On 28 November 2018, 20 black clergy in Philadelphia announced their opposition to the continuation of the controversial tax, breaking what had been their support for Philadelphia Mayor Jim Kenney's tax program, noting its disproportionately racial impact.

Nearly two years after the city’s sugary beverage tax went into effect, 20 members of Philadelphia’s Black clergy are calling for its repeal over concerns that the revenue-generator is regressive and disproportionately taxing African Americans and the poor.

“I don’t see how the tax, as it is constructed, can really effectively do what it is intending to do. We think it needs to be repealed and reconceptualized,” said the Rev. Jay Broadnax, president of the Black Clergy of Philadelphia and Vicinity....

The Philadelphia pastor said the 1.5-cent-an-ounce levy on sugary beverages, including diet soda, was having unintended consequences by saddling people of color, the poor and senior citizens with higher grocery bills, while dips in soda sales were hurting small neighborhood business owners.

“The way that it has worked out is that it seems to be hurting more than it’s helping,” Broadnax said.

Indeed it has, which has been evident for quite some time. Last December, economic analysis firm Oxford Economics (OE) quantified their assessment of the economic impact from the unpopular tax, finding:

Overall, our models indicate an employment decline of 1,192 workers in Philadelphia as a result of the PBT, or roughly 0.14 percent of Philadelphia employment. These job losses broke out to roughly 5 percent from bottling, 25 percent from beverage trade and transport margins, and 70 percent from reduced non-beverage grocery retail. Operational data provided by bottlers suggests that this modeling actually understates true job losses, by roughly 72 jobs. The modeled job losses correspond to $80 million in lost GDP, and $54 million less labor income. This reduced economic activity results in consequent tax losses, which our modeling can estimate. Overall, we find a $4.5 million reduction in local tax revenue.

Since the Oxford Economics report was commissioned by the American Beverage Association, its findings have been challenged on just that basis by political supporters of the soda tax who decry the influence of "Big Soda". We have no affiliation with the ABA, its members, or soda tax supporters, where we can offer an objective and independent assessment of its economic impact based on up-to-date information.

The following tool updates a previous analysis we provided in June 2017 to reflect the findings of other independent economic research, specifically the following key points:

- "Overall, we find that the estimates of the impact of the tax on the consumption of added sugars from SSBs and the frequency of consuming all taxed beverages are negative but not statistically significant for children and adults", which is to say that there is no meaningful positive benefit that is "correcting" any negative externality associated with sweetened soft drink consumption that might exist. (If anything, it has contributed to creating even bigger negative externalities.)

- "The tax was fully passed through to consumers, raising prices by 1.6 cents per ounce, on average, across all taxed beverages."

In our tool, we'll limit the price increase to just the 1.5 cents-per-ounce that was directly imposed upon beverages distributed in the city for retail sale by the Phildadelphia Beverage Tax. We will also incorporate quantity data for the full 2017 calendar year, where we've estimated from other data provided by the City if Philadelphia that 8,438 million ounces of sweetened beverages would have been distributed for sale in the city without the tax, and that 5,256 million ounces were actually distributed in the city during the tax' first year in effect.

With those changes noted, here's the updated tool. If you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version of the tool. If you would rather not, here is a screen shot of the results we obtained using the default data.

With the default data, our tool estimates the deadweight loss to Philadelphia's economy to be $23.8 million. This figure is a little under a third of the total $80 million economic loss projected by Oxford Economics in their methodology from data for first four months of the Philadelphia Beverage Tax being in effect.

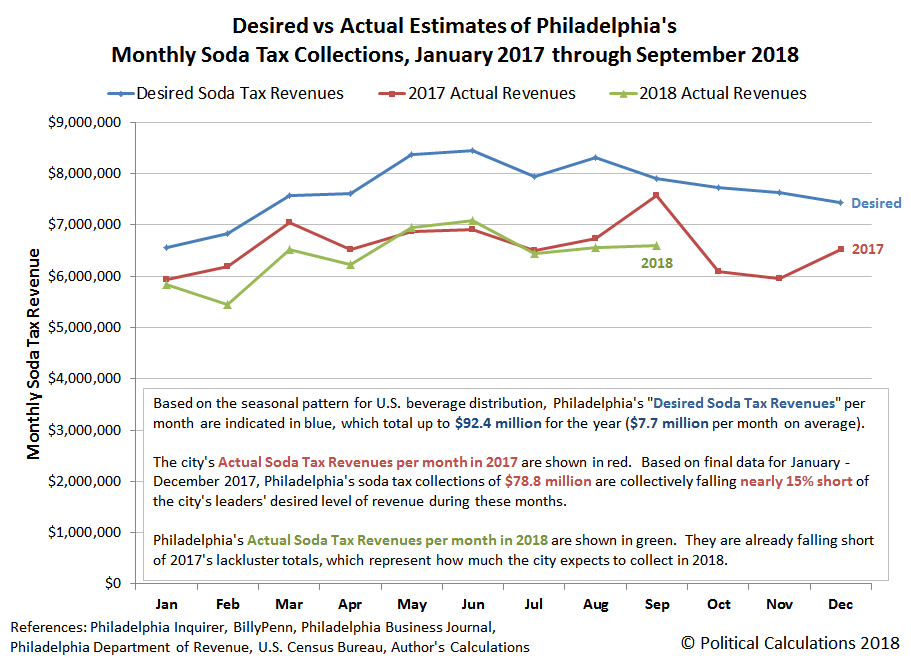

Moving the clock forward to 2018, we can confirm that Philadelphia's beverage tax collections are continuing to fall short of city lowered expectations, where we find that through October 2018, the city is cumulatively running about $3 million behind where they were at the same point of time in 2017.

Philadelphia's civic leaders therefore have less money to spend than what they were expecting, but as it happens, they're not spending much of the soda tax money that they are collecting.

How much the soda tax has raised

From the time tax it went into effect in January 2017 to the end of the most recent fiscal quarter: $137 million.

...And how much has been spent

- $101 million is sitting unspent in the general fund (74 percent of total)

- $31.7 million on Pre-K programs (23 percent)

- $3.5 million Community Schools (2.5 percent)

- $605k on Rebuild projects (less than 1 percent)

Philadelphia's new controller, Rebecca Rhynhart, is taking issue with how Philadelphia's political leaders are managing the money from its soda tax:

Philadelphia's contentious sugary beverage tax, now in its third fiscal year of collections, just became much more transparent to the public.

City Controller Rebecca Rhynhart released a searchable data set on Tuesday that provides access to all revenue and expenditures for the tax since it was enacted in January 2017....

Rhynhart had criticized the Kenney administration for keeping the revenue in the city's general fund rather than creating a segregated reserve account.

"The use of a segregated reserve account would ensure that revenue is spent only on earmarked programs and would promote transparency by making it easier to track revenue to expenses," Rhynhart's office said in a statement accompanying the data release.

Rhynhart is greatly concerned that Philadelphia's civic leaders might consider treating the money collected from the tax, which is supposed to be dedicated to funding pre-K programs, community schools, and improvements to public facilities, like a slush fund within the city's accounts. With about three-quarters of the all the soda tax money sitting in the general fund unspent, it's virtually an open invitation for it to be misappropriated.

Meanwhile, the city's old controller, Alan Butkovitz, who has recognized many of the problems that have arisen from the Philadelphia Beverage Tax, is now running for mayor, where his opposition to current Mayor Jim Kenney's pet tax project is a centerpiece of his campaign.

There's a lot that is wrong with Philadelphia's soda tax, but the bottom line is that is isn't working.

Previously on Political Calculations

We've been covering the story of Philadelphia's flawed soda tax on roughly a monthly basis from almost the very beginning, where our coverage began as something of a natural extension from one of the stories we featured as part of our Examples of Junk Science Series. The linked list below will take you through all our in-near-real-time analysis of the impact of the tax, which at this writing, has still to reach its end.

- Examples of Junk Science: Taxing Treats

- Philadelphia Soda Tax Crushes Soft Drink Sales

- The Tax Incidence and Deadweight Loss of Philadelphia's Soda Tax

- Philadelphia's Soda Tax Collections Are Falling Short

- Philly's Soda Tax Collections Continue to Fall Short of Goals

- Jobs Gained and Lost from Philadelphia's Soda Tax

- Philadelphia Soda Sales Volume Down 34% Since Tax

- Philadelphia Soda Tax to Shrink City's Economy by $20 Million

- Big Miss for Philadelphia's Beverage Tax

- Odds and Ends for Philadelphia's Soda Tax

- Legal Jeopardy for Philadelphia's Soda Tax

- Soda Tax Driving Philadelphians To Drink?

- Philadelphia Soda Tax Collections Start Fiscal Year in Deep Hole

- Philadelphia Soda Tax Collections Continues Falling Flat

- A Natural Experiment for Philadelphia's Soda Tax

- Philadelphia Soda Tax $20 Million Short with One Month to Go in First Year

- Philadelphia Soda Tax Falls 15% Short of Target

- Philadelphia Mayor Scales Back Soda Tax Ambitions

- Philadelphia Soda Tax Boosts City's Alcohol Sales

- Philadelphia Soda Tax Collections Falling Further Short in Year 2

- Philadelphia Soda Tax Underperforming Lowered Expectations

- PA Supreme Court Rules Philly Soda Tax Legal

- Philadelphians Sure Drink a Lot More Alcohol Since the City's Soda Tax Was Imposed

- Philly's Soda Tax Impact on City's Calorie Consumption

- Tax Avoidance and the Philadelphia Soda Tax

- Philadelphia Rebuild Paying Price for Soda Tax Shortfalls

- Philadelphia's Soda Tax Isn't Working

Labels: economics, food, politics, taxes, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.