American Home Mortgage Tumbles on Liquidity Issues was a major headline in the news yesterday, as the company's shares fell sharply on news that the company is having financial difficulty. So a natural question to ask is: what exactly are liquidity issues and why are they a bad thing for a business?

American Home Mortgage Tumbles on Liquidity Issues was a major headline in the news yesterday, as the company's shares fell sharply on news that the company is having financial difficulty. So a natural question to ask is: what exactly are liquidity issues and why are they a bad thing for a business?

If you run a business, there can be times when being able to quickly come up with cash to cover your obligations is the most important thing you can do. After all, running out of money to pay essential bills and debts when they come due is something that you never, never want to have happen. Your ability to avoid this situation depends upon your business' liquidity, or rather, your business' ability to convert the assets you have into cash for the purpose of paying your liabilities when they must be paid.

But how can you determine if your business has enough liquidity to meet its needs?

That's where liquidity ratios come in! These are financial metrics that you can use to determine how much of a safety cushion your business has in covering its liabilities. These metrics include the amount of your Working Capital, your Current Ratio, your Quick, or "Acid-Test" Ratio and finally, your Operating Cash Flow Ratio.

Our tool below can take all this information and find each of these metrics for you! What's more, it also works for publicly-traded companies as well: the default values in the tool above are all taken by adding up the appropriate items from American Home Mortgage's quarterly balance sheet and quarterly cash flow statement reported on March 31, 2007:

Now, let's talk about each of these measures, focusing on their value as a snapshot of financial health:

Net Working Capital

Net Working Capital is simply the difference between the value of your current assets and your current liabilities. A positive value here means that your business will have little trouble in paying back your creditors in the short term. A negative value, on the other hand, may be a red flag:

If a company's current assets do not exceed its current liabilities, then it may run into trouble paying back creditors in the short term. The worst-case scenario is bankruptcy. A declining working capital ratio over a longer time period could also be a red flag that warrants further analysis.

Current, or Working Capital, Ratio

The Current Ratio, or Working Capital Ratio is the proportion of your business' current assets to its current liabilities. Here, a larger value is better, and values over 100% are very good as they indicate that the business has more than enough in assets to fully cover all its near-term liabilities.

A current ratio that comes in under 100% in the tool above indicates some trouble. From Investopedia:

A ratio under 1 suggests that the company would be unable to pay off its obligations if they came due at that point. While this shows the company is not in good financial health, it does not necessarily mean that it will go bankrupt - as there are many ways to access financing - but it is definitely not a good sign.

Quick, or Acid-Test, Ratio

The Quick Ratio, also called the Acid-Test Ratio is similar to, but represents a more conservative measure of financial health than the Current Ratio, as it does not consider the value of a company's inventory among its current assets. Removing the value of inventory from the total value of a company's current assets makes sense in that it can be difficult to convert inventory into cash on short notice.

Aa company with a Quick Ratio less than 100% for our tool should be considered to not be in good financial health, but has all the same options that a company with a Current Ratio less than 100% does. Investopedia notes some characteristics of companies with low Acid Test Ratios:

... if the acid-test ratio is much lower than the working capital ratio [Current Ratio], it means current assets are highly dependent on inventory. Retail stores are examples of this type of business.

Operating Cash Flow Ratio

The Operating Cash Flow Ratio is the proportion between the cash flow you receive from operating your business to your current liabilities and is perhaps the single best indicator of its long-term liquidity, or better, its ability to pay bills (liabilities) over time with the cash generated from operating the business.

A value less that 100% in the tool above indicates that the company's cash flow is not sufficient to solely meet its debt obligations. That means that funding must be obtained from elsewhere if the business is to survive.

American Home Mortgage

Using the default data, we can see that American Home Mortgage (AHM) was already in a world of hurt back on March 31, 2007. What's changed since then is that the company's financial situation has become more dire, which is reflected in the company's stock price as the market has become more aware of its increasing poor liquidity situation, particularly beginning in mid-June 2007:

As a business or stock owner, you never, never want to see something like this happen, as it indicates that bankruptcy is becoming a more and more likely outcome. Where AHM is concerned, we suspect we'll know our answer soon enough....

Previously on Political Calculations

- Predicting Bankruptcy - Our tool that can help determine whether a publicly-traded company may be undergoing the kind of financial distress that leads to bankruptcy.

- A Top Ten Countdown - What are the top ten reasons why businesses fail? We apply the list to a pre-bankruptcy Air America Radio network.

- Turnaround and Crisis Management - What do you need to do if your business is going under? We start you down the road you need to be on!

- The Future of Air America - We introduced the business strategy matrix as a tool for analyzing the options available to then-failing Air America Radio.

Not long ago, we were contacted by MSNBC's Eve Tahmincioglu, as she was researching an article for her new blog within the MSNBC universe, YourBiz. She had stumbled across the tool we created that estimates the impact of a minimum wage increase upon a small business, which she featured in her second official blog post!

Pretty good timing as the first phase of the recently approved increase in the federal minimum wage just took effect last week!

After noting that the overall effect upon the economy should be pretty minor (see our post here), which is largely due to the continually decreasing numbers of people earning the minimum wage in the U.S. in the past two decades, Eve noted another challenge for U.S. businesses:

There may be yet another bigger work force problem looming for small business owners – a lack of skilled workers.

Many of the nation’s fastest growing privately held firms view the lack of enough skilled employees as one of the top growth inhibitors for their companies.

A survey of more than 300 CEOs from smaller companies released this year by PricewaterhouseCoopers found that the availability of qualified, skilled workers was cited by 50 percent as a potential barrier to growth. The problem was equally bad in both service and manufacturing sectors.

So even if you pony up the cash, there might not be enough qualified workers to go around. Maybe Ironman can create a calculator for that.

That seems like our kind of challenge! Except, we don't need to go to the trouble of creating a tool to solve this particular problem.

In fact, we suspect this problem could be fully solved in less than four years - and all these CEOs need to do is to commit to paying people more for the specific positions for which they want to attract qualified candidates.

The quickest, easiest way to attract large numbers of new candidates to any position is to pay really well, as the Suffolk County Police Department has discovered, or if money is an issue, to offer alternative forms of compensation that individuals might value more.

They need to commit to doing so, both now and to continue doing so in the future, mainly for the sake of signaling students in college or in trade schools, for those positions that require additional education and training. This way, the students can direct their studies in such a way that they become ideal job candidates for these positions when they graduate.

The commitment to pay more in the future is purely for the sake of retention. Otherwise, why would a qualified applicant stay in a position if they can do the same or similar work elsewhere for greater rewards?

That these CEOs seem unwilling to do so is more a reflection that they're not yet serious about really addressing the situation.

The CEOs' dilemma also provides a window to the current job market. That the problem the employers have right now is a shortage of qualified job candidates is a really good indication that the job market is very strong. The BEA's advance news release for 2nd Quarter 2007 GDP last week confirms that's been the case for a while - in addition to releasing the latest GDP data and revisions, they also revised real (inflation-adjusted) disposable income upward to show an annualized rate of increase of 2.8% for the period from 2003 through 2006 (they previously had the figure at 2.5%.) Translation: employers are already paying people more, which confirms a strong job market.

Further translation: Paying people more for having highly-in-demand skills is already happening. In our view, at least 300 small company CEOs ought to accept it and adjust their compensation plans accordingly.

Eve is the author of From the Sandbox to the Corner Office: Lessons Learned on the Journey to the Top, a well-reviewed book of what business lessons CEOs acquired as children that we'll be putting on our reading list in the very near future (which we hope also explains the title of our post!)

Labels: jobs, minimum wage

Welcome to this Saturday, July 28, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

Welcome to this Saturday, July 28, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

This week, we reviewed well over two hundred posts from more than two dozen blog carnivals. But before preparing our list of the best posts of the week, we eliminated the blog carnivals that weren't hosted by humans.

Seems a bit rash, right? Especially since we eliminated all but seven blog carnivals from this past week. But OMM is about finding the best of the best, and that includes the hosts who cared enough to actually read through and review each of the posts submitted to the carnival they volunteered to host. Otherwise, what's the point of having a blogger contribute to a collection of links nobody has any reason to follow back to their blog?

There are, after all, more effective ways to draw search engines to your blog. And like banner ads that become invisible after people get used to them, link spam carnivals are becoming just as invisible. Don't just take our word for it - if you're a blogger who contributed to these carnivals, go to your traffic logs and see just how many hits you received from each carnival to which you contributed.

It's just not worth it!

If you want to participate in blog carnivals, your better bet is to use our list of carnivals each week to find the ones that are worth your time. Just scroll down for the best posts from the best carnivals of the week that was!...

| On the Moneyed Midways for July 28, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Bootstrapping Entrepreneurs | Plan Your Trip Now for Your Business! | Desty Online | Shawn shows how creating a business plan can be almost identical to planning to go on a trip. |

| Carnival of Fraud | Invasion of the Pod People, Round 2 (L-O-N-G) | Wisdom from Wenchypoo's Mental Wastebasket | What's wrong with today's most hypocritical "progressive" politicians, their more dubious causes, and the people who give them their unquestioning support? Wenchypoo, well, we'll just quote her: "I see Pod People…they're everywhere…and they don't even know they're being used!" The Best Post of the Week, Anywhere! |

| Carnival of Real Estate | Expected Rate of Decline of Home Prices in the Next Year | The Digerati Life | Given the seemingly housing-driven market turmoil this week, we suspect this may be the most popular post of this week's edition - the Silicon Valley Blogger gives her take on the slipping home market. |

| Carnival of Real Estate | Selling Like a Catholic Schoolgirl | Active Rain | Brian Brady shares what he learned about the art of the sale from his Catholic grade school education. Absolutely essential reading! |

| Carnival of the Capitalists | Intuit: The Small Business Helpers | Adam Pieniazek | What do Intuit's managers do right? Adam Pieniazek reviews the internal corporate culture of the tax and accounting software giant. |

| Festival of Stocks | Stocks as Income Investments | The Real Returns | In a neat investing lesson, the Real Returns walks through the math that confirms that the S&P 500, as represented by one share of the SPY exchange traded fund bought in January 1994, now has a dividend yield of 5.62%! |

| Lead Optimize | Cellular Retailers Must Greet Customers Within 30 Seconds - Study | Learn Good Customer Service | Jason Rakowski discusses a J.D. Power & Associates study that found a strong correlation between when a customer is greeted and a wireless retailer's customer satisfacton scores, along with other factors that influence custome perception that are not to be missed! |

| Small Business Issues | Turning Coal Into Diamonds: A Case Study on Customer Complaint Tracking | Productivity Planner | Chris Russell shows what you can learn about turning the "coal" of customer complaints into customer satisfying "diamonds" from a company that actually manufactures diamonds! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The office grapevine is the ultimate informal communication system. Managers often pay attention to it to keep their fingers on the pulse of their company. Employees use it to communicate gripes or to pass along information about anyone and anything work-related.

Or not. Sometimes, the office grapevine degenerates into a giant rumor mill that thrives on serving up episodes of that tragedy called life for the sake of advancing a co-worker's deepest Machiavellian interests.

But what about your own deepest Machiavellian interests? Should you pass along gossip in your office? What if doing so might further your career? And what if it could derail someone else's career track? How should you factor the possible repercussions into your choice of whether or not to join in the office gossip mill?

This blog isn't called Political Calculations(TM) for nothing! Geek Logik's Garth Sundem developed the math behind our latest tool, which can help you decide if, and also how, you should join in the guilty pleasure that is office gossip at your company:

Garth Sundem explains the mechanics behind the math used in the tool:

In this equation, your chance of transmitting office gossip depends not only on its validity and entertainment value but on its usefulness as a business tool. Will this information increase or decrease your chances of ascending the corporate ladder? How likely is it that transmitting gossip will come back to haunt you?

Then again, some things are just too juicy to keep bottled up, even if they might result in damaging your own career in the process. Garth continues:

Of course, if it's just too spicy to keep to yourself and you have a tendency toward feistiness, you might have to throw logic and caution to the wind and spill to anyone and everyone who will listen.

All we have to add is that if that's you, the gossip had *really* better be worth it, or else, as Tony Soprano might say, "there have to be consequences." And with certain people in the office, we would guarantee there will be.

Labels: geek logik, tool

The value of U.S. goods and services being exported to China may be on the verge of sustainably doubling in value for the second time during George W. Bush's tenure as President. The following chart shows the value of exports from the U.S. to China provided by the U.S. Census from January 1985 through May 2007, the most recently available data:

As we see in the chart above, the value of U.S. exports to China has only doubled four times since the Census began collecting and reporting this data in 1985. Since January 2001, when President Bush assumed office, the value of goods and services exported from the U.S. to China has doubled in value twice, doing so at a rate twice as fast as that achieved during the previous eight years of the Clinton administration.

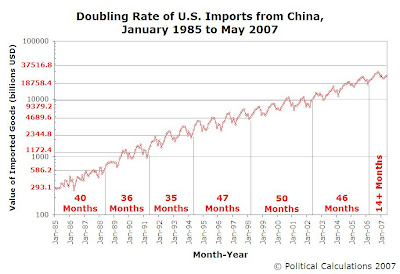

More remarkably, the rate of growth of U.S. exports to China continues to exceed the rate of growth of China's exports to the U.S.:

This chart reveals that while the total value of all the goods and services the U.S. imports from China is much higher than the total value of goods and services the U.S. exports to China, the rate of growth of these imports to the U.S. is slower than that of what the U.S. exports to China. We see this in the slower doubling rate of the value of Chinese imports to the U.S. in recent years, as the amount of time needed to achieve a double in trade value is longer than for the U.S. in recent years.

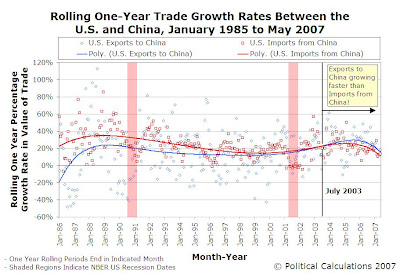

The following chart drives this point home. Here, we look at the rate of growth of both China's and the U.S.' exports to each other over rolling one-year periods:

We verify that the rate of growth of U.S. exports to China has exceeded the rate of growth of China's exports to the U.S. since July 2003.

It's still too early to confirm that the value of U.S. exports to China will continue to sustainably exceed the latest doubling threshold, but if China's continuing strong GDP growth is any indication, we should be able to confirm it soon.

Labels: trade

Peter Gordon recently said this about us:

Newmark's Door points us to this very cool blog. Talk about public goods!

We won't dispute the "very cool blog" part, but is Political Calculations really a public good? And if so, where are the buckets of tax money that we ought to be getting from the government for providing you with our particular brand of public good?

On second thought, just have someone tell Congressman Jack Murtha (D-PA) that we're based somewhere in his district and we'll make it up through earmarks....

Speaking of Peter Gordon, he proposed that instead of building Los Angeles' "Subway to the Sea," that the money that would be used to build it might better be spent by giving low-income riders a "lifetime pension of $5,000 per year," which King Banaian argues would provide the riders with the option of buying a used car or paying for other bills (or a new car too - let's not rule that out if that's their choice!)

The problem with this proposal is that the money from the government will instead likely result in driving up the cost of all cars and whatever else the low-income individuals might spend the money upon, spurring higher inflation in the economy. Much like how increasing financial aid for students almost invariably results in even higher tuitions at the nation's colleges and universities.

Could there be a way to achieve the goals of light rail (less gas consumption, cleaner air, less road congestion), the taxpayer (less wasteful government spending), and low-income earners without sparking higher inflation?

We see a way to achieve a lot of different goals here using the money that might otherwise be used to build light rail systems. All hinging upon when the low-income recipients of money redirected away from light rail projects might choose to retire.

Compared to their high-income counterparts, those with low incomes will work much longer before becoming able to retire from the workforce. So, if you directed the money from light rail to instead go into Individual Retirement Accounts owned by the low-income recipients (our former light-rail riders), you would accelerate the build-up of their retirement savings to the point where they can choose to retire from work (and their daily commute) much sooner than they otherwise could have.

As an added bonus, since their annual incomes would not be inflated by the funds from light rail, the prices of the things they buy won't be driven up by the inflationary forces unleashed whenever the government floods the economy with money.

Getting out of the rat race dramatically reduces the amount of gas an individual uses, not to mention removing them from the road at the times when most people are trying to use them. So, with our proposal, we have, in one stroke, increased individual savings, made it possible for low-income people to retire earlier, kept inflation under control and reduced the amount of gas used in the future while simultaneously removing congestion from our roads and carbon emissions from the planet.

Then again, instead of obsessing over how to get a pretty low percentage of people to be able to afford earlier retirement by giving them other people's money and controlling what they do with it, we could just reduce taxes across the board and achieve all these things by making it possible for all income-earners to be able to afford to retire just a little bit earlier.

Holy cow! Political Calculations is a public good! Send those tax dollars to....

Labels: random thoughts

In 2006, the rate at which the cost of tuition at U.S. colleges and universities increased at a rate of 6.71%. By comparison, the rate at which inflation increased in the general U.S. economy was just 3.23%, less that half the rate at which the average U.S. university jacked up the price of tuition at their institutions.

In 2006, the rate at which the cost of tuition at U.S. colleges and universities increased at a rate of 6.71%. By comparison, the rate at which inflation increased in the general U.S. economy was just 3.23%, less that half the rate at which the average U.S. university jacked up the price of tuition at their institutions.

These numbers are provided by FinAid, one of the most comprehensive sources of student financial aid information we've found on the Internet.

But a better question is: Why should the cost of tuition rise so much faster than inflation?

Gary Wolfram of the Cato Institute examined data going back to 1977 in a 2005 paper, in which he found a very high correlation between financial aid increases and tuition hikes. What though is less clear is how much of the high rate of tuition inflation is due to increases in the amount of financial aid provided by the U.S. federal government.

That murkier picture was described in recent Senate testimony. In December 2006, Harvard's Dr. Bridget Terry Long noted that given the complexity of federal financial aid programs, it would be difficult to assess how much an impact it would have in increasing tuitions. Instead, she focused her testimony on several other separate factors that would seem to also play a role:

- Reduction in the Amount States Provide to Public Colleges and Universities

- Higher Labor Costs for Faculty and Staff

- New Expenses (Technology, Student Services)

- Financial Aid Provided by the College or University Itself

These factors are no strangers to America's higher education policymakers, including those at the University of Pennsylvania. Back in 1998, several members of the University's Cost Containment Committee acknowledged all these factors to some extent in an article for the University of Pennsylvania's Almanac.

Where they differed from Dr. Long's assessment however was in presenting how university policymakers view financial aid in setting tuition rates. Here, UPenn's policymakers provided this essential glimpse as they were specifically responding to whether the schools within the University of Pennsylvania had a structural deficit:

First, financial aid is directly tied to tuition; if not for the higher level of financial aid expenditures, we would not have been able to increase tuition rates over the past ten years at the levels we did and still, at the same time, maintain a world-class student body. Any discussion of financial aid expenditures decoupled from tuition revenue presents an incomplete and inaccurate picture.

The remainder of the statement goes into a description of the funding for different university budgets. For our purposes however, there are two ways to read this statement. First, one could argue that if not for increases in financial aid, they would have increased tuition more.

This seems unlikely. According to FinAid, the average rate of tuition increase for all U.S. colleges and universities in those 10 years from 1988 to 1998 was 7.44%. General inflation in the U.S. was 3.33%. In the absence of specific data for UPenn, we assume that the University of Pennsylvania increased its tuition prices by this average rate throughout this period. Frankly, we're not sure how much more "world-class" maintenence they could get away with charging UPenn's student body.

This seems unlikely. According to FinAid, the average rate of tuition increase for all U.S. colleges and universities in those 10 years from 1988 to 1998 was 7.44%. General inflation in the U.S. was 3.33%. In the absence of specific data for UPenn, we assume that the University of Pennsylvania increased its tuition prices by this average rate throughout this period. Frankly, we're not sure how much more "world-class" maintenence they could get away with charging UPenn's student body.

The other reading of UPenn's policymakers' statement is that the increases in financial aid available to students allowed them to charge substantially higher tuition fees than they could otherwise. Higher levels of financial aid allow the colleges and universities to charge higher tuitions, as the students themselves would effectively only have to pay the difference between the higher tuition rates for the classes they take and the amount of financial aid they receive.

The university, in the meantime, gets all the money in that transaction. It would then appear to us that increasing financial aid does indeed drive college costs up as the motive, means and opportunity to do so are all present.

Previously on Political Calculations

Update: Corrected grammatical errors produced by our Department of Redundancy Department!

Labels: education

Welcome to the regular Friday, July 20, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

Welcome to the regular Friday, July 20, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

This week, we read a little under two hundred blog posts contributed to nearly a dozen money and business-related blog carnivals in our quest to seek out the very best posts in each carnival, as the summer season seems to have taken a toll on the hosts of the blog carnivals. As always, we named the best post we found with the title of being The Best Post of the Week, Anywhere!(TM), and posts that came near that level this week were awarded the title of being Absolutely essential reading!(TM).

How rough was the reading this last week? Aside from the outright absence of some of our favorite carnivals, there were a lot more on autopilot this week ("on autopilot" meaning overly reliant on the boilerplate text generated by Blog Carnival's online submission form) which we find to be really uninteresting to read.

Even where the host made the extra effort to actually indicate both that they had actually read the contributed posts and to create an original post around them was tough going this week. We can now add sport elimination brackets to our list of formats blog carnival hosts really shouldn't use (certainly as it was used in this week's Carnival of Real Estate.)

We'll give the host points for creativity in this case, and they did fairly well at setting up the brackets to downselect to their best choice (which ultimately was the same as ours from the carnival), but it was very hard to read and follow, especially as the links to the surviving posts disappeared by the "Quarterfinals".

Still, it was nowhere near as bad as the blog carnival that was presented in haiku. We still shudder when remembering that experience.

But enough about all that! Scroll down for the best posts of the week that was!...

| On the Moneyed Midways for July 20, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Image and Influence | The Nine Best Story Lines for Marketing | Change the World | Guy Kawasaki outlines Lois Kelly's description of the nine kinds of stories that people like to talk about, and which should be in the toolbox of every good marketer. |

| Carnival of Image and Influence | Mission Statements Don't Work, Get Something that Does | SmallFuel | What's the point of having a mission statement for your company if nobody bothers reading them? Mason Hipp finds what's wrong with mission statements and explains how to make them effective tools for your business. |

| Carnival of Money Stories | Why Not Borrow Against 401k? | Extreme Perspective | Paul looks at his 401(k)'s investment options and wonders if borrowing money from his account and paying it back to himself makes more financial sense that investing in the plan's fixed-income option. Absolutely essential reading! |

| Carnival of Real Estate | The Imperative of Divorced Commissions, Part 2: The Inherent Value of Free | BloodhoundBlog | Jeff Kempe looks at the real costs of "free" in the real estate industry, argues that buyers aren't being represented very well, and proposes a way to sift the wheat from the chaff where real estate agents are concerned. |

| Carnival of the Capitalists | How to Start an Online Store | The Beef Jerky Blog | What kind of stuff do you need to do to start up your own storefront on the web? Jerky Beef explains the basics and points to some good resources. |

| Carnival of the Capitalists | Will an HSA Solve Your Health Insurance Problem? | The Freestyle Entrepreneur | If you're looking for health insurance, you might want to take a serious look at John Ingrisano's experience with Health Savings Accounts. Absolutely essential reading! |

| Cavalcade of Risk | The Big Pizza Bust | Workers Comp Insider | If you think workers comp insurance is expensive, wait until you find out how much not having it costs. Jon Coppelman weighs in on the reports of 32 pizza parlors, delies and restaurants that were recently busted in an affluent corner of New York for workers comp fraud. |

| Festival of Stocks | Results-Based Pharma (JNJ)(GSK) | 24/7 Wall St. | What if you only paid for an expensive drug treatment if it actually worked? Douglas A. McIntyre discusses an innovative proposal by Johnson & Johnson in The Best Post of the Week, Anywhere! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

But to give credit where credit's due, we actually got the idea over at William Polley's blog in the comments thread!

Now, we've done something like this before with our Lemony Snicket and the S&P 500 scenario tool, but we didn't match the recorded worst-case stock market performances with the actual inflation in play over the periods of time for the investment.

So today, we're going to present what we found when we ran the numbers for the actual worst case inflation-adjusted returns ever realized in the entire history of the S&P 500 index!

For our scenario, we found the future value of a series of once-a-year $1000 investments as if they had earned the worst-ever recorded real rates of return for periods of time from 1 to 50 years long. Then we added the totals to find the progressive cumulative value of our "really, really bad timing" investor portfolio.

We'll also compare these values against those obtained from an investment that receives a 0% real rate of return, which is roughly the equivalent of investing in 30-day T-bills. We'll also find the future value of an investment that produces a positive 2% and 3% real rate of return, which spans the typical range for long-term U.S. Treasury bonds.

As an interesting side note, stuffing money in a mattress actually loses money over time through the cumulative effects of inflation, which is why investing in very short term U.S. Treasuries is needed to produce a 0% rate of return.

The chart below illustrates what we found. All values presented reflect real, or rather, inflation-adjusted, returns, with full dividend reinvestment and do not account for fees, commissions or taxes that might have to be paid over the period of the investments. (We'll assume, in other words, that our hypothetical investor has other money they might use to cover these costs.):

It's no secret that if you have really bad luck with your investments, you can expect to lose money. What is a secret is if you had really bad luck with your investments in the S&P 500, you would actually have broke even and moved into the black after a long period of time.

How long? Well, to break even and achieve a 0% real rate of return on the cumulative value of your horribly-timed portfolio, you can expect 32 years of pain before you get out from being underwater!

And then, believe it or not, you start making money, even with regularly having the actual worst-case historical real rates of return ever recorded by the S&P 500. In fact, you would have netted a positive 2% real rate of return in a little under 42 years. At 50 years, had you made these terrible investments, you would have realized a solid 3% real rate of return on the sum total of your truly awful portfolio.

That says a lot about the strength of the component stocks within the S&P 500, the diversification they provide to reduce risk and the buy and hold investing strategy.

It also says a lot about our hypothetical investor. That's a lot of stubbornness (or faith) working if they're willing to go through 32 years of being in the red before breaking even. Now, imagine if that voice in our stubborn investor's head telling them every day how bad their investments are is Jim Cramer's. Kind of redefines hell, doesn't it? [Editor's Note: Sorry Jim, we couldn't resist!]

Then again, no one has actually ever done that badly with their S&P 500 investments, which maybe is the real point to take away from this exercise.

Labels: investing, SP 500, stock market, worst case

The Bureau of Labor Statistics released the latest Consumer Price Index figure this morning, which means that we finally have the final missing piece to be able to update our signature tool, The S&P 500 at Your Fingertips, all the way through the end of June 2007!

The table below provides the annualized rates of return a hypothetical investor might have had in the S&P 500, assuming full reinvestment of dividends, if they had first started way back in January 1871 or a year ago or since January of this year:

| Annualized Rates of Return in the S&P 500, Assuming Full Dividend Reinvestment | |||

|---|---|---|---|

| Annualized Rates | Nominal Rate of Return | Rate of Inflation | Real Rate of Return |

| Since January 1871 | 9.20% | 2.09% | 7.11% |

| Year over Year | 23.04% | 2.69% | 20.36% |

| Year to Date | 17.99% | 7.18% | 10.82% |

These are, indeed, green days for the humble stock market investor!

Labels: investing, SP 500, stock market

Once upon a time, we said:

Economically speaking, of all the ways to transport people between cities, rail is perhaps the stupidest. Nowhere else do we see the confluence of extraordinarily high infrastructure costs (land, construction, equipment, facilities, etc.) and extraordinarily high operating costs (labor, maintenance, fuel, utilities, overhead, etc.) combine with extraordinarily low demand by commuters to produce such little tangible benefit.

And that was just for moving people between cities. When it comes to moving people within cities, as light rail is intended to do, it becomes perhaps even more stupid. The only way to make it work, in fact, is to redesign cities themselves, which costs magnitudes of money even more than what putting a light rail system in place costs.

Speaking of the costs of putting a light rail system in place, we're reminded of a bet proposed by the Coyote Blog's Warren Meyer:

The system [in Phoenix, Arizona] is not up and running yet, so I have not seen ridership numbers, but I will make a bet: If we take the entire cost of the system's construction, plus its annual operating losses/subsides, I will bet that we could have bought every regular rider of the rail system a nice car instead and gas for life cheaper than the cost of the rail system.

Well, let's find out! Fortunately, the St. Louis Federal Reserve's Molly D. Castelazo and Thomas A. Garrett considered this question, specifically looking at St. Louis' MetroLink light rail service, and worked out the basic math for us! We took that math, enhanced it a bit, and built the tool below so you can run numbers for whatever light rail system you might want to consider:

Having run the default numbers, some of which were provided by Castelazo and Garrett, we confirmed that instead of pouring money into low return light rail, the government could simply purchase cars for the light rail riders without them and still have enough money left over to provide all the other riders with substantial credits to use for bus service or other subsidized mass transportation options.

The Coyote Blog's Warren Meyer did follow up his original post with some figures from Los Angeles. And before we leave off, let's also remember that the costs of putting in a light rail system and the subsidies to operate them are not one-time only events.

Light rail. The gift to politicians and the local developers who support them that taxpayers keep giving, and giving, and giving....

Where to Get Numbers

How much a local light rail system is receiving from the government is best found in the appropriate transit authority's annual financial statements of their operating costs (or as is often the case, their annual operating losses.) These agencies should also be able to provide daily average ridership data. The percentage of light rail riders who do not own cars is difficult to estimate, but will most likely range between 10 and 20 percent. To divide the entire annual government subsidy for light rail equally among all individual riders, set this percentage to 0.

The best resource we found for finding the purchase price and annual operating expenses for a car is the Auto Channel's New Car Buying Guide's Total Operating Costs database. The default numbers we entered are those for a base model 2007 Toyota Prius 4-door hatchback for five years, which matches the term of the car loan. The tool assumes this is the term for which the car will be owned and operated.

The tool also assumes that loan payments are made monthly (12 per year.) Current car loan interest rates may be found through Bankrate.com.

Previously on Political Calculations

- A Grand Plan for Rail in the West

- Trouble on the Tracks

- Linear Cities

- Telephones, Steam Engines and Zeer Pots

Labels: public transportation, tool

In news from the British Isles, researchers at Oxford University have proposed a Pigovian tax to reduce the number of unhealthy diet related deaths each year in the United Kingdom:

In news from the British Isles, researchers at Oxford University have proposed a Pigovian tax to reduce the number of unhealthy diet related deaths each year in the United Kingdom:

Researchers at Oxford University say that charging Value Added Tax (VAT) at 17.5 percent on foods deemed to be unhealthy would cut consumer demand and reduce the number of heart attacks and strokes.

The purchase tax is already levied on a small number of products such as potato crisps, ice cream, confectionery and chocolate biscuits, but most food is exempt.

The move could save an estimated 3,200 lives in Britain each year, according to the study in the Journal of Epidemiology and Community Health.

But, there are things that cloud this otherwise sunny outcome:

However, they said their research only gave a rough guide to the number of lives that could be saved and said more work was needed to get an exact picture of how taxes could improve public health.

Any "fat tax" might be seen as an attack on personal freedom and would weigh more heavily on poorer families, the study warned.

A food tax would raise average weekly household bills by 4.6 percent or 67 pence per person.

Ooo - numbers! Let's do some math!

First, according to the CIA's World Factbook, the population of Britain as of July 2007 is 60,776,238.

At 67 pence per person, that means the U.K. government could expect to take in 40,720,070 GBP (at the currency exchange rates of July 12, 2007, that's 82,703,247 in U.S. dollars) through the increased value added tax on "unhealthy" food items.

And that's just every week! Over the course of a year, the UK government could expect to rake in over 2,123,260,817 GBP (or rather, 2.1 billion pounds, or 4.3 billion U.S. dollars or roughly 2% of next year's 104 billion GBP budget of the UK's National Health System.)

Now, let's divide those figures by the 3,200 deaths the tax is predicted to delay from occurring each year. We find that the cost to British taxpayers of delaying just one death per year through higher taxes on "unhealthy" food to be 663,519 GBP (or 1,347,620 USD) for each death delayed.

Whether this really makes sense or not depends upon this figure being less than what it would cost the UK's National Health Service to achieve the same feat through the health care methods it now has at its disposal.

This also assumes that the patients who would benefit ever get to the point of treatment in Britain's nationalized system of health insurance, where everyone has government-funded health care.

Any ideas on which approach might actually be cheaper?

Maybe a better question would be, where can the money raised by the tax be expected to go? We would argue that should any portion of the tax revenue generated through the "Fat VAT" find its way back to Oxford to fund further research, we very likely don't have to go very far to understand who the true beneficiaries of the policy are really intended to be.

Elsewhere....

Tim Haab wonders if the proposed tax is correcting a market failure or is simply blatant paternalism.

Labels: taxes

Welcome to this Saturday, July 14, 2007 edition of On the Moneyed Midways, the blogosphere's weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

Welcome to this Saturday, July 14, 2007 edition of On the Moneyed Midways, the blogosphere's weekly review of the best posts from the most recent editions of the best of the world of business and money-related blog carnivals!

Every week, we read hundreds of blog posts contributed to dozens of money and business-related blog carnivals, seeking out the very best posts in each carnival. The best post we find wins the title of being The Best Post of the Week, Anywhere!(TM) Posts that come near that level are awarded the title of being Absolutely essential reading!(TM)

The best posts of the week that was await below....

| On the Moneyed Midways for July 14, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Fraud | Detecting Fraud | SOX First | Leon Gettler reveals the tell-tale signs of fraud found by forensic examiners in a recent study. Absolutely essential reading! |

| Carnival of Money Stories | What to Do with $4.32 in the Wells Fargo Checking Account and Bills to Pay | MoneyNing | Ning considers the options when there's just not enough cash in your checking account and you have bills you need to pay. |

| Carnival of Real Estate | Stocks versus Real Estate Investments | Worldwide Success | David of Worldwide Success examines where real estate might have an advantage over stocks as an investment vehicle. |

| Carnival of Shopping | The Wal-Mart Dilemma - To Shop or Not to Shop? | Money, Matter, and More Musings | Golbguru wonders if shopping at Wal-Mart is such a good idea, and asks a lot of very interesting questions about whether Wal-Mart is good or bad for the economy. Worth reading for the comments too! |

| Carnival of the Capitalists | Outraged at Oil Companies, but Not Chicken Farmers? | Breaking the Shackles of the 9 to 5 | Even though chicken prices have increased more than gas prices from March through July, people aren't upset at chicken farmers the way they are at the oil companies - but when it comes to being an investor, the same fundamentals apply! Absolutely essential reading! |

| Carnival of the Capitalists | Massive Mass Ifs (Part 1) | InsureBlog | Hank Stern does the math that shows why the health care reform that presidential candidate Mitt Romney implemented in Massachusetts will ultimately fail. |

| Festival of Stocks | Lessons in Contrarian Investing from Peter Lynch | College Analysts | Mark Perkins looks to model legendary fund manager Peter Lynch's investing style in scanning for cheap growth stocks. |

| Personal Development Carnival | The Law of Attrations Should be Renamed the Law of Distraction | Renovate Your Life with Craig | Craig Harper has some issues with the Law of Attraction and argues that it distracts people from pursuing change principles that actually work. Absolutely essential reading! |

| Small Business Issues | How to Overcome the Biggest Obstacle to Your Success | Debra Moorhead | Debra Moorhead identifies the single biggest obstacle to your success and three things you can do to move past it. Quite simply, The Best Post of the Week, Anywhere! |

| Small Business Issues | Respecting Your Competition | The Freestyle Entrepreneur | What you say about your competitors can either clinch a sale or cost you business. Bill Sheridan describes the lessons he's learned in how to talk about his competitors with prospective clients. |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Wow, that was fast! Just yesterday, we were looking at the fading fortunes of the New York Times and today, we find out that the mainstream media company's long-term bond rating has been cut from BBB+ to BBB by Standard & Poor. (HT: Michelle Malkin and Thomas Lifson).

Now, if you're like most people, that bond rating talk is just so much gibberish. In school, there's not that much difference between a B+ and a B, so how is this any different?

Truthfully, there really isn't all that much difference between these two bond rating levels. What it does mean is that now, it will cost the New York Times slightly more to borrow money, as investors will demand slightly higher interest rates on bonds issued by the New York Times to justify the slightly increased risk of holding its debt. The risk for bond investors has increased, in the judgment of the bond rating services, since their analysis suggests that the New York Times Company and its management will be less able to generate revenue going forward.

How much more will it cost the New York Times to borrow money? Glad you asked! As it happens, we created a tool for guesstimating the cost of corporate credit, which we can use to answer this question! We've updated it with the latest data below so we can find out:

Using the values above, with the before and after bond ratings for the New York Times, we find that the effective interest rates that investors are now demanding from the company and its management have risen from 6.99% (BBB+) to 7.17% (BBB). That's not that big of a change.

Where this really matters though is on the New York Times' bottom line. Using our tool for paying off a loan, we find that at 6.99%, taking a million dollar "loan" over 20 years will require the New York Times' management to pay a total of $1,858,277.11 in principal and interest over the life of the loan. At 7.17%, this figure increases by $27,009.25 to $1,885,286.36.

That's still not that big of a change. Of course, should the New York Times' financial situation worsen enough so that it needs to restructure and refinance the debt that it already has issued through corporate bonds at lower interest rates, that action would have a large impact on the company's financial health. There is, after all, a huge difference between the interest payments required by a bond issued at 7.17% compared to one issued at say 6.17%.

And if the New York Times' ability to generate revenue deteriorates enough so that its bond rating falls to junk status (at BBB, it's now just two steps above junk status, which begins at BB+), the interest rate increases will become much larger as the company's bond rating becomes lower. This means that the corresponding hit to the company's bottom line would become much less trivial with every downgrade in its credit.

Go ahead and run the numbers for yourself above and see! For now though, we don't expect the change from BBB+ to BBB to have much impact on the ability of the New York Times to continue operating, nor do we expect that it will provide enough incentive for its management to change their course.

Since we mentioned the New York Times yesterday, we thought it might be time to look again at the business health of the nation's "most influential" newspaper. A year ago, we looked at the circulation figures the New York Times presented in their annual reports to the Security and Exchange Commission going all the way back to 1993. So now, a year later, we're doing the same to see how the Gray Lady has fared.

It's not pretty. First, here's the New York Times' weekday (Monday through Friday) circulation figures from 1993 through 2006:

We find that within the 31 county area that includes and surrounds New York City, and which encompasses the New York Times' home market, circulation has now dropped 30.0% below its 1993 peak. Meanwhile, when we include the newspaper's national circulation, we find that the New York Times' total circulation has dropped some 6.7% below its 1993 peak.

The following table provides the year-by-year weekday circulation data provided by the New York Times in their annual filings with the SEC:

| New York Times Weekday Circulation, 1993-2006 |

|---|

| Year | Weekday Circulation (Mon-Fri) | Percentage of Total Circulation in NYC | Weekday Circulation Within NYC Market | Weekday Circulation Outside NYC Market |

|---|---|---|---|---|

| 1993 | 1,183,100 | 64 | 757,184 | 425,916 |

| 1994 | 1,148,800 | 64 | 735,232 | 413,568 |

| 1995 | 1,124,300 | 62 | 697,066 | 427,234 |

| 1996 | 1,111,800 | 62 | 689,316 | 422,484 |

| 1997 | 1,090,900 | 62 | 676,358 | 414,542 |

| 1998 | 1,088,100 | 61 | 663,741 | 424,359 |

| 1999 | 1,109,700 | 60 | 665,820 | 443,880 |

| 2000 | 1,122,400 | 59 | 662,216 | 460,184 |

| 2001 | 1,143,700 | 58 | 663,346 | 480,354 |

| 2002 | 1,131,400 | 55 | 622,270 | 509,130 |

| 2003 | 1,132,000 | 53 | 599,960 | 532,040 |

| 2004 | 1,124,700 | 50 | 562,350 | 562,350 |

| 2005 | 1,135,800 | 49 | 556,542 | 579,258 |

| 2006 | 1,103,600 | 48 | 529,728 | 573,872 |

The data in the table confirms that the New York Times has primarily become a national newspaper at the expense of its home market. In 1993, the 31-county New York City market represented 64% of its total circulation. In 2006 however, the New York City market represents just 48% of its total weekday circulation.

The data also confirms that the first drop in the newspaper's national year-over-year circulation figures since its management began focusing on a national publication strategy in 1998, as this figure declined by 0.94%.

But what about the Sunday edition of the New York Times? How has it fared over this period?

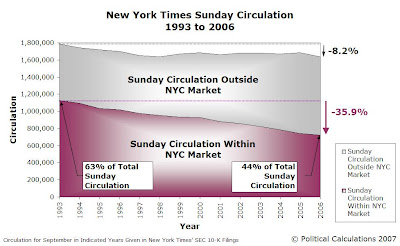

Would you believe worse? The following chart illustates the decline of the New York Times' Sunday edition:

We find that the New York Times' circulation in its home market has steadily dropped to a figure 35.9% below its peak value in 1993. Meanwhile, when we add the newspaper's national circulation to the totals in 2006, we find that it has declined by 8.2% since 1993's peak.

The table below provides the year-by-year circulation figures for the New York Times' Sunday edition:

| New York Times Sunday Circulation, 1993-2006 |

|---|

| Year | Sunday Circulation | Percentage of Total Circulation in NYC | Sunday Circulation Within NYC Market | Sunday Circulation Outside NYC Market |

|---|---|---|---|---|

| 1993 | 1,783,900 | 63 | 1,123,857 | 660,043 |

| 1994 | 1,742,200 | 63 | 1,097,586 | 644,614 |

| 1995 | 1,720,300 | 60 | 1,032,180 | 688,120 |

| 1996 | 1,701,800 | 60 | 1,021,080 | 680,720 |

| 1997 | 1,651,400 | 59 | 974,326 | 677,074 |

| 1998 | 1,638,900 | 58 | 950,562 | 688,338 |

| 1999 | 1,671,200 | 56 | 935,872 | 735,328 |

| 2000 | 1,686,700 | 55 | 927,685 | 759,015 |

| 2001 | 1,659,900 | 53 | 879,747 | 780,153 |

| 2002 | 1,682,100 | 51 | 857,871 | 824,229 |

| 2003 | 1,682,100 | 49 | 824,229 | 857,871 |

| 2004 | 1,669,700 | 47 | 784,759 | 884,941 |

| 2005 | 1,684,700 | 44 | 741,268 | 943,432 |

| 2006 | 1,637,700 | 44 | 720,588 | 917,112 |

Again, we find that 2006 marked the first year in which the Times' circulation outside the NYC market, fell from the previous year since the newspaper's management began focusing on growing its national circulation in 1998. The year over year drop from 2005 to 2006 represents a 2.8% decrease in the Sunday edition's circulation.

We wonder if these declines in the output of the New York Times in 2006 might account for the perception of its reporter, David Leonhardt ($$$), that the entire U.S. manufacturing sector is in recession, despite all evidence to the contrary since he made his statement in February 2007. (HT: Tom Blumer)

In any case, the substantial declines of both the weekday editions and the Sunday edition of the newspaper suggest, combined with recent changes by the newspaper's management that will likely accelerate these trends, means that the New York Times is running out of time and thus, the Gray Lady is fading into the twilight of its existence. At very least, as we have known it.

Previously on Political Calculations

- The Incredibly Shrinking New York Times

- Declining Circulation at the New York Times

- The Legacy of Walter Duranty

Labels: business

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.