in the company, but rather he "invested" taxpayer money instead (aka "someone else's money"), the rate of return is outstanding! The real question though is whether Miller's "dividend yield" is sufficiently low enough that other government officials might choose to ignore the apparent benefit he received for the sake of saving the cost of pursuing a serious investigation.

Then again, it may be a "low margin, high volume" type business, with "low" profit margins being made up for by processing lots of transactions. With earmarking pork to the nation's rent seekers being such a competitive business, that's the only way an individual politician might be able to keep up with other elected officials, or their staffers out there doing the similar things in the government pork barrel spending market!

And why wouldn't they? As we've just shown, earmarking taxpayer money to pork barrel spending pays politicians dividends! In any case, even though it's almost redundant given how simple the math is, here's a tool you can use to calculate what kind of dividend yield your elected official may be collecting for their own coffers:

Here's the amount of pork earmarked by each individual member of Congress, and here's OpenSecrets.org's site, which maintains a database of campaign contributions to help get you started....

Update: Corrected link for Contra Costa Times' article.

Welcome to the Saturday, June 14, 2008 edition of On the Moneyed Midways, the only place on the web where you'll find the best posts from the best of the past week's business and money-related blog carnivals!

Welcome to the Saturday, June 14, 2008 edition of On the Moneyed Midways, the only place on the web where you'll find the best posts from the best of the past week's business and money-related blog carnivals!

Lots of news this week in the world of the blog carnivals we regularly cover. First, the good news: the Carnival of Fraud has reappeared after a long absence, and it's become likely that the Carnival of the Capitalists may soon have a new edition after a long hiatus.

The bad news is that The Boring Made Dull's Economics and Social Policy blog carnival appears to have officially died this past week. Meanwhile, our favorite real estate related blog carnival, Bloodhoundblog's Odysseus Medal, continues on its hiatus, as several major events have kept Greg Swann & company exceptionally busy (we understand that hosting and liveblogging a national conference can do that!)

If we were to pick a recent Bloodhoundblog post as an Odysseus Medal winner ourselves, though, Brian Brady's view that the Canadian real estate market in the western provinces has entered the danger zone, which he argues bodes well for the investing climate in the U.S., would be our pick.

For the rest of our picks from the active members of the world of business and money-related blog carnivals, keep scrolling down....

| On the Moneyed Midways for June 14, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How to Get Out of Credit Card Debt, and Stay Out | frugaldad | Absolutely essential reading! The frugaldad used to work in a credit card call center, which gave him some unique insights into what steps people need to take to get out of debt. The really unexpected but essential step? Get angry…. |

| Carnival of Personal Finance | 13 Fun (Free) Things To Do This Summer | The Q Family Adventure | This very kid-friendly list is aimed at Georgia, but ought to give you some very good ideas no matter where you are! |

| Carnival of Real Estate | Which Home Is Yours? | Turning Houston Green - One Home at a Time | Stephanie Edwards-Musa adds environmental and energy efficiency factors to her arsenal when staging a home for potential buyers. |

| Festival of Frugality | The Unlikely Way to Save Money | The Rants and Musings of a Gay Lunatic | Andy Heath actively considered becoming homeless as a strategy to deal with his mounting debts, and even took steps to do so, before settling on the only really logical approach he could think of. The Best Post of the Week, Anywhere! |

| Festival of Stocks | Price of Oil: Manipulation? Bubble? Supply/Demand? | Trader's Narrative | Babak believes we're seeing a "perfect storm" that are driving oil prices upward, and even finds a silver lining if the storm continues. |

| Carnival of Money Stories | Auditor Reveals How Risky Mortgages Were Allowed To Go Through | Fraud Files | Tracy Warren was an auditor for Watterson-Prime, who reviewed subprime loans before they were sold to companies like Bear Stearns. And even when she found bad loans and said "No," her supervisors overruled her assessment and said "Yes." Absolutely essential reading! |

| Carnival of Fraud | Dell's Mixed Report Card | SOX First | After a guilty verdict for false advertising and fraud in how they went about financing debt for consumers, Leon Gettler notes that Dell may be on the verge of turning around its struggling business. |

| Carnival of Money Hacks | Save Money on Your Hospital Bills Just by Asking | Bible Money Matters | BM2 discovers that it may be possible to get a discount for hospital bills just by asking! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We'll have a late "special" Saturday edition of On the Moneyed Midways this week. In the meantime, the picture says it all!...

Labels: none really

We're about to go out on a huge limb, so let's lead off with it: Order has re-emerged in the stock market following the disruptive event of January 2008. We recognize that order has emerged since the stock market is now trading within a range of variation that might be described by a normal distribution.

We're about to go out on a huge limb, so let's lead off with it: Order has re-emerged in the stock market following the disruptive event of January 2008. We recognize that order has emerged since the stock market is now trading within a range of variation that might be described by a normal distribution.

We base this claim on just five points of data in time. Specifically the five points of data defined by the average daily closing values of the S&P 500 index for each month from January through May of 2008 and the index' approximate trailing year dividends per share for each of these months.

But before we show you why we think that this is the case, let's discuss some basic quantum mechanics and atomic physics....

Quantum Phenomena

More specifically, we're going to take you back in time to the turn of the last century, when physicist Niels Bohr first came up with a working model of the hydrogen atom. Here, the most advanced theories of physics at the time couldn't explain why hydrogen gas, when heated up until it glowed, would only emit light at certain wavelengths of the visible light spectrum when the light was passed through a prism.

More specifically, we're going to take you back in time to the turn of the last century, when physicist Niels Bohr first came up with a working model of the hydrogen atom. Here, the most advanced theories of physics at the time couldn't explain why hydrogen gas, when heated up until it glowed, would only emit light at certain wavelengths of the visible light spectrum when the light was passed through a prism.

The Bohr model of the atom was the first such theoretical model to explain this phenomenon successfully. Bohr argued that the single electron that orbited the nucleus of a hydrogen atom did so in special orbits, which might be identified by their energy states. The lowest energy state corresponded to the lowest (closest) orbit to the nucleus, with each higher energy state corresponding to an orbit further away from the nucleus.

Bohr further argued that the electron orbiting the hydrogen atom nucleus would instantaneously "jump" from energy level to energy level, as the electron either gained energy by absorbing a photon of light or lost energy by emitting a photon of light. The spectrum lines generated by heating hydrogen gas correspond with the energy states of the electrons within the hydrogen atoms.

As we'll show you next, the U.S. stock market would appear to behave in a somewhat similar fashion, with stock prices acting in the role of electrons and dividends acting in the role of photons.

Shifting Energy States in the Stock Market

We originally featured the following chart in our third anniversary post The Sun, in the Center, which shows the relationship between stock prices and trailing year dividends per share from January 1871 through November 2007:

The trendline shown in the chart represents the very long term regression analysis of each month's average daily closing price versus each month's approximate trailing year dividends per share. Because it's easier to see given the scale of this chart, we'll focus our discussion on the portion of the chart corresponding to dividends per share greater than $1.00, which largely coincides with the modern era of the stock market (post-World War 2), although the same phenomena that we'll point out are also evident in the pre-WWII period (that rat's nest looking mess below $1.00!)

What becomes readily apparent is that the trajectory of stock share prices versus trailing year dividends per share tends to move in roughly straight lines over extended periods of time. During these periods of relative stability and order, we've found that stock prices behave as if they fall into a normal distribution. Or rather, we've found that we cannot rule out that stock prices behave as if they fall into a normal distribution during such periods.

Where quantum effects would seem to come into play is that when these periods of stability end, stock prices enter into a relatively brief period of disorder or a disruptive event, in which the previous normal distribution is effectively broken, followed by the re-emergence of order that would seem to suggest that stock prices have shifted to a new "energy state."

In other words, stock price changes are the result of normal variation until they're not. Periods in which stock prices behave normally may last months or years, and perhaps as long as a decade. There is however, no evidence that stock prices have ever followed a normal distribution for periods much longer than that, as disruptive events occur that alter the effective energy state of the stock market, with order ultimately re-emerging at a different level of equilibrium.

Looking Closer at Recent History

Let's now take a closer look at the stock market as it moves from order, passes through a disruptive event into a new order, which finally breaks with the onset of a new disruptive event. We featured the following chart showing the period from March 1991 through February 2008 in Recognizing Disorder in the Stock Market:

The chart above shows the following periods:

- March 1991 through March 1997: These six years represent a period of relative order extending from the end of the 1991 recession through the initial onset of the Dot-Com stock market bubble.

- April 1997 through May 2003: The Dot-Com Bubble builds and bursts. We recognize this entire period as a disruptive event as stocks broke from following the fundamental relationship that describes the relationship between stock share prices and dividends per share.

- June 2003 through December 2007: Order re-emerges in the stock market.

- January 2008 to February 2008: A new disruptive event occurs, breaking the order established in the previous three and a half years.

The disruptive events identified above, in which the previous order that existed in the stock market was broken, were driven by changes investors expected in the future of stock dividends.

Dividend-Driven Stock Prices

Established theory presents stock prices as representing the discounted value of future dividend payments to stock shareholders (interesting reading noting this topic here.) As a result, what investors expect to receive in future dividends is the key driver affecting today's stock prices.

Back in the early days of the bubble, corporate earnings in S&P 500 companies surged. As a result, investors bid up stock prices, anticipating that dividends would follow. The bubble, it would seem, had some very rational roots!

As we noted earlier in this post, the electron of a hydrogen atom will change energy states by either absorbing an photon and moving to a higher energy state or emitting one and moving to a lower energy state. For the Dot-Com stock market bubble, the expectation of greater than previously anticipated dividends acted like a photon that would be absorbed into the stock market, and as a result, stock prices were propelled to higher levels.

From our perspective, dividends really represent the component of corporate earnings that a company's leadership believes to be sustainable for the foreseeable future. When dividends didn't follow corporate earnings and stock prices upward, it became inevitable that a severe disruption would take place. Unlike the electrons orbiting a hydrogen atom however, the entire process for the stock market played out over a number of years rather than instantaneously.

And so, in the order that emerged following the bursting of the Dot Com Bubble, investors were far more cautious, demanding substantially greater dividends in return for higher stock prices. This is reflected in the lower slope of the general trendline of the period from June 2003 through December 2007 compared to the previous period of order from March 1991 through March 1997.

Which brings us to the disruptive event that began in January 2008.

The Market in 2008, So Far

For the stock market, the last months of 2007 were somewhat unusual. Investors and traders knew that the bursting of the housing bubble earlier in the year would have an effect on the financials, mortgage lenders and homebuilders who had grown tremendously in the previous few years on the strength of the U.S. housing market, but nobody knew when the ax was really going to fall. December 2007 came and went, all dividends that had been promised to be paid were paid, and the market was fine.

Until the books finally closed on the fourth quarter of 2007 and the new books for the first quarter of 2008 were opened. Beginning early in January 2008, a number of large financials and mortgage lenders began announcing they would be cutting their dividend payments and slashed their earnings forecasts. Stock prices quickly dropped, as these actions broke the existing order in a new disruptive event.

As it happened, things kept getting worse through March, as investors waited for more shoes to drop. When they didn't, well, here's the chart along with those five points of data corresponding to each month this year that we mentioned at the beginning of this post:

Going back to our quantum metaphor, the expectation (and reality) of lower dividend payments in the future acted as a photon being emitted. The market moved to a lower "energy state." Which, if you believe Student's t-distribution has any meaning, suggests that the stock market might be expected to move along a new, stable trajectory. Again, with investors demanding higher dividends in return for bidding up stock prices.

At least, until the expectation and reality of future dividend payments creates a new disruptive event!

Want to See How We Got Here?

Believe it or not, there is actual theory, observations and math behind our discussion above, much of which we've fully built from scratch! The following posts, presented in reverse chronological order, hit the main highlights of how we got here and also provide some essential background information.

- A Less Distressed U.S. Stock Market

- Snapshots of the S&P 500 Through March 2008

- Recognizing Disorder in the Stock Market

- Distress, Recessions, Market Bottoms and the Future

- The Beating Heart of the Stock Market

- Deriving the Price Dividend Growth Ratio

- The Sun, in the Center - This is where it really all begins!

- The History of S&P 500 Dividends in Pictures

- The Problem with Earnings

Labels: dividends, earnings, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.