Median household income in the United States rebounded to reach a new record high of $64,430 in June 2019, a 1.0% increase from Sentier Research's initial May 2019 estimate of $63,799.

The following chart shows the nominal (red) and inflation-adjusted (blue) trends for median household income in the United States from January 2000 through June 2019. The inflation-adjusted figures are presented in terms of constant June 2019 U.S. dollars, where June 2019's figure is just a bit below the inflation-adjusted peak of $64,809 recorded in January 2019.

The year-over-year growth rate for median household income in the U.S. showed a small rebound in June 2019, increasing to 3.6% from 3.1% in the previous month in nominal terms, which is shown as the red line in the following chart.

Adjusted for inflation, the year-over-year growth rate of median household income was 1.9% in June 2019.

Analyst's Notes

With its latest data release, the U.S. Bureau of Economic Analysis revised its previously reported personal income data from January 2014 through May 2019. We have updated our alternate model accordingly, with the updated relationships between average annualized wage and salary income per capita and median household income presented in the following chart.

Following the revision, our alternate methodology for estimating median household income using all of the updated data reported by the U.S. Bureau of Economic Analysis would put the figure at $64,761 for June 2019, which is within a half-percent of Sentier Research's estimate.

Coming up in September 2019, the U.S. Census Bureau will publish its estimate of median household income for 2018, which will provide a reference point for assessing Sentier Research's monthly estimates of median household income during that calendar year.

References

In generating inflation-adjusted portion of the Median Household Income in the 21st Century chart and the corresponding year-over-year growth rate chart above, we've used the Consumer Price Index for All Urban Consumers (CPI-U) to adjust the nominal median household income estimates for inflation, so that they are expressed in terms of the U.S. dollars for the month for which we're reporting the newest income data. Our data sources and other references are provided in the following list.

Sentier Research. Household Income Trends: January 2000 through June 2019. [Excel Spreadsheet with Nominal Median Household Incomes for January 2000 through January 2013 courtesy of Doug Short]. [PDF Document]. Accessed 30 July 2019. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars.]

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database]. Last Updated: 30 July 2019. Accessed: 30 July 2019.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database]. Last Updated: 30 July 2019. Accessed: 30 July 2019.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 11 July 2019. Accessed: 11 July 2019.

Labels: median household income

Nationally, the total valuation of aggregate existing home sales have dipped in May 2019 from April 2019's level. Regionally, almost all of that decline was registered in the U.S. Census Bureau's West region.

State level existing home sales data through May 2019 is now available from Zillow's databases, which now includes data from New Hampshire in the period July 2017 to the present. The following chart illustrates the trends we see for the 43 states for which Zillow provides seasonally-adjusted sale prices and volumes for existing homes in 43 states and the District of Columbia.

The following charts break the national aggregate existing home sales totals down by U.S. Census Bureau major region from January 2016 through May 2019, where we have omitted states whose available data only covers a portion of that period, which provides an apples-to-apples comparison of trends from one month's data to the next. The first two charts below show the trends for the West and the Northeast, which have respectively been the weakest and strongest regions in the nation over the last several months.

By contrast, the U.S. South and Midwest regions have seen a relatively flat level of aggregate existing home sales since early 2018.

Finally, because we can drill down to state level data, the final chart shows the recent trends for aggregate existing home sales for each state of the South region.

The states that stand out in this region are Texas, Louisiana and Oklahoma, whose aggregate existing home sales have shown relative declines in recent months compared to other states in the region, which coincides with recent distress in the oil and gas industries that make up a large share of these states' economies.

In upcoming weeks, we'll revisit the individual states of the West region, since it is continuing to show weakness compared to other major regions in the U.S.

Labels: real estate

The fourth week of July 2019 was far less noisy than previous weeks, thanks largely to the muzzling of the Fed's minions as they entered a communications blackout period in the week before they are set to reset short term interest rates onto a downward trajectory.

The following screenshot of the CME Group's FedWatch Tool's estimated probabilities of various potential rate cuts being announced at the Fed's upcoming Federal Open Market Committee meetings indicates that investors are now expecting just three quarter point rate cuts, with the first announced next week, the second before the end of 2019-Q3, and better than even odds of a third rate cut being announced in 2020-Q1.

In the welcome silence from Fed officials, investors focused instead upon stronger than expected earnings being reported during the week, and the better than expected GDP reported by the U.S. Bureau of Economic Analysis for the second quarter of 2019.

The combination of news kept investors focused on 2020-Q1 in setting stock prices, as they lifted the S&P 500 (Index: SPX) to a new record high closing value.

Here are the headlines that stood out to us during the week that was the fourth week of July 2019:

- Monday, 22 July 2019

- Tuesday, 23 July 2019

- Wednesday, 24 July 2019

- Oil falls 1% despite large U.S. stockpile decline

- Bigger trouble developing

in Chinaall over: - Cracks in home building sector rattle Australia's economy

- Japan July manufacturing contracts a third straight month though at slower pace: flash PMI

- French business activity cools unexpectedly in July: PMI

- IMF lowers global growth forecasts amid trade, Brexit uncertainties

- Exclusive: Bearing brunt of trade war, Singapore chipmakers cut jobs

- Bigger stimulus developing

in Chinaall over: - With finger on trigger, ECB aims at more stimulus

- South Korea second-quarter GDP bounces as public spending offsets private sector drag

- Brazil GDP to get 0.35 percentage point boost from worker fund stimulus

- S&P 500, Nasdaq hit record highs; euro drops on soft data

- Thursday, 25 July 2019

- Oil climbs on Iran tensions, U.S. inventory decline

- Bigger trouble developing

in Chinaall over: - Recession is spreading across German industry, Ifo economist says

- Global economic growth rut at risk of deepening despite rate cuts: Reuters polls

- Asian firms cut capex, weakening outlook for demand and jobs

- Bigger stimulus developing

in Chinaall over: - ECB opens door to rate cuts, more QE, tiering

- European shares sink as Draghi disappoints rate-cut bulls

- Wall Street gives up record high following weak results, Draghi

- Friday, 26 July 2019

- Oil gains on U.S. economic data, Gulf crude tanker dispute

- Bigger trouble developing

in Chinaall over: - Singapore factory output at near four-year low as electronics take a hit

- China gives big distressed debt managers nod to make M&A plans for troubled smaller banks: sources

- Mexico's economy seen posting 0% growth in second quarter

- U.S. second quarter GDP growth slows to 2.1% but tops estimates

- Bigger stimulus developing

in Chinaall over: - Indonesia central bank reiterates room for accommodative policy as inflation seen low

- China Shandong province to spend $145 billion by year-end to speed key projects

- Alphabet, Starbucks drive Wall Street to record high

Elsewhere, Barry Ritholtz found the negatives outweighed the positives in the week's news flow, identifying 6 positives and 8 negatives.

This upcoming week will hopefully be mostly quiet, but once we get past the FOMC's end-of-July meeting, we expect the news will return to higher noise levels. How that might affect how far forward in time investors cast their attention remains to be seen.

The Navier-Stokes equations describing the flow of fluids are among the most useful math equations that have ever been developed. So much so that if a mathematician should someday demonstrate they can either demonstrate the equations will always work or can provide an example where they do not, they will win a $1 million prize from the Clay Mathematics Institute for solving one of its Millennium Problems.

In doing that, the eventual winner of the prize will be able to predictably explain how order, in the form of the smooth, laminar flow of an incompressible (contant density) fluid, transitions into disorderly turbulence, as illustrated in the following mesmerizing two-and-a-half minute video from the Lutetium Project:

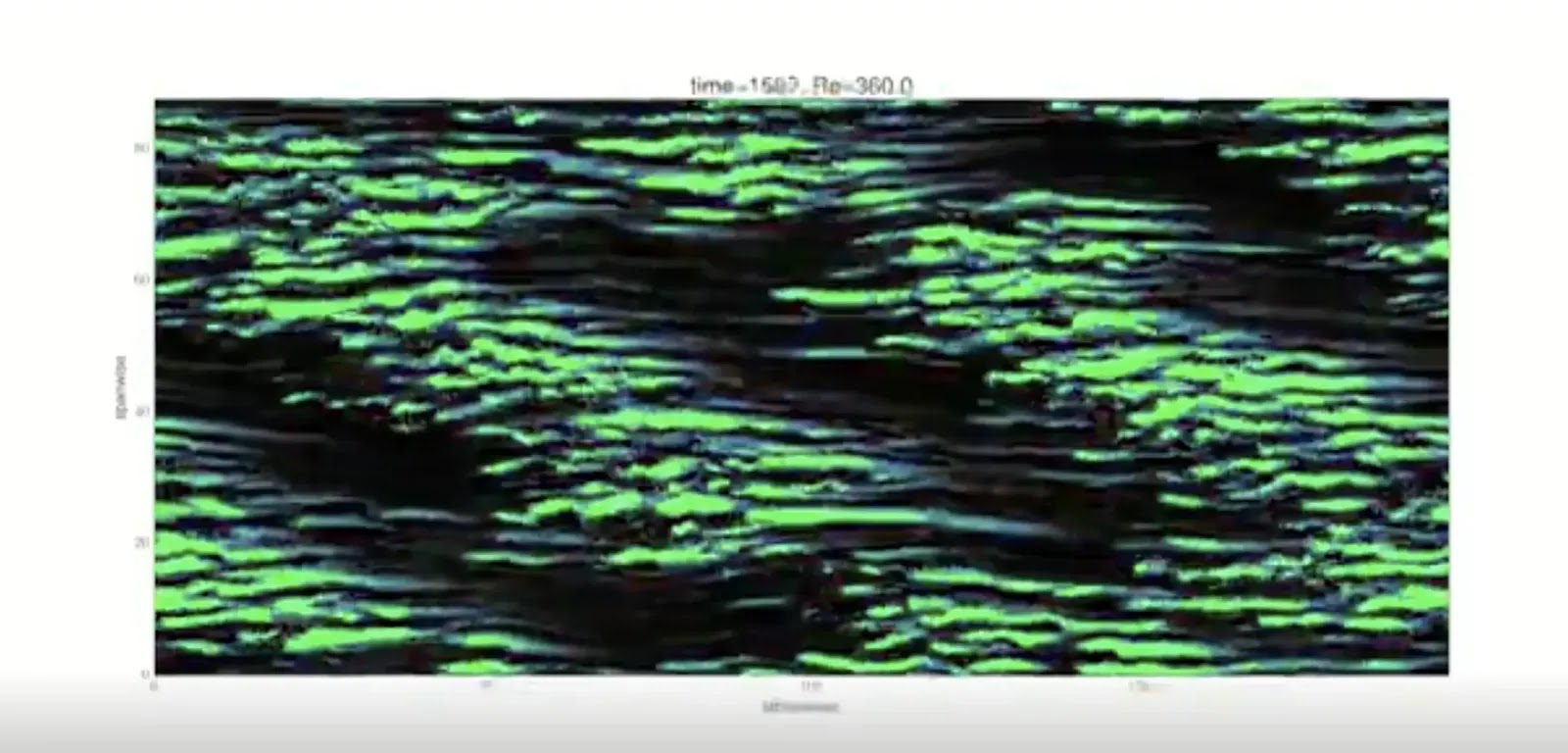

And they will be also be able to accurately describe how some sense of order might spontaneously emerge from turbulent flow, as recently modeled for a recent paper using the Navier-Stokes equations by Florian Reetz, Tobias Kreilos and Tobias M. Schneider of the Ecole polytechnique fédérale de Lausanne (EPFL). The following image from EPFL shows the emergence of an orderly, layered structure within a turbulent flow from their modeling work.

Here's why the application of Navier-Stokes equations to reveal this pattern is such a big deal:

Though physicists had observed this phenomenon experimentally, they can now explain why this happens using fundamental fluid dynamics equations, bringing them a step closer to understanding why particles behave in this way. [The Biggest Unsolved Mysteries in Physics]

In the lab, when a fluid is placed in between two parallel plates that are moving in opposite directions from each other, its flow becomes turbulent. But after a little while, the turbulence starts to smooth out in a striped pattern. What results is a canvas of smooth and turbulent lines running at an angle to the flow (imagine slight wind-created waves in a river).

"You get structure and clear order out of the chaotic motion of turbulence," said senior author Tobias Schneider, an assistant professor in the school of engineering at the Swiss Federal Institute of Technology Lausanne. This "kind of weird and very obscure" behavior has "fascinated scientists for a long, long time."

Physicist Richard Feynman predicted that the explanation must be hidden in fundamental equations of fluid dynamics, called the Navier-Stokes equations.

But these equations are very difficult to solve and analyze, Schneider told Live Science. (Showing that the Navier-Stokes equations even have a smooth solution at every point for a 3D fluid is one of the $1 million Millennium Prize problems.) So up until this point, no one knew how the equations predicted this pattern-forming behaviors. Schneider and his team used a combination of methods, including computer simulations and theoretical calculations to find a set of "very special solutions" to these equations that mathematically describe each step of the transition from chaos to order.

While not the kind of mathematical proof that will win the million-dollar Millennium Prize, Reetz, Kreilos and Schneider have created a remarkable demonstration of the ability of Navier-Stokes equations to accurately describe some of the chaotic mechanics of fluids in motion that are observed in the real world.

As for the status of the Navier-Stokes Millennium Prize, the jury is still out on whether Tristan Buckmaster and Vlad Vicol's initial work demonstrating that the equations do not always generate unique solutions will claim the prize, which we have previously described as the biggest math story of 2017. They have since teamed with Maria Colombo on a new paper (preprint available via arXiv) in following up the topic.

References

Florian Reetz, Tobias Kreilos & Tobias M. Schneider. Exact invariant solution reveals the origin of self-organized oblique turbulent-laminar stripes. Nature Communications 10, 2277 (2019). DOI: 10.1038/s41467-019-10208-x. 23 May 2019.

The Lutetium Project. The transition to turbulence. [Online Video]. 15 November 2016.

Image Credits via Creative Commons Attribution 4.0 International License.

Labels: data visualization, math, physics

After having plunged from October 2018 through March 2019, median new home sale prices in the U.S. would appear to be stabilizing in recent months, with their initial trailing year average for June 2019 unchanged from the previous month at $319,300.

The decline in median new home sale prices began shortly after 30-year mortgage rates in the U.S. peaked at 4.87% in November 2018, the highest they had been since February 2011, which was nearly a full percentage point higher than the 3.92% recorded in November 2017. In June 2018 however, the average 30-year mortgage rates in the U.S. has dropped to 3.80%, having fallen by more than a full percentage point during the last seven months.

The decline in median new home sale prices while median household incomes in the U.S. have generally continued to rise has resulted in new homes becoming relatively more affordable in recent months. In June 2019, the median sale price of a new home sold in the U.S. was a little over five times the estimated median household income for the month.

References

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [Excel Spreadsheet]. Accessed 24 July 2019.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 24 July 2019.

Sentier Research. Household Income Trends: April 2019. [PDF Document]. Accessed 30 May 2019. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars, and are using a projection for June 2019's estimate.]

Labels: real estate

How much of the U.S. stock market is owned by foreigners?

Through the end of the second quarter of 2018, the most recent period for which the data is available from the U.S. Treasury Department, the answer is $8.1 trillion, which is the equivalent of about 35% of the $23.0 trillion market capitalization of the S&P 500 at that time.

In 2002, foreigners owned just $1.4 trillion, or the equivalent of 15% of the S&P 500's market cap at that time. In between, the share of U.S. equities held by foreigners rose steadily to peak at 36.5% in 2015, but has dipped slightly and stabilized in recent years.

If you think about it, the growth of foreign holdings of U.S. stocks has had considerable influence over the growth of the U.S. stock market during the early 21st century.

References

Standard and Poor. S&P 500 Earnings and Estimate Report. [Excel Spreadsheet]. 18 July 2019.

U.S. Department of the Treasury and Federal Reserve Bank of New York. Foreign Portfolio Holdings of U.S. Securities, as of June 30, 2008. [PDF Document]. 18 November 2009.

U.S. Department of the Treasury and Federal Reserve Bank of New York. Foreign Portfolio Holdings of U.S. Securities, as of June 30, 2012. [PDF Document]. April 2013.

U.S. Department of the Treasury and Federal Reserve Bank of New York. Foreign Portfolio Holdings of U.S. Securities, as of June 29, 2018. [PDF Document]. 15 May 2019.

Labels: data visualization, SP 500, stock market

As China's economic growth has slowed considerably since 2017, Chinese leaders have been increasing seeking to halt its decline by firing up its stimulus engine, where to date, they have achieved mixed results.

But they are clearly having an effect on China's economy, which we can see in the rebound of the rate at which carbon dioxide is accumulating in the Earth's atmosphere:

Where carbon dioxide emissions are concerned, China is "the world's largest emitting country" by a wide margin, where the effects of China's latest series of economic stimulus has not gone unnoticed by environmental analysts:

The country’s sudden, significant increase in carbon emissions could be linked to a wider slowdown in the economy, environmental analysts said.

“Under pressure of the current economic downturn, some local governments might have loosened supervision on air pollution and carbon emissions,” said Yang Fuqiang, an energy adviser to the Natural Resources Defense Council, a U.S. environmental organization.

China’s top planning agency said Wednesday that three areas — Liaoning in the northeast Rust Belt and the big coal-producing regions of Ningxia and Xinjiang in the northwest — had failed to meet their targets to curb energy consumption growth and improve efficiency last year.

Other recent headlines confirm that where China's economy is achieving new stimulus-sparked growth coincides with the kind of industrial output that produces large volumes of new carbon dioxide emissions:

- China June aluminum output climbs to daily record - Reuters calculations

- China churns out record daily steel output in June - Reuters calculation

- China June industrial output up 6.3% year-on-year, beats forecasts, retail sales up 9.8%

- China June coal output hits record high as miners ramp up ahead of summer

- China Energy to expand ultra-low emission coal-fired power: executive

In 2014, the most recent year for which it has provided data, China acknowledges it emitted 12.3 billion tonnes of carbon dioxide into the Earth's atmosphere, which are believe to have continued to increase in the years since. That is more than double the 5.73 billion tonnes of carbon dioxide emitted by the United States in 2017, whose emissions have been declining in recent years.

References

National Oceanographic and Atmospheric Administration. Earth System Research Laboratory. Mauna Loa Observatory CO2 Data. [File Transfer Protocol Text File]. 8 July 2019.

Labels: economics, environment

New York Fed president John Williams gave a prepared speech on Thursday, 18 July 2019. In the speech, he argued the Fed should do two things with its monetary policy learned from model simulations when it takes action to head off an economic downturn when interest rates are already low or are near what he calls the Zero Lower Bound (ZLB):

The first: don’t keep your powder dry—that is, move more quickly to add monetary stimulus than you otherwise might. When the ZLB is nowhere in view, one can afford to move slowly and take a “wait and see” approach to gain additional clarity about potentially adverse economic developments. But not when interest rates are in the vicinity of the ZLB. In that case, you want to do the opposite, and vaccinate against further ills. When you only have so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress.

This brings me to my second conclusion, which is to keep interest rates lower for longer. The expectation of lower interest rates in the future lowers yields on bonds and thereby fosters more favorable financial conditions overall. This will allow the stimulus to pick up steam, support economic growth over the medium term, and allow inflation to rise.

Investors interpreted those statements as calling for a more aggressive series of rate cuts than the expectations Fed officials have set forward to date, which for a moment, caused bond yields to fall, the value of the dollar to drop, and stock prices to sharply rise, at least until the New York Fed was forced to step in to "clarify" Williams' comments.

For the S&P 500 (Index: SPX), Williams' speech had the effect of focusing investors on 2020-Q1 more closely, with the probability of a fourth rate hike spiking over 50% on 18 July 2019. A day later, those odds dropped back below 50%, as indicated by the CME Group's FedWatch Tool:

That stock market investors have more closely tightened their focus on 2020-Q1 can be seen in our alternative futures 'spaghetti forecast' chart, which projects the potential future levels of the S&P 500 based on dividend futures-based model.

Even though investors maintained their forward-looking focus on 2020-Q1 and the expectations associated with that future point of time in setting current day stock prices, we believe the market is currently at a heightened risk of having investors shift their focus to other points of time in the future, where shifts toward any other quarter before 2020-Q3 would be accompanied by a significant decline in stock prices, with a shift toward 2020-Q2 being the largest and most negative. Such a shift would be driven by investors' response to the random onset of new information, which provides the random element in the market's quantum random walk.

Speaking of the onset of new information, here are the headlines that influenced investors during the third week of July 2019:

- Monday, 15 July 2019

- Oil prices down on dwindling storm impact, Chinese economic data

- Bigger trouble, bigger stimulus developing in China:

- China second-quarter GDP growth slows to 27-year low as trade war bites, more stimulus seen

- China central bank injects 200 billion yuan in one-year MLF rollover, rate unchanged

- Previous stimulus getting traction in China:

- China June aluminum output climbs to daily record - Reuters calculations

- China churns out record daily steel output in June - Reuters calculation

- China June industrial output up 6.3% year-on-year, beats forecasts, retail sales up 9.8%

- China June coal output hits record high as miners ramp up ahead of summer

- S&P ends near flat as Citigroup results sink banks; Nasdaq hits new high

- Tuesday, 16 July 2019

- Oil falls as Iran tensions seen easing

- Bigger stimulus developing in China:

- China's premier says will make good use of 'counter-cyclical' measures

- China's first half fixed-asset investment projects rise 81% year-on-year to 472 billion yuan

- China boosts local government bond issuance to $104 billion in June to spur economy

- Fed minions set stage for rate cut:

- Powell says many at Fed seeing stronger case for U.S. rate cut

- Fed's Kaplan: bond market signal may warrant 'limited' rate cut

- Fed's Kaplan says sees an argument for a tactical rate cut

- St. Louis Fed wanted cut to discount rate in June: minutes

- Fed's Daly says she is not leaning one way or the other on rate decision

- Trump says U.S., China still have a long way to go on trade deal

- Wall Street slips as bank earnings, Trump trade comments weigh

- Wednesday, 17 July 2019

- Oil prices fall more than 1% after U.S. fuel inventories build

- U.S. housing market stuck in a rut even as mortgage rates fall

- Fed's George hints she could be open to lower interest rates

- Wall St. falls as CSX results signal damage from trade tensions

- Trade, earnings worry drag on stocks; U.S. Treasury yields fall

- Starting with Netflix, FANG reports to test Wall St rally's mettle - Note: Netflix' bad news came after the market closed on 17 July 2019....

- Thursday, 18 July 2019

- Oil falls about 2.5% as U.S. Gulf production returns

- Bigger trouble developing

in Chinaall over: - China's debt tops 300% of GDP, now 15% of global total: IIF

- Sliding Japan exports, manufacturing gloom heighten economic risks

- Poland's central bank governor downplays surprising fall in output

- UK may be entering full-blown recession: budget watchdog

- Bigger stimulus developing

in Chinaall over: - ECB to cut rates in September, QE 2.0 still on the cards: Reuters poll

- Indonesia central bank cuts rates for first time in nearly two years to fire up growth

- South Korea central bank surprises with rate cut, likely to loosen again

- Fed minions stoke rate cut expectations, then try to walk them back:

- Federal Reserve officials lay out case for aggressive rate cuts

- Wall Street rises as Fed's Williams cements rate-cut expectations

- New York Fed takes unusual step of clarifying president’s speech - referring to New York Fed president John Williams' speech

- Time for the Fed to join the computer age - commentary from Scott Sumner, on how to fix "the clown show experienced yesterday at the New York Fed" where confusion reigned among the Fed's minions.

- Stocks gain on Fed rate cut optimism; oil drops

- Friday, 19 July 2019

- Oil climbs as Middle East tensions offset demand worries

- Fed minions continue sending mixed messages:

- A rally and a redirect: why the markets are so focused on the Fed

- U.S. rate cut will 'ratify' what people already expect: Fed's Bullard

- Fed's Rosengren U.S. economy 'reasonable,' no need to cut rates

- Wall Street falls as Fed signals smaller rate cut

Barry Ritholtz weighed the news of the week negatively, finding 6 positives and 7 negatives.

When you go out to a coffee shop to get a cup-of-Joe, what are you really paying for when you buy an average cup of coffee?

To answer that question, we built the following interactive chart in Datawrapper using data from the Financial Times applied to the average price of a cup of coffee sold in New York City, where you can hover over the data segments to highlight them. If you're accessing this article on a site that republishes our RSS news feed, please click through to our site to access a a working version.

We were inspired to take on this data visualization exercise by chartr's United Kingdom-priced version at Data Is Beautiful, which breaks down the costs even further for coffee, which is surprisingly one of the smallest contributors to the cost of a cup of coffee.

References

Terazono, Emiko; Webber, Jude; and Schipani, Andres. The abandoned farms behind the global coffee craze. Financial Times. [Online Article]. 19 May 2019.

chartr. The Economics of a Typical Cup of Coffee. Data Is Beautiful. [Online Article]. 8 June 2019.

McCarthy, Niall. The Price of a Cup of Coffee Worldwide. Statista. [Online Article]. 1 June 2018.

Labels: business, data visualization, food

Komal Sri-Kumar is the president and founder of Sri-Kumar Global Strategies who just had a very interesting bit of analysis published by Bloomberg: The Bond Market Is Now a Giffen Good. In this piece, he makes the argument that sovereign debt, such as U.S. Treasuries, may be considered to be a Giffen good, which he explains in his opening paragraphs:

With some $13 trillion of bonds worldwide yielding less than zero percent, it would be easy to characterize fixed-income assets as nothing more than a giant bubble waiting to burst. Those who agree probably haven’t heard of the concept of a “Giffen good.”

Simply put, a Giffen good is a paradox of economics where rising prices lead to higher demand, which is in contrast to the negatively sloped demand curve that students learn in Economics 101. Named after 19th century Scottish economist Sir Robert Giffen, a Giffen good is typically an essential item that, because of its higher price, leaves less resources to purchase other items. (To be sure, many economists debate whether a Giffen good actually exists.)

In terms of the bond market, it’s important to understand that the rapid plunge in yields, especially for sovereign debt, reflects increased concern about the state of the global economy. Those concerns, in turn, only fuel demand for the safest assets even at negative yields, which pushes prices higher and yields even lower.

He goes on to identify three factors (which we've excerpted below) for why the interest rate yields of sovereign bonds and Treasuries are falling, which in the strange world of bond investing, means their prices are going up:

First, inflation rates have been low or declining in the U.S., euro zone and Japan, encouraging investors to allocate more resources to fixed-income assets despite falling yields. High rates of inflation reduce the purchasing power of bond holders, but low rates of inflation do the opposite....

Second, expectations for central bank monetary policy have been kind to bond investors. Ten-year yields have fallen below policy rates in the U.S., Germany and Japan, providing a reason – and pressure - for monetary authorities to reduce rates....

Third, the steep decline in U.S. and German risk-free yields have increased the attractiveness of lower-rated sovereign credits.

How long sovereign bonds and Treasuries might act like Giffen goods remains to be seen, but we should recognize that the conditions that bring Giffen goods into existence are typically transitory. Either those conditions will not endure, or should they persist, at some point, the rising prices that might have initially motivated investors to buy increased quantities of sovereign bonds may grow too high, with demand for sovereign debt sharply dropping off after that point as the Law of Demand reasserts itself.

No one really knows how high that price is. Nobody should want to find out the hard way.

More Reading

Frank Steindl introduced the concept of Money and Bonds as Giffen Goods back in December 1973, which is the earliest reference to the concept that we can find. It is also the only reference we can find before we began exploring the concept of Debt as a Giffen Good back in May 2009.

Since then, a few analysts have weighed in on the topic, including StatsGuy's Money as the Ultimate Giffen Good at The Baseline Scenario in December 2009, Eric Falkenstein's Treasuries a New Kind of Giffen Good at Falkenblog in August 2011, Kevin Erdmann's discussion of Bonds and Real Estate as Giffen Goods in May 2014, and our own followup More Evidence That Debt Is A Giffen Good in January 2017.

While not considering the role of either money or debt as a Giffen good, Timothy Taylor wrote about recent, strong evidence of Giffen Goods in Real Life at Conversable Economist in January 2012. Since the reputation of Giffen goods is that they are elusive, it's fascinating to see them documented whenever they appear.

And speaking of sovereign debt, we would be remiss if we didn't include Visual Capitalist's United Nations of Debt infographic showing data from 2017:

Nearly every nations' debt is bigger now. What could possibly go wrong?

Labels: debt, economics, national debt

We came across a news story in the Los Angeles Times about San Francisco's 2019 Point-In-Time count of its homeless population that caught our attention because it indicated that the total number of homeless counted in San Francisco in January 2019 wasn't 8,011 as previously reported, but 9,784 after more accurately accounting for the "hidden homeless". Here's an excerpt:

Over the last several months, cities and counties across California have been releasing homeless counts. The results have been grim.

San Francisco was no exception. In May, the city released data that showed homelessness had jumped 17%. That was bad enough. Last week, a more complete accounting, known as a point-in-time count, showed the problem was even worse.

The count revealed that homelessness in a city that’s become a caricature of wealth inequality in the U.S. had actually increased by about 30% from 2017, when the last count took place.

The new numbers use a broader definition of what’s considered to be homeless that goes beyond what’s mandated by the U.S. Department of Housing and Urban Development. They include homeless people in jails, hospitals and residential treatment facilities.

Partly what stands out in this story is its bad reporting, because the figure behind the 17% increase in San Francisco's homeless count that was reported in May 2019 and the figure behind the 30% increase reported last week were both the result of the city's 2019 Point-In-Time Count of its homeless population. The difference between the two figures is who they include in their totals, where the claim that the later reported figure was the result of "a more complete accounting, known as a point-in-time count" is highly misleading.

The count of 8,011 homeless is based on a standardized definition of who should be counted as homeless that is set by the U.S. Department of Housing and Urban Development, which may be compared with data reported in other regions and for the same region in previous years, which makes the data valid for tracking trends across space and time. The higher count of 9,784 reflects the results of what we believe is a reasonable expanded definition of who should be counted as being homeless that is useful for better quantifying the true size of the city's homeless population, which is specifically useful for directing how public officials and private relief organizations might use their limited resources to address problems related to the region's full homeless population.

We can show how both these aspects matter by getting into the city's actual report, rather of relying upon the LA Times account of it, where we started with the question: how many of San Francisco's residents are homeless and how many are not?

The answers to these questions are shown in the following chart, which also confirms that 1.1% of San Francisco's estimated population of 883,305 (as of July 2018) was counted as being homeless in January 2019:

The expanded definition of San Francisco's homeless population includes 472 who were in jail during the period of the January 2019 Point-In-Time count, so we decided to focus on this subset of the city's homeless population, where we wondered what percent of the city's imprisoned population they made up.

While San Francisco's four jails have a total capacity of 1,531 inmates, they hold an average of 1,330 inmates on any given day. Using that latter figure, the homeless would account for about 35% of the city's average daily inmate population:

At this point, it would be nice to know if there is a changing trend with respect to the number of homeless San Franciscans being incarcerated in the city's jails. The city's report indicates that some 299 homeless people were incarcerated in the city's jails back in January 2017, however the 2019 report also indicates that the homeless count survey's methodology significantly changed between 2017 and 2019. As such, rather than comparing apples-to-apples, the 2017 and 2019 data for the city's jailed homeless represent more of an apples-to-oranges comparison, where the two figures cannot be used to establish if any trend exists. Standard definitions matter for this reason.

One thing stands out to us in this data is the apparent rate of incarceration for San Francisco's homeless population. While 4.8% (about 1 in 20) of the city's homeless were residing in the city's jails in late January 2019, that's a relatively huge fraction of the base population compared to the incarcerated share of 0.1% for the city's non-homeless population.

The following chart expresses these percentages as the number of inmates per 100,000 of each group's base population, where we confirm that San Francisco's homeless were 49 times more likely to be in jail than the city's non-homeless population at the time of the city's 2019 Point-In-Time count of its homeless population.

That's fascinating because the city has been seeking to close one of its jails and has been implementing progressive reforms to its criminal justice system to make that possible through reduced arrests and prosecutions. In the absence of more effective law enforcement, property crimes and low-level offenses have spiked in San Francisco, making it all-but-impossible for the city officials to follow through their jail-closing ambition.

But perhaps it could if it more effectively addressed the problems posed by its homeless population and the problems that made them homeless in the first place. As it is, San Francisco's leaders seem to have made the very expensive choice to effectively dedicate a large portion of its available jail space to house about 5% of its homeless population without doing anything to reduce any of the city's crime. With the expanded numbers better describing the city's homeless population, they can develop better solutions than they have done to date to deal with all these problems.

What do you suppose the numbers would look like for Los Angeles if that city performed its own expanded count of its very large homeless population?

Labels: data visualization, demographics

We're a little over the halfway point between the Federal Open Market Committee's scheduled meetings, where the Federal Reserve's interest rate-setting body will announce a quarter point rate cut in the Federal Funds Rate at the conclusion of its next two-day meeting on 31 July 2019, its first reduction since December 2008 when it dropped to near-zero.

According to the probabilities indicated by the CME Group's FedWatch Tool, that reduction will be the first of three rate cuts in 2019, which if all are implemented as currently expected, will lower the target range for the interest rate the Fed charges banks to borrow money overnight from today's level of 2.25-2.50% to 1.50-1.75% by the end of 2019.

Using a model developed by Jonathan Wright back in 2006, at today's levels, the Federal Funds Rate combined with the ongoing inversion of the 10-Year and 3-Month U.S. Treasuries indicate a nearly 1-in-10 chance that the National Bureau of Economic Research will someday determine that a national recession began in the United States sometime between 12 July 2019 and 12 July 2020. The Recession Probability Track shows those odds as a 10% probability, which has occurred because of the sustained inversion of the U.S. Treasury yield curve since 23 May 2019.

The Recession Probability Track is based on Jonathan Wright's 2006 paper describing a recession forecasting method using the level of the effective Federal Funds Rate and the spread between the yields of the 10-Year and 3-Month Constant Maturity U.S. Treasuries.

Because Wright's model was developed using historic data prior to when the Fed adopted its unconventional monetary policy of quantitative easing as the Federal Funds Rate was held at near-zero levels, it doesn't take into account the effects of the reverse of that policy, quantitative tightening, which has been ongoing since May 2014, and which the Fed plans to continue into September 2019.

Measured as the "shadow Federal Funds Rate", several analysts have indicated they believe quantitative tightening would add at least three full percentage points to the nominal Federal Funds Rate if it were incorporated in that interest rate, raising it to an adjusted level of about 5.4%.

When we substitute that adjusted Federal Funds Rate into our recession odds reckoning tool, which like our Recession Probability Track chart is based on Jonathan Wright's paper, we find the adjusted probability of recession starting between 12 July 2019 and 12 July 2020 is 40%, or rather, a chance of 1-in-2.5.

If you have a particular recession risk scenario you would like to consider, please take advantage of our recession odds reckoning tool. It's really easy, and if it helps, the average yields of the 10-Year and 3-Month Treasuries over the last 90 calendar days ending on 12 July 2019 are 2.28% and 2.32% respectively, while the average effective Federal Funds Rate over the same period is 2.40%.

If you would like to catch up on any of the analysis we've previously presented, here are all the links going back to when we restarted this series back in June 2017.

Previously on Political Calculations

- The Return of the Recession Probability Track

- U.S. Recession Probability Low After Fed's July 2017 Meeting

- U.S. Recession Probability Ticks Slightly Up After Fed Does Nothing

- Déjà Vu All Over Again for U.S. Recession Probability

- Recession Probability Ticks Slightly Up as Fed Hikes

- U.S. Recession Risk Minimal (January 2018)

- U.S. Recession Probability Risk Still Minimal

- U.S. Recession Odds Tick Slightly Upward, Remain Very Low

- The Fed Meets, Nothing Happens, Recession Risk Stays Minimal

- Fed Raises Rates, Recession Risk to Rise in Response

- 1 in 91 Chance of U.S. Recession Starting Before August 2019

- 1 in 63 Chance of U.S. Recession Starting Before September 2019

- 1 in 54 Chance of U.S. Recession Starting Before November 2019

- 1 in 42 Chance of U.S. Recession Starting Before December 2019

- 1 in 26 Chance of U.S. Recession Starting Before February 2020

- 1 in 16 Chance of U.S. Recession Starting Before April 2020

- 1 in 14 Chance of U.S. Recession Starting Before April 2020

- 1 in 13 Chance of U.S. Recession Starting Before May 2020

- 1 in 12 Chance of U.S. Recession Starting Before June 2020

- 1 in 11 Chance of U.S. Recession Starting Before July 2020

Labels: recession forecast

At 3,013.77, the S&P 500 (Index: SPX) closed at the highest level in its history on Friday, 12 July 2019, having spent the entire day trading above 3,000 for the first time ever.

Then again, the index has achieved new record high closing values 11 times in the last four weeks. What is more notable is that investors have continued to set their forward-looking focus on 2020-Q1 in setting stock prices...

Even though investors are now expecting the Fed to cut short term interest rates in the U.S. three times in upcoming months, with quarter point reductions expected after the Federal Open Market Committee concludes upcoming meetings on 31 July 2019, on 18 September 2019 and on 11 December 2019.

Investor expectations of a fourth quarter point rate cut being announced in 2020-Q1 has been oscillating about the 50% probability mark in recent weeks, with the CME Group's FedWatch Tool indicating the probability of that event being around 35% as of the end of trading on 12 July 2019.

That's where most of the action has been for investors looking forward in time in making their current day investing decisions ahead of the earnings season for 2019-Q3 officially getting underway in the next week, as Fed officials have been 'flooding the zone' in attempting to set future expectations. Here are the market-moving headlines we extracted from the week's news, where you can see the unusually large representation of statements made by the Fed's minions among the regular flow of news on Wednesday and Thursday....

- Monday, 8 July 2019

- Oil steadies as demand worries offset Iran's new nuclear threats

- Bigger trouble developing

in Chinaall over: - China refiners curb fuel output after massive new plants stoke glut

- Japan machinery orders fall most in eight months in worrying sign for economy

- Euro zone investor morale falls further in July, German recession looms: Sentix

- Bigger stimulus developing

in Chinaall over: - China June new loans seen at 5-month high as central bank keeps liquidity ample: Reuters poll

- Fed easing could prompt first China rate cut in four years - analysts

- 'The Incredible Disappearing Bond Yields'

- Wall St. drops as Apple falls, Fed eyed

- Tuesday, 9 July 2019

- Oil rises more than 1% after U.S. stockpile drop; Brent nears $65

- White House's Kudlow sees room for Fed to reverse rate hike

- Fed's Harker sees 'no immediate need' for U.S. interest rate cut: Wall Street Journal

- Atlanta Fed's Bostic: Officials debating merits, risks of 'hotter' economy

- S&P 500 ekes out gain though profit worries weigh

- Wednesday, 10 July 2019

- Oil prices jump 4.5% on U.S. crude stocks draw, Gulf of Mexico storm

- Bigger stimulus developing in China:

- China's 2019 growth seen slowing to 6.2% as trade war weighs

- China June exports seen falling, adding to fears of global slowdown: Reuters poll

- China's producer prices stall in June, fuel deflation worries

- Powell testimony, Fed meeting highlight case for 'insurance'

- Fed's George says does not look like inflation set to surge

- Many Fed officials saw near-term rate cut, not all convinced: minutes

- Instant view: Powell - Fed stands ready to act "as appropriate" to sustain expansion

- U.S. Fed policy-makers debate merit of a repo facility

- Wall Street touches new highs after comments by Fed's Powell

- Thursday, 11 July 2019

- Oil falls on dim OPEC demand outlook, pares gains from Gulf of Mexico storm

- Bigger trouble developing

in Chinaall over: - Bigger stimulus developing

in Chinaall over: - China second-quarter GDP growth seen easing to 6.2%, more stimulus expected: Reuters poll

- Australia's rate cuts, tax rebate helping economy, says central bank governor

- ECB ready to ease again as inflation goal is 'some distance away'

- IMF sees prolonged anemic growth in euro zone, urges ECB stimulus

- Fed minions try to steer expectations, in all different directions:

- Fed's Powell affirms rate cut view; others see U.S. economy humming

- Fed's Barkin sees risks to U.S. economy: Bloomberg

- Fed's Barkin sees little case for cutting interest rates

- Fed's Barkin leaves door open to 'insurance' cut

- Bostic: Fed's focus is its mandates not market pricing for rate cuts

- Fed's Kashkari says need 'stronger medicine' to boost inflation

- Fed's Brainard signals support for rate cut

- Fed's Williams says case for a U.S. rate cut is stronger

- S&P 500, Dow climb as health insurers, financials gain

- Friday, 12 July 2019

- Oil flat as tropical storm limits output, glut forecasts weigh

- Bigger trouble developing in China:

- China's June exports, imports fall as trade war takes heavier toll

- China copper imports in June fall 27% from a year earlier

- China iron ore imports in June fall to lowest since Feb 2016

- China June soybean imports fall on trade war, deadly pig disease

- Singapore's decade-low growth triggers recession warning

- Fed's Evans: 'A couple' of rate cuts needed to boost inflation

- Wall St. notches all-time highs on lingering rate-cut optimism

Elsewhere, Barry Ritholtz listed 6 positives and 6 negatives he found among the week's major market and economy-related news. Barry also celebrated the fifth anniversary of his Bloomberg Radio Masters In Business - if you've been looking for a podcast focused on business and finance topics to tune in during your daily commute, do check it out!

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.