Paul Butler wondered what he would see if he tried to visualize how geography and political borders affected people's friendships, which he could do as a intern with access to Facebook's social network data representing the connections of some 500 million people. The image below is his result:

And since we suspect Santa sees much the same thing when he travels the world on Christmas Eve, we'll wish you a Merry Christmas and a Happy New Year - we'll return in 2011!

Labels: data visualization

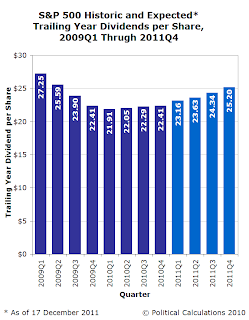

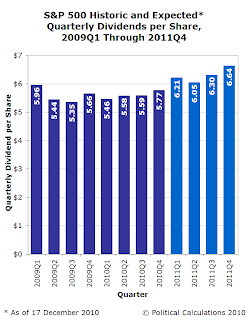

What does the future for stock market dividends look like through 2011?

The two charts we're presenting today, showing what the dividend futures market is signaling is in store for 2011, at least, as of 17 December 2010, reveal that business is set to improve through much of the year.

First, looking at the quarterly data, we see that the first quarter of 2011 would appear to be pretty robust - but that's perhaps a bit misleading.

Until this past weekend, when the lame-duck Congress and Obama administration acted to sustain lower taxes through 2012, it was uncertain whether or not the tax rates that would apply to dividends would go up. A number of firms, anticipating much higher taxes on dividends, had been considering shifting the timing of when they would pay their dividends to get around the change in tax rates that would have otherwise have taken effect on 1 January 2011.

Many of these higher dividends payments were slated to be paid out to shareholders in the period covering 17 December 2010 through the end of 2010, which is covered by the dividend futures contract for the first quarter of 2011, which is why the dividends for this quarter would appear to be so elevated.

When we look at the projected trailing year dividend data however, we observe that this elevated quarterly dividend for the first quarter 2011 is likely the result of shifting around when future dividend payments would otherwise have occurred. Here, we see that the projected trailing year dividends is mainly following the upward trend that has existed since trailing year dividends bottomed in the first half of 2010.

In fact, if we were to draw an imaginary line from the top of the bar for 2010Q4 to the top of the bar for 2011Q4 in this chart, we can see that only the data for 2011Q1 and 2011Q2 would seem to deviate from the trend, with 2011Q1 being elevated above the line and the data for 2011Q2 falling below the line.

This outcome suggests that a number of companies were pulling their expected dividend payments from 2011Q2 ahead into 2011Q1 to get around the risk of exposure to higher dividend taxes.

From an economic standpoint however, the currently expected trend in dividends suggests that 2011 will be a better year for U.S. businesses than was 2010.

In case you missed it in the news, the world's eighth largest army successfully deployed and conducted widespread and sustained operations involving the live fire of ordnance against a native population, in which they inflicted significant loss of life while incurring no casualties themselves.

You likely missed it in the news because the events described above took place entirely within the state of Wisconsin (HT: voluntaryXchange):

The state of Wisconsin has gone an entire deer hunting season without someone getting killed. That's great. There were over 600,000 hunters.

Allow me to restate that number. Over the last two months, the eighth largest army in the world – more men under arms than Iran; more than France and Germany combined – deployed to the woods of a single American state to help keep the deer menace at bay.

But that pales in comparison to the 750,000 who are in the woods of Pennsylvania this week. Michigan's 700,000 hunters have now returned home. Toss in a quarter million hunters in West Virginia, and it is literally the case that the hunters of those four states alone would comprise the largest army in the world.

Of course, they still lack an effective air force to seriously challenge any of the more well-known armies, but perhaps that's beginning to change....

Labels: none really

Did you know that December is *the* most popular month for wedding proposals to be made.

We guess that makes sense, since June would appear to be the most popular month for weddings to take place, but before you consider popping the question, shouldn't you answer a more basic question first?

Should you get married?

Well, should you? Are you really ready? Wouldn't it be nice if you use a tool to take the guesswork out of whether or not you should seriously propose marriage at this time?

You're darn right it would be nice! Here at Political Calculations, our stock in trade is making tools people can use to answer some of the most sensitive questions affecting their lives, and this is no different! We've adapted Geek Logik author Garth Sundem's formula addressing this very delicate situation for your exclusive, confidential use in this holiday season, so you can confirm, with precise mathematical certainty, that yes, you *should* get married.

Or not, in the case that you shouldn't! After all, maybe you're not really ready at this moment. Either way, our tool stands ready to help you know when you're ready. Just enter the indicated information below, and we'll take care of the rest....

In the tool, a "Tie the Knot" Index value greater than or equal to one will indicate that you are indeed ready to start shopping for a ring, while a value less than one will suggest that you're not ready yet. We provide this information so you can gauge just how close you might be to the threshold of either popping the question or not if your circumstances were just a bit different.

And because you made it this far, here are the other awkward questions that we've developed tools to help you answer:

- What Are the Chances Your Marriage Will Last?

- Picking the Right Date for Valentine's Day

- The Indisputable Inter-Age Rule for Dating

- Men: What's Your Sex Appeal?

- Men: Are You Old Enough to Propose Yet?

- Should You Become Intimate with a Coworker?

- Is Your Personal Grooming Adequate?

- How Much Should You Spend on Gifts this Christmas?

- Should You Call in Sick?

- Are You Too Good for Your Job?

- Should You Buy Something (or Not)?

- How Many Cups of Coffee Should You Drink This Morning?

- How Many Beers Should You Have at the Company Picnic?

- Earth Live: Walk, Bike or Drive?

- Should You Say It on the Grapevine?

- Should You Start or Stop Procrastinating?

- Should You Apologize?

- Should You Lie?

- Should You Quit Your Job?

- Should You Go Out with the Guys?...

- Are You Whipped?

- Do You Dare Run for Public Office?

- How Many Hours of Sports Can You Watch (Without Her Getting Angry)?

- Should You Stop to Put Gas in the Car?

- How Big Should Your Kids Halloween Bucket Be?

- When Will You Become Obsolete?

- The Robin Hood Morality Quiz

- The Ultimate Mobile App

Labels: geek logik, tool

Welcome to this Friday, December 17, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found among the best of the past week's money and business-related blog carnivals!

Welcome to this Friday, December 17, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found among the best of the past week's money and business-related blog carnivals!

This will be the final regular edition of On the Moneyed Midways for 2010, as we'll be away through the holidays. The final editions of OMM for 2010 will then appear in the first week of January 2011, where we'll reveal both The Best Blogs We Discovered in 2010 and celebrate The Best Posts of 2010!

And that can only mean one thing - we'll also be awarding our top honor The Best Post of the Year, Anywhere!

Our final roundup for the year, and the final entries into our annual contest, is ready for your review below. See you next year!...

| On the Moneyed Midways for December 17, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | Will Someone Please Tell the World that There's a Difference Between Income and Wealth? | Free Money Finance | Can't tell the difference between income and wealth? If that's you, you're likely to set FMF off on a rant like nobody's business! And if you're Forbes magazine, you might want to try not killing off one of your devoted readers because you can't get it right!... |

| Carnival of Debt Reduction | What Happens to Your Debts When You Die? | Cash Money Life | We've heard how death and taxes are inevitable, but what about death and debt? Ryan Guina explains what your heirs can expect if you haven't gotten your debts haven't expired by the time you do! |

| Carnival of Personal Finance | Make Money Shopping at CVS and Walgreens | The Penny Hoarder | Have you heard of the "drug store game?" The one that might let you load up on a ton of stuff at pennies on the dollar, which you can then turn around and sell for a profit? The Penny Hoarder provides the game's rules.... |

| Cavalcade of Risk | Weight and Mortality: Fear Not, It's Not that Bad | Disease Management Care Blog | Jaan Sidorov scans the headlines for reports indicating that while having a high BMI might be correlated with a higher relative hazard of dying, it might not mean that a high BMI person's absolute risk of dying is significantly higher. The Best Post of the Week, Anywhere! |

| Festival of Frugality | Toyota Millionaires vs Mercedes Millionaires | Watson Inc | Roshawn Watson considers the differences between millionaires by what kind of cars they drive. |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - December 17, 2010

- On the Moneyed Midways - December 10, 2010

- On the Moneyed Midways - December 3, 2010

- On the Moneyed Midways - November 26, 2010

- On the Moneyed Midways - November 19, 2010

- On the Moneyed Midways - November 12, 2010

- On the Moneyed Midways - November 5, 2010

- On the Moneyed Midways - October 30, 2010

- On the Moneyed Midways - October 22, 2010

- On the Moneyed Midways - October 15, 2010

- On the Moneyed Midways - October 8, 2010

- On the Moneyed Midways - October 1, 2010

- On the Moneyed Midways - September 24, 2010

- On the Moneyed Midways - September 17, 2010

- On the Moneyed Midways - September 10, 2010

- On the Moneyed Midways - September 3, 2010

- On the Moneyed Midways - August 27, 2010

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Every Christmas presents a dilemma to the Christmas shopper: how to stay within a budget while shopping for everyone you're giving gifts to this year.

That dilemma then carries down to each individual gift purchase, as our hypothetical shopper must work how much to spend on each. Surely there must be a better way to work out how much to spend on each gift!

And yes, as it happens, there is! Brain Candy author Garth Sundem shows how to apply math to solve this problem of gift-giving with a budget:

Obviously, that kind of math is hard to work out while on the go, so we're happy to present a tool to help you make your shopping list! Just enter the indicated data below into our generic list below and we'll work out how much you should target spending on each:

We'll leave it as an exercise to you to identify just who Person A, B, C, etc. are when you print out the list and take it with you while shopping!

In the meantime though, we can recommend Garth's book Brain Candy as a fun book you might consider wrapping up giving as a gift this Christmas season.

And the best part is that Garth's gift-budget system isn't included in the book, so the recipient will have no idea how you decided to spend what you did on them!

Labels: brain candy, geek logik, tool

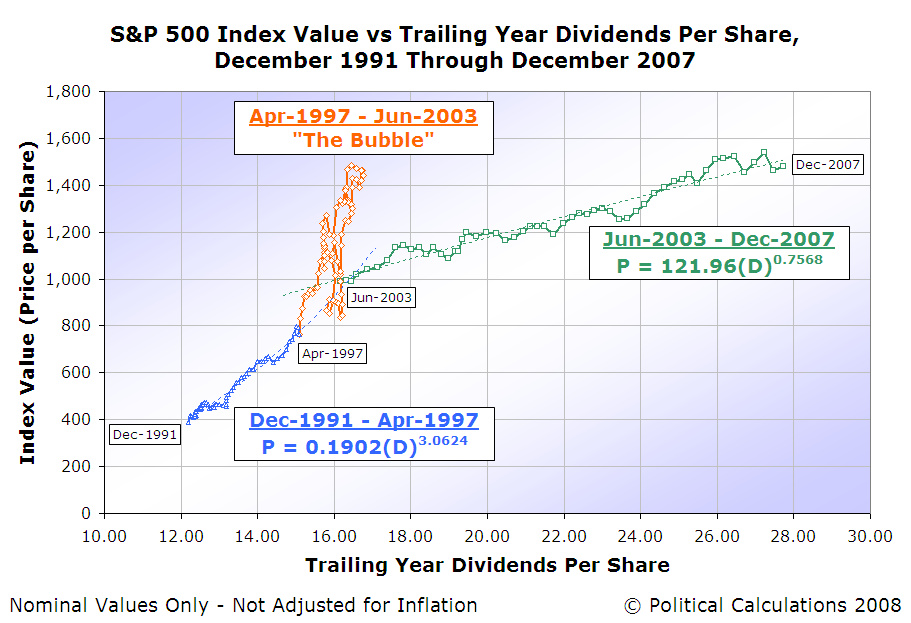

We've long known that the U.S. stock market's "Dot Com Bubble" really began in April 1997 and ended in June 2003, but we've never addressed two key questions about the event:

- What caused it to begin?

- What caused it to end?

Today, we can answer those two questions. Let's begin by revisiting and tweaking our operational definition of just what an economic bubble is:

An economic bubble exists whenever the price of an asset that may be freely exchanged in a well-established market first soars then plummets over a sustained period of time at rates that are decoupled from the rate of growth of the income that might reasonably be expected to be realized from owning or holding the asset.

By applying that definition and noting the last month that changes in stock prices were coupled with changes in their underlying dividends per share before the Dot Com Bubble began, we identified April 1997 as the true starting point in time for the Dot Com Bubble. Likewise, we identified June 2003 as being the first month following the end of the period in which changes in stock prices and their dividends per share were decoupled from one another.

Having now identified those key months, we can look toward the specific events that occurred either during that month or the month preceding these months to identify the specific causes of the Dot Com Bubble's beginning and end.

As it happens, we discovered the specific cause behind the rapid expansion of the Dot Com Bubble in what we'll describe as a landmark paper by Zhonglan Dai, Douglas A. Shackelford and Harold H. Zhang. In "Capital Gains Taxes and Stock Return Volatility: Evidence from the Taxpayer Relief Act of 1997", Dai, Shackelford and Zhang describe the events that led to the Dot Com Bubble's inflation:

We use the Taxpayer Relief Act of 1997 as our event to empirically test the impact of a change in the capital gains tax rate on stock return volatility. TRA97 lowered the maximum tax rate on capital gains for individual investors from 28 percent to 20 percent for assets held more than 18 months. TRA97 is particularly attractive for an event study because the capital gains tax cut was large and relatively unexpected, and the bill included few other changes that might confound our analysis. Little information was released about TRA97, until Wednesday, April 30, 1997, when the Congressional Budget Office (CBO) surprisingly announced that the estimate of the 1997 deficit had been reduced by $45 billion. Two days later, on May 2, the President and Congressional leaders announced an agreement to balance the budget by 2002 and, among other things, reduce the capital gains tax rate. These announcements greatly increased the probability of a capital gains tax cut. On Wednesday, May 7, 1997, Senate Finance Chairman William Roth and House Ways and Means Chairman William Archer jointly announced that the effective date on any reduction in the capital gains tax rate would be May 7, 1997. As promised, the lower tax rate on long-term capital gains (eventually set at 20 percent) became retroactively effective to May 7, 1997, when the President signed the legislation on August 5, 1997.

Empirically testing stock market return data before and after the key date of 7 May 1997, when investors would suddenly have a reasonable expectation that a reduction in the capital gains tax rate would become effective, the authors made a stunning finding:

To provide more compelling evidence that the 1997 tax cut affected volatility (and mitigate concerns about omitted correlated variables), we focus on cross-sectional tests which are designed to detect the differential responses in return volatility of stocks with different characteristics. We hypothesize that the effect of a capital gains tax change on stock return volatility should vary depending upon dividend policy and the size of the unrealized capital losses (or gains). Consistent with expectations, we find that non- and lower dividend-paying stocks experienced a larger increase in return volatility than high dividend-paying stocks. We also find that stocks with large unrealized capital losses had a larger increase in return volatility after a capital gains tax rate reduction than stocks with small unrealized capital losses. However, we do not find a similar relation with unrealized capital gains.

The difference in volatility between high dividend-paying stocks and non-or-low dividend paying stocks provided the key evidence pointing the finger at the Taxpayer Relief Act of 1997:

We infer from the findings in this study that the volatility left, after controlling for every known determinant, reflects the influence of the 1997 capital gains tax rate cut. Stock return volatility was substantially greater after 1997. Furthermore, firms most affected by the rate reduction showed the greatest change in volatility. Specifically, non-dividend paying firms had a greater increase in volatility than dividend-paying firms and firms with large unrealized capital losses experienced a greater increase in volatility than firms with small unrealized losses.

The reason we find that conclusion to be significant is because the Taxpayer Relief Act of 1997 left dividend tax rates unchanged - they continued to be taxed at the same rates as regular income in the United States, which provided a powerful incentive for investors to treat the two kinds of stocks very differently, favoring the low-to-no dividend paying stocks over those that paid out more significant dividends.

At least, until May 2003, when the compromises that led to, and ultimately the signing of the Jobs and Growth Tax Relief Reconciliation Act of 2003 would set both the tax rates for capital gains and for dividends to once again be equal to one another, as they had been in the years from 1986 through 1997:

With the disparity in taxes assessed against dividend paying compared to non-dividend paying stocks now gone, stock prices once again resumed their closely-coupled relationship with their dividends per share, and volatility was reduced.

Of course, that raises the question of why a bubble didn't exist in the pre-1986 period where both capital gains and dividends were taxed at different rates. We would however point out that a very large percentage of publicly-traded companies paid dividends in that earlier period, limiting the effect of such a disparity.

By contrast, the founding and rapid growth of new computer and Internet technology-oriented companies in the early 1990s, which grew rapidly to become large companies and which as growth companies, did not pay significant dividends to shareholders, provided the critical mass needed for the 1997 capital gains tax cut to launch the Dot Com Bubble. We can see this in the size of Initial Public Offerings in each year since 1980, beginning from a very low level at the beginning of the 1980s, to their peak at the height of the Dot Com Bubble:

In the end however, we find that it took an act of Congress to launch the stock market bubble of the late 1990s, and that it took another act of Congress to undo its disruptive effect. The Taxpayer Relief Act of 1997 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 are quite literally the bookends defining the period of disorder in the U.S. stock market known as the Dot Com Bubble.

Labels: dividends, SP 500, stock market, taxes

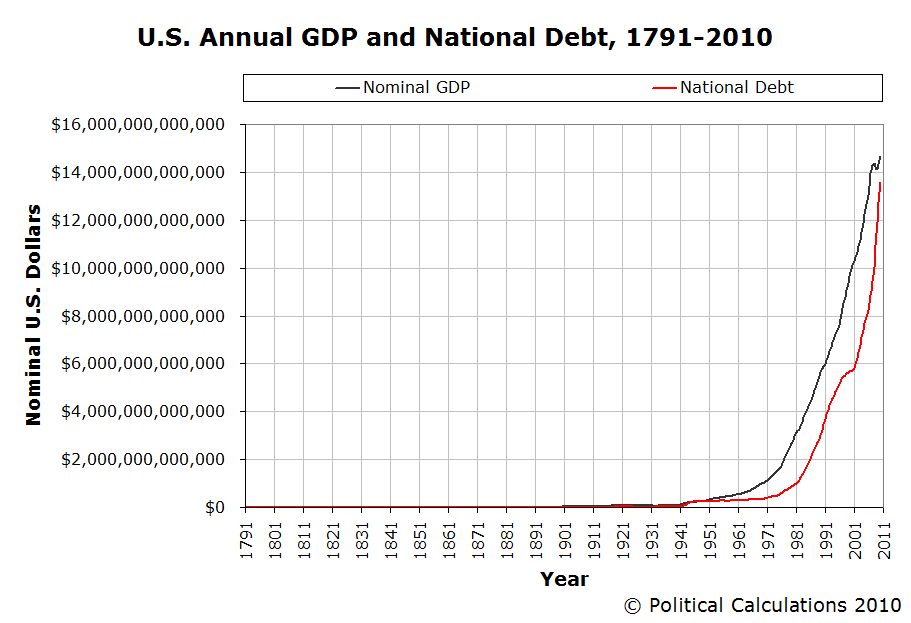

It's time to update our U.S. national debt history visualization project, bringing it fully up to date through Fiscal Year 2010. First up, the exponential view of both annual GDP and the national debt:

And now, the same data, but shown on a log-lin chart:

Here is another log-lin chart, but this time, showing GDP and the national debt per capita:

Finally, let's conclude with the U.S. national debt burden, or rather, the debt-to-income ratio for the nation:

Data Sources

- Population 1791-1999

- Population 2000-Present

- U.S. GDP 1791-2009 - Note: the 2010 GDP figure used in the charts above is based on our projection of what it will be for the year based upon already reported quarters.

- National Debt 1791-1849 - Note: Data for 1843 marks shift in date recorded from January 1 to July 1.

- National Debt 1850-1899

- National Debt 1900-1949

- National Debt 1950-1999 - Note: Data spanning 1975 through 1985 rounded to the nearest million.

- National Debt 2000-Present

Notes

The national debt data used in the charts above is for the United States' total public debt outstanding, which includes the so-called intragovernmental holdings category, which mostly represents where surplus Social Security tax collections have gone since the early 1980s.

Since this category of the national debt must be repaid through tax collections or from the proceeds from the issuance of new debt held directly by the public whenever Social Security runs in the red, as it has begun to do in recent quarters and is projected to do consistently after 2017, we recognize no meaningful difference between the intragovernmental holdings portion of the national debt and the regular debt held by the public.

Labels: data visualization, gdp, national debt

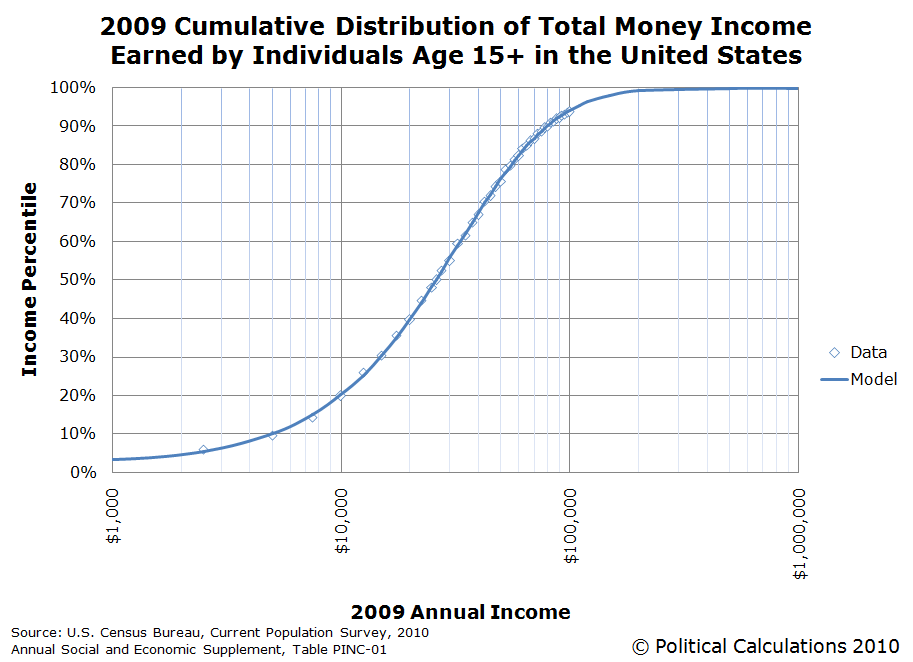

Did you ever wonder just where you fit in among all income-earning Americans?

Update 20 September 2013: Before going any further, please note that we've posted a newer version of this tool based on the most recently available data! Go here to find out more!

Well, wonder no more! Our latest tool will tell you exactly where you rank among all Americans, or rather, the 211,254,000 Americans over the age of 15 who earned money in 2009, which we worked out using U.S. Census data and modeling the distribution using ZunZun's 2D Function Finder.

Just enter your annual income into the tool below, and we'll give you a good idea of where you rank, or would have back in 2009. One last quick note - our model tops out with the lowest 2.35% and highest 0.13% of U.S. income earners and bottoms out with the lowest incomes, so entering very low or very high incomes will produce static results1....

Update 22 September 2011: Before you go any further, we also have the newest U.S. income distribution data through all of 2010 for both individuals and households - just follow the links! (The tool below is based on income data for 2009, not 2010!)

And now you know, within about 135 U.S. dollars of income 1, where you fit into the American income spectrum!

Not an American?

If you don't work in the United States, you can still find out where you might rank by income in the U.S., but you'll need to convert your income into equivalent U.S. dollars. We recommend using XE's Universal Currency Converter to do that math before you enter your equivalent income in U.S. dollars in our tool above.

1 Update 20 December 2010: We tweaked our income distribution model to better capture the lowest end of the U.S. income spectrum!

Labels: income, income distribution, tool

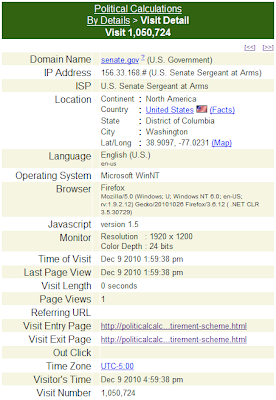

As many of our longtime readers know, we pay attention to where our site traffic originates. For instance, we know that many of our newest posts are frequently read on Capitol Hill, which makes sense since we frequently take on a number of public policy topics that are related to current events.

Yesterday and today however, a post we wrote back in November 2008 appears to have caught the imagination of one or more people in the U.S. Senate:

That's scary because of what the post discussed: a proposal supported by leading Democratic Party legislators seeking to eliminate the tax deduction for 401(k) plans in favor of mandating that all working Americans spend 5% of their income on U.S. savings bonds through Social Security for a new "guaranteed retirement account". That forced investment program would be added on top of the other taxes Americans currently pay to support the regular Social Security program.

The government would sweeten the pot by adding $600 per year to each of the "guaranteed retirement accounts."

Here are the two key takeaways we had in analyzing the proposal:

The government would gain from this proposal in two ways. First, by being able to collect tax dollars at the highest marginal rates paid by the former 401(k) investors on their income, the government would expect to see its net tax revenues rise as this amount dwarfs the proposed $600 taxpayer funded annual contribution to each of the individual accounts.

[...]

Second, by requiring all U.S. individuals earning incomes to contribute above and beyond what they already do to support the Social Security program, the government would be able to substantially increase the percentage of debt financing it obtains from domestic sources. The government gains by having this larger, captive source of debt financing to support either new spending programs or to substantially expand existing spending programs.

Going by the distribution of taxpayer household income in 2005, we estimated that this forced investment program would add some $315 billion to the U.S. Treasury each year, just from households with annual incomes between $0 and $500,000.

In return, American "investors" would earn a three percent return on their lifelong "investment", without adjusting for the effects of inflation over time. (We put the words "investors" and "investment" in quotes because real investing involves people who are free to make real choices - there would be no real choice or freedom under this proposal).

So at best, assuming zero inflation, Americans would see the value of their government "guaranteed retirement accounts" double once every 24 years.

That our post from two years ago is suddenly being reviewed today indicates that this proposal, or one very similar to it, is being actively considered in Washington D.C.

Given the government's reach into health care, the financial system, the housing market, the auto industry, the insurance industry, et cetera in just the last two years, it appears that having all that under their thumbs just isn't enough to satisfy the insatiable need for money and control in the nation's halls of power.

And so we end with the words we wrote for the title of this post. Be afraid. Be very afraid.

Update 9:10 AM: They're back! Or rather, the ones who read us on a daily basis have begun to pick up on this post:

Note the difference in how they got to our post from November 2008. Here, they clearly picked up on our RSS feed through Google Reader, clicking the link to our older post first before clicking to get to this post directly. This is an example of what we would describe as a typical visit from Capitol Hill.

By contrast, there's no Referring URL in the two visits we highlighted earlier in this post. That's usually an indication that someone has come our site after having bookmarked a post previously, typing a link directly, or who perhaps has gone to the trouble to block the referring source. Which means that yesterday afternoon's site visit is not the first time someone working in the U.S. Senate has reviewed our November 2008 post.

Others arriving late might need to start playing some serious catchup....

Labels: politics

Welcome to this Friday, December 10, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found among the best of the past week's money and business-related blog carnivals!

Welcome to this Friday, December 10, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found among the best of the past week's money and business-related blog carnivals!

We got lucky this week with the happy intersection of a number of weekly, biweekly and monthly blog carnival editions, making this week's edition of OMM one of the largest we've had in a while. Plus, we get to roll out a new category for the top post of the week Absolutely fun reading!

It all begins.... now! Thank you for joining us for this week's edition of OMM!

| On the Moneyed Midways for December 10, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | The 3 to 6 Month Emergency Fund Rule Is Stupid | Provident Planning | Paul Williams challenges on the rule of thumb that says you need up to half a year's pay socked away for a rainy day! |

| Best of Money | Do You Have Alien Abduction Insurance? | Dough Roller | Yes, there really are markets in everything! More surprising though, DR reports that at least one company has had two successful claims paid out…. Absolutely fun reading! |

| Carnival of HR | Visualizing Performance | Steve Boese's HR Technology | Steve Boese analyzes Hoopism's inspired basketball player relative performance charts and finds inspiration for finding something better to do with all the data HR departments handle. |

| Carnival of Debt Reduction | Pay Down Debt or Save Money? | Nerd Wallet | The Dough Roller guest posts at Nerd Wallet, considering the three factors that would steer you to put extra money toward your savings or toward paying down your debt. |

| Carnival of Personal Finance | Patience Is a Virtue, Learn It If You Can (But Please Hurry) | Len Penzo dot Com | Len Penzo can't help but notice that people who are debt free didn't get that way by being impulse shoppers or looking for instant gratification as he explores his own personal debt situation, as measured by furniture! |

| Carnival of Taxes | Ten Tax Breaks for Stuff You Should Be Doing Anyway | Billeater | Jessica Bosari outlines ten ways for keeping more of the money you earned out of Uncle Sam's greedy hands by going along with what he wants. |

| Leadership Development Carnival | When All Else Fails, MAKE A DECISION | ReThink HR | Benjamin McCall explains what to do if no one steps up when a decision needs to made. Absolutely essential reading! |

| Carnival of Money Stories | How We Slashed Our Rent in Half (and Why We're Not Crazy) | Daily Currency | Adam Baker, his wife and two-year-old just returned to the U.S. after living overseas for a year and needed to find a new place to live. They could afford to rent a house in a good neighborhood for $900 per month, upgrade to a great neighborhood for $1250 per month or get a one bedroom apartment in an okay neighborhood for $450 per month. Why they chose the apartment makes Baker's story The Best Post of the Week, Anywhere! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - December 10, 2010

- On the Moneyed Midways - December 3, 2010

- On the Moneyed Midways - November 26, 2010

- On the Moneyed Midways - November 19, 2010

- On the Moneyed Midways - November 12, 2010

- On the Moneyed Midways - November 5, 2010

- On the Moneyed Midways - October 30, 2010

- On the Moneyed Midways - October 22, 2010

- On the Moneyed Midways - October 15, 2010

- On the Moneyed Midways - October 8, 2010

- On the Moneyed Midways - October 1, 2010

- On the Moneyed Midways - September 24, 2010

- On the Moneyed Midways - September 17, 2010

- On the Moneyed Midways - September 10, 2010

- On the Moneyed Midways - September 3, 2010

- On the Moneyed Midways - August 27, 2010

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.