We're going to wrap up our publishing year with an old classic, courtesy of Snopes, which considers the physics governing the timely delivery of presents on Christmas Eve....

No known species of reindeer can fly. BUT there are 300,000 species of living organisms yet to be classified, and while most of these are insects and germs, this does not COMPLETELY rule out flying reindeer which only Santa has ever seen.

There are two billion children (persons under 18) in the world. BUT since Santa doesn't appear to handle the Muslim, Hindu, Jewish and Buddhist children, that reduces the workload to 15% of the total —

378 million according to Population Reference Bureau. At an average (census) rate of3.5 children per household, that's91.8 million homes. One presumes there's at least one good child in each.Santa has 31 hours of Christmas to work with, thanks to the different time zones and the rotation of the earth, assuming he travels east to west (which seems logical). This works out to

822.6 visits per second.This is to say that for each Christian household with good children, Santa has 1/1000th of a second to park, hop out of the sleigh, jump down the chimney, fill the stockings, distribute the remaining presents under the tree, eat whatever snacks have been left, get back up the chimney, get back into the sleigh and move on to the next house. Assuming that each of these

91.8 million stops are evenly distributed around the earth (which, of course, we know to be false but for the purposes of our calculations we will accept), we are now talking about.78 miles per household, a total trip of75½ million miles, not counting stops to do what most of us must do at least once every31 hours, plus feeding and etc.

This means that Santa's sleigh is moving at 650 miles per second, 3,000 times the speed of sound. For purposes of comparison, the fastest man-made vehicle on earth, the Ulysses space probe, moves at a poky

27.4 miles persecond — a conventional reindeer can run, tops,15 miles per hour.If every one of the 91.8 million homes with good children were to put out a single chocolate chip cookie and an

8 ounce glass of2% milk, the total calories (needless to say other vitamins and minerals) would be approximately225 calories (100 for the cookie, give or take, and 125 for the milk, give or take). Multiplying the number of calories per house by the number of homes (225 x 91.8 x 1000000), we get the total number of calories Santa consumes that night, which is 20,655,000,000 calories. To break it down further,1 pound is equal to3500 calories. Dividing our total number of calories by the number of calories in a pound (20655000000/3500) and we get the number of pounds Santa gains, 5901428.6, which is2950.7 tons. The payload on the sleigh adds another interesting element. Assuming that each child gets nothing more than a medium-sized lego set (two pounds), the sleigh is carrying 321,300 tons, not counting Santa, who is invariably described as overweight. On land, conventional reindeer can pull no more than

300 pounds. Even granting that "flying reindeer" (see above) could pull TEN TIMES the normal amount, we cannot do the job with eight, or even nine. We need 214,200 reindeer. This increases the payload (not even counting the weight of the sleigh) to 353,430 tons. Again, for comparison, this is four times the weight of the Queen Elizabeth. 353,000 tons traveling at650 miles per second creates enormous airresistance — this will heat the reindeer up in the same fashion as spacecraftre-entering the earth's atmosphere. The lead pair of reindeer will absorb14.3 QUINTILLION joules of energy. Per second. Each.

In short, they will burst into flame almost instantaneously, exposing the reindeer behind them, and create deafening sonic booms in their wake. The entire reindeer team will be vaporized within

4.26 thousandths of a second. Santa, meanwhile, will be subjected to centrifugal forces 17,500.06 times greater than gravity. A 250-pound Santa (which seems ludicrously slim) would be pinned to the back of his sleigh by 4,315,015 pounds of force.In conclusion: If Santa ever DID deliver presents on Christmas Eve, he's dead now.

Of course, these results would apply only in Newtonian space. Things get quite different when you bring Einstein and relativity into the picture. For that, we turn to North Carolina State University's Larry Silverberg, who introduces us to the concept of "relativity clouds":

The Evolution of Santa's Science and Technology

- Santa's society of elves has at least five hundred uninterrupted years to evolve- socially and intellectually.

- Their understanding of physics and engineering exceeds our own.

- To deliver presents in a single night, Santa and elves would have researched a means to create more "time" - recognizing that time itself can be stretched like a rubber band, that space itself can be squeezed like an orange, and that light itself can be bent (based on general relativistic principles).

- It is thought that the first breakthrough came when they learned how to control time, how to control space and how to control light. They would have created “relativity clouds.”

- In contrast with Santa's five hundred years of understanding general relativistic principles, our understanding spans less than 100 years - and it's incomplete. We haven't unified the electrical and gravitational forces, nor resolved issues associated with wave-particle duality, nor examined singularities and other dramatic curvatures of space-time that could be used to manipulate space-time.

- Relativity clouds are controllable domains (volumes) within which space-time is controlled. An observer inside a relativity cloud perceives time, space and light differently than an observer outside the relativity cloud.

- Inside the relativity cloud, Santa has months to deliver presents. Santa sees the world frozen and only hears silence.

- Upon returning to the North Pole, and leaving the domain of the relativity cloud, only a few minutes go by.

- The presents are truly delivered in the wink of an eye.

Merry Christmas! We'll see you again in the new year!

Labels: none really

Once again, for no reason other than that it's really popular (and that we actually received an e-mail requesting an update), we've thrown the nations of the European Union into an economic cage match against the individual United States to find out where they all rank with respect to each other!

Once again, for no reason other than that it's really popular (and that we actually received an e-mail requesting an update), we've thrown the nations of the European Union into an economic cage match against the individual United States to find out where they all rank with respect to each other!

In our version of an economic cage match, the only deciding factor is how each nation ranks with respect to each others Gross Domestic Product (GDP) adjusted for Purchasing Power Parity (PPP), population and their GDP-PPP per Capita. What makes this version different from last year's smackdown is that we've updated it all, using data exclusively from 2007.

We've put this data into the dynamic table you see below, which will allow you to sort the data in the table by clicking on the various column headings. Doing so will almost instantaneously sort the data in the table from low to high value or from high to low (by clicking a column heading a second time.) To restore the original order, you'll need to refresh this page in your web browser.

We'll have some more commentary below the table - in the meantime, you know you can't resist....

| 2006 GDP-PPP Rankings of EU Nations vs Individual US States |

|---|

| US State or EU Nation | 2007 GDP-PPP [billions USD] | 2007 Population | 2007 GDP-PPP per Capita [USD] |

|---|---|---|---|

| United States - All | 13,743.02 | 301,621,157 | 45,563.85 |

| US - Alabama | 165.80 | 4,627,851 | 35,825.70 |

| US - Alaska | 44.52 | 683,478 | 65,133.04 |

| US - Arizona | 247.03 | 6,338,755 | 38,971.06 |

| US - Arkansas | 95.37 | 2,834,797 | 33,642.97 |

| US - California | 1,812.97 | 36,553,215 | 49,598.04 |

| US - Colorado | 236.32 | 4,861,515 | 48,611.18 |

| US - Connecticut | 216.27 | 3,502,309 | 61,749.55 |

| US - Delaware | 60.12 | 864,764 | 69,519.55 |

| US - District of Columbia | 93.82 | 588,282 | 159,479.64 |

| US - Florida | 734.52 | 18,251,243 | 40,244.88 |

| US - Georgia | 396.50 | 9,544,750 | 41,541.58 |

| US - Hawaii | 61.53 | 1,283,388 | 47,944.97 |

| US - Idaho | 51.15 | 1,499,402 | 34,112.93 |

| US - Illinois | 609.57 | 12,852,548 | 47,427.95 |

| US - Indiana | 246.44 | 6,345,289 | 38,838.10 |

| US - Iowa | 129.03 | 2,988,046 | 43,180.73 |

| US - Kansas | 117.31 | 2,775,997 | 42,256.89 |

| US - Kentucky | 154.18 | 4,241,474 | 36,351.51 |

| US - Louisiana | 216.15 | 4,293,204 | 50,346.08 |

| US - Maine | 48.11 | 1,317,207 | 36,522.73 |

| US - Maryland | 268.69 | 5,618,344 | 47,822.81 |

| US - Massachusetts | 351.51 | 6,449,755 | 54,500.36 |

| US - Michigan | 381.96 | 10,071,822 | 37,923.92 |

| US - Minnesota | 254.97 | 5,197,621 | 49,055.14 |

| US - Mississippi | 88.55 | 2,918,785 | 30,336.60 |

| US - Missouri | 229.47 | 5,878,415 | 39,036.03 |

| US - Montana | 34.25 | 957,861 | 35,759.89 |

| US - Nebraska | 80.09 | 1,774,571 | 45,133.73 |

| US - Nevada | 127.21 | 2,565,382 | 49,588.33 |

| US - New Hampshire | 57.34 | 1,315,828 | 43,577.88 |

| US - New Jersey | 465.48 | 8,685,920 | 53,590.64 |

| US - New Mexico | 76.18 | 1,969,915 | 38,670.70 |

| US - New York | 1,103.02 | 19,297,729 | 57,158.23 |

| US - North Carolina | 399.45 | 9,061,032 | 44,083.94 |

| US - North Dakota | 27.73 | 639,715 | 43,339.61 |

| US - Ohio | 466.31 | 11,466,917 | 40,665.59 |

| US - Oklahoma | 139.32 | 3,617,316 | 38,515.57 |

| US - Oregon | 158.23 | 3,747,455 | 42,224.12 |

| US - Pennsylvania | 531.11 | 12,432,792 | 42,718.48 |

| US - Rhode Island | 46.90 | 1,057,832 | 44,335.96 |

| US - South Carolina | 152.83 | 4,407,709 | 34,673.34 |

| US - South Dakota | 33.93 | 796,214 | 42,619.20 |

| US - Tennessee | 243.87 | 6,156,719 | 39,610.22 |

| US - Texas | 1,141.97 | 23,904,380 | 47,772.21 |

| US - Utah | 105.57 | 2,645,330 | 39,907.31 |

| US - Vermont | 24.54 | 621,254 | 39,505.58 |

| US - Virginia | 382.96 | 7,712,091 | 49,657.61 |

| US - Washington | 311.27 | 6,468,424 | 48,121.46 |

| US - West Virginia | 57.71 | 1,812,035 | 31,848.72 |

| US - Wisconsin | 232.29 | 5,601,640 | 41,468.75 |

| US - Wyoming | 31.51 | 522,830 | 60,275.81 |

| European Union - All | 14,430.00 | 490,426,060 | 29,423.40 |

| EU - Austria | 322.00 | 8,199,783 | 39,269.33 |

| EU - Belgium | 376.50 | 10,392,226 | 36,229.00 |

| EU - Bulgaria (*) | 86.71 | 7,322,858 | 11,841.01 |

| EU - Cyprus | 21.40 | 788,457 | 27,141.62 |

| EU - Czech Republic (*) | 251.00 | 10,228,744 | 24,538.69 |

| EU - Denmark | 203.30 | 5,468,120 | 37,179.14 |

| EU - Estonia (*) | 28.69 | 1,315,912 | 21,802.37 |

| EU - Finland | 188.40 | 5,238,460 | 35,964.77 |

| EU - France | 2,075.00 | 63,718,187 | 32,565.27 |

| EU - Germany | 2,807.00 | 82,400,996 | 34,065.12 |

| EU - Greece | 327.60 | 10,706,290 | 30,598.83 |

| EU - Hungary | 191.70 | 9,956,108 | 19,254.51 |

| EU - Ireland | 191.60 | 4,109,086 | 46,628.37 |

| EU - Italy | 1,800.00 | 58,147,733 | 30,955.64 |

| EU - Latvia (*) | 40.05 | 2,259,810 | 17,722.73 |

| EU - Lithuania (*) | 59.98 | 3,575,439 | 16,775.56 |

| EU - Luxembourg | 38.14 | 480,222 | 79,421.60 |

| EU - Malta | 9.40 | 401,880 | 23,390.07 |

| EU - Netherlands | 645.50 | 16,570,613 | 38,954.50 |

| EU - Poland | 623.10 | 38,518,241 | 16,176.75 |

| EU - Portugal | 232.30 | 10,642,836 | 21,826.89 |

| EU - Romania (*) | 247.10 | 22,276,056 | 11,092.63 |

| EU - Slovakia | 110.20 | 5,447,502 | 20,229.46 |

| EU - Slovenia | 56.19 | 2,009,245 | 27,965.73 |

| EU - Spain | 1,361.00 | 40,448,191 | 33,647.98 |

| EU - Sweden | 338.50 | 9,031,088 | 37,481.64 |

| EU - United Kingdom | 2,130.00 | 60,776,238 | 35,046.59 |

Sources and Acknowledgements:

- 2007 US State GDP Data: Bureau of Economic Analysis, U.S. Department of Commerce, All Industry Total

- 2007 US State Population Estimates (July 1, 2007): US Census [Excel spreadsheet]

- 2007 EU Nation GDP-PPP Data: The World Factbook, 2008

- 2007 EU Nation Population Estimates (July 1, 2007): The World Factbook, 2008

- Dynamic Table Sorting Function: The Daily Kryogenix.

- 2007 US State Population Estimates (July 1, 2007): US Census [Excel spreadsheet]

The GDP and population data for the United States as a whole, as well as for the European Union as a whole, was obtained by adding up the state and national values we found for each. GDP-PPP per capita was found by dividing each region's 2007 GDP figure by its population estimate as of July 1, 2007.

We will note that the CIA's estimate of GDP-PPP for some European nations for 2007 is really different from what they indicated for 2006. For instance, nations such as Greece, the Netherlands and Spain would have effectively seen their GDP-PPP per Capita grow by more than 20%, even though the CIA also indicates that economic growth in these nations has been growing at comparatively moderate rates.

We wondered if that might be an effect of the relative valuations of the U.S. dollar with respect to the Euro, but we would then expect nations like France and Germany to also have similarly high levels of year-over-year GDP-PPP per Capita growth, but that's just not the case - their year over year growth is in the single digits.

So, we just might have a mystery! We don't know why the 2007 GDP-PPP for these nations is so different from what it was in 2006.

A Cage Match Contest

Since this kind of ranking invariably draws commentary from other quarters of the blogosphere, we thought it might be fun to try an experiment - why not have an open contest for the blog that can best explain why the data is the way that it is?

For our part, we'll be happy to link to, and possibly excerpt analysis from, the blogs that drive the most traffic to this post (in other words, you don't need to e-mail us to enter - you just need to link to us from your post that proposes a solution to this mystery!) We'll reserve a place of honor for the blogger who offers the most compelling analysis.

If it helps make that analysis easier, we've shaded the original EU-15 nations in light purple, while the twelve additional nations that have joined the EU in more recent years are shaded in light green.

What's more, we've also identified the nations in the EU with flat income taxes with asterisks (*). Those nations averaged 12.2% year over year growth in their GDP-PPP per capita.

And that's where we'll leave the rest to you! We'll look forward to what you come up with!

Previously on Political Calculations

2006 Economic and Population Data

- 2006 GDP-PPP EU vs US Smackdown!

- Africa GDP Rankings for 2006

- Asia GDP Rankings for 2006

- 2006 GDP Rankings for the Americas

- 2006 GDP Rankings for Europe

2004 Economic and Population Data

- Pacific Rim: 2004 GDP Rankings

- GDP Rankings in Muslim Nations

- 2004 GDP Rankings for Asia

- European Union 2004 GDP Rankings

- GDP in Africa: 2004

- GDP Rankings of the Americas: 2004 Edition

- EU vs US: Two Years of Economic Data Later....

2002 Economic and Population Data

- EU vs USA

- Cool Tools and GSP

- GDP of the Americas

- GDP in the Muslim World

- GDP in Europe

- GDP: Africa

- GDP Along the Pacific Rim

- GDP in Asia

- GDP: And the rest...

Labels: gdp

What if you didn't have to work or go into debt to pay for the stuff you want to buy?

What if you didn't have to work or go into debt to pay for the stuff you want to buy?

Sounds pretty cool, right? Believe it or not, that's something that's possible, but there's a catch. You have to have enough saved or invested to be able to pull it off. What's more, you need to set your spending at a level that doesn't shrink your savings or investment account below a level where it won't deliver enough interest or dividends to continue supporting your buying habits.

So, what level should you set your savings or investment account at?

It turns out there's something out there called the "Multiply by 25 Rule" (HT: frugaldad) that makes it super easy to figure out how much money you have to have saved or invested in an interest-bearing or dividend-paying account. Here's how it works:

- Figure out how much it would cost (per year) to buy what you want.

- Multiply that figure by 25.

The result of that multiplication is a pretty good estimate of the amount that you need to have saved or invested to pay for what you want without working, going into debt, or drawing your savings or investment down too low to be able to keep paying for what you want to buy.

Without going into a whole lot of detail, there are some key assumptions behind that math. First, it assumes that you are earning a annual rate of return on your savings of 4%. If your rate of return is lower than that, you're falling behind, and if your rate of return is higher than that, you're coming out ahead.

Second, that simple math ignores taxes. Yes, you'll have to pay taxes on any interest or dividend income that you may receive. (But if you're smart, you'll have extra saved or invested to pay for all the taxes you have to pay because of this factor!)

Third, it ignores inflation. If the prices of the things you want to buy are going down, that may not be a problem. If they're rising, well, that's a different story....

Now, if you know us, you know exactly where this is going! We've built a tool you can use to quickly estimate how much passive income you need to support one, some or all of your buying habits without working or taking on debt! And of course, we've gone the extra mile - we've made it possible for you to factor taxes and inflation, at least through one year. Just enter your figures for each into our tool below:

Our default numbers are taken from the frugal dad's Netflix expenses, the inflation rate is the U.S.' long term average of 3.3% per year and the tax rate is 28%. As always, if you don't like these assumptions, just substitute your own!

Finally, if you're willing to go to the extreme of working out what it would cost to pay for your entire desired existence, you might just find that magic number you need to have stashed away in your savings and investment accounts to never have to work again!...

Labels: personal finance, tool

Welcome to the Friday, December 19, 2008 edition of On the Moneyed Midways, the one place you can go to cut through the noise to find the best of the money and business blogosphere!

Welcome to the Friday, December 19, 2008 edition of On the Moneyed Midways, the one place you can go to cut through the noise to find the best of the money and business blogosphere!

Each week, we scan dozens of money and business-related blog carnivals, reading hundreds of posts, choosing the best from each then also declaring one to be The Best Post of the Week, Anywhere! Near contenders for that title are identified as being Absolutely essential reading!

And now that we're getting to the end of the year, we're gearing up to name The Best Post of the Year, Anywhere! as well as The Best Blogs We Found in 2008. Those two topics will be covered in the first two editions of OMM in 2009.

That said, this is our final edition for 2008! The best posts we found in the best of the past week's business and money-related blog carnivals await you below....

| On the Moneyed Midways for December 19, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | The College Student Debt Machine: A National Disgrace | Tough Money Love | Mr. Tough Money Love pulls no punches in wondering if what colleges are really teaching students is how to be "comfortable" with astronomical levels of debt. |

| Carnival of Personal Finance | The Diary of a Mad Black Fridayee | Frugal Franco | Franco camped out overnight outside a Best Buy to take advantage of their Black Friday doorbusters and shares his "diary" of the experience! |

| Carnival of Real Estate | The Tale of a Near Death Accident, a Bank Robbery, a Washing Machine & the Completed Short Sale | Northern Virginia & Washington DC Real Estate | Did you ever wonder what could *really* go wrong in trying to complete a real estate transaction? Brian Block provides his short sale war story…. |

| Carnival of Trust | The Edifice Complex | Seth Godin's Blog | The Best Post of the Week, Anywhere! Seth Godin describes how he'd redirect a lot of marketing money away from advertising and toward investing in people. |

| Cavalcade of Risk | Government Bonds: An Exciting New Way to Lose Money to the Bear Market | Monevator | The Investor has come to the conclusion that all those government bonds being bought up now aren't such a great investment. |

| Festival of Stocks | Start With Re-Defining the Incentives | College Analysts | James Cullen won't be buying any bank stocks, even the best of them, anytime soon. Absolutely essential reading! for the very interesting idea he has for addressing the misguided tax incentives that helped create the current crisis. |

| Money Hacks Carnival | Facing the Recession | PennyJobs | Curtis Ophoven makes a strong argument favoring the idea that the best thing the government can do in facing the recession is to allow it to run its course. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The two scientists took data from the Spatial Hazard Event and Loss Database for the United States (SHELDUS), and refined it to improve its accuracy in identifying deaths resulting from a modern categorization of natural hazards by geographic location. From there, Borden and Cutter analyzed the spatial distribution of mortality resulting from each type of natural hazard in the U.S. (excepting Alaska and Hawaii) for the years from 1970 through 2004.

In all, they identified some 19,958 deaths resulting from natural hazards. The chart in the upper right corner of this post, taken from their paper, illustrates the percentage breakdown of mortality resulting from each type.

The results from their spatial analysis is especially interesting. The map below illustrates the mortality data down by Federal Emergency Management Area (FEMA) region for the years from 1970 through 2004:

As you might expect, we see winter weather as a major hazard in the northern parts of the United States. But remarkably, we see that heat and drought are remarkably fatal in much of the same regions. For the hotter southern portion of the country, and most remarkably, for the very hottest part of the country (the desert southwest), deaths caused by heat and drought are remarkably low (falling into the "Other" category.)

Instead, we see that heat and drought conditions are more likely to have caused an unexpectedly high proportion of deaths due to natural hazard in the midwest and in the mid-Atlantic states. What that suggests to us is that the infrastructure in these parts of the country is much less capable of handling high heat situations than those parts of the U.S. that routinely experience high heat and drought conditions.

Another remarkable observation is how much severe weather, tornados and lightning would appear to have contributed to deaths caused by natural hazards, especially in the southeast part of the U.S.

Borden and Cutter describe their results:

Chronic everyday hazards such as severe weather (summer and winter) and heat account for the majority of natural hazard fatalities. The regions most prone to deaths from natural hazards are the South and intermountain west, but sub-regional county-level mortality patterns show more variability. There is a distinct urban/rural component to the county patters as well as a coastal trend.

The intermountain west has the highest standardized mortality ratio in the U.S. for natural hazards, with winter weather, flooding and severe weather accounting for over three quarters of deaths caused by natural hazards.

Previously on Political Calculations

Labels: data visualization

Why are dividends so important? And better still, when did they become so important?

Why are dividends so important? And better still, when did they become so important?

The answer goes all the way back to the year 1602, to the invention of the world's first true stock: the Dutch East India Company (or rather, the Vereenigde Oostindische Compagnie). The company came into existence in that year as a result of a merger of several established sea merchants, who were collectively granted a geographic monopoly by the goverment of the Netherlands for trading in Asia, as well as the exclusive right to establish colonies there as well.

What made the Dutch East India Company unique was in how the ownership of the company was established and in how profits among the company's owners were distributed. Here, the individual merchants and other owners were jointly issued shares of ownership in the larger company. In itself, this kind of ownership structure wasn't new. The issuance of shares for the purpose of determining how profits would be divided among engaged parties goes back hundreds of years before the creation of the Dutch East India Company, but the concept of a true joint stock company was still relatively new.

What made the Dutch East India Company unique was in how the ownership of the company was established and in how profits among the company's owners were distributed. Here, the individual merchants and other owners were jointly issued shares of ownership in the larger company. In itself, this kind of ownership structure wasn't new. The issuance of shares for the purpose of determining how profits would be divided among engaged parties goes back hundreds of years before the creation of the Dutch East India Company, but the concept of a true joint stock company was still relatively new.

It's here though that we see the first advantage the Dutch East India Company gained over a number of its peers. Instead of being organized around a single trade voyage, as many of its contemporaries were, several different trading ventures were combined under one ownership structure. This reduced the risk to the company's owners and investors since it diminished the impact of a single failure upon the profits generated by the combined venture.

That was highly important at the dawn of the seventeenth century, as all it took to make a single failure was a single storm, a single pirate or just plain bad timing, such as delivering your cargo at the same time to the same place as your competition, sending prices plunging. Any one of these could make any prospect of profits disappear quickly.

But it was how the profits that were made would be divided that gave the Dutch East India Company a longevity that would be unmatched by its contemporaries and ultimately helped make it the world's richest company for nearly two hundred years. That innovation was to divide the generated profits periodically among all of the company's stock holders. Those payments are called dividends.

But it was how the profits that were made would be divided that gave the Dutch East India Company a longevity that would be unmatched by its contemporaries and ultimately helped make it the world's richest company for nearly two hundred years. That innovation was to divide the generated profits periodically among all of the company's stock holders. Those payments are called dividends.

What dividends did for the Dutch East India Company's investors and owners was to reduce their risk of owning stock in the company for long periods of time. Here, investors could instead collect their proportionate share of the profits generated by the venture instead of having to take steps to dissolve and liquidate the company to be able to fully realize their share of those profits. With the periodic receipt of dividend payments, investors were content to allow the company to continue operating. And when the company flourished, and its dividends grew, it became even more attractive to investors, who bid the price of the company's stock up to reflect its success in generating those precious dividends.

That, in turn, led to the success of the third great innovation whose success directly stems from the formation of the Dutch East India Company and its first ever issuance of stock: the stock exchange.

Labels: dividends, stock market

Worth1000s is running a contest for Photoshop enthusiasts, themed around the idea of reworking vintage advertisements for today's high technology products (HT: Core77). Here are all the entries, our favorites are below....

|

|

|---|---|

|

|

And our very favorite:

Labels: none really

Once upon a time, there was a blameless girl called Consumerella, who didn’t have enough money to buy all the lovely things she wanted. She went to her Fairy Godmother, who called a man called Rumpelstiltskin who lived on Wall Street and claimed to be able to spin straw into gold. Rumpelstiltskin sent the Fairy Godmother the recipe for this magic spell. It was written in tiny, tiny writing, so she did not read it but hoped the Sorcerers’ Exchange Commission had checked it.

The Fairy Godmother carried away armfuls of glistening straw-derivative at a bargain price. Emboldened by the deal, she lent Consumerella – who had a big party to go to – 125 per cent of the money she needed. Consumerella bought a bling-bedizened gown, a palace and a Mercedes – and spent the rest on champagne. The first payment was due at midnight.

At midnight, Consumerella missed the first payment on her loan. (The result of overindulgence, although some blamed the pronouncements of the Toastmaster, a man called Peston.) Consumerella’s credit rating turned into a pumpkin and Rumpelstiltskin’s spell was broken. He and the Fairy Godmother discovered that their vaults were not full of gold, but ordinary straw.

All seemed lost until Santa Claus and his helpers, men with implausible fairy-tale names such as Darling and Bernanke, began handing out presents. It was only in January that Consumerella’s credit card statement arrived and she discovered that Santa Claus had paid for the gifts by taking out a loan in her name. They all lived miserably ever after. The End.

Labels: none really

Welcome to the Friday, December 12, 2008 edition of On the Moneyed Midways, the only review of the best posts to be found in the best of the past week's money and business related blog carnivals!

Welcome to the Friday, December 12, 2008 edition of On the Moneyed Midways, the only review of the best posts to be found in the best of the past week's money and business related blog carnivals!

What do you say we just get straight to it this week! The best posts of the week that was, including The Best Post the Week, Anywhere!, await you below....

| On the Moneyed Midways for December 12, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Another Thing I Didn't Know About Credit Cards | Christian PF | Did you know where you use your credit card may affect whether or not your credit card company cuts your credit lines? Bob explains why bars, nightclubs, pool halls and marriage counselors should be paid by other means…. |

| Carnival of HR | So, Say an Employee of Yours Shoots Himself in the Leg… Your Response Would Be? | Jessica Lee Writes | Jessica Lee explains why you, as an employer, need to act to protect your company's "employment brand" if an employee of yours does something "newsworthy," but not in a good way. |

| Carnival of Personal Finance | How Old Are You Financially? | Almost Frugal | Kelly shows how you handle money says a lot about how old you are mentally! The Best Post of the Week, Anywhere! and a fun "see where you fit" kind of test! |

| Carnival of Real Estate | Blue Carpet Is the Kiss of Death - Things That Make Houses Sit There and Not Sell | Active Rain | Diane Tuman reviewed this post by real estate agent Robin Rogers of San Antonio in her contribution to the latest edition of the Carnival of Real Estate. We think Robin's post is the best real estate offering this week! |

| Festival of Frugality | The Wine Industry: A Lesson in Marketing | The Personal Financier | Dorian Wales dislikes pretentiousness in a wine, drawing inspiration from a play that wondered if wine in bottles without labels would present a crisis for a proud wine connoisseur. |

| Festival of Stocks | S&P Set for 50% Gains? Not So Fast, UBS | College Analysts | James Cullen doesn't buy UBS strategist David Bianco's forecast that the S&P 500 is headed straight back up to 1,300, and explains why. |

| Money Hacks Carnival | Some Myths About Couples and Money | Simply Forties | Mary takes on three myths affecting couples: 1. If we love each other, we won't fight about money, 2. It takes money to make money, and 3. If we don't talk about money, everything will be okay. Absolutely essential reading! |

| Carnival of Money Stories | Bear With Me as I Talk Myself Out of Getting a New Car | Digerati Life | Tanesha Morgan really likes the 2009 Nissan Maxima, but can't convince herself its time to trade in her 2005 Toyota Camry. Here, she works through the pros and cons of doing the deal! |

| Carnival of Taxes | My First 1040 | Wandering Tax Pro | Robert D. Flach reflects back on the first tax return he ever prepared as a professional and how the experience was so very different back in 1971! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Env-Econ's Tim Haab has a problem: his nearly brand new car. Tim explains how a vehicle that was ideal for him and his family has suddenly become much less so, all without any significant change in its physical condition (or his family's!):

Env-Econ's Tim Haab has a problem: his nearly brand new car. Tim explains how a vehicle that was ideal for him and his family has suddenly become much less so, all without any significant change in its physical condition (or his family's!):

July 2008: I trade-in the decrepit family mini-van, complete with enough McDonald's french fries under the seats to make my own Happy Meal, for a new 2008 Saturn Aura. Why Saturn? Because GM finally seemed to get the mid-size family car right. Good fuel efficiency, good quality, nice-looking. That and they were offering employee pricing to Ohio State employees, but mostly the other stuff.

General Motors hasn't officially announced the end of Saturn, but in a restructuring plan submitted to Congress, the automaker said it would concentrate resources on four core brands -- Chevrolet, Cadillac, Buick and GMC.

You'd think as an economist, I might have seen that coming before I bought a Saturn.

You'd be wrong.

So, as we understand it, Tim finds himself on the losing end of GM's woes for several different reasons, including:

- Increased difficulty in servicing his car, as:

- GM will eventually discontinue production of replacement parts suitable for Saturn vehicles.

- Saturn dealers will disappear, making it harder to find mechanics who can service Saturn vehicles.

- Lower resale value if he attempts to trade-in the vehicle for a new one. Who will buy a car they don't make any more for something other than the parts or for scrap, especially if it's not considered a classic?

- The shame of being an economist who didn't see it coming (yes, we're very willing to point out the very obvious!)

To be sure, the Saturn Aura is a solid vehicle with decent fuel mileage and environmental performance. But we must consider the worst-case scenario for Tim. What if he can never dispose of it? Sure, he could dump it into Chesapeake Bay in a misguided attempt to provide much-needed habitat for Maryland blue crabs, but as an environmental economist, he'll likely have calculated the low benefit to cost ratio and will discard those plans. Maybe. Remember, he bought a Saturn.

Instead, we believe we have an ideal solution for Tim. He should continue to drive his car for a few years after the Saturn division is no more. At the end of that time, he should begin scuttling his Saturn Aura to salvage its parts, particularly the engine and transmission components, or really, anything in front of the driver and passenger seats. This way, he can get maximum value for the parts that will become increasingly difficult to replace in the years ahead.

That leaves the question of what to do with the rest of the heap, which at this point would be little more than the back end of the car. Since Tim is a college professor at a university operated as an outreach effort by a major athletic program, we would recommend Tim pimp the remainder of his ride as illustrated below:

The perfect solution for the professor who wants to tailgate in style and get maximum value out of his manufacturer-abandoned vehicle!

Labels: none really

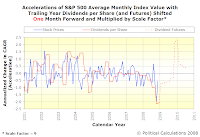

In analyzing the stock market, we often find ourselves going back to the concepts of basic physics. Today is no exception, in that we're going to reveal how the concept of acceleration factors into how stock prices change with time.

In analyzing the stock market, we often find ourselves going back to the concepts of basic physics. Today is no exception, in that we're going to reveal how the concept of acceleration factors into how stock prices change with time.

We'll begin with the raw price and trailing year dividend per share data for the S&P 500, which is available in spreadsheet form from Robert Shiller going back to 1871 (more current price and dividend data may be available from Standard & Poor). The price data in Shiller's spreadsheet is the average of the indicated calendar month's daily closing values for the S&P 500 index.

Next, we'll find the compound annual growth rate for each year-over-year period for both the stock price and trailing year dividends per share data. In doing this, we match the data for January 1871 and January 1872, then February 1871 and February 1872, and so on, all the way to our most recently available data, which spans from November 2007 through November 2008. Those results are graphically presented here.

Now, here's where acceleration comes into play. We'll next find the rate at which the compound annual growth rate of both the S&P 500's average monthly values and trailing year changes with time. We do this by first finding the difference between each month's growth rate and the value of the growth rate for the preceding month, then multiplying each of these values by 12 to get an annualized change. Graphing the data from February 1872 onward produces the following chart:

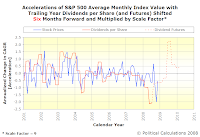

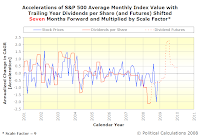

Let's next zoom in on the arbitrary ten year period from 2001 through 2011. We've selected this time frame since we have dividend futures data extending midway into 2010, which we wanted to incorporate for its potential relevance:

For our next trick, we're going to amplify the dividend acceleration data by multiplying all of it by a factor of 9 for this period. We obtained this number through trial and error - it's really just enough to make the peaks in each data stream roughly the same:

Now, the only thing that remains to to shift the trailing year dividend growth rate acceleration data forward (earlier) in time so that it roughly coincides with the accelerations in the stock price growth rate. This makes sense if what investors expect for the future value of dividends are the key driver of stock prices. We've presented our data in the table below, which shows how stock price and dividend accelerations match up when shifting the dividend data earlier anywhere from one to seven months:

|  |  |

| ||

|  |  |

We find that investors typical alter stock prices in the S&P 500 anywhere from two to seven months in advance to account for expected changes in the growth rate of the index' dividends per share. We also find that they most often alter stock prices between three and four months ahead of when a corresponding change in the dividend acceleration is expected to occur (we've emphasized the four-month period in the graphs above, but could very easily have selected the three-month time shift.)

Of course, the logical consequence of all this is that if you know what stock prices are today and if you know how much their rate of growth is going to change, (and thanks to the S&P 500's dividend futures data, we do), you can predict where they're going to be in the future with a fair degree of accuracy.

The trick though, as we've shown, is to work out when they're going to get there. As you can see from our charts above, that may not be so easy!

We'll conclude this post by offering some observations from a quick survey of the full span of the historic data:

- This analysis method appears to work well when stock prices and dividends are couples (or interdependent.) It doesn't appear to work well when the relationship between stock prices and dividends has decoupled (such as occurred during the Dot-Com Bubble.)

- The scale factor by which the acceleration of dividends is multiplied changes in value over time. It may be constant for periods as long as years, but is not a constant over the entire range of data.

- Investors are generally forward looking, with stock prices most often changing as a result of investors changing their future expectations for the growth of dividends, leading the actual change in the dividends. But not always. There are times when the growth rate of stock prices lag a corresponding change in the dividend growth rate.

On a quick side note, while we're a few days late due to other posting obligations, we thought we'd celebrate our fourth anniversary with this post. Our annual anniversary tradition is to post something absolutely mind-blowing. We hope demonstrating how dividends have directly driven stock prices in the 21st century qualifies!

Elsewhere on the Web

Thanks to Gary Santoni and Alex Tabarrok, we have a pretty good idea that we're on the right track with this kind of analysis. Here's the conclusion to their 2002 paper Expected Dividend Growth, Valuation Ratios and Rational Optimism, emphasis ours:

Large changes in valuation ratios can be explained by relatively small changes in the expected dividend growth rate. We use the Gordon growth model to back out an "expected" dividend growth rate and we compare this rate with the actual rate of dividend growth. We cannot reject the hypothesis that our estimated rate is a rational expectation of the actual. As a result, a model of valuation ratios based solely on a handful of fundamentals can easily explain the variation in the data. In particular, the historically high ratios of the late 1990s and today are consistent with rational expectations about dividend growth.

Santoni, G. and A. Tabarrok. 2002. Expected Dividend Growth, Valuation Ratios and Rational Optimism. Journal of Financial and Economic Practice 1 (1): 110-119.

The main weakness of the paper is that Santoni and Tabarrok utilize the Gordon growth model, which assumes a constant growth rate for dividends, which we've shown only holds for limited periods of time. Also, in our view, Gordon's growth model dances around the real non-linear allotropic relationship between dividends and stock prices, which we uncovered just over a year ago.

Elsewhere on Political Calculations

| Essential Reading to Get Up to Speed with Us! |

|---|

| Date Posted | Post | Remark |

|---|---|---|

| 2007-12-06 | The Sun, in the Center | We used historic data for the S&P 500 to uncover the fundamental power-law relationship that exists between dividends per share and stock prices. |

| 2007-12-17 | Deriving the Price Dividend Growth Ratio | We do hard core algebra to identify what makes up the different parts of the fundamental relationship between stock prices and dividends. And a mind control experiment (we know better than to post raw math by itself in a blog post!) |

| 2008-06-24 | Stock Prices: Normal Until They're Not, But They're Not Normal! | If you've read enough of our posts, you'll note that we've often presented our data using something that looks a lot like control charts as a tool to identify significant changes in stock prices with respect to their underlying dividends per share. This post explains why! |

| 2008-08-25 | The S&P 500 from December 1991 Onward | This is the first post in which we noted that changes in the rate of growth of the S&P 500's dividends are correlated with and perhaps even drive larger changes in stock prices. |

| 2008-11-19 | The Black Monday Stock Market Crash, Explained | This is the post that directly led to this one. We identify changes in the acceleration of the growth of dividends as a key factor driving changes in stock prices. We'll be taking a closer look at this event again sometime in the future, as we were rather stunned to see the correlations apparent in the data since 2001, which we presented in this post. |

| 2008-08-28 | Hey Look - Brownian Motion! | This post looks at the Dot-com Bubble, in which stock prices and dividends per share were fully decoupled from each other, which we should note would make the kind of analysis presented in this post unworkable until the relationship is re-established. The result: unadulterated Brownian Motion (complete with video!) |

| 2008-07-15 | Defining Bubbles, Order, Disorder and Disruptive Events | We provide our operating definitions for each of these concepts describing the associated states of the stock market. |

| 2008-03-18 | Recognizing Disorder in the Stock Market | How do you know when how things were aren't the way they're going to be with stocks? We discuss how to recognize when disorder erupts in the stock market. |

| 2008-06-12 | Emerging Order in the Stock Market | The flip side to our post on how to recognize when disorder has erupted in the stock market. Plus, we introduce quantum phenonoma! |

| 2008-01-23 | Distress, Recessions, Market Bottoms and the Future | We find an interesting correlation between when the market hits bottom, recessions and peaks of distress as measured by our price-dividend growth rate ratio! |

| 2008-01-09 | The Beating Heart of the Stock Market | Here, we find we can use the price-dividend growth rate ratio as a tool to measure the level of distress in the stock market. |

| 2006-12-06 | The S&P 500 at Your Fingertips | We put the entire history of the S&P 500, including the index' price, dividends, and earnings data at your fingertips! As a bonus, we also find the rate of return between any two calendar months in the index' history, both with and without inflation and with and without dividend reinvestment! |

Update: We modified the Elsewhere on Political Calculations section of this post to incorporate our list of posts into a dynamic sorting table. Just click the column headings to sort the table by date or post title!

Labels: chaos, dividends, SP 500, stock market

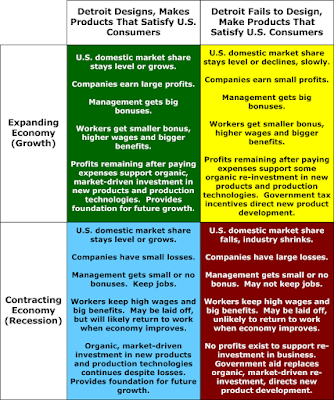

With the U.S. automakers now in line for aid from the federal government, we thought it might be valuable to present the following four square chart, which depicts the typical historic interaction between the strength of the economy and how well Detroit satisfies consumers in the U.S. with the outcomes they produce for management, workers and the future of the auto industry (click for a sharper image):

For most living Americans, Detroit has never been anywhere but in the yellow and red corners of the four-square diagram above.

Now, ask yourself: "If Detroit has always been in the right half of the four-square chart above as a result of consistently failing to design or make products that satisfy U.S. consumers, even in good economic times, what are the odds that fully substituting consumer-driven demand with government mandates in return for receiving a bailout to continue operating is something other than the completion of Detroit's death spiral?"

Asked a different way, how would making the cars the government mandates the carmakers to build to satisfy political special interest groups instead of the cars U.S. consumers might actually want to buy somehow produce a thriving domestic auto industry?

Felix Salmon has the right idea: specialization. Detroit needs to target those specific niches within the U.S. market where it can deliver outstanding products that consumers are willing to buy and restructure itself to serve those niches.

Speaking of which, if anyone wants to know what niche would satisfy us as a U.S. consumer, it's this one....

|

|

Sigh. If only Detroit were looking to go out with a bang rather than a whimper, we wouldn't have to settle for a British import. And then we could finally get this comeback to work in real life:

"Hey, handsome, what's the fastest way to New York?"

"Rocket car."

Speaking of which, the Mystery Science Theater 3000: 20th Anniversary Edition is available at Amazon. For real MST3K connoisseurs, we recommend The Essentials, which includes the very seasonal Santa Claus Conquers the Martians and our favorite modern Xmas standard Let's Have a Patrick Swayze Christmas (lyrics here).

Labels: business, none really

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.