A little over three years ago, Artificial Intelligence (AI) technology took off in the public consciousness with OpenAI's public release of ChatGPT.

That event took place in a period of relative chaos for the U.S. stock market. That period of chaos started with the S&P 500's plunge after February 2020 with the arrival of 2020's coronavirus pandemic in the U.S., which ended the period of relative order that had established itself in December 2018. The inflation phase of the bubble began after March 2020 with the passage of COVID stimulus funds, which initiated the inflation of the COVID/Biden Stimulus Bubble.

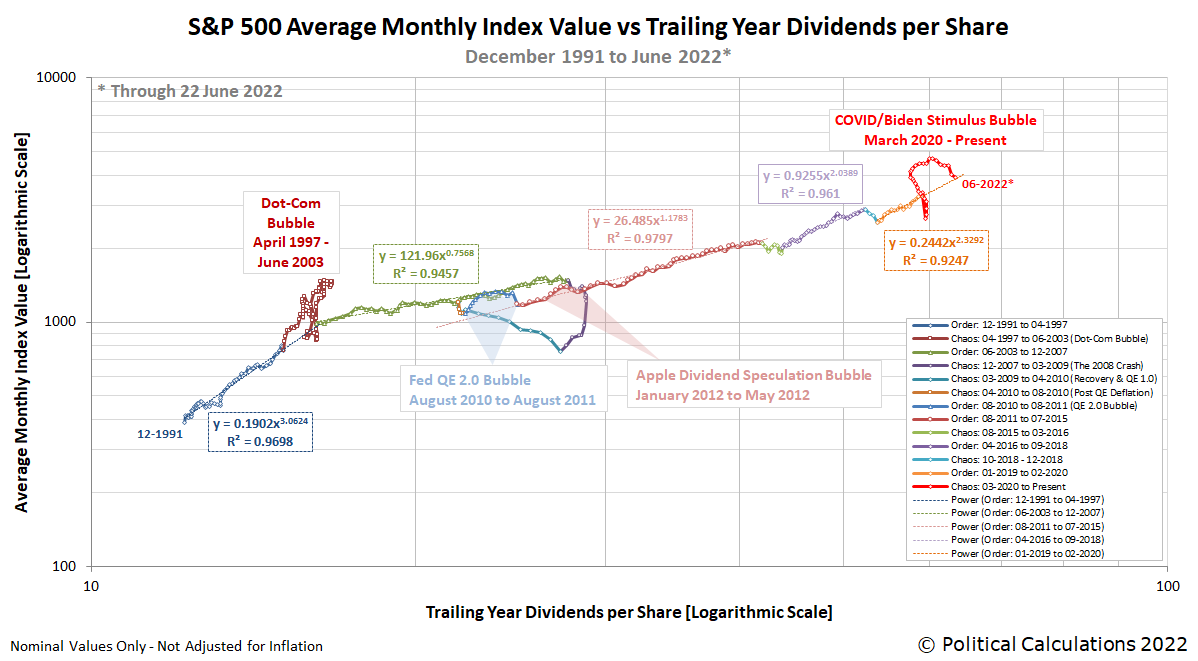

The deflation phase of that bubble began after it peaked in December 2021 and by June 2022, the level of the S&P 500 had returned to levels consistent with where stock prices would have been had the relative order that had been in place starting in December 2018 had simply continued. The following chart, which tracks the average monthly value of the S&P 500 against its underlying trailing year dividends per share shows the scale of that event in the context of the relative periods of order and chaos we've documented since December 1991.

Stock prices continued falling through September 2022 before starting to re-establish some semblance of relative order in the latter part of that year when stock prices began to recover. ChatGPT was rolled out in that environment on 30 November 2022, which helped contribute to the stock market's initial recovery phase that ran through late July 2023, then reversed through late October 2023. It wasn't until 29 December 2023 that what we define as the current period of relative order established itself.

From here, we can track the progress of the current period of relative order in the U.S. stock market on a more refined chart. Here is what that period of order looks like from 29 December 2023 through 2 December 2025:

This chart allows us to quantify what most analysts might identify as the AI bubble, but which we do not because of how we define what a bubble is. Here is our working definition:

An economic bubble exists whenever the price of an asset that may be freely exchanged in a well-established market first soars then plummets over a sustained period of time at rates that are decoupled from the rate of growth of the income that might be realized from owning or holding the asset.

Going back to our chart of the current period of relative order, we find it captures the inflation and deflation phase of the so-called "AI Bubble" that has occurred within it. The inflation phase runs from 29 December 2023 and continues until it peaks in 19 February 2025, just ahead of a market-shaking event for AI stocks. That event came in the form of China's Hangzhou DeepSeek Artificial Intelligence Basic Technology Research company's Friday, 21 February 2025 statement that they would release an open source version of their advanced AI system in the following week, which they followed through and did on Monday, 24 February 2025.

This event popped the proverbial AI bubble. Stock prices plunged until they started to stabilize in late March 2025, but by then, what passed for the AI bubble had all but fully deflated.

Shortly afterward, President Trump's 2 April 2025 "Liberation Day" global tariff announcement sent the S&P 500 plunging much lower, threatening to break the market's current relative period of order. It didn't because less than a week later, President Trump announced a 90-day suspension of the higher tariffs would seek to impose, which prompted a rapid recovery in stock prices that prevented order from fully breaking down.

However, it's not until late June 2025, after Nvidia (NYSE: NVDA) announced blockbuster earnings of its AI-chip systems that we see signs the AI-bubble may have begun a new inflation phase.

From our perspective, the so-called AI bubble doesn't yet deserve that designation. Although it has contributed to making the current relative period of order somewhat chaotic, stock prices remain within the range we identify has established itself during this period, for which we can used the tools of statistical analysis to quantify. The first inflation-deflation phase of the AI-bubble would at best cover 2.5 standard deviations of the variation of stock prices recorded between 29 December 2023 and 2 December 2025, or about 612 points. What passes as its new inflation phase, which we track from 20 June 2025 to the present, is similar in magnitude and is equivalent to about 9% of the current value of the S&P 500.

What would it take for us to officially recognize the AI Bubble as an actual bubble? We would need to see the 20-day moving average of the S&P 500 rise above the upper red dashed line indicated on our refined chart and stay there. For the upcoming milestone of the S&P 500's trailing year dividends reaching $79 per share, that would mean the index sustaining a level above $7,000 for at least 20 trading days to even begin to qualify. Which is to say the earliest that might happen would be early in 2026.

Celebrating Political Calculations' Anniversary

We hope you've enjoyed this analysis because we're celebrating our anniversary a little early this year! Our anniversary posts typically represent the biggest ideas and celebration of the original work we develop here each year, where we've only missed 2024 because we were tied up with other projects. Here are our landmark posts from previous years:

- A Year's Worth of Tools (2005) - we celebrated our first anniversary by listing all the tools we created in our first year. There were just 48 back then. Today, there are over 300....

- The S&P 500 At Your Fingertips (2006) - the most popular tool we've ever created, allowing users to calculate the rate of return for investments in the S&P 500, both with and without the effects of inflation, and with and without the reinvestment of dividends, between any two months since January 1871.

- The Sun, In the Center (2007) - we identify the primary driver of stock prices and describe a whole new way to visualize where they're going (especially in periods of order!)

- Acceleration, Amplification and Shifting Time (2008) - we apply elements of chaos theory to describe and predict how stock prices will change, even in periods of disorder.

- The Trigger Point for Taxes (2009) - we work out both when, and by how much, U.S. politicians are likely to change the top U.S. income tax rate. Sadly, events in recent years have proven us right.

- The Zero Deficit Line (2010) - a whole new way to find out how much federal government spending Americans can really afford and how much Americans cannot really afford!

- Can Increasing the Minimum Wage Boost GDP? (2011) - using data for teens and young adults spanning 1994 and 2010, not only do we demonstrate that increasing the minimum wage fails to increase GDP, we demonstrate that it reduces employment and increases income inequality as well!

- The Discovery of the Unseen (2012) - we go where so-called experts on income inequality fear to tread and reveal that U.S. household income inequality has increased over time mostly because more Americans live alone!

We marked our 2013 anniversary in three parts, since we were telling a story too big to be told in a single blog post! Here they are:

- The Major Trends in U.S. Income Inequality Since 1947 (2013, Part 1) - we revisit the U.S. Census Bureau's income inequality data for American individuals, families and households to see what it really tells us.

- The Widows Peak (2013, Part 2) - we identify when the dramatic increase in the number of Americans living alone really occurred and identify which Americans found themselves in that situation.

- The Men Who Weren't There (2013, Part 3) - our final anniversary post installment explores the lasting impact of the men who died in the service of their country in World War 2 and the hole in society that they left behind, which was felt decades later as the dramatic increase in income inequality for U.S. families and households.

Resuming our list of anniversary posts....

- The Toolmaker's Tool (2014) - we make the code we use for creating online tools available to all!

- Replacing GDP with the National Dividend (2015) - we explore our development of an alternative measure of economic welfare that can replace GDP.

- The Gamblers Who Invented Modern Encryption (2016) - we discover that a group of gamblers seeking to break the law in Missouri back in 1905 put together many of the elements that underlie secure electronic communications and financial transactions!

- The Isolation of El Niño (2017) - in which we advanced the development of a global economic indicator for Earth!

- Telescoping Median Household Income Back in Time (2018) - we find a way to nearly double the available supply of monthly median household income estimates with reasonable accuracy.

- Cashing Out of the S&P 500 (2019) - we develop a tool to answer the question of whether you can survive being retired if you're counting on cashing out your investment in the S&P 500!

- The Deadly Intersection of Anti-Police Protests and COVID-19 (2020) - it was the year of the coronavirus and political protests, so we combined the two in a way that only we could.

- The Birth of the Martian Economy (2021) - we don't mess around when we say we celebrate big ideas, and what's bigger idea to celebrate than the birth of an entire planet's economy?

- The S&P 500 Dividend Engine (2022) - we put the entire history of the S&P 500's cash dividends at your fingertips!

- The Origin of Ancient Alien Theory (2023) - how and when did the idea of aliens visiting Earth to do things like build pyramids get started?

Image credit: Multicolored soap bubble image by Alexa from Pixabay.

Labels: ideas, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.