We'll be back in the New Year, but we thought we'd stop in long enough to comment on the unusual placement of headlines at the Drudge Report this morning. We snapped the following image of the middle column of the site:

Hmmm. Just whose technology do you think is better?...

Elsewhere on the Web

The links to the articles behind the Drudge headlines!

Labels: none really

... continues to retreat in an orderly fashion!

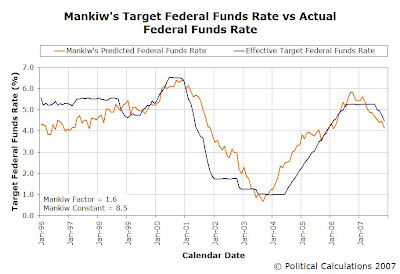

Looks like our prediction from February 1, 2007 has come true. Sorry, Paul!

Labels: recession forecast

Welcome to the Friday, December 21, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts that we could find in the past week's best business and money-related blog carnivals!

Welcome to the Friday, December 21, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts that we could find in the past week's best business and money-related blog carnivals!

This is the last edition of OMM for the year for us! We'll be gone all next week and when we come back in the new year, the first edition of On the Moneyed Midways will not just exclusively feature the best posts we found in 2007, we'll also highlight the best bloggers we found in 2007 as well!

So, until then, the best posts of the week that was await you below....

| On the Moneyed Midways for December 21, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Why the $1000 Emergency Fund? Choice #1 | I've Paid for This Twice Already | Paidtwice provides invaluable advice in explaining why setting up a decent-sized emergency fund should be the first thing you do when beginning to work your way out of debt! |

| Carnival of HR | Forget "Succession Planning." Instead Think "Leadership Development." | Three Star Leadership | Wally Bock delivers Absolutely essential reading! for any business owner or manager within a company: "Succession planning is all about having 'a name in an envelope' to replace the CEO. Leadership development is about having two or more qualified replacements for any management position." |

| Carnival of Real Estate | Think to Differentiate Your Real Estate, Restaurant, or Retail Store | Business is Personal | Mark Riffey finds the mashup potential of marketing your business given its relationship to the things around it - things like restaurants, entertainment venues, coffee houses, schools, daycare, etc. Absolutely essential reading! |

| Festival of Stocks | This Year's Christmas Gift: FBR Group | Value Investing News | Jeffrey Annello reviews the investment potential of Friedman, Billings Ramsey Group (aka FBR or, our favorite abbreviation of a corporate name: Fried Bill Rams), a company that has transformed itself in the wake of the sub-prime lending and real estate fallout into what he argues is a very strong value (and yes, he owns the stock.) |

| Small Business Issues | Do People Remember You? | Copywriting Tips | Do you want to sell your skills quickly? Do you have an elevator speech yet? Carol Bentley takes you step-by-step through how you can create your own elevator speech in The Best Post of the Week, Anywhere! |

| Black Pearl (Real Estate) | What Is a Brand? | BloodhoundBlog | Gregg Swann didn't award any real estate business-related posts with the Odysseus Medal this week, so we're featuring his Black Pearl winner. Bill Leider contradicts the conventional wisdom that a brand is only about name recognition and argues that "the kind of experience people have in doing business with you IS an integral piece of your Brand." |

| Carnival of Personal Finance | Confessions of a Car Salesman | Million Dollar Journey | Want to get the best deal on a new or used car? Frugal Trader excerpts the key lessons to take away from an article at Edmunds.com on all the tricks car salesmen use to make the most money for the dealer and themselves. |

| Festival of Frugality | Mommy I'm Bored! | Mommy Gets Paid | Mommygetspaid finds 10 things that kids stuck inside in bad weather can do that won't strain your pocketbook! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Once again, we here at Political Calculations dare to plunge into the treacherous waters of economic forecasting, now that the final revision for US GDP in the third quarter of 2007 has now been released by the BEA!

First up, let's take a look at our GDP bullet charts for the most recent reporting period, which shows the annualized change in inflation-adjusted GDP over a one-quarter and two-quarter period against the backdrop of the next two most recent quarters and overall historical GDP performance since 1980 (shown as the temperature scale background!):

As we've noted before, these figures are far higher than we had originally anticipated and, if we could put our finger on one thing that might be behind it, we would point to the data's Price Deflator, which clocked in at the especially low level of 1.0% for the third quarter of 2007. This figure has shown quite a bit of volatility in the past year, ranging from a high of 4.2% just two quarters earlier in 2007-Q1 to 1.0% as of 2007-Q3. The table below shows the level of the price deflator for each quarter from 2004-Q1 onward:

| GDP Price Deflator Percentage by Quarter, 2004-2007 | ||||

|---|---|---|---|---|

| Quarter | 2004 | 2005 | 2006 | 2007 |

| First | 3.7 | 3.9 | 3.4 | 4.2 |

| Second | 3.8 | 2.6 | 3.5 | 2.6 |

| Third | 2.3 | 3.5 | 2.4 | 1.0 |

| Fourth | 3.2 | 3.5 | 1.7 | |

| Annual Range [Maximum - Minimum] | 1.5 | 1.3 | 1.8 | 3.2 |

It's interesting to note that when the Real GDP annualized one-quarter growth rate clocked in at 0.6% back in 2007-Q1, the corresponding GDP Price Deflator was 4.2%, the highest we've seen over these years. Likewise, the exceptionally high GDP figure for 2007-Q3 coincides with the lowest level noted by the BEA for this period. In the meantime, Our best guess is that at some point in the future, the price deflator data for 2007 will be straightened out in another revision as other economic data fills in the larger economic picture.

Regardless, the GDP numbers are the only numbers we have now, so we're going to run with them! Our following chart shows where we might expect GDP to be for the fourth quarter of 2007 using the Climbing Limo method and the Modified Limo method for forecasting GDP levels:

Given the huge swings that we've observed in the GDP Price Deflator, we would anticipate the Real GDP figure will come in between the forecast values produced by the Climbing Limo and the Modified Limo forecasting methods. It may even very well be in negative territory when considering a one-quarter annualized growth rate (the two-quarter annualized growth rate should still be positive.)

But Can We Trust the BEA's GDP Price Deflator?

Tom Blumer has observed that the last time that we saw the Real GDP growth rates at the levels that they've registered in this year was in the run-up to the 2000 elections. Like the upcoming 2008 election, the year 2000 was the last time in which an incumbent was not running for re-election as President.

Now, let's have some fun and explore a political conspiracy theory! Let's say that foul things are afoot and that the data jocks at the BEA favor one political party in particular for the Presidency. Let's call that party "The Democrats."

In 2000, "The Democrats" were the incumbent party of the Presidency. Let's say that the BEA data jocks, favoring this party, wanted to use their influence over the numbers to try to skew the picture of the U.S. economy to favor their preferred party's presidential replacement candidate. If you were the leader of these crooked bean counters, how would you skew the GDP numbers to favor that candidate?

If you answer "way up," you might be on to something! The year 2000 saw some of the highest reported GDP growth rates of recent times that weren't a result of the economy rebounding after a large-scale natural disaster.

More importantly, these original figures were revised sharply downward years later to reflect what was actually an economy sliding strongly toward recession.

The Illusion of Recession

Now, let's flash forward to 2008. Let's say that the BEA is still under the sway of many of the same bean counters as in 2000, but now, the incumbent party of the presidency is not "The Democrats." We'll ask the question again: as the leader of the Evil Data Jocks, how might you skew the GDP data under your control to favor the candidate of your preferred party?

More than likely, "way down" would be your choice. The reason why is pretty straightforward - history suggests that if the economy is doing all right, the odds favor the incumbent party of the presidency. But, if the economy is not doing all right, they favor the party that's out of power in the presidency.

Update (22 December 2007): Greg Mankiw posts a chart that would seem to confirm this correlation!

So, if you can create the illusion that the economy is not doing all right, that would shift things in favor of your preferred party. The question then becomes "how can you create that illusion?"

For that, you might first want to jack up the apparent rate of GDP growth in the economy in the year before the election, then create an "artificial recession" by skewing the underlying data to produce apparently negative growth rates. From what we've seen in the influence it has over the Real GDP figure, manipulating the level of the GDP Price Deflator might be an ideal way to achieve this effect.

Is There Really a Conspiracy?

We don't know, and we doubt it, but it sure is fun to consider! In the meantime, we'll have wait to see what the evil data jocks at the BEA are cooking up with the next GDP data release!

Are the BEA's Data Jocks Really Evil?

All data jocks are evil. You didn't know?

Labels: gdp, gdp forecast

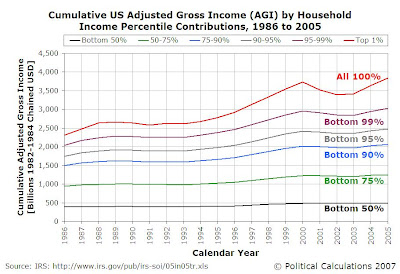

We're picking up the job that Mickey Kaus "commissioned" as it provides the opportunity to, as Mickey put it, "extract the trend [the New York Times David Cay] Johnston failed to extract," while also allowing us to discard the rather lame attempt at such produced by the leftist-financed Economic Policy Institute whose work, as we've found in our experience, suffers from too many deficiencies to be taken simply at face value.

We're picking up the job that Mickey Kaus "commissioned" as it provides the opportunity to, as Mickey put it, "extract the trend [the New York Times David Cay] Johnston failed to extract," while also allowing us to discard the rather lame attempt at such produced by the leftist-financed Economic Policy Institute whose work, as we've found in our experience, suffers from too many deficiencies to be taken simply at face value.

In looking at the spreadsheet data from the Congressional Budget Office, the first thing we noted is that it seemed to be undercounting the number of households in the top percentiles by significant numbers. We know this because we cross-checked the percentile figures with data we found at the IRS' Tax Statistics web site. The discrepancy was large enough that we decided to instead use the original source data from the IRS for all households with positive Adjusted Gross Incomes (AGI).

Update: David Cay Johnston e-mails to help clarify where the difference in the numbers between the CBO and the IRS arise:

... the IRS data, on which I have reported extensively, does NOT measure households, as you posted. It measures taxpayers, who can be a individual or a married couple.

It would appear that the CBO consolidated these types of return filers purely into households, which would largely account for the differences between the two sets of data.

The downside of using this data is that it only covers the twenty year period from 1986 to 2005, rather than the twenty-seven year period covered by the CBO's data. The advantage of using this data is the greater accuracy of the numbers from an original source (the CBO would be a secondary source) and the twenty year period covered by this data is more than adequate from which to determine any trends.

In our next step, we extracted the number of households within the IRS' data sources' percentile groupings and found how much income each of the resulting groupings had from 1986 through 2005. The groupings of households for which we found this data include:

- Households in the bottom 50% of positive AGI earners

- Households between 50% and 75% of positive AGI earners

- Households between 75% and 90% of positive AGI earners

- Households between 90% and 95% of positive AGI earners

- Households between 95% and 99% of positive AGI earners

- Households in the top 1% of positive AGI earners

Having extracted the household data the way that we have, we can now "stack" each group on top of each other to gain a sense of measure the total Adjusted Gross Income "base" for each year from 1985 through 2005 from which income taxes would be applied. Our results are revealed in the following chart, in which the income data has been adjusted for inflation using 1982-1984 as the base period of the Consumer Price Index for Urban Consumers:

This chart reveals that the years from 2001 through 2004 were exceptionally bad years for those at the top of the income spectrum in the United States, as their contribution to overall adjusted gross income earned dipped the most in these post-Dot-Com Bubble, post-2001 recession years.

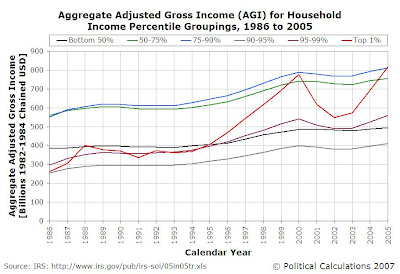

In our next chart, we'll "unstack" the year-to-year data from 1986 to 2005 for each of our household income percentile groupings. This step allows us to directly compare the annual contribution of each year's groupings with respect to one another:

Looking over the entire span of the data, we find that all the percentile groupings in 2005 are well ahead in the aggregate of where their counterparts were in 1986, as their accumulated adjusted gross incomes generally rose throughout this twenty year period.

What's more interesting is shown by the red line representing the Top 1% of positive AGI-earning tax filers, which confirms the extent to which the years between 2000 and 2005 were bad ones for billionaires. It's only in 2005 that the households represented by this grouping reached and slightly topped the levels seen last in the year 2000. Meanwhile, the other top percentile groups show either minor dips or relative flatness in their aggregate income for these years, but nowhere near the degree that we see for the Top 1% of income tax filers.

The volatility in the top-tier of household AGI earnings is underscored in the next chart. Here, we've simply charted the number of positive AGI-earning tax filing households for each year from 1986 through 2005 that fall within the Top 1% Household AGI Percentile:

Update 15 February 2008 The chart we had originally posted was mislabeled. It showed the non-inflation adjusted income for each tax year from 1986 through 2005, instead of the number of tax filers in the Top 1% based on adjusted gross income, which we now show above!

The level of volatility seen in just this twenty year period has important implications for determining an appropriate and sustainable tax policy for the United States. To see why, consider an incompetently designed tax policy, such as California's 2006 Proposition 82, which would have paid for universal preschool in that state with a dedicated 1.7% tax on individual incomes over $400,000 and couples' incomes over $800,000, above and beyond California's already high income tax rates for these income levels.

As this group falls within the Top 1% of income tax filers, the consequence of having a series of bad years for billionaires, much like the period from 2001 through 2004, would put California's entire preschool system at risk as the funds needed to operate the universal preschool system would simply not be available. The consequences of this funding "shortfall" would obviously spill over to the entire California state budget as the state would be forced to reconsider all its spending priorities. This inevitable outcome would be true for any tax imposed on a specific group or product to provide dedicated funding for a government program.

So we see that rather than just soaking the rich to benefit the children, the advocates of Proposition 82 would actually be screwing over the children too! If only these advocates really cared about them....

Fortunately, for Californians and especially preschool-age children and their families, California's 2006 Proposition 82 failed. And now you know why that was a good thing, as well as why jacking up taxes on "the rich" to pay for "universal" programs may not be such a great idea.

Labels: income distribution, taxes

And we read a lot of them! Here's Tim Haab:

Oh, they're going with the pixie dust theory.

And there's so much more! Absolutely essential reading!(TM)

Labels: none really

Much is being made of the disagreements between the leadership of the U.S. House of Representatives and the U.S. Senate that has largely resulted in a legislative quagmire where the body is largely unable to meet its basic obligations on behalf of the people of the United States. Worse, many of the so-called leaders are acting like spoiled children throwing a tantrum.

Much is being made of the disagreements between the leadership of the U.S. House of Representatives and the U.S. Senate that has largely resulted in a legislative quagmire where the body is largely unable to meet its basic obligations on behalf of the people of the United States. Worse, many of the so-called leaders are acting like spoiled children throwing a tantrum.

While we're firmly in the camp that the root cause of the problem is the lack of effective quality leadership on both sides of the U.S. Capitol building, it does occur to us that the President does have a useful authority in settling the disagreements between the two houses of Congress: the President could give the members of the House and the Senate a much needed recess until they can get their act together. From the U.S. Constitution, Article II, Section 3, emphasis ours:

Section 3 - State of the Union, Convening Congress

He shall from time to time give to the Congress Information of the State of the Union, and recommend to their Consideration such Measures as he shall judge necessary and expedient; he may, on extraordinary Occasions, convene both Houses, or either of them, and in Case of Disagreement between them, with Respect to the Time of Adjournment, he may adjourn them to such Time as he shall think proper; he shall receive Ambassadors and other public Ministers; he shall take Care that the Laws be faithfully executed, and shall Commission all the Officers of the United States.

From this, it would appear to us that the President does indeed have the authority to give the Congress that apparently much needed time-out and metaphorically send the members of Congress to their rooms until they can work their leadership problems out.

We would suggest that a good place to start would be to revisit who should be in the positions of leadership of the U.S. Congress. Perhaps we could convince the members of the congressional majority who are angling to be their party's presidential candidate in 2008 come back to Capitol Hill and use the opportunity to show if they actually have any real leadership ability.

Then again, why wait to go through all this? All these potential presidential candidates could demonstrate to the people of the United States that they can be effective in taking charge by fixing the problems within the Congress without having to have the President adjourn it. It's a fantastic opportunity, if only they take it!

What would it say about them and their leadership ability if they won't?

Update: Could the news that Senator Robert Byrd is being dethroned from chairing the Senate Appropriations Committee be evidence that the majority party in Congress is finally starting to deal with its deep-rooted leadership problems?

Labels: politics

Not long ago, we revealed the basic mathematical equation that describes the relationship between share prices and dividends in the stock market, which we found works better than the Price Earnings Ratio (P/E Ratio) as a gage that you may use to assess the valuation of the stock market. The general form of that equation is:

The most important part of this equation is the exponent G, which we stated to be the ratio of the growth rate of stock prices and the growth rate of dividends per share.

Well, we stated that, but we didn't show that. We're going to show how to get there today, but in doing so, we recognize that we risk having a major portion of our audience tune out entirely, as there's nothing more boring than reading a blog post with a lot of math in it. We're well aware that incorporating a lot of math into a blog post can really deliver the kiss of death for reader interest. Unless, that is, there's some other hook to capture the reader's attention.

So, with your as-of-now willing consent, we're going to simultaneously conduct an experiment in mind control. If you don't want to participate, you really need to back out now.

Still here? Good! What enables our ability to seize control of your advanced mental functions is a technology invented back in the 1990s called "hypno-helio-static-stasis." Developed by Dr. Clayton Forrester, hypno-helio-static-stasis breaks down the neural synapses centered in the portion of your brain that controls your free will, rendering you unable to exercise that free will.

Still here? Good! What enables our ability to seize control of your advanced mental functions is a technology invented back in the 1990s called "hypno-helio-static-stasis." Developed by Dr. Clayton Forrester, hypno-helio-static-stasis breaks down the neural synapses centered in the portion of your brain that controls your free will, rendering you unable to exercise that free will.

The key to the technology hinges upon it being delivered via a medium that would normally simply cause great boredom to descend upon you, which creates the necessary conditions by which certain neural receptors become vulnerable to the control technology, X-4. In his day, Dr. Forrester used the movie "Radar Secret Service" as his primary delivery vehicle. Today, we're going to use math, which should work just as well, if not better. We'll be monitoring your progress as we go along. Let's get started.

We'll begin by noting that both share prices, as represented by the index value of the S&P 500, and dividends per share have historically both exhibited exponential growth over much of their histories, which is confirmed by regression analysis (shown in the two charts below, which provide the average monthly figures for each covering the modern era for dividends in the S&P 500):

![P(t - to) = Po*e^[Rp*(t - to)]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEisTJBvjnIStO7OWyOmrKfK0ZRxoExfJlEFLb8GYnh6dEFbs4e5asReQm6hyHvlamgYSwGbI-D4FFRt97YlqyoyZLTBkxp6wGLyW99-InUj5inc9uMobX8QdGrCznuFAOExUA2_/s400/SP500-Price-per-Share-Jan-1952-to-Nov-2007-Log-Scale.JPG)

![D(t - to) = Do*e^[Rd*(t - to)]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgzcU0BA0taizilpURxu85zWDOqlyI_M0pATuQRkCf4-v_BUsiVjL337597xLs6ANkTzTvT0APwnT9yJ5RdBUiN6AcBAuLkOfP5joLRpZPXWT7gE7Jq0-UKB_Sy4G6Q7-cOUWVm/s400/SP500-Dividends-per-Share-Jan-1952-to-Nov-2007-Log-Scale.JPG)

The general form of these exponential functions, as taken from an arbitrary starting point in time, t0, is given by:

Share Price:

Dividends per Share:

where:

P0 = Share Price at the arbitrary starting point in time D0 = Dividends per Share at the starting point in time Rp = Growth Rate of the Share Price Rd = Growth Rate of Dividends per Share t = A subsequent point in Time (occurring after the arbitrary starting point)

For shorthand purposes, we'll rewrite the difference between t and t0 as: T = t - t0, which represents Elapsed Time. Rewriting these equations with this shorthand, we get:

Share Price:

Dividends per Share:

By now, you should begin feeling the hypno-helio-static-stasis technology beginning to take effect. Eyes starting to glaze over, difficulty focusing, that sort of thing. Don't worry, it won't hurt. Not much, anyway. And then, maybe you might be one of the few who can resist? We'll see about that....

From here, we'll substitute these expressions into our equation that defines the relationship between Share Price, P and Dividends per Share, D:

This becomes, after our substitutions:

Has your mind begun retreating to the safety of your childhood under the influence of the effects of hypno-helio-static-stasis yet? No? Fear not, you'll be there soon....

The next step will be to deal with the constant, A. We'll do this by noting our boundary conditions, which are defined at the arbitrary starting point represented by our equations, when the Elapsed Time is equal to zero:

Initial Share Price:

Initial Dividends per Share:

Making these replacements representing the initial Share Price and Dividends per Share into our equation gives us the following:

We can now solve for A, which turns out to be the ratio of the Share Price and the Dividends per Share raised to the power, G:

Are you reading this as A Po DoG? The po dog says WOOF! The cow says MOO! Back to your childhood, just as we told you! We're nearly ready to take control now....

All that's now left to determine in our formulation of the relationship between Share Price and Dividends per Share is "G". We'll replace A with the value we just found in our more general equation:

Applying the properties of exponents, namely those of raising a power to a power and raising a product to a power, we can rewrite this equation as follows:

Now we have it. From now on, we control the horizontal. We control the vertical. We're working on the diagonal. This... is wrong tool. We'll be back with you shortly.

With the term D0G appearing in both the numerator and denominator in the expression on the right hand side of our equation, we verify that this portion of our term is equal to one, effectively cancelling it out of the equation:

Quick, think of a color!

Now, think of a tool.

If you're now thinking of a red hammer, your free will is no more! And if you're one of the few who imagined a tool of another color, what's left of your free will soon will crumble as you fight to keep from thinking of a white giraffe. As long as you don't think about a white giraffe, you still have what remains of your free will. Whoops! There it goes! Oh, don't whine. The release form has been signed, it's an improvement, and it's not like you ever really used it for anything anyway so you can't complain about it now. Literally....

Our next step will be to eliminate the P0 term in the equation by dividing both sides of the equation by P0:

From here, we'll take the natural logarithm of both sides of the equation:

Since the natural logarithm is the inverse of the exponential function, we can now write our equation as:

We can now solve directly for G. Dividing both sides of the equation by RdT, we obtain our final result:

This result confirms that the exponent G is the ratio of the Growth Rate of Share Price and the Growth Rate of Dividends per Share. For simplicity, we'll call this relationship the Price-Dividend Growth Ratio, or maybe even more simply, the G-Ratio!

We can now write our fundamental stock market equation relating share prices and dividends per share as follows:

Muhuhahahahahahah! You know that tune you can't stop playing over and over in your head? We're the bandleader! Dance, puppet, dance!

And that concludes our experiment, all except for the post-hypno-helio-static-stasis suggestion we implanted and will activate at some arbitrary time in the future. Until then, your free will, such as it is, is now again your own. Thank you for participating!

Welcome to the Friday, December 14, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts contributed to and collected from the past week's best business and money-related blog carnivals!

Welcome to the Friday, December 14, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts contributed to and collected from the past week's best business and money-related blog carnivals!

It was a very slow week in the world of business and money-related blog carnivals! So much so that three of this week's top posts came from the Carnival of the Capitalists! With any luck though, next week should be much better as we'll be in sync with the carnivals that post on a biweekly schedule.

Until then, the best posts of the week that was await you below....

| On the Moneyed Midways for December 14, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Personal Finance | 2 Ways to Save That Shouldn't Work | Getting To Enough | GTE finds two counterintuitive ways to increase how much you can save: spending part of your windfalls and not continually shopping for the best deals! |

| Carnival of Money Stories | Losing My (Investing) Virginity | Credit Withdrawal | Randall was young once, and naïve, and a bit stupid about finance - and then one day became an investor. He recounts the story in a short post that highlights the first three investing mistakes he made, and what he'd do differently today. |

| Carnival of the Capitalists | Do Sears' Troubles Hint at Coming Wave of Bankruptcies? | The Corner Office | Just two years ago, Wall Street whiz Eddie Lampert was considered to be a genius when he acquired Sears. Today, the company has falling sales and may soon be forced to restructure itself by selling off assets. William J. Holstein weighs in on the irony of an old-fashioned business being tougher to run than engineering hugely complex takeover deals. |

| Carnival of the Capitalists | A Post-Mortem on a Lean Six Sigma Training Disaster | The Scratching Post | What good is training to implement Lean Six Sigma process improvement practices for an organization that can't really benefit from it? K T Cat compares the effort to Mao's disastrous Great Leap Forward in China. |

| Carnival of the Capitalists | Madness of Groups | SOX First | Leon Gettler asks why smart executives make bad decisions, then points the finger of blame at "Groupthink." The Best Post of the Week, Anywhere! |

| Festival of Frugality | The Perfect Gift to Give When You're Broke | Broke Grad Student | The Broke Grad Student finds a gift worth giving that's cheap, shows you care, and tastes delicious! |

| Small Business Issues | Refer, Refer and Be Referred | Copywriting Tips | Carol Bentley talks through a step-by-step method for creating your own referral matrix to track the progress of your business' relationships. |

| Odysseus Medal (Real Estate) | Is Something Shaking at Point2 Agent/ | The Phoenix Real Estate Guy | Recently, Phoenix-based Realtor Jay Thompson commented on the departure of Point2's Chief Operating Officer. Soon however, his site traffic showed something a lot bigger was underway in Saskatoon, Saskatchewan as he ended up breaking a bigger story! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The Bureau of Labor Statistics just released the latest Consumer Price Index data for November 2007 just minutes ago, and we here at Political Calculations are on top of it! We've already updated our signature tool, The S&P 500 at Your Fingertips, with the stock market's data through the previous month, and the table below shows the index' performance for the year-to-date, year-over-year and since January 1871:

| S&P 500 Selected Performance Data | |||

|---|---|---|---|

| Annualized Rates | Nominal Rate of Return (%) | Rate of Inflation (%) | Real Rate of Return (%) |

| Since January 1871 | 9.15 | 2.09 | 7.06 |

| Year over Year | 7.27 | 4.28 | 2.99 |

| Year to Date | 5.17 | 4.58 | 0.59 |

Today's S&P 500 Chart

Building on our earlier work for benchmarking the performance of the S&P 500 in terms of the remarkable relationship between the index' value and dividends per share, we've plotted the S&P 500 index value at market open on December 14, 2007 (1488.41) against where S&P anticipates the trailing one-year dividends per share will come in for December 2007 (27.85):

The chart demonstrates that for all the volatility we've seen given the liquidity issues in the financial sector related to the fallout in the sub-prime mortgage portions of these companies' portfolios, the basic order that emerged in the post-Dot-Com Bubble stock market continues to be robust. As such, the current value of the market is well within the range of where we should expect it to be in the absence of a disruptive event.

We were surprised to find out this morning that our S&P 500 At Your Fingertips tool is now included among the stock data resources maintained by London-based JF Holdings in their Equity Warehouse. You'll find us at the bottom, just below the links to the various text files incorporating annual UK stock market data going back as far as 1800.

Meanwhile, Jay Solo recently said the following about a recent post:

Political Calculations intrigued me with a post I expected to be boring: The Sun, in the Center. It's about a method of measuring appropriate stock values without relying on the traditional earnings per share. The correlation over time, using dividends as a leading indicator, is remarkable.

The part about expecting to be bored and turning out to be intrigued sounds about par for the course for our readers. If nothing else, it suggests to us that it may be time for a new motto to replace "Interactive Tools for Interactive Politics": "Unexpectedly Intriguing!"

Hey, it beats "Mostly Harmless," and is light-years ahead of "The Boring Made Dull, " and then some lawyer snapped up InstaPundit, so what else can we do?...

Labels: random thoughts

The U.S. Census released the latest trade data through October 2007 yesterday and, where trade between the U.S. and China is concerned, the U.S. trade "deficit" reached a new peak for the month, breaking the previous record set just a year earlier.

Not that this was much of a surprise. As our following chart indicates, the U.S. trade "deficit" with China typically peaks in October-November each year, as consumer goods produced in China, especially toys and consumer electronics, are delivered to the U.S. in advance of the Christmas shopping season:

Meanwhile, the growth rate of U.S. exports to China continued to outpace the growth rate of Chinese exports to the U.S. - much as it has since July 2003:

The faster pace of U.S. exports to China with respect to the growth rate of Chinese exports to the U.S. are reflected in our trade volume doubling period charts. The chart below confirms that the U.S. has doubled in volume again for the second time since January 2001:

The next chart shows the doubling rate of Chinese exports continuing at or near the pace it has maintained since April 1994:

Now for the questions:

- Is this the peak for the U.S. trade "deficit" for the foreseeable future? With the U.S. economy expected to slow, the rate of exports from China should slow as well, much as they did back in the March-November 2001 recession in the U.S. and especially if the Chinese economy grows at a faster pace. Combined with a slowly declining U.S. dollar with respect to the Chinese currency, the trade deficit should decline as Chinese exports to the U.S. become more expensive for U.S. consumers.

- If you were a Chinese exporter, and you expected both conditions described above to continue well into next year, would you seek to accelerate your exports to the U.S. to attempt to extract maximum value for your goods? Moving an increased volume of goods now might minimize the currency risk to you, but would the tradeoff be that you'll further reduce the amount that you'll export to the U.S. in the future below what you might have if the U.S. economy slows as expected?

Isn't trade fun?

Labels: trade

There it is! The question is now out and in the open and you are now compelled to find out. Geek Logik author Garth Sundem spells out why as only he can:

Whapish! Whapish!: the universal sign for "your girlfriend rules your life." There's even a chance your friends already crack this imaginary whip in your direction. But what's the real deal? Are you really whipped or do your friends simply have unreal expectations of you, due of course to their status as desperate geeks incapable of finding a date themselves and jealous of your good thing?

Well, one way you could find out who really rules your world is to use our latest Geek Logik tool, which is based upon the intricate formula Garth concocted just to help you answer this key question now dominating your existence! Just enter the indicated information in the guys-only tool below and we'll provide your results.

Before you do though, you'll need to get your output results from this other tool from our Geek Logik series, which the tool below requires as the third input factor. Don't worry about clicking the link and losing what you may already have entered - we'll open up the other tool in a new browser window, and it won't hurt a bit (unless she, and you know who we mean, finds out!...)

You are, of course, welcome to share your findings with your friends. Or keep them under wraps - we won't tell!

Labels: geek logik, tool

Today, the Federal Reserve will either cut the Federal Funds Rate (FFR) by 0.25% or they will cut it by 0.50%. In making this decision, they'll be using forward looking data that we might use to reverse engineer where the Fed believes the U.S. economy might be heading in the very near future.

Today, the Federal Reserve will either cut the Federal Funds Rate (FFR) by 0.25% or they will cut it by 0.50%. In making this decision, they'll be using forward looking data that we might use to reverse engineer where the Fed believes the U.S. economy might be heading in the very near future.

Last month, we modified our tool for anticipating where the Federal Reserve might next set the FFR using the two aspects of economic activity that the Fed has been tasked to balance: inflation and employment. The key measures our tool uses are inflation, as measured by the Consumer Price Index, Less Food and Energy and employment, as measured by the headline rate of unemployment.

The following charts illustrate the likely scenarios we see. Our first chart considers the possibility that November 2007 will come in at the same level as October 2007, with CPI less food and energy coming in at 2.17% and the rate of unemployment at 4.7%:

This chart suggests that the Fed is right on target with where it has set the Federal Funds Rate at 4.5%. The next chart considers the possibility that the rate of inflation will come in a tenth of a point lower, at 2.07%, with the unemployment rate unchanged at 4.7%:

With a predicted FFR of 4.29%, this scenario supports a quarter-percent cut and suggests that the Federal Reserve anticipates a lower rate of inflation ahead. Our third chart considers inflation less food and energy dropping to 2.07% as in the previous scenario, but with a 0.1% increase in the U.S. unemployment rate to 4.8%:

Coming in with a predicted FFR of 4.13, this scenario would be the most likely should the Fed choose to cut rates by 0.5% today. To get to the same place by just tweaking the inflation number, CPI less food and energy would need to drop by 0.2% to 1.97% from October 2007's level, which is not likely given historic factors (over the past ten years, the month of November features either the highest or second highest rate of inflation for the calendar year.)

These are just our possible scenarios - if you have you're own, you're more than welcome to get in on the fun!

And there you have it - a glimpse of what's in the Fed's crystal ball!

Update: The Fed only cut the Federal Funds Rate target to 4.25%, which suggests to us that unemployment will hold fairly steady, while the rate of inflation in the U.S. has slightly decreased, coinciding with a slowing economy. We'll have our confirmation soon as the Bureau of Labor Statistics is due to release the latest inflation figures on December 14th!

Meanwhile, a final-exam laden Bill Polley surveys the fallout....

Labels: forecasting

How's this for fun? In just one week, Political Calculations went from being a humble blog at with a readability level at the Junior High School level, with occasional posts written at the Elementary school level (for journalists):

All the way up to the post-grad level!

And the best part is that none of our regular readers skipped a beat!

The point of this post? None, really. Except maybe to point out that if you're looking to get smart fast, you should read Political Calculations on a regular basis!

HT: New Economist, where you have to be already be a genius to understand what the blog's talking about - we can only take you so far!

Labels: none really

Welcome to this Saturday, December 8, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts contributed to and collected from the past week's best business and money-related blog carnivals!

Welcome to this Saturday, December 8, 2007 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts contributed to and collected from the past week's best business and money-related blog carnivals!

What hot topics made our listing of the best posts of the past week? Combine the worsening housing market in the U.S. with credit cards, the dangers of being overly reliant on company-paid health insurance with plans to cut debt and finally, toss in a post about toilet paper and that pretty much covers this week's edition!

All these, and the rest of the best posts of the week that was, await you below....

| On the Moneyed Midways for December 8, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Side Effects of Being in Debt | Recipe for Financial Freedom | The Chef is going through an attitude shift, moving past the initial pleasure of owning things wanted and obtained via debt to now dealing with the mental side effects. Absolutely essential reading! |

| Carnival of Financial Goals | My 2008 Financial Resolution | Broke Grad Student | Broke Grade Student is tired of calling himself broke, and has a plan to pay $833 per month to pay off half his student loans by the end of 2008. |

| Carnival of Personal Finance | Are Credit Cards Appropriate 'Toys' for Kids? | Don't Mess with Taxes | Kay Bell examines how paying with plastic is becoming the preferred method for buying things for teens, while the classic games younger children play are being re-geared to incorporate credit cards. |

| Carnival of Real Estate | Fear Based or Reality Based… | Boggs Development Group | Doug Boggs believes there's really no such thing as a national real estate market, and is finding places where the micro-economic climate and demographic trends makes sense for investing. |

| Carnival of Taxes | Taking the Mystery Out of Home Office Tax Deductions | Ask the Career Counselor | Did you know the home office tax deduction is no longer a red flag for the IRS? The Career Counselor explains that and a lot more in a post aimed for anyone who works from home! |

| Carnival of the Capitalists | Cognitive Fitness, The Future of Work, and Concept Maps | SharpBrains | There are really no words to describe this post, and that's because it's mostly a picture, or rather, a concept map! |

| Cavalcade of Risk | Why Getting Your Health Insurance at Work Could Be Dangerous | Consumer's Health Insurance Blog | Jonathan Pletzke spells out why those with significant medical problems who are unable to continue working should consider buying an individual health policy. |

| Festival of Frugality | Don't Skimp on the Toilet Paper | AskDong | Dong dares do what few, if any, have ever done before: work out the math to find out just how much over a lifetime you could save by buying the cheapest, roughest, and flimsiest toilet paper there is - and answers if it's really worth it! The Best Post of the Week, Anywhere! |

| Festival of Stocks | Dividend Stock Wednesday: PepsiCo Inc (PEP) | The Dividend Guy | The Dividend Guy personally prefers drinking Coke products (and owns the stock), but was willing to consider buying Pepsi for his portfolio. After running the numbers, he won't be anytime soon! |

| Odysseus Medal (Real Estate) | 2008 Housing Market Outlook for U.S. Investors | Mortgage rates Report | Calling the U.S. housing market outlook for 2008 "somewhat bleak," Brian Brady thinks that mortgage lenders are delaying foreclosures and short sales into next year to "hide" the 2007 numbers in what they expect to be larger numbers in 2008. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The latest jobs numbers from the Bureau of Labor Statistics and payroll processing giant ADP are out, and that means we can use our tool for finding the weighted average for the monthly change in jobs in the US! Here's the breakdown for the inputs we use in our tool, which is based on math developed by Jim Hamilton to get a better picture of the jobs data:

| Jobs Data for November 2007 | |

|---|---|

| Jobs Data | Values |

| BLS Nonfarm Payroll Employment Monthly Change | +94,000 |

| BLS Table A, Household Data, Civilian Labor Force, Employment, Monthly Change | +617,000 |

| BLS Table A, Establishment Data, Nonfarm Employment, Government, Monthly Change | +30,000 |

| ADP Employment Report | +189,000 |

Using this data in our tool, we find the weighted average of all these changes in the level of jobs in the U.S. from October to November to be 211,100. Looks like Barry Ritholtz picked the wrong day to bet the under!... (To be fair, Barry focuses on the Non-Farm Payroll number and not the weighted average figure. He has post-news release comments here!)

The Skeptical Optimist has also looked at the jobs report and compared the quality of jobs today compared to those of one year ago. He finds that:

Our economy created more high-paying jobs than it lost in the last 12 months. (Either that, or we imported more high-paying jobs than we exported, which would mean we have a trade surplus in jobs. Presumably, that's great news to Lou Dobbs and John Edwards, so we should be hearing them cheer up any time now, one would think.)

Be sure to see the charts (which the Skeptical Optimist does better than anyone!)

Labels: jobs

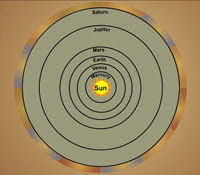

Once, the Earth was held to be at the center of the entire universe. While a strange idea to most people today, it's really not all that hard to understand why. For ancient astronomers viewing the heavens from the Earth, everything, the sun, the moon, the planets and the stars, all appeared to be moving about the Earth in an orderly procession of circular orbits. It made sense because it seemed to describe reality.

Once, the Earth was held to be at the center of the entire universe. While a strange idea to most people today, it's really not all that hard to understand why. For ancient astronomers viewing the heavens from the Earth, everything, the sun, the moon, the planets and the stars, all appeared to be moving about the Earth in an orderly procession of circular orbits. It made sense because it seemed to describe reality.

At least, until they began looking more closely. The movements of two planets, Venus and Mercury in particular, were a particular puzzle as they would, from time to time, stop moving in that orderly procession, go into reverse, stop again, then resume what appeared to be their proper path. And so, to accommodate such discrepancies, the model that ancient astronomers constructed to explain the universe became more complicated. Instead of heavenly bodies simply moving in pure circles about the Earth, they moved in circles within circles. And this model was widely accepted because it was consistent with what came before and seemed to explain reality pretty well.

As more time went by, and as people became better and better at measuring how the sun, moon and planets moved about in the sky, the geocentric model became more and more complicated and elaborate with its circles within circles. A lot of highly intelligent people contributed to the understanding of the motion of the planets and the fact that they were able to describe much of what they saw so well using this model is a testament to their brilliance.

All that changed in 1530 when Nicolas Copernicus (born Mikolaj Kopernik), challenged this prevailing model of the universe with his own observations that suggested that the Sun, and not the Earth, was truly at the center of all the planets and that this heliocentric model was not only much simpler than the elaborately complex geocentric models of his day, it did a much better job at describing the order evident in the sky.

All that changed in 1530 when Nicolas Copernicus (born Mikolaj Kopernik), challenged this prevailing model of the universe with his own observations that suggested that the Sun, and not the Earth, was truly at the center of all the planets and that this heliocentric model was not only much simpler than the elaborately complex geocentric models of his day, it did a much better job at describing the order evident in the sky.

It was controversial, to say the least, as it upended nearly a thousand years of the best thinking of a lot of very smart and powerful people in how they viewed the universe, but as people continued to become better and better at measuring the movement of objects in the sky, and aided by new tools like the telescope that really expanded that ability, ultimately confirmed that the heliocentric model is a much better way to describe the reality we observe.

We're going to do that today with the U.S. stock market.

The Price/Earnings Ratio

The Price-to-Earnings Ratio, or P/E Ratio, is the result of dividing a stock's price per share by its earnings per share. Originally developed by Benjamin Graham and David L. Dodd, the P/E Ratio is the benchmark against which investors measure the performance of the stock market. The following chart follows Graham and Dodd's original formulation of the P/E ratio for the S&P 500 for the period from January 1871 through November 2007, in which the Price per share is the average monthly value of the S&P 500 index and the Earnings per share are taken over a one-year period ending in the month in which the price per share is given (trailing one-year earnings):

The problem with this model of stock market valuation may be seen in the all-time peak value of 46.71 for the P/E ratio that occurred in March 2002. Prior to this time, the P/E Ratio provided a pretty good method of evaluating whether stocks were relatively priced too high or too low compared to the market's long term averages. The extremely high valuations in the Price/Earnings Ratio that coincided with the time of the Dot-com Bubble, which is generally believed to have occurred in the period from 1995 to 2001, would seem to validate that observation. At least, until that inconvenient spike in the P/E Ratio in March of 2002 occurred.

Circles Within Circles

For Robert Shiller, who had famously described the stock market bubble of the late 1990s in his book Irrational Exuberance, that spike in the P/E Ratio in March 2002 is particularly inconvenient as it took place well outside the accepted period of the Dot-com Bubble. So, Shiller adapted the standard model of the P/E Ratio to better reflect that reality by making the original P/E model more elaborate, and more complex.

Building on earlier work with John Campbell, Shiller recalculated the Price-Earnings Ratio for the S&P 500 using the average of annual earnings per share for the index over rolling 10-year periods. Doing so has the effect of smoothing out the volatility of the earnings per share data, while also reducing their value (as corporate earnings have generally and consistently risen over time). The following chart, taken from the New York Times, illustrates the result for the period from January 1881 (recalling that the earnings data covers the period from January 1871 to January 1881) to either June or July 2007:

To further illustrate the increased complexity of this model, we should note that Shiller needed to adjust the earnings per share data to account for inflation in the earnings per share data used to produce the 10-year average. Likewise, Shiller adjusted the price per share data as well (to maintain an apples-to-apples calculation.) These adjustments aren't necessary in the standard P/E Ratio model, as the value of the dollars in which average monthly Price per share and one-year trailing Earnings per share in the period in which they are taken are nearly identical, assuming relatively low changes in the rate of inflation, as has generally been the case in U.S. history.

Why This More Complex Approach Seems to Work Better

Beyond better matching the Dot-com stock market bubble to the period in which it's generally recognized to have taken place, Shiller's method better describes the level of sustainable earnings per share for the companies of the S&P 500. While the one-year trailing earnings show a great deal of volatililty, the averaged inflation-adjusted earnings per share over a ten year period produces much smoother transitions over time.

In fact, Shiller's method is somewhat reminiscent of the method that some boards of directors use in setting their companies' dividends - that of averaging corporate earnings over a number of years, then multiplying by a percentage to get the amount of dividends to be paid out to the companies' shareholders. As we recently discussed, the level at which dividends are set signal what the boards of directors of these publicly traded companies believe to represent the portion of their earnings that they believe to be sustainable in the long term. This may be seen in our chart comparing various measures of corporate earnings against dividends over the last eleven years that we presented earlier this week.

In fact, the rate of growth of cash dividends is the most important factor in setting the overall rate of growth of the stock market. And as we'll soon show, the key to a better benchmark against which to measure stock market performance.

Discovery

We maintain a number of charts illustrating the historic performance of the S&P 500. This first chart shows the S&P 500's index value, or rather, this index' price per share, from January 1871 through November 2007 on a logarithmic scale:

The second chart shows the S&P 500's average monthly one-year trailing dividends per share over the same period, also on a logarithmic scale:

We noticed, in changing views between our copies of these charts in Microsoft Excel, that they seemed to closely correspond. Our next chart superimposes the datas from the two charts together, which confirmed the close correspondence:

This was too good to pass up. So we created a new chart plotting the S&P 500's average monthly price per share against its average trailing one-year dividends per share. The next chart is as we first saw it, in normal scale, connecting the values for each point from earlier to later in time (generally from left to right):

In this chart, which we feel should have the title of being the most remarkable stock market-related chart ever, the stock market bubble of the late 1990's is clearly visible. We can now confirm, with some precision, that the bubble really began in January 1998 when it broke from its previous link to the long term relationship between the S&P 500's price and dividends per share and, in effect, went vertical. The disruptive event which encompasses the meteoric rise of the Dot-com bubble, its peak in August 2000 and subsequent crash, continued until the order that defines the basic relationship between the index' value and its dividends per share re-emerged in June 2003.

The Basic Relationship That Defines the Stock Market

Our next chart illustrates the same data as the previous chart, only using a logarithmic scale for both the S&P 500's average monthly index value and dividends per share, again from January 1871 through November 2007, and incorporates a power function regression trendline that for the entire series of data:

What's especially interesting about this chart isn't the Dot-com bubble of the late 1990s, but the long periods of time in which the relationship between the S&P 500's index value and its dividends per share nearly parallel the long-term trendline. This confirms that there is a very simple mathematical relationship that largely describes the relationship between these two values.

That relationship is given by the following equation:

where the important parts of the equation are P, Price per share, D, Dividends per share and G, which is the ratio of the rate of growth of Price per share to the rate of growth of Dividends per share. A is a constant value.

Update: Digging deeper into the relationship, we found that A is actually not a constant value, but is instead a function of G.

In essence, what the presence of so many straight lines tells us is that for long stretches of time, the ratio of the growth rates of price per share and dividends per share may be treated as a constant during the periods where these lines exist. What's more, the vertical lines that connect these parallel lines represent disruptive events, which punctuate the history of the stock market.

Aside from the Dot-com bubble, which we've already identified, if you look roughly at where the dividends are just under one dollar per share, the vertical line you see there represents the ultimate in disruptive events: the Wall Street Crash of 1929.

These disruptive events, aside from producing relatively rapid changes in the value of stocks, also would seem to have the effect of resetting the conditions under which order emerges in the stock market. After passing through such an event, the growth rate ratio of stock prices to dividends per share reflect the rates at which investors are willing to bid up stock prices in exchange for increases in the companies' dividends, and will do so at a new base price level.

Once established, the price-dividend growth rate ratio may be used as the prime factor for determining whether stocks are appropriately priced with respect to the level of their dividends.

The Long Term Stock Market

Going back to our long-term view of the S&P 500 from January 1871 through November 24, here's the equation that generally describes the S&P 500's longest term relationship between price per share and dividends per share:

With the price dividends growth rate ratio being greater than zero, this relationship indicates that stocks have generally increased in value over time. With the ratio of the growth rate of price per share with respect to the growth rate of dividends per share being greater than one, this relationship indicates that the value that investors have placed on stocks has generally increased faster than the value they can expect to receive in dividends over time.

This makes sense when you consider that the rate of dividend growth reflects only the rate of growth of company earnings that the boards of directors feel can be sustained for the foreseeable future. In addition to this additional earnings component, there are also a number of intangible components that may factor into investor valuations, including the value of the companies' brands, intellectual property, future expectations, etc., all of which add to the typical premium that investors are willing to pay for stocks.

More than this, this premium in the growth rate of stocks compared to the growth rate of dividends explains why dividend yields have decreased over time, and to a lesser extent, why the price earnings ratio itself has tended to increase over time. It's a mathematically inevitable outcome of how investor's have historically valued stocks with respect to dividends (or rather, sustainable earnings.)

The Post Dot-Com Bubble Market

Since order emerged in the stock market following the end of the disruptive event of the Dot-Com Bubble and subsequent crash, we find the relationship between the value of stocks in the S&P 500 and their dividends, presented in the following chart and shown in normal scale, to be:

Simply looking at this chart, the current valuations of the stock market are fully consistent with what we would expect in the post-Dot-com Bubble world, indicating that the value of stocks today is not out of line with the order in the market that has emerged since June 2003.

In the chart, we show the ratio of stock price to be 0.7597 and, being less than 1, this value indicates that in the post-Dot-com Bubble market, investors are requiring greater levels of dividends to justify bidding up the price of stocks than they have historically. From the perspective of market psychology, this also makes sense. Having gone through the Dot-com Bubble's period of inflated valuations, investors are now collectively doing the same thing that banks do with their business loans when credit gets tight - they're requiring higher levels of concrete performance on the part of the businesses to justify making the transactions.

What Will Happen Next

By and large, the market will continue on its current trajectory unless and until another disruptive event occurs. That could be a good thing, such the widespread implementation of computing technology that drove the productivity boom of the mid-1990s, which preceded the actual bubble phase of the stock market, and which we know now former U.S. Federal Reserve Chairman Alan Greenspan erroneously called "irrational exuberance" at the time. Or it could be a bad thing, as in the case of a market crash.

In any case, when order re-emerges, the price dividend growth rate ratio will set the pace for what investors can expect from the stock market. It will be a brand new day - only now, the sun will be in the center.

What better way to celebrate our third anniversary?

Labels: dividends, earnings, economics, investing, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

![P(t - to) = Po*e^[Rp*(t - to)]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhnsyphIw2gEyvTuXkH-Ol_3Jw-UESaW149w3eAGaUH7yIuezZQBVcEVVtZS6rLvUMzx9FBa5vtIFH4QBwMELpRQI8hoDaVzBITXQ5eXNqlBOne_wSqVn_kCWB07QUQs5mk7U4a/s400/EQN002.GIF)

![D(t - to) = Do*e^[Rd*(t - to)]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhL6mDL8IbtCydQrkFPeQR88JDtOwucrYzcNg0feXNo5t0FYkILc0fEswdMSxZEHNaAF3jWXSzfV467pre3zzB9Bf4QgD_aXG8HzkbAbbUV00IQOJ7XSvzzP4Xh1VPUcjKHJKx4/s400/EQN003.GIF)

![P(T) = Po*e^[Rp*T]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhYfk1vYKc5AeXnvDo9boBBW8pv3pr4_bSy-332c7VAyqMt93gEfr3tE-w-5DDkUbR9wOxChSQFGnaZxlwSLmlYxYF9kBZZtoqt86NNteGP2dT-hh1exHhZj3Jnfmk7UN2pEMMq/s400/EQN004.GIF)

![D(T) = Do*e^[Rd*T]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh-K0jw2EZKOQ0T62J5S3bddLgmFmrfj2qV8QBOwrQkz6iQ0MhFfhSSRuCG1ZuaNYitjy45OnYSPlevtqvukqOIfFdmI1mGNi71UQmC7spT0OM0yp-eivhXs3Yw7pDP0G7hOzKy/s400/EQN005.GIF)

![Po*e^[Rp*T] = A*(Do*e^[Rd*T])^G](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh2rapx59IPL6SFveYVt8xhRki_h4MICBgJXMcvQdlMIoyWRXADK9pT81iGFMaHvN-EsSQ2ektqTEyoTVUDmT5Nmpu_ezX3iT2lunsCKNncrH0brL3TkFhpPl5VbLEHuV7_VHn_/s400/EQN007.GIF)