If you're the parent of a toddler, you know that life can get pretty messy. Especially when your toddler is attempting to drink something that isn't already in a sippy cup.

The problem is that creates somewhat of a hassle for today's busy parent, because that means you to go to the time and trouble of transferring some sort of drinkable liquid from its container into your toddler's sippy cup whenever it's empty and they're still thirsty. And if you're filling the cup with a different kind of beverage from what you previously filled it up with, that means that you'll have to fully rinse out both the cup and lid before you can even fill it with the new beverage.

That's a lot of extra steps just for getting fluids into a thirsty toddler!

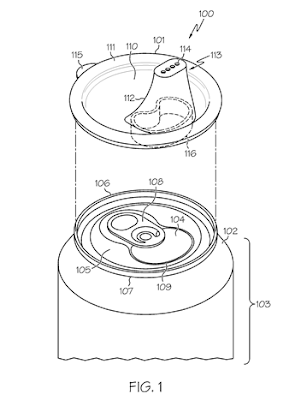

That's the problem that inventor Ellyn Audrey Yacktman solved with her patented invention, the Sippy Cup Lid for a Beverage Can, as documented in U.S. Patent 8,286,827.

Yacktman's invention can convert a typical aluminum beverage can into a spillproof container. Fitting the tops of today's typical cans, Yacktman's lid would make it very easy to change out a toddler's beverage for a fresh one, with perhaps a quick rinse of just the lid when changing beverage types. Life for the busy parent gets both easier and simpler!

We can only imagine how New York City Mayor Michael Bloomberg would react if he saw lots of toddlers in Central Park drinking straight from soda cans topped with the sippy cup lids. Or better yet, one of those big energy drink cans!...

We'd leave it there, but we can't help but notice that this particular invention also overlaps the innovations in canning technology taking place in the beer industry that we've recently featured.

We think that connecting the sippy cup lid to a can of beer has some potential beyond just the toddler market. We're thinking it would also be a good novelty item aimed at the college market, where we suspect that it will always find some sales. And then, it would also make a good gift item for that beer-drinking friend of yours who somehow always manages to spill some of it all over themselves and the things around them.

At the very least, once the sippy cup lid for cans hits the market, we think that Popular Mechanics might want to add the inventions to their list of 8 easy-drinking gadgets for the beer enthusiast!

Other Stuff We Can't Believe Really Exists

- Inventions in Everything: Anatomical Lego Figures

- It's Not What You Think....

- Inventions in Everything: Soup Bowl Attraction

- Inventions in Everything: Making Life More Difficult

- Inventions in Everything: The Oreo Separator Machine

- Air Shark!

- Markets in Everything: Stormtrooper Motorcycle Suit

- The Bike That Rides You

- One Inventor's Stick-to-itiveness

- High Five!

- Inventions for Everything

- The Best Mousetrap Ever

- An Invention for the True Wine Connoisseur

- Three of Ten Things You Don't Need on St. Patrick's Day

- The Future Just Got a Lot Cooler Than It Used to Be

- The Worst Piece of Design Ever Done

- The Magic Marker of the Future

- Coming Soon, to a Gym Near You!

Labels: technology

Have you ever heard of the 70-year cycle in history? Here's an excerpt from an essay by Eric A. that introduces the concept:

Many of you may be familiar with the Foundation series by Issac Asimov. In it, mathematician "Hari Seldon spent his life developing a branch of mathematics known as psychohistory. Using the laws of mass action, it can predict the future, but only on a large scale; it is error-prone on a small scale."

In practice, we can see that this would be theoretically correct: we study history precisely because human nature is relatively the same and the same events recur with the same predictable responses. If history really were chaos--a muddle of events appearing randomly and being resolved in unpredictable ways--there would be no point in studying it.

So what of 70 years? It seems that American politics goes through a roughly 70 year long cycles where it swings from one side of the political pendulum to the other. For example, if we start in 1789, which marks the real beginning of the United States as a single nation with the inauguration of George Washington as the nation's first president under the Constitution, the passage of 70 years suddenly puts us on the cusp of the U.S. Civil War in 1859 as the nation was getting set to try to tear itself apart.

From then, Random Jottings' David Weidel notes a general 70-year cycle in American politics:

The theory says that America became a Republican country starting about the year 2000. (From 1860 Republicans were dominant, and then the Dems starting about 1930.) Each cycle is about two political generations. The 70 years before 1860 don't have today's parties, but they fit otherwise, with the Revolutionary generation and then a follow-on generation stuck in old habits of thought. And then a problem that needed a new political alignment to solve.

But what if it's not just American politics? What if it's really a cycle that's driven by opposing ideologies in conflict?

For example, in 1896, the U.S. Supreme Court made it legal to institutionalize racial segregation in the United States. Almost 70 years later, the U.S. Congress was undoing the damage in the landmark Civil Rights Act of 1964.

This is 2013. What sort of conflict was the U.S. engaged in 70 years ago?

Well, that would put us in 1943. And in 1943, the United States fought and succeeded in forcing fascist Italy to surrender and switch sides in World War 2.

The Concise Encyclopedia of Economics explains what fascism in Italy was all about, emphasis ours:

As an economic system, fascism is socialism with a capitalist veneer. The word derives from fasces, the Roman symbol of collectivism and power: a tied bundle of rods with a protruding ax. In its day (the 1920s and 1930s), fascism was seen as the happy medium between boom-and-bust-prone liberal capitalism, with its alleged class conflict, wasteful competition, and profit-oriented egoism, and revolutionary Marxism, with its violent and socially divisive persecution of the bourgeoisie. Fascism substituted the particularity of nationalism and racialism—“blood and soil”—for the internationalism of both classical liberalism and Marxism.

Where socialism sought totalitarian control of a society’s economic processes through direct state operation of the means of production, fascism sought that control indirectly, through domination of nominally private owners. Where socialism nationalized property explicitly, fascism did so implicitly, by requiring owners to use their property in the “national interest”—that is, as the autocratic authority conceived it. (Nevertheless, a few industries were operated by the state.) Where socialism abolished all market relations outright, fascism left the appearance of market relations while planning all economic activities. Where socialism abolished money and prices, fascism controlled the monetary system and set all prices and wages politically. In doing all this, fascism denatured the marketplace. Entrepreneurship was abolished. State ministries, rather than consumers, determined what was produced and under what conditions.

Now that you've read what fascism entails, consider the following excerpt from an article yesterday at The Huffington Post, noting how nearly 40% of U.S. CEOs have come to have a very large portion of their income paid for by U.S. taxpayers:

WASHINGTON -- More than one-third of the nation's highest-paid CEOs from the past two decades led companies that were subsidized by American taxpayers, according to a report released Wednesday by the Institute for Policy Studies, a liberal think tank.

"Financial bailouts offer just one example of how a significant number of America's CEO pay leaders owe much of their good fortune to America's taxpayers," reads the report. "Government contracts offer another."

IPS has been publishing annual reports on executive compensation since 1993, tracking the 25 highest-paid CEOs each year and analyzing trends in payouts. Of the 500 total company listings, 103 were banks that received government bailouts under the Troubled Asset Relief Program, while another 62 were among the nation's most prolific government contractors.

Meanwhile, that all would be occurring as American entrepreneurs would appear to be harder and harder to find:

The US entrepreneurial spirit may be faltering. Check out these data points from The Wall Street Journal: a) In 1982, new companies made up roughly half of all US businesses, according to census data. By 2011, they accounted for just over a third; b) from 1982 through 2011, the share of the labor force working at new companies fell to 11% from more than 20%; c) Total venture capital invested in the US fell nearly 10% last year and is still below its prerecession peak, according to PricewaterhouseCoopers.

The United States would appear to be well on its way to adopting fascist Italy's political-economic system, favoring the politically-connected while starving entrepreneurs out of the economy. Although today in America, we call it "crony capitalism". And the people who practice it "progressives".

Do you think we should start calling it what it really is?

Recommended Reading

Elsewhere on the Web

- IPS' report Executive Excess 2013: Bailed Out, Booted, Busted (full PDF version available), plus an Excel spreadsheet with the compensation data for the top 25 highest paid CEOs for each year from 1994 through 2013.

- Barry Ritholtz weighs in on the transfer of wealth from taxpayer to CEOs documented in IPS' report.

Previously on Political Calculations

- Barack Obama: Crony Capitalist in Chief? Part 1

- Barack Obama: Crony Capitalist in Chief? Part 2

- The Twenty Percent President

- Stranded in the Food Desert

- Has the U.S. Become a Banana Republic?

- How GE Became a Basket Case

- GE CEO Stuck Inside Wet Paper Bag

- Top 10 Corporate Welfare Recipients by "ObamaCare"

Is President Obama planning to default on the U.S. national debt?

We had some interesting traffic on our site yesterday, as an individual in the Executive Office of the White House took an unusually strong interest in our Timeline of Major Events Driving the Risk of U.S. Default, which documents much of the last debt ceiling crisis that culminated in the summer of 2011.

We don't think they were very happy with our independent analysis of the White House's role in increasing the risk of a U.S. government default during that period of time, although they would seem to have appreciated it enough where they used a combination of terms that are unique to our analysis in a Google search to specifically track it down and to refamiliarize themselves with it.

More practically however, we had used Credit Default Swaps for U.S. Treasuries as a tool to measure the relative risk of a U.S. federal government default upon its national debt payments. Unfortunately, the same tool will be of little value in considering the current situation where the U.S. is once again approaching its debt ceiling. Reuters explains:

LONDON, July 8 (IFR) - Credit default swaps are no longer viewed as a reliable indicator of sovereign risk, traders say, as an EU ban on speculative activity has successfully eviscerated an instrument that European policymakers once blamed for exacerbating the eurozone crisis.

Portugal's political establishment was rocked by multiple ministerial resignations last week, causing the country's CDS to soar by more than 20% in a day to 506bp on Wednesday, its widest level in seven months, while the yield on its 10-year government bond almost reached 7.5%.

But in stark contrast to previous examples of sovereign stress, traders professed to be largely ignoring CDS spreads, as a huge drop off in volumes and liquidity has undermined the price discovery value of the product.

"People pricing sovereign risk now look at the bonds, so why would you look at the CDS if bonds are where the information lies? Back in the day it was the other way around, with CDS levels being the crucial signal - it's a fundamental change," said Paul McNamara, investment director at GAM.

To translate, because they were unhappy that the market had a tool that clearly communicated the risk of a sovereign government defaulting on its debt payments, the people who run the European Union chose to scapegoat the trading of credit default swaps for its problems and banned them.

It's kind of like how the people who are successful in shorting stocks are blamed for the problems of the failing companies whose stock prices are falling because of bad business decisions made by the insiders running the companies. Only here, the insiders of the failing entities have the ability to shut down that kind of trading.

The E.U. ban directly affects U.S. credit default swaps because it eliminates much of the source of liquidity and volume needed to make its price a good signal of the level of perceived risk of default.

And so, we go into the U.S. federal government's next debt ceiling crisis with a broken tool. We could perhaps use the yields of the 10-Year U.S. Treasury as a substitute, but that has been rising ever since May 1, as the market has been progressively pricing in the end of the Federal Reserve's current round of quantitative easing (QE).

In fact, we would say that virtually all of the increase in the yield of the 10-Year U.S. Treasury since 1 May 2013 may be attributed to speculation associated with when the Fed will begin to act to end its QE programs. Although the Obama administration is targeting mid-October in its plans for when the U.S. Treasury will reach the nation's debt ceiling, the market pretty much shrugged off the news as Treasury yields fell, which indicates that they aren't placing very much stock in the administration's pronouncements.

It would seem then that President Obama will need to behave much more irresponsibly in taking actions that will boost Treasury yields if he hopes to send the market a signal that the U.S. will default on its debt at his direction.

Labels: national debt

If the purpose of federal government-provided welfare benefits is to lift people above the poverty line, where they would have sufficient income to cover the basic costs of food, clothing and shelter, does it really make sense for the federal government to be even more generous with the taxpayer's money than that?

And yet, in 33 states and the District of Columbia, the federal government is being extremely generous with taxpayer dollars:

The data in the chart above is based upon Michael Tanner and Charles Hughes' recently-published study of the typical government-provided benefits that are available to a typical welfare recipient - a three-person household consisting of one adult and two children, which we've divided by the official federal poverty income threshold for each state.

We've provided an interactive version of the chart below, which will also let you mine down into and visualize the source data for our chart:

Amazingly, welfare benefits can take their recipients well over the 200% of poverty threshold mark in 10 states, mainly concentrated in the northeastern part of the U.S., but also including Hawaii, which tops the charts at over 275%. California falls just shy of that mark at 195%.

Since welfare benefits are not subject to tax, we wonder if this extreme generosity is creating a situation where the people who actually have to be productive to earn the equivalent incomes that welfare recipients enjoy are kicking themselves for being too stupid to exploit the system the same way as their nonproductive peers are led by their communities' organizers.

Rather that see that situation grow into outright hostility, we think the real answer is to treat the recipients of government-provided welfare the same way that people who work for a living are treated by the government, but with just a bit of compassion.

Here's an idea: let's require that the federal, state and local government agencies responsible for dispensing welfare benefits issue 1099 tax forms to welfare recipients documenting the full value of the benefits they received and also to the IRS.

The welfare recipients would then have to report this unearned income on their federal tax returns. Any amount provided in excess of the difference between the federal poverty level that applies in their state and any regular income they may have earned should then be taxed at the same rates that apply for unearned income.

It's one thing to accommodate the basic needs of people who struggle to make ends meet in taking care of their most basic needs, but it's quite another to give welfare recipients benefits whose value far exceeds that level. By making the excess portion of their otherwise "free" income subject to tax as the unearned income it really is, they'll be treated just the same as those in the Top 1%, who also have lots of unearned income, and will share the same burden of taxes.

And just like the Top 1%, they will have the ability to choose how much unearned income they have subject to being taxed above the federal poverty threshold to minimize their tax bill.

It may not be an ideal way of dealing with having government welfare benefits be provided so far in excess of that required to boost individuals and families above the poverty line that applies in their states, but it certainly would be a lot more fair all around than today's situation.

Data Sources

Tanner, Michael and Hughes, Charles. The Work Versus Welfare Trade-Off: 2013. An Analysis of the Total Level of Welfare Benefits by State. Table 4 - Pretax Wage Equivalents Compared to Median Salaries. CATO Institute. [PDF Document]. 19 August 2013.

U.S. Department of Health and Human Services. 2012 HHS Poverty Guidelines. [Online Document]. Federal Register. 26 January 2012.

Previously on Political Calculations

Labels: taxes

What a boring week!

The week ending on 23 August 2013 was a week in which the Fed's officials very clearly went out of their way to not make any noise as they jetted off to Jackson Hole, Wyoming for their annual retreat. And in the absence of other noise or significant changes in the fundamental outlook for the companies that make up most of the U.S. stock market, the market pretty much ended exactly at the same level it ended in the previous week.

Really! To illustrate the point, we added just two words to our notes on our chart from last week. Actually, just the same word twice "Still":

The biggest market-driving news of the week was the release of the notes from the Fed's 31 July 2013 meeting on Wednesday, 21 August 2013. And because they didn't provide any greater clarity for when the Fed might begin slowing the purchases of U.S. Treasuries and mortgage-backed securities that make up its current quantitative easing scheme, the change in the growth rate of stock prices remained stuck about halfway between the future associated with an earlier slowdown (2013-Q3) and the future associated with a later slowdown (2014-Q1).

It's almost as if the whole last week never happened!

Speaking of the split in the consensus for when the Fed's current QE program will begin to draw down, we wonder if the split in the consensus of the Federal Reserve's Open Market Committee is the same as the split we observe in the expectations for these two potential futures.

There was one item in last week's news that we found noteworthy. It seems an economist from Princeton University has arrived at the same conclusion about the role of the Fed in creating the market turbulence we've seen this summer that we did just a day after the event in question, although it took them over two months to reach that same conclusion and communicate it to Fed officials.

JACKSON HOLE, Wyo.—The Federal Reserve believes that providing clear guidance about the likely future course of its policies make them more effective in boosting the economy, while helping to tamp down on market volatility and uncertainty.

That may not be so, said a paper presented here Saturday by Jean-Pierre Landau of Princeton University at the research conference hosted by the Federal Reserve Bank of Kansas City.

Over the last year, the Fed has been buying $85 billion a month of bonds in an effort to lower long-term interest rates, hoping that will spur growth and lower unemployment. Fed officials have been warning for months since May that they could start scaling back the program if the economy continues to improve as they expect.

The problem for the Fed is that as its policy makers have tried to prepare markets for this shift, they've generated considerable market volatility, in part driving up bond yields and boosting borrowing costs.

But the best part is when the Princeton economist discovers the role of what we've long described as "noise events" in affecting markets:

Mr. Landau lays a lot of the blame for the bond-market turbulence on the Fed itself. The paper notes that current Fed guidance on the policy outlook eliminates the cost of leverage, and creates "strong incentives" to increase and even overextend investment exposures.

In turn, "this makes financial intermediaries very sensitive to 'news,'" whatever that may be, he wrote. In this case, the catalyst for the market tumult is the Fed's statements about possibly scaling back the bond program this year. Once that view was conveyed to markets, it drove a big shift in market positions, to a degree that was very surprising to many observers.

But perhaps not so surprising if you know what expectations for things like stock prices are associated with different points of time in the future. And as we're emphasizing today, for the current "market tumult", it's really just a matter of determining how split investors are between the outlooks that apply for each of those alternative futures.

We'll see how long it takes Princeton's economics department to catch up to that realization. Our guess though is that Princeton's physics department may beat them to it, since this is, after all, the financial equivalent of the many-worlds variant of Schrödinger's Cat experiment....

Previously on Political Calculations

We had looked forward to a boring summer. Instead, we've found ourselves providing the following observations and near real-time analysis of the economic story of the summer, to which the economics department at Princeton University would appear to only just be beginning to catch on....

- The World Investors and the Fed Live In Now - Our snapshot of the market right before the event, in which we note that investor concern about the future of QE was growing and remark that there will be a market reaction in response to the outcome of the Fed's two-day meeting later that week.

- The Bernanke Noise Event - as the Summer of 2013 shall ever be known to investors....

- Now Is It Time to Sell? - according to statistics, a quaint branch of mathematics that only works to describe how stock prices vary with respect to their trend when order is present in the market. The problem with it is that the market goes in and out of order, so it's periodically pretty useless....

- The Fed's Real QE Mistake: Timing - We explain how Bernanke really screwed up.

- Now What Will You Do? - the statistical line is crossed! We look at everything that we see screaming "sell", without actually saying it's time to sell.

- The Fed Attempts to Walk It Back - we anticipate how the Fed will respond to Bernanke's error, and we determine if it will work.

- The GDP Multiplier for QE - Not about investing, at all! Instead, we explain why sustaining QE at current levels is so important to the U.S. economy at present.

- "Never Bet Against the Fed" - we visually illustrate that the Fed's response to repairing the damage from Chairman Bernanke's blunder is working and recap why fears of stock market doom, despite signals to the contrary, were really overblown.

- Bernanke Closes the Gap - we mark the end of the Bernanke Noise Event.

- The Noise of Summers - we note the beginning of a new negative noise event....

- The S&P 500 Hits 1700 A Month Late - Finally, after all that noise!

- The Fed's Minions Shoot Themselves in the Foot - we discuss the role of new data and comments by Fed officials in forcing stock prices off the pace the Fed had previously preferred.

- How the Timing of the Tapering Is Driving Stock Prices - we apply the kind of analysis that we invented to explain why the market would appear to be split between two very different futures.

The Kind of Analysis That We Invented

- How Stock Prices Work - The basic theory for why "Which Future?" is the most important question for investors to answer.

- The Math Behind How Stock Prices Work - Just as advertised. Welcome to chaos!

- Whither Dividend Futures - we tell you exactly where we get our data. Between this and our math (linked above), you can do this kind of cutting edge analysis too....

- Acceleration, Amplification and Shifting Time - the discovery that led to our inventing this kind of analysis, plus links to our earlier discoveries that made it possible....

It's time again to check in on who really owns the U.S. national debt. This edition of our occasional series is different however, because the official size of the U.S. national debt hasn't meaningfully changed over the last three months.

That's because of the deal struck between President Obama and the U.S. Congress, which allowed the national debt to increase while both the House of Representatives and the Senate passed budget proposals, which was a real accomplishment for the U.S. Senate, since that body hadn't fulfilled its Constitutional responsibilities for passing any budget proposal for years.

But after that, the window for further debt increases closed, with the total public debt outstanding for the U.S. since then frozen within a few billion of $16.738 trillion.

If you would, please take a moment to think about how casually we're describing those very, very big numbers....

That $16.738 trillion is approximately the current level of the debt ceiling for the U.S. federal government. Since reaching that level in May 2013, the U.S. Treasury has been employing "extraordinary" measures to ensure that the official national debt of the U.S. does not exceed that level, which include such steps as delaying borrowing money to fund the pensions of federal government bureaucrats.

Meanwhile, the Federal Reserve has maintained its quantitative easing programs, where it has been acquiring an average of $85 billion per month in U.S. Treasuries (UST) and Mortgage-Backed Securities (MBS).

Both these factors account for the big changes that we observe have taken place since the end of the U.S. federal government's 2012 fiscal year on 30 September 2012.

Since that time, the Federal Reserve's share of the total public debt outstanding of the United States has increased from 10.8% to 12.0%, as the share held in the U.S. Civil Service Retirement Trust Fund has declined from 5.6% to 4.4%.

With the Federal Reserve sustaining its QE bond-buying program, we also observe that the relative share of the national debt by foreign entities has declined. This is a result of the Fed's QE policy "crowding out" these other lenders from the market for U.S. government-issued debt securities.

Data Sources

Federal Reserve Statistical Release. H.4.1. Factors Affecting Reserve Balances. Release Date: 5 July 2013. [Online Document]. Accessed 20 August 2013.

U.S. Treasury. Major Foreign Holders of Treasury Securities. Accessed 20 August 2013.

U.S. Treasury. Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2013 Through June 30, 2013. [PDF Document].

Labels: national debt

"How does the compensation of federal civilian employees compare with that of employees in the private sector?" is a question that the Congressional Budget Office once asked and answered, finding that the combined cash income and benefits that Uncle Sam's employees are paid is a lot more generous than what their peers in the private sector earn, even after controlling for factors like education, years of experience and job descriptions.

But we wondered how does the productivity of federal civilian employees compare with that of employees in the private sector? After all, if a civilian employee of the U.S. federal government is more productive than their similarly educated and experienced peer doing the same or similar job in the private sector, that difference could well justify their more generous compensation. If everything else is equal, it makes sense that a person who is more economically productive in doing a job would be compensated more than a less productive person doing the same work.

Thanks to a natural experiment, we're about to find out just how productive federal bureaucrats really are with respect to their direct peers in the private sector!

This summer, as part of the cost-cutting measures related to the budget sequester required by the Budget Control Act of 2011, President Obama acted to discontinue the operations of the Department of Labor's International Labor Comparisons (ILC) program, which converts the economic statistics produced by other nations' governments to adhere to U.S. standards and definitions, which allows for direct apples-to-apples comparisons to be made between the nations' economic data. Here's the announcement of the program's elimination that appeared in the Federal Register on 25 June 2013:

The International Labor Comparisons (ILC) program adjusted foreign data to a common framework of concepts, definitions, and classifications to facilitate data comparisons between the United States and other countries. ILC data were used to assess United States economic performance relative to other countries, as well as to evaluate the competitive position of the United States in international markets.

On March 1, 2013, President Obama ordered into effect the across-the-board spending cuts (commonly referred to as sequestration) required by the Balanced Budget and Emergency Deficit Control Act, as amended. In order to achieve these budget cuts and protect core programs, The Bureau of Labor Statistics is eliminating the International Labor Comparisons program. Subject to BLS policies and procedures, the underlying data and the methodology used to produce the data will be available upon request.

Shutting down the ILC program had been one of the President's budget objectives for some time. The Washington Post described the ILC's operations and President Obama's desire to cut the program back on 3 March 2010:

President Obama's budget would eliminate the International Labor Comparisons office and transfer its 16 economists to expand the bureau's work tracking inflation and occupational trends. The White House says the cut, estimated to save $2 million, is one of many difficult decisions the president was forced to make to control spending.

On 27 June 2013, the non-profit Conference Board announced that it would take over reporting the international labor comparisons. (The Conference Board is the same outfit that conducts the Consumer Confidence Survey and that reports the Index of Leading Economic Indicators, both of which are frequently cited in the media.)

The Conference Board announced today that it will continue a statistical program on international labor statistics that is to be eliminated by the federal government due to across-the-board spending cuts. The Bureau of Labor Statistics, a unit of the United States Department of Labor, has announced that it will shut down the International Labor Comparison (ILC) program on July 1.

The program provides businesses, government agencies, academics, and the public with high-quality data on manufacturing productivity, unit labor costs, consumer price, wage rates, and employment and unemployment for up to 34 countries. It adjusts data to a common framework of concepts, definitions, and classifications to facilitate data comparisons across countries. ILC data are used to assess United States economic performance relative to other countries, as well as to evaluate the competitive position of the United States in international markets. The Conference Board will continue the program on its current basis and make the data available to the public at no cost. The Conference Board will implement the transition of the program over the summer.

"Every large company needs access to this data, and it can only be gathered effectively by leveraging non-commercial relationships between various government and statistical agencies around the world," said Jon Spector, President and CEO of The Conference Board. "If a government agency cannot continue to maintain this information, it requires an independent institution to take over the task."

Clearly, the Conference Board believes that there is value in sustaining the output of the International Labor Comparisons program. But the question we wanted to answer is "how many people will they seek to hire to do the work?"

Since the private sector Conference Board wasn't doing the work previously, to take on the new work, it would very likely have to both retask its current employees to add to their current job responsibilities while also creating new jobs specifically to do the additional work.

The number of dedicated new hires would be especially revealing because that would provide a direct indication of the relative productivity of people doing the exact same jobs in both the public and private sector. If the number of new hires in the private sector required to do the work turns out to be greater than the number of dedicated federal employees who were previously doing it, that would be a clear indication that the federal bureaucrats are more productive than their private sector peers, and thus are deserving of a higher level of compensation.

As best as we can tell from its job postings since its announcement, the private sector Conference Board will hire at least two and possibly three people to do the work that would appear to have required 16 dedicated bureaucrats when the same work was done by the U.S. federal government. Here are the job descriptions for the positions that the Conference Board is seeking to fill related to this work:

- Senior Economist International Labor Comparison

- Research Analyst, Economics International Labor Comparisons Program

- Research Assistant, Economics

The last Research Assistant position doesn't reference the International Labor Comparisons program, which means that it isn't the primary purpose of the position, but it's clear from the job description that the person hired to fill the opening could very well be tasked with work related to the ILC program. We should also recognize that it is possible that the job posting for the Research Analyst position that does specifically reference the ILC work may represent more than one opening with the same job description, but there is no indication that is the case in the description for the position, so we tend to think that is not the case.

Those things noted, these job postings suggest that the private sector Conference Board believes it will take the addition of no more than 3 people to do the same work that 16 bureaucrats were dedicated to doing as employees of the U.S. federal government. That would mean that the federal government employees who were previously doing the work would appear to be less than one-fifth as productive as their private sector peers in working to produce the same output.

We therefore find that the higher level of compensation for civilian federal government employees is not justifiable on the basis of their relative productivity with respect to similarly skilled and experienced workers in the private sector.

In fact, the lower apparent productivity of federal bureaucrats would also be a big reason why cuts to government spending reduces the nation's GDP by considerably less than the actual amount of the spending reduction.

Speaking of those 16 displaced federal government employees, since it appears that they have been reassigned to other areas within the Bureau of Labor Statistics, whose remaining workload is unchanged following the elimination of the International Labor Comparisons program, that means that the collective productivity of the federal government's employees at the BLS has decreased.

Of course, that is exactly what we should expect to happen when more people become involved in generating an unchanged level of output. But at least, in doing less work per person than before, but for the same pay, that means that their total compensation per person has become just ever so much greater than their private sector peers.

It's all just another perk of working for Uncle Sam!

References

Conference Board. The Conference Board Takes Over International Labor Statistics Program from the U.S. Government. [Online Article]. 27 June 2013.

Labor Statistics Bureau. International Labor Comparisons. [Online Article]. Federal Register. 25 June 2013.

MacGillis, Alec. Obama Administration Plans to Close International Labor Comparisons Office. [Online Article]. Washington Post. 3 March 2010.

Labels: business, economics, jobs, quality

According to a study by Michael Tanner and Charles Hughes, the money that people can make on welfare in many states is more than they can make in an entry-level job. And in some states, it's more than what a person who works to earn the median income takes home.

The Wall Street Journal describes the findings of the study:

The state-by-state estimates are based on a hypothetical family participating in about seven of the 126 federal anti-poverty programs: Temporary Assistance for Needy Families; the Women, Infants and Children program; Medicaid; Supplemental Nutrition Assistance Program; and receiving help on housing and utilities.

In Hawaii, that translates into a 2013 package of $49,175 — up $7,265 from an inflation-adjusted $41,910 in 1995. Rounding out the top five areas for welfare benefits, along with their 2013 amounts, were: the District of Columbia ($43,099), Massachusetts ($42,515), Connecticut ($38,761) and New Jersey ($38,728).

The state with the lowest benefits package in 2013 was Mississippi, at $16,984, followed by Tennessee ($17,413), Arkansas ($17,423), Idaho ($17,766) and Texas (18,037).

From our perspective, the report is interesting because all the data is presented in the form of tables. That creates an opportunity for us, because we can take that data and visualize it!

So we have, using the data visualization tools available at IBM's ManyEyes site. And what's more, we've taken it to the next level by incorporating an interactive version of the map we created in this post to illustrate each state's typical pre-tax welfare "income", their median incomes, and also their hourly "welfare", median and also minimum wages, which we added for good measure!)

And as a bonus, we also calculated the percent of welfare benefit with respect to each state's prevailing minimum wage, so we can identify all the states where welfare really does pay more than an entry level job.

If you're reading this article on a site that republishes our RSS news feed, you won't be able to play with the interactive map we've created - for that, you'll need to visit the original article on our site.

In the interactive map above, you can show all six of the maps we generated at once, and you can find each state's value for each category by hovering your cursor over it. You can even switch from a color scale on the map to a bubble presentation, which the size of each state's bubble is proportionate to the value being illustrated. You just need to click the "click to interact" button in the top left corner to get started!

References

Tanner, Michael and Hughes, Charles. The Work Versus Welfare Trade-Off: 2013. An Analysis of the Total Level of Welfare Benefits by State. Table 4 - Pretax Wage Equivalents Compared to Median Salaries. CATO Institute. [PDF Document]. 19 August 2013.

U.S. Department of Labor. Wage and Hour Division. Minimum Wage Laws in the States - January 1, 2013. [HTML Document]. Accessed 20 August 2013.

Labels: data visualization

Since we last looked at the S&P 500's expected trailing twelve-month earnings per share some three months ago, the future for the S&P 500's forecast earnings has grown dim.

We can see that's the case in comparing our previous 17 May 2013 snapshot of the S&P 500's expected trailing year earnings per share for the fourth quarter of 2013 (2013-Q4, ending 31 December 2013) with our new snapshot just taken on 15 August 2013. To put the situation bluntly, the spike in optimism that investors had for a significantly brighter future in 2013 just three months ago has collapsed almost back to where it was six months ago.

Here, we've been tracking the expectations for the fourth quarter of 2013. Looking at the trailing year earnings per share expected for 2013-Q4, we see that investors have decreased the level of earnings they expect to be reported for the S&P 500 in 2013 by $7.27 per share as compared to our previous snapshot that was taken just three months ago, with the new trailing twelve month figure now expected to be $100.91 per share.

This is close to the level that investors had first expected for 2013-Q4 back on 15 February 2013.

One observation we can take away from this edition of our earnings snapshot chart is that there was an earnings recession that ran approximately from the first quarter of 2012 through the first quarter of 2013, which we recognize in the revised earnings per share that have been reported by Standard & Poor for the S&P 500.

What's more remarkable however is that the earnings per share data that was originally reported during that period did not indicate that situation. Our trailing twelve month earnings per share snapshots for 15 January 2012, 20 May 2012, and 13 August 2012 all indicated that earnings were rising during the early portion of this period of recession for stock market earnings.

It's not until our snapshot taken on 8 November 2012 that we see that the earlier earnings data had been revised enough to indicate a slow-to-no growth condition in the U.S. economy. Since then, our snapshots taken on 15 February 2013, 17 May 2013 and the newest on 15 August 2013 all confirm that earnings in the private sector of the U.S. economy actually contracted during these quarters.

By contrast, the number of publicly-traded companies acting to cut their dividends per share each month provided a near real-time confirmation of those recessionary conditions being present in the U.S. economy. Our most recent reading of that data indicates that the private sector of the U.S. economy is still experiencing recessionary conditions, but is perhaps finally beginning to exit from them.

But then, as we keep pointing out, dividends provide the clearest signal of the state of the private sector of the U.S. economy. It's just a bonus that they are also the fundamental driver of stock prices.

Reference

Silverblatt, Howard. S&P Indices Market Attribute Series. S&P 500 Monthly Performance Data. S&P 500 Earnings and Estimate Report. [Excel Spreadsheet]. Last Updated 15 August 2013. Accessed 17 August 2013.

Labels: earnings, forecasting, SP 500

Why is the prospect of the Fed acting to taper off its purchases of securities in its current Quantitative Easing (QE) program appear to be driving stock prices lower?

Keep in mind that even though the Fed's QE efforts is clearly responsible for keeping the U.S. economy out of recession following the second quarter of 2012, the reason the Fed believes it can begin taking its foot off the QE gas is because the U.S. economy would appear to be beginning to recover from its microrecession.

As far as the economy is concerned, the Fed's tapering of its bond-buying through its QE program as the economy improves is really just maintaining a status quo. If the Fed's bond-buying has been successful in keeping real economic growth rates at a stable level, then as the economy gradually becomes capable of generating its own positive growth rate, it can offset what the Fed has been doing with its QE efforts, which means that the Fed can gradually ease off the gas.

And since the Fed's tapering policy is just maintaining the status quo for economic growth rates, stock prices should not be affected, because the portion of earnings that the businesses who make up the market could reasonably anticipate should likewise be unchanged in those conditions, simply because the rate of real economic growth is not expected to significantly change.

But that's not how prices really work. As we're about to show you, there hasn't really been any significant change in the future expectations for the sustainable portion of future earnings (aka "dividends"). And in fact, the only thing that has changed for investors is the point in the future to which serious and influential investors are focusing their attention in setting stock prices, which is being driven by the timing for when the Fed will begin tapering its QE programs.

They had been focused on 2014-Q1, which corresponds to a future in which the tapering of QE would not be expected to begin until 2014. New information of an improving situation for the U.S. economy combined with the comments of Fed officials is forcing them to shift their attention to an earlier point in time, 2013-Q3, since that coincides to the nearest future point of time in which Fed would announce that it is beginning the tapering of its QE program.

As it happens, those future quarters have different expectations for changes in the year-over-year growth rate of dividends that will be earned in them, which is what sets the fundamental pace of change in the growth rate of stock prices. And that difference in expectations at these discrete points of time in the future is what is driving stock prices today.

All these things we just described is visualized in our chart below. Mind the comments in the margin, because we believe can use what we know to measure the degree to which the forward-looking focus of investors is currently split in the stock market:

Notice in the chart above that the level for the acceleration of dividends for both 2013-Q3 and 2014-Q1 has been steady for weeks. That is the confirmation that what publicly-traded companies reasonably expect to earn in these quarters is unchanged.

But the acceleration of stock prices is changing from pacing the expectations associated with 2014-Q1 toward the expectations associated with 2013-Q3. Through 16 August 2013, they've covered 52% of the distance between them.

Put another way, that's an indication that the market currently now placing a 52% probability that the tapering of QE will begin in 2013-Q3 rather than in 2014-Q4. If it helps put the recent decline in stock prices into proper perspective, what having investors 100% fully focused on 2013-Q3 would mean for stock prices is an S&P 500 potentially falling to around the 1500 level in September 2013.

Of course, the good news in that is that the much more positive alternative future for stock prices of 2014-Q1 would still be in the future. Investors would be able to re-shift their focus back to this point of time in the future, which would correspond to a major rally in stock prices.

If the Fed had instead indicated that the tapering of QE wouldn't begin until then, we could be enjoying that rally today. But apparently, the Fed's minions had other plans....

Previously on Political Calculations

Unless it becomes relevant as events develop, this is probably the last time that we'll feature the following chain of analysis in considering the major market drivers this summer. We know we said that last week, but let us know when the links below stop being immediately relevant to the current situation in the market....

- How Stock Prices Work - The basic theory for why "Which Future?" is the most important question for investors to answer.

- The Math Behind How Stock Prices Work - Just as advertised. Welcome to chaos!

- Whither Dividend Futures - we tell you exactly where we get our data. Between this and our math (linked above), you can do this kind of cutting edge analysis too....

Next, that electronic trail of analysis we've provided throughout the event:

- The World Investors and the Fed Live In Now - Our snapshot of the market right before the event, in which we note that investor concern about the future of QE was growing and remark that there will be a market reaction in response to the outcome of the Fed's two-day meeting later that week.

- The Bernanke Noise Event - as the Summer of 2013 shall ever be known to investors....

- Now Is It Time to Sell? - according to statistics, a quaint branch of mathematics that only works to describe how stock prices vary with respect to their trend when order is present in the market. The problem with it is that the market goes in and out of order, so it's periodically pretty useless....

- The Fed's Real QE Mistake: Timing - We explain how Bernanke really screwed up.

- Now What Will You Do? - the statistical line is crossed! We look at everything that we see screaming "sell", without actually saying it's time to sell.

- The Fed Attempts to Walk It Back - we anticipate how the Fed will respond to Bernanke's error, and we determine if it will work.

- The GDP Multiplier for QE - Not about investing, at all! Instead, we explain why sustaining QE at current levels is so important to the U.S. economy at present.

- "Never Bet Against the Fed" - we visually illustrate that the Fed's response to repairing the damage from Chairman Bernanke's blunder is working and recap why fears of stock market doom, despite signals to the contrary, were really overblown.

- Bernanke Closes the Gap - we mark the end of the Bernanke Noise Event.

- The Noise of Summers - we note the beginning of a new negative noise event....

- The S&P 500 Hits 1700 A Month Late - Finally, after all that noise!

- The Fed's Minions Shoot Themselves in the Foot - we discuss the role of new data and comments by Fed officials in forcing stock prices off the pace the Fed had previously preferred.

- How the Timing of the Tapering Is Driving Stock Prices - this post, as it appears on our own site, in all its properly formatted glory!

Do you remember the Stephen Wright joke about powdered water? The one that goes:

I bought some powdered water, but I don't know what to add to it.

Thanks to the efforts of chemical engineer Sergio Jésus Rico Velasco, who has spent years working to find a solution to the drought conditions faced by farmers in Mexico, we now know the answer to Stephen Wright's quandary. You need to add water!

Modern Farmer's Jesse Hirsch describes the innovation and the potential impact for agriculture in arid regions:

Solid Rain looks like sugar, and it sells for $25 a pound. And if you're a bit skeptical of its maker's claims, we understand. This Mexican product, which bills itself as a miracle powder that could solve the world's drought problems, seems like it belongs right alongside magic beans and Herbalife on the "I wasn't born yesterday" spectrum.

But rest assured: Solid Rain is very real, and very effective.

Solid Rain's creator, Sergio Jésus Rico Velasco, is a Mexican chemical engineer who spent decades trying to mitigate his country’s drought issues. His initial inspiration for Solid Rain was baby diapers, an item that absorbs lots of liquid in a minimal space.

That's the basic process used by Solid Rain — it's a highly absorbent polymer called potassium polyacrylate, which soaks in water up to 500 times its original size. A whole liter of water can be absorbed in just 10 grams of Solid Rain, which converts into a thick, translucent gel. The water is then retained for up to a year, and it will not evaporate, run off into the soil or go anywhere until it's consumed by a plant's roots. Think of it like a little powdered reservoir.

The innovation has demonstrated its ability to improve the yields of crops in dry regions over the past decade by keeping them much better hydrated throughout the year, and especially during the dry seasons. Interestingly, the material itself is safe for the environment because it's not itself soluble in water, so it stays in the soil and isn't absorbed into the roots of plants. Better still, it also appears to have the potential to improve crop yields by keeping soil nutrients from washing away when fields are irrigated, since it reduces the need to irrigate them frequently, with the result being that more nutrients make it into the plants being grown, which then helps them grow more quickly.

In a way, solid rain is potentially to agriculture what hydraulic fracturing (or "fracking") is proving to be for oil and gas production - a way to unlock much a greater production of resources than was previously possible due to small and systematic improvements in technology over time through human ingenuity.

(HT: Core77)

Previously on Political Calculations

Labels: technology

According to the carefully crafted plan of the Obama administration, there would be one million electric cars cruising around America's streets and highways by 2015. According to the plan, almost half of those vehicles would be Chevrolet Volts.

So how well are President Obama's industrial policy plans working out in the real world?

The easiest way to find out is to count up the number of Chevrolet Volt sales over time. Electric vehicle industry observer InsideEVs provides a monthly scorecard of the number of sales recorded for each primarily electricity-powered automobile in the U.S., from which we extracted the data for GM's Chevrolet Volt and visualized in the following chart:

Through July 2013, we find that GM has sold a total of 43,111 Chevrolet Volts, which is about 161,889 vehicles short of the number that would need to be sold through this point of time to meet President Obama's planned sales total of 495,000 for these vehicles by 2015. That shortfall might help explain why GM has recently moved to mark down their recommended sale price for the Chevy Volt by $5,000.

Considering all of the primarily electricity-powered vehicles listed on InsideEVs monthly sales scorecard, through July 2013, some 117,788 electric vehicles have been sold in the United States. To reach President Obama's target of 1,000,000 electric automobiles sold by the end of 2015, some 882,212 more electric cars will have to be sold by December 2015.

That means that the number of sales of electric automobiles from August 2013 through December 2015 will have to average 30,421 per month between now and then. Through July 2013, the rolling twelve-month average for electric vehicle sales is 6,689 per month, a difference of 23,732 sales per month, which is about 78% below the average pace needed to hit President Obama's planned goal of having one million electric cars on the road by that time.

At present, the rolling twelve month average of Chevy Volt sales is nearly 80% below President Obama's planned average figure of 10,000 per month.

Put another way, there would appear to be an eighty percent difference between what President Obama promises and the reality of what he delivers.

And that would make Barack Obama the twenty percent President.

Update 16 August 2013: Writing at Innocent Bystanders, Geoff notes that we should have included one more graph in our analysis, which he has been kind enough to create: a comparison of President Obama's projected cumulative number of Chevy Volts that were supposed to be sold, and harsh reality:

Thanks Geoff!

References

U.S. Department of Energy. One Million Electric Vehicles by 2015, February 2011 Status Report. February 2011.

InsideEVs. Monthly Plug-In Sales Scorecard. Accessed 10 August 2013.

Previously on Political Calculations

- Is the Government Subsidizing the Chevy Volt Enough? - we find that the $7,500 tax credit that the U.S. government was giving every buyer of GM's Chevrolet Volt was more than adequate to cover the relatively higher cost to the consumer for the Volt's electricity-driven engine.

- Comparing MPGs for Alternative Fuel Vehicles - GM claimed the Chevy Volt will go 230 miles for every gallon of gasoline that it consumes. We built a tool to determine just what kind of mileage that consumers could really expect to get out of the electric car with the backup gasoline-powered engine.

- Barack Obama: Crony Capitalist in Chief? Part 2 - after setting the stage in Part 1, we tell the sad story of a failing car company and how its electric car concept was used as the bait to commit a willing politician looking to grease the wheels of crony capitalism in America for political advantage into providing a massive taxpayer-funded bailout of the company.

- Is GM Headed Back to Bankruptcy? - despite the President Obama's bailout of the company, we find that GM's financial situation is such that it is still in the danger zone for going through bankruptcy again.

Now that the BEA has released its massive revision of the United States' Gross Domestic Product, we're going to put our Keynesian-style GDP multiplier tool to the test. Will it still be able to accurately predict what a future quarter's nominal GDP will be for the current U.S. economy based only based only on a previous quarter's GDP and a handful of fiscal and monetary policy GDP input shocks? Or will it fold up like the cheap suits worn by Keynesian-style economists?

To do this analysis, we'll be projecting the future value for nominal GDP from the starting point of the fourth quarter of 2012. This is the final quarter preceding major changes in the U.S. government's policies for taxes and spending, which makes it an ideal zero point in time from which to consider the impact of these shocks to the economy. The table below presents the values we'll be using in this analysis.

| Changes in Fiscal or Monetary Policy Drivers Since 2012-Q4 | ||

|---|---|---|

| Fiscal or Monetary Policy Driver | Total Through 2013-Q1 | Total Through 2013-Q2 |

| Change in Expected Tax Collections | +$56.3 billion | +$112.6 billion |

| Change in Government Spending | -$26.6 billion | -$29.1 billion |

| Amount of Quantitative Easing | +$295.0 billion | +$572.0 billion |

Now it's time to do the math! We've entered the data that applies through the first quarter of 2013 into the tool below, which you'll need to change to the values that apply for 2013-Q2 to project the value of GDP for that quarter.

But before you go any farther, if you're reading this article on a site that republishes our RSS news feed, please click here to access a working version of this tool at our site, where it will also be properly formatted (we're looking at you, feedly - we speak CSS, you should too!...)

What we find is that with the data for 2013-Q1, for the Keynesian-style GDP multipliers that apply for fiscal and monetary policy, our tool would predict that nominal GDP would be $16,530.4 billion. That compares with the $16,535.3 billion actually recorded by the BEA for the nation's GDP in the first quarter of 2013, which means that our tool would appear to have underpredicted GDP in 2013-Q1 by $4.9 billion, an error of 0.03%.

After substituting in the data for 2013-Q2, with the exact same GDP multipliers, our tool predicts that nominal GDP would be $16,637.0 billion. The BEA's first estimate of GDP for the second quarter of 2013 is actually $16,633.4 billion, as our tool appears to have overpredicted GDP in 2013-Q2 by $4.4 billion, also an error that rounds to 0.03%.

The BEA will not finalize its estimate of GDP for 2013-Q2 until September 2013, so the actual difference between our tool's projection and the official figure will be subject to change until then. Regardless, from the data we do have, it appears that our tool can predict future nominal GDP levels for the current economy with a surprising degree of accuracy.

Update 14 September 2013: It occurs to us that a picture might be worth 1000 words here. Here's a chart illustrating how the puzzle pieces fit together, based upon the BEA's second estimate of GDP for 2013-Q2 (the third estimate will come out near the end of September 2013):

It is pretty clear from these results that if not for the Fed's quantitative easing programs, the U.S. economy would have contracted in recession during these quarters. You can consider the impact to what the U.S.' GDP would be by zeroing out this value in our tool above.

These results also demonstrate that monetary policy can remain highly effective even if basic interest rates are at or near the zero level. We'll discuss the mechanisms by which we think the Fed's quantitative easing programs affect the nation's economy in an upcoming post.

In the meantime, you can take advantage of our tool to get a sense of the extent to which the federal government's tax hikes and spending cuts in 2013 are actually affecting the nation's GDP by alternately zeroing out these figures. One thing that you'll find is that over 90% of the negative drag on GDP may be attributed to the tax hikes that took effect in 2013. Less than 10% may be attributed to reductions in government spending at all levels in the U.S.

Finally, if you really want to play the "what if" game, try combining government spending cuts with modest tax cuts in our tool above. One may wonder why today's politicians aren't discussing implementing this particular combination of fiscal policies.

About the Numbers in the Tool

GDP and Government Spending: The GDP ($16,420.3 billion) for our starting quarter (2012-Q4) was taken from the BEA's massive revision of GDP from 1929 through the first quarter of 2013, as were the numbers we've indicated for the total change in government spending from that starting quarter (-$26.6 billion for 2013-Q1 and -$29.1 billion for 2013-Q2). Most of the reduction in government spending occurred at the federal government level, with the balance being recorded for state and local governments.

We should also note that total government spending appears to have only fallen by $2.5 billion from 2013-Q1 to 2013-Q2 in the BEA's initial estimate for the more recent quarter, all of which occurred at the federal government level. We anticipate that this number will change as the BEA updates its estimate of government spending for 2013-Q2.

2013's Tax Hikes

The total for the change in the amount of taxes in the U.S. is based on the fiscal cliff tax deal of 3 January 2013, which increased the Social Security payroll tax by 2%, as well as increased the tax rates paid by high income earners and also the tax rates for investments.

The total for the change in the amount of taxes in the U.S. is based on the fiscal cliff tax deal of 3 January 2013, which increased the Social Security payroll tax by 2%, as well as increased the tax rates paid by high income earners and also the tax rates for investments.

Social Security Payroll Tax Hike: Here, we estimated the additional amount that President Obama expects to collect through Social Security's combined employer-employee payroll tax of 12.4% in 2013 (as indicated by Table 2.4 of President Obama's FY2014 budget proposal) compared to what would have been collected under 2012's combined tax rate of 10.4%, arriving at a figure of $108.6 billion for the year, for which we assumed that one-fourth ($27.16 billion) would be collected in the first quarter of 2013.

Obamacare Taxes: We also took into account the tax increases that went into effect on investment income and upon high income earners as part of the Patient Protection and Affordable Care Act, which are expected to total $36 billion in 2013, one-fourth ($9 billion) of which we assumed was incurred in the first quarter.

Fiscal Cliff Income and Investment Tax Hikes: The remaining portion of tax increases taking effect were a direct outcome of the increases in the top income tax rates and upon investment income mandated as part of the fiscal cliff tax deal at the beginning of 2013, where a static analysis indicates that the $80.6 billion more in taxes will be collected in 2013, one-fourth ($20.15 billion) of which might be applied to the first quarter of the year.

Combined, these values total up to a tax bill for Americans that's $225.2 billion higher for Americans in 2013 than in 2012, which works out to be approximately $56.3 billion higher for just 2013-Q1. To come up with the cumulative total of expected changes in tax collections from 2012-Q4 through 2013-Q2, we simply multiplied this quarterly change by a factor of 2.

About the Multipliers

We featured a discussion of the fiscal multipliers for government spending and tax policies in our previous discussion of Spain's disastrous economic choices of 2012. At present, we're simply assuming that the fiscal multiplier for the Fed's quantitative easing programs is 1.0, in the absence of data that might contradict that figure. As yet, there really isn't any data to contradict this estimate.

We featured a discussion of the fiscal multipliers for government spending and tax policies in our previous discussion of Spain's disastrous economic choices of 2012. At present, we're simply assuming that the fiscal multiplier for the Fed's quantitative easing programs is 1.0, in the absence of data that might contradict that figure. As yet, there really isn't any data to contradict this estimate.

Quantitative Easing

Our estimates of the cumulative amount of quantitative easing being provided by the Federal Reserve through the first and second quarters of 2013 were determined by finding the change in the total assets held by the Fed with respect to their holdings at the end of 2012. That worked out to be $295.0 billion through 2013-Q1 and $572.0 billion through 2013-Q2.

Data Sources

Board of Governors of the Federal Reserve System. All Federal Reserve Banks - Total Assets, Eliminations from Consolidation. [Text Document]. Accessed 11 August 2013.

Cloyne, James. What Are the Effects of Tax Changes in the United Kingdom? New Evidence from a Narrative Evaluation. [PDF Document]. CESIFO Working Paper No. 3433. April 2011.

Owyang, Michael T., Ramey, Valerie A. and Zubairy, Sarah. Are Government Spending Multipliers Greater During Periods of Slack? Evidence from 20th Century Historical Data. [PDF Document]. Federal Reserve Bank of St. Louis. Economic Research Division. Working Paper 2013-004A. January 2013.

Romer, Christina D. and Romer, David H. The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks. [PDF Document]. March 2007.

U.S. Bureau of Economic Analysis. National Income and Product Accounts, Gross Domestic Product: Second Quarter 2013 (Advance Estimate), Comprehensive Revision: 1929 through First Quarter 2013. [Text Document]. 31 July 2013.

Labels: economics, gdp, gdp forecast, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.