A lot of Americans set out to do a lot of their shopping for Christmas on Black Friday, the day after Thanksgiving, but that can present a dilemma to the Christmas shopper if their money is tight: how to stay within a budget while shopping for everyone you're giving gifts to this year.

That dilemma then carries down to each individual gift purchase, as our hypothetical shopper must work how much to spend on each. Surely there must be a better way to work out how much to spend on each gift!

And yes, as it happens, there is! Brain Candy and Beyond IQ author Garth Sundem shows how to apply math to solve this problem of gift-giving with a budget:

Obviously, that kind of math is hard to work out while on the go, so we're happy to present a tool to help you make your shopping list! Just enter the indicated data below into our generic list below and we'll work out how much you should target spending on each:

We'll leave it as an exercise to you to identify just who Person A, B, C, etc. are when you print out the list and take it with you while shopping. In the meantime though, we can recommend Garth's books Brain Candy or Beyond IQ as gifts for those thinking people you know this Christmas season.

But the best part is that Garth's gift-budget system isn't included in either of these books, so the recipients will have no idea how you decided to spend what you did on them!

Labels: geek logik, math, tool

After you watch these timely videos, you'll have a much better appreciation for our suggested conversation tips for this year's Thanksgiving dinner. Because otherwise, they could be a lot like this:

Or if your family prefers tradition, like this:

Have a happy Thanksgiving!

Labels: none really, thanksgiving

For many Americans, part of what makes the Thanksgiving holidays such an ordeal from year to year is simply finding something new and interesting to talk about with family members around the dining table.

We've decided to make that a lot easier to do this year, because we've uncovered a pretty uncanny, yet spurious correlation between the average live weight of farm-raised turkeys in the United States and the value of the MSCI World Stock Market Index since 1970!

As you can see in our carefully calibrated chart above, whenever the value of the MSCI World index has exceeded the equivalent live weight of an average farm-raised turkey in the U.S., the index went on to either stagnate or crash. And in 2014, the value of the the MSCI World Stock Market Index has once again exceeded that key threshold, which can only mean one thing.... The climate for investors has changed, and it's time to sell!

And if they try to tell you that doesn't make any real sense, you should hold firm and tell them that the correlation is really strong (the R² is 0.9616), which means that the science is settled and that they really shouldn't want to be some kind of climate change science denier.

Speaking of which, the rising live weight of U.S. farm-raised turkeys also is strongly correlated with global warming. Believe it or not, the correlation between atmospheric carbon dioxide and global temperatures is not very strong at all (other factors do a much more coherent job in explaining actual temperature observations).

Say what you will about the science, but you cannot deny that by using tips like this, you can make the conversation around your Thanksgiving dinner table a lot more lively this year!

Previously on Political Calculations

References

U.S. Department of Agriculture. Turkeys Raised. [PDF Document]. 30 September 2014.

National Turkey Federation. Sourcebook. [PDF Document]. October 2013.

MSCI. World Stock Market Index Performance. [Online Database]. Accessed 20 November 2014.

Labels: none really, stock market, thanksgiving, turkey

In 2014, the early projections indicated that the population of turkeys produced in the United States continued to shrink, with an estimated 235 million turkeys. That's down about 2% from the 240 million that were produced in 2013.

That's also the lowest that the population of turkeys produced in the U.S. has been since 1986.

Previously on Political Calculations

References

U.S. Department of Agriculture. Turkeys Raised. [PDF Document]. 30 September 2014.

National Turkey Federation. Sourcebook. [PDF Document]. October 2013.

Labels: business, food, thanksgiving, turkey

In 2014, the average live weight of the typical turkey that will be consumed during the Thanksgiving holiday is 30.2 pounds.

Compared to the 1970's, when the live weight of turkeys produced in the United States had stagnated at 18.6 pounds per bird, that makes 2014's turkey about 61% heavier. Or about 88% heavier than the typical "heritage" turkey that might be found in the wild!

References

The Poultry Site. USDA Livestock, Dairy and Poultry Outlook - November 2014. [PDF Document]. 17 November 2014.

U.S. Department of Agriculture. Turkeys Raised. [PDF Document]. 30 September 2014.

National Turkey Federation. Sourcebook. [PDF Document]. October 2013.

Labels: food, thanksgiving, turkey

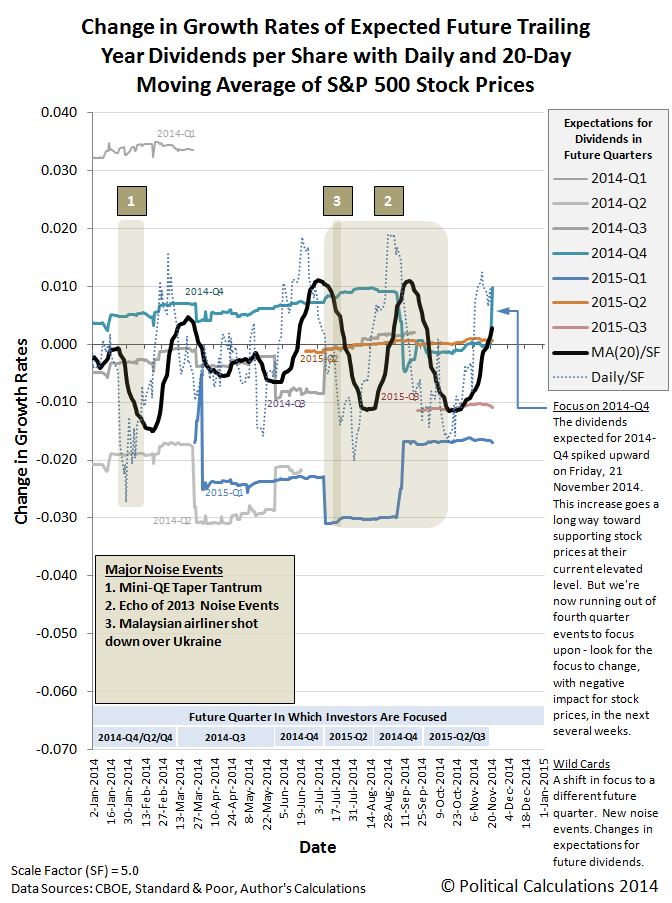

Friday, 21 November 2014 saw a major change in the expectations for future dividends per share in the stock market for the current quarter (2014-Q4), as measured by the Chicago Board of Exchange's dividend futures contracts, as not much changed for all of the other more distant future quarters for which we have data. Our first chart below shows the amount of quarterly dividends per share that are now expected to be paid out for the S&P 500 before the expiration of each dividend futures contract through the third quarter of 2015, which should be compared to our previous snapshot of these same expectations from two months ago.

As a quick side note, the term mismatch issue that exists between the data reported by S&P and that indicated by the CBOE's contracts is such that we expect that the value for 2014-Q4 will be adjusted significantly upward at the expense of 2015-Q1 when S&P reports its data for the fourth quarter of 2014 early in 2015.

Using this data to calculate first the year-over-year growth rates of the S&P 500's trailing year dividends per share, and then the change in those growth rates from one quarter to the next, we can see the expectations surge for 2014-Q4, while the other future quarters don't change very much at all.

Since investors have been largely focused on 2014-Q4 in setting stock prices since the Fed's October meeting, stock prices rose significantly on Friday 21 November 2014, and very soon after the market opened, they peaked at 2071.37 before finally fading to close at 2063.50, just 10.75 points above its previous closing value.

As best as we can tell, the one thing that caused investors to suddenly focus on 2014-Q4 and to adjust their expectations for the amount of dividends that S&P 500 companies would pay out for the quarter was China's central bank's surprise action to cut interest rates to stimulate that nation's slowing economy as it approaches recessionary levels.

Normally, that sort of thing wouldn't amount to much more than what we would describe as a noise event, where the change in stock prices would be relatively short-lived, but this noise event coincided with a change in the fundamental driver of stock prices. That makes it unlike the minor speculative boost in U.S. stock prices following a merger announcement in the biotech industry earlier in the week. And as such, it is a rare example of how noise can actually contribute to the efficiency of setting stock prices, although as we've observed in previous examples, its contribution is most often rationally inefficient.

Now let's throw some chaos into the mix. Right now, investors are very much focused on 2014-Q4 in setting today's stock prices. But the quarter is more than half over, so the key question is how long will that continue? They will soon have to shift their forward-looking focus to some other point of time in the future.

That's where the recent improved expectations for the current quarter can come back to bite. Since the outlook for the other future quarters that investors have to select from did not improve, and because those outlooks are, at present, largely negative, the boost in stock prices today will set up a larger decline in the future when the attention of investors does shift.

And how big that decline will be is something that will itself be determined by the expectations associated with the alternative future points of time that investors might choose to focus upon next.

The best outcome would be if investors focus upon 2015-Q2, which is something they might be prompted to do if the Fed more clearly indicates that it will boost short term interest rates in that quarter.

The intermediate outcome would be if investors have reason to return their focus to 2015-Q3, which is something they might do since that's when the Fed last indicated it was likely to boost those short term interest rates.

And the worst outcome would be if investors suddenly had reason to focus upon 2015-Q1.

Programming Notes

We're following our annual tradition of focusing almost entirely on the Thanksgiving holiday all next week, but we'll find a way to tie in stock prices in some way, shape, manner or form before the week is over. And turkeys. Probably together in an incredibly unlikely way!

And now, you can't say you weren't warned!

Needless to say, the secret to superior paper aerodynamics requires precise fabrication! (HT: Kottke)

The paper folding tool shown in the video is surprisingly affordable, as is the bag clip!

Labels: none really, technology

Every three months, in the middle of each financial quarter, we've been taking a snapshot of the earnings per share for the S&P 500 that are expected going forward for as far as Standard & Poor projects them. In our last installment, we saw that there had continued to be a large amount of erosion in the expectations for stock market earnings in future quarters.

This time however, it would appear that the outlook for future earnings has stabilized, which would be a positive development.

We see that there has been some minor erosion in the very near term, or rather, the expectations through the end of 2014-Q3, which are still being reported, but we see that there has also been some minor improvement in the expectations for quarters following 2015-Q1. Overall however, the most significant takeaway from the changes since August 2014 is how little the expectations of future earnings per share have changed during the last three months.

Still, it's a good time to point out, once again, how volatile the expectations for the S&P 500's earnings per share are over time. It's a good thing that the expectations for these earnings have so little impact upon stock prices!

Labels: earnings, forecasting, SP 500

The southern land border of the United States with Mexico is 1,954 miles, or 3,145 kilometers, long. The U.S. government has established a total of 670 miles of fencing, spanning 34.3% of the length of the border.

In many ways, the U.S.' Mexican border fence is just the most recent and visible barrier established between the two nations. Its history dates back to the Carter administration, which initiated the fence in response to a government bureaucrat-created "crisis":

In this context, federal resources for boundary enforcement increased significantly, starting in the second half of the Carter administration with a focus on California, where local and state officials were making the most noise in favor of a border crackdown. There, the federal government installed a 10-foot-high chain-link fence along the seven westernmost miles of the divide, backed by floodlights and increased helicopter patrols.

After that initial effort, known as the "Tortilla Curtain," not much happened until increasing border enforcement to stop people from crossing into the U.S. from Mexico became a major priority for the federal government once more during the Clinton administration.

Seeking to repay the labor unions that provided critical political support during the 1992 elections, newly elected President William Clinton initiated a series of border enforcement operations aimed at preventing Mexican migrant workers from competing for U.S. agricultural industry jobs, beginning with Operation Hold the Line in El Paso, Texas in 1993.

That initial effort was followed by Operation Gatekeeper in San Diego, California, Operation Safeguard in southern Arizona and Operation Rio Grande in Brownsville, Texas over the next four years, where the increased border enforcement activity greatly increased the costs for individuals seeking to unlawfully cross the border into the United States. Princeton's Mexican Migration Project has documented the cost of unlawful border crossings during President Clinton's tenure in office from 1993 through 2000, which increased exponentially from approximately $750 in 1992 to $2,000 in 2000:

These costs primarily represent what human smugglers, popularly known as coyotes, charge Mexican and other foreign nationals to get across the U.S.-Mexico border and past U.S. border patrol agents. In addition to human smuggling, coyotes often engage in other criminal activity, such as drug trafficking and bribery, and have a history of employing bloody acts against their competitors and law enforcement officials.

The exponential increase in border crossing costs decelerated with the election of President George W. Bush, who was sworn into office in January 2001. However, the costs that foreign individuals pay human smugglers to enter into the U.S. has continued to increase steadily, largely due to the increased border security measures that the U.S. adopted in response to the terrorist acts of 11 September 2001.

On 26 October 2006, just ahead of the elections in which the Republican party would lose its majorities in Congress, President Bush signed the Secure Fence Act of 2006, which mandated the construction of 850 miles of reinforced fencing along the border. That was later reduced to 670 miles of reinforced fencing by the Consolidated Appropriations Act of 2008, which was approved by the Democratic party majorities that had taken control of the U.S. Congress after the 2006 elections, which was ordered to be completed by 31 December 2008.

In 2008, the average amount that human traffickers made in smuggling people across the U.S.-Mexico border into the United States was $2,500. Between 2000 and 2008, the criminal cost of entry into the U.S. had increased at an average pace of $62.50 per year.

Through the end of 2012, with those 670 miles of reinforced fencing in place, the cost of illegally crossing the U.S.-Mexican border into the United States has risen to approximately $3,000. With just a limited amount of reinforced fencing in place, the criminal cost of entry into the U.S. has increased at an average pace of $125 per year, double what it was when active border enforcement operations were the only impediment in place to the unlawful activity.

Back in 2008, we had actually proposed building what we have, a partially fenced border, for the purpose of further increasing the cost of unlawful entry into the U.S.

We now have the means to completely undercut the coyotes' human smuggling business. If the U.S. government were to now allow foreign individuals to enter into the U.S. after they pay an entry bond/work visa of $1,200, or 40% of what human traffickers charge, they can nearly completely cut the criminal element out of the picture.

Why set that value at 40% of the criminal cost of entry into the U.S.? The idea here is to allow at least two people to be able to lawfully enter into the U.S. for less than what the coyotes charge for one, which would thoroughly undercut their criminal human trafficking enterprise. Border security officials would then be able to focus their efforts upon the purely criminal activities at the border, because there would be no longer be any reason for honest people with no intention of engaging in any other criminal activity to continue to associate with the coyotes.

At the same time, the cost is high enough where it would not lead to a border-crossing free-for-all.

The entry bond/work visa would also provide a source of revenue for deporting the fraction of those foreign nationals who outstay their work visas, while at the same time providing for their replacements in the U.S. labor force.

The question now is are the immigration reform wonks smart enough to adopt the rest of our plan for dealing with illegal immigration?

Labels: business, crime, economics

Today, we're testing out a super-simple method for dealing with short term echoes for our standard model for forecasting stock prices.

Echoes, as our long term readers will know, are the result of past volatility in stock prices and their effect upon our forecasting model. Because our forecasting model incorporates a number of historic stock prices in the math underlying the model, from time to time when there is a larger than typical amount of volatility in the historic data, it can result in deviation between our model's projections and the actual trajectory of stock prices. The chart below shows the base reference points in the historic data that we've used for our standard model's projections throughout 2014.

We've previously focused our efforts on those situations where the echoes of past volatility were present for a sustained period of time, which we dealt with by simply rebaselining our model to more distant base reference points in the past, which proved to be very successful. We could most certainly do that again, but we wondered if that wouldn't be overkill for the situation where there is an echo present in the data that simply won't be around for such a long period of time.

For echoes with durations of just a few weeks or less, we wondered if we could just simply draw a straight line to bridge across the gap corresponding to the echo effect upon our forecasting model. And since we have just such a situation happening right now in the stock market, thanks to a short, sudden correction from a month ago, which is coincidentally one of the base reference points we use for making our projections of the present, we thought we'd try it out.

The results are presented in our alternative futures chart below. Here, we observed that stock prices were following the trajectory associated with investors being focused on the current quarter, 2014-Q4, in setting current day stock prices. We then identified the next point in time in our projection for that trajectory that would be outside of the echo effect. And then we connected the dots....

So far, so good. We'll see if stock prices continue to behave that nicely during this week, which we also think will be increasingly unlikely as time progresses forward.

Should you bother signing up for subsidized Affordable Care Act health insurance through the state or federal government-run "marketplaces" this year? Or if you signed up for it last year, should you consider cancelling your coverage this year before you get hit with higher bills if you just let your current coverage roll over?

Believe it or not, when it comes to Obamacare, you might find yourself a lot better off if you choose to not to pay the premiums for your health insurance and pay the "penalty" tax instead! Or perhaps consider more affordable alternatives that will help you avoid paying any tax altogether.

In setting up the its system for mandating that all Americans have health insurance, the Patient Protection and Affordable Care Act (PPACA), which is more popularly known as Obamacare, actually creates some really perverse incentives that may make it more desirable for people to dump their health insurance coverage instead. At least, until they might actually need to have it.

You see, Obamacare actually mandates that Americans who aren't covered by their employer's health insurance either choose to buy costly policies on their state's newly established health insurance exchanges and perhaps benefit from a tax credit subsidy to do so, or choose to "self-insure" and pay a potentially much less costly tax instead.

Here's how the self-insurance part of that works. Because the Affordable Care Act prohibits health insurance providers from denying coverage to people with pre-existing conditions, healthy people can choose to go without any coverage and only buy it if they actually need to during the next enrollment period. If the amount of any penalty tax they have is considerably less than the cost of the health insurance they might otherwise choose to buy, they might have a powerful incentive to do just that.

For healthy Americans, the self-insurance aspect of their choice would mean that they would simply pay out of pocket for the health care they actually consume - just the same as those covered by health insurance will do through the co-pays and deductibles for the low quality coverage they have available to them. And while you might be surprised at how inexpensive medical care can be if health insurance is not involved, even for major surgical procedures, the real challenge would come if they suddenly find themselves faced with health care costs that are considerably higher than what they might be able to pay out of pocket using their income, savings and credit accounts.

In the worst case scenario, they might have to pay their health care provider out of pocket during the maximum 90-day limit that the law mandates health insurers to provide coverage after they enroll. But they will still be able to get insurance coverage, and if the incentive to drop it remains after they no longer need it, they are free to choose to do so, because the law permits it and because as honest taxpayers, they cannot be denied their right to get health insurance coverage if and when they might choose otherwise.

Some might say that these Americans are wasting money on taxes that they could be using to buy insurance instead. But then, those people are ignoring that healthy people can go many years without needing any more than basic, low-cost health care, and that in the year where might might first need health insurance coverage, any tax they might have to pay would be pro-rated for the portion of the year they went without any coverage, reducing any potential waste to a minimum. And then, there are those more affordable alternatives that could even make Obamacare's income tax liability go away altogether.

Our tool below is the first that's designed to help Americans find out which option under the Obamacare law, paying a premium or the penalty tax, specifically is better for them, which we've updated for the latest enrollment period for insurance coverage starting in the next year. To get started, you will need to get the health insurance coverage cost data that applies for your region, which you can get from either Healthcare.gov, assuming it works, or to a more reliable and transparent health insurance shopping site, such as TheHealthSherpa.com to find out how much the plans that will be available on your region's health insurance exchange may cost you.

In doing that, we'll need you to identify the monthly premiums associated with three of the plans that will be available to you: the second-lowest cost "Silver" plan, which is used to find out how much of a tax credit subsidy you might receive, the monthly premium of the lowest cost "Bronze" plan, which sets a limit for how much you might have to pay in Obamacare taxes, and the monthly premium for the plan you would actually consider purchasing.

Also, if you're accessing this tool on a site that republishes our RSS news feed, you'll want to click here to access a working version of our tool.

As a bonus, we've also made the tool capable of considering how much your Obamacare income tax might be if the tax rates that will be fully implemented in 2016 were in force today.

One Final Note

The man in the video below, who happens to be the main architect of Obamacare's super convoluted tax and subsidy scheme and who deliberately tried to either deceive or confuse honest Americans into supporting the Affordable Care Act, appears to think that you're too stupid to do this kind of math for yourself. Especially if you supported the law.

We're very happy to make the math easy to do!

About This Tool

In building this tool, we've made a handful of assumptions. Here they are, along with links to our references for data:

- The federal government's poverty income thresholds for 2013 will initially apply in 2014.

- The Kaiser Family Foundation's description of how Obamacare's subsides will be calculated is accurate.

- The map of states we used to identify which are expanding their eligibility for their Medicaid programs up to 138% of the federal poverty income threshold and which are not is largely accurate. For states that had not made their determination as 1 September 2013, we've assumed that they are not expanding their Medicaid program's eligibility. We will update this periodically as new information becomes available.

- CNNMoney's description of how the penalty tax will work is accurate. Update 20 September 2013: Our thanks to Sean Parnell of The Self-Pay Patient blog, who identifies an exemption from the tax that we originally missed - it turns out that people who live in regions where the lowest-cost Bronze plan is more than 8% of their household income even after the subsidy will be fully exempt from the tax! (Of course, you realize that means that skipping out on not paying health insurance too until they might actually need it just became an even more attractive option for those who will be fully exempt from the tax!)

- The default values associated with selecting the "United States" are those that will apply for a majority of the nation's population.

- People will mostly act rationally where their financial incentives and the assessment of their health care needs are involved.

Beyond this, we've assumed that for some people there may be a "gray area", who would only have a small incentive to not purchase health insurance, where any benefit in doing so is not very large with respect to their household income, and where the decision to buy or not buy should instead be based upon an assessment of what the buyer's actual health care needs for their household will be in the near term, rather than purely upon its cost with respect to the Obamacare income tax.

Mathematically, we've defined that gray area as being equal to the difference between the penalty tax they might choose to pay or an amount equal to 3.1% of their income before taxes, which closely corresponds to the average expenditure of U.S. households for health insurance, according to the Consumer Expenditure Survey report for 2012.

Legal Disclaimer

Materials on this website are published by Political Calculations to provide visitors with free information and insights regarding the incentives created by the laws and policies described. However, this website is not designed for the purpose of providing legal, medical or financial advice to individuals. Visitors should not rely upon information on this website as a substitute for personal legal, medical or financial advice. While we make every effort to provide accurate website information, laws can change and inaccuracies happen despite our best efforts. If you have an individual problem, you should seek advice from a licensed professional in your state, i.e., by a competent authority with specialized knowledge who can apply it to the particular circumstances of your case.

Labels: health, health care, insurance, personal finance, taxes, tool

A new trend for new jobless claims has become established since the end of June 2014.

We believe the sustained break in oil and gasoline prices in the U.S. that began in late June 2014 accounts for what appears to be a step-change in the number of initial unemployment insurance claims being filed, as the number of new jobless claims being filed each week began to fall more steeply than it had during the previous trend.

To put this new trend into full context, the chart below shows each of the major primary trends we've tracked since January 2006.

The chart below adjusts for the volatility in the data that is attributable to the rising or falling trends that have existed, showing the residual distribution that best describes the variation of the data about their primary trend trajectory.

Finally, the table below describes each of the major trends for new jobless claims since January 2006. For those accessing this post through a source that republishes our RSS feed, please click here to see the nicely formatted version of the table on our own site!

| Timing and Events of Major Shifts in Layoffs of U.S. Employees | |||

|---|---|---|---|

| Period | Starting Date | Ending Date | Likely Event(s) Triggering New Trend (Occurs 2 to 3 Weeks Prior to New Trend Taking Effect) |

| A | 7 January 2006 | 22 April 2006 | This period of time marks a short term event in which layoff activity briefly dipped as the U.S. housing bubble reached its peak. Builders kept their employees busy as they raced to "beat the clock" to capitalize on high housing demand and prices. |

| B | 29 April 2006 | 17 November 2007 | The calm before the storm. U.S. layoff activity is remarkably stable as solid economic growth is recorded during this period, even though the housing and credit bubbles have begun their deflation phase. |

| C | 24 November 2007 | 26 July 2008 | Federal Reserve acts to slash interest rates for the first time in 4 1/2 years as it begins to respond to the growing housing and credit crisis, which coincides with a spike in the TED spread. Negative change in future outlook for economy leads U.S. businesses to begin increasing the rate of layoffs on a small scale, as the beginning of a recession looms in the month ahead. |

| D | 2 August 2008 | 21 March 2009 | Oil prices spike toward inflation-adjusted all-time highs (over $140 per barrel in 2008 U.S. dollars.) Negative change in future outlook for economy leads businesses to sharply accelerate the rate of employee layoffs. |

| E | 28 March 2009 | 7 November 2009 | Stock market bottoms as future outlook for U.S. economy improves, as rate at which the U.S. economic situation is worsening stops increasing and begins to decelerate instead. U.S. businesses react to the positive change in their outlook by significantly slowing the pace of their layoffs, as the Chinese government announced how it would spend its massive economic stimulus effort, which stood to directly benefit U.S.-based exporters of capital goods and raw materials. By contrast, the U.S. stimulus effort that passed into law over a week earlier had no impact upon U.S. business employee retention decisions, as the measure was perceived to be excessively wasteful in generating new and sustainable economic activity. |

| F | 14 November 2009 | 11 September 2010 | Introduction of HR 3962 (Affordable Health Care for America Act) derails improving picture for employees of U.S. businesses, as the measure (and corresponding legislation introduced in the U.S. Senate) is likely to increase the costs to businesses of retaining employees in the future. Employers react to the negative change in their business outlook by slowing the rate of improvement in layoff activity. |

| G | 18 September 2010 | 2 April 2011 | Possible multiple causes. Political polling indicates Republican party could reasonably win both the U.S. House and Senate, preventing the Democratic party from being able to continue cramming unpopular and economically destructive legislation into law, bringing relief to distressed U.S. businesses. Fed Chairman Ben Bernanke announces Federal Reserve will act if economy worsens, potentially restoring some employer confidence. The White House announces there will be no big new stimulus plan, eliminating the possibility that more wasteful economic activity directed by the federal government would continue to crowd out the more effective economic activity of U.S. businesses. |

| H | 9 April 2011 | 26 November 2011 | Rising oil and gasoline prices exceed the critical $3.50-$3.60 per gallon range (in 2011 U.S. dollars), forcing numerous small businesses to act to reduce staff to offset rising costs in order to prevent losses. The trend ends when average motor gasoline prices in the U.S. fall back below the $3.50 level in the week between 5 November 2011 and 12 November 2011 - the corresponding improvement in business outlook shows up in the data with the next full pay cycle (2-3 weeks later, or rather, the week ending 26 November 2011!) |

| I | 3 December 2011 | 11 February 2012 | With average gasoline prices in the U.S. having fallen below the critical $3.50 per gallon level, employers respond to the improving business outlook by reducing the number weekly layoffs at a faster rate, as both businesses and consumers benefit from lower transporation and fuel costs, while consumers gain more disposable income. Trend I ended shortly after gasoline prices rose back above the $3.50 per gallon mark in late January 2012. |

| J | 18 February 2012 | 23 June 2012 | With average gasoline prices continuing to be a high levels through the spring and summer, the pace of layoffs in the U.S. steadily increased until June 2012, when the national average price of gasoline in the U.S. finally dropped back below the $3.50 per gallon mark. |

| K | 30 June 2012 | 15 September 2012 | Trend K began with a sudden shift downward in the number of new jobless claims as gasoline prices fell below the $3.50 per gallon mark in June 2012, and although the average price of gasoline in the U.S. has since risen back above that level, there has been no sudden upward shift in new jobless claims. Instead, the number of initial unemployment insurance benefit claim filings has been rising at a faster rate than at any time since on the onset of the 2007 recession. This increase may have in part contributed to the Fed's decision to launch QE 3.0 in September 2012 in order to arrest the development of a new recession. |

| L | 23 September 2012 | 16 February 2013 | A surging housing market beginning in July 2012 followed by the Fed's action to aim its QE efforts directly at the industry on 13 September 2012 helped averted a developing recession in the U.S. at the end of 2012 as it stabilized the number of new jobless claims filed each week. Still, Trend L was characterized by a having a tremendous number of outliers as compared to previous trends, primarily due to the impact of Hurricane Sandy. |

| M | 23 February 2013 | 28 June 2014 | Trend M began with a sudden shift downward in the number of new jobless claims beginning in mid-January 2013, which became a definitive shift by mid-February. With gasoline prices elevated at the time, our thinking is that other factors, including a boost to the housing industry from money exiting the stock market as part of the "Fiscal Cliff" crisis at the end of the year combined with the Fed's amping up of its QE program on 12 December 2012 in its attempt to avert a full recession in 2013 are responsible for the downward shift in the number of claims - monetary policy offset the fiscal drag from government spending cuts (10% of drag) and tax hikes (90% of fiscal drag). The trend is characterized by a lot of volatility, much of which may be attributed to issues with California's implementation of an "improved" system for processing new jobless claims. |

| N | 5 July 2014 | Present | A rapid reduction in initial jobless claims began to take hold in July 2014 as organic growth began to return to the U.S. economy, primarily as oil and gasoline prices began to fall rapidly at that time. Average gasoline prices dropped below $3.70 per gallon (in 2014 U.S. dollars, the equivalent of $3.50 per gallon in 2011 U.S. dollars - see notes above!), thanks to increasing world supply (thanks to increased production in U.S.) and reduced demand (due to economic slowdowns in Europe and China), which contribute to an improved economic situation in the U.S. (at least, for now). |

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

.jpg)